Benchmarking Working Europe 2018 ETUI Publications Are Published to Elicit Comment and to Encourage Debate

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Role of Taxes in Location and Sourcing Decisions

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Studies in International Taxation Volume Author/Editor: Alberto Giovannini, R. Glen Hubbard, and Joel Slemrod, eds. Volume Publisher: University of Chicago Press Volume ISBN: 0-226-29701-2 Volume URL: http://www.nber.org/books/giov93-1 Conference Date: Sept. 26-28, 1991 Publication Date: January 1993 Chapter Title: The Role of Taxes in Location and Sourcing Decisions Chapter Author: G. Peter Wilson, R. Glen Hubbard, Joel Slemrod Chapter URL: http://www.nber.org/chapters/c7998 Chapter pages in book: (p. 195 - 234) 6 The Role of Taxes in Location and Sourcing Decisions G. Peter Wilson This descriptive study examines how nine firms integrate tax planning into other business planning. I More specifically, it considers how taxes influence companies’ decisions on capacity expansion (the location decision) and on the use of existing capacity (the sourcing decision). The study will identify im- portant tax and nontax factors that firms consider when making location and sourcing decisions and will assess the relative importance of different factors on these decisions. The findings are based on interviews with chief financial officers and high-level manufacturing, treasury, tax, and strategy managers. These conversations centered on sixty-eight location decisions that were made during the past twenty-five years. The subsequent analysis argues that the relative importance of taxes in ex- plaining location and sourcing decisions varies considerably across industries and business activities (e.g., R&D, manufacturing, marketing). A conceptual framework, based largely on theory discussed in Porter (1990) and Scholes and Wolfson (1991), is proposed to identify salient industry and business ac- G. -

Clarity on Swiss Taxes 2019

Clarity on Swiss Taxes Playing to natural strengths 4 16 Corporate taxation Individual taxation Clarity on Swiss Taxes EDITORIAL Welcome Switzerland remains competitive on the global tax stage according to KPMG’s “Swiss Tax Report 2019”. This annual study analyzes corporate and individual tax rates in Switzerland and internationally, analyzing data to draw comparisons between locations. After a long and drawn-out reform process, the Swiss Federal Act on Tax Reform and AHV Financing (TRAF) is reaching the final stages of maturity. Some cantons have already responded by adjusting their corporate tax rates, and others are sure to follow in 2019 and 2020. These steps towards lower tax rates confirm that the Swiss cantons are committed to competitive taxation. This will be welcomed by companies as they seek stability amid the turbulence of global protectionist trends, like tariffs, Brexit and digital service tax. It’s not just in Switzerland that tax laws are being revised. The national reforms of recent years are part of a global shift towards international harmonization but also increased legislation. For tax departments, these regulatory developments mean increased pressure. Their challenge is to safeguard compliance, while also managing the risk of double or over-taxation. In our fast-paced world, data-driven technology and digital enablers will play an increasingly important role in achieving these aims. Peter Uebelhart Head of Tax & Legal, KPMG Switzerland Going forward, it’s important that Switzerland continues to play to its natural strengths to remain an attractive business location and global trading partner. That means creating certainty by finalizing the corporate tax reform, building further on its network of FTAs, delivering its “open for business” message and pressing ahead with the Digital Switzerland strategy. -

An Analysis of Legislative Assistance in the European Parliament

PhD-FLSHASE-2015-12 The Faculty of Language and Literature, Humanities, Arts and Education DISSERTATION Defense held on 27 March 2015 in Luxembourg to obtain the degree of DOCTEUR DE L’UNIVERSITÉ DU LUXEMBOURG EN SCIENCES POLITIQUES by Andreja PEGAN Born on 1 February 1985 in Koper (Slovenia) An Analysis of Legislative Assistance in the European Parliament Dissertation defense committee: Dr. Philippe Poirier, dissertation supervisor Université du Luxembourg Dr. Christine Neuhold Professor, University of Maastricht Dr. Robert Harmsen, Chairman Professor, Université du Luxembourg Dr. Cristina Fasone European University Institute Dr. Olivier Costa, Vice Chairman Professor, Centre Emile Durkheim Sciences Po Bordeaux, College of Europe Brugge Acknowledgements I would like to thank my supervisor Philippe Poirier for giving me the opportunity to do this PhD. Thank you also to Robert Harmsen, David Howarth and Anna-Lena Högenauer from the Political Science Institute. I am grateful to Olivier Costa who served on my Assessment Committee (CET). Morten Egeberg kindly hosted me at the Arena Centre for European Studies and provided me with valuable comments on my research. Assistance given by Guy Vanhaeverbeke has been a great help in the field stage of my research. I am particularly grateful to all the respondents who took the time to speak with me or participated in the online survey. This research was supported by the National Research Fund Luxembourg (FNR) under the funding scheme Aides à la Formation Recherche (AFR) (Project number 1080494). My -

