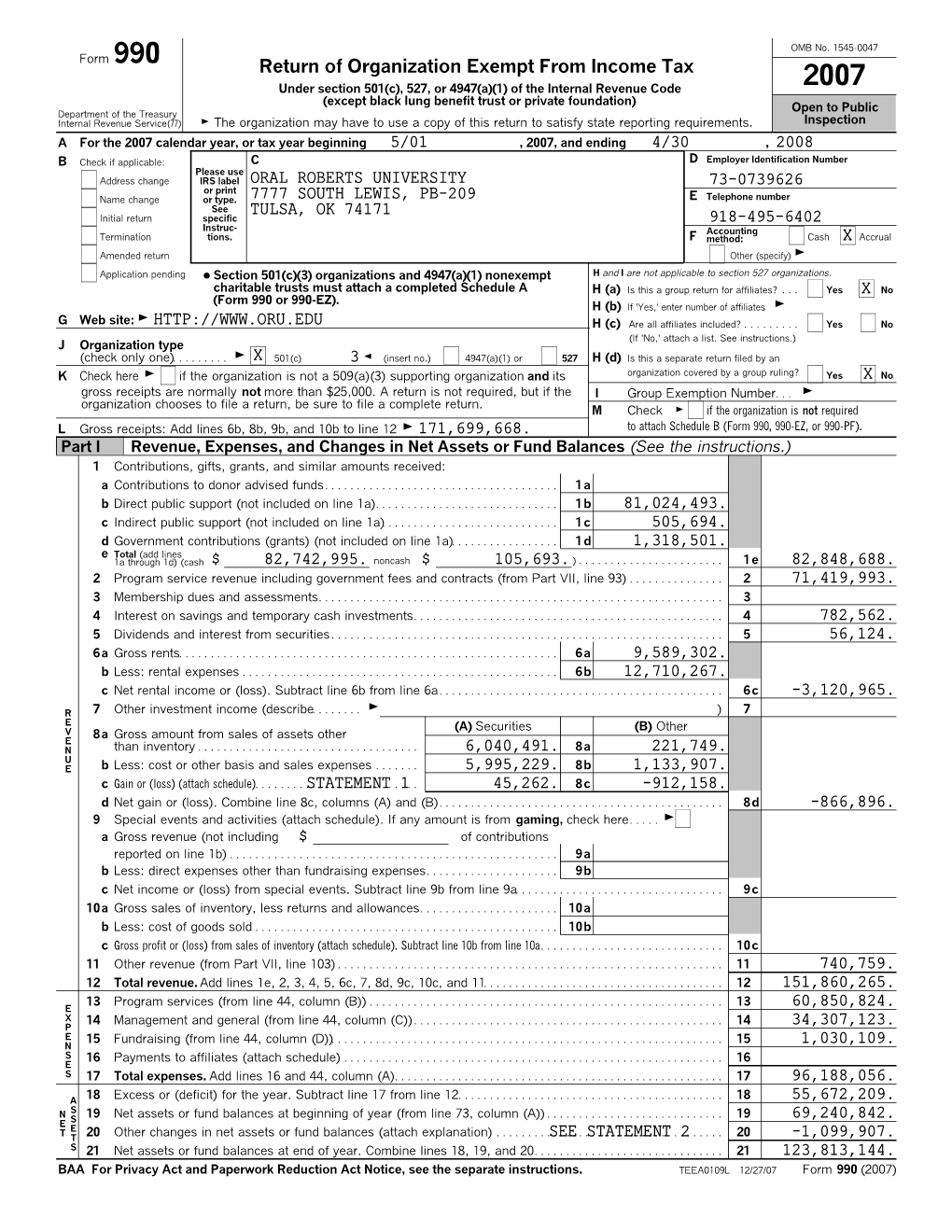

Return of Organization Exempt from Income

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reflections-Grassleys Requests.Pub

