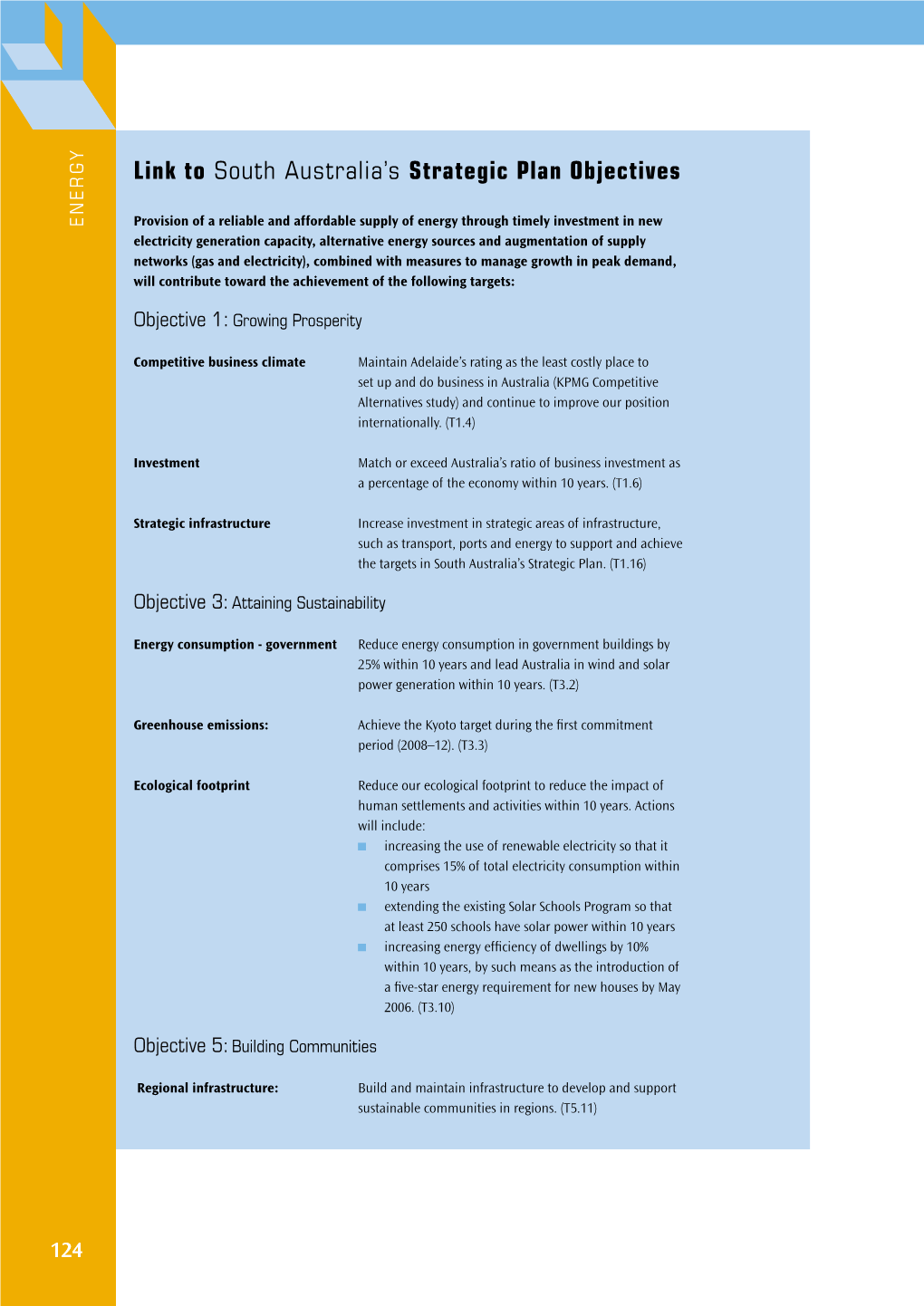

Link to South Australia's Strategic Plan Objectives

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Does Extending Daylight Saving Time Save Energy? Evidence from an Australian Experiment

