Annual Report 2015 Report Annual

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Read H. C. Hirschboeck Autobiography

AUTOBIOGRAPHY HERBERT C. HIRSCHBOECK Copr. 1981 H.C. Hirschboeck TO MERT AUTOBIOGRAPHY HERBERT C. HIRSCHBOECK Page No. 1. Early Years .......................................... 2 2. After High School .................................... 6 3. Amateur Theater ...................................... 11 4. After Law School ..................................... 13 5. Beginning Law Practice ............................... 17 6. Europe ............................................... 20 7. Dunn & Hirschboeck ................................... 25 8. Early Supreme Court Appeals .......................... 26 9. The Depression ....................................... 34 10. City Attorney's Office .............................. 36 11. Baby Bonds .......................................... 49 12. Miller, Mack & Fairchild ............................ 56 13. Marriage ............................................ 60 14. Return to Individual Practice ....................... 68 15. Cancer .............................................. 74 16. Hirschboeck & McKinnon .............................. 77 17. Thorp Finance Corporation ........................... 79 18. John Smith .......................................... 83 19. World War II ........................................ 86 20. Whyte & Hirschboeck ................................. 90 21. New Associates and Partners ......................... 95 22. Michael and John Cudahy ............................. 97 23. Milwaukee Bar Association ........................... 100 24. Miller Brewing Company ............................. -

The Liquor Industry

The liquor industry Technical Brief No. 14 Aug 2012 ISSN 1836-9014 David Richardson Technical Brief About TAI The Australia Institute is an independent public policy think tank based in Canberra. It is funded by donations from philanthropic trusts and individuals, memberships and commissioned research. Since its launch in 1994, the Institute has carried out highly influential research on a broad range of economic, social and environmental issues. Our philosophy As we begin the 21st century, new dilemmas confront our society and our planet. Unprecedented levels of consumption co-exist with extreme poverty. Through new technology we are more connected than we have ever been, yet civic engagement is declining. Environmental neglect continues despite heightened ecological awareness. A better balance is urgently needed. The Australia Institute’s directors, staff and supporters represent a broad range of views and priorities. What unites us is a belief that through a combination of research and creativity we can promote new solutions and ways of thinking. Our purpose—‘Research that matters’ The Institute aims to foster informed debate about our culture, our economy and our environment and bring greater accountability to the democratic process. Our goal is to gather, interpret and communicate evidence in order to both diagnose the problems we face and propose new solutions to tackle them. The Institute is wholly independent and not affiliated with any other organisation. As an Approved Research Institute, donations to its Research Fund are tax deductible for the donor. Anyone wishing to donate can do so via the website at https://www.tai.org.au or by calling the Institute on 02 6206 8700. -

