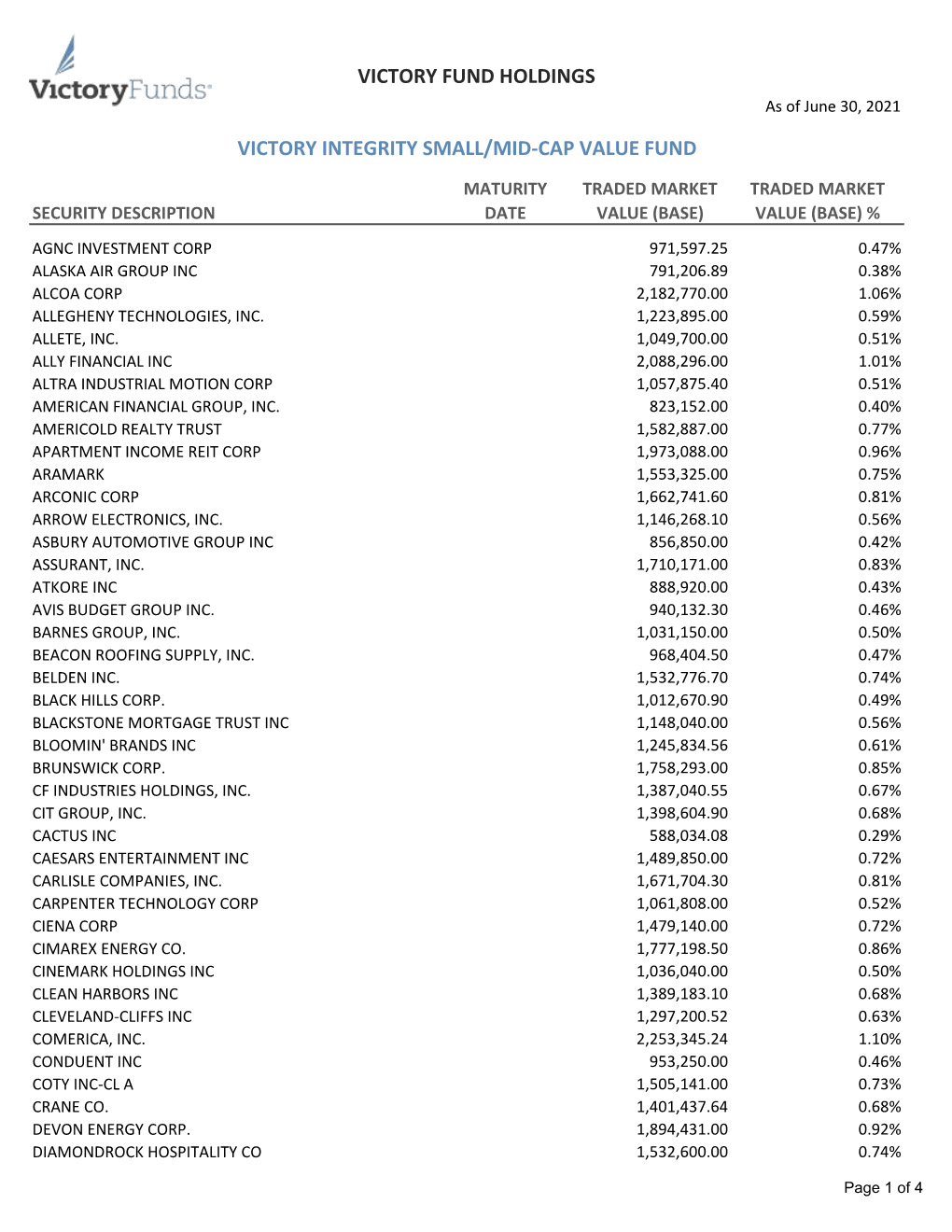

Victory Fund Holdings Victory Integrity Small/Mid

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Fidelity® Puritan® Fund

Quarterly Holdings Report for Fidelity® Puritan® Fund May 31, 2021 PUR-QTLY-0721 1.800346.117 Schedule of Investments May 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 69.6% Shares Value (000s) COMMUNICATION SERVICES – 9.6% Entertainment – 1.3% Activision Blizzard, Inc. 603,018 $ 58,644 Electronic Arts, Inc. 254,137 36,324 Live Nation Entertainment, Inc. (a) 800,608 72,143 LiveXLive Media, Inc. (a) (b) (c) 6,788,150 33,533 Roblox Corp. (a) (b) 499,118 46,802 The Void LLC (a) (d) (e) (f) 40,946 0 The Walt Disney Co. (a) 998,933 178,459 425,905 Interactive Media & Services – 7.7% Alphabet, Inc. Class C (a) 752,424 1,814,515 Facebook, Inc. Class A (a) 2,233,877 734,342 Snap, Inc. Class A (a) 437,546 27,180 2,576,037 Media – 0.3% Endeavor Group Holdings, Inc. (a) (b) 181,500 5,381 Endeavor Group Holdings, Inc. (a) 2,673,426 71,340 ViacomCBS, Inc. Class B 126,973 5,386 Vice Holding, Inc. (a) (e) (f) 86,301 4,578 86,685 Wireless Telecommunication Services – 0.3% T‑Mobile U.S., Inc. 836,523 118,326 TOTAL COMMUNICATION SERVICES 3,206,953 CONSUMER DISCRETIONARY – 10.7% Automobiles – 0.6% General Motors Co. (a) 3,189,016 189,141 Neutron Holdings, Inc. (f) 4,168,198 57 Thor Industries, Inc. 161,648 19,883 209,081 Diversified Consumer Services – 0.0% Bright Horizons Family Solutions, Inc. (a) 31,358 4,335 Hotels, Restaurants & Leisure – 1.7% Airbnb, Inc. -

