2019 RFQ Qualified Pools 082520

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TEACHERS' RETIREMENT SYSTEM of the STATE of ILLINOIS 2815 West Washington Street I P.O

Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Performed as Special Assistant Auditors for the Auditor General, State of Illinois Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Table of Contents Schedule Page(s) System Officials 1 Management Assertion Letter 2 Compliance Report Summary 3 Independent Accountant’s Report on State Compliance, on Internal Control over Compliance, and on Supplementary Information for State Compliance Purposes 4 Independent Auditors’ Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards 8 Schedule of Findings Current Findings – State Compliance 10 Supplementary Information for State Compliance Purposes Fiscal Schedules and Analysis Schedule of Appropriations, Expenditures and Lapsed Balances 1 13 Comparative Schedules of Net Appropriations, Expenditures and Lapsed Balances 2 15 Comparative Schedule of Revenues and Expenses 3 17 Schedule of Administrative Expenses 4 18 Schedule of Changes in Property and Equipment 5 19 Schedule of Investment Portfolio 6 20 Schedule of Investment Manager and Custodian Fees 7 21 Analysis of Operations (Unaudited) Analysis of Operations (Functions and Planning) 30 Progress in Funding the System 34 Analysis of Significant Variations in Revenues and Expenses 36 Analysis of Significant Variations in Administrative Expenses 37 Analysis -

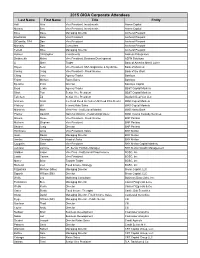

2015 GIOA Corporate Attendees

2015 GIOA Corporate Attendees Last Name First Name Title Entity Hall Wes Vice President, Investments Alamo Capital Mullally Ben Vice President, Investments Alamo Capital Bove Dave Managing Director Amherst Pierpont Brudzinski Beau Vice President Amherst Pierpont DiCamillo, CFA Dan Vice President Amherst Pierpont Markaity Dan Consultant Amherst Pierpont Teifeld Mike Managing Director Amherst Pierpont Holmen Christopher Investments Andress Enterprises Deshmukh Nisha Vice President, Business Development ASPN Solutions Li Shen Trader Bank of America Merrill Lynch Hayes Sean Vice President, SSA Origination & Syndicate Bank of Montreal Conley Craig Vice President - Fixed Income Bank of the West Ching Jerry Agency Trader Barclays Fisher Michael Rates Sales Barclays Bjursten Peter Director Barclays Capital Boyd Lewis Agency Trader BB&T Capital Markets Short Tom Senior Vice President BB&T Capital Markets Tollefsen Ed Senior Vice President Blaylock Beal Van LLC Graham Scott Co-Head Fixed Inc Sales US/Head Prim Dealer BMO Capital Markets Pilsbury Bill Interest Rate Sales BMO Capital Markets Mitrovich Mark Vice Pres - Institutional Market BMO Harris Bank Preiner David B. National Director - Relationship Devel BMO Trust & Custody Services Gavula Steve Vice President - Fixed Income BNP Paribas Mulhern Stephen Vice President BNP Paribas Shubert Craig Director BNP Paribas Hennessy Anna Vice President, Sales BNY Mellon Isaac David Managing Director BNY Mellon Jacobs Christopher Head of Sales BNY Mellon Coughlin Sean Vice President BNY Mellon Capital Markets Jemison Johnnie VP, Senior Portfolio Manager BNY Mellon Wealth Management Glidden Jason Vice Pres - Institutional Fixed Income BOSC, Inc Lewis Camee Vice President BOSC, Inc Maher Brian Taxable Trader BOSC, Inc Rietveld Joel Fixed Income Strategy BOSC, Inc Fitzpatrick Michael (Mike) Managing Director Brean Capital, LLC Sapoch William (Bill) Director Brean Capital, LLC Wells Les Marketing Consultant Business Data Links, Inc. -