The Deity's Beer List.Xls

Page 1 The Deity's Beer List.xls 1 #9 Not Quite Pale Ale Magic Hat Brewing Co Burlington, VT 2 1837 Unibroue Chambly,QC 7% 3 10th Anniversary Ale Granville Island Brewing Co. Vancouver,BC 5.5% 4 1664 de Kronenbourg Kronenbourg Brasseries Stasbourg,France 6% 5 16th Avenue Pilsner Big River Grille & Brewing Works Nashville, TN 6 1889 Lager Walkerville Brewing Co Windsor 5% 7 1892 Traditional Ale Quidi Vidi Brewing St. John,NF 5% 8 3 Monts St.Syvestre Cappel,France 8% 9 3 Peat Wheat Beer Hops Brewery Scottsdale, AZ 10 32 Inning Ale Uno Pizzeria Chicago 11 3C Extreme Double IPA Nodding Head Brewery Philadelphia, Pa. 12 46'er IPA Lake Placid Pub & Brewery Plattsburg , NY 13 55 Lager Beer Northern Breweries Ltd Sault Ste.Marie,ON 5% 14 60 Minute IPA Dogfishhead Brewing Lewes, DE 15 700 Level Beer Nodding Head Brewery Philadelphia, Pa. 16 8.6 Speciaal Bier BierBrouwerij Lieshout Statiegeld, Holland 8.6% 17 80 Shilling Ale Caledonian Brewing Edinburgh, Scotland 18 90 Minute IPA Dogfishhead Brewing Lewes, DE 19 Abbaye de Bonne-Esperance Brasserie Lefebvre SA Quenast,Belgium 8.3% 20 Abbaye de Leffe S.A. Interbrew Brussels, Belgium 6.5% 21 Abbaye de Leffe Blonde S.A. Interbrew Brussels, Belgium 6.6% 22 AbBIBCbKE Lvivske Premium Lager Lvivska Brewery, Ukraine 5.2% 23 Acadian Pilsener Acadian Brewing Co. LLC New Orleans, LA 24 Acme Brown Ale North Coast Brewing Co. Fort Bragg, CA 25 Actien~Alt-Dortmunder Actien Brauerei Dortmund,Germany 5.6% 26 Adnam's Bitter Sole Bay Brewery Southwold UK 27 Adnams Suffolk Strong Bitter (SSB) Sole Bay Brewery Southwold UK 28 Aecht Ochlenferla Rauchbier Brauerei Heller Bamberg Bamberg, Germany 4.5% 29 Aegean Hellas Beer Atalanti Brewery Atalanti,Greece 4.8% 30 Affligem Dobbel Abbey Ale N.V. -

2018 Annual Report

AB InBev annual report 2018 AB InBev - 2018 Annual Report 2018 Annual Report Shaping the future. 3 Bringing People Together for a Better World. We are building a company to last, brewing beer and building brands that will continue to bring people together for the next 100 years and beyond. Who is AB InBev? We have a passion for beer. We are constantly Dreaming big is in our DNA innovating for our Brewing the world’s most loved consumers beers, building iconic brands and Our consumer is the boss. As a creating meaningful experiences consumer-centric company, we are what energize and are relentlessly committed to inspire us. We empower innovation and exploring new our people to push the products and opportunities to boundaries of what is excite our consumers around possible. Through hard the world. work and the strength of our teams, we can achieve anything for our consumers, our people and our communities. Beer is the original social network With centuries of brewing history, we have seen countless new friendships, connections and experiences built on a shared love of beer. We connect with consumers through culturally relevant movements and the passion points of music, sports and entertainment. 8/10 Our portfolio now offers more 8 out of the 10 most than 500 brands and eight of the top 10 most valuable beer brands valuable beer brands worldwide, according to BrandZ™. worldwide according to BrandZTM. We want every experience with beer to be a positive one We work with communities, experts and industry peers to contribute to reducing the harmful use of alcohol and help ensure that consumers are empowered to make smart choices. -

Blue Moon Belgian White Witbier / 5.4% ABV / 9 IBU / 170 CAL / Denver, CO Anheuser-Busch Bud Light Lager

BEER DRAFT Blue Moon Belgian White Pint 6 Witbier / 5.4% ABV / 9 IBU / 170 CAL / Denver, CO Pitcher 22 Blue Moon Belgian White, Belgian-style wheat ale, is a refreshing, medium-bodied, unfiltered Belgian-style wheat ale spiced with fresh coriander and orange peel for a uniquely complex taste and an uncommonly... Anheuser-Busch Bud Light Pint 6 Lager - American Light / 4.2% ABV / 6 IBU / 110 CAL / St. Louis, Pitcher 22 MO Bud Light is brewed using a blend of premium aroma hop varieties, both American-grown and imported, and a combination of barley malts and rice. Its superior drinkability and refreshing flavor... Coors Coors Light Pint 5 Lager - American Light / 4.2% ABV / 10 IBU / 100 CAL / Pitcher 18 Golden, CO Coors Light is Coors Brewing Company's largest-selling brand and the fourth best-selling beer in the U.S. Introduced in 1978, Coors Light has been a favorite in delivering the ultimate in... Deschutes Fresh Squeezed IPA Pint 7 IPA - American / 6.4% ABV / 60 IBU / 192 CAL / Bend, OR Pitcher 26 Bond Street Series- this mouthwatering lay delicious IPA gets its flavor from a heavy helping of citra and mosaic hops. Don't worry, no fruit was harmed in the making of... 7/2/2019 DRAFT Ballast Point Grapefruit Sculpin Pint 7 IPA - American / 7% ABV / 70 IBU / 210 CAL / San Diego, CA Pitcher 26 Our Grapefruit Sculpin is the latest take on our signature IPA. Some may say there are few ways to improve Sculpin’s unique flavor, but the tart freshness of grapefruit perfectly.. -