733600137 HUM Hamilton U.S. Mid Small-Cap Financials ETF;SOI

Hamilton U.S. Mid/Small-Cap Financials ETF (HUM, HUM.U:TSX) Summary of Investment Portfolio As at March 31, 2021 % of ETF's Asset Mix Net Asset Value Net Asset Value U.S. Equities $ 45,337,253 94.02% Global Equities 3,181,073 6.60% Currency Forward Hedge* (513,777) -1.07% Cash and Cash Equivalents 338,960 0.70% Other Assets less Liabilities (121,439) -0.25% $ 48,222,070 100.00% % of ETF's Sector Mix Net Asset Value Net Asset Value Financials $ 47,831,452 99.19% Information Technology 686,874 1.43% Currency Forward Hedge* (513,777) -1.07% Cash and Cash Equivalents 338,960 0.70% Other Assets less Liabilities (121,439) -0.25% $ 48,222,070 100.00% * Positions in forward contracts are disclosed as the gain/(loss) that would be realized if the contracts were closed out on the date of this report. Hamilton U.S. Mid/Small-Cap Financials ETF (HUM, HUM.U:TSX) Summary of Investment Portfolio (continued) As at March 31, 2021 % of ETF’s Top 25 Holdings Net Asset Value Western Alliance Bancorp 3.27% Raymond James Financial Inc. 3.16% Pinnacle Financial Partners Inc. 3.09% First Horizon National Corp. 3.01% LPL Financial Holdings Inc. 2.99% Arch Capital Group Ltd. 2.93% Ares Management Corp. 2.88% Nasdaq Inc. 2.85% Ally Financial Inc. 2.83% Signature Bank 2.72% Cadence Bancorp. 2.64% Synovus Financial Corp. 2.44% Lazard Ltd. 2.27% Prosperity Bancshares Inc. 2.26% Voya Financial Inc. 2.24% WSFS Financial Corp. -

UNITED CHURCH of CHRIST, INC. SCHEDULE of INVESTMENTS June 30, 2018 Unaudited - for Information Purposes Only

