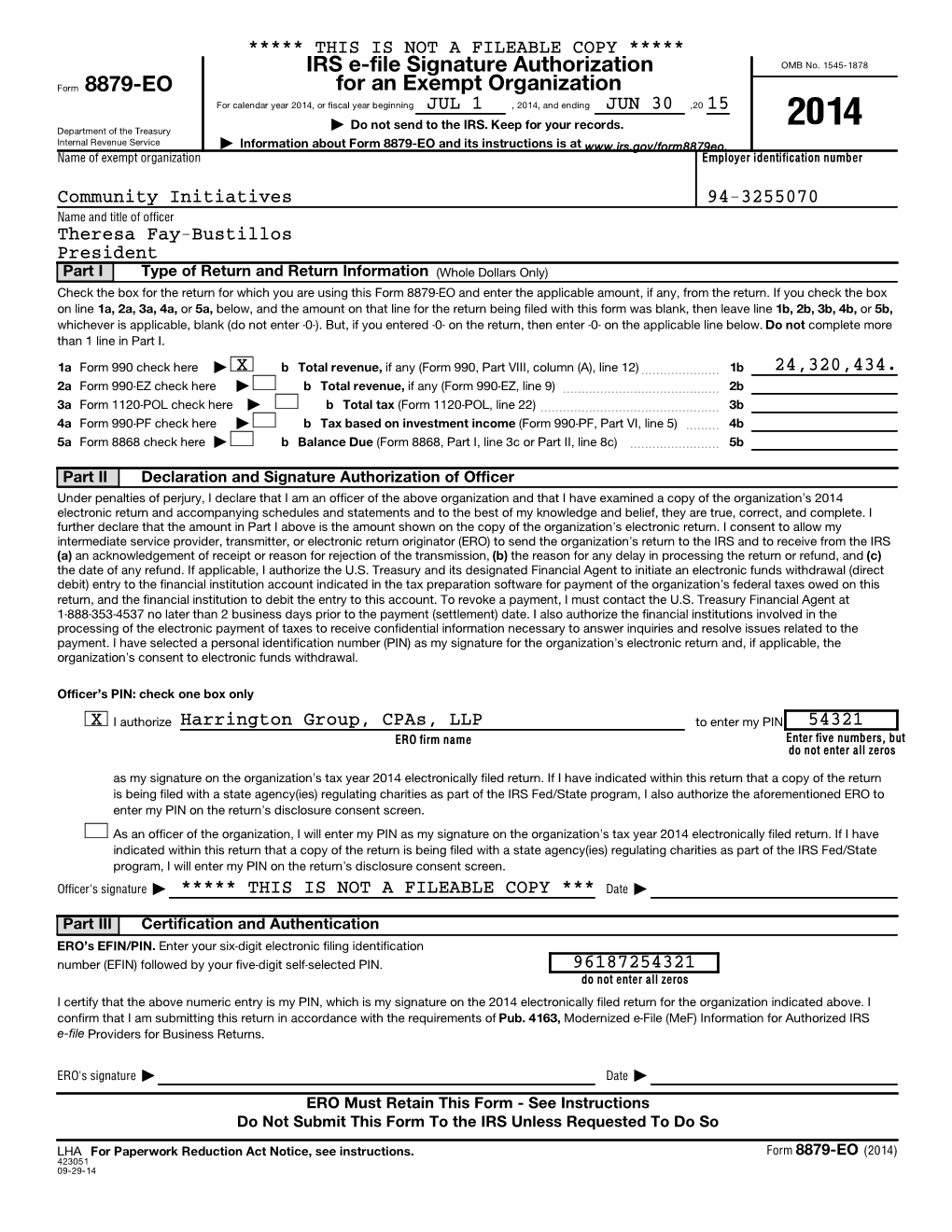

IRS E-File Signature Authorization for an Exempt Organization 8879-EO

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Overview a Quarterly Publication of the San Francisco Office Market by the Axiant Group 1St Quarter 2020

