Sanofi-Aventis Needs Successes, Not Failures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

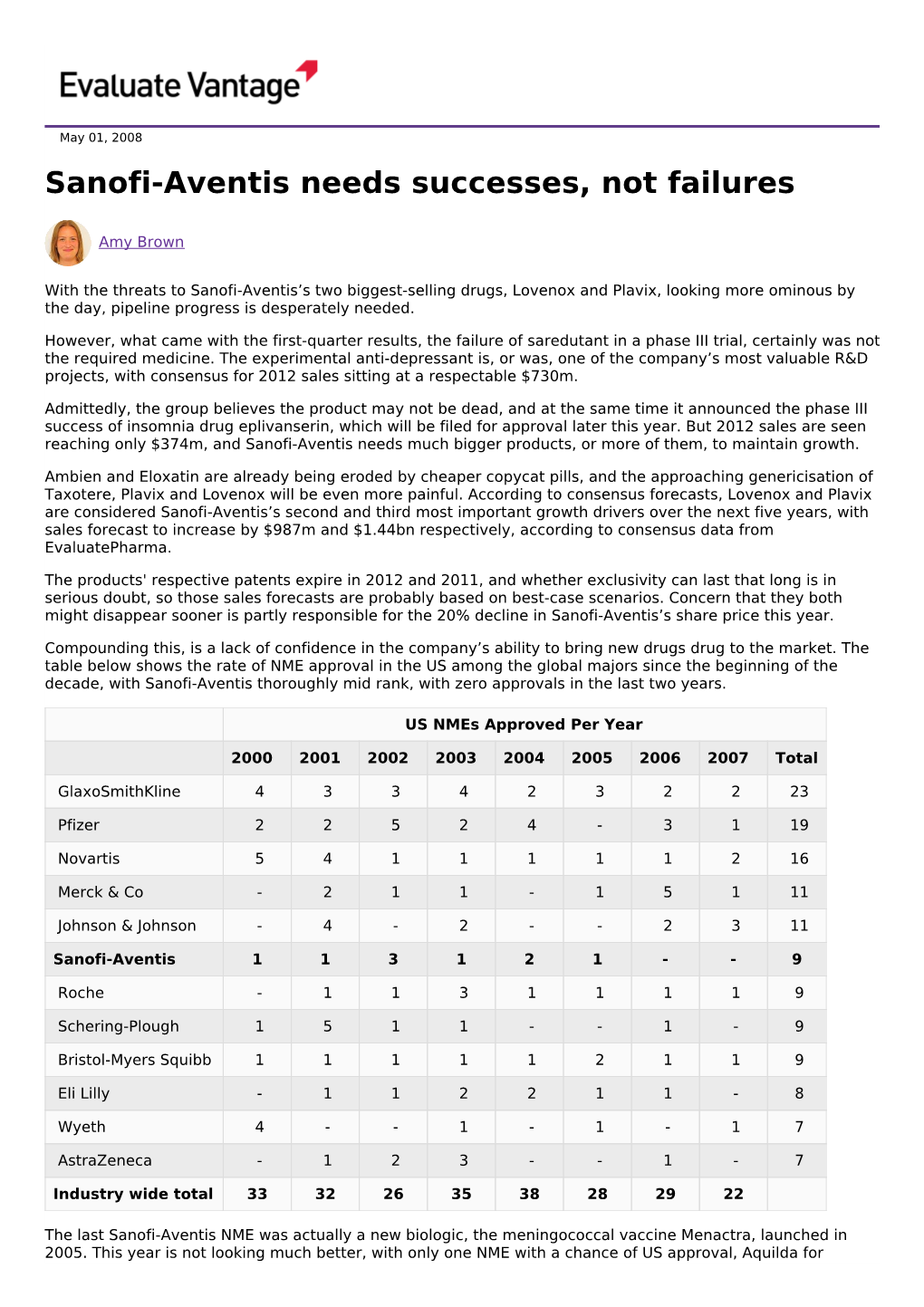

(12) Patent Application Publication (10) Pub. No.: US 2012/0190743 A1 Bain Et Al

US 2012O190743A1 (19) United States (12) Patent Application Publication (10) Pub. No.: US 2012/0190743 A1 Bain et al. (43) Pub. Date: Jul. 26, 2012 (54) COMPOUNDS FOR TREATING DISORDERS Publication Classification OR DISEASES ASSOCATED WITH (51) Int. Cl NEUROKININ 2 RECEPTORACTIVITY A6II 3L/23 (2006.01) (75) Inventors: Jerald Bain, Toronto (CA); Joel CD7C 69/30 (2006.01) Sadavoy, Toronto (CA); Hao Chen, 39t. ii; C Columbia, MD (US); Xiaoyu Shen, ( .01) Columbia, MD (US) A6IPI/00 (2006.01) s A6IP 29/00 (2006.01) (73) Assignee: UNITED PARAGON A6IP II/00 (2006.01) ASSOCIATES INC., Guelph, ON A6IPI3/10 (2006.01) (CA) A6IP 5/00 (2006.01) A6IP 25/00 (2006.01) (21) Appl. No.: 13/394,067 A6IP 25/30 (2006.01) A6IP5/00 (2006.01) (22) PCT Filed: Sep. 7, 2010 A6IP3/00 (2006.01) CI2N 5/071 (2010.01) (86). PCT No.: PCT/US 10/48OO6 CD7C 69/33 (2006.01) S371 (c)(1) (52) U.S. Cl. .......................... 514/552; 554/227; 435/375 (2), (4) Date: Apr. 12, 2012 (57) ABSTRACT Related U.S. Application Data Compounds, pharmaceutical compositions and methods of (60) Provisional application No. 61/240,014, filed on Sep. treating a disorder or disease associated with neurokinin 2 4, 2009. (NK) receptor activity. Patent Application Publication Jul. 26, 2012 Sheet 1 of 12 US 2012/O190743 A1 LU 1750 15OO 1250 OOO 750 500 250 O O 20 3O 40 min SampleName: EM2OO617 Patent Application Publication Jul. 26, 2012 Sheet 2 of 12 US 2012/O190743 A1 kixto CFUgan <tro CFUgan FIG.2 Patent Application Publication Jul. -

Nitrate Prodrugs Able to Release Nitric Oxide in a Controlled and Selective