Big Beer Duopoly a Primer for Policymakers and Regulators

Big Beer Duopoly A Primer for Policymakers and Regulators Marin Institute Report October 2009 Marin Institute Big Beer Duopoly A Primer for Policymakers and Regulators Executive Summary While the U.S. beer industry has been consolidating at a rapid pace for years, 2008 saw the most dramatic changes in industry history to date. With the creation of two new global corporate entities, Anheuser-Busch InBev (ABI) and MillerCoors, how beer is marketed and sold in this country will never be the same. Anheuser-Busch InBev is based in Belgium and largely supported and managed by Brazilian leadership, while MillerCoors is majority-controlled by SABMiller out of London. It is critical for federal and state policymakers, as well as alcohol regulators and control advocates to understand these changes and anticipate forthcoming challenges from this new duopoly. This report describes the two industry players who now control 80 percent of the U.S. beer market, and offers responses to new policy challenges that are likely to negatively impact public health and safety. The new beer duopoly brings tremendous power to ABI and MillerCoors: power that impacts Congress, the Office of the President, federal agencies, and state lawmakers and regulators. Summary of Findings • Beer industry consolidation has resulted in the concentration of corporate power and beer market control in the hands of two beer giants, Anheuser-Busch InBev (ABI) and MillerCoors LLC. • The American beer industry is no longer American. Eighty percent of the U.S. beer industry is controlled by one corporation based in Belgium, and another based in England. • The mergers of ABI and MillerCoors occurred within months of each other, and both were approved much quicker than the usual merger process. -

Operation Brewery.Indd

OPERATION BREWERY Black Hops - The Least Covert Operation in Brewing A step-by-step guide to building a brewery on a budget Dan Norris with Eddie Oldfield and Michael McGovern Copyright 2016 Dan Norris with Eddie Oldfield and Michael McGovern ALL RIGHTS RESERVED. This book contains material protected under International and Federal Copyright Laws and Treaties. Any unauthorized reprint or use of this material is prohibited. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording, or by any information storage and retrieval system without express written permis- sion from the author/publisher. ISBN: 978-1535548618 Contents Join us in the Black Hops Ambassador group .................................v What this book is, and what it isn’t ............................................. vii Foreword ...................................................................................... xiii Chapter 1: Eggnog What? ...........................................................1 Chapter 2: How to Build a Brand ................................................8 Chapter 3: What Do You Need to Start a Brewery? .................17 Chapter 4: Our First Commercial Brew ....................................29 Chapter 5: Relationships ...........................................................39 Chapter 6: Business Models ......................................................47 Chapter 7: Marketing ................................................................53 Chapter 8: -

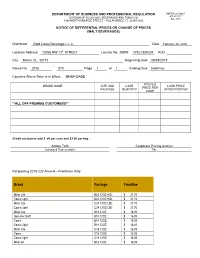

DEPARTMENT of BUSINESS and PROFESSIONAL REGULATION DBPR Form AB&T DIVISION of ALCOHOLIC BEVERAGES and TOBACCO 4000A-032E Rev