Educating & Empowering Donors to Support Christian Ministries December 2007 MinistryWatch.com Grassley’s Requests of Televangelists are Well-Founded Unchecked media churches could undermine the Gospel message By Michael Barrick When Senator Charles Grassley (R-Iowa) recently re- raised eyebrows. Grassley explained, “As a Christian quested that numerous high-profile televangelists dis- myself, and a person who believes in tithing, I feel I close financial information to the Senate Finance Com- have a right to know where my money goes. If a person mittee by early December, his call precipitated debate gets a tax deduction for a donation, the deduction and among Christian church and ministry leaders concerned donation should be for a legitimate purpose.” about overreaching government. Church leaders critical of Grassley’s call are setting up a It shouldn’t have. While Grassley’s move is admittedly straw man. It is irrelevant that it is a secular official call- dramatic, what he has called for is reasonable – proof ing these televangelists to account. The Bible could not that these church leaders are not misusing funds in- be clearer – church leaders are held to a high standard. tended for charitable purposes. Grassley, the ranking “For the overseer must be above reproach as God’s member of the Senate Finance Committee, is doing steward…” (Titus 1:7a NASB). If the Church fails to what the Church should do – ensure that its leaders ad- hold its own accountable and if its most visible leaders here to fundamental biblical principles such as transpar- fail to live by the very standards they purport to pro- ency and honesty while exhibiting a sacrificial lifestyle claim, then we should applaud when a leader with the modeled after Jesus. -

An Examination of the Prosperity Gospel: a Plea for Return to Biblical Truth

Liberty University Baptist Theological Seminary AN EXAMINATION OF THE PROSPERITY GOSPEL: A PLEA FOR RETURN TO BIBLICAL TRUTH This Thesis Project Submitted to The faculty of Liberty Baptist Theological Seminary In Candidacy for the Degree of Doctor of Ministry By Aaron B. Phillips Lynchburg, Virginia August 2015 Copyright © 2015 by Aaron B. Phillips All Rights Reserved i Liberty University Baptist Theological Seminary Thesis Project Approval Sheet ______________________________ Dr. Charlie Davidson, Associate Professor of Chaplaincy Mentor ______________________________ Dr. David W. Hirschman Associate Prof of Religion, Reader ii ABSTRACT AN EXAMINATION OF THE PROSPERITY GOSPEL: A PLEA FOR RETURN TO BIBLICAL TRUTH Aaron B. Phillips Liberty University Baptist Theological Seminary, 2015 Mentor: Dr. Charlie Davidson The prosperity gospel teaches that the Bible promises health, wealth and uncommon success to all believers. A problem surfaces when the prosperity that is promised does not materialize to all members of the congregation. In examining the validity of this teaching, extensive writings, books, articles and sermons by leading proponents, have been reviewed. Additionally, interviews with at least one hundred pastors inform this writing. The purpose of the research is to furnish contemporary, active insight to this project. The conclusion of this writer is that the prosperity gospel offers an unbalanced application of scripture, which results in a departure from a clear biblical orientation for articulating the doctrine of Jesus Christ. -

4 Simple Ways to Identify the Prosperity Gospel

4 Simple Ways to Identify the Prosperity Gospel The prosperity gospel is also sometimes called the health and wealth gospel, word-faith theology, or simply the faith movement. The prosperity gospel comes in different shapes and sizes, but at the heart of it is the teaching that God desires all Christians to prosper in every aspect of their lives. While this includes prospering in things like having healthy relationships, those who teach some version of prosperity theology usually emphasize financial and physical health. If you ask someone if they affirm prosperity teaching, they usually won’t admit it. So, how do you know if someone is simply affirming the biblical truth that God is our provider and that God heals, or if they are moving into prosperity teaching? © 2017 AndrewKGabriel.com How can you identify the prosperity gospel? These four factors won’t guarantee that you have found a prosperity teacher, but they will help you identify if you might be in the presence of one. 1) Key Phrases Those who have an emphasis on the health and wealth gospel tend to use speak of: • Divine destiny • Divine health • Divine wealth • Declaring your faith • Releasing your faith • Speaking A, B, or C over your life • Declaring A, B, or C over your life 2) The Church Name While it isn’t always the case, churches that have the prosperity gospel as an underlying theme (it’s not always explicit) sometimes have names like: • Victory Center • Word of Faith Church • World Changers • Winners Church • Overcoming Faith Church © 2017 AndrewKGabriel.com 3) The -

June 29 , 2020 SENT VIA EMAIL ONLY: [email protected] Chief

June 29 , 2020 SENT VIA EMAIL ONLY: [email protected] Chief, Freedom of Information/Privacy Acts Office U.S. Small Business Administration 409 Third St. SW, eighth floor Washington, DC 20416 Re: Freedom of Information Act Request To Whom it May Concern: I am writing on behalf of the Freedom From Religion Foundation to request public records. FFRF is a national nonprofit dedicated to defending the constitutional separation between state and church, and educating the public about matters related to nontheism. On June 17, 2020, FFRF filed a request for the records of all churches and religious organizations that received loans provided by the CARES Act. We are now filing this second request for records of funds given to specific churches and religious organizations. Since churches are not required to file documentation with the federal government, it is difficult to make this request with specificity. For instance, these houses of worship might be incorporated in states where their principal church is not located, but it is difficult to determine because of the total lack of government oversight. To assist the records custodian in identifying these records, we have provided EINs, addresses, and names of clergy representing the houses of worship where possible. These may not match the legal entities that applied to SBA for assistance. To be clear, we are requesting all records of all SBA forgivable loans that were provided to any of the churches or church representatives listed below, or their affiliates. This request is in addition to our earlier FOIA request and does not abrogate that request in any way. -