Europäisches Patentamt *EP001336602A1* (19) European Patent Office Office européen des brevets (11) EP 1 336 602 A1 (12) EUROPEAN PATENT APPLICATION (43) Date of publication: (51) Int Cl.7: C07C 205/00, A61K 31/00 20.08.2003 Bulletin 2003/34 (21) Application number: 02425075.5 (22) Date of filing: 13.02.2002 (84) Designated Contracting States: (71) Applicant: Scaramuzzino, Giovanni AT BE CH CY DE DK ES FI FR GB GR IE IT LI LU 20052 Monza (Milano) (IT) MC NL PT SE TR Designated Extension States: (72) Inventor: Scaramuzzino, Giovanni AL LT LV MK RO SI 20052 Monza (Milano) (IT) (54) Nitrate prodrugs able to release nitric oxide in a controlled and selective way and their use for prevention and treatment of inflammatory, ischemic and proliferative diseases (57) New pharmaceutical compounds of general effects and for this reason they are useful for the prep- formula (I): F-(X)q where q is an integer from 1 to 5, pref- aration of medicines for prevention and treatment of in- erably 1; -F is chosen among drugs described in the text, flammatory, ischemic, degenerative and proliferative -X is chosen among 4 groups -M, -T, -V and -Y as de- diseases of musculoskeletal, tegumental, respiratory, scribed in the text. gastrointestinal, genito-urinary and central nervous sys- The compounds of general formula (I) are nitrate tems. prodrugs which can release nitric oxide in vivo in a con- trolled and selective way and without hypotensive side EP 1 336 602 A1 Printed by Jouve, 75001 PARIS (FR) EP 1 336 602 A1 Description [0001] The present invention relates to new nitrate prodrugs which can release nitric oxide in vivo in a controlled and selective way and without the side effects typical of nitrate vasodilators drugs. -

