Athi River Investment Opportunity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

County Urban Governance Tools

County Urban Governance Tools This map shows various governance and management approaches counties are using in urban areas Mandera P Turkana Marsabit P West Pokot Wajir ish Elgeyo Samburu Marakwet Busia Trans Nzoia P P Isiolo P tax Bungoma LUFs P Busia Kakamega Baringo Kakamega Uasin P Gishu LUFs Nandi Laikipia Siaya tax P P P Vihiga Meru P Kisumu ga P Nakuru P LUFs LUFs Nyandarua Tharaka Garissa Kericho LUFs Nithi LUFs Nyeri Kirinyaga LUFs Homa Bay Nyamira P Kisii P Muranga Bomet Embu Migori LUFs P Kiambu Nairobi P Narok LUFs P LUFs Kitui Machakos Kisii Tana River Nyamira Makueni Lamu Nairobi P LUFs tax P Kajiado KEY County Budget and Economic Forums (CBEFs) They are meant to serve as the primary institution for ensuring public participation in public finances in order to im- Mom- prove accountability and public participation at the county level. basa Baringo County, Bomet County, Bungoma County, Busia County,Embu County, Elgeyo/ Marakwet County, Homabay County, Kajiado County, Kakamega County, Kericho Count, Kiambu County, Kilifi County, Kirin- yaga County, Kisii County, Kisumu County, Kitui County, Kwale County, Laikipia County, Machakos Coun- LUFs ty, Makueni County, Meru County, Mombasa County, Murang’a County, Nairobi County, Nakuru County, Kilifi Nandi County, Nyandarua County, Nyeri County, Samburu County, Siaya County, TaitaTaveta County, Taita Taveta TharakaNithi County, Trans Nzoia County, Uasin Gishu County Youth Empowerment Programs in urban areas In collaboration with the national government, county governments unveiled -

Sediment Dynamics and Improvised Control Technologies in the Athi River Drainage Basin, Kenya

Sediment Dynamics in Changing Environments (Proceedings of a symposium held 485 in Christchurch, New Zealand, December 2008). IAHS Publ. 325, 2008. Sediment dynamics and improvised control technologies in the Athi River drainage basin, Kenya SHADRACK MULEI KITHIIA Postgraduate Programme in Hydrology, Department of Geography and Environmental Studies, University of Nairobi, PO Box 30197, 00100 GPO, Nairobi, Kenya [email protected] Abstract In Kenya, the changing of land-use systems from the more traditional systems of the 1960s to the present mechanized status, contributes enormous amounts of sediments due to water inundations. The Athi River drains areas that are subject to intense agricultural, industrial, commercial and population settlement activities. These activities contribute immensely to the processes of soil erosion and sediment transport, a phenomenon more pronounced in the middle and lower reaches of the river where the soils are much more fragile and the river tributaries are seasonal in nature. Total Suspended Sediments (TSS) equivalent to sediment fluxes of 13 457, 131 089 and 2 057 487 t year-1 were recorded in the headwater areas, middle and lower reaches of the river, respectively. These varying trends in sediment transport and amount are mainly due to the chemical composition of the soil coupled with the land-soil conservation measures already in practice, and which started in the 1930s and reached their peak in the early 1980s. This paper examines trends in soil erosion and sediment transport dynamics progressively downstream. The land-use activities and soil conservation, control and management technologies, which focus on minimizing the impacts of overland flow, are examined to assess the economic and environmental sustainability of these areas, communal societal benefits and the country in general. -