IZA DP No. 2704 Does Extending Daylight Saving Time Save Energy? Evidence from an Australian Experiment Ryan Kellogg Hendrik Wolff DISCUSSION PAPER SERIES DISCUSSION PAPER March 2007 Forschungsinstitut zur Zukunft der Arbeit Institute for the Study of Labor Does Extending Daylight Saving Time Save Energy? Evidence from an Australian Experiment Ryan Kellogg University of California, Berkeley Hendrik Wolff University of California, Berkeley and IZA Discussion Paper No. 2704 March 2007 IZA P.O. Box 7240 53072 Bonn Germany Phone: +49-228-3894-0 Fax: +49-228-3894-180 E-mail: [email protected] Any opinions expressed here are those of the author(s) and not those of the institute. Research disseminated by IZA may include views on policy, but the institute itself takes no institutional policy positions. The Institute for the Study of Labor (IZA) in Bonn is a local and virtual international research center and a place of communication between science, politics and business. IZA is an independent nonprofit company supported by Deutsche Post World Net. The center is associated with the University of Bonn and offers a stimulating research environment through its research networks, research support, and visitors and doctoral programs. IZA engages in (i) original and internationally competitive research in all fields of labor economics, (ii) development of policy concepts, and (iii) dissemination of research results and concepts to the interested public. IZA Discussion Papers often represent preliminary work and are circulated to encourage discussion. Citation of such a paper should account for its provisional character. A revised version may be available directly from the author. IZA Discussion Paper No. -

Forward Contracts in Electricity Markets: the Australian Experience

Forward Contracts in Electricity Markets: the Australian Experience Edward J Anderson and Xinmin Hu Australian Graduate School of Management University of New South Wales, Sydney, NSW 2052, Australia Donald Winchester Faculty of Commerce & Economics University of New South Wales, Sydney, NSW 2052, Australia Abstract Forward contracts play a vital role in all electricity markets, and yet the details of the market for forward contracts are often opaque. In this paper we review the existing literature on forward contracts and explore the contracting process as it operates in Australia. The paper is based on interviews with participants in Australia’s National Electricity Market. The interviews were designed to understand the contracting process and the practice of risk management in the Australian energy-only pool market. This survey reveals some significant gaps between the assumptions made in the academic literature and actual practice in the Australian market place. 1 Introduction Wholesale markets for electricity are complex, and their structure varies from one country to another. However, they have in common the characteristic that spot prices for electricity are highly volatile. This is a consequence of the inability to store electric power at any significant scale, so that power consumption and generation need to match each other very closely. Electricity demand is highly variable (e.g. with time of day and weather) and the volatility in price is exacerbated by the way that consumers are usually charged a fixed retail price independent of the spot market price. In this situation various types of generator reserves play an important role in ensuring stability of supply, with the necessary balancing role being 1 played by a ‘system operator’ who has the ability to dispatch generation. -

ADAM PEARD Manager and Principal Consultant

ADAM PEARD Manager and Principal Consultant PERSONAL DETAILS: Name: Adam Peard Languages: English, Pidgin English Email: [email protected] PROFESSIONAL QUALIFICATIONS: • Bachelor of Engineering (Electrical), The University of Queensland, 2002. • Advanced Diploma, Electronics Engineering, 1999. PROFESSIONAL AFFILIATIONS: AUSTRALIA • Fellow, Engineers Australia (FIEAust) • Chartered Professional Engineer, Engineers Australia (CPEng) • Registered Professional Engineer Queensland (RPEQ) EMPLOYMENT SUMMARY: 2017 – Present Manager and Principal Consultant Amplitude Consultants Pty Ltd (Part time in 2017) (Brisbane) 2017 – 2017 Director GridLink Consulting Pty Ltd (Western Australia) 2014 – 2016 System Analysis and Solutions Area Manager (SAS) Western Power Corporation (Western Australia) 2015 – 2016 Network Connections and Access Project Lead Public Utilities Office (Western Australia) 2013 – 2014 Engineering Team Leader Western Power Corporation (Western Australia) 2011 – 2013 Principal Engineer Western Power Corporation (Western Australia) 2010 – 2011 Senior Engineer Western Power Corporation (Western Australia) 2009 – 2010 Principal Engineer Australian Energy Market Operator – AEMO (Queensland) 2005 – 2009 Planning Specialist National Electricity Market Management Company NEMMCO (Queensland) 2003 – 2005 Planning Engineer National Electricity Market Management Company NEMMCO (Queensland) Amplitude Consultants Pty Ltd 2002 – 2003 National Product Manager (P&B Engineering Protection Relays) Control Logic (Queensland) 2001 – 2002 -