Tachykinins and Airway Microvascular Leakage Induced by Hcl Intra-Oesophageal Instillation

Copyright #ERS Journals Ltd 2002 Eur Respir J 2002; 20: 268–273 European Respiratory Journal DOI: 10.1183/09031936.02.00250902 ISSN 0903-1936 Printed in UK – all rights reserved Tachykinins and airway microvascular leakage induced by HCl intra-oesophageal instillation S. Daoui*,B.D9Agostino#, L. Gallelli#, X. Emonds Alt}, F. Rossi#, C. Advenier* Tachykinins and airway microvascular leakage induced by HCl intra-oesophageal *Dept of Pharmacology, University instillation. S. Daoui, B. D9Agostino, L. Gallelli, X. Emonds Alt, F. Rossi, C. Advenier. Paris V, Paris, France, #Dept of #ERS Journals Ltd 2002. Experimental Medicine, Faculty of ABSTRACT: Gastro-oesophageal reflux is a common clinical disorder associated with Medicine and Surgery, Naples, Italy, }Sanofi Synthelabo Research, Montpel- a variety of respiratory symptoms, including chronic cough and exacerbation of asthma. lier, France. In this study, the potential role of acid-induced tachykinin release was examined in guinea pigs and rabbits, by examining the effects of the tachykinin NK1 and NK3 Correspondence: C. Advenier receptors antagonists (SR 140333 and SR 142801, respectively) (1–10 mg?kg-1)on Universite´ Paris V plasma protein extravasation induced in airways by hydrochloric acid (HCl) infusion in UPRES EA220, Pharmacologie the oesophagus. 45 rue des Saints Pe`res Guinea pigs were anaesthetised with urethane, while rabbits were subject to F-75006 Paris neuroleptoanalgesia with hypnorm. Airway vascular leakage was evaluated by France Fax: 33 142863810 measuring extravasation of Evans blue dye. All animals were pretreated with atropine E-mail: [email protected] (1 mg?kg-1 i.p.), propranolol (1 mg?kg-1 i.p.), phosphoramidon (2.5 mg?kg-1 i.v.) and -1 saline or tachykinin receptor antagonists (1–10 mg?kg i.p.). -

PHARMACEUTICAL APPENDIX to the TARIFF SCHEDULE 2 Table 1

Harmonized Tariff Schedule of the United States (2020) Revision 19 Annotated for Statistical Reporting Purposes PHARMACEUTICAL APPENDIX TO THE HARMONIZED TARIFF SCHEDULE Harmonized Tariff Schedule of the United States (2020) Revision 19 Annotated for Statistical Reporting Purposes PHARMACEUTICAL APPENDIX TO THE TARIFF SCHEDULE 2 Table 1. This table enumerates products described by International Non-proprietary Names INN which shall be entered free of duty under general note 13 to the tariff schedule. The Chemical Abstracts Service CAS registry numbers also set forth in this table are included to assist in the identification of the products concerned. For purposes of the tariff schedule, any references to a product enumerated in this table includes such product by whatever name known. -