Word-Faith Movement (Positive Confession Movement)

Word-Faith Movement (Positive Confession Movement) History, Beliefs, and Practices Identity: A movement (not a denomination as such) whose proponents teach that divine health and prosperity are the rights of every Christian who will apply enough faith to receive them. Popularized by television evangelists, the Word-Faith movement urges the appropriation of faith through the making of a “positive confession.” The movement is otherwise referred to as “Prosperity Gospel,” “Health and Wealth Gospel,” and “Name It and Claim It.” Founder(s): The movement has no “founders” as such, though Essek William Kenyon (1867-1948) is often credited with laying the foundation for the Word-Faith movement. Identified as subscribing to Word-Faith teaching are personalities such as Paul and Jan Crouch (Trinity Broadcasting Network), David Yonggi Cho, Kenneth and Gloria Copeland, John Avazani, Joel Osteen, T. L. Osborne, Robert Tilton, Marilyn Hickey, Frederick Price, Benny Hinn, Oral Roberts, Jerry Savelle, Morris Cerullo, Casey Treat, Dwight Thompson, Rodney Howard-Browne,and Kenneth Hagin. Word-Faith ideas are featured and promulgated through television principally by the Trinity Broadcasting Network. Statistics: No statistics on the number of followers is available. History: The beginnings of the Word [of] Faith or Positive Confession Movement can be traced to the writings of the radio preacher and Methodist minister William Essek Kenyon (1867- 1948). He wrote about fifteen books in which he “stressed the power of words spoken in faith and the supremacy of a so-called revelation knowledge over knowledge obtained by the senses: ‘A strong confession [of positive faith]…brings God on the scene…Faith counts the thing done before God has acted. -

Reconsidering the Form 990 Exemption

MONTAGUE.35.1 (Do Not Delete) 10/9/2013 6:22 PM THE LAW AND FINANCIAL TRANSPARENCY IN CHURCHES: RECONSIDERING THE FORM 990 EXEMPTION John Montague† Most tax-exempt organizations are required to file the IRS Form 990, an information return that is open to the public. The Form 990 is used by watchdogs and donors to learn detailed financial information about charities. However, churches are exempt from filing the Form 990 and need not disclose any financial information to the IRS, the public, or their donors. In December 2012, the Evangelical Council for Financial Accountability recommended to Senator Charles Grassley that Congress should preserve the exemption, despite recent financial scandals at churches. Examining the legislative history, this Article argues that the primary function of the information return has become its utility to donors, and policymakers have recognized the role that public access can play in keeping nonprofits honest and efficient. Unfortunately, because churches do not have to be transparent or accountable, few of them are. Using research and insights from sociology, this Article contends that because of their opacity and the unique nature of religious authority, churches are more likely to foster and shelter malfeasance. Churchgoers are unlikely to challenge leaders because doing so can endanger their position in the religious community, making it imperative that transparency be mandated by outside authorities. Ironically, increased transparency may actually be good for churches because, as studies suggest, it is likely to increase donations and because, by minimizing opportunities for financial improprieties, it may preserve the religious experience of churchgoers. In addition, transparency is consistent with the teaching of many Christian leaders and with the expressed preferences of a large portion of churchgoers. -

The Prosperity Gospel Defined

The Prosperity Gospel Defined • The “Prosperity Gospel” is a view now promoted from many pulpits that… • A) Financial well-being is God’s reward/sign of approval for Christians. • B) Sufficient faith, “positive” mind-sets, and monetary donations to churches will garner the approval of God, and thus serve to increase one’s wealth. • C) Also known as “health and wealth” gospel. “The Bankruptcy of Prosperity Preaching”, October 17th, 2010 , Southside Church of Christ, Fort Myers, FL • From Robert Tilton…“I believe that it is the will of God for all to prosper because I see it in the Word [of God], not because it has worked mightily for someone else. I do not put my eyes on men, but on God who gives me the power to get wealth.” • “God desires us to become wealthy for him.” (Tecoy Porter, Releasing Your Inner Treasure: 8 Kingdom Keys to Unlocking the Wealth Within You, xxvi). • From Joel Osteen…“God wants us to prosper financially, to have plenty of money, to fulfill the destiny He has laid out for us.” Verses used by Prosperity proponents to support belief • Malachi 3:10: "Bring ye all the tithes into the storehouse, that there may be meat in mine house, and prove me now herewith, saith the LORD of hosts, if I will not open you the windows of heaven, and pour you out a blessing, that there shall not be room enough to receive it" (KJV). • Matthew 25:14–30: the Parable of the talents. • John 10:10: "I am come that they might have life, and that they might have it more abundantly" (KJV). -

