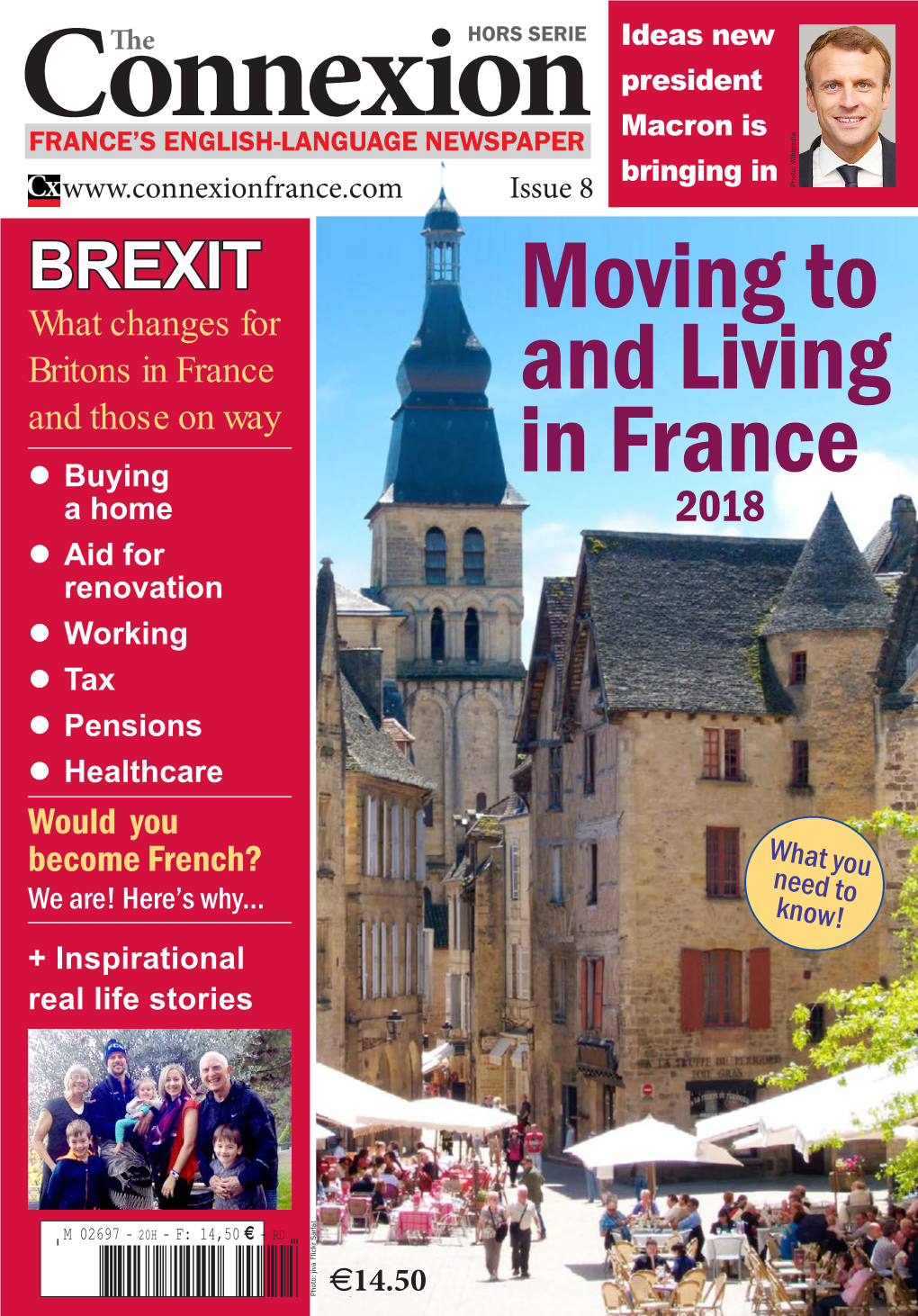

Moving-To-France-2018.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vallée De La Loire Et De L'allier Entre Cher Et Nièvre

