Budweiser Brewing Company APAC Limited 百威亞太控股有限公司

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Operation Brewery.Indd

OPERATION BREWERY Black Hops - The Least Covert Operation in Brewing A step-by-step guide to building a brewery on a budget Dan Norris with Eddie Oldfield and Michael McGovern Copyright 2016 Dan Norris with Eddie Oldfield and Michael McGovern ALL RIGHTS RESERVED. This book contains material protected under International and Federal Copyright Laws and Treaties. Any unauthorized reprint or use of this material is prohibited. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system without express written permis- sion from the author/publisher. ISBN: 978-1535548618 Contents Join us in the Black Hops Ambassador group .................................v What this book is, and what it isn’t ............................................. vii Foreword ...................................................................................... xiii Chapter 1: Eggnog What? ...........................................................1 Chapter 2: How to Build a Brand ................................................8 Chapter 3: What Do You Need to Start a Brewery? .................17 Chapter 4: Our First Commercial Brew ....................................29 Chapter 5: Relationships ...........................................................39 Chapter 6: Business Models ......................................................47 Chapter 7: Marketing ................................................................53 Chapter 8: -

L & F to Purchase Desert Eagle Dist

Modern Brewery Age Weekly E-Newsletter •Volume 58, Number 51• December 17, 2007 Miller Brewing Co. to test “lite” craft beers Miller Brewing Co. has announced that it will test the ‘‘Miller Lite Brewers Collection,’’ a portfolio of craft-style beers that are lower in calories and carbohydrates. Miller will test the collection in four markets— Minneapolis, Charlotte, San Diego and Baltimore, beginning in February 2008. The Brewers Collection will feature three beers—Blonde Ale, an Amber and a Wheat—each with fewer calories and carbs than a typical craft beer for that style. Miller Chief Marketing Officer Randy Ransom said “Miller is seeking to again establish a whole new category for the beer industry—craft-style-light. “The brewer who can provide a more refreshing and drinkable craft style can stake out a whole new niche in the market. (Continued on Page 10) L & F to purchase Desert Eagle Dist. Desert Eagle Distributing, which controls 76 percent of El Paso's beer market is sell- ing the company to L&F Distributors, a larger McAllen, TX-based, family-owned distributor, the El Paso Times reports. "The future of the business will be large, Jim Sloan, vice president, Star Brand Imports, pours the first draft beer from a rare keg of Affligem mega wholesalers. We either had to grow Noel tapped at the Ginger Man in New York City this past week. Star Brands is importing 61 20-liter the business or sell out. In our case we had kegs of the celebrated Belgian seasonal, to be sold on draft in select accounts in the New York, no acquisition possibilities," J. -

View Presentation

WORLD BREWING CONGRESS 2016 World Brewing Congress August 13-17, 2016 Prospective demand for malting barley and malt quality for the global brewing industry Sheraton Downtown Denver 159 Peter Watts1, Dr. Yueshu Li1 and Dr. Jessica Yu2 Denver, CO 80202, U.S.A. 1. Canadian Malting Barley Technical Centre, Winnipeg, Manitoba, Canada R3C 3G7 2. Tsingtao Brewery Co. Ltd, Qingdao, China 266100 Introduction China Beer Market Evolving Quality Requirements Rapid changes in the world brewing industry including the boom in craft brewing, diversification in In addition to international brewing groups such as Carlsberg and AB-InBev, China Resource Snow Brewery, Tsingtao Brewery, and Beijing Yangjing Beer are dominant Rising beer production in China and the rapid development of craft brewing in the US beer brand/style as well as changing ownership present both challenges and opportunities for the players in China accounting for 71% of beer output. Increasingly Chinese beer manufacturers are strengthening their brand positioning. In 2014 China Resources Snow are driving increased demand for malting barley and malt, and are also shifting quality malting barley industry. In this presentation, trends in global malting and brewing sectors, Breweries produced 107 million hectolitres of Snow beer making it the world’s largest beer brand at 5.4% of the global market. Its total volume is higher than the requirements. In China, brewers are demanding barley with higher grain protein and specifically in China and the United States, and changing quality requirements for malting barley combined volume of Budweiser (4.6 billion liters) and Budlight (5.0 billion liters). Together with Tsingtao Brewery and Beijing Yangjing Beer, these three Chinese brewers very high enzyme potential to compensate for large adjunct incorporation. -