Market Overview A quarterly publication of the San Francisco office market by The Axiant Group 1st Quarter 2020 multiple buildings in Oakland, three of which they owned. COVID-19 will undoubtedly change Kaiser sited construction costs and delays as the major the future of real estate. The 1st quarter factors in the decision, not COVID-19. Many felt the project lost significant momentum when its Kaiser’s Chairman and numbers do not reflect the shelter-in- CEO, Bernard Tyson, the chief activist and mentor for the place order as it went into effect just prior project, died in November at age 60. to the end of the quarter. Overall rents The sale of the Uptown Station remain stable, vacancy rates increased. (former Capwell’s/ Sears) project fell Vacancy Rate Increases, Rent Stable apart when the First quarter vacancy rates increased from an adjusted buyer, Blackstone 5.5% in the 4th quarter to 6.5% in the 1st quarter. Gross Group, walked away leasing activity decreased from 1,886,983 square feet in the from a $20 million 4th quarter to 1,037,496 square feet in the 1st quarter. Net deposit upon fears UPTOWN STATION, OAKLAND absorption was significantly lower and negative at -603,723 that the real estate square feet, compared to 4th quarter. With positive absorption of and finance markets would become shaky in the wake of 743,407 square feet. This represents a swing of over 1,300,000 the COVID-19 pandemic. The sale would have come in at square feet. over $1,000 per foot, $300 per foot higher than any other Average asking comparable real estate transactions in the Oakland market. -

BOMA Bulletin Marble West Mcmillan Electric Co

SEPTEMBER/OCTOBER 2006 www.bomasf.org B OMA S a n F r a n c i s c o a d v a n c e s t h e c o m m e r c i a l r e a l e s t a t e i n d u s t r y t h r o u g h a d v o c a c y , p r o f e s s i o n a l d e v e l o p m e n t , a n d i n f o r m a t i o n e x c h a n g e Support our Associate Members: Buying BOMA Benefits Us All By Kathy Mattes, CPM, CCIM, Flynn Properties Inc. On the Inside good portion of our membership and involved with the local BOMAs there, has spent the past few months as well. If I’m doing business elsewhere working on their 2007 budgets. and don’t know the market but need some ELMER JOHNSON RECAP This process, arduous as it may seem, assistance, I know where to turn. And • •• 4 •• • reminds us where we spend our valuable that’s comforting. Adollars, and what expenditures give us the best return on investment. As a Principal Our Associate members are a great UILDING OUR 2006 B T BOMA member, I know the value received resource to BOMA San Francisco. • •• 6 •• • for my dues investment. I know that, as a Associate members contribute not only result of BOMA’s advocacy efforts, my dues and sponsorship support to our dues of approximately $0.01638 activities; they also actively CALENDAR per square foot per year saves serve on many committees that • •• 7 •• • 1.54 per square foot per year in do the work of our association. -

Mckesson HBOC, Inc. Securities Litigation 99-CV-20743-US District

US District Court Civil Docket as of February 8, 2013 Retrieved from the court on February 11, 2013 U.S. District Court California Northern District (San Jose) CIVIL DOCKET FOR CASE #: 5:99-cv-20743-RMW Aronson, et al v. McKesson HBOC, Inc., et al Date Filed: 04/28/1999 Assigned to: Judge Ronald M. Whyte Date Terminated: 03/26/2008 Referred to: Magistrate Judge Patricia V. Trumbull Jury Demand: Both Demand: $0 Nature of Suit: 850 Case in other court: Ninth Circuit, 06-15987 Securities/Commodities Cause: 15:78m(a) Securities Exchange Act Jurisdiction: Federal Question Plaintiff Andrew Aronson represented by D. Brian Hufford on behalf of himself and all others Pomerantz Haudek Block Grossman & similarly situated Gross LLP 100 Park Ave 26th Flr New York, NY 10017-5516 (212) 661-1100 LEAD ATTORNEY ATTORNEY TO BE NOTICED Daniel L. Berger Bernstein Litowitz Berger & Grossmann 1285 Avenue of the Americas 33rd Flr New York, NY 10019 (212) 554-1400 LEAD ATTORNEY ATTORNEY TO BE NOTICED Gerald J. Rodos Barrack Rodos & Bacine 2001 Market St 3300 Two Commerce Sq Philadelphia, PA 19103 (215) 963-0600 Email: [email protected] LEAD ATTORNEY ATTORNEY TO BE NOTICED Jeffrey W. Golan Barrack Rodos & Bacine 2001 Market St 3300 Two Commerce Sq Philadelphia, PA 19103 (215) 963-0600 LEAD ATTORNEY ATTORNEY TO BE NOTICED Joseph J. Tabacco , Jr. Berman DeValerio One California Street Suite 900 San Francisco, CA 94111 415-433-3200 Fax: 415-433-6382 Email: [email protected] LEAD ATTORNEY ATTORNEY TO BE NOTICED Leonard Barrack Barrack Rodos & Bacine 2001 Market St 3300 Two Commerce Sq Philadelphia, PA 19103 (215) 963-0600 Email: [email protected] LEAD ATTORNEY ATTORNEY TO BE NOTICED Max W. -

