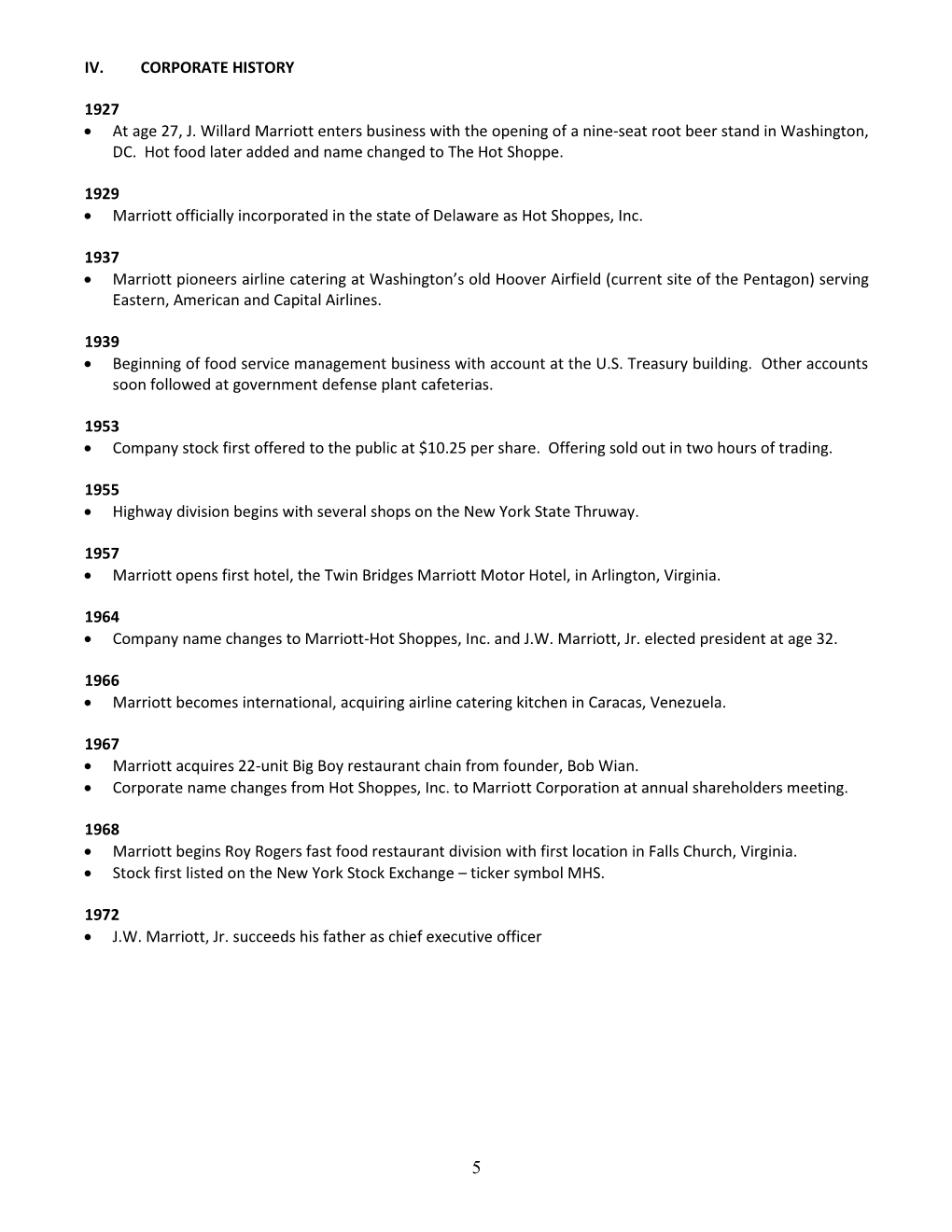

IV. CORPORATE HISTORY 1927 • at Age 27, J. Willard Marriott Enters

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Roundup of Noteworthy Foodservice Findings for the Week of Dec. 7, 2020 ECONOMIC IMPACT NAVIGATOR