Compositions for Treating Centrally Mediated

(19) TZZ Z_T (11) EP 2 722 045 B1 (12) EUROPEAN PATENT SPECIFICATION (45) Date of publication and mention (51) Int Cl.: of the grant of the patent: A61K 31/4178 (2006.01) A61K 31/473 (2006.01) 06.07.2016 Bulletin 2016/27 A61K 31/496 (2006.01) A61K 31/573 (2006.01) A61K 45/06 (2006.01) A61K 9/00 (2006.01) (2006.01) (2006.01) (21) Application number: 14151683.1 A61K 9/20 A61K 9/48 A61P 1/08 (2006.01) (22) Date of filing: 18.11.2010 (54) Compositions for treating centrally mediated nausea and vomiting Zusammensetzungen zur Behandlung von zentral vermitteltem Unwohlsein und Erbrechen Compositions pour traiter les nausées et vomissements à médiation centrale (84) Designated Contracting States: (56) References cited: AL AT BE BG CH CY CZ DE DK EE ES FI FR GB WO-A1-2008/049552 WO-A2-2007/096763 GR HR HU IE IS IT LI LT LU LV MC MK MT NL NO PL PT RO RS SE SI SK SM TR • REDDY G KESAVA ET AL: "Novel neurokinin-1 antagonists as antiemetics for the treatment of (30) Priority: 18.11.2009 US 262470 P chemotherapy-induced emesis.", SUPPORTIVE 14.09.2010 US 382709 P CANCER THERAPY 1 APR 2006 LNKD- PUBMED:18632487, vol. 3, no. 3, 1 April 2006 (43) Date of publication of application: (2006-04-01), pages140-142, XP002626039, ISSN: 23.04.2014 Bulletin 2014/17 1543-2912 • DIEMUNSCH P ET AL: "Neurokinin-1 receptor (62) Document number(s) of the earlier application(s) in antagonists in the prevention of postoperative accordance with Art. -

WO 2015/072852 Al 21 May 2015 (21.05.2015) P O P C T

(12) INTERNATIONAL APPLICATION PUBLISHED UNDER THE PATENT COOPERATION TREATY (PCT) (19) World Intellectual Property Organization International Bureau (10) International Publication Number (43) International Publication Date WO 2015/072852 Al 21 May 2015 (21.05.2015) P O P C T (51) International Patent Classification: (81) Designated States (unless otherwise indicated, for every A61K 36/84 (2006.01) A61K 31/5513 (2006.01) kind of national protection available): AE, AG, AL, AM, A61K 31/045 (2006.01) A61P 31/22 (2006.01) AO, AT, AU, AZ, BA, BB, BG, BH, BN, BR, BW, BY, A61K 31/522 (2006.01) A61K 45/06 (2006.01) BZ, CA, CH, CL, CN, CO, CR, CU, CZ, DE, DK, DM, DO, DZ, EC, EE, EG, ES, FI, GB, GD, GE, GH, GM, GT, (21) International Application Number: HN, HR, HU, ID, IL, IN, IR, IS, JP, KE, KG, KN, KP, KR, PCT/NL20 14/050780 KZ, LA, LC, LK, LR, LS, LU, LY, MA, MD, ME, MG, (22) International Filing Date: MK, MN, MW, MX, MY, MZ, NA, NG, NI, NO, NZ, OM, 13 November 2014 (13.1 1.2014) PA, PE, PG, PH, PL, PT, QA, RO, RS, RU, RW, SA, SC, SD, SE, SG, SK, SL, SM, ST, SV, SY, TH, TJ, TM, TN, (25) Filing Language: English TR, TT, TZ, UA, UG, US, UZ, VC, VN, ZA, ZM, ZW. (26) Publication Language: English (84) Designated States (unless otherwise indicated, for every (30) Priority Data: kind of regional protection available): ARIPO (BW, GH, 61/903,430 13 November 2013 (13. 11.2013) US GM, KE, LR, LS, MW, MZ, NA, RW, SD, SL, ST, SZ, TZ, UG, ZM, ZW), Eurasian (AM, AZ, BY, KG, KZ, RU, (71) Applicant: RJG DEVELOPMENTS B.V. -