Hanoi a Beer Drinker'

Hanoi a beer drinker's haven (11/10/2012) Hanoi has been named one of the cheapest and best places to drink fresh beer in Asia by travel guides and journalists, thanks to its lively drinking culture. Many tourists look forward to the chance to join local Hanoians and enjoy the city's famous Bia Hoi (fresh beer) - a light-bodied pilsner without preservatives that is brewed and delivered daily to drinking places throughout the capital. Hanoi has become a magnet for tourists who enjoy drinking beer, which is readily available at local pavement shops as well as in luxurious bars. There are thousands of corner bars with tiny plastic stools set out on the sidewalk and small low tables laden with glasses of beer. Visitors should taste Vietnamese beer and learn how local people drink. "Mot, hai, bazo!! (One, two, three go!!) and "Tram phan tram! ("100 percent" or "bottoms up") are common chants that accompany a drinking session in these local establishments. "Bia Hoi is one of things you should not miss when you come to Hanoi, says Thomas, a foreign tourist who chooses Hanois old quarter as his favourite place to imbibe a cool brew. He says he likes Hanoi beer because it is very cheap and delicious. Another thing that amazes visitors is that the beer bars are mostly on the sidewalk where drinkers sometimes have to raise their voices over the din of motorbike traffic or breathe in the clouds of diesel exhaust belched over the plastic tables by a passing bus. "Sitting on the pavement, listening to the mixed sounds, drinking beer and just looking at what's happening around me has become my habit during my time in Hanoi, Thomas elaborates. -

Tianjin Open 2015: Tale of the Winners 2015天津公开赛:胜利者的故事

2015.082015.082015.08 Tianjin Open 2015: Tale of the Winners 2015天津公开赛:胜利者的故事 InterMediaChina www.tianjinplus.com IST offers your children a welcoming, inclusive international school experience, where skilled and committed teachers deliver an outstanding IB education in an environment of quality learning resources and world-class facilities. IST is... fully accredited by the Council of International Schools (CIS) IST is... fully authorized as an International Baccalaureate World School (IB) IST is... fully accredited by the Western Association of Schools and Colleges (WASC) IST is... a full member of the following China and Asia wide international school associations: ACAMIS, ISAC, ISCOT, EARCOS and ACMIBS 汪正影像艺术 VISUAL ARTS Wang Zheng International Children Photography Agency 汪 正·天 津 旗下天津品牌店 ■婴有爱婴幼儿童摄影 ■韩童街拍工作室 ■顽童儿童摄影会馆 ■汪叔叔专业儿童摄影 ■素摄儿童摄影会馆 转 Website: www.istianjin.org Email: [email protected] Tel: 86 22 2859 2003/5/6 ■ Prince&Princess 摄影会馆 ■韩爱儿童摄影会馆 ■本真儿童摄影会馆 4006-024-521 5 NO.22 Weishan South Road, Shuanggang, Jinnan District, Tianjin 300350, P.R.China 14 2015 2015 CONTENTS 11 CONTENTS 11 Calendar 06 Beauty 38 46 Luscious Skin Sport & Fitness 40 Partner Promotions 09 Tianjin Open 2015: A Tale of Upsets, Close Calls and Heroic Performances Art & Culture 14 How to 44 Eat me. Tianjin style. How to Cope with Missing Home Feature Story 16 Beijing Beat 46 16 The Rise of Craft Beer in China Off the Tourist Trail: Perfect Family Days Out Cover Story 20 Special Days 48 Tianjin Open 2015: Tale of the Winners Special Days in November 2015 Restaurant -