Industry Insights A roundup of noteworthy foodservice findings for the week of Dec. 7, 2020 ECONOMIC IMPACT NAVIGATOR WHEN CONSUMERS WILL FEEL COMFORTABLE Comfort With Dine-in DINING ON-PREMISE 3% 1 to 4 weeks Service Will Remain 10% 1% 1 to 2 months Low 3% 7% The majority of consumers (54%) This time line to return to on-premise 3 to 4 months indicate that they won’t feel comfortable dining is extending, and uncertainty is 8% dining indoors for at least six months, increasing overall compared to August, and a quarter (24%) are unsure when when only an average of 20% 11% 4 to 6 months they will feel comfortable. expressed uncertainty around returning 10% to on-premise dining. However, with a The comfort level of dining indoors is vaccine on the horizon, we may see surely tied to the explosion of COVID- 26% expectations solidify, but that is unlikely 6 months to 1 year 19 cases and associated risks with 21% to shrink the time frame significantly. spending time indoors, while comfort with outdoor dining may also factor in 28% More than a year cooler weather and a distaste for the 17% outdoor dining experience, which is reflected in a higher level of uncertainty 24% around returning to outdoor dining I don’t know compared to indoor dining. 29% Indoors Outdoors Base: 505 (indoors) and 543 (outdoor) consumers who aren’t currently dining on-premise Source: Technomic Economic Impact Navigator Program, survey from Nov. 4-7, 2020 © 2020 Technomic, Inc. 2 IGNITE COMPANY TOTAL U.S. FOODSERVICE INDUSTRY Industry Sales ANNUAL NOMINAL SALES CHANGE (%) Forecasted to Fall 3.7% 3.9% Over 26% in 2020 Due to the severe and prolonged Additional forecasting and segment- impact of the COVID-19 pandemic, U.S. -

OUTSULATION® Exterior Insulation and Finish System DUK202

OUTSULATION® Exterior Insulation and Finish System DUK202 The Facts: Dryvit Outsulation is unequaled for proven integrity and quality. • Structural Testing – Page 2 • MIL Standards Testing – Page 2 • ASTM Testing – other than fire – Page 2 • Federal Test Method Standard 141A – Page 3 • Insulation Board Analysis – Page 3 • Fire Testing: - Summary – Page 3 - Test Descriptions – Pages 4-5 - Conclusion – Page 5 • Building Code Listings and Approvals – Page 6 • National Accounts – Page 7 • Services – Page 8 - Research & Technology - Field & Technical - Prefabrication OUTSULATION THE FACTS: Testing As the pioneer and acknowledged leader of the EIFS industry, Dryvit UK Ltd. has always considered stringent testing of key importance to quality performance. Outsulation has been subjected to testing well beyond code minimums at national testing laboratories as well as at Dryvit’s own research, technology and manufacturing facilities – unparalleled in the industry. The data provided on the following pages will convince you that Dryvit demonstrates a full commitment to excellence in both product and performance. Such a commitment offers extraordinary peace of mind to the architect and developer specifying Outsulation. And only Dryvit Outsulation can show over 30 years of proven application results in North America – over 350,000 buildings, both new and retrofit construction. Dryvit products are designed to minimize upkeep. However, as with all building products, normal maintenance and cleaning are required. TEST METHOD RESULTS STRUCTURAL TESTING Positive and Negative ASTM E330 Tested to pressures in excess of Windloads 180 psf without loss of bond to the substrate. ASTM Salt Spray Resistance ASTM B117 300 hours. No deleterious effects. Freeze/Thaw ASTM C67 60 cycles. -

Premier Tier List 2019

INTERVAL INTERNATIONAL® 2019 RESORT RECOGNITION PROGRAM Interval International Premier Resorts provide an outstanding vacation experience, with state-of-the-art conveniences and modern features and appointments. 2019 2019 Florida, Miami South Carolina, Myrtle Beach Area Vermont Eastern U.S.A. Marriott’s Villas at Doral |VD M Dunes Village Resort | TDU & DVL Trapp Family Lodge Guest Houses | TFL & TF2 Owners Quarters at Crescent Shores |CX T CENTRAL FLORIDA Florida, Miami Beach Sheraton Broadway Plantation |W ST Florida, Orlando Marriott Vacation Club Pulse®, South Beach |B MQ Western U.S.A. CLC Encantada |TD E Tennessee, Gatlinburg Grand Beach | EGE & EG2 Florida, Naples and Marco Island Bent Creek Golf Village |NT B MIDWEST Lighthouse Key Resort & Spa | LKE Charter Club Resort of Naples Bay | CHN & CH1 Michigan Marriott’s Harbour Lake |Z MH Eagle’s Nest on Marco Beach |L EG Virginia, Virginia Beach The Inn at Bay Harbor | INB & LKQ Marriott’s Imperial Palms | MIP The Surf Club of Marco |M SC Boardwalk Resort and Villas |W TR Vacation Club 1 | VPN Marriott’s Royal Palms |P MR Ocean Beach Club and Oceanaire at Marriott’s Sabal Palms | MSP Florida, The Palm Beaches Ocean Beach Club | OCB & OCI Minnesota Mystic Dunes Resort & Golf Club |CC P Marriott’s Ocean Pointe |PB M Turtle Cay Resort |TL T The Village at Izatys | VIZ Parkway International Resort | PKY, PK1 & PK2 Sheraton Vistana Resort | VIT & VIO Virginia, Williamsburg Missouri, Branson Star Island Resort |BR V Florida, Panhandle The Colonies at Williamsburg |WQ C The Falls Village -

