Global Entertainment & Media Outlook 2021-2025

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Marco Rossi Doria a Radio1 Che Giorno È

Sezione:CON I BAMBINI raiplayradio.it Rassegna del 29/04/2021 www.raiplayradio.it Notizia del:29/04/2021 Lettori: 16.664 Foglio:1/2 Che giorno è Asilo nido, ampio divario tra il nord e il sud Italia - Marco Rossi Doria a radio1 Che giorno è 29/04/2021 Vai al programma Aggiungi a Playlist Condividi Marco Rossi Doria, presidente impresa sociale Con i Bambini Ascolta l'audio Ultime Puntate e Podcast Vai a tutte Recovery. Il piano scuola e i progetti estivi - Fine Vita Ascolta 29/04/2021 Podcast Con Francesca Romana Ceci e Massimo Giraldi Regia di Ludovico Suppa MEDIASCOPE-111934887 Il presente documento e' ad uso esclusivo del committente. Servizi di Media Monitoring LINK ALL'ARTICOLO Sezione:CON I BAMBINI raiplayradio.it Rassegna del 29/04/2021 www.raiplayradio.it Notizia del:29/04/2021 Lettori: 16.664 Foglio:2/2 Opzioni Situazione Rsa - Lauree abilitanti per l'esercizio delle professioni Ascolta 28/04/2021 Podcast Con Francesca Romana Ceci e Massimo Giraldi Regia di Ludovico Suppa Opzioni Il caso Pfas - Replica di Draghi sul Recovery Ascolta 27/04/2021 Podcast Con Francesca Romana Ceci e Massimo Giraldi Regia di Ludovico Suppa Opzioni Da oggi l'Italia riapre - La didattica a scuola tra internet e Ascolta "tradizione" 26/04/2021 Podcast Con Francesca Romana Ceci e Massimo Giraldi Regia di Ludovico Suppa Opzioni Canali Generi Rai Radio 1 Rai Radio 2 Musica Intrattenimento Cultura Rai Radio 3 Rai Isoradio Attualità Musica Pop Storie Rai Radio 1 Sport Rai Radio 2 Indie Sport Ambiente Archivio Rai Radio 3 Classica Rai GRParlamento Arte Biografie Canzone d'autore Rai Radio Kids Rai Radio Live Cinema Comici .. -

Marco Rossi Doria a Radio1 Che Giorno È

Sezione:CON I BAMBINI raiplayradio.it Rassegna del 30/03/2021 www.raiplayradio.it Notizia del:30/03/2021 Lettori: 16.664 Foglio:1/2 Che giorno è DAD un anno dopo, opportunità o limitazione? Marco Rossi Doria a Radio1 Che giorno è 30/03/2021 Vai al programma Aggiungi a Playlist Condividi Marco Rossi Doria, vicepresidente di Fondazione Con i Bambini, esperto di politiche educative e sociali, già sottosegretario all'Istruzione Ascolta l'audio Ultime Puntate e Podcast Vai a tutte Un anno di Dad - Vaccini. Accordo nazionale e farmacisti Ascolta 30/03/2021 Podcast Con Francesca Romana Ceci e Massimo Giraldi Regia di Ludovico Suppa MEDIASCOPE-110416662 Il presente documento e' ad uso esclusivo del committente. Servizi di Media Monitoring LINK ALL'ARTICOLO Sezione:CON I BAMBINI raiplayradio.it Rassegna del 30/03/2021 www.raiplayradio.it Notizia del:30/03/2021 Lettori: 16.664 Foglio:2/2 Opzioni Covid19, stato campagna vaccinale da Viggiù a Dipignano - E etti Ascolta del coronavirus sui circhi 29/03/2021 Podcast Con Francesca Romana Ceci e Massimo Giraldi Regia di Ludovico Suppa Opzioni Scuola. Tra scioperi e aperture - Lettura - Sottotraccia Ascolta 26/03/2021 Podcast Con Francesca Romana Ceci e Massimo Giraldi Regia di Ludovico Suppa Opzioni Venezia compie 1600 anni - 50 anni di medici senza frontiere Ascolta 25/03/2021 Podcast Con Francesca Romana Ceci e Massimo Giraldi Regia di Ludovico Suppa Opzioni Canali Generi Rai Radio 1 Rai Radio 2 Musica Intrattenimento Cultura Rai Radio 3 Rai Isoradio Attualità Musica Pop Storie Rai Radio 1 Sport Rai Radio 2 Indie Sport Ambiente Archivio Rai Radio 3 Classica Rai GRParlamento Arte Biografie Canzone d'autore Rai Radio Kids Rai Radio Live Cinema Comici .. -