DEPARTMENT OF BUSINESS AND PROFESSIONAL REGULATION DBPR Form AB&T DIVISION OF ALCOHOLIC BEVERAGES AND TOBACCO 4000A-032E Rev. 5/04 1940 NORTH MONROE STREET • TALLAHASSEE, FL 32399-1022 NOTICE OF DIFFERENTIAL PRICES OR CHANGE OF PRICES (MALT BEVERAGES) Distributor Gold Coast Beverage L.L.C. Date February 26, 2016 Location Address 10055 NW 12th STREET License No. JDBW WSL2300224 KLD City Miami, FL 33172 Beginning Date 09/28/2015 - Notice No. 2016 074 Page 1 of 1 Ending Date Indefinite Counties Where Price is in Effect: MIAMI-DADE POSTED BRAND NAME SIZE AND CASE CASH PRICE PRICE PER PACKAGE QUANTITY AFTER POSTING CASE **ALL OFF PREMISE CUSTOMERS** Credit customers add $ .40 per case and $2.00 per keg. Amber Toth Corporate Pricing Analyst Authorized Representative Title Ref posting 2015-222 Amend – Frontlines Only Brand Package Frontline Miller Lite B24 12OZ HGL $ 21.70 Coors Light B24 12OZ HGL $ 21.70 Miller Lite C24 12OZ LSE $ 21.70 Coors Light C24 12OZ LSE $ 21.70 Miller Lite B18 12OZ $ 16.05 Genuine Draft B18 12OZ $ 16.05 Coors B18 12OZ $ 16.05 Coors Light B18 12OZ $ 16.05 Miller Lite C18 12OZ $ 16.05 Coors C18 12OZ $ 16.05 Coors Light C18 12OZ $ 16.05 Miller 64 B18 12OZ $ 16.05 Miller 64 C18 12OZ $ 16.05 Lite B24 12OZ 12P $ 21.80 Genuine Draft B24 12OZ 12P $ 21.80 Coors Light B24 12OZ 12P $ 21.80 Miller Lite C24 12OZ 12P $ 21.80 Coors Light C24 12OZ 12P $ 21.80 Coors Banquet C24 12OZ 12P $ 21.80 Coors Banquet Stubby B24 12OZ 12STB $ 21.80 Coors LT Citrus Radler C24 12OZ 12P $ 21.80 Miller Lite B24 12OZ 6P $ 22.40 Coors Light B24 12OZ -

AB Inbev-Sabmiller Merger Bash: Who Will Have the Most Fun by HELEN THOMAS and SPENCER JAKAB, WSJ, Sept

AB InBev-SABMiller Merger Bash: Who Will Have the Most Fun By HELEN THOMAS And SPENCER JAKAB, WSJ, Sept. 16, 2015 12:53 p.m. ET Anheuser-Busch InBev has finally opted to down its pint, but everyone else in the bar may end up having more fun. The world’s largest brewer by sales said Wednesday that it planned to make an offer to buy SABMiller, a long-awaited deal that would bring together companies controlling 30% of global beer volumes. The timing, at least from AB InBev’s standpoint, makes sense. SABMiller has underperformed other beer companies this year, thanks to its huge emerging-markets exposure. Nearly 70% of its sales are made in China or markets reliant on commodities like Nigeria, Australia or sub-Sahran Africa, notes Barclays, the highest in the European staples sector. Longer-term this should translate into higher growth. Indeed, increasing its exposure to markets like Colombia, Peru and in Africa may be part of the appeal for AB InBev. But given current anxieties, SABMiller’s valuation had dropped to about 18 times forecast earnings, a slight discount to the sector. Over the past year, the stock has underperformed AB InBev by about 30 percentage points. SABMiller still won’t come cheap. Even before the deal announcement, its valuation was at a slight premium to its five- year average of about 18.3 times. Its substantial shareholders, Altria and Colombia’s Santo Domingo family, from whom SAB bought Bavaria in 2005, together control more than 40% of the company. But AB InBev’s formidable reputation in slashing costs means a deal helps to offset concerns about its own slowing growth. -