Australia's National Electricity Market

Australia’s National Electricity Market Wholesale Market Operation Executive Briefing Disclaimer: All material in this publication is provided for information purposes only. While all reasonable care has been taken in preparing the information, NEMMCO does not accept liability arising from any person’s reliance on the information. All information should be independently verified and updated where necessary. Neither NEMMCO nor any of its agents makes any representation or warranty, express or implied, as to the currency, reliability or completeness of the information. ©NEMMCO 2005 – All material in this publication is subject to copyright under the Copyright Act 1968 (Commonwealth), and permission to use the information must be obtained in advance in writing from NEMMCO. Section 1 Contents Introduction 2 Section 1: Market Operator 2 History of Electricity Supply in Australia 3 Design of the NEM 4 Regional Pricing 4 The Spot Price 4 Value of Lost Load (VoLL) 5 Gross Pool and Net Pool Arrangements 5 Locational and Nodal Pricing 5 Energy-only Market 5 Section 2: Operating the Market 6 Registration of Participants 6 Generators 7 Scheduled and Non-scheduled Generators 8 Market and Non-market Generators 8 Market Network Service Providers 8 Scheduled Loads 8 Monitoring Demand 9 Forecasting Supply Capacity 9 Participation in Central Dispatch 9 Bidding 10 Pre-dispatch 11 Spot Price Determination 12 Scheduling 12 Dispatch 14 Failure to Follow Dispatch Instructions 14 Section 3: Operating the Ancillary Services Markets 15 Ancillary Services 15 Ancillary -

Economics of Power Markets

December 2003 Electricity industry restructuring in Australia Hugh Outhred School of Electrical Engineering and Telecommunications The University of New South Wales Sydney, Australia Tel: +61 2 9385 4035; Fax: +61 2 9385 5993; Email: [email protected] www.sergo.ee.unsw.edu.au Electricity industry restructuring: a complex design process • A design process within a cultural context: – Industry-specific laws, codes & markets • A mix of technical, economic & policy issues: – Physical behaviour continuous & cooperative – Commercial behaviour individual & competitive • Restructuring is still a learning situation: – A “social experiment” with few “safe exits” – No complete successes, some notable failures – Must solve commercial, technical & institutional challenges to keep the lights on at the right price Hugh Outhred: Electricity restructuring in Australia 2 Key lessons to date (Joskow, May ‘03): • Electricity market design: – Doesn’t matter much when: • Demand is moderate, supply elastic, ownership not concentrated & transmission not congested – Does matter when this is not the case, eg: • Few hours when demand high & network congested • Key aspects of good market design: – (approximate) nodal pricing – Derivatives including financial transmission rights – Consistent energy and ancillary service markets – Retail markets with spot & forward pricing Hugh Outhred: Electricity restructuring in Australia 3 The central challenge of electricity restructuring: to make economics & engineering compatible Main commercial markets (humans; individual; -

AGL Supplementary

AGL submission to Australian Energy Market Commission Review of Effectiveness of Competition in the Electricity and Gas Retail Markets in South Australia Date: September 2008 Table of Contents Introduction........................................................................... 1 The South Australian Wholesale Market...................................... 2 The Torrens Island Power Station.............................................. 6 Summer 2007/2008................................................................ 7 Outlook for prices in South Australia........................................ 11 Comments on the UnitingCare Wesley Submissions ................... 13 Introduction AGL has made a submission to the Commission in support of the Commission’s finding in its Draft Report1 that the gas and electricity markets in South Australia are demonstrating effective competition. In that submission we said that: • AGL concurs with the Commission’s findings that the South Australian energy markets are competitive; • The high prices for the first quarter of 2008 reflected the structure of the South Australian market and the extreme summer that had occurred; and • Market churn was not directly related to high prices. Since making that submission, AGL has becoming increasingly concerned about a number of comments made by an interested party in submissions to the Commission’s Issues Paper and the Draft Report that claim there is a lack of competition in the wholesale electricity market in South Australia. AGL believes that the facts do not support these contrary submissions and the arguments made in them cannot be supported. We are therefore providing additional information to the Commission to more fully discuss pricing issues in South Australia and to counter these claims. AGL notes that similar claims of market failure and generator profiteering were made in the aftermath of the extreme summer of 2000/01. -