Vallée de la Loire et de l’Allier entre Cher et Nièvre Directive Habitats, Faune, Flore Directive Oiseaux Numéro europé en : FR2600965 ; FR2610004 ; FR8310079 (partie Nièvre) Numéro régional : 10 Département : Cher, Nièvre Arrondissements : cf. tableau Communes : cf. tableau Surface : 16 126 hectares Le site Natura 2000 « Vallée de la Loire et de l’Allier entre Cher et Nièvre » inclut les deux rives de la Loire sur un linéaire d’environ 80 Km et les deux rives de l’Allier sur environ 20 kilomètres dans le département de la Nièvre et du Cher. Ce site appartient majoritairement au secteur dit de la « Loire moyenne » qui s’étend du Bec d’Allier à Angers, également nommé « Loire des îles ». Il regroupe les divers habitats naturels ligériens, véritables refuges pour la faune et la flore façonnés par la dynamique des deux cours d’eau, et constitue notamment une zone de reproduction, d'alimentation ou de passage pour un grand nombre d'espèces d’oiseaux nicheuses, migratrices ou hivernantes. Le patrimoine naturel d’intérêt européen Le lit mineur de la Loire et de l’Allier : La Loire et son principal affluent sont des cours d’eau puissants. Leur forte dynamique façonne une multitude d’habitats naturels possédant un grand intérêt écologique. Les grèves, bancs d’alluvions sableuses ou graveleuses, permettent le développement d’une végétation spécifique, adaptée à la sécheresse temporaire et à la submersion et constituent un lieu de vie et de reproduction important pour plusieurs espèces de libellules et certains oiseaux pour leur reproduction. La Sterne naine, la Sterne pierregarin et l’Oedicnème criard, nichent exclusivement sur les sols nus et graveleux des grèves ou des bancs d’alluvions formés au gré de ces cours d’eau. -

3B2 to Ps.Ps 1..5

1987D0361 — EN — 27.05.1988 — 002.001 — 1 This document is meant purely as a documentation tool and the institutions do not assume any liability for its contents ►B COMMISSION DECISION of 26 June 1987 recognizing certain parts of the territory of the French Republic as being officially swine-fever free (Only the French text is authentic) (87/361/EEC) (OJ L 194, 15.7.1987, p. 31) Amended by: Official Journal No page date ►M1 Commission Decision 88/17/EEC of 21 December 1987 L 9 13 13.1.1988 ►M2 Commission Decision 88/343/EEC of 26 May 1988 L 156 68 23.6.1988 1987D0361 — EN — 27.05.1988 — 002.001 — 2 ▼B COMMISSION DECISION of 26 June 1987 recognizing certain parts of the territory of the French Republic as being officially swine-fever free (Only the French text is authentic) (87/361/EEC) THE COMMISSION OF THE EUROPEAN COMMUNITIES, Having regard to the Treaty establishing the European Economic Community, Having regard to Council Directive 80/1095/EEC of 11 November 1980 laying down conditions designed to render and keep the territory of the Community free from classical swine fever (1), as lastamended by Decision 87/230/EEC (2), and in particular Article 7 (2) thereof, Having regard to Commission Decision 82/352/EEC of 10 May 1982 approving the plan for the accelerated eradication of classical swine fever presented by the French Republic (3), Whereas the development of the disease situation has led the French authorities, in conformity with their plan, to instigate measures which guarantee the protection and maintenance of the status of -

Language Planning and Textbooks in French Primary Education During the Third Republic

Rewriting the Nation: Language Planning and Textbooks in French Primary Education During the Third Republic By Celine L Maillard A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy University of Washington 2019 Reading Committee: Douglas P Collins, Chair Maya A Smith Susan Gaylard Ana Fernandez Dobao Program Authorized to Offer Degree: Department of French and Italian Studies College of Arts and Sciences ©Copyright 2019 Céline L Maillard University of Washington Abstract Rewriting the Nation: Language Planning and Textbooks in French Primary Education During the Third Republic Celine L Maillard Chair of the Supervisory Committee: Douglas P Collins Department of French and Italian Studies This research investigates the rewriting of the nation in France during the Third Republic and the role played by primary schools in the process of identity formation. Le Tour de la France par deux enfants, a textbook written in 1877 by Augustine Fouillée, is our entry point to illustrate the strategies used in manufacturing French identity. We also analyze other texts: political speeches from the revolutionary era and from the Third Republic, as well as testimonies from both students and teachers written during the twentieth century. Bringing together close readings and research from various fields – history, linguistics, sociology, and philosophy – we use an interdisciplinary approach to shed light on language and national identity formation. Our findings underscore the connections between French primary education and national identity. Our analysis also contends that national identity in France during the Third Republic was an artificial construction and demonstrates how otherness was put in the service of populism. -