THE PENSION BOARDS - UNITED CHURCH OF CHRIST, INC. SCHEDULE OF INVESTMENTS June 30, 2018 Unaudited - for information purposes only. SUMMARY OF INVESTMENTS COST VALUE STABLE VALUE INVESTMENTS Short-Term Investments $ 6,566,917 $ 6,566,917 Fixed Maturity Synthetic Guaranteed Investment Contracts 38,995,288 38,995,288 Constant Duration Synthetic Guaranteed Investment Contracts 126,234,758 126,234,758 TOTAL STABLE VALUE INVESTMENTS $ 171,796,963 $ 171,796,963 SHORT-TERM INVESTMENTS Short-term Investments $ 95,552,274 $ 95,552,274 TOTAL SHORT-TERM INVESTMENTS $ 95,552,274 $ 95,552,274 FIXED-INCOME INVESTMENTS Bonds $ 943,137,735 $ 929,127,457 Bond funds 235,065,068 238,580,280 Asset-backed & Mortgage-backed Securities 167,221,040 162,522,120 TOTAL FIXED-INCOME INVESTMENTS $ 1,345,423,843 $ 1,330,229,857 EQUITY INVESTMENTS Common stocks and equivalents $ 754,559,724 $ 1,047,247,659 Equity funds 364,289,377 398,472,808 Emerging Markets Discounted Assets 100,671,500 86,596,087 TOTAL EQUITY INVESTMENTS $ 1,219,520,601 $ 1,532,316,554 OTHER INVESTMENTS Hedge funds $ 70,137,861 $ 83,227,777 Real Assets 69,437,464 70,498,810 Participation in the United Church Funds, Inc. 38,344,068 42,641,757 TOTAL OTHER INVESTMENTS $ 177,919,393 $ 196,368,344 TOTAL INVESTMENTS $ 3,010,213,074 $ 3,326,263,992 PRINCIPAL INTEREST DESCRIPTION SERIES MATURITY COST VALUE AMOUNT RATE % SHORT-TERM INVESTMENTS MFB NI Treasury Money Market Fund $ 6,566,917 $ 6,566,917 TOTAL SHORT-TERM INVESTMENT $ 6,566,917 $ 6,566,917 FIXED MATURITY SYNTHETIC GUARANTEED INVESTMENT CONTRACTS: Asset-Backed Securities 1,155,548 AEP Texas Central Company 1.98 6/1/2021 $ 1,165,840 $ 1,144,164 1,600,000 Capital One Multi-Asset Execution Trust 1.33 6/15/2022 1,599,615 1,574,914 645,871 Carmax Auto Owner Trust 2016-1 1.61 11/16/2020 645,714 642,237 630,912 CenterPoint Energy, Inc. -