Liste Complète Des Chaînes

Liste complète des chaînes Mise à jour: 2 juin 2020 Retrouvez ci-dessous l'ensemble des chaînes disponibles dans nos différents abonnements ainsi que les chaînes disponibles gratuitement (Free to Air) via la télévision numérique par satellite. Important: les chaînes positionnées sur 23,5 et 28,2 (POS) nécessitent une tête LNB spécifique non disponible dans nos packs. Chaînes disponibles dans notre abonnement Live TV. Options Restart & Replay disponibles pour cette chaîne. NR CHAÎNE ABONNEMENT POS FREQ POL SYMB FEC 1 La Une HD Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 2 La Deux Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 3 RTL-TVI HD Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 4 Club RTL / Kidz RTL Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 5 Plug RTL Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 6 La Trois Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 7 AB3 Basic Light Basic Basic+ 19.2 12515 H 22000 5/6 8 C8 HD Basic Light Basic Basic+ 19.2 12207 V 29700 2/3 9 Infosport+ Basic Light Basic Basic+ 19.2 12207 V 29700 2/3 10 TF 1 HD Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 11 France 2 HD Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 12 France 3 Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 13 France 4 Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 14 France 5 Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 15 France Ô Basic Basic+ 13.0 12692 H 27500 3/4 18 TV Breizh HD Basic Basic+ 19.2 12402 V 29700 2/3 19 Comédie+ HD Basic+ 19.2 12441 V 29700 2/3 24 MCM Basic+ 19.2 12402 V 29700 2/3 25 TMC Basic Basic+ -

Senderliste Radio

ÜBERSICHT RADIOSENDER Deutschsprachige Radiosender Radio Munot WDR 2 Radio SRF 1 FM1 WDR 3 Radio SRF 1 ZH FM1 Süd WDR 4 Radio SRF 1 BE toxic.fm WDR 5 Radio SRF 1 BS Radio Südostschweiz Fritz Radio SRF 1 AG Radio Rottu Sputnik Radio SRF 1 LU my105 radioeins Radio SRF 1 SG Virgin Radio Hits MDR Kultur Radio SRF 1 GR Virgin Radio Rock Klassik Radio Radio SRF 2 Kultur Rockit Radio DLF Kultur Radio SRF 3 Energy Hits hr2 Radio SRF 4 News Vintage Radio DLF Radio SRF Musikwelle diis Radio RTL Radio Radio SRF Virus James FM Antenne Bayern Swiss Pop Radio Top Two RSA Radio Swiss Classic Radio Kaiseregg Radio Regenbogen Swiss Jazz Radio Inside Radio Seefunk Radio RTR Schlager Radio Radio 7 Radio Freiburg Radio Tell Sunshine Live Canal 3 D Radio Eviva Oe 1 Radio Bern1 Radio Melody Oe 2 Vorarlberg Energy Bern Country Radio Switzerland Oe 3 Hitradio Radio RaBe Jam on Radio FM 4 Radio BeO GDS.FM Radio L Radio neo1 Open Broadcast Radio 32 Radio4TNG STINGRAY Radio Argovia Spitalradio Luz STINGRAY Swiss Hits Kanal K Radio Blind Power STINGRAY Rock Energy Basel Radio Gloria STINGRAY Drive Radio Basilisk Radio Maria Schweiz STINGRAY Kuschelsongs Radio X Life Channel STINGRAY Hits D Radio Pilatus ERF Plus STINGRAY Hits I Radio 3fach Radio Horeb STINGRAY Sommer Feelings Radio Sunshine Bayern 1 STINGRAY Dance Radio Central Bayern 2 STINGRAY Disco Funk Radio Zürisee BAYERN 3 STINGRAY Urban Radio 1 BR-KLASSIK STINGRAY Rewind Radio 24 SWR1 BW STINGRAY Revival Radio LoRa SWR2 STINGRAY RocknRoll Energy Zürich SWR3 STINGRAY Chansons 20 Minuten Radio SWR4 BW STINGRAY -