The Water Crisis in Kenya: Causes, Effects, and Solutions

Global Majority E-Journal, Vol. 2, No. 1 (June 2011), pp. 31-45 The Water Crisis in Kenya: Causes, Effects and Solutions Samantha Marshall Abstract Located on the eastern coast of Africa, Kenya, a generally dry country with a humid climate, is enduring a severe water crisis. Several issues such as global warming (causing recurrent and increasingly severe droughts as well as floods), the contamination of drinking water, and a lack of investment in water resources have enhanced the crisis. This article provides an overview of Kenya’s water crisis, along with a brief review of the literature and some empirical background. It reviews the main causes of the water crisis and how it affects the health of millions of Kenyans. Furthermore, the article summarizes some of the main solutions proposed to overcome the crisis. I. Introduction There are about 40 million people living in Kenya, of which about 17 million (43 percent) do not have access to clean water.1 For decades, water scarcity has been a major issue in Kenya, caused mainly by years of recurrent droughts, poor management of water supply, contamination of the available water, and a sharp increase in water demand resulting from relatively high population growth. The lack of rainfall affects also the ability to acquire food and has led to eruptions of violence in Kenya. In many areas, the shortage of water in Kenya has been amplified by the government’s lack of investment in water, especially in rural areas. Most of the urban poor Kenyans only have access to polluted water, which has caused cholera epidemics and multiple other diseases that affect health and livelihoods. -

Baseline Review and Ecosystem Services Assessment of the Tana River Basin, Kenya

IWMI Working Paper Baseline Review and Ecosystem Services Assessment of the Tana 165 River Basin, Kenya Tracy Baker, Jeremiah Kiptala, Lydia Olaka, Naomi Oates, Asghar Hussain and Matthew McCartney Working Papers The publications in this series record the work and thinking of IWMI researchers, and knowledge that the Institute’s scientific management feels is worthy of documenting. This series will ensure that scientific data and other information gathered or prepared as a part of the research work of the Institute are recorded and referenced. Working Papers could include project reports, case studies, conference or workshop proceedings, discussion papers or reports on progress of research, country-specific research reports, monographs, etc. Working Papers may be copublished, by IWMI and partner organizations. Although most of the reports are published by IWMI staff and their collaborators, we welcome contributions from others. Each report is reviewed internally by IWMI staff. The reports are published and distributed both in hard copy and electronically (www.iwmi.org) and where possible all data and analyses will be available as separate downloadable files. Reports may be copied freely and cited with due acknowledgment. About IWMI IWMI’s mission is to provide evidence-based solutions to sustainably manage water and land resources for food security, people’s livelihoods and the environment. IWMI works in partnership with governments, civil society and the private sector to develop scalable agricultural water management solutions that have -

Geology of the Nairobi Region, Kenya

% % % % % % % % %% %% %% %% %% %% %% % GEOLOGIC HISTORY % %% %% % % Legend %% %% %% %% %% %% %% % % % % % % HOLOCENE: %% % Pl-mv Pka %%% Sediments Mt Margaret U. Kerichwa Tuffs % % % % %% %% % Longonot (0.2 - 400 ka): trachyte stratovolcano and associated deposits. Materials exposed in this map % %% %% %% %% %% %% % section are comprised of the Longonot Ash Member (3.3 ka) and Lower Trachyte (5.6-3.3 ka). The % Pka' % % % % % % L. Kerichwa Tuff % % % % % % Alluvial fan Pleistocene: Calabrian % % % % % % % Geo% lo% gy of the Nairobi Region, Kenya % trachyte lavas were related to cone building, and the airfall tuffs were produced by summit crater formation % % % % % % % % % % % % % % % % % Pna % % % % %% % (Clarke et al. 1990). % % % % % % Pl-tb % % Narok Agglomerate % % % % % Kedong Lake Sediments Tepesi Basalt % % % % % % % % % % % % % % % % %% % % % 37.0 °E % % % % 36.5 °E % % % % For area to North see: Geology of the Kijabe Area, KGS Report 67 %% % % % Pnt %% % PLEISTOCENE: % % %% % % % Pl-kl %% % % Nairobi Trachyte % %% % -1.0 ° % % % % -1.0 ° Lacustrine Sediments % % % % % % % % Pleistocene: Gelasian % % % % % Kedong Valley Tuff (20-40 ka): trachytic ignimbrites and associated fall deposits created by caldera % 0 % 1800 % % ? % % % 0 0 % % % 0 % % % % % 0 % 0 8 % % % % % 4 % 4 Pkt % formation at Longonot. There are at least 5 ignimbrite units, each with a red-brown weathered top. In 1 % % % % 2 % 2 % % Kiambu Trachyte % Pl-lv % % % % % % % % % % %% % % Limuru Pantellerite % % % % some regions the pyroclastic glass and pumice has been -