Office of the State Treasurer Summary of Responses to Request For

Office of the State Treasurer Summary of Responses to Request for Disclosure July 1, 2017 through June 30, 2018 INVESTMENT PAID 3RD COMPANY NAME DIVISION SERVICES PAYMENT ARRANGEMENTS COMMENTS PARTY FEES? PROVIDER? Aberdeen Asset Management Inc. PFM Yes No ACA Financial Guaranty Corporation DEBT Yes No Acacia Financial Group, Inc. DEBT Yes No Academy Securities DEBT Yes No Acadian Asset Management, Inc. PFM Yes No AIG Financial Products Corp. DEBT Yes No Alliance Bernstein ("AB") PFM Yes No Altaris Constellation Partners IV, L.P. PFM Yes No Altaris Health Partners II, L.P. PFM Yes No Altaris Capital Partners, LLC was paid management fees Management fees are permissible third party payments. (See C.G.S. § Altaris Health Partners III, L.P. PFM Yes Yes totaling $180,961 pursuant to the Limited Partnership 3-13l (b)(2). Agreement. Altaris Capital Partners, LLC was paid management fees Management fees are permissible third party payments. (See C.G.S. § Altaris Health Partners IV, L.P. PFM Yes Yes totaling $86,119 pursuant to the Limited Partnership 3-13l (b)(2). Agreement. Ambac Assurance Corporation DEBT Yes No American Realty Advisors PFM Yes No AMTEC Corp. DEBT No No Anderson, Kill & Olick PFM Yes No Aon Hewitt Investment Consulting, Inc. PFM Yes No Apollo Capital Management VIII, LLC PFM Yes No Apollo Capital Management IX, LLC PFM Yes No Appomattox Advisers, Inc. PFM Yes No (Thomas Welles Fund I, LLC ) AQR Capital Management, LLC PFM Yes No Arclight Energy Partners Fund V, L.P. PFM Yes No TransPacific Group LLC was paid $2,100,000 in connection Placement agent fees are permissible third party payments. -

Underwriter and Commercial Paper Dealer Pool Term: April 2021 ‐ March 2026

Debt Management Department Qualification No. 10089751‐21‐W RFSQ Investment Banking Services ‐ Underwriter and Commercial Paper Dealer Pool Term: April 2021 ‐ March 2026 Firms currently in the pool as of April 22, 2021: Senior Manager Academy Securities, Inc. Piper Sandler & Co. BofA Securities, Inc Raymond James & Associates, Inc. Cabrera Capital Markets LLC RBC Capital Markets, LLC Citigroup Global Markets Inc. Samuel A. Ramirez & Co., Inc. D.A. Davidson & Co. Siebert Williams Shank & Co., LLC Goldman Sachs & Co. LLC Stern Brothers & Co. Jefferies LLC Stifel, Nicolaus & Company, JP Morgan Securities LLC Incorporated Loop Capital Markets UBS Financial Services Inc. Morgan Stanley & Co. LLC Wells Fargo Securities Co‐Manager 280 Securities Mischler Financial Group, Inc. Academy Securities, Inc. Morgan Stanley & Co. LLC Alamo Capital Multi‐Bank Securities, INC. American Veterans Group, PBC Piper Sandler & Co. BofA Securities, Inc Samuel A. Ramirez & Co., Inc. Blaylock Van, LLC Raymond James & Associates, Inc. Cabrera Capital Markets LLC RBC Capital Markets, LLC Citigroup Global Markets Inc. Rice Securities, LLC D.A. Davidson & Co. Siebert Williams Shank & Co., LLC Drexel Hamilton, LLC Stern Brothers & Co. Goldman Sachs & Co. LLC Stifel, Nicolaus & Company, Jefferies LLC Incorporated JP Morgan Securities LLC UBS Financial Services Inc. Loop Capital Markets Wells Fargo Securities Commercial Paper Dealer BofA Securities, Inc Piper Sandler & Co. Goldman Sachs & Co. LLC RBC Capital Markets, LLC Jefferies LLC Siebert Williams Shank & Co., LLC JP Morgan Securities LLC UBS Financial Services Inc. Morgan Stanley & Co. LLC Wells Fargo Securities For questions regarding the City’s Investment Banking Services ‐ Underwriter and Commercial Paper Dealer Pool, please contact Taif Tozy at (619) 533‐4517 or [email protected] Updated 4/22/2021 . -

