The ALM Vanguard: HR Operations Consulting 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Personalisation for Your People

Personalisation for your people How COVID-19 is reshaping the race for talent Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. BCG was the pioneer in business strategy when it was founded in 1963. Today, we help clients with total transformation—inspiring complex change, enabling organizations to grow, building competitive advantage, and driving bottom-line impact. To succeed, organizations must blend digital and human capabilities. Our diverse, global teams bring deep industry and functional expertise and a range of perspectives to spark change. BCG delivers solutions through leading-edge management consulting along with technology and design, corporate and digital ventures—and business purpose. We work in a uniquely collaborative model across the firm and throughout all levels of the client organization, generating results that allow our clients to thrive. Personalisation for your people How COVID-19 is reshaping the race for talent Chris Mattey, Christoph Hilberath, Nicole Sibilio, Jasmine Aurora, Hermann Ruiz June 2020 AT A GLANCE The COVID-19 crisis has activated a modern industrial revolution. It has forced a rapid shift in where and how most Australians work, and broken through longstand- ing barriers to change in just three months. To understand this shift, BCG conduct- ed an online workforce sentiment survey of 1,002 people to uncover experiences and attitudes to working during COVID-19. The survey findings provide a snapshot of how employees feel about work. Some findings are intuitive, such as three-quarters of employees faced barriers to working during COVID-19, but nearly the same number also experienced positive impacts on their work. -

2014 Registration Document Annual Financial Report Contents

2014 REGISTRATION DOCUMENT ANNUAL FINANCIAL REPORT CONTENTS 1 4 Presentation of the Company Financial Information 129 and its activities 5 4.1 Analysis on Capgemini 2014 Group consolidated 1.1 Milestones in the Group’s history and its values 6 results AFR 130 1.2 The Group’s activities 8 4.2 Consolidated accounts AFR 136 1.3 Main Group subsidiaries and simplified 4.3 Comments on the Cap Gemini S.A. Financial organization chart 13 Statements AFR 195 1.4 The market and the competitive environment 15 4.4 Cap Gemini S.A. financial statements AFR 197 1.5 2014, a year of strong growth 17 4.5 Other financial and accounting information AFR 221 1.6 The Group’s investment policy, financing policy and market risks AFR 25 1.7 Risk analysis AFR 26 5 CAP GEMINI and its shareholders 223 2 5.1 Cap Gemini S.A. Share Capital AFR 224 5.2 Cap Gemini S.A. and the stock market 229 Corporate governance 5.3 Current ownership structure 233 and Internal control 33 5.4 Share buyback program AFR 235 2.1 Organization and activities of the Board of Directors AFR 35 6 2.2 General organization of the Group AFR 54 2.3 Compensation of executive corporate officers AFR 58 2.4 Internal control and risk management Report of the Board of Directors procedures AFR 70 and draft resolutions 2.5 Statutory Auditors’ report prepared in accordance with Article L.225-235 of the French Commercial of the Combined Shareholders’ Code on the report prepared by the Chairman Meeting of May 6, 2015 237 of the Board of Directors AFR 79 6.1 Resolutions presented at the Ordinary Shareholders’ -

Catalysing Change Through Corporate Social Responsibility'

NASSCOM Foundation Offices across India Delhi Office FEB, 2015 A1 -125, Third Floor, Safdarjung Enclave Opposite Ambience Public School New Delhi – 110029, India Phone : +91 11 64782655/56/57/58/59/60/61/62 Mumbai Office Samruddhi Venture Park Ground Floor, Office # 13-16 y t Central MIDC Road Andheri East Mumbai- 400093 India i l Phone : +91 22 28328535/36/37/38/18/19 i b i Fax : +91 22 28361576 s n o Catalysing change through p Bangalore Office s e JSS Institutions Campus, First Floor, l r corporate social responsibility a CA Site No.1, HAL 3rd Stage i c Behind Hotel Leela Palace Bangalore 560 008 India o Phone: +91-80- 4115 1705-706 e s t Fax: +91-80- 41151707 a r o p Hyderabad Office r Unit 105, 1st Floor, Maximus 2B Raheja o h c MindSpace, Madhapur Hyderabad 500082 g u Phone: +91-40- 6636 6111/222/333/ 4025 1616 o r Fax: +91-40- 6636 6333 h e t g Pune Office n a B Wing, 5th Floor,MCCIA Trade Tower, h International Convention Centre Complex, g c n Senapati Bapat Road, i s Pune – 411016 y l a Fax: 020 25630415 t a Email: E-mail: [email protected] C FEB, 2015 contents Foreword 01 About The Boston Consulting About NASSCOM Foundation Preface 03 Group (BCG) Executive Summary 04 BCG is a global management consulting firm and the world's NASSCOM Foundation is a trust registered under the Indian Trust leading advisor on business strategy. We partner with clients Act 1882. -