( 12 ) United States Patent

US009974742B2 (12 ) United States Patent (10 ) Patent No. : US 9 , 974 , 742 B2 Ottoboni et al. (45 ) Date of Patent: * May 22, 2018 ( 54 ) EMULSION FORMULATIONS OF AN NK - 1 2013 /0236501 A1 * 9 /2013 Booth . .. .. .. A61K 9 /0019 424 / 400 RECEPTOR ANTAGONIST AND USES 2013 /0317016 AL 11 /2013 Hingorani et al. THEREOF 2016 / 0024092 Al 1 / 2016 Wan et al. 2016 / 0082013 Al 3 / 2016 Ottoboni et al . @(71 ) Applicant : Heron Therapeutics , Inc. , Redwood 2016 /0206622 A1 3 / 2016 Ottoboni et al . City , CA (US ) 2017 / 0112847 AL 4 /2017 Ottoboni et al. @(72 ) Inventors : Thomas B . Ottoboni, Belmont, CA (US ) ; Han Han , Mountain View , CA FOREIGN PATENT DOCUMENTS (US ) CN 102379 * 3 / 2012 CN 102379845 A 3 / 2012 @(73 ) Assignee : Heron Therapeutics, Inc. , San Diego , WO WO 2005 /016308 AL 2 / 2005 WO WO 2009 / 124756 AL 10 / 2009 CA (US ) WO WO 2011 / 158053 AL 12 / 2011 WO WO 2013 / 177501 A2 11 / 2013 @( * ) Notice : Subject to any disclaimer , the term of this WO WO 2014 /0209962 AL 12 /2014 patent is extended or adjusted under 35 WO WO 2014 /005606 AL 3 / 2016 U . S . C . 154 ( b ) by 0 days . days . WO WO 2016 /044784 Al 3 / 2016 This patent is subject to a terminal dis claimer . OTHER PUBLICATIONS (21 ) Appl. No. : 15 /012 , 532 Cassileth et al. in Arch . Intern Med . 1983 ; 143 ( 7 ) : 1347 - 1349 ( Abstract ) . * Dexamethasone Hydrogen Phosphate at web .archive . org/ web / ( 22 ) Filed : Feb . 1 , 2016 20141224130045 /http :/ /www . drugs . com / pro / dexamethasone -so dium -phosphate .html ( retrieved on the internet Mar. -

Modifications to the Harmonized Tariff Schedule of the United States To

U.S. International Trade Commission COMMISSIONERS Shara L. Aranoff, Chairman Daniel R. Pearson, Vice Chairman Deanna Tanner Okun Charlotte R. Lane Irving A. Williamson Dean A. Pinkert Address all communications to Secretary to the Commission United States International Trade Commission Washington, DC 20436 U.S. International Trade Commission Washington, DC 20436 www.usitc.gov Modifications to the Harmonized Tariff Schedule of the United States to Implement the Dominican Republic- Central America-United States Free Trade Agreement With Respect to Costa Rica Publication 4038 December 2008 (This page is intentionally blank) Pursuant to the letter of request from the United States Trade Representative of December 18, 2008, set forth in the Appendix hereto, and pursuant to section 1207(a) of the Omnibus Trade and Competitiveness Act, the Commission is publishing the following modifications to the Harmonized Tariff Schedule of the United States (HTS) to implement the Dominican Republic- Central America-United States Free Trade Agreement, as approved in the Dominican Republic-Central America- United States Free Trade Agreement Implementation Act, with respect to Costa Rica. (This page is intentionally blank) Annex I Effective with respect to goods that are entered, or withdrawn from warehouse for consumption, on or after January 1, 2009, the Harmonized Tariff Schedule of the United States (HTS) is modified as provided herein, with bracketed matter included to assist in the understanding of proclaimed modifications. The following supersedes matter now in the HTS. (1). General note 4 is modified as follows: (a). by deleting from subdivision (a) the following country from the enumeration of independent beneficiary developing countries: Costa Rica (b). -

Selective Blockade of NK2 Or NK3 Receptors Produces Anxiolytic- and Antidepressant-Like Effects in Gerbils ⁎ N