ACVR NT High Income

American Century Investments® Quarterly Portfolio Holdings NT High Income Fund June 30, 2021 NT High Income - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 94.0% Aerospace and Defense — 1.9% Bombardier, Inc., 6.00%, 10/15/22(1) 1,287,000 1,291,240 Bombardier, Inc., 7.50%, 12/1/24(1) 1,450,000 1,517,070 Bombardier, Inc., 7.50%, 3/15/25(1) 676,000 696,702 Bombardier, Inc., 7.875%, 4/15/27(1) 1,100,000 1,142,636 BWX Technologies, Inc., 4.125%, 4/15/29(1) 525,000 535,521 F-Brasile SpA / F-Brasile US LLC, 7.375%, 8/15/26(1) 600,000 620,250 Howmet Aerospace, Inc., 5.125%, 10/1/24 1,925,000 2,129,493 Howmet Aerospace, Inc., 5.90%, 2/1/27 125,000 146,349 Howmet Aerospace, Inc., 5.95%, 2/1/37 1,975,000 2,392,574 Rolls-Royce plc, 5.75%, 10/15/27(1) 600,000 661,668 Spirit AeroSystems, Inc., 5.50%, 1/15/25(1) 400,000 426,220 Spirit AeroSystems, Inc., 7.50%, 4/15/25(1) 875,000 936,587 Spirit AeroSystems, Inc., 4.60%, 6/15/28 600,000 589,515 TransDigm, Inc., 7.50%, 3/15/27 675,000 718,942 TransDigm, Inc., 5.50%, 11/15/27 6,000,000 6,262,500 TransDigm, Inc., 4.625%, 1/15/29(1) 1,275,000 1,279,195 TransDigm, Inc., 4.875%, 5/1/29(1) 1,425,000 1,440,319 Triumph Group, Inc., 8.875%, 6/1/24(1) 315,000 350,833 Triumph Group, Inc., 6.25%, 9/15/24(1) 275,000 280,159 Triumph Group, Inc., 7.75%, 8/15/25 375,000 386,250 23,804,023 Air Freight and Logistics — 0.3% Cargo Aircraft Management, Inc., 4.75%, 2/1/28(1) 850,000 869,584 Western Global Airlines LLC, 10.375%, 8/15/25(1) 875,000 1,003,520 XPO Logistics, Inc., 6.125%, 9/1/23(1) 1,100,000 1,111,820 XPO Logistics, Inc., 6.75%, 8/15/24(1) 475,000 494,000 3,478,924 Airlines — 1.1% American Airlines Group, Inc., 5.00%, 6/1/22(1) 750,000 751,890 American Airlines, Inc., 11.75%, 7/15/25(1) 2,475,000 3,109,219 American Airlines, Inc. -

Greater Pittsburgh CIO Group

Greater Pittsburgh CIO Group Q3 2020 Combined Meeting September 22, 2020 Agenda • Welcome • Main topic: Data Loss Prevention o Presented by Howmet Aerospace • Leadership Development Program o Cohort 3 in development o Nomination process and timeline • Membership o Confirming members o Donation opportunities cio.com • Q4 Meeting - o October 21, 2020 o Partnering with Premier Connects www.pgh Greater Pittsburgh CIO Group, CISO Group, IT Manager Group Welcome www.pgh-cio.com September 22, 2020 Welcome • Greater Pittsburgh CIO Group is a non-profit organization that has been in existence for 20 years. Expanded to include the CISO Group and IT Managers Group. Currently over 200 total members… • Mission is to provide an open forum for Pittsburgh IT decision-makers to share their experiences in an environment free from sales and marketing solicitations • Bringing IT leaders together on a regular basis o Host quarterly membership meetings to broaden knowledge o Co-host the CIO of the Year Awards to recognize Pittsburgh IT leaders o Collaborate with other organizations to provide learning experiences (NCFTA, Pgh Technology Council, Premier Connects cio.com • Continuing to improve - o New website: https://pgh-cio.com/ o Planning a Microsoft O365 tenant to increase collaboration www.pgh o Expanding the Leadership Development Program to “masters” level Advisory Boards CIO Group IT Managers Group CISO Group cio.com - www.pgh Presentedby Howmet Aerospace Prevention Loss Data www.pgh-cio.com September 22, 2020 Data Loss Prevention (DLP) • DLP is a set of technologies and processes that monitors and inspects data on the corporate network to ensure sensitive data is not lost or stolen. -