469880Esw0whit10cities0rep

Report No. 46988 Public Disclosure Authorized &,7,(62)+23(" GOVERNANCE, ECONOMIC AND HUMAN CHALLENGES OF KENYA’S FIVE LARGEST CITIES Public Disclosure Authorized December 2008 Water and Urban Unit 1 Africa Region Public Disclosure Authorized Public Disclosure Authorized Document of the World Bank __________________________ This document has a restricted distribution and may be used by recipients only in the performance of their official duties. Its contents may not otherwise be disclosed without written authorization from the World Bank. ii PREFACE The objective of this sector work is to fill existing gaps in the knowledge of Kenya’s five largest cities, to provide data and analysis that will help inform the evolving urban agenda in Kenya, and to provide inputs into the preparation of the Kenya Municipal Program (KMP). This overview report is first report among a set of six reports comprising of the overview report and five city-specific reports for Nairobi, Mombasa, Kisumu, Nakuru and Eldoret. The study was undertaken by a team comprising of Balakrishnan Menon Parameswaran (Team Leader, World Bank); James Mutero (Consultant Team Leader), Simon Macharia, Margaret Ng’ayu, Makheti Barasa and Susan Kagondu (Consultants). Matthew Glasser, Sumila Gulyani, James Karuiru, Carolyn Winter, Zara Inga Sarzin and Judy Baker (World Bank) provided support and feedback during the entire course of work. The work was undertaken collaboratively with UN Habitat, represented by David Kithkaye and Kerstin Sommers in Nairobi. The team worked under the guidance of Colin Bruce (Country Director, Kenya) and Jamie Biderman (Sector Manager, AFTU1). The team also wishes to thank Abha Joshi-Ghani (Sector Manager, FEU-Urban), Junaid Kamal Ahmad (Sector Manager, SASDU), Mila Freire (Sr. -

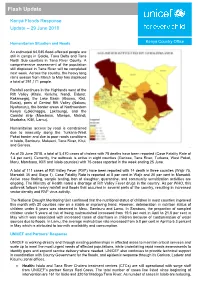

Flash Update

Flash Update Kenya Floods Response Update – 29 June 2018 Humanitarian Situation and Needs Kenya Country Office An estimated 64,045 flood-affected people are still in camps in Galole, Tana Delta and Tana North Sub counties in Tana River County. A comprehensive assessment of the population still displaced in Tana River will be completed next week. Across the country, the heavy long rains season from March to May has displaced a total of 291,171 people. Rainfall continues in the Highlands west of the Rift Valley (Kitale, Kericho, Nandi, Eldoret, Kakamega), the Lake Basin (Kisumu, Kisii, Busia), parts of Central Rift Valley (Nakuru, Nyahururu), the border areas of Northwestern Kenya (Lokichoggio, Lokitaung), and the Coastal strip (Mombasa, Mtwapa, Malindi, Msabaha, Kilifi, Lamu). Humanitarian access by road is constrained due to insecurity along the Turkana-West Pokot border and due to poor roads conditions in Isiolo, Samburu, Makueni, Tana River, Kitui, and Garissa. As of 25 June 2018, a total of 5,470 cases of cholera with 78 deaths have been reported (Case Fatality Rate of 1.4 per cent). Currently, the outbreak is active in eight counties (Garissa, Tana River, Turkana, West Pokot, Meru, Mombasa, Kilifi and Isiolo counties) with 75 cases reported in the week ending 25 June. A total of 111 cases of Rift Valley Fever (RVF) have been reported with 14 death in three counties (Wajir 75, Marsabit 35 and Siaya 1). Case Fatality Rate is reported at 8 per cent in Wajir and 20 per cent in Marsabit. Active case finding, sample testing, ban of slaughter, quarantine, and community sensitization activities are ongoing. -