ORU Fall 2002

YOUR VOICE The Mission Is the Answer re you on the mission field? Washington, D.C., and this is my mis- I am. Every day. sion field. As ORU alumni, we’ve been That might sound just a called to “everyman’s world” and I’m little crazy, since what I do learning day by day just what that A most days is drive up the means. George Washington Parkway, cross Sometimes it means taking on a pro the Potomac River, and go to an office bono case where, through my legal in the heart of our nation’s capital. work, I can care for the widow and Martin Luther King wrote his “I Have orphan, as Jesus commanded — seek- a Dream” speech in the building ing political asylum for those in danger where I work, and Abraham Lincoln in their home countries. Most of the lived here for a few months while wait- time, though, my legal work is more ing to move into the White House removed from “the mission” and it’s next door. Now it is mostly inhabited hard to see a clear connection. Some Bob Vander Lugt with Alumni Office staff member by law firms, including days, all I do is work on Tammy Denton (right) and Laneice Goodwin (left; the one where I work. technology transfer daughter of John [74]), an ORU student who This is not the place As ORU alumni, issues between U.S. and interned at the Pentagon this year. most Christians picture foreign corporations. and in lives of ORU alumni who have when they think about we’ve been called But I’m learning that dared to accept the challenge to live this the mission field. -

Sermon Guide

The Book of Titus The Book of Titus False Teachers Among You: The Prosperity Gospel Part I False Teachers Among You: The Prosperity Gospel Part I June 6, 2021 June 6, 2021 Prosperity Gospel Defined John 10:10 Prosperity Gospel Defined John 10:10 → It is ______________________ for every believer to experience the → It is ______________________ for every believer to experience the abundant life of health, wealth, happiness, and anointing. abundant life of health, wealth, happiness, and anointing. → The Prosperity Gospel is part of the __________________________ → The Prosperity Gospel is part of the __________________________ movement. movement. → The Prosperity Gospel is being _____________ around the world. → The Prosperity Gospel is being _____________ around the world. → The Prosperity Gospel is a ___________________ Gospel! → The Prosperity Gospel is a ___________________ Gospel! Prosperity Gospel False Teachings Prosperity Gospel False Teachings The Prosperity Gospel __________________ the Gospel message. The Prosperity Gospel __________________ the Gospel message. John 10:10 John 10:10 The Prosperity Gospel __________________ the atonement. The Prosperity Gospel __________________ the atonement. II Corinthians 8:9 II Corinthians 8:9 The Prosperity Gospel promotes the _______________ it, The Prosperity Gospel promotes the _______________ it, ______________ it theology. Our mouths through declaration or ______________ it theology. Our mouths through declaration or confession control our health, wealth, and happiness. confession control our health, wealth, and happiness. Mark 11:23-24 Mark 11:23-24 The Prosperity Gospel ___________ God’s sovereignty by stating The Prosperity Gospel ___________ God’s sovereignty by stating that our faith is a force, and that God must respond to our faith. -

Senator Grassley's Review of Six Tax-Exempt Ministries Charlene

GRASSLEY 1 Congressional Oversight of the Nonprofit Sector: Senator Grassley’s Review of Six Tax-Exempt Ministries Charlene D. Orchard University of Utah * Draft Date: March 22, 2013. Abstract In a 2011 press release, Senator Charles Grassley stated, “The tax-exempt sector is so big that from time to time, certain practices draw public concern. My goal is to help improve accountability and good governance so tax-exempt groups maintain public confidence in their operations.” Since his election to the Senate in 1980, the Iowa Republican has developed a reputation for being a “good government guy,” and one instance of his work in this area was a multi-year review of six tax-exempt ministries. This paper discusses challenges faced in providing oversight of the nonprofit sector generally and of churches in particular. The case of Grassley’s investigation of tax-exempt ministries reveals the promise but mostly the perils of such a crusade, especially if reelection is a goal. Key Words: nonprofit organizations, nonprofit sector, governance, accountability, the electoral connection GRASSLEY 2 Congressional Oversight of the Nonprofit Sector: Senator Grassley’s Review of Six Tax-Exempt Ministries Private jets, $350,000 Bentleys, multiple vacation homes, Rolls Royces, cosmetic surgeries, a $23,000 marble top for a commode, $20 million headquarters, and multi-million dollar mansions for CEOs. These are not characteristics one would expect of tax-exempt, nonprofit organizations and certainly not of religious institutions. Yet reports of lavish lifestyles among leaders of some churches have come into Senator Charles Grassley’s office over the years. As a leading member and former chair of the Senate Finance Committee, Grassley investigated nonprofits such as the Nature Conservancy, the United Way, and the Red Cross, and has been the go-to member of congress for all things nonprofit and tax-exempt. -