Aon Plc 2020 10-K

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ____________________________________________________________________________ FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 1-7933 ___________________________________________________________________________________________ Aon plc (Exact name of registrant as specified in its charter) IRELAND 98-1539969 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) Metropolitan Building, James Joyce Street, Dublin 1, Ireland D01 K0Y8 (Address of principal executive offices) (Zip Code) +353 1 266 6000 (Registrant’s Telephone Number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol Name of Each Exchange on Which Registered Class A Ordinary Shares, $0.01 nominal value AON New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: NONE ________________________________________________________________________________________________________________________________________________________________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Carbon Footprint & Energy Transition Report

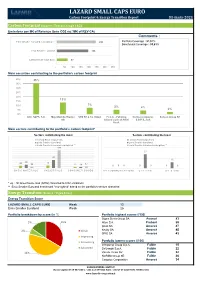

LAZARD SMALL CAPS EURO Carbon Footprint & Energy Transition Report 31-mars-2021 Carbon Footprint (Source : Trucost, scope 1&2) Emissions per M€ of Revenue (tons CO2 éq.*/M€ of REV CA) Comments : Emix Smaller Euroland reweighted ** 242 Portfolio Coverage : 97,51% Benchmark Coverage : 93,61% Emix Smaller Euroland 196 Lazard Small Caps Euro 67 - 50 100 150 200 250 300 350 Main securities contributing to the portfolio's carbon footprint 40% 35% 35% 30% 25% 20% 13% 15% 10% 7% 5% 4% 5% 2% 0% Altri, SGPS, S.A. Mayr-Melnhof Karton STO SE & Co. KGaA F.I.L.A. - Fabbrica Corticeira Amorim, Surteco Group SE AG Italiana Lapis ed Affini S.G.P.S., S.A. S.p.A. Main sectors contributing to the portfolio's carbon footprint* Sectors contributing the most Sectors contributing the least Lazard Small Caps Euro Lazard Small Caps Euro Emix Smaller Euroland Emix Smaller Euroland Emix Smaller Euroland reweighted ** Emix Smaller Euroland reweighted ** 193 27 87 12 35 28 24 13 17 12 11 00 0 0 0 0 0 BASIC MATERIALS INDUSTRIALS CONSUMER GOODS TELECOMMUNICATIONS UTILITIES OIL & GAS * eq. : All Greenhouse Gas (GHG) converted to CO2 emissions ** Emix Smaller Euroland benchmark "reweighted" based on the portfolio's sectors allocation Energy Transition (Source : Vigeo Eiris) Energy Transition Score LAZARD SMALL CAPS EURO Weak 13 Emix Smaller Euroland Weak 25 Portfolio breakdown by score (in %) Portfolio highest scores (/100) Sopra Steria Group SA Avancé 83 5% 10% Alten S.A. Probant 59 Ipsos SA Amorcé 47 2% Weak Nexity SA Amorcé 45 SPIE SA Amorcé 43 Improving Portfolio lowest scores (/100) Convincing Interpump Group S.p.A. -

Marsh & Mclennan Companies 2009 Notice of Annual Meeting and Proxy

Marsh & McLennan Companies Notice of Annual Meeting 2009 and Proxy Statement Important Notice Regarding the Availability of Proxy Materials for the MMC Annual Meeting of Stockholders to be held on May 21, 2009: This proxy statement and MMC’s 2008 Annual Report are available at http://www.proxy09.mmc.com. Dear MMC Stockholder: You are cordially invited to attend the annual meeting of stockholders of Marsh & McLennan Companies, Inc. The meeting will be held at 10:00 a.m. on Thursday, May 21, 2009 in the second floor auditorium at 1221 Avenue of the Americas, New York, New York. In addition to voting on the matters described in this proxy statement, we will use the meeting as an opportunity to report on MMC’s recent activities. You will be able to ask questions, and to meet your company’s directors and senior executives. Whether or not you plantoattend the annual meeting, your vote is important and we urge you to participate in electing directors and deciding the other items on the agenda for the annual meeting. You will find information on how to vote in the first section of this proxy statement. Very truly yours, BRIAN DUPERREAULT President & Chief Executive Officer April 2, 2009 MARSH & McLENNAN COMPANIES, INC. 1166 Avenue of the Americas New York, New York 10036-2774 NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT Time: 10:00 a.m. Local Time Date: May 21, 2009 Place: Second Floor Auditorium 1221 Avenue of the Americas New York, New York 10020 Purpose: 1. To elect four persons named in the accompanying proxy statement to serve as directors for a one-year term; 2. -