Population Density and Spatial Patterns of Informal Settlements in Nairobi, Kenya

sustainability Article Population Density and Spatial Patterns of Informal Settlements in Nairobi, Kenya Hang Ren 1,2 , Wei Guo 3 , Zhenke Zhang 1,2,*, Leonard Musyoka Kisovi 4 and Priyanko Das 1,2 1 Center of African Studies, Nanjing University, Nanjing 210046, China; [email protected] (H.R.); [email protected] (P.D.) 2 School of Geography and Ocean Science, Nanjing University, Nanjing 210023, China 3 Department of Social Work and Social Policy, Nanjing University, Nanjing 210023, China; [email protected] 4 Department of Geography, Kenyatta University, Nairobi 43844, Kenya; [email protected] * Correspondence: [email protected]; Tel.: +86-025-89686694 Received: 21 August 2020; Accepted: 15 September 2020; Published: 18 September 2020 Abstract: The widespread informal settlements in Nairobi have interested many researchers and urban policymakers. Reasonable planning of urban density is the key to sustainable development. By using the spatial population data of 2000, 2010, and 2020, this study aims to explore the changes in population density and spatial patterns of informal settlements in Nairobi. The result of spatial correlation analysis shows that the informal settlements are the centers of population growth and agglomeration and are mostly distributed in the belts of 4 and 8 km from Nairobi’s central business district (CBD). A series of population density models in Nairobi were examined; it showed that the correlation between population density and distance to CBD was positive within a 4 km area, while for areas outside 8 km, they were negatively related. The factors determining population density distribution are also discussed. We argue that where people choose to settle is a decision process between the expected benefits and the cost of living; the informal settlements around the 4-km belt in Nairobi has become the choice for most poor people. -

Kenya, Groundwater Governance Case Study

WaterWater Papers Papers Public Disclosure Authorized June 2011 Public Disclosure Authorized KENYA GROUNDWATER GOVERNANCE CASE STUDY Public Disclosure Authorized Albert Mumma, Michael Lane, Edward Kairu, Albert Tuinhof, and Rafik Hirji Public Disclosure Authorized Water Papers are published by the Water Unit, Transport, Water and ICT Department, Sustainable Development Vice Presidency. Water Papers are available on-line at www.worldbank.org/water. Comments should be e-mailed to the authors. Kenya, Groundwater Governance case study TABLE OF CONTENTS PREFACE .................................................................................................................................................................. vi ACRONYMS AND ABBREVIATIONS ................................................................................................................................ viii ACKNOWLEDGEMENTS ................................................................................................................................................ xi EXECUTIVE SUMMARY ............................................................................................................................................... xiv 1. INTRODUCTION ............................................................................................................................................. 1 1.1. GROUNDWATER: A COMMON RESOURCE POOL ....................................................................................................... 1 1.2. CASE STUDY BACKGROUND ................................................................................................................................. -