San Francisco Listings December 2015

San Francisco Listings December 2015 For more information, please contact: Jason Karbelk 415 568 3422 [email protected] www.cushmanwakefield.com San Francisco Office Roster December 2015 201 California Street, Suite 800 | San Francisco | California 94111 Tel 415 781 8100 | Fax 415 953 3381 One Front Street, Suite 3025 | San Francisco | California 94111 Tel 415 352 2400 | Fax 415 352 2401 425 Market Street, Suite 2300 | San Francisco | California 94105 Tel 415 397 1700 | Fax 415 397 0933 www.cushmanwakefield.com Agent Specialty Title Phone Email Address Address Eckard, George Brokerage - Capital Markets Executive Director 415-773-3513 [email protected] 425 Market St Gilley, Robert Brokerage - Capital Markets Executive Managing Director 415-677-0468 [email protected] 201 California St Hermann, Steven Brokerage - Capital Markets Executive Managing Director 415-677-0465 [email protected] 201 California St Lammersen, Grant Brokerage - Capital Markets Senior Director 415-773-3518 [email protected] 425 Market St Lasoff, Adam Brokerage - Capital Markets Director 415-397-1700 [email protected] 425 Market St Parr, Jason Brokerage - Capital Markets 415-397-1700 [email protected] 425 Market St Siegel, Seth Brokerage - Capital Markets 415-773-3580 [email protected] 425 Market St Venezia, Ryan Brokerage - Capital Markets Senior Financial Analyst 415-658-3602 [email protected] 425 Market St Christian, Tom Brokerage - Industrial Executive Managing Director 415-677-0424 [email protected] -

Brief of Creditor Reliant Energy Services, Inc., Regarding Debtor's

McCUTCHEN, DOYLE, BROWN & ENERSEN, LLP 1 10 -- TERRY J. HOULIHAN (SBN 42877) 2 WILLIAM BATES III (SBN 63317) RANDY MICHELSON (SBN 114095) 3 GEOFFREY T. HOLTZ (SBN 191370) Three Embarcadero Center 4 San Francisco, California 94111-4067 Telephone: (415) 393-2000 5 Facsimile: (415) 393-2286 6 Attorneys for Creditor Reliant Energy Services, Inc. 7 8 UNITED STATES BANKRUPTCY COURT 9 NORTHERN DISTRICT OF CALIFORNIA 10 SAN FRANCISCO DIVISION 11 12 In re Case No. 01-30923 DM 13 PACIFIC GAS AND ELECTRIC COMPANY, a Chapter 11 California corporation, 14 PROOF OF SERVICE Debtor. 15 Tax Identification No. 94-742640 16 17 18 I am over 18 years of age, not a party to this action and employed in the County 19 of San Francisco, California at Three Embarcadero Center, San Francisco, California 94111 20 4067. I am readily familiar with the practice of this office for collection and processing of 21 correspondence for facsimile transmission/mail/hand delivery/next business day delivery, and 22 they are deposited that same day in the ordinary course of business. 23 Today I served the following: 24 BRIEF OF CREDITOR RELIANT ENERGY SERVICES, INC. RE 25 DEBTOR'S MOTION FOR ORDER ESTABLISHING PROCEDURES CLAIMS 26 AND DEADLINES FOR FILING CERTAIN ADMINISTRATIVE PROOF OF SERVICE (--1 1 OPPOSITION OF CREDITOR RELIANT ENERGY SERVICES, INC. TO 2 MOTION FOR AUTHORITY TO ASSUME POWER PURCHASE 3 AGREEMENTS BETWEEN PG&E AND CERTAIN QUALIFYING FACILITIES 4 DECLARATION OF BILL T. HAMILTON IN SUPPORT OF BRIEF OF 5 CREDITOR RELIANT ENERGY SERVICES, INC. RE DEBTOR'S MOTION FOR ORDER ESTABLISHING PROCEDURES AND 6 DEADLINES FOR FILING CERTAIN ADMINISTRATIVE CLAIMS 7 on the following by facsimile transmission/mail/hand delivery/next business day delivery, in 8 sealed envelope(s), as respectively noted, with all fees prepaid at San Francisco, California, 9 addressed as follow: 11 SEE ATTACHED SERVICE LIST 12 I declare under penalty of perjury under the laws of the United States of America 13 that the foregoing is true and correct and that this declaration was executed on August 2, 2001. -