The Demarcation Line

No.7 “Remembrance and Citizenship” series THE DEMARCATION LINE MINISTRY OF DEFENCE General Secretariat for Administration DIRECTORATE OF MEMORY, HERITAGE AND ARCHIVES Musée de la Résistance Nationale - Champigny The demarcation line in Chalon. The line was marked out in a variety of ways, from sentry boxes… In compliance with the terms of the Franco-German Armistice Convention signed in Rethondes on 22 June 1940, Metropolitan France was divided up on 25 June to create two main zones on either side of an arbitrary abstract line that cut across départements, municipalities, fields and woods. The line was to undergo various modifications over time, dictated by the occupying power’s whims and requirements. Starting from the Spanish border near the municipality of Arnéguy in the département of Basses-Pyrénées (present-day Pyrénées-Atlantiques), the demarcation line continued via Mont-de-Marsan, Libourne, Confolens and Loches, making its way to the north of the département of Indre before turning east and crossing Vierzon, Saint-Amand- Montrond, Moulins, Charolles and Dole to end at the Swiss border near the municipality of Gex. The division created a German-occupied northern zone covering just over half the territory and a free zone to the south, commonly referred to as “zone nono” (for “non- occupied”), with Vichy as its “capital”. The Germans kept the entire Atlantic coast for themselves along with the main industrial regions. In addition, by enacting a whole series of measures designed to restrict movement of people, goods and postal traffic between the two zones, they provided themselves with a means of pressure they could exert at will. -

Beginning French Research for Non-French Speakers PART TWO

Beginning French Research for Non-French Speakers PART TWO Amberly Beck a thegenealogygirl.blog | Twitter — @genealogygirl_ | Facebook @thegenealogygirl | [email protected] Basic Vocabulary ____________________________________________________________________________________________________________________________________________________________________________________________________________ Developing a basic vocabulary of French words commonly found in church and civil records will help you research more effectively. The French Genealogical Word List in the FamilySearch Research Wiki is an excellent tool filled with many commonly used words in French records. For French numbers, months, times of day, and so on, please begin here and scroll down. Below is a simple list of common key words found in baptism, marriage, and burial records. Many of these same words will be found in civil records as well. Common key words in baptism records: Common key words in marriage records: In French In English In French In English baptisé baptized bans banns femme wife fille daughter fils son fils son fille daughter frère brother legitime mariage legitimate marriage L'epouse the bride or the wife marrain godmother L'epoux the groom or the husband mère mother mariage marriage né born, male form oncle uncle née born, female form mère mother parrain godfather père father père father Common key words in burial records: Common relationship words in French records: In French In English In French In English âgé(e) aged beau-frère brother-in-law, -

The Loire Valley Digital Open Joint Syndicate Selects Tdf to Roll out and Operate Fiber in Rural Areas

Press Release Montrouge, January 15, 2018 THE LOIRE VALLEY DIGITAL OPEN JOINT SYNDICATE SELECTS TDF TO ROLL OUT AND OPERATE FIBER IN RURAL AREAS The Syndicat Mixte Ouvert Val de Loire Numérique (Loire Valley Digital Open Joint Syndicate) recently selected TDF to roll out and operate optical fiber in French counties Indre-et-Loire and Loir-et-Cher. A big project covering 306,000 connections and 513 communities Following a tender lasting several months, TDF has won the contract to roll out, operate and market the fiber network of French counties Indre-et-Loire and Loir-et-Cher under a 25-year public service concession. The project runs over a five-year period, entails installing 306,000 connections serving 513 communities (excluding 'AMII' areas) and will provide ultra high-speed broadband for local inhabitants and businesses alike. The Loire Valley Digital Open Joint Syndicate's digital development project is challenging: under a total €490 million budget, which includes a state subsidy, by 2022 TDF is due to have installed an ultra high-speed fiber-to-the-home (FTTH) network throughout the territory of the two counties involved. A game-changing project for the counties There is a lot at stake, namely bringing ultra high-speed internet to everyone's homes throughout the territory under terms promoting development of market-based services for both individuals and business. Both counties' Joint Syndicate seeks to make Indre-et-Loire and Loir-et-Cher more appealing to business, especially the tourism industry and foreign tourists who are attracted to the stunning cultural sights in the Loire Valley. -