Marriott Bonvoy

B:24.5” T:24” S:23.5” ELITE ELITE-LEVEL BENEFITS AT A GLANCE PARTICIPATING BENEFIT DESCRIPTION BRANDS MARRIOTT BONVOY™ GOLD ELITE 25 Nights/Year MARRIOTT BONVOY™ SILVER ELITE 10 Nights/Year MARRIOTT BONVOY™ PLATINUM ELITE 50 Nights/Year MARRIOTT BONVOY™ TITANIUM ELITE 75 Nights/Year MARRIOTT BONVOY™ AMBASSADOR ELITE 100 NIights + $20K Rev/Year A member is matched with a personal Ambassador (above property), who is the member’s point person for every stay. Ambassador Service is the highest level of service All brands Ambassador Service l for members. All brands except Marriott Vacation Club® Flexibility to check in and out of the room outside of normal arrival and departure times. For example, check in at 9 p.m. and check out at 9 p.m. Requests for Your24 and participating Vistana™ properties Your24™ l are communicated through Ambassadors. and Design Hotels™ All brands except resorts, 48-Hour Guarantee Marriott Vacation Club, and participating l l Guaranteed room availability for reservations booked 48 hours prior to arrival (at Residence Inn and TownePlace Suites, benefit applies to studio room only). Vistana properties and Design Hotels™ • JW Marriott® Access to lounge for member plus one guest. This benefit only applies to the one guest room in which the Platinum Elite/Titanium Elite/Ambassador Elite member is staying. • Marriott Hotels® • Delta Hotels® Brand Lounge Offer Guest Compensation2 • Autograph Collection® Hotels US$100 if no breakfast • Renaissance® Hotels US/CAN: If lounge is closed or hotel does not have a lounge, offer -

Strictly Hospitality Seminar

ADVANCE REGISTRATION DEADLINE: SEPTEMBER 2 , 2 0 1 1 STRICTLY HOSPITALITY SEMINAR SEPTEMBER 22–23, 2011 IN-HOUSE SPEAKERS FIRESKY RESORT INCLUDING SCOTTSDALE, ARIZONA DORINA HERTNER ACCOR NORTH AMERICA STUART M. KREINDLER CHOICE HOTELS INTERNATIONAL INC. LESTER E. WASHINGTON, JR. MARRIOTT INTERNATIONAL TONY FASO ROYAL CARIBBEAN CRUISES LTD. KORIN A. NEFF REASONS TO ATTEND WYNDHAM WORLDWIDE CORPORATION Learn about the latest legal issues facing the hospitality industry from bedbugs and foodborne illnesses to employee immigration issues, security matters and post-accident investigations Network with hospitality lawyers across the industry whose clients include restaurants, hotels and cruise lines Earn up to 12 hours of CLE, including 1 hour of ethics credit DRI’s Strictly Hospitality Seminar is Program Schedule 3 specifically tailored to educate those within the hospitality industry on strategies for General Information 6 handling the top issues affecting the industry today. The seminar is packed with practical presentations and the relevant law that governs Seminar Sponsors 7 the hospitality industry from start to finish. This one-stop seminar is a must for the hospitality provider and outside hospitality lawyer. 2011–2012 Seminar Schedule 7 Faculty Biographies 8 Membership Application 11 Cynthia P. Arends Paul Caleo Registration Form 12 Program Chair Committee Chair William F. Ray WHAT YOU WILL LEARN Law Institute n What you need to do as a hospitality provider to protect your guests and Presented by DRI’s employees during an infectious disease Retail and Hospitality Committee outbreak or a criminal or terrorist threat n What you need to do to comply with the Medicare Secondary Payor Act n How to comply with immigration requirements and handle an enforcement action n How to conduct investigations into data breaches or on-site accidents n How to anticipate changes brought about by the new Restatement provisions September 22–23, 2011 3 PROGRAM SCHEDULE what you need to know when employees or customers become sick. -