Industrialization of Athi River Town

\l INDUSTRIALIZATION OF ATHI ( f RIVFR TOWN ' BY CALEB (m o * MIRERI This Thesis is submitted in partial fulfilment of the requ i rements of the degree of Masters of Arts in Planning in the Department of Urban and Regional Planning, Faculty of Architecture, Design and Development of the University of Nairobi. May 21st., 1992 DECLARATION This thesis is my original work and has not been presented for a degree in any other university. Cand idate---- 's“-— ^ ------ ignature ) Caleb Mc’Mireri DEPARTMENT OF URBAN AND REGIONAL PLANNING Faculty of Architecture. Design and Development P. 0. Bex 3 0 19 7 . Tel. 2 7 4 41 UNIVERSITY Of NAIROBI. This thesis has been submitted for examination with my approval as the University Supervisor. S i g n e d -^*3^l __ Dr. George Ngugi (Supervisor) June 21st, 1992. ITT DEDICATION In Memorium of Jaduong’ James Mireri IV Acknowledgement A great many people helped me develop this thesis most of whom I cannot mention their names here. 1 am indebted to them all but in particular to my Supervisor Dr. George Ngugi of the University of Nairobi. His comments were consistently thoughtful and insightful and he persistently sought to encourage and support me. Also, Dr. Peter Ngau of the University of Nairobi gave me a far reaching support throughout the time of this thesis writing, by his incisive comments. T also want to thank all academic members of staff and students of D.U.R.P, who listened to the early versions of this study in seminars and the information they offered was of great help. -

Biodiversity: the UK Overseas Territories. Peterborough, Joint Nature Conservation Committee

Biodiversity: the UK Overseas Territories Compiled by S. Oldfield Edited by D. Procter and L.V. Fleming ISBN: 1 86107 502 2 © Copyright Joint Nature Conservation Committee 1999 Illustrations and layout by Barry Larking Cover design Tracey Weeks Printed by CLE Citation. Procter, D., & Fleming, L.V., eds. 1999. Biodiversity: the UK Overseas Territories. Peterborough, Joint Nature Conservation Committee. Disclaimer: reference to legislation and convention texts in this document are correct to the best of our knowledge but must not be taken to infer definitive legal obligation. Cover photographs Front cover: Top right: Southern rockhopper penguin Eudyptes chrysocome chrysocome (Richard White/JNCC). The world’s largest concentrations of southern rockhopper penguin are found on the Falkland Islands. Centre left: Down Rope, Pitcairn Island, South Pacific (Deborah Procter/JNCC). The introduced rat population of Pitcairn Island has successfully been eradicated in a programme funded by the UK Government. Centre right: Male Anegada rock iguana Cyclura pinguis (Glen Gerber/FFI). The Anegada rock iguana has been the subject of a successful breeding and re-introduction programme funded by FCO and FFI in collaboration with the National Parks Trust of the British Virgin Islands. Back cover: Black-browed albatross Diomedea melanophris (Richard White/JNCC). Of the global breeding population of black-browed albatross, 80 % is found on the Falkland Islands and 10% on South Georgia. Background image on front and back cover: Shoal of fish (Charles Sheppard/Warwick -

KENYA POPULATION SITUATION ANALYSIS Kenya Population Situation Analysis

REPUBLIC OF KENYA KENYA POPULATION SITUATION ANALYSIS Kenya Population Situation Analysis Published by the Government of Kenya supported by United Nations Population Fund (UNFPA) Kenya Country Oce National Council for Population and Development (NCPD) P.O. Box 48994 – 00100, Nairobi, Kenya Tel: +254-20-271-1600/01 Fax: +254-20-271-6058 Email: [email protected] Website: www.ncpd-ke.org United Nations Population Fund (UNFPA) Kenya Country Oce P.O. Box 30218 – 00100, Nairobi, Kenya Tel: +254-20-76244023/01/04 Fax: +254-20-7624422 Website: http://kenya.unfpa.org © NCPD July 2013 The views and opinions expressed in this report are those of the contributors. Any part of this document may be freely reviewed, quoted, reproduced or translated in full or in part, provided the source is acknowledged. It may not be sold or used inconjunction with commercial purposes or for prot. KENYA POPULATION SITUATION ANALYSIS JULY 2013 KENYA POPULATION SITUATION ANALYSIS i ii KENYA POPULATION SITUATION ANALYSIS TABLE OF CONTENTS LIST OF ACRONYMS AND ABBREVIATIONS ........................................................................................iv FOREWORD ..........................................................................................................................................ix ACKNOWLEDGEMENT ..........................................................................................................................x EXECUTIVE SUMMARY ........................................................................................................................xi