KPMG Brand Perceptions 2016

EXTRACT CLIENT AND BRAND INSIGHTS 2016 BRAND PERCEPTION SUMMARY KPMG 2 About this brand perception summary The data contained in this summary represents the views of clients (senior end users of consulting services) as expressed to us via an online survey, more details of which you’ll find in the section entitled “methodology”. It does not represent the view of analysts. The interpretation of that data, however, is ours. It’s based on the unparalleled knowledge that we’ve acquired through years of surveying and interviewing consultants and their clients, and through the work we’ve done—and continue to do—advising the leaders of the world’s biggest and most successful consulting firms about their businesses. A full list of firms for which brand perception summaries are available can be found towards the back of this document. REPORT EXTRACT: non-exclusively licensed for internal use only 3 Methodology In December 2015 we surveyed 2,649 clients—senior end users of consulting services from around the globe, all of whom had made extensive use of consultants—and asked them to tell us about three Firms included in our global study and consulting firms of their choosing, giving us 9,278 responses in total. We asked about those firms’ how we classify them: capabilities, across a range of consulting services, about the extent to which they deliver value relative to the fees they charge, and about the attributes they associate with each firm. We also asked about the Accenture Technology likelihood of using a firm, whether they have recommended a firm, and if that firm is their first choice Aon Hewitt HR for each service. -

Why Paid Family Leave Is Good Business the Boston Consulting Group (BCG) Is a Global Management Consulting Firm and the World’S Leading Advisor on Business Strategy

Why Paid Family Leave Is Good Business The Boston Consulting Group (BCG) is a global management consulting firm and the world’s leading advisor on business strategy. We partner with clients from the private, public, and not-for- profit sectors in all regions to identify their highest-value opportunities, address their most critical challenges, and transform their enterprises. Our customized approach combines deep in sight into the dynamics of companies and markets with close collaboration at all levels of the client organization. This ensures that our clients achieve sustainable compet itive advantage, build more capable organizations, and secure lasting results. Founded in 1963, BCG is a private company with 85 offices in 48 countries. For more information, please visit bcg.com. Why PaId FamILy Leave Is Good BusIness Trish sTrOman Wendy WOOds GaBrielle FiTzGerald shalini Unnikrishnan liz Bird February 2017 | The Boston Consulting Group Contents 3 EXECUTIVE SUMMARY 6 INTRODUCTION: TAKING ANOTHER LOOK AT PAID FAMILY LEAVE 8 THE CHANGING DYNAMICS OF PAID FAMILY LEAVE Absent a Federal or State Policy, Paid Family Leave Is Employer Driven Demand Is Increasing Diverse Industries Are Responding 13 THE BUSINESS CASE FOR PAID FAMILY LEAVE Employee Retention Talent Attraction Reinforced Company Values Improved Engagement, Morale, and Productivity Enhanced Brand Equity The Tradeoff Between Costs and Benefits 19 LESSONS FROM THE LEADERS Reflecting Company Values Weeks Off: Not the Only Value Driver Set an Example at the Top Support Systems Metrics to Measure Success 24 FOR FURTHER ReADING 25 NOTE TO THE ReADER 2 | Why Paid Family Leave Is Good Business exeCutIve summary any private-sector organizations in the US are taking a new look at Mpaid family leave—paid time off to enable employees to care for a new child or an ill family member. -

Strategies for Impact Strategy Consultant What We Do Hope

Strategies for Impact 353 Sacramento St, Suite 1700 San Francisco, CA 94111 +1.503.789.4808 phone [email protected] email Strategy Consultant What We Do Hope Consulting is a boutique strategy consulting firm with a social sector focus. We craft effective strategies for addressing major social sector issues, and bring the correct set of players to the table to drive those solutions forward. Our practice areas include market analysis and customer research, growth strategy and strategic planning, program strategy and design, and organizational development. In our first two years in business, our work has attracted attention in the social sector as well as in the mainstream news media, with coverage in the New York Times, the Economist, and other media outlets. In our international work, we combine top-tier business strategy skills with extensive experience on the ground in the developing world, to develop strategies that work for our clients and the people they serve. Where appropriate (and it is often appropriate), we use deep customer research capabilities to identify how our clients can more effectively meet the needs of the poor. The research is short-cycle, commercial market research, designed to provide organizations with insights they can rapidly use to better serve customer needs, and to increase product and service adoption among the poor in the developing world. We make experienced hires from the top tier business strategy firms, including Marakon Associates, the Boston Consulting Group, Lippincott Mercer, and Oliver Wyman. Our team members have significant track records in strategy, customer, and market analysis, primarily for the world’s leading companies. -