SAB 201406240040A Annual Financial Report Sabmiller Plc

SAB 201406240040A Annual Financial Report SABMiller plc JSEALPHA CODE: SAB ISIN CODE: SOSAB ISIN CODE: GB0004835483 Annual Financial Report SABMiller plc has today submitted a copy of the 2014 Annual Report and Accounts, Notice of the 2014 Annual General Meeting and Shareholder Proxy Form (UK) to the National Storage Mechanism and they will shortly be available for inspection at www.hemscott.com/nsm.do. The Annual Report and Notice of Annual General Meeting are also available on the Company’s website www.sabmiller.com SABMiller plc’s Annual General Meeting will be held on Thursday, 24 July 2014 at the InterContinental London Park Lane, One Hamilton Place, Park Lane, London W1J 7QY. A condensed set of SABMiller’s financial statements and information on important events that have occurred during the financial year and their impact on the financial statements were included in SABMiller’s preliminary results announcement released on 22 May 2014. That information, together with the information set out below, which is extracted from the 2014 Annual Report, constitutes the material required by Disclosure and Transparency Rule 6.3.5 to be communicated to the media in unedited full text through a Regulatory Information Service. This announcement is not a substitute for reading the full 2014 Annual Report. Page numbers and cross- references in the extracted information below refer to page numbers and sections in the 2014 Annual Report. PRINCIPAL RISKS AND UNCERTAINTIES (page 18 & 19) Principal risks Focused on managing our risks The principal risks facing the group and considered by the board are detailed below. The group’s well-developed risk management process is described in the corporate governance section while financial risks are discussed in the Chief Financial Officer’s review on page 39 and in note 21 to the consolidated financial statements. -

AUCTION 44 April 28Th to May 8Th, 2021 Print Post: PP 381712/02531

AUCTION 44 April 28th to May 8th, 2021 Print Post: PP 381712/02531 www.abcrauctions.com FINISH TIME: 7 PM AEST. Details: Travis Dunn: 0417 830 939 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Lot Type Description Condition & Grading (out of 10) Estimate Green & Compy, Fitzroy, Lion TM. Aqua. 235 mm. VG, tiny open lip bubble, spots of surface wear $4,000 - 1 Codd An exceptionally rare and important bottle. and scufs, surface fake, pitted spot (7.5) 5,000 2 Codd A. V. Cowap, Launceston, Kangaroo TM. Aqua. 187 mm. VG, hazy, wear, milky bruise, scratches (7.1) $100-150 3 Codd Anglo-Australian Brewery, Beechworth. Aqua. 188 mm. VG, polished, scratches, lip fake (7.4) $30-40 4 Codd Eberhard & Co, Clunes & Talbot, Crown TM. Aqua. 184 mm. VG, dull, lip impact, scufy, scratches (7.0) $40-60 5 Codd Yoxall, R’glen & Wangaratta, Arm & Dagger. Aqua. 187 mm. VG, tiny lip bruise, scufy, wear (7.9) $30-50 6 Codd M. A. Whittaker, Maryborough, MAW TM. Aqua. 178 mm. VG, small lip chips, wear and marks (7.5) $40-60 7 Codd Mount Gambier Brewing, MGBCo TM. Aqua. 196 mm. Fair, very heavily polished, some pitting (5.9) $50-75 P. G. Dixon & Co, Melbourne, Lion TM. Aqua. 201 mm. NM, a few spots of dirt and a spot or two of 8 Codd $150-200 A superb example of this lovely looking whittled codd. surface rust should all clean of, fsheye (9.3) 9 Codd Phillips & Stone, Bairnsdale, PS TM. -

Meet China's Corporates: a Primer

Meet China’s Corporates: A Primer An At-A-Glance Guide to China’s Non-Financial Sectors July 9, 2020 S&P Global (China) Ratings www.spgchinaratings.cn July 9, 2020 Meet China’s Corporates: A Primer July 9, 2020 Contents Beer ..................................................................................................... 3 Car Makers ........................................................................................... 6 Cement ................................................................................................ 9 Chemical Manufacturers .................................................................... 11 Coal ................................................................................................... 13 Commercial Real Estate ..................................................................... 16 Engineering and Construction ............................................................ 18 Flat Panel Display Technology ............................................................ 21 Household Appliances ....................................................................... 23 Liquor ................................................................................................ 25 Online and Mobile Gaming.................................................................. 28 Power Generation ............................................................................... 31 Real Estate Development ................................................................... 34 Semiconductors ................................................................................