2018 Hotel Brand Reputation Rankings: USA & Canada

REPORT 2018 Hotel Brand Reputation Rankings: USA & Canada October 2018 INDEX Introduction 4 Methodology 6 The Importance of Brand Reputation 7 Key Data Points: All Chain Scales 8 Key Findings 9 Summary of Top Performers 10 ECONOMY BRANDS Overview 13 Top 25 Branded Economy Hotels 14 Economy Brand Ranking 15 Economy Brand Ranking by Improvement 16 Economy Brand Ranking by Service 17 Economy Brand Ranking by Value 18 Economy Brand Ranking by Rooms 19 Economy Brand Ranking by Cleanliness 20 Review Sources: Economy Brands 21 Country Indexes: Economy Brands 22 Response Rates: Economy Brands 22 Semantic Mentions: Economy Brands 23 MIDSCALE BRANDS Overview 24 Top 25 Branded Midscale Hotels 25 Midscale Brand Ranking 26 Midscale Brand Ranking by Improvement 27 Midscale Brand Ranking by Service 28 Midscale Brand Ranking by Value 29 Midscale Brand Ranking by Rooms 30 Midscale Brand Ranking by Cleanliness 31 Review Sources: Midscale Brands 32 Country Indexes: Midscale Brands 33 Response Rates: Midscale Brands 33 Semantic Mentions: Midscale Brands 34 UPPER MIDSCALE BRANDS Overview 35 Top 25 Branded Upper Midscale Hotels 36 Upper Midscale Brand Ranking 37 Upper Midscale Brand Ranking by Improvement 38 Upper Midscale Brand Ranking by Service 39 Upper Midscale Brand Ranking by Value 40 Upper Midscale Brand Ranking by Rooms 41 Upper Midscale Brand Ranking by Cleanliness 42 Review Sources: Upper Midscale Brands 43 Country Indexes: Upper Midscale Brands 44 Response Rates: Upper Midscale Brands 44 Semantic Mentions: Upper Midscale Brands 45 Index www.reviewpro.com -

HVS Asia-Pacific Hotel Operator Guide Excerpt 2016

2016 EDITION | Price US$800 SUMMARY THE ANNUAL HVS ASIA-PACIFIC HOTEL OPERATOR GUIDE (AS OF 31 DECEMBER 2015) Setthawat Hetrakul Assistant Manager Daniel J Voellm Managing Partner HVS.com HVS | Level 21, The Centre, 99 Queen’s Road Central, Hong Kong The HVS Asia-Pacific Hotel Operator Guide 2016 Foreword It is with great pleasure that I share with you our third annual Asia-Pacific Operator Guide, data as of 31 December 2015. This third edition will continue to serve owners as a reference for which operator has a strong presence in their home market and in potential future markets further ashore as well as key feeder markets across the region. With China rapidly becoming a strong outbound market, brands and operators that are well positioned there are better positioned to welcome Chinese travelers overseas. Branding, anchored by the management expertise and distribution power that operators bring to a hotel property, is becoming more and more critical. In the face of increasing competition, non-branded properties often perform at a discount to their branded peers due to lack of awareness and quality assurance. Running a hotel is no easy task and owners have a tendency to view operators’ fees as unjustified for the value they deliver. It is essential that owner and operator align their interest from very early in the process and work towards a common goal, rather than start their long-term relationship from conflicting standpoints. In this third edition, we have captured close to one million existing and more than half a million pipeline rooms spread over 6,546 properties. -