F I L E D Certificate of Service by Electronic Mail Or U.S

F I L E D CERTIFICATE OF SERVICE BY ELECTRONIC MAIL OR U.S. MAIL12-28-12 04:59 PM I, the undersigned, state that I am a citizen of the United States and am employed in the City and County of San Francisco; that I am over the age of eighteen (18) years and not a party to the within cause; and that my business address is Pacific Gas and Electric Company, Law Department B30A, Post Office Box 7442, San Francisco, CA 94120. On the 28th day of December, 2012, I served a true copy of: COMPLIANCE FILING OF PACIFIC GAS AND ELECTRIC COMPANY (U 39E), SOUTHERN CALIFORNIA EDISON COMPANY (U 338E) AND SAN DIEGO GAS & ELECTRIC COMPANY (U 902M) PURSUANT TO ORDERING PARAGRAPH 7 OF D.11-07-029 [XX] By Electronic Mail – serving the enclosed via e-mail transmission to each of the parties listed on the official service list for R.09-08-009 with an e-mail address. [XX] By U.S. Mail – by placing the enclosed for collection and mailing, in the course of ordinary business practice, with other correspondence of Pacific Gas and Electric Company, enclosed in a sealed envelope, with postage fully prepaid, addressed to those parties listed on the official service list for R.09-08-009 without an e-mail address. And on the following individual by hand delivery: ALJ Regina DeAngelis California Public Utilities Commission 505 Van Ness Avenue San Francisco, CA 94102 I certify and declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct. -

SAN FRANCISCO 2Nd Quarter 2014 Office Market Report

SAN FRANCISCO 2nd Quarter 2014 Office Market Report Historical Asking Rental Rates (Direct, FSG) SF MARKET OVERVIEW $60.00 $57.00 $55.00 $53.50 $52.50 $53.00 $52.00 $50.50 $52.00 Prepared by Kathryn Driver, Market Researcher $49.00 $49.00 $50.00 $50.00 $47.50 $48.50 $48.50 $47.00 $46.00 $44.50 $43.00 Approaching the second half of 2014, the job market in San Francisco is $40.00 continuing to grow. With over 465,000 city residents employed, the San $30.00 Francisco unemployment rate dropped to 4.4%, the lowest the county has witnessed since 2008 and the third-lowest in California. The two counties with $20.00 lower unemployment rates are neighboring San Mateo and Marin counties, $10.00 a mark of the success of the region. The technology sector has been and continues to be a large contributor to this success, accounting for 30% of job $0.00 growth since 2010 and accounting for over 1.5 million sf of leased office space Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2012 2012 2012 2013 2013 2013 2013 2014 2014 this quarter. Class A Class B Pre-leasing large blocks of space remains a prime option for large tech Historical Vacancy Rates companies looking to grow within the city. Three of the top 5 deals involved 16.0% pre-leasing, including Salesforce who took over half of the Transbay Tower 14.0% (delivering Q1 2017) with a 713,727 sf lease. Other pre-leases included two 12.0% full buildings: LinkedIn signed a deal for all 450,000 sf at 222 2nd Street as well 10.0% as Splunk, who grabbed all 182,000 sf at 270 Brannan Street. -