Tech Procurement in the UK Justice Sector

Tech Procurement in the UK Justice Sector December 2020 Trusted Insight on Government Contracts and Spend Trusted by suppliers, the public sector, and the media — Corporate Government Media 550+ Press citations since Jan 2019 “Serious-minded business data provider Tussell” Matthew Vincent 22nd September 2018 2 | Trends and Opportunities in the Justice Sector We transform open data into useful data – so you don’t have to — Open data Third party data Useful data Use cases CONTRACT DATA Public Sector Aggregate Get better value from TED (EU) suppliers Companies House Contracts Finder (UK), Sell2Wales, PCS Match Digital Marketplace Suppliers Normalise Win government Circa 70 local portals contracts Cleanse SPEND DATA Moody’s Analytics 6800+ Central Gov’t, Press Local Gov’t & NHS Machine Scrutinise public bodies learn spending 3 | Trends and Opportunities in the Justice Sector Total data coverage: Justice — Spend Contracts Q1 2016 – Q2 2020 Q1 2015 – Q3 2020 864,000 invoices 7,000 contracts £28bn spend value £17bn contract value 43 buyers 100 buyers 31,000 suppliers 2,600 suppliers 4 | Trends and Opportunities in the Justice Sector Questions Tussell will answer — 1. How big is the market? 2. What’s the breakdown by sub-sector? 3. Can new entrants break through? 4. Has demand recovered from Covid? 5. How can I position my firm for future rebids? 5 | Procurement in the UK EdTech market Technology spend in the justice sector in the five years from 2016-2020 was £3bn in total, an average of £597m per annum Spend data £728M £710M Average: £597M £578M -

Top Companies for Leaders 2011 Study Insights and Best Practices Asia Pacifi C

Consulting Talent & Rewards Top Companies for Leaders 2011 Study Insights and Best Practices Asia Pacifi c Aon Hewitt I Consulting 1 About Aon Hewitt's Top Companies for Leaders (TCFL) study is one of the the Study most comprehensive studies on organizational leadership practices around the globe. 478 organizations participated in the 2011 global study. Our fi rst study results, published in 2002, uncovered a link between fi nancial success and great leadership practices and identifi ed differentiating elements found only in Top Companies. We conducted this study again in 2003, 2005, 2007 and 2009. The data derived from these fi ve studies provided the foundation for our 2011 study which we believe to be the most comprehensive global study available on leadership to date. Aon Hewitt conducted the 2007, 2009 and 2011 Top Companies for Leaders studies in partnership with FORTUNE and The RBL Group. 2 Top Companies For Leaders 2011 Study Executive Organizations that have great leadership practices demonstrate strong fi nancial results over the long term. Leadership is the single most valuable competitive advantage today. While it helps in gaining an Summary edge over competition, it proves to be even more valuable as economies go through ups and downs. It was within this economic context that Aon Hewitt and its study partners - The RBL Group and FORTUNE - undertook the 2011 Top Companies for Leaders study. Globally, 478 companies participated in the research of which 152 companies were from Asia Pacifi c (APAC). A comprehensive evaluation process comprising of a scan of leadership practices and policies of organizations, in-depth interviews with HR leaders, CEOs and senior leaders, and fi nally blind judging from the shortlist, culminated in the Global Top Companies for Leaders. -

Relatório De Contas 2020 Aon Reinsurance, S.A

Relatório de contas 2020 Aon Reinsurance, S.A Relatório de Gestão Aon Reinsurance, SA Exercício findo em 31 de dezembro de 2020 AON REINSURANCE, S.A. EXERCÍCIO DE 2020 RELATÓRIO DE GESTÃO A sociedade Aon Reinsurance, S.A. tem por objeto a corretagem de resseguros, consultadoria de seguros e, por último, a aquisição de participações no capital de outras sociedades, desde que previamente autorizadas pelo Instituto de Investimento Estrangeiro. GOVERNO SOCIETÁRIO O capital social da sociedade no montante de 100.000 euros, representado por 20.000 ações de valor nominal de 5 Euros, encontra-se integralmente subscrito e realizado, sendo subscrito em 100% pela sociedade Aon Portugal, S.A.. As ações são nominativas, sendo representadas por títulos de uma, cinco, dez, cinquenta e cem ações. Os acionistas gozam direito de preferência na alienação onerosa das ações mesmo a favor de outros acionistas. A administração da Sociedade é exercida por um Conselho de Administração, composto por um número ímpar de membros, de três a nove, eleitos pela Assembleia Geral, que designará também o respetivo presidente, por um período de quatro anos podendo ser reeleitos uma ou mais vezes. O Conselho de Administração reunirá, pelo menos, duas vezes em cada exercício. Compete ao Conselho de Administração, dentro dos limites da lei e dos estatutos da sociedade, deliberar sobre qualquer assunto de administração da sociedade e, nomeadamente, sobre: a) Relatório e contas anuais; b) Aquisição, alienação e oneração de bens imóveis; c) Abertura ou encerramento de estabelecimentos; d) Modificações importantes na organização da Empresa; e) Mudança da sede social e aumento de capital; e f) Aquisição ou alienação de participações sociais de outras sociedades, nos termos legais.