$2,290,000,000* State of California General Obligation Bonds

SQUIRE DRAFT 9/11/14 PRELIMINARY OFFICIAL STATEMENT DATED SEPTEMBER 11, 2014 NEW ISSUE – BOOK ENTRY ONLY Ratings: Moody’s: Aa3 S&P: A Fitch: A (See “RATINGS” herein) In the opinion of Bond Counsel to the State of California (the “State”), interest on the Bonds is excluded from gross income for federal income tax purposes under Section 103 of the Internal Revenue Code of 1986, as amended (the “Code”), and interest on the Bonds is exempt from State personal income taxes. See “TAX MATTERS” herein. $2,290,000,000* STATE OF CALIFORNIA GENERAL OBLIGATION BONDS $940,000,000* $200,000,000 * n or qualification or filing under the under or filing qualification or n VARIOUS PURPOSE VARIOUS PURPOSE GENERAL OBLIGATION BONDS GENERAL OBLIGATION BONDS (GREEN BONDS) $950,000,000* $200,000,000 * VARIOUS PURPOSE VARIOUS PURPOSE GENERAL OBLIGATION REFUNDING BONDS GENERAL OBLIGATION BONDS (MANDATORY PUT BONDS) ll this Preliminary Official Statement constitute an offer to sell or the offer sell to an constitute Statement Official Preliminary this ll Dated: Date of Delivery Bonds Due: As shown under “SUMMARY OF THE OFFERING” The State of California is issuing $940,000,000* Various Purpose General Obligation Bonds (the “Construction Bonds”), $200,000,000* Various Purpose General Obligation Bonds (Green Bonds) (the “Green Bonds”) and $950,000,000* Various Purpose General Obligation Refunding Bonds (the “Refunding Bonds”), all bearing interest at fixed rates (collectively, the “Fixed Rate Bonds”), and $200,000,000*Various Purpose General Obligation Bonds (Mandatory Put Bonds), comprised of __________series designated as Series ___ and Series ___ Bonds (each a “Series of Mandatory Put Bonds”), each bearing interest at a fixed rate to the applicable Mandatory Tender Date as further described herein (the “Mandatory Put Bonds” and together with the Fixed Rate Bonds, the “Bonds”). -

Fees – for Plan Related Accounts That Do Not Indicate a Specific Outsid

March 23, 2017 ADP Inc. Re: Form 5500 Schedule C Information To Whom It May Concern: This correspondence is in response to your request dated January 13, 2017, regarding the Form 5500 Schedule C reporting requirements created by regulations issued by the Department of Labor (“DOL”) and its instructions and related guidance (“Schedule C”). We’ve been asked to provide certain information regarding direct or indirect compensation received by our mutual funds and affiliates or paid by our mutual funds to third parties in connection with the investment by the retirement plan clients of ADP Inc. (“Plan”) in our mutual funds for the Plan’s year ended 2016. As an initial matter, please note that the information contained in this response relates solely to reportable compensation, for purposes of Schedule C, received by Morgan Stanley Investment Management Inc. and its affiliated mutual fund service providers (“MSIM”) but does not purport to report compensation for third parties or for any banks or broker dealers that may be affiliated with MSIM. While we are happy to help coordinate inquiries to any other service provider for which the Plan may wish our assistance in contacting, please note we view the reporting of compensation received by such other entities to be beyond the scope of what MSIM is legally obligated to report for Schedule C purposes (as MSIM is not the ultimate recipient of such compensation). For direct or indirect compensation received by MSIM related to the Plan, we intend that all such compensation, as described as follows, is within the definition of Eligible Indirect Compensation (“EIC”) under Schedule C: • Management Fees – Morgan Stanley Investment Management Inc. -

3Q 2019 Contents Credits & Contact

Global League Tables 3Q 2019 Contents Credits & contact PitchBook Data, Inc. Introduction 2 John Gabbert Founder, CEO Adley Bowden Vice President, PE firms 3-11 Market Development & Analysis Content VC firms 12-19 Garrett James Black Senior Advisors/accountants & investment banks 20-25 Manager, Custom Research & Publishing Law firms: VC & PE 26-35 Van Le Senior Data Analyst Acquirers 36-38 Contact PitchBook Research [email protected] Cover design by Kelilah King Click here for PitchBook’s report methodologies. Introduction Thank you to all who participated in the surveys that firm for each given section), however, spacing and enable these rankings to be possible. Once again, near- aggregate tallies prevented us from adopting that cutoff record submissions led to this edition of the Global consistently on every page. All in all, we are confident League Tables being released somewhat later in the that the current tables will provide a useful, accurate quarter. As always at PitchBook, we prioritize accuracy snapshot of activity throughout 3Q 2019 by our array of above all else. We will continue to elect to provide the typical criteria, from venture transactions by stage to US most precise information over speed until we are sure we region. can accomplish both. Stay tuned for potential changes to these rankings as In this edition, we carried over our style of rankings, we continue to look for the most efficient and accurate which should prove helpful for quick consultation. We way to showcase the most active firms across private endeavored to keep the number of rankings equivalent markets. per page (e.g. -