Recent Trends in Public-Sector Performance and Productivity in Europe

Recent Trends in Public-sector Performance and Productivity in Europe First published in Japan by the Asian Productivity Organization Leaf Square Hongo Building 2F 1-24-1 Hongo, Bunkyo-ku Tokyo 113-0033, Japan www.apo-tokyo.org © 2016 Asian Productivity Organization Asian Productivity Organization (APO) or any APO member. The views expressed in this publication do not necessarily reflect the official views of the All rights reserved. None of the contents of this publication may be used, reproduced, stored, or transferred in any form or by any means for commercial purposes without prior written permission from the APO. i CONTENTS Acknowledgement iii Executive Summary 1 1. Introduction, Background, and Key Learning Points 3 2. First Public-sector Performance Study Mission in Europe 8 3. Case Studies and Learning Points 10 Delegates 12 4. Summary of Key Benefits and Learning Points by Study Mission 5. European Public-sector Initiatives: Evolution and Recent Trends and Topics at the 8QC 15 6. The EIPA 20 7. The CAF 21 8. Key Learning Points on the CAF by Study Mission Delegates 23 9. Conclusions and Recommendations to the APO 24 References 29 Figures Figure 1. APO PSP Program framework. 6 Figure 2. Study mission map. 8 Figure 3. Delegate feedback on the study mission. 13 Figure 4. OECD toolbox overview by theme and topic. 18 Figure 5. The CAF model. 21 Annex 1. Site Visits and Presentation Reports 30 Annex 2. Report on the APO Study Mission on Recent Trends in Public-sector Productivity and Performance in Europe (Belgium, the Netherlands, Germany, and Luxembourg) from September 27 to October 2, 2015 under the APO Development of Center of Excellence by Magdalena L. -

Luxembourg's Development Cooperation Annual Report 2015

Luxembourg’s development cooperation Annual report 2015 Lëtzebuerger Entwécklungszesummenaarbecht www.cooperation.lu There is also an independent microsite containing the annual reports on Luxembourg’s development cooperation since 2010 at the following address: www.cooperation.lu. Table of contents Annual report 2015 4 Introduction by the Minister 7 Meetings and trips in 2015 11 European Year for Development 14 COP21 and the Paris Agreement 16 I. Luxembourg’s official development assistance in 2015 26 II. Cooperation with the main partner countries 26 The new Indicative Cooperation Programmes and the focus on least developed countries 29 Africa 29 Burkina Faso 30 Cabo Verde 31 Mali 32 Niger 33 Senegal 34 Central America 34 El Salvador 35 Nicaragua 36 Asia 36 Laos 37 Vietnam 38 III. Regional cooperation and cooperation with other countries 40 Balkans (Kosovo – Montenegro – Serbia) 40 Mongolia 41 Myanmar 42 Occupied Palestinian Territories 43 Afghanistan/Tajikistan 44 IV. Multilateral cooperation 53 V. European Union 55 VI. Cooperation with development NGOs 59 VII. Humanitarian action 67 VIII. Programme support 69 IX. Development education and awareness raising 70 X. Inclusive finance 71 XI. Evaluation 73 XII. Report on the progress of the work of the Interministerial Committee 77 Appendices 77 A. Useful addresses 79 B. Organisational chart of the Directorate for Development Cooperation 81 C. Useful links 3 Introduction by the Minister Dear friends of Luxembourg’s development cooperation, It is my pleasure to present to you this annual report 2015 on Luxembourg de- velopment cooperation. In last year’s annual report I highlighted the fact that 2015 would be a pivotal year for development cooperation and that the major international meetings would to a large extent reconfigure our post-2015 devel- opment cooperation and its financing. -

Financial Mechanisms for Innovative Social and Solidarity Economy Ecosystems

Financial Mechanisms for Innovative 100 Social and Solidarity Economy 95 Ecosystems 75 25 5 0 Cover_BASE 11 November 2019 09:30:13 Financial Mechanisms for Innovative Social and Solidarity Economy Ecosystems Samuel Barco Serrano1, Riccardo Bodini2, Michael Roy,3 Gianluca Salvatori4 1 Co-founder and CEO, SOKIO Cooperative. 2 Director, Euricse. 3 Professor of Economic Sociology and Social Policy, Yunus Centre for Social Business and Health/Glasgow Schoof for Business and Society, Glasgow Caledonian University. 4 Secretary General, Euricse. Copyright © International Labour Organization 2019 First published 2019 Publications of the International Labour Office enjoy copyright under Protocol 2 of the Universal Copyright Convention. Nevertheless, short excerpts from them may be reproduced without authorization, on condition that the source is indicated. For rights of reproduction or translation, application should be made to ILO Publications (Rights and Licensing), International Labour Office, CH-1211 Geneva 22, Switzerland, or by email: [email protected]. The International Labour Office welcomes such applications. Libraries, institutions and other users registered with a reproduction rights organization may make copies in accordance with the licences issued to them for this purpose. Visit www.ifrro.org to find the reproduction rights organization in your country. ________________________________________________________________________________________________________ Financial mechanisms for innovative social and solidarity economy ecosystems – -