Die Tv-Sender Im Überblick … Liste Des Chaînes De

FRANZÖSISCHSPRACHIGE SENDER RADIOSENDER DIVERTISSEMENT Kanal Nummer DEUTSCH Kanal Nummer RTS 1 HD 79 Radio SRF 1 104 RTS 2 HD 80 Radio SRF 2 Kultur 105 TF 1 HD 81 Radio SRF 3 106 France 2 HD 82 Radio SRF 4 News 107 France 3 HD 83 Radio SRF Musikwelle 108 France 4 HD 84 Radio SRF Virus 109 DIE TV-SENDER IM ÜBERBLICK … France 5 HD 85 Swiss Pop 110 M6 HD 86 Swiss Classic 111 LISTE DES CHAÎNES DE TÉLÉVISION … W9 HD 87 Swiss Jazz 112 THE TV CHANNELS AT A GLANCE … RTL 9 HD 88 Radio BeO 113 TMC Monte Carlo HD 89 Radio Tell 114 TV5Monde 90 Radio Eviva 115 SPORTS Energy Bern 116 MySports One HD 91 Sputnik 117 Radio neo1 118 ITALIENISCHSPRACHIGE SENDER Bayern 1 119 DIVERTIMENTO BR-Klassik 120 RSI LA 1 HD 92 SWR1 BW 121 RSI LA 2 HD 93 SWR2 BW 122 TeleTicino HD 94 SWR3 123 Rai 1 HD 95 FRANZÖSISCH Rai 2 HD 96 RTS la 1 ère 124 Rai 3 HD 97 RTS Espace 2 125 Canale 5 HD 98 RTS Couleur 3 126 Italia 1 HD 99 RTS Option Musique 127 Rete 4 HD 100 Radio Suisse Classique 128 Rouge FM 129 INTERNATIONALSPRACHIGE SENDER ITALIENISCH RSI Rete uno 130 TVE Int. 101 RSI Rete due 131 RTP Int. 102 RSI Rete tre 132 TRT-TÜRK 103 Rai Radio 1 133 Rai Radio 2 134 Rai Radio 3 135 Rai Radio 3 Classica 136 DEUTSCHSPRACHIGE SENDER ENGLISCHSPRACHIGE SENDER UNTERHALTUNG Kanal Nummer NACHRICHTEN Kanal Nummer ENTERTAINMENT Kanal Nummer SRF 1 HD 1 euronews D 30 BBC One HD 60 SRF 2 HD 2 n-tv HD 31 BBC Two HD 61 SRF Info HD 3 WELT HD 32 CBBC HD 62 3+ HD 4 tagesschau24 HD 33 BBC Four/Cbeebies HD 63 TV24 HD 5 SPORT ITV 1 HD 64 S1 HD 6 MySports One HD 34 ITV 2 65 TV25 HD 7 SPORT1 HD 35 ITV 3 66 Das Erste HD 8 Eurosport 1 36 ITV 4 67 ZDF HD 9 Sky Sport News HD 37 Channel 4 HD 68 E4 69 ZDF neo HD 10 LANDESSCHAU Arte HD 11 Tele Bärn HD 38 More 4 70 3sat HD 12 TeleZüri HD 39 Film 4 71 RTL HD 13 TeleBielingue HD 40 Channel 5 72 RTL Zwei HD 14 TeleBasel HD 41 NEWS ProSieben HD 15 Tele M1 HD 42 CNN Int. -

Bilancio Di Sostenibilità Gruppo Rai Dichiarazione Consolidata 2020 Di Carattere Non Finanziario Redatta Ai Sensi Del D