ERC0274-Mandatory PFR Final Determination EMBARGOED

Australian Energy Market Commission RULE DETERMINATION RULE NATIONAL ELECTRICITY AMENDMENT (MANDATORY PRIMARY FREQUENCY RESPONSE) RULE 2020 PROPONENTS AEMO Dr. Peter Sokolowski 26 MARCH 2020 Australian Energy Rule determination Market Commission Mandatory PFR 26 March 2020 INQUIRIES Australian Energy Market Commission PO Box A2449 Sydney South NSW 1235 E [email protected] T (02) 8296 7800 F (02) 8296 7899 Reference: ERC0274 CITATION AEMC, Mandatory primary frequency response, Rule determination, 26 March 2020 ABOUT THE AEMC The AEMC reports to the Council of Australian Governments (COAG) through the COAG Energy Council. We have two functions. We make and amend the national electricity, gas and energy retail rules and conduct independent reviews for the COAG Energy Council. This work is copyright. The Copyright Act 1968 permits fair dealing for study, research, news reporting, criticism and review. Selected passages, tables or diagrams may be reproduced for such purposes provided acknowledgement of the source is included. Australian Energy Rule determination Market Commission Mandatory PFR 26 March 2020 EXECUTIVE SUMMARY 1 The Australian Energy Market Commission (AEMC or Commission) has made a more preferable final rule to require all scheduled and semi-scheduled generators in the National Electricity Market (NEM) to support the secure operation of the power system by responding automatically to changes in power system frequency. An increase in the provision of primary frequency response (PFR) from generators will improve the security of the national electricity system for the benefits of consumers and will give the Australian Energy Market Operator (AEMO) greater confidence that it is maintaining the power system in a secure operating state. -

Inquiry Into Sustainable Cities 2025

Australian Business Council for Sustainable Energy Inquiry into Sustainable Cities 2025 Submission to the House of Representatives Standing Committee on Environment and Heritage November 2003 Australian Business Council for Sustainable Energy Suite 304, 3rd Floor 60 Leicester St Carlton Victoria 3053 Tel. +61 3 9349 3077 Fax. +61 3 9349 3049 Email: [email protected] www.bcse.org.au Page 1 Introduction The Australian Business Council for Sustainable Energy (BCSE) welcomes the opportunity to make a submission to the House of Representatives’ Standing Committee on Environment and Heritage Inquiry into Sustainable Cities 2025. The BCSE has endeavoured to provide an effective, considered submission that benefits from ongoing BCSE engagement with the Australian sustainable energy industry in addition to leading research and analysis in this field. As such, this submission focuses on the sustainable energy industry, which is defined below. The sustainable energy industry is critical in the context of developing sustainable cities in greenhouse terms by 2025. Sustainability in this submission refers to the stabilisation and eventual reduction of greenhouse gas emissions in order to avoid detrimental change in climate. Great potential exists in Australia to meet sustainability in the energy sector. Provided with the correct policy framework, the sustainable energy industry is poised to meet customers’ energy needs in a manner that reduces greenhouse emissions while simultaneously increasing economic activity, jobs and investment. The BCSE asserts that from 2006 all new commercial buildings and all Government office buildings should have zero net greenhouse emissions. Household greenhouse emissions from energy use should be limited to one tonne per person (nearly a one-third reduction). -

Useful Acronyms

NSWIC PO Box R1437 Royal Exchange NSW 1225 NEW SOUTH WALES Tel: 02 9251 8466 IRRIGATORS’ Fax: 02 9251 8477 [email protected] COUNCIL www.nswic.org.au ABN: 49 087 281 746 Updated 8th December 2015 USEFUL ACRONYMS AAR Average Annual Recharge – Volume of water added to the groundwater source (aquifer) naturally, by infiltration from rainfall and river flows, assessed on a long-term average basis. ABC Australian Broadcasting Corporation – National TV and Radio ABARES Australian Bureau of Agriculture and Resource Economics and Sciences – Research organisation within DAFF. Providing independent, economic and scientific analysis on issues facing Australia’s primary industries. ABS Australian Bureau of Statistics – Government agency which collects statistical data for publication. Also conducts a census every 5 years which every person in Australia needs to fill in. ACCC Australian Competition and Consumer Commission – Australian government organisation responsible for ensuring compliance with the Trade Practices Act 1974. AEMA Australian Energy Market Agreement – sets out the legislative and regulatory framework for Australia’s energy markets. It provides for national legislation that is implemented in each participating state and territory. AEMC Australian Energy Market Commission –is an independent, national body responsible to the Council of Australian Governments (COAG) through the Standing Council on Energy and Resources (SCER). Has two roles, as statutory rule maker for the energy market and expert adviser for federal, state and territory governments. AEMO Australian Energy Market Operator – Commencing operations on 1 July 2009, superseding several organisations including NEMMCO, VENCorp, ESIPC, REMCo (South Australian operations only), GMC and GRMO. Delivers a range of gas and electricity market, operational, development and planning functions. -