Aviation Week & Space Technology

STARTS AFTER PAGE 38 How AAR Is Solving Singapore Doubles Its Workforce Crisis RICH MEDIA Down on Aviation ™ EXCLUSIVE $14.95 FEBRUARY 10-23, 2020 BRACING FOR Sustainability RICH MEDIA EXCLUSIVE Digital Edition Copyright Notice The content contained in this digital edition (“Digital Material”), as well as its selection and arrangement, is owned by Informa. and its affiliated companies, licensors, and suppliers, and is protected by their respective copyright, trademark and other proprietary rights. Upon payment of the subscription price, if applicable, you are hereby authorized to view, download, copy, and print Digital Material solely for your own personal, non-commercial use, provided that by doing any of the foregoing, you acknowledge that (i) you do not and will not acquire any ownership rights of any kind in the Digital Material or any portion thereof, (ii) you must preserve all copyright and other proprietary notices included in any downloaded Digital Material, and (iii) you must comply in all respects with the use restrictions set forth below and in the Informa Privacy Policy and the Informa Terms of Use (the “Use Restrictions”), each of which is hereby incorporated by reference. Any use not in accordance with, and any failure to comply fully with, the Use Restrictions is expressly prohibited by law, and may result in severe civil and criminal penalties. Violators will be prosecuted to the maximum possible extent. You may not modify, publish, license, transmit (including by way of email, facsimile or other electronic means), transfer, sell, reproduce (including by copying or posting on any network computer), create derivative works from, display, store, or in any way exploit, broadcast, disseminate or distribute, in any format or media of any kind, any of the Digital Material, in whole or in part, without the express prior written consent of Informa. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017

Report of Activities Pursuant to Act 44 of 2010 Appendix D - Securities Held by Funds October 18, 2017 Annual Report of Activities Pursuant to Act 44 of 2010 October 18, 2017 Appendix D: Securities Held by Funds The Four Funds hold thousands of publicly and privately traded securities. Act 44 directs the Four Funds to publish “a list of all publicly traded securities held by the public fund.” For consistency in presenting the data, a list of all holdings of the Four Funds is obtained from Pennsylvania Treasury Department. The list includes privately held securities. Some privately held securities lacked certain data fields to facilitate removal from the list. To avoid incomplete removal of privately held securities or erroneous removal of publicly traded securities from the list, the Four Funds have chosen to report all publicly and privately traded securities. The list below presents the securities held by the Four Funds as of June 30, 2017. 1345 AVENUE OF THE A 1 A3 144A AAREAL BANK AG ABRY MEZZANINE PARTNERS LP 1721 N FRONT STREET HOLDINGS AARON'S INC ABRY PARTNERS V LP 1-800-FLOWERS.COM INC AASET 2017-1 TRUST 1A C 144A ABRY PARTNERS VI L P 198 INVERNESS DRIVE WEST ABACUS PROPERTY GROUP ABRY PARTNERS VII L P 1MDB GLOBAL INVESTMENTS L ABAXIS INC ABRY PARTNERS VIII LP REGS ABB CONCISE 6/16 TL ABRY SENIOR EQUITY II LP 1ST SOURCE CORP ABB LTD ABS CAPITAL PARTNERS II LP 200 INVERNESS DRIVE WEST ABBOTT LABORATORIES ABS CAPITAL PARTNERS IV LP 21ST CENTURY FOX AMERICA INC ABBOTT LABORATORIES ABS CAPITAL PARTNERS V LP 21ST CENTURY ONCOLOGY 4/15 -

Investing in Financials

BARON F I R S T Q U A R T E R 2 0 1 6 INSIGHT Investing in Financials Michael Baron, VP, Research Analyst; Josh Saltman, VP, Research Analyst; Jose Barria, Research Analyst The Financials sector has lagged significantly since the 2007-08 financial Baron has a long and successful history of utilizing its bottom-up, crisis. As of March 31, 2016, the category was down 14% since its research-driven, long-term investment approach in the Financials October 9, 2007 peak, compared with the broader market as measured sector. As with all of our investments, Baron looks for financial by the Russell 3000 Index, which increased 59%. Many financial companies that have significant long-term growth opportunities, companies experienced subdued profitability and growth in the sustainable competitive advantages, and strong management teams, aftermath of the crisis as a result of heightened regulation, fines, and at an attractive valuation. We believe this investment style and the historically low interest rates. Most recently, credit risk in the energy sector’s relative value have allowed us to discover many potentially space has weighed on the sector. The decreasing likelihood of near-term successful investments in Financials. U.S. Federal Reserve rate hikes has not helped either. Opportunities in Banks and Insurance While their stock prices lag, financial company fundamentals and the economy continue to improve. Most financial institutions have paid Although traditional banks and insurance companies comprise a large back government loans and some are increasing share buybacks and weight in the Financials index, Baron tends not to invest in these dividend payments, reflecting greater financial soundness and stability. -