Anheuser-Busch Inbev

Our Dream: Anheuser-Busch InBev Annual Report 2014 1 ABOUT ANHEUSER-BUSCH INBEV Best Beer Company Bringing People Together For a Better World Contents 1 Our Manifesto 2 Letter to Shareholders 6 Strong Strategic Foundation 20 Growth Driven Platforms 36 Dream-People-Culture 42 Bringing People Together For a Better World 49 Financial Report 155 Corporate Governance Statement Open the foldout for an overview of our financial performance. A nheuser-Busch InBev Annual / 2014 Report Anheuser-Busch InBev 2014 Annual Report ab-inbev.com Our Dream: Anheuser-Busch InBev Annual Report 2014 1 ABOUT ANHEUSER-BUSCH INBEV Best Beer Company Bringing People Together For a Better World Contents 1 Our Manifesto 2 Letter to Shareholders 6 Strong Strategic Foundation 20 Growth Driven Platforms 36 Dream-People-Culture 42 Bringing People Together For a Better World 49 Financial Report 155 Corporate Governance Statement Open the foldout for an overview of our financial performance. A nheuser-Busch InBev Annual / 2014 Report Anheuser-Busch InBev 2014 Annual Report ab-inbev.com Anheuser-Busch InBev Annual Report 2014 1 ABOUT ANHEUSER-BUSCH INBEV About Revenue was Focus Brand volume EBITDA grew 6.6% Normalized profit Net debt to EBITDA 47 063 million USD, increased 2.2% and to 18 542 million USD, attributable to equity was 2.27 times. Anheuser-Busch InBev an organic increase accounted for 68% of and EBITDA margin holders rose 11.7% Driving Change For of 5.9%, and our own beer volume. was up 25 basis points in nominal terms to Anheuser-Busch InBev (Euronext: ABI, NYSE: BUD) is the leading AB InBev’s dedication to heritage and quality originates from revenue/hl rose 5.3%. -

Brands, Corporations

Havana Club Bombay Saphire gin Dewar's Scottish Martini Sauza tequila Jacob's Creek Australia Mumm champagne Foster's Miller Castle rum whiskey (only for American market) Courvoisier konjak The Glenlivet 25 year old whiskey Liquor Beer Pilsner Urquell Grey Goose Wine Wine Owning Australia's biggest beer brand vodka (France) And Ready-To-Drinks (RTDs) Representing 60 countries Chives Regal 18 year old Beefeater gin Jim Beam bourbon whiskey Bacardi Foster's Group Bavaria Biggest alcohol company in the world not in the Victoria, Australia Stock market Absolut vodka Martell XO konjak Wine, beer, licquor, alcohol-free beverages Represented in 100 markets with together 200 brands Liquor World's 4th biggest liquor producer Havana club rum SABMiller Liquor 2002 South African Breweries bought American Wine World's 2nd biggest World's 4th biggest wine producer Miller Brewing Company Beam Global Spirits & Wine Wyborowa vodka 2008 takeover Vin&Sprit London Integrated in corporation Fortune Brands Johannesburg Deerfield, Illinois, USA Tanqueray gin Milwaukee, Wisconsin 80 brands in 160 countries Jameson whiskey Pernod Ricard Close cooperation with Molson Coors in USA Malibu Paris owning more than 200 brands Cuervo tequila '75 when two wine producers merged Baileys liquor Ballentine's 21 year old 2005 takeover of Allied Domecq whiskey Kahlua cofee liquor Multinational corporation that still tries to Johnny Walker Whiskey appear as family business Liquor Diageo is world leader in terms of "premium spirits" Möet Hennessey with 9 of the world's 20 biggest liquor brands Harbin Brewery Group Ltd. China's 4th biggest brewery corporation Grupo Modelo Mexico's biggest brewery corporation THE Captain Morgan rum Diageo Brahma GLOBAL London ALCOHOL INDUSTRY '97 when Grand Metropolitan and Guinness merged Smirnof vodka Anheuser-Busch InBev "global priority brands" 2004 Belgian Interbrew and Brazilian Ambev form InBev Beer (Guinness) Ca. -