A South Australia's Electricity and Gas Industries

A South Australia's Electricity and Gas Industries Both the electricity and gas industries in South Australia have undergone a range of significant reforms over the last fifteen years, commencing with the vertical disaggregation of the electricity and gas supply chains in the mid-1990s and culminating with the introduction of FRC for customers of all sizes during 2003-04. In the wake of FRC, gas and electricity retailing in South Australia has moved from a single host retailer model to a multiple retailer model. The remainder of this appendix provides both an historic perspective on the reforms that were undertaken in advance of the introduction of FRC and an overview of the current structure of energy retailing. A.1. Progression to FRC A.1.1. Electricity industry progression to FRC Between 1946 and 1995, the Electricity Trust of South Australia (ETSA) was responsible for undertaking all aspects of the electricity supply chain in South Australia including the generation, transmission, distribution and retail sale of electricity. On 1 July 1995, the Electricity Trust of South Australia was corporatised and became ETSA Corporation under the Public Corporations Act 1993. In January 1997 the South Australian Government undertook the first steps towards vertical disaggregation, by transferring ETSA’s generation assets to SA Generation Corporation. The second step toward vertical disaggregation occurred in October 1998 when the South Australian Government announced that, in order to meet its commitments under the Competition Principles Agreement and in preparation for entry into the NEM, ETSA Corporation and SA Generation Corporation would need to be further disaggregated. -

LIVING OUR VALUES: ENERGEX 2009/10 Annual Report And

We aim to live our corporate values every day. Our values express who we are and all that They underpin everything we do as a company we aspire to be. They are the foundation and articulate what we see as most important. for our reputation and success. PUT DELIVER IMPRESS SAFETY BALANCED OUR FIRST RESULTS CUSTOMERS We are committed We are passionate and disciplined Servicing our customers to achieving an about achieving our targets to ensure a injury free workplace to deliver sustainable performance positive experience RESPECT BE SET & SUPPORT A TEAM A GREAT EACH OTHER PLAYER EXAMPLE We value each We operate as a team We create an environment other’s views to achieve and leverage and learn that encourages people to grow, success together from each other achieve goals and lead the way Powering Lifestyles Forever – articulates our vision, our people and technical capabilities to deliver network reinforces our strategic direction and provides performance that achieves legislated Minimum Service a reference to guide both strategic planning and Standards (MSS), Guaranteed Service Levels (GSLs), day-to-day business operations. The purpose supports and associated network standards. our transition to becoming a customer-centric and sustainable business that delivers sustainable energy Linked with this goal is a focus on ‘lifestyles’ which solutions and balanced commercial outcomes. refl ects our growing need to understand the changing lifestyle, business and economic preferences of our Our purpose represents the three core areas upon customers and the implications this has for the way which we must focus to deliver our vision. A focus on in which we deliver power. -

Mark up of National Electricity Rules

National Electricity Rules Version 21 Status Information This is a draft consolidation based on the latest electronically available version of the National Electricity Rules as at 1 July 2008. This draft consolidated version of the National Electricity Rules includes the following draft amendment. Draft National Electricity Amendment (Regulatory Test Thresholds and Information Disclosure on Network Replacements) Rule 2008 This version of the National Electricity Rules is provided for information purposes only. The Australian Energy Market Commission does not guarantee the accuracy, reliability or completeness of this consolidated version. The official Draft National Electricity Amendment (Regulatory Test Thresholds and Information Disclosure on Network Replacements) Rule 2008 is published separately on the website of the Australian Energy Market Commission. This coversheet was last updated on 1 July 2008 TABLE OF CONTENTS 5. Network Connection 17 5.1 Statement of Purpose 17 5.1.1 [Deleted] 17 5.1.2 Purpose 17 5.1.3 Principles 17 5.2 Obligations 18 5.2.1 Obligations of Registered Participants 18 5.2.2 Connection agreements 19 5.2.3 Obligations of network service providers 20 5.2.4 Obligations of customers 24 5.2.5 Obligations of Generators 24 5.3 Establishing or Modifying Connection 25 5.3.1 Process and procedures 25 5.3.2 Connection enquiry 26 5.3.3 Response to connection enquiry 26 5.3.4 Application for connection 29 5.3.4A Negotiated access standards 30 5.3.5 Preparation of offer to connect 32 5.3.6 Offer to connect 33 5.3.7 Finalisation