Micro Estimates of Tax Evasion Response and Welfare Effects in Russia

IZA DP No. 3267 Myth and Reality of Flat Tax Reform: Micro Estimates of Tax Evasion Response and Welfare Effects in Russia Yuriy Gorodnichenko Jorge Martinez-Vazquez Klara Sabirianova Peter DISCUSSION PAPER SERIES DISCUSSION PAPER December 2007 Forschungsinstitut zur Zukunft der Arbeit Institute for the Study of Labor Myth and Reality of Flat Tax Reform: Micro Estimates of Tax Evasion Response and Welfare Effects in Russia Yuriy Gorodnichenko University of California, Berkeley, NBER and IZA Jorge Martinez-Vazquez Georgia State University Klara Sabirianova Peter Georgia State University and IZA Discussion Paper No. 3267 December 2007 IZA P.O. Box 7240 53072 Bonn Germany Phone: +49-228-3894-0 Fax: +49-228-3894-180 E-mail: [email protected] Any opinions expressed here are those of the author(s) and not those of the institute. Research disseminated by IZA may include views on policy, but the institute itself takes no institutional policy positions. The Institute for the Study of Labor (IZA) in Bonn is a local and virtual international research center and a place of communication between science, politics and business. IZA is an independent nonprofit company supported by Deutsche Post World Net. The center is associated with the University of Bonn and offers a stimulating research environment through its research networks, research support, and visitors and doctoral programs. IZA engages in (i) original and internationally competitive research in all fields of labor economics, (ii) development of policy concepts, and (iii) dissemination of research results and concepts to the interested public. IZA Discussion Papers often represent preliminary work and are circulated to encourage discussion. -

2015 Activity Report

lkjlkjhjhhon–– 2015 Activity Report 2015 Activity Report www.orpha.net Table of contents Abbreviation list ........................................................................................................................... 4 1. Overview .............................................................................................................................. 6 1.1. Objective .................................................................................................................................... 6 1.2. Activities ..................................................................................................................................... 6 1.3. Highlights of 2015 ...................................................................................................................... 7 Orphanet international positioning ............................................................................................... 7 Improving transparency and traceability ....................................................................................... 7 Orphanet database updates ........................................................................................................... 7 Orphanet documents update ......................................................................................................... 7 Orphanet website information ...................................................................................................... 8 Codification of RD using ORPHA codes ......................................................................................... -

Luxembourg Presidency Conclusions 2015-11-27 (Final)

27 November 2015 PRESIDENCY CONCLUSIONS of the Luxembourg Presidency of the Council of the European Union on the occasion of the Informal Ministerial Meetings on Territorial Cohesion and Urban Policy Luxembourg, 26 and 27 November 2015 At the invitation of the Luxembourg Presidency of the Council of the European Union, the Informal Ministerial Meeting on Territorial Cohesion took place in Luxembourg on 26 November 2015 and the Informal Ministerial Meeting on Urban Policy took place in Luxembourg on 27 November 2015. The Ministers responsible for Territorial Cohesion and Urban Policy in the European Union, together with the Commissioner for Regional Policy of the European Commission, the Chair of the Committee on Regional Development of the European Parliament, the President of the European Committee of the Regions, the President of the ECO Section of the European Economic and Social Committee, representatives of the European Investment Bank, representatives from Serbia and Turkey as well as Norway and Switzerland, and representatives of relevant stakeholder organisations and several observers, (1) Considering that in the framework of intergovernmental cooperation the Territorial Agenda 2020 was decided with the aim of promoting and enhancing an integrated and place-based territorial approach to support territorial cohesion, and was subject to an evaluation of the necessity to be reviewed under the Latvian and Luxembourg Presidencies; territorial cohesion was considered as a new EU objective in the Lisbon Treaty and the Treaty has now -

Essays on the Measurement of Corporate Tax Avoidance and the Effects of Tax Transparency