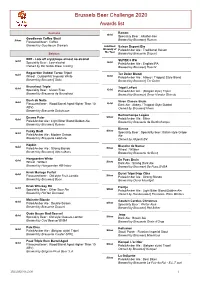

Brussels Beer Challenge 2020 Awards List

Brussels Beer Challenge 2020 Awards list Australia Ramon Gold Speciality Beer : Alcohol-free Goodieson Coffee Stout Silver Brewed by Brouwerij Roman Flavoured beer : Coffee Brewed by Goodieson Brewery Gold Best Saison Dupont Bio Brewery of Pale&Amber Ale : Traditional Saison the Year Belgium Brewed by Brasserie Dupont BIIR - Lots off cry(o)hops almost no alcohol SUPER 8 IPA Gold Gold Speciality Beer : Low-alcohol Pale&Amber Ale : English IPA Owned by Biir Noble Brew Trading Brewed by Brouwerij Haacht Bogaerden Dubbel Tarwe Tripel Ter Dolen Blond Gold Gold Wheat : DubbelWit/ Imperial White Pale&Amber Ale : Abbey / Trappist Style Blond Brewed by Brouwerij Sako Brewed by Brouwerij Ter Dolen Brunehaut Triple Tripel LeFort Gold Gold Speciality Beer : Gluten Free Pale&Amber Ale : (Belgian style) Tripel Brewed by Brasserie de Brunehaut Brewed by Brouwerij Omer Vander Ghinste Bush de Nuits Viven Classic Bruin Gold Gold Flavoured beer : Wood/Barrel Aged Higher Than 10 Dark Ale : Abbey / Trappist Style Dubbel ABV) Owned by Brouwerij Viven Brewed by Brasserie Dubuisson Bertinchamps Légère Ename Pater Silver Gold Pale&Amber Ale : Bitter Pale&Amber Ale : Light Bitter Blond/Golden Ale Brewed by Brasserie de Bertinchamps Brewed by Brouwerij Roman Bienne Funky Brett Silver Gold Speciality Beer : Speciality beer: Italian style Grape Pale&Amber Ale : Modern Saison Ale Brewed by Brasserie Lefebvre Owned by Aligenti BV Hapkin Blanche de Namur Gold Silver Pale&Amber Ale : Strong Blonde Wheat : Witbier Brewed by Brouwerij Alken-Maes Brewed by Brasserie du -

Kirin Report 2016

KIRIN REPORT 2016 REPORT KIRIN Kirin Holdings Company, Limited Kirin Holdings Company, KIRIN REPORT 2016 READY FOR A LEAP Toward Sustainable Growth through KIRIN’s CSV Kirin Holdings Company, Limited CONTENTS COVER STORY OUR VISION & STRENGTH 2 What is Kirin? OUR LEADERSHIP 4 This section introduces the Kirin Group’s OUR NEW DEVELOPMENTS 6 strengths, the fruits of the Group’s value creation efforts, and the essence of the Group’s results OUR ACHIEVEMENTS and CHALLENGES to OVERCOME 8 and issues in an easy-to-understand manner. Our Value Creation Process 10 Financial and Non-Financial Highlights 12 P. 2 SECTION 1 To Our Stakeholders 14 Kirin’s Philosophy and TOPICS: Initiatives for Creating Value in the Future 24 Long-Term Management Vision and Strategies Medium-Term Business Plan 26 This section explains the Kirin Group’s operating environment and the Group’s visions and strate- CSV Commitment 28 gies for sustained growth in that environment. CFO’s Message 32 Overview of the Kirin Group’s Business 34 P. 14 SECTION 2 Advantages of the Foundation as Demonstrated by Examples of Value Creation Kirin’s Foundation Revitalizing the Beer Market 47 Todofuken no Ichiban Shibori 36 for Value Creation A Better Green Tea This section explains Kirin’s three foundations, Renewing Nama-cha to Restore Its Popularity 38 which represent Group assets, and provides Next Step to Capture Overseas Market Growth examples of those foundations. Myanmar Brewery Limited 40 Marketing 42 Research & Development 44 P. 36 Supply Chain 46 SECTION 3 Participation in the United Nations Global Compact 48 Kirin’s ESG ESG Initiatives 49 This section introduces ESG activities, Human Resources including the corporate governance that —Valuable Resource Supporting Sustained Growth 50 supports value creation. -

Tsingtao Brewery Company Case Study Tsingtao Brewery Co., Ltd

Tsingtao Brewery Company Case Study Tsingtao Brewery Co., Ltd., one of the oldest beer makers in China, was founded in 1903 by German and British merchants under the name Nordic Brewery Co., Ltd. Tsingtao Branch. Today, Tsingtao Brewery is China’s largest brewery and was also an Official Sponsor of the Beijing 2008 Olympic Games. On July 15, 1993, Tsingtao Brewery became the first-ever Chinese company to be listed on the Hong Kong Stock Exchange (stock code 0168). On August 27, 1993, it listed on the Shanghai Stock Exchange (stock code: 600600), making Tsingtao Brewery the first Chinese company to be listed in both Mainland China and Hong Kong. China now has about 500 breweries, nearly one for every three counties, but 80 per cent have an annual production capacity of less than 50,000 tons and most have operational difficulties. This has spelled opportunities for the three heavyweights, Tsingtao, Yanjing and China Resources. They have all pursued a domestic expansion plan through numerous strategic mergers, purchasing insolvent companies, reorganization, and joint-venture partnerships. Still, in spite of its having the second largest market in the world, China still has a long way to go because per capita beer consumption annually is only about 15 liters, compared to 84 liters in the United States. In 2007, Tsingtao Brewery achieved a total sales volume of 5.05 million kiloliters globally, with the market share of Tsingtao Beer in China reaching 13% . In that same year, World Brand Lab valued the brand at RMB 25.827 billion, placing it first in China’s brewing industry. -