Horwath HTL Latam Hotel Chains Report

HHTL_LATAM_Hotel Chains Report.qxp_Layout 1 10/10/2017 12:10 Page 1 LATAM & Caribbean Hotels & Chains Report 2017 HHTL_LATAM_Hotel Chains Report.qxp_Layout 1 10/10/2017 12:10 Page 2 HHTL_LATAM_Hotel Chains Report.qxp_Layout 1 10/10/2017 12:10 Page 3 Key Services Welcome to Horwath HTL, the global leader in hospitality consulting. We are the industry choice; a global brand providing quality solutions for hotel, tourism & leisure projects. HHTL_LATAM_Hotel Chains Report.qxp_Layout 1 10/10/2017 12:10 Page 4 HHTL_LATAM_Hotel Chains Report.qxp_Layout 1 10/10/2017 12:10 Page 5 Horwath HTL l The Global Leader in Hotel, Tourism and Leisure Consulting CONTENTS 7 Foreword 9 Introduction 10 Latin America & The Caribbean 17 Argentina 23 Brazil 29 Chile 35 Colombia 41 Dominican Republic 47 Ecuador 53 Mexico 59 Peru Other Countries 64 Bolivia 65 Costa Rica 66 Cuba 67 Panama 68 Paraguay 69 Uruguay Horwath HTL l LATAM & The Caribbean Hotels & Chains Report 2017 5 HHTL_LATAM_Hotel Chains Report.qxp_Layout 1 10/10/2017 12:10 Page 6 HHTL_LATAM_Hotel Chains Report.qxp_Layout 1 10/10/2017 12:10 Page 7 Horwath HTL l The Global Leader in Hotel, Tourism and Leisure Consulting FOREWORD “The goal behind this report was to try and accurately shed light on the current hotel situation and see how each market is evolving. Investors need transparency and brands need to know what the competitive landscape looks like.” A few years ago, our team in Rome decided to Some of this data exists elsewhere of course, put together a report on the state of hotel chains there are a number of countries that have good in Italy, no easy task as you can imagine. -

Restaurant Trends App

RESTAURANT TRENDS APP For any restaurant, Understanding the competitive landscape of your trade are is key when making location-based real estate and marketing decision. eSite has partnered with Restaurant Trends to develop a quick and easy to use tool, that allows restaurants to analyze how other restaurants in a study trade area of performing. The tool provides users with sales data and other performance indicators. The tool uses Restaurant Trends data which is the only continuous store-level research effort, tracking all major QSR (Quick Service) and FSR (Full Service) restaurant chains. Restaurant Trends has intelligence on over 190,000 stores in over 500 brands in every market in the United States. APP SPECIFICS: • Input: Select a point on the map or input an address, define the trade area in minute or miles (cannot exceed 3 miles or 6 minutes), and the restaurant • Output: List of chains within that category and trade area. List includes chain name, address, annual sales, market index, and national index. Additionally, a map is provided which displays the trade area and location of the chains within the category and trade area PRICE: • Option 1 – Transaction: $300/Report • Option 2 – Subscription: $15,000/License per year with unlimited reporting SAMPLE OUTPUT: CATEGORIES & BRANDS AVAILABLE: Asian Flame Broiler Chicken Wing Zone Asian honeygrow Chicken Wings To Go Asian Pei Wei Chicken Wingstop Asian Teriyaki Madness Chicken Zaxby's Asian Waba Grill Donuts/Bakery Dunkin' Donuts Chicken Big Chic Donuts/Bakery Tim Horton's Chicken -

Hotels Moving Into Old Buildings by AMY ZIPKINMARCH 10, 2014

BUSINESS DAY Hotels Moving Into Old Buildings By AMY ZIPKINMARCH 10, 2014 The vault from the Cotton Exchange is used as office space at the Cotton Exchange Hotel in New Orleans. Credit William Widmer for The New York Times Reuse and recycle are taking on new meaning for hotels. The Lamb’s Theater, a longtime fixture on West 44th Street inside the Manhattan Church of the Nazarene, is now the luxury Chatwal Hotel. In Philadelphia, the previously empty Lafayette Building near Independence Hall opened in 2012 as the Hotel Monaco. In New Orleans, new life is being breathed into the Cotton Exchange Hotel off Bourbon Street. As the hotel industry shakes off recession doldrums and new hotels are being built, the once-standard chain hotel has a sibling, hotels repurposed from existing buildings like offices, warehouses and hospitals. Behind the push is the changing tastes of younger travelers, who flock to cities and are bringing an urban sensibility to their accommodations. “Travelers don’t want consistency and reliability to come at the expense of authenticity,” said Henry Harteveldt, a travel analyst for the research firm Hudson Crossing. The adaptive-use hotel is a presence in smaller cities like Amarillo, Tex.; Pittsburgh; and Stamford, Conn.; as well as big cities like New York, Washington, Boston and New Orleans. “Brands have realized standardization doesn’t mean as much to guests as it did in the past,” said Bjorn Hanson, divisional dean of the Preston Robert Tisch Center for Hospitality, Tourism and Sports Management at New York University. Executives at Marriott estimate that 10 percent to 20 percent of their Courtyards opening this year will have had other uses. -