Aviation Week & Space Technology

STARTS AFTER PAGE 36 20 Twenties Aerospace’s Has Aircraft Leasing Class of 2020 Perfect Storm Gone Too Far? ™ $14.95 MARCH 9-22, 2020 BOEING’S ATTACK CONTENDER Digital Edition Copyright Notice The content contained in this digital edition (“Digital Material”), as well as its selection and arrangement, is owned by Informa. and its affiliated companies, licensors, and suppliers, and is protected by their respective copyright, trademark and other proprietary rights. Upon payment of the subscription price, if applicable, you are hereby authorized to view, download, copy, and print Digital Material solely for your own personal, non-commercial use, provided that by doing any of the foregoing, you acknowledge that (i) you do not and will not acquire any ownership rights of any kind in the Digital Material or any portion thereof, (ii) you must preserve all copyright and other proprietary notices included in any downloaded Digital Material, and (iii) you must comply in all respects with the use restrictions set forth below and in the Informa Privacy Policy and the Informa Terms of Use (the “Use Restrictions”), each of which is hereby incorporated by reference. Any use not in accordance with, and any failure to comply fully with, the Use Restrictions is expressly prohibited by law, and may result in severe civil and criminal penalties. Violators will be prosecuted to the maximum possible extent. You may not modify, publish, license, transmit (including by way of email, facsimile or other electronic means), transfer, sell, reproduce (including by copying or posting on any network computer), create derivative works from, display, store, or in any way exploit, broadcast, disseminate or distribute, in any format or media of any kind, any of the Digital Material, in whole or in part, without the express prior written consent of Informa. -

Exclusion List

Exclusion list ROBECO INSTITUTIONAL ASSET MANAGEMENT 1 Sustainability Inside Excluded companies: 61 Rimbunan Sawit Bhd 15 Bots Inc 62 Riverview Rubber Estates BHD 16 Bright Packaging Industry Bhd Controversial behavior 63 Salim Ivomas Pratama Tbk PT 17 Brilliant Circle Holdings International Ltd 1 G4S International Finance PLC 64 Sarawak Oil Palms Bhd 18 British American Tobacco Bangladesh Co Ltd 2 G4S PLC 65 Sarawak Plantation Bhd 19 British American Tobacco Chile Operaciones SA 3 Korea Electric Power Corp 66 Scope Industries Bhd 20 British American Tobacco Holdings The Netherlands BV 4 Oil & Natural Gas Corp Ltd1 67 Sin Heng Chan Malaya Bhd 21 British American Tobacco Kenya PLC 5 ONGC Nile Ganga BV 68 Sinar Mas Agro Resources & Technology Tbk PT 22 British American Tobacco Malaysia Bhd 6 ONGC Videsh Ltd 69 Socfin 23 British American Tobacco PLC 7 Vale Indonesia Tbk PT 70 Socfinasia SA 24 British American Tobacco Uganda Ltd 8 Vale SA2 71 Societe Camerounaise de Palmeraies 25 British American Tobacco Zambia PLC 72 Societe des Caoutchoucs de Grand-Bereby 26 British American Tobacco Zimbabwe Holdings Ltd Palm oil 73 SSMS Plantation Holdings Pte Ltd 27 Bulgartabac Holding AD 1 A Brown Co Inc 74 Sterling Plantations Ltd 28 Carreras Ltd/Jamaica 2 Agalawatte Plantations PLC 75 Subur Tiasa Holdings Bhd 29 Casey’s General Stores Inc 3 Anglo-Eastern Plantations PLC 76 Sungei Bagan Rubber Co Malaya Bhd 30 Cat Loi JSC 4 Astra Agro Lestari Tbk PT 77 Sunshine Holdings PLC 31 Ceylon Tobacco Co PLC 5 Astral Asia Bhd 78 Ta Ann Holdings Bhd 32 Champion