Pharmacology, Biochemistry and Behavior 83 (2006) 533–539 www.elsevier.com/locate/pharmbiochembeh Selective blockade of NK2 or NK3 receptors produces anxiolytic- and antidepressant-like effects in gerbils ⁎ N. Salomé, J. Stemmelin, C. Cohen , G. Griebel Sanofi-Aventis, Department of Psychopharmacology, 31 av Paul Vaillant-Couturier, 92220 Bagneux, France Received 17 October 2005; received in revised form 1 March 2006; accepted 9 March 2006 Available online 19 April 2006 Abstract There is a growing interest in the potential anxiolytic- and antidepressant-like effects of compounds that target neurokinin receptors. Since the structure and the pharmacology of the human neurokinin receptor resembles that of gerbils, rather than that of mice or rats, we decided to investigate the anxiolytic- and /or antidepressant-like effects of NK1 (SSR240600), NK2 (saredutant) and NK3 (osanetant) receptor antagonists in gerbils. It was found that saredutant (3–10 mg/kg, p.o.) and osanetant (3–10 mg/kg, p.o.) produced anxiolytic-like effects in the gerbil social interaction test. These effects were similar to those obtained with the V1b receptor antagonist SSR149415 (3–10 mg/kg, p.o.), diazepam (1 mg/kg, p.o.) and buspirone (10 mg/kg, p.o.). Fluoxetine and SSR240600 were devoid of effects in this test. In the tonic immobility test in gerbils, saredutant (5–10 mg/kg, i.p.) and osanetant (5–10 mg/kg, i.p.) produced similar effects to those observed with fluoxetine (7.5–15 mg/kg, i.p.), SSR149415 (10–30 mg/kg, p.o.) and buspirone (3 mg/kg, i.p.). Diazepam and SSR240600 were inactive in this paradigm. -

G Protein-Coupled Receptors

S.P.H. Alexander et al. The Concise Guide to PHARMACOLOGY 2015/16: G protein-coupled receptors. British Journal of Pharmacology (2015) 172, 5744–5869 THE CONCISE GUIDE TO PHARMACOLOGY 2015/16: G protein-coupled receptors Stephen PH Alexander1, Anthony P Davenport2, Eamonn Kelly3, Neil Marrion3, John A Peters4, Helen E Benson5, Elena Faccenda5, Adam J Pawson5, Joanna L Sharman5, Christopher Southan5, Jamie A Davies5 and CGTP Collaborators 1School of Biomedical Sciences, University of Nottingham Medical School, Nottingham, NG7 2UH, UK, 2Clinical Pharmacology Unit, University of Cambridge, Cambridge, CB2 0QQ, UK, 3School of Physiology and Pharmacology, University of Bristol, Bristol, BS8 1TD, UK, 4Neuroscience Division, Medical Education Institute, Ninewells Hospital and Medical School, University of Dundee, Dundee, DD1 9SY, UK, 5Centre for Integrative Physiology, University of Edinburgh, Edinburgh, EH8 9XD, UK Abstract The Concise Guide to PHARMACOLOGY 2015/16 provides concise overviews of the key properties of over 1750 human drug targets with their pharmacology, plus links to an open access knowledgebase of drug targets and their ligands (www.guidetopharmacology.org), which provides more detailed views of target and ligand properties. The full contents can be found at http://onlinelibrary.wiley.com/doi/ 10.1111/bph.13348/full. G protein-coupled receptors are one of the eight major pharmacological targets into which the Guide is divided, with the others being: ligand-gated ion channels, voltage-gated ion channels, other ion channels, nuclear hormone receptors, catalytic receptors, enzymes and transporters. These are presented with nomenclature guidance and summary information on the best available pharmacological tools, alongside key references and suggestions for further reading. -

The Use of Stems in the Selection of International Nonproprietary Names (INN) for Pharmaceutical Substances

WHO/PSM/QSM/2006.3 The use of stems in the selection of International Nonproprietary Names (INN) for pharmaceutical substances 2006 Programme on International Nonproprietary Names (INN) Quality Assurance and Safety: Medicines Medicines Policy and Standards The use of stems in the selection of International Nonproprietary Names (INN) for pharmaceutical substances FORMER DOCUMENT NUMBER: WHO/PHARM S/NOM 15 © World Health Organization 2006 All rights reserved. Publications of the World Health Organization can be obtained from WHO Press, World Health Organization, 20 Avenue Appia, 1211 Geneva 27, Switzerland (tel.: +41 22 791 3264; fax: +41 22 791 4857; e-mail: [email protected]). Requests for permission to reproduce or translate WHO publications – whether for sale or for noncommercial distribution – should be addressed to WHO Press, at the above address (fax: +41 22 791 4806; e-mail: [email protected]). The designations employed and the presentation of the material in