November 23, 2004 Marlene H. Dortch, Secretary Federal

November 23, 2004 By ELECTRONIC FILING Marlene H. Dortch, Secretary Federal Communications Commission 445 Twelfth Street, S.W. Washington, D.C. 20554 Re: Written Ex Parte Presentation, Unbundled Access to Network Elements; Review ofthe Section 251 Unbundling Obligations ofIncumbent Local Exchange Carriers, WC Docket No. 04-313, CC Docket No. 01-338 Dear Ms. Dortch: On November 16, 2004, Verizon filed an ex parte letter in this docket, attaching a recent filing by MCI in a California state regulatory proceeding. As Verizon expressly acknowledges, MCI's pleading was submitted in response to a request by the California Public Utilities Commission "for comment on whether it should revise traditional retail regulation of ILECs.,,1 Verizon contends that this filing amounts to an admission by MCI "that the arguments it advanced in this proceeding no longer are valid,,2 - a claim that misstates the facts and ignores the context in which the California pleading was filed. Even a cursory review of the MCI submission shows that MCI did not contradict the facts or contentions that it has advanced in this proceeding concerning the state of intermodal competition. More fundamentally, the California proceeding and this Commission's pending Triennial Remand proceeding involve very different issues. The California Public Utilities Commission is examining in two concurrent proceedings the retail regulatory framework applicable to the state's foremost ILECs, and the application of intrastate switched access charges. In the instant proceeding, the FCC is charged with examining impairment in the absence ofthe availability of Letter from Dee May, Verizon, to Marlene H. Dortch, FCC, WC Docket No. -

Bankruptcy Forms

Case 21-10632-MBK Doc 3 Filed 01/26/21 Entered 01/26/21 03:41:26 Desc Main Document Page 1 of 63 United States Bankruptcy Court New Jersey In re L'Occitane, Inc. Case No. Debtor(s) Chapter 11 VERIFICATION OF CREDITOR MATRIX I, the Regional Managing Director of the corporation named as the debtor in this case, hereby verify that the attached list of creditors is true and correct to the best of my knowledge. Date: January 26, 2021 /s/ Yann Tanini Yann Tanini/Regional Managing Director Signer/Title I, Mark E. Hall MH-9621 , counsel for the petitioner(s) in the above-styled bankruptcy action, declare that the attached Master Address List consisting of 2 page(s) has been verified by comparison to Schedules D through H to be complete, to the best of my knowledge. I further declare that the attached Master Address List can be relied upon by the Clerk of Court to provide notice to all creditors and parties in interest as related to me by the debtor(s) in the above-styled bankruptcy action until such time as any amendments may be made. Date: January 26, 2021 /s/ Mark E. Hall Signature of Attorney Mark E. Hall MH-9621 Fox Rothschild LLP 49 Market Street Morristown, NJ 07960 973-992-4800 Fax: 973-992-9125 Software Copyright (c) 1996-2020 Best Case, LLC - www.bestcase.com Best Case Bankruptcy Case 21-10632-MBK Doc 3 Filed 01/26/21 Entered 01/26/21 03:41:26 Desc Main Document Page 2 of 63 Creditor Matrix Name Attention Address 1 Address 2 Address 3 City State Zip Country #0257-004865 Broughton Street Partn PO Box 742939 Atlanta GA 30374-2939 #339475 GGP Ala Moana L.L. -

Before the Public Utilities Commission of the State of California

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA Order Instituting Rulemaking to Implement Electric Utility Wildfire Mitigation Plans R.18-10-007 Pursuant to Senate Bill 901 (2018). (Filed October 25, 2018) CERTIFICATE OF SERVICE I hereby certify that, pursuant to the Commission’s Rules of Practice and Procedure, I have this day served a true copy RESPONSE OF LIBERTY UTILITIES (CALPECO ELECTRIC) LLC (U 933 E) TO ADMINISTRATIVE LAW JUDGE’S RULING SEEKING ADDITIONAL INFORMATION ON WILDFIRE MITIGATION PLANS AND NOTICE REGARDING THE LOCATION OF DOCUMENTS REFERENCED IN ITS WILDFIRE MITIGATION PLAN on all parties identified. Service was effected by one or more means indicated below: ☒ Transmitting the copies via e-mail to all parties who have provided an e-mail address. ☒ Placing the copies in sealed envelopes and causing such envelopes to be delivered by U.S. mail to the offices of the Assigned ALJ(s) or other addressee(s) on the service list without an e-mail address. ALJ Peter V. Allen ALJ Sarah R. Thomas CPUC CPUC 505 Van Ness Avenue, Room 5017 505 Van Ness Avenue, Room 5033 San Francisco, CA 94102-3214 San Francisco, CA 94102-3214 Executed February 26, 2019, at Downey, California. /s/ AnnMarie Lett AnnMarie Lett LIBERTY UTILITIES (California) 9750 Washburn Road Downey, CA 90241 CPUC - Service Lists - R1810007 Page 1 of 15 CPUC Home CALIFORNIA PUBLIC UTILITIES COMMISSION Service Lists PROCEEDING: R1810007 - CPUC - OIR TO IMPLEM FILER: CPUC LIST NAME: LIST LAST CHANGED: FEBRUARY 26, 2019 Download the Comma-delimited File About Comma-delimited Files Back to Service Lists Index Parties PETE SMITH ALI AMIRALI CITIZENS TRANSMISSION LLC STARTRANS IO, LLC 88 BLACK FALCON AVENUE, SUITE 342 591 W. -