Atotech Prices Initial Public Offering

Atotech Prices Initial Public Offering February 4, 2021 BERLIN, Feb. 03, 2021 (GLOBE NEWSWIRE) -- Atotech Limited (“Atotech”), a leading specialty chemicals technology company and a market leader in advanced electroplating solutions, has priced its initial public offering of 29,268,000 of its common shares at $17.00 per share. The shares are expected to begin trading on Thursday, February 4, 2021 on the New York Stock Exchange under the ticker symbol “ATC,” and the offering is expected to close on February 8, 2021, subject to customary closing conditions. The underwriters of the offering will also have a 30-day option to purchase up to an additional 4,390,200 common shares from certain affiliates of The Carlyle Group Inc. (the “selling shareholders”). Citigroup, Credit Suisse, BofA Securities and J.P. Morgan are lead book-running managers for the proposed initial public offering. Additional book-running managers are Barclays, Deutsche Bank Securities, Jefferies, RBC Capital Markets, UBS Investment Bank, Baird, BMO Capital Markets and HSBC. The co-managers are TCG Capital Markets L.L.C. and Mischler Financial Group, Inc. A registration statement relating to these securities has been declared effective by the U.S. Securities and Exchange Commission (“SEC”). The offering of these securities is being made only by means of a written prospectus forming part of the effective registration statement. A copy of the final prospectus relating to the offering will be filed with the SEC, which may be obtained, when available, from Citigroup Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, Attn: Prospectus Department, Telephone: (800) 831-9146; Credit Suisse Securities (USA) LLC, 6933 Louis Stephens Drive, Morrisville, NC 27560, Attn: Prospectus Department, Telephone: (800) 221-1037, Email: [email protected]; BofA Securities, NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte, NC 28255-0001, Attn: Prospectus Department, Email: [email protected]; and J.P. -

Pricing Supplement for 3134GVFG8

PRICING SUPPLEMENT DATED March 3, 2020 (to the Offering Circular Dated February 13, 2020) $2,076,500,000 Freddie Mac Variable Rate Medium-Term Notes Due March 5, 2021 Issue Date: March 5, 2020 Maturity Date: March 5, 2021 Subject to Redemption: No Interest Rate: See “Description of the Medium-Term Notes” herein Principal Payment: At maturity CUSIP Number: 3134GVFG8 You should read this Pricing Supplement together with Freddie Mac’s Global Debt Facility Offering Circular, dated February 13, 2020 (the “Offering Circular”), and all documents that are incorporated by reference in the Offering Circular, which contain important detailed information about the Medium-Term Notes and Freddie Mac. See “Additional Information” in the Offering Circular. Capitalized terms used in this Pricing Supplement have the meanings we gave them in the Offering Circular, unless we specify otherwise. The Medium-Term Notes may not be suitable investments for you. You should not purchase the Medium-Term Notes unless you understand and are able to bear the yield, market, liquidity and other possible risks associated with the Medium-Term Notes. You should read and evaluate the discussion of risk factors (especially those risk factors that may be particularly relevant to this security) that appears in the Offering Circular under “Risk Factors” before purchasing any of the Medium-Term Notes. The Medium-Term Notes, including any interest or return of discount on the Medium-Term Notes, are not guaranteed by and are not debts or obligations of the United States or any federal agency or instrumentality other than Freddie Mac. Price to Public (1)(2) Underwriting Discount (2) Proceeds to Freddie Mac (1)(3) Per Medium-Term Note 100% .02% 99.98% Total $2,076,500,000 $415,300 $2,076,084,700 1. -