Essays on the Measurement of Corporate Tax Avoidance and the Effects of Tax Transparency Inauguraldissertation zur Erlangung des Doktorgrades der Wirtschafts- und Sozialwissenschaftlichen Fakultät der Universität zu Köln 2019 vorgelegt von Hubertus Wolff, M.Sc. aus Zwiesel Referent: Prof. Dr. Michael Overesch, Universität zu Köln Korreferent: Prof. Dr. Christoph Kuhner, Universität zu Köln Tag der Promotion: 16. Dezember 2019 I Vorwort Die vorliegende Arbeit entstand während meiner Tätigkeit als wissenschaftlicher Mitarbeiter am Seminar für ABWL und Unternehmensbesteuerung der Universität zu Köln. Sie wurde im Dezember 2019 von der Wirtschafts- und Sozialwissenschaftlichen Fakultät der Universität zu Köln als Dissertation angenommen. Das Entstehen dieser Arbeit wurde durch die Unterstützung zahlreicher Personen geprägt, denen ich an dieser Stelle danken möchte. Mein größter Dank gilt meinem Doktorvater Herrn Prof. Dr. Michael Overesch. Der häufige fachliche Austausch und seine permanente Unterstützung trugen maßgeblich zum Gelingen dieser Arbeit bei. Zudem danke ich Herrn Prof. Dr. Christoph Kuhner für die Erstellung des Zweitgutachtens und Herrn Prof. Dr. Michael Stich für die Übernahme des Vorsitzes der Prüfungskommission. Ebenso gilt mein ausdrücklicher Dank Prof. Kevin Markle, welcher mir einen Forschungsaufenthalt an der University of Iowa ermöglichte. Großer Dank gebührt auch meinen Kolleginnen und Kollegen am Seminar für ABWL und Unternehmensbesteuerung der Universität zu Köln. Die freundschaftliche Atmosphäre am Lehrstuhl und -

Annual Report 2015

ECPC ANNUAL REPORT 2015 "Nothing about us without us!" TABLE OF CONTENTS ECPC: Rising to new heights .............................................................................................. 4 ECPC Annual general meeting 2015 ........................................................................................... 4 Enhanced collaboration with an increased ECPC member base ................................................... 4 Make Sense Campaign ..................................................................................................................... 5 Guide for patients on immuno-oncology ......................................................................................... 5 Nutrition Survey ............................................................................................................................... 5 The Brain Tumour Charity ................................................................................................................ 5 Lung Cancer Europe (LuCE) .............................................................................................................. 5 PAVEL ............................................................................................................................................... 6 ECPC Staff ................................................................................................................................. 6 Financial Officer .............................................................................................................................. -

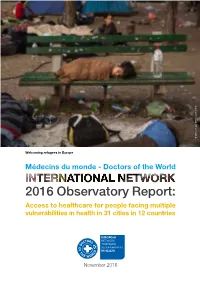

Access to Healthcare for People Facing Multiple Vulnerabilities in Health in 31 Cities in 12 Countries

© Olmo CALVO/ Médicos del Mundo © Olmo CALVO/ Welcoming refugees in Europe Access to healthcare for people facing multiple vulnerabilities in health in 31 cities in 12 countries C : 100 M : 60 J : 0 N : 0 NovemberMédecins du monde - Identité visuelle ANGLETERRE 08/07/2009 2016 TABLE OF CONTENTS 3/ ACKNOWLEDGMENTS 27/ BARRIERS IN ACCESS TO HEALTHCARE 4/ EXECUTIVE SUMMARY Overview 27 5/ 2015 IN FIGURES Giving up seeking medical European survey results (11 countries) 5 advice or treatment 30 Key figures for Turkey 5 Denial of access to care by a health provider 30 Focus: Pregnant women 5 Discrimination in healthcare facilities 30 Focus: Children 6 Fear of being arrested 30 Focus: Violence 6 31/ SELF-PERCEIVED HEALTH STATUS 7/ EUROPEAN NETWORK AND INTERNATIONAL OBSERVATORY 32/ HEALTH STATUS 7/ THE SOCIAL, ECONOMIC Health problems 32 AND POLITICAL CONTEXT IN 2015 Contraception 32 Urgent care 32 10/ RECENT LEGAL CHANGES, Acute and chronic health conditions 33 FOR BETTER OR WORSE Necessary treatment 33 France 10 Patients had received little or Germany 10 no care before visiting our clinics 33 Greece 10 Chronic conditions: Luxembourg 10 no access, no continuity 34 Norway 10 Infectious disease screening 34 Spain 10 Sweden 11 36/ FOCUS ON PREGNANT WOMEN Switzerland 11 Geographic origin of pregnant women 37 Turkey 11 Administrative status 37 United Kingdom 11 Living conditions 37 Isolation 37 12/ 2015 INTERNATIONAL Limiting movements 37 OBSERVATORY SURVEY HIV and hepatitis screening 38 Methodology 12 Access to healthcare 38 Statistics 12 Pregnant