Bilancio di Sostenibilità Gruppo Rai Dichiarazione consolidata 2020 di carattere non finanziario redatta ai sensi del D. Lgs 254/16 Bilancio di Sostenibilità Gruppo Rai Dichiarazione consolidata 2020 di carattere non finanziario redatta ai sensi del D. Lgs 254/16 Indice 4 Lettera agli Stakeholder 7 215 1. Scenario di riferimento 5. Il nostro impegno e identità del Gruppo Rai verso l’ambiente 31 235 2. I nostri Stakeholder 6. I nostri fornitori 79 253 3. Il nostro impegno 7. Il sistema di controllo per lo sviluppo del Paese interno e gestione dei rischi 187 4. Le nostre persone 265 268 Nota metodologica Indicatori GRI e tabelle di raccordo 280 Relazione della Società di Revisione 4 Lettera agli Stakeholder Lo sconvolgimento che si è determinato nel 2020, con l’avvento dell’emergenza pandemica, ha confermato ancora una volta l’importanza per il Paese di poter contare su un Servizio Pubblico multimediale in grado di affiancare e supportare una popolazione travolta da un sentiment caratterizzato principalmente da spavento e incertezza. In questo contesto, che si spera possa essere superato in tempi del tutto ragionevoli e che ha visto modificare la vita, le abitudini e gli interessi in genere di ciascuno, la Rai è repentinamente intervenuta su tutta l’offerta, attivando un insieme di iniziative sotto il profilo più squisitamente editoriale, per accompagnare e sostenere gli utenti, soprattutto i più svantaggiati. In particolare, i principali interventi hanno riguardato: il rafforzamento e la razionalizzazione dell’offerta informativa e istituzionale dei telegiornali e dei principali programmi di approfondimento, l’incremento dell’offerta divulgativa e culturale su tutte le Reti Tv e Radiofoniche e il potenziamento dell’offerta nelle piattaforme digitali. -

Scenario Di Riferimento E Identità Del Gruppo Rai

1. Scenario di riferimento e identità del Gruppo Rai Contesto 9 di riferimento Quadro normativo 13 e aspetti rilevanti per Rai Il Gruppo e il modello 15 di business Confronto con i principali 20 Servizi Pubblici europei Corporate 26 Governance Etica 29 del business 9 1. Scenario di riferimento e identità del Gruppo Rai 1.1 Contesto di riferimento Se per una qualsiasi impresa la capacità di generare valore sociale, al proprio interno così come nel contesto in cui opera, rappresenta un fattore competitivo, alla luce della sempre più evidente correlazione positiva tra performance del business e valore sociale generato, per il Gruppo Rai, concessionario di Servizio Pubblico, la capacità di creare un valore reale e percepibile rappresenta un imperativo ineludibile. Tale necessità non si riflette solo verso i propri utenti o le altre categorie di Stakeholder ma, più in generale, sull’intera collettività. Le parti che seguono identificano gli elementi essenziali delcontesto di riferimento entro il quale il Gruppo Rai si muove. Lo scenario di sostenibilità globale Il tema della sostenibilità continua ad acquisire una rilevanza a livello globale, tanto più in questa situazione emergenziale che ha colpito l’intero pianeta, con effetti che stanno determinando ricadute significative sui comportamenti delle imprese, delle persone e delle Istituzioni. Le organizzazioni, in particolare, stanno definendo modalità di condotta per identificare e attivare nuove pratiche volte a coniugare crescita, sostenibilità sociale e ambientale, con le performance economiche. Dal 24th Annual Global CEO Survey di PwC1, si riscontra una crescita di tematiche quali il cambiamento climatico, l’instabilità sociale e la disinformazione tra le venti principali minacce del 2021. -

TV Over IP Ch List & IP Adresses

Password for "Unprotected Sheet": upc MySports HD D / MySports HD F The base channel (in FTA groups 15 and 44) Weekly a game of the Swiss League and the National League Individual Bundesliga matches per season Formula E, Swiss handball, beach volleyball, TV over IP Ch List & IP Adresses Football and other sports Customer, [email protected], daqXXXxxx MySports Business DE* / FR* (PayTV) The premium package (only with AppearTV) Address, ZIP City The all-round package for true sports fans. Discover the MySports Pro world below. *inklusiv MySports Business 1 & 2 Selected Services Valid from 2020-10-16, replaces the last version from 2019-03-30. (Subject to change) HDTV Quantity: 0 Total 379 Services. 114 TV HD + 130 TV SD = Total 244 TV Services Radio: 135 Services TV Quantity: 0 HDTV & TV Quantity: 0 Note: bitrate is dependent on program content, and can vary. EPG for DVB-C (UPC Mini Head End) available. Radio Quantity: 0 Average bitrates: TV HD: 11.0 Mbps; TV SD: 4.5 Mbps; Radio: 0.4 Mbps EPG for IP Multicast Stream has to be edited by the customer Note: + = supported languages on many TV services are time and content dependent. himself, the EPG data can be downloaded via FTP access. Total Channel Group 0 E.g.: movies are often in multiple languages. capacity / dimensioning (click for information) Audio Selected Frequenzen Mcast Country Language Group Set TV Channel IP Address SID Type EPG Channel Group for Port ISO 3166-1 ISO 639-1 Name TSID mpeg ac-3 (x) DVB-C SRF 1 HD 239.192.0.82 3791 9038 TV HD CH de, + x x x 0 German SRF zwei HD 239.192.0.83 -

Senderliste Kabelfernsehen EW Goms

Senderliste Kabelfernsehen Nr. Sendername Frequenz Service-ID Nr. Sendername Frequenz Service-ID 1 SRF 1 (HD) 538000 2021 48 Super RTL 570000 2464 2 SRF zwei (HD) 538000 2023 49 Disney Channel 682000 2466 3 SRF info (HD) 594000 2030 50 KiKA (HD) 682000 2462 4 EWinfo 626000 4984 51 ONE (HD) 562000 2380 5 rroTV (HD) 626000 2104 52 zdf_neo (HD) 602000 2385 6 3+ (HD) 594000 2176 53 ZDFinfo (HD) 602000 2387 7 4+ (HD) 594000 2178 54 ARD-alpha 602000 2422 8 5+ (HD) 594000 2179 55 PHOENIX (HD) 562000 2427 9 S1 (HD) 634000 2182 56 tagesschau24 (HD) 554000 2378 10 TV24 (HD) 634000 2186 57 Welt (HD) 554000 2432 11 Puls 8 (HD) 634000 2187 58 euronews (HD) 706000 2436 12 Star TV (HD) 634000 2188 59 K-TV 810000 2513 13 SWISS 1 (HD) 634000 2196 60 Bibel TV (HD) 810000 2516 20 Das Erste (HD) 546000 2211 61 Eurosport 1 674000 2450 21 ZDF (HD) 546000 2213 62 Sport 1 (HD) 674000 2446 22 ORF 1 (HD) 538000 2221 63 Kanal 9 (HD) 658000 2107 23 ORF 2 (HD) 538000 2223 70 BBC One (HD) 690000 2833 24 RTL 642000 2280 71 BBC Two (HD) 722000 2835 25 SAT.1 642000 2290 72 itv (HD) 722000 2845 26 ProSieben 642000 2294 73 itv 2 818000 2846 27 VOX 642000 2301 74 BBC News (HD) 722000 2864 28 RTL 2 642000 2310 75 CNN Int. 570000 2868 29 kabel eins 642000 2307 80 RSI 1 (HD) 714000 2761 30 SWR BW (HD) 610000 2231 81 RSI 2 (HD) 714000 2763 31 BR (HD) 610000 2237 82 Rai 1 (HD) 714000 2770 32 WDR Köln (HD) 610000 2245 83 Rai 2 (HD) 714000 2771 33 hr-fernsehen (HD) 666000 2257 84 Rai News 818000 2810 34 MDR (HD) 666000 2260 85 Rai Sport (HD) 818000 2815 35 rbb (HD) 666000 2266 90 RTS un (HD) 570000 2681 36 NDR (HD) 554000 2271 91 RTS deux (HD) 570000 2683 37 3sat (HD) 562000 2391 92 TF1 (HD) 706000 2690 38 arte (HD) 546000 2393 93 France 2 (HD) 706000 2692 39 DMAX (HD) 674000 2322 94 France 24 506000 2748 40 NITRO 642000 2314 95 TVE 570000 3010 41 ProSieben MAXX 650000 2324 96 RTPi 506000 3080 42 SAT.1 Gold 642000 2330 97 Record Int. -

Canal Digitaal Is Een Merk Gebruikt Door Canal+ Luxembourg S.À.R.L

Deze lijst werd voor het laatst gewijzigd op 08/06/2021 voor digitale tv en radio via de satelliet Bezoek onze website voor nieuws en veelgestelde vragen: www.canaldigitaal.nl/klantenservice Bezoek ons blog voor meer informatie: www.canaldigitaal.nl/blog Instructievideo’s (o.a. voor het inladen van de zenderlijst): www.canaldigitaal.nl/video Voork. Zender TV/RAdio Positie Freq. H-V Symb. FEC Te zien met/vanaf Genre 1 NPO 1 HD TV 23,5 12187 H 29900 2/3 Riant Algemeen 2 NPO 2 HD TV 23,5 11739 V 29900 2/3 Riant Algemeen 3 NPO 3 HD TV 23,5 12187 H 29900 2/3 Riant Algemeen 4 RTL 4 HD TV 23,5 11856 V 29900 2/3 Riant Algemeen 5 RTL 5 HD TV 23,5 11856 V 29900 2/3 Riant Algemeen 6 SBS 6 HD TV 23,5 11739 V 29900 2/3 Riant Algemeen 7 RTL 7 HD TV 23,5 11856 V 29900 2/3 Riant Algemeen 8 Veronica / DisneyXD HD TV 23,5 12187 H 29900 2/3 Riant Algemeen/Kids 9 Net5 HD TV 23,5 12187 H 29900 2/3 Riant Algemeen 10 RTL 8 HD TV 23,5 11856 V 29900 2/3 Riant Algemeen 11 FOX TV 23,5 11739 V 29900 2/3 Riant TV-series 12 SBS9 TV 23,5 12129 V 29900 2/3 Riant Algemeen 13 RTL Z TV 23,5 11856 V 29900 2/3 Riant 14 Filmbox HD TV 23,5 11739 V 29900 2/3 Riant 15 één HD TV 23,5 12187 H 29900 2/3 Riant Algemeen 16 Canvas HD TV 23,5 12187 H 29900 2/3 Riant Culture 17 Comedy Central TV 23,5 11934 V 27500 3/4 Riant Humor/Kids 18 BBC First HD TV 23,5 12187 H 29900 2/3 Riant 19 BBC Entertainment TV 23,5 11739 V 29900 2/3 Rijk 20 Spike TV 23,5 11934 V 27500 3/4 Riant 21 National Geographic HD TV 23,5 12129 V 29900 2/3 Riant Documentaires 22 Film 1 Premiere HD TV 23,5 12129 V 29900 2/3 Film1 Films 23 Film 1 Action TV 23,5 12129 V 29900 2/3 Film1 Films 24 Film 1 Family TV 23,5 12129 V 29900 2/3 Film1 Films 25 Film 1 Drama TV 23,5 12129 V 29900 2/3 Film1 Films 26 XITE HD TV 0,0 0 H 0 Riant 27 FIGHTBOX TV 23,5 11739 V 29900 2/3 Riant 28 Eurosport 1 Deutschland TV 19,2 12226 H 27500 3/4 Vrij te ontvangen Sport 29 ESPN HD TV 23,5 11739 V 29900 2/3 ESPN Compleet, Rijk Sport 30 ESPN 2 HD TV 23,5 11856 V 29900 2/3 ESPN Compleet Sport © 2021 Canal+ Luxembourg S.à.r.l. -

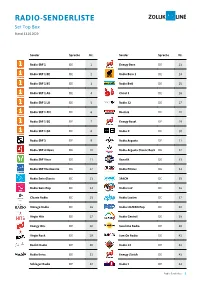

RADIO-SENDERLISTE Set Top Box Stand: 13.10.2020

RADIO-SENDERLISTE Set Top Box Stand: 13.10.2020 Sender Sprache Nr. Sender Sprache Nr. Radio SRF 1 DE 1 Energy Bern DE 23 Radio SRF 1 BE DE 2 Radio Bern 1 DE 24 Radio SRF 1 BS DE 3 Radio BeO DE 25 Radio SRF 1 AG DE 4 Canal 3 DE 26 Radio SRF 1 LU DE 5 Radio 32 DE 27 Radio SRF 1 ZH DE 6 Basilisk DE 28 Radio SRF 1 SG DE 7 Energy Basel DE 29 Radio SRF 1 GR DE 8 Radio X DE 30 Radio SRF 3 DE 9 Radio Argovia DE 31 Radio SRF 4 News DE 10 Radio Argovia Classic Rock DE 32 Radio SRF Virus DE 11 Kanal K DE 33 Radio SRF Musikwelle DE 12 Radio Pilatus DE 34 Radio SwissClassic DE 13 3FACH DE 35 Radio SwissPop DE 14 Radio LuZ DE 36 Classix Radio DE 15 Radio Lozärn DE 37 Vintage Radio DE 16 Radio LUZERN Pop DE 38 Virgin Hits DE 17 Radio Central DE 39 Energy Hits DE 18 Sunshine Radio DE 40 Virgin Rock DE 19 Jam On Radio DE 41 Rockit Radio DE 20 Radio 24 DE 42 Radio Eviva DE 21 Energy Zürich DE 43 Schlager Radio DE 22 Radio 1 DE 44 Radio-Senderliste 1 Sender Sprache Nr. Sender Sprache Nr. Kanal8610 DE 45 RSA Radio DE 71 Radio Zürichsee DE 46 Antenne Voralberg DE 72 Radio Top DE 47 ERF Plus DE 73 Top Two DE 48 BBC World Service EN 74 Radio Stadtfilter DE 49 Rai Isoradio IT 75 Radio 4TNG DE 50 RTL Radio 102.5 IT 76 Radio Munot DE 51 Deejay IT 77 Radio Rasa DE 52 Rouge FM FR 78 FM1 DE 53 RJB FR 79 Radio Melody DE 54 GRRIF FR 80 Toxic FM DE 55 NPO Radio 1 NL 81 Radio Südostschweiz DE 56 Radio SRF 2 DE 82 rro DE 57 Radio SwissJazz DE 83 rro swiss melody DE 58 20 Minuten Radio DE 84 rro müsig pur DE 59 Life Channel DE 85 diis Radio DE 60 Radio Gloria DE 86 Radio Freiburg DE 61 Radio Maria DE 87 BR Heimat DE 62 RaBe DE 88 BR puls DE 63 neo 1 DE 89 mdr Klassik DE 64 Radio Tell Heimatklang DE 90 Kulturradio DE 65 Radio Inside DE 91 NDR Blue DE 66 Radio LoRa DE 92 NDR Info DE 67 SWR 1 BW DE 93 baden.fm DE 68 SWR 2 BW DE 94 rundfunk.fm DE 69 SWR 3 DE 95 Radio Smash DE 70 SWR 4 BW DE 96 Radio-Senderliste 2 Sender Sprache Nr. -

Palinsesti 16 Luglio 2020 Compressed

Anno LXII n.29 16 Luglio 2020 Indice 5 6 12 18 20 25 27 32 65 70 92 116 133 134 145 148 151 154 156 È un anno speciale per tutti, ma ancora di più per i bambini e i ragazzi. Dopo una esperienza così straordinaria, l’offerta Rai per i più giovani cambia e amplia i suoi obiettivi. La chiusura delle scuole e la quarantena hanno interrotto la routine di normalità e soprattutto quella rete di relazioni sociali, a partire dai compagni e dagli ami- ci, che è essenziale per la crescita personale. L’incertezza, la preoccupazione per la salute di genitori e nonni, lo stress dell’isolamento, hanno portato conse- guenze psicologiche profonde. La Rai è stata chiamata di colpo a fare di più: informazione su quello che stava accadendo con il linguaggio adatto ai più piccoli, educazione per ragazzi che la mattina non avevano più scuola, intrattenimento per le lunghe giornate chiusi in casa, persino terapia, contro lo stress, l’ansia, le regressioni infantili, la mancan- za di movimento, per favorire la condivisione e la comunicazione nelle case. È una esperienza che ha cambiato il rapporto tra Rai Ragazzi e il suo pubblico, come dimostra anche il boom di interazioni social. E che adesso riallinea le pri- orità editoriali al vissuto dei ragazzi e delle famiglie. Parole come socialità, responsabilità delle proprie azioni, fiducia nel futuro e nella scienza, impegno nello studio, fantasia, acquistano un significato nuovo. Sullo sfondo la visione del nostro unico pianeta e il tema della sostenibilità del- lo sviluppo. Le Nazioni Unite hanno fissato 17 obiettivi di sviluppo sostenibile da raggiungere per il 2030.