BEFORE the PUBLIC UTILITIES COMMISSION of the STATE of CALIFORNIA Order Instituting Rulemaking to Integrate and Refine Procureme

BEFORE THE PUBLIC UTILITIES COMMISSION FILED OF THE STATE OF CALIFORNIA 11/10/20 04:59 PM Order Instituting Rulemaking to Integrate and Refine Rulemaking 12-03-014 Procurement Policies and Consider Long-Term (Filed March 22, 2012) Procurement Plans. CERTIFICATE OF SERVICE I, Rosa Gutierrez, certify that I have on this 10th day of November 2020 caused a copy of the foregoing THREE-DAY NOTICE OF EX PARTE MEETINGS to be served on all known parties to R. 12-03-014 listed on the most recently updated service list available on the California Public Utilities Commission website, via email to those listed with email and via U.S. mail to those without email service. Commissioner Liane Randolph ALJ Julie A. Fitch California Public Utilities Commission California Public Utilities Commission 505 Van Ness Avenue, 5th Floor Division of Administrative Law Judges San Francisco, California 94102 505 Van Ness Avenue San Francisco, California 94102 I declare under penalty of perjury that the foregoing is true and correct. Executed this 10th day of November 2020 at San Francisco, California. By /s/ Rosa Gutierrez Rosa Gutierrez 3836/001/X221610.v1 1 / 16 CPUC - Service Lists - R1203014 https://ia.cpuc.ca.gov/servicelists/R1203014_80295.htm CPUC Home CALIFORNIA PUBLIC UTILITIES COMMISSION Service Lists PROCEEDING: R1203014 - CPUC - OIR TO INTEGR FILER: CPUC LIST NAME: LIST LAST CHANGED: NOVEMBER 9, 2020 Download the Comma-delimited File About Comma-delimited Files Back to Service Lists Index Parties ADAM GUSMAN ANDREW WANG CORPORATE COUNSEL SOLARRESERVE, LLC GLACIAL ENERGY OF CALIFORNIA, INC. EMAIL ONLY EMAIL ONLY EMAIL ONL Y, CA 00000 EMAIL ONLY, VI 00000 FOR: SOLARRESERVE FOR: GLACIAL ENERGY OF CALIFORNIA, INC. -

F I L E D State of California 02-14-11 04:59 Pm

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE F I L E D STATE OF CALIFORNIA 02-14-11 04:59 PM Order Instituting Rulemaking to Develop ) Additional Methods to Implement the California ) Rulemaking 06-02-012 Renewables Portfolio Standard Program. ) (Filed February 16, 2006) ) APPLICATION OF SOUTHERN CALIFORNIA EDISON COMPANY (U 338-E) FOR REHEARING OF DECISION 11-01-025 MICHAEL D. MONTOYA CATHY A. KARLSTAD Attorneys for SOUTHERN CALIFORNIA EDISON COMPANY 2244 Walnut Grove Avenue Post Office Box 800 Rosemead, California 91770 Telephone: (626) 302-1096 Facsimile: (626) 302-1935 E-mail: [email protected] Dated: February 14, 2011 APPLICATION OF SOUTHERN CALIFORNIA EDISON COMPANY (U 338-E) FOR REHEARING OF DECISION 11-01-025 TABLE OF CONTENTS Section Page I. BACKGROUND AND SUMMARY..............................................................................................2 II. THE DECISION EXCEEDS THE SCOPE OF THE COMMISSION’S JURISDISCTION ............................................................................................................................6 III. THE COMMISSION’S RECLASSIFICATION OF OUT-OF-STATE BUNDLED TRANSACTIONS AS REC-ONLY, MARRIED WITH A 25% LIMITATION AND PRICE CAP, VIOLATES THE COMMERCE CLAUSE ............................8 IV. THE COMMISSION’S ADOPTION OF DIFFERENT RPS RULES FOR DIFFERENT LSES VIOLATES CALIFORNIA STATUTES.....................................................12 V. CONCLUSION..............................................................................................................................14