A College Affordable to All

Dr. Zalmer J. Nichols Chancellor Executive Office: 210 S. main Independence, Mo. 64050 Phone 816– 252-7710 Founded 1997 A College Affordable to All 2018 – 2019 Catalog AFFILIATE MEMBER OF ORAL ROBERTS UNIVERSITY ED. FELL. FAITH BIBLE COLLEGE 210 S. MAIN, INDEPENDENCE, MISSOURI, 64050 Phone: 816-252-7710 “SCHOOL OF THE SPIRIT” “AFFILIATE MEMBER OF ORAL ROBERTS UNIVERSITY ED. FELL.” CHANCELLOR: DR. ZALMER J. (NICK) NICHOLS Ph. D., R. E. D., Th. D., S. Ph. D., P. Th. D., C.C. D. ASSISTANT CHANCELLOR: DR. Michelle Nichols C.E.D DEAN: DR. EVA NICHOLS R. E. D., C.C. D., Th. D., C. E. D., F.B.C. D., S. Ph. D. Extension Instructions 1. All Evaluation money and Graduation fees are to be submitted in full to the main campus. 2. All other fees are divided equally 50-50. A. Application Fees of $25.00 B. Registration Fees of $75.00 C. Tuition and Book Fees $130.00 3. All losses are shared equally by the extension and the main campus. 4. All monies collected after the first week of enrollment one-half of the money is to be sub- mitted to the main campus. 5. At the end of the semester all monies collected during the semester one-half is to submitted to the main campus. 6. Faith Bible College accepts all classes of F.B.C. taught with 3 credits given for each class. 7. If a husband and wife are attending then if one spouse is completely paid for in the first week, then the other spouse will be charged one-half price on their tuition. -

Total-Life-Prosperity-By-Creflo-Dollar

CREFLO A. DOLLAR JR. THOMAS NELSON PUBLISHERS* Nashville Copyright © 1999 by Creflo A. Dollar Jr. All rights reserved. Written permission must be secured from the publisher to use or reproduce any part of this book, except for brief quotations in critical reviews or articles. Published in Nashville, Tennessee, by Thomas Nelson, Inc. Unless otherwise noted, Scripture quotations are from THE KING JAMES VERSION of the Bible. Scripture quotations noted NKJV are from THE NEW KING JAMES VERSION. Copyright © 1979, 1980, 1982, Thomas Nelson, Inc., Publishers. Scripture quotations noted AMPLIFIED are from THE AMPLIFIED BIBLE: Old Testament. Copyright © 1962, 1964 by Zondervan Publishing House (used by permission); and from THE AMPLIFIED NEW TESTAMENT. Copyright © 1958 by the Lockman Foundation (used by permission). Scripture quotations noted The Message are from The Message: The New Testament in Contemporary English. Copyright © 1993 by Eugene H. Peterson. Scripture quotations noted TLB are from The Living Bible, copyright 1971 by Tyndale House Publishers, Wheaton, IL. Used by permission. Library of Congress Cataloging-in-Publication Data Dollar, Creflo A. Total life prosperity : 14 practical steps to receiving God's full blessing / Creflo A. Dollar Jr. p. cm. ISBN 0-7852-6900-2 (pbk.) 1. Success—Religious aspects—Christianity. 2. Wealth—Religious aspects—Christianity. I. Title. BV4598.3.D65 1999 248.4—dc21 99-15324 CIP Printed in the United States of America. 6 04 03 02 01 00 CONTENTS Preface...............................................................................vii Introduction........................................................................ ix 1. Peace, Be Still..............................................................13 2. Step 1: Ensure That the Lord Is with You................... 19 3. Step 2: Know God's Ways and How He Operates.......33 4.