Ac43f35b215d8d679224bf95f75

Find the complete programme of events at: www.the70th-normandy.com 70TH ANNIVERSARY OF D-DAY AND THE Battle OF NORMANDY Marked by the 70th anniversary of the D-Day Landings and the Battle of Normandy, 2014 will be a year for peace and reconci- liation. Through an exceptional programme showcasing this his- torical event in dedicated sites and museums, you will be able to relive and better understand this crucial phase of the Second World War. On the occasion of this 70th anniversary, the chal- lenges of our cultural and family-oriented programme of events, suitable for all, will be to show, evoke and explain so that people can see, understand and remember. In this brochure you will find a small selection of events which Normandy is planning. THE OFFICIAL COMMEMORATIONS The official commemorations of June 5th, 6th and 7th 2014 will bring together many heads of State and Government. Only holders of invitations will be able to gain access to the sites of these official commemorations. To stay abreast of the latest news about conditions of ac- cess to the sites, please consult the following site regularly: www.the70th-normandy.com In any case, areas will be open to the general public in immediate proximity to these sites and many other sites and museums will be easily accessible so that you can find out about the history of the D-Day Landings and the Battle of Normandy. 2 What’S ON IN 2014? From February to December From March to October Juno Beach Centre Calvados Courseulles-sur-Mer (14) LEAVING THE WAR BEHIND. -

Assessing Relationships Between Human Adaptive Responses and Ecology Via Eco-Cultural Niche Modeling William E

Assessing relationships between human adaptive responses and ecology via eco-cultural niche modeling William E. Banks To cite this version: William E. Banks. Assessing relationships between human adaptive responses and ecology via eco- cultural niche modeling. Archaeology and Prehistory. Universite Bordeaux 1, 2013. hal-01840898 HAL Id: hal-01840898 https://hal.archives-ouvertes.fr/hal-01840898 Submitted on 11 Nov 2020 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Thèse d'Habilitation à Diriger des Recherches Université de Bordeaux 1 William E. BANKS UMR 5199 PACEA – De la Préhistoire à l'Actuel : Culture, Environnement et Anthropologie Assessing Relationships between Human Adaptive Responses and Ecology via Eco-Cultural Niche Modeling Soutenue le 14 novembre 2013 devant un jury composé de: Michel CRUCIFIX, Chargé de Cours à l'Université catholique de Louvain, Belgique Francesco D'ERRICO, Directeur de Recherche au CRNS, Talence Jacques JAUBERT, Professeur à l'Université de Bordeaux 1, Talence Rémy PETIT, Directeur de Recherche à l'INRA, Cestas Pierre SEPULCHRE, Chargé de Recherche au CNRS, Gif-sur-Yvette Jean-Denis VIGNE, Directeur de Recherche au CNRS, Paris Table of Contents Summary of Past Research Introduction .................................................................................................................. -

Première Édition

Première édition Les 4 lauréats du concours Eco-trophée du Parc naturel régional de la Brenne ont été dévoilés lors de la cérémonie de remise des prix qui s’est tenue à la Maison du Parc (Rosnay), jeudi 18 novembre. Près de 100 personnes étaient présentes (entreprises et associations candidates, élus et partenaires de l’opération). Une première édition qui se clôture sous le signe de la réussite. Pour rappel, 41 dossiers ont été déposés dans les 3 catégories : - Respect de l’environnement : actions en faveur de l’environnement dans différents domaines que peuvent être les déchets, l’eau, l’air, les énergies, la sauvegarde de la biodiversité… - Renforcement du lien social : actions favorisant le lien social dans l’établissement : formation des salariés, accompagnement d’apprentis, de stagiaires, recrutement de personnes en difficultés d’insertion, sécurité et santé du personnel… - Harmonie territoriale : actions liées à la reconnaissance et au développement de son territoire : approvisionnements locaux, sauvegarde de ressources et de savoir-faire locaux, service rendu à la population… Un prix a été décerné par catégorie, auquel s’ajoute le prix coup de cœur du jury. Les résultats Catégorie « Respect de l’environnement » 16 dossiers étaient présentés Le prix a été attribué à l’exploitation agricole, l’EARL du Bois d’Angles. Chefs d’exploitation Xavier JACQUET et Benjamin MEREAU Commune Lurais Activité Production de céréales et élevage de canards gras et canards prêts à engraisser Date de reprise 1er septembre 2006 Réalisation présentée Traitement des eaux usées en milieu agricole à l’Eco-trophée Xavier Jacquet et Benjamin Mereau ont aménagé en 2009 une aire de lavage pour le matériel de gavage et le matériel agricole. -