Pitchbook's Annual Global League Tables

Global League Tables 2019 Annual 1 PITCHBOOK 2019 ANNUAL GLOBAL LEAGUE TABLES Contents Credits & Contact PitchBook Data, Inc. Introduction 2 John Gabbert Founder, CEO Adley Bowden Vice President, PE firms 3-11 Market Development & Analysis VC firms 12-19 Content Garrett James Black Senior Advisors/accountants & investment banks 20-25 Manager, Custom Research & Publishing Law firms: VC & PE 26-35 Aria Nikkhoui Data Analyst II Keenan Durham Dataset Team Lead Acquirers 36-38 Kylie Hannus Senior Research Associate Kunal Rai Senior Research Associate Madison Bond Senior Research Associate Johnny Starcevich Research Associate Contact PitchBook Research [email protected] Cover design by Kelilah King Click here for PitchBook’s report methodologies. Introduction For the inaugural edition of Global League Tables in 2020, Once again, thanks to all the survey participants that we are doing something new. In addition to the usual collaborate with our teams; all the mutual hard work rankings provided here, we hope to release an interactive enables more accurate representation of overall private table in the coming weeks, which will hopefully present a markets activity. more user-friendly, immersive experience and avoid any spatial constraints. Garrett James Black However, the customary array of rankings can still be Senior Manager, Custom Research expected, from the breakdown of the most active private & Publishing equity firms by US region to the law firms that advise on the most M&A transactions worldwide. 2 PITCHBOOK 2019 ANNUAL GLOBAL LEAGUE -

HSBC USA INC /MD/ Form FWP Filed 2015-08-04

SECURITIES AND EXCHANGE COMMISSION FORM FWP Filing under Securities Act Rules 163/433 of free writing prospectuses Filing Date: 2015-08-04 SEC Accession No. 0000903423-15-000474 (HTML Version on secdatabase.com) SUBJECT COMPANY HSBC USA INC /MD/ Mailing Address Business Address 452 FIFTH AVENUE 452 FIFTH AVE CIK:83246| IRS No.: 132764867 | State of Incorp.:MD | Fiscal Year End: 1231 NEW YORK NY 10018 NEW YORK NY 10018 Type: FWP | Act: 34 | File No.: 333-202524 | Film No.: 151026444 2125253735 SIC: 6021 National commercial banks FILED BY HSBC USA INC /MD/ Mailing Address Business Address 452 FIFTH AVENUE 452 FIFTH AVE CIK:83246| IRS No.: 132764867 | State of Incorp.:MD | Fiscal Year End: 1231 NEW YORK NY 10018 NEW YORK NY 10018 Type: FWP 2125253735 SIC: 6021 National commercial banks Copyright © 2015 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Issuer Free Writing Prospectus Filed Pursuant to Rule 433 Registration No. 333-202524 August 4, 2015 Pricing Term Sheet August 4, 2015 $850,000,000 2.000% Notes due 2018 $1,600,000,000 2.750% Notes due 2020 Final Term Sheet: Issuer: HSBC USA Inc. Sole Bookrunner: HSBC Securities (USA) Inc. 3-year Senior Notes due 2018 (the “2018 Notes”) Structure: 5-year Senior Notes due 2020 (the “2020 Notes”) Ratings:* A2 /A (stable/ stable) (Moody’s/S&P) Pricing Date: August 4, 2015 Settlement Date: August 7, 2015 (T+3) General corporate purposes, which may include investments in and advances to our affiliates Use of Proceeds: or subsidiaries, including HSBC Bank USA, National Association. -

Summary Annual Report FY 2018

Technology, Management & Budget Summary Annual Report for the Judges Retirement System, a Pension and Other Postemployment Benefit Trust Fund of the State of Michigan Fiscal Year Ended Sept. 30, 2018 Prepared by Office of Retirement Services Department of Technology, Management and Budget A Message From The Director The Department of Technology, Management and Budget (DTMB) Office of Retirement Services (ORS) is pleased to present the Summary Annual Report for the Judges Retirement System (JRS), henceforth referred to as the System, for the fiscal year ended Sept. 30, 2018. ORS provides retirement and related retiree healthcare plans to help attract, retain, and reward a highly qualified workforce. ORS is able to cost–effectively provide these benefits to retirees. In 2018, the total defined benefit (DB) pension administration cost was $57 per active member and retiree. This was $37 below the peer average of $94 per active member and retiree (CEM Benchmarking). Accomplishments Dedicated Gains Policy Successfully that ensure the System is valued and funded Reduces Assumed Rate of Return properly. The most recent five–year cycle In summer 2017, the DTMB director concluded on Sept. 30, 2017, and the actuary and the retirement board adopted a delivered its evaluation in spring 2018. The mechanism that gradually reduces results of the evaluation are more conservative the assumed rate of investment return economic and demographic assumptions. (AROR). This policy was necessary to The actuary and ORS collaborated to provide align the AROR with industry trends detailed information to department leaders toward more prudent investment and the retirement board about the proposed expectations. Whenever investment adjustments and the impact to the State returns exceed the assumed return (e.g., and school budgets.