Travel in Vietnam

citypassguide.com BY LOCALS, FOR LOCALS - YOUR MONTHLY HCMC GAZETTE Volume 8 | June 2016 TRAVEL IN VIETNAM / “A journey is best meASURED IN FRIENDS, RATHER THAn miles.” – TIM CAHILL / MY THO PHONG NHA SAPA THE GATE TO THE MEKONG LARGEST CAVE IN THE WORLD THE TOWN IN THE CLOUDS 6 19 22 What’s Happening • Travel • Destinations Emmotional Baggage • Events PUBLISHED BY #iAMHCMC NEWS NEWS #iAMHCMC The following information Korea for the first time. Customs figures showed regions without clean water, and 1.1 million Foreign investment #iAMHCMC is provided by that 7,800 cars worth around US$140 million in need of food support. Officials from the By Locals, For Locals made in Thailand were sold to Vietnam in the agriculture ministry and United Nations have It has been a good few months for foreign investors first three months, up 64.5 percent from a year estimated that more than 60,000 women and in Vietnam. The government has decided to open What’s Happening ago. The market growth was thanks mostly to children in 18 hardest-hit provinces are facing up the fuel retail market for outsiders, with Japan’s a new free trade agreement that has cut import malnutrition. Around 1.75 million people from Idemitsu Kosan and Kuwait Petroleum on track by Le Trung Dung tariffs among the 10 ASEAN member states from farming families have suffered heavy losses to jointly launch the first fully foreign-owned oil CEO Patrick Gaveau 50 percent to 40 percent this year. The tax rate as drought damage to agriculture activities is business in the country. -

Best Beer Company Bringing People Together for a Better World Our

Our Dream: Anheuser-Busch InBev Annual Report 2014 1 ABOUT ANHEUSER-BUSCH INBEV Best Beer Company Bringing People Together For a Better World Contents 1 Our Manifesto 2 Letter to Shareholders 6 Strong Strategic Foundation 20 Growth Driven Platforms 36 Dream-People-Culture 42 Bringing People Together For a Better World 49 Financial Report 155 Corporate Governance Statement Open the foldout for an overview of our financial performance. A nheuser-Busch InBev Annual / 2014 Report Anheuser-Busch InBev 2014 Annual Report ab-inbev.com WorldReginfo - f27cd37d-7e71-4b08-bf24-9aae9267483a Our Dream: Anheuser-Busch InBev Annual Report 2014 1 ABOUT ANHEUSER-BUSCH INBEV Best Beer Company Bringing People Together For a Better World Contents 1 Our Manifesto 2 Letter to Shareholders 6 Strong Strategic Foundation 20 Growth Driven Platforms 36 Dream-People-Culture 42 Bringing People Together For a Better World 49 Financial Report 155 Corporate Governance Statement Open the foldout for an overview of our financial performance. A nheuser-Busch InBev Annual / 2014 Report Anheuser-Busch InBev 2014 Annual Report ab-inbev.com WorldReginfo - f27cd37d-7e71-4b08-bf24-9aae9267483a Anheuser-Busch InBev Annual Report 2014 1 ABOUT ANHEUSER-BUSCH INBEV About Revenue was Focus Brand volume EBITDA grew 6.6% Normalized profit Net debt to EBITDA 47 063 million USD, increased 2.2% and to 18 542 million USD, attributable to equity was 2.27 times. Anheuser-Busch InBev an organic increase accounted for 68% of and EBITDA margin holders rose 11.7% Driving Change For of 5.9%, and our own beer volume. was up 25 basis points in nominal terms to Anheuser-Busch InBev (Euronext: ABI, NYSE: BUD) is the leading AB InBev’s dedication to heritage and quality originates from revenue/hl rose 5.3%.