Download the Catalogue

ARTIGNY Dimanche 6 juin 2021 Lundi 7 juin 2021 r ORDRE DE VENTE Provenant de grandes demeures du Val de Loire Dimanche 6 juin 2021 à 14 h Rubens et son temps 1 - 27 L'art de vivre au XVIIIe siècle 40 - 62 Le pari de l'Impressionnisme 70 - 81 Spectaculaire Second Empire 90 - 115 Lundi 7 juin 2021 à 14 h Bijoux & Montres 150 - 187 Antiques & Orfèvrerie 200 - 237 Tableaux & Bel ameublement 250 - 303 D EXPOSITIONS PUBLIQUES au Château d’Artigny Vendredi 4 juin, de 15 à 19 heures Samedi 5 juin, de 9 à 17 heures Dimanche 6 juin, de 9 à 11 heures Lundi 7 juin, de 9 à 11 heures 02 54 80 24 24 depuis 1989 LAC CATALOGUE COMPLET ROUIL VENTE LIVE www.rouillac.com LIVE 33 e vente GardenPdepuais 19r89ty par Philippe et Aymeric Rouillac Château d’Artigny 92, rue de Monts - 37250 Montbazon Dimanche 6 juin 2021 à 14h Lundi 7 juin 2021 à 14h En provenance de grandes demeures et châteaux privés du Val de Loire Marteau de commissaire-priseur créé spécialement par Goudji Route de Blois 41, bd du Montparnasse 22, bd Béranger 41100 VENDÔME 75006 PARIS 37000 TOURS +33 2 54 80 24 24 +33 1 45 44 34 34 +33 2 47 61 22 22 [email protected] SVV n° 2002-189 rouillac.com 1 Comment Face aux contraintes sanitaires, nous mettons tout en œuvre pour faciliter votre participation à cette 33 e vente Garden Party. Expositions privées et virtuelle Catalogue sur rouillac.com à Vendôme et à Paris chez les experts, sur • Catalogue illustré par plus de 1.500 photos ren dez-vous. -

Prolegomena to Pastels & Pastellists

Prolegomena to Pastels & pastellists NEIL JEFFARES Prolegomena to Pastels & pastellists Published online from 2016 Citation: http://www.pastellists.com/misc/prolegomena.pdf, updated 10 August 2021 www.pastellists.com – © Neil Jeffares – all rights reserved 1 updated 10 August 2021 Prolegomena to Pastels & pastellists www.pastellists.com – © Neil Jeffares – all rights reserved 2 updated 10 August 2021 Prolegomena to Pastels & pastellists CONTENTS I. FOREWORD 5 II. THE WORD 7 III. TREATISES 11 IV. THE OBJECT 14 V. CONSERVATION AND TRANSPORT TODAY 51 VI. PASTELLISTS AT WORK 71 VII. THE INSTITUTIONS 80 VIII. EARLY EXHIBITIONS, PATRONAGE AND COLLECTIONS 94 IX. THE SOCIAL FUNCTION OF PASTEL PORTRAITS 101 X. NON-PORTRAIT SUBJECTS 109 XI. PRICES AND PAYMENT 110 XII. COLLECTING AND CRITICAL FORTUNE POST 1800 114 XIII. PRICES POST 1800 125 XIV. HISTORICO-GEOGRAPHICAL SURVEY 128 www.pastellists.com – © Neil Jeffares – all rights reserved 3 updated 10 August 2021 Prolegomena to Pastels & pastellists I. FOREWORD ASTEL IS IN ESSENCE powdered colour rubbed into paper without a liquid vehicle – a process succinctly described in 1760 by the French amateur engraver Claude-Henri Watelet (himself the subject of a portrait by La Tour): P Les crayons mis en poudre imitent les couleurs, Que dans un teint parfait offre l’éclat des fleurs. Sans pinceau le doigt seul place et fond chaque teinte; Le duvet du papier en conserve l’empreinte; Un crystal la défend; ainsi, de la beauté Le Pastel a l’éclat et la fragilité.1 It is at once line and colour – a sort of synthesis of the traditional opposition that had been debated vigorously by theoreticians such as Roger de Piles in the previous century. -

Pré Diagnostic Hydromorphologiqué Dés Massés D'éau Du Bassin Dé L

Pré diagnostic hydromorphologiqué dés massés d’éau du bassin dé l’Anglin Syndicat Intercommunal d’Aménagement du bassin de l’Anglin Août 2014 Avec la collaboration de : Table des matières GLOSSAIRE ............................................................................................................................................................................. 2 CONTEXTE .............................................................................................................................................................................. 4 EXPLICATIONS SUR L’OUTIL SYRAH-CE ............................................................................................................................. 5 METHODES ............................................................................................................................................................................. 6 PRESENTATION SUCCINCTE DU BASSIN ................................................................................................................................ 6 I. HYDROLOGIE : QUANTITE ET DYNAMIQUE .............................................................................................................. 12 I.1 Anglin ............................................................................................................................................................... 12 I.2 Le Salleron ....................................................................................................................................................