Speaker Biographies Conference Producer and Co-Founder

SPEAKER BIOGRAPHIES CONFERENCE PRODUCER AND CO-FOUNDER HARRY JAVER President - The Conference Bureau, Inc. Harry Javer is the founder and president of The Conference Bureau. In 1994, Harry created and co-founded The Lodging Conference, which is now in its 21st year. Harry is the current chairman of the AH&LEF Fund Development Committee, which is responsible for overseeing the Annual Giving Campaign. The Lodging Conference has sponsored AH&LEF scholarship recipients to attend the conference for the last 13 years. With 34 years of experience creating and running conferences, seminars, concerts and tradeshows, Harry has produced events featuring such notables as: Al Gore, Rudy Giuliani, Sir Richard Branson, Bishop Desmond Tutu, Donald Trump, Pete Peterson, Bono, Charlton Heston, Anthony Robbins, Magic Johnson, Deepak Chopra, Jerry Lewis, Joe Torre, George Foreman, Kareem Abdul-Jabbar, Joe Montana, and thousands of America’s corporate leaders. Harry is an advisor to some of the nation’s leading live event companies including One Day University, and The Learning Annex. The Conference Bureau has also co-produced the Rock N’ Roll Fantasy Camp. A graduate of Stony Brook University, Harry resides in New York City with his wife Elizabeth and son Jack. SPEAKER BIOGRAPHIES MATTHEW D. AHO Consultant - Akerman LLP Matthew Aho helps clients identify and pursue opportunities at the nexus of Cuba policy and business. During his years at the Council of the Americas, the Western Hemisphere’s premiere business membership organization, Matthew led efforts to unite senior executives of select-Fortune 500 companies with officials from the U.S. departments of State, Commerce, Treasury, and the National Security Council to discuss topics including financial services, telecommunications, energy, pharmaceuticals, hospitality, and agriculture. -

Boston Market District Feasibility Study

Boston Market District Feasibility Study PROJECT FOR PUBLIC SPACES 3 Boston Market District Feasibility Study January 2009 SUBMITTED TO: THE BOSTON REDEVELOPMENT AUTHORITY SUBMITTED BY: PROJECT FOR PUBLIC SPACES 4 BOSTON REDEVELOPMENT AUTHORITY PROJECT FOR PUBLIC SPACES 5 TABLE OF CONTENTS EXECUTIVE SUMMARY 6 INTRODUCTION 8 THE BOSTON MARKET DISTRICT 13 HAYMARKET 21 ADVANCING THE MARKET DISTRICT 28 CONCEPTS FOR OUTDOOR MARKET SITES & Uses 42 PARCEL 9 CONSTRUCTION & MITIGATION PLAN 47 CONCLUSION & NEXT STEPs 48 APPENDIX 49 6 BOSTON REDEVELOPMENT AUTHORITY EXECUTIVE SUMMARY An improved and expanded market district in worked on, and its geographic reach exceeds the area of Boston’s historic downtown mar- any we have seen. Its annual sales volume ap- ketplace has the potential to be not only a suc- pears to be equivalent to that of an average cessful enterprise but an iconic place within supermarket. In addition to the essential ser- the city. Full-fledged market districts are the vice it brings to its customers and to the liveli- most highly evolved form of public markets. hood it provides its vendors, its social charac- They function as synergistic economic zones ter and atmosphere are Boston attractions in in which open air markets, specialty food their own right. At the same time, Haymarket stores, and market halls reinforce each other’s presents issues of trash management, limited customer base and their economic dynamism cold and dry storage, and oversight by its man- attracts related businesses. A Boston market agement association and the City of Boston. district market district would increase the range of healthy food available to its residents, The addition of one or more market halls stimulate its economy, and enliven its culture.