The Director, Bureau of Retirement Claims

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

III. 3. Rights Claimed by Littoral States in Adjacent Seas. Claims to The

International Law Studies – Volume 46 International Law Documents U.S. Naval War College (Editor) The thoughts and opinions expressed are those of the authors and not necessarily of the U.S. government, the U.S. Department of the Navy or the Naval War College. 182 navigable waters, within the limits to be defined and under conditions to be prescribed by him, provided application is made to him prior to depositing such material; and whenever any permit is so granted the conditions thereof shall be strictly complied with, and any violation thereof shall be unlawful. (3) Oil Pollution Act, 7 june 1924 (excerpts) (43 Stat. 604-605.) SEc. 2. When used in this Act, unless the context otherwise requires- (a) The term "oil" means oil of any kind or in any form, including fuel oil, oil sludge, and oil refuse; (b) The term "person" means an individual, partnership, corporation, or association; any o':vner, master, officer or em ployee of a vessel; and any officer, agent, or employee of the United States; (c) The term "coastal navigable waters of the United States" means all portions of the sea within the territorial jurisdiction of the United States, and all inland waters navigable in fact in which the tide ebbs and flows; (d) The term "Secretary" means the Secretary of War. (43 Stat. 604-605, ch. 316.) SEc. 3. That, except in case of emergency imperiling life or property, or unavoidable accident, collision, or stranding, and except as otherwise permitted by regulations prescribed by the Secretary as hereinafter authorized, it shall be unlawful for any person to discharge, or suffer, or permit the discharge of oil by any method, means, or manner into or upon the coastal navi gable waters of the United States from any vessel using oil as fuel for the generation of propulsion power, or any vessel carry ing or having oil thereon in excess of that necessary for its lubricating requirements and such as may be required under the laws of the United States and the rules and regulations pre scribed thereunder. -

June, 1947 1/3/47 I Ice Skating Carnivals in Each Five Boroughs On

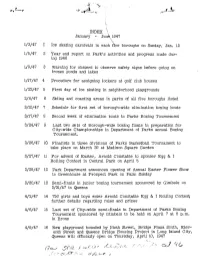

INDEX \ January - June, 1947 1/3/47 I Ice skating carnivals in each five boroughs on Sunday, Jan. 12 1/5/47 2 Year end report on Park's activities and progress made dur- ing 1946 1/9/47 3 Warning for skaters to observe safety signs before going on frozen ponds and lakes 1/17/47 4 Procedure for assigning lockers at golf club houses 1/22/47 5 First day of ice skating in neighborhood playgrounds 2/8/47 6 Skiing and coasting areas in parks of all five boroughs listed 3/10/47 7 Schedule for first set of borough-wide elimination boxing bouts 3/17/47 8 Second week of elimination bouts in Parks Boxing Tournement 3/24/47 9 Last two sets of Borough-wide boxing finals in preparation for City-wide Championships in Department of Parks annual Boxing Tournement. 3/26/47 10, Finalists in three divisions of Parks Basketball Tournament to take place on March 29 at Madison Square Garden 3/27/47 11 For advent of Easter, Arnold Constable to sponser Egg & I Rolling Contest in Central Park on April 5 3/29/47 12 Park Department announces opening of Annual Easter Flower Show in Greenhouse at Prospect Park on Palm Sunday 3/30/47 13 Semi-finals in junior boxing tournement sponsored by Gimbels on 3/31/47 in Queens 4/2/47 14 750 girls and boys enter Arnold Constable Egg & I Rolling Contest; further details regarding rules and prizes 4/6/47 15 Last set of City-wide semi-finals in Department of Parks Boxing Tournement sponsored by Gimbels to be held on April 7 at 8 p.m. -

Convention on International Civil Aviation Signed at Chicago on 7 December 1944

CONVENTION ON INTERNATIONAL CIVIL AVIATION SIGNED AT CHICAGO ON 7 DECEMBER 1944 Entry into force: The Convention entered into force on 4 April 1947. Status: 193 parties. This list is based on information received from the depositary, the Government of the United States of America Date of deposit of instrument of ratification or notification of State adherence (A) Afghanistan 4 April 1947 Albania 28 March 1991 (A) Algeria 7 May 1963 (A) Andorra 26 January 2001 (A) Angola 11 March 1977 (A) Antigua and Barbuda 10 November 1981 (A) Argentina 4 June 1946 (A) Armenia 18 June 1992 (A) Australia 1 March 1947 Austria 27 August 1948 (A) Azerbaijan 9 October 1992 (A) Bahamas 27 May 1975 (A) Bahrain 20 August 1971 (A) Bangladesh 22 December 1972 (A) Barbados 21 March 1967 (A) Belarus 4 June 1993 (A) Belgium 5 May 1947 Belize 7 December 1990 (A) Benin 29 May 1961 (A) Bhutan 17 May 1989 (A) Bolivia (Plurinational State of) 4 April 1947 Bosnia and Herzegovina 13 January 1993 (A) Botswana 28 December 1978 (A) Brazil 8 July 1946 Brunei Darussalam 4 December 1984 (A) Bulgaria 8 June 1967 (A) Burkina Faso 21 March 1962 (A) Burundi 19 January 1968 (A) Cabo Verde 19 August 1976 (A) Cambodia 16 January 1956 (A) Cameroon 15 January 1960 (A) Canada 13 February 1946 Central African Republic 28 June 1961 (A) Chad 3 July 1962 (A) Chile 11 March 1947 China (1) 20 February 1946 Colombia 31 October 1947 Comoros 15 January 1985 (A) Congo 26 April 1962 (A) Cook Islands 20 August 1986 (A) Costa Rica 1 May 1958 Côte d’Ivoire 31 October 1960 (A) Croatia 9 April 1992 (A) -

Social Security Legislation, January-June 1948: Legislative History and Background

Social Security Legislation, January-June Historical Background One of the first significant steps 1948: Legislative History and Background leading to the passage of the news vendors law occurred in April 1944, By Wilbur J. Cohen and James L. Calhoon* when the Supreme Court declared that vendors making street sales at established locations and working The following article outlines the legislation in the field full time for the Hearst Corporation of social security enacted by the Eightieth Congress in the and other publishers in Los Angeles first 6 months of 1948. Because of the divergent viewpoints were employees of the newspapers for underlying the development of some of the amendments purposes of the National Labor Re• and the implication of the provisions for the social security lations Act (National Labor Relations program, the authors have also sketched in briefly, as a Board v. Hearst Publications, Inc., 322 matter of record, the legislative history and background of U. S. 111). This decision seemed to the various provisions. indicate that the vendors might be employees under the Social Security THERE was considerable legislative cording to the sponsor of the legis• Act. In 1946 the District Court of the activity in the field of social security lation, are affected immediately.1 United States for the Northern Dis• during the second regular session of The new law does not change the trict of California, Southern Division, the Eightieth Congress. Numerous status of the ordinary newsboy. Most heard the cases, Hearst Publications, bills to amend the Social Security Act newsboys are not covered by the Social Inc. -

'The Partition of India' from the Süddeutsche Zeitung (14 June 1947)

'The partition of India' from the Süddeutsche Zeitung (14 June 1947) Caption: On 14 June 1947, the German daily newspaper Süddeutsche Zeitung considers the implications of India’s political independence and expresses fears of future violence between the Hindu and Muslim communities following the partition of India and Pakistan. Source: Süddeutsche Zeitung. Münchner Neueste Nachrichten aus Politik, Kultur, Wirtschaft und Sport. Hrsg. Friedmann, Werner; Goldschagg, Edmund; Schöningh, Dr. Franz Joseph; Schwingenstein, August. 14.06.1947. München: Süddeutscher Verlag. "Indiens Teilung", auteur:WS , p. 1. Copyright: (c) Translation CVCE.EU by UNI.LU All rights of reproduction, of public communication, of adaptation, of distribution or of dissemination via Internet, internal network or any other means are strictly reserved in all countries. Consult the legal notice and the terms and conditions of use regarding this site. URL: http://www.cvce.eu/obj/the_partition_of_india_from_the_suddeutsche_zeitung_14_ june_1947-en-bef70443-3cc5-42a8-aebe-c73c1b630550.html Last updated: 01/03/2017 1/3 The partition of India What is taking place at the present time is surely the most significant event in recent English history, but it is, in fact, too much overshadowed by other events on the international political stage for the European observer to catch sight of it. This event is the partitioning of British India, something that may well lead to its departure from the British Commonwealth of nations. When Lord Mountbatten succeeded Lord Wavell as the Viceroy of India in late February, he was aware that the tasks that he faced in that office would be completely different from the problems that had occupied his lengthy chain of predecessors since the creation of the office of Viceroy by Lord Canning in 1858. -

New Evidence on the Soviet Rejection of the Marshall Plan, 1947: Two Reports”

WOODROW WILSON INTERNATIONAL CENTER FOR SCHOLARS NEW EVIDENCE ON THE SOVIET Lee H. Hamilton, Christian Ostermann, Director Director REJECTION OF THE MARSHALL BOARD OF PLAN, 1947: TWO REPORTS TRUSTEES: ADVISORY COMMITTEE: Joseph A. Cari, Jr., Chairman SCOTT D. PARRISH William Taubman Steven Alan Bennett, University of Texas in Austin (Amherst College) Vice Chairman Chairman PUBLIC MEMBERS MIKHAIL M. NARINSKY Michael Beschloss The Secretary of State (Historian, Author) Colin Powell; Institute of Universal History, Moscow The Librarian of Congress James H. Billington James H. Billington; Working Paper No. 9 (Librarian of Congress) The Archivist of the United States John W. Carlin; Warren I. Cohen The Chairman of the (University of Maryland- National Endowment Baltimore) for the Humanities Bruce Cole; John Lewis Gaddis The Secretary of the Smithsonian Institution (Yale University) Lawrence M. Small; The Secretary of Education James Hershberg Roderick R. Paige; (The George Washington The Secretary of Health University) & Human Services Tommy G. Thompson; Washington, D.C. Samuel F. Wells, Jr. PRIVATE MEMBERS (Woodrow Wilson Center) Carol Cartwright, March 1994 John H. Foster, Jean L. Hennessey, Sharon Wolchik Daniel L. Lamaute, (The George Washington Doris O. Mausui, University) Thomas R. Reedy, Nancy M. Zirkin COLD WAR INTERNATIONAL HISTORY PROJECT THE COLD WAR INTERNATIONAL HISTORY PROJECT WORKING PAPER SERIES CHRISTIAN F. OSTERMANN, Series Editor This paper is one of a series of Working Papers published by the Cold War International History Project of the Woodrow Wilson International Center for Scholars in Washington, D.C. Established in 1991 by a grant from the John D. and Catherine T. MacArthur Foundation, the Cold War International History Project (CWIHP) disseminates new information and perspectives on the history of the Cold War as it emerges from previously inaccessible sources on “the other side” of the post-World War II superpower rivalry. -

Government Records Concerning the Roswell Crash

...... ·- .. · United States General Accounting Office GAO· Washington, D.C. 20548 National Security and International Affairs Division B-262046 July 28, 1995 The Honorable Steven H. Schiff House of Representatives Dear Mr. Schiff: On July 8, 1947, the Roswell Anny Air Field (RAAF) public information office in Roswell, New Mexico, reported the crash and recovery of a "flying disc." Army Air Forces personnel from the RM.F's 509th Bomb Group were credited with the recovery. The following day, the press reported that the Commanding General of the U.S. Eighth Air Force, Fort Worth, Texas, announced that RAAF personnel had recovered a crashed radar-tracking (weather) balloon, not a "flying disc." After nearly 50 years, speculation continues on what crashed at Roswell. Some observers believe that the object was of extraterrestrial origin. In the July 1994 Report of Air Force Research Regarding the Roswell Incident, the Air Force did not dispute that something happened near Roswell, but reported that the most likely source of the wreckage was from a balloon-launched classified government project designed to determine the state of Soviet nuclear weapons research. The debate on what crashed at Roswell continues. Concerned that the Department of Defense (DOD) may not have provided you with all available infonnation on the crash, you asked us to determine the requirements for reporting air accidents similar to the crash near Roswell and identify any government records concerning the Roswell crash. We conducted an extensive search for government records related to the crash near Roswell. We examined a wide range of classified and unclassified documents dating from July 1947 through the 1950s. -

Major Economic Changes in 1948

UNITED NATIONS MAJOR ECONOMIC CHANGES IN 1948 Department of Economic Affairs Lake Success, New York January 1949 Major Economic Changes in" 1948 Department of Economic Affairs UNITED NATIONS Lake Success, New York January 1949 UNITED NATIONS PUBLICATIONS Sales No.: 1949. n.C. I PREFACE Ma]or Economic Changes in 1948 is the third of a series of reports dealing with world economic conditions, prepared by the Department of Economic Affairs of the United Nations. The first, Economic Report: Salient Features of the World Economic Situation 1945-47, was issued in January 1948; a supple- ment to that report, Selected World Economic Indices, was issued in July 1948. The purpose of the present publication is to make generally available a preliminary review of important economic developments which occurred during 1948. It is being issued at this time in order to provide the Economic and Social Council with a useful factual background for discussion of the current world economic situation at its eighth session in February 1949. A comprehensive economic survey of the world situation will be issued towards the middle of 1949. That survey will take account both of the regional economic reports which will become available during the early months of 1949 from the secre- tariats of the regional economic commissions of the United Nations in Europe, Latin America and the Far East, and of the economic activities of the specialized agencies. Part I of Major Economic Changes in 1948 provides a broad picture of the main economic develop- ments during the year 1948, based on data, necessarily incomplete for the year, which were available at the time the report was prepared. -

US Coast Guard Log Books

USCG Log Books - 1947 Series (RG 26, Entry 159G) Box 1 Box 12 Acacia (Jan.-Dec.) Arundel (June-Dec.) Active (Jan.-Feb.) Aspen (Jan.) Aster (Aug.-Dec.) Box 2 Active (Mar.-Aug.) Box 13 Acushnet (Jan.-Aug.) Atalanta (Jan.-July) Aurora (Jan.-June) Box 3 Acushnet (Sept.-Dec.) Box 14 Agassiz (Jan.-Nov.) Aurora (July-Dec.) Balsam (Jan.-Mar., Dec.) Box 4 Barberry (Jan.-Apr.) Agassiz (Dec.) Air Ibis (Jan.-Apr.) Box 15 Air Mallard (Jan.) Barberry (May-Dec.) Air Puffin (Jan.) Basswood (Jan.-June) Alder (Jan.-Mar.) Alert (Jan.-Apr.) Box 16 Basswood (July-Dec.) Box 5 Bedloe (Jan.-July) Alert (May-Dec.) Beech (Jan.-Mar.) Algonquin (Jan.) Althea (Jan.-Apr.) Box 17 Beech (Apr.-Dec.) Box 6 Bibb (Jan.-June) Althea (May-Dec.) Androscoggin (Jan.-Apr.) Box 18 Bibb (July-Dec.) Box 7 Birch (Jan.-Apr.) Androscoggin (May-Nov.) Box 19 Box 8 Birch (May-Dec.) Androscoggin (Dec.) Bittersweet (Jan.-June) Anemone (Jan.-June) Apalachee (Jan.-Mar.) Box 20 Bittersweet (July-Dec.) Box 9 Blackhaw (Jan.-Aug.) Apalachee (Apr.-Dec.) Arbutus (Jan.-June) Box 21 Blackhaw (Sept.-Dec.) Box 10 Blackrock (Jan.-Oct.) Arbutus (July-Dec.) Argo (Jan.-Aug.) Box 22 Blackrock (Nov.-Dec.) Box 11 Blackthorn (Jan.-Dec.) Argo (Sept.-Dec.) Bluebell (Jan.) Arundel (Jan.-May) Box 23 Box 36 Bluebell (Feb.-Dec.) Cherokee (Jan.-Oct.) Bluebonnet (Dec. 1946-Apr. 1947) Box 37 Box 24 Cherokee (Nov.-Dec.) Bluebonnet (Apr.-Dec.) Cherry (Jan.-Dec.) Bonham (Jan.-May) Chinook (Jan.) Box 25 Box 38 Bonham (June-Dec.) Chinook (Feb.-Dec.) Boutwell (Jan.-June) Citrus (Jan.-Mar.) Box 26 Box 39 Boutwell (July-Dec.) -

2 the Three Partitions of 1947

2 The three partitions of 1947 Elections, commissions, protest and strife The years 1945 to 1947 were marked by intense struggle in the sub continent. What the Second World War established, and the end of the war only underlined, was the changed military, political and economic position of Britain in the world and the radical transformation of the political temper in India. All this lent unprecedented urgency to the question of the transfer of power and the establishment of national gov- ernment(s) in the subcontinent. It was in this situation that the Indian National Congress leadership was released from jail, efforts at mobilisa tion of different sections of the society were actively renewed, large-scale urban demonstrations and rural uprisings occurred, new elections were held and sustained high-level constitutional negotiations took place after 1945. Much of the politics of the previous three or four decades had been about national liberation. It was a serious complication that the call for Indian self-government was now joined by the call for Muslim self- government in a new country to be named Pakistan. Talk of independence was rife. However, while the Congress and those in sympathy with it ex pected the independence of a united India, the Muslim League slogan became 'Pakistan for Independence'. There were two nations in India, it was argued, and the acceptance of the Pakistan demand was the only road to the genuine independence of all Indians, the Muslims in a free Pakistan and the Hindus in a free Hindustan. Yet the idea of Pakistan itself, the proposal for a partition of British India between its Muslim-majority and its Hindu-majority provinces, had not had a long history. -

UAW Local 78 Records

THE UAW LOCAL 78 COLLECTION Papers, 1938-1968 (Predominantly, 1940-1964) 101/2 linear feet Accession Number 645 L. C. Number MS The papers of UAW Local 78 were placed in the Archives of Labor and Urban Affairs in May of 1974, by Local 78 President Edward Tillis and were opened for research in August of 1984. UAW Local 78 was chartered September 5, 1947, from Detroit's UAW Amalgamated West-Side Local 174 to represent the hourly workers of the Kelsey-Hayes Wheel Company who had previously been within Local 174 since 1937. The papers of Local 78 reflect the efforts to secure wage increases from the War Labor Board during World War II, its acquisition of a charter as an independent local and its participation in the Civil Rights movement. Important subjects covered in this collection are: Civil Rights Labor During World War II Cold War Women's Concerns Among the important correspondents are: Emil Mazey Victor Reuther Roy Reuther Walter Reuther An index to subjects and correspondents will be found on pg. 7 UAW Local 78 Collection - 2 - Contents 21 manuscript boxes Series I, UAW West-Side Local 174, 1938-1947, Boxes 1-2: Announcements, arbitration records, bargaining committee reports, correspondence, and other items relating to Kelsey-Hayes workers while represented by Local 174. Series II, UAW Local 78, 1947-1968, Boxes 3-21: Agendas, announcements, bargaining committee reports, correspondence, and other items relating to Kelsey-Hayes during the period of the Cold War and of the Civil Rights movement. Non-manuscript Material: Received in this collection were 40 published pamphlets concerned various subjects relating to the Local's and other union activities. -

Cedarville College Bulletin, June 1947 Cedarville College

Cedarville University DigitalCommons@Cedarville Cedarville College Bulletin 6-1947 Cedarville College Bulletin, June 1947 Cedarville College Follow this and additional works at: https://digitalcommons.cedarville.edu/cc_bulletin Part of the Higher Education Commons, and the Organizational Communication Commons Recommended Citation Cedarville College, "Cedarville College Bulletin, June 1947" (1947). Cedarville College Bulletin. 181. https://digitalcommons.cedarville.edu/cc_bulletin/181 This Book is brought to you for free and open access by DigitalCommons@Cedarville, a service of the Centennial Library. It has been accepted for inclusion in Cedarville College Bulletin by an authorized administrator of DigitalCommons@Cedarville. For more information, please contact [email protected]. Cedarville College Bulletin Vol. XXX Cedarville, Ohio, June 1947 No. 3 Summer Sessions Begin on June 9 and July 14 at Cedarville College Commencement Week Program Baccalaureate 8:00 p. m. Sunday, May 25, 1947 Speaker Dr. John W. Bickett, ‘97. Alumni Reunion Wednesday, May 28, 1947. Commencement Thursday, May 29, 1947. Speaker Dr. J. Alvin Orr, ‘97. It is suggested that old grad uates, especially members of the classes that end in seven plan to spend the week at Cedar ville College. Dean C. W. Steele has receiv ed word that former Governor M. ,Q. Sharpe of Kennebec, South Dakota has returned to private practice and business. It will be remembered that Gov ernor Sharpe received the de gree of Doctor of Humanities at Cedarville College last Sept ember. College Adjusts Religious Emphasis Week March 17-21 To GI Influx likely that Harriman Hall will During the week of March 17 Summer School be used as a girls’ dormitory to 21, Religious Emphasis Week Cedarville College is adjust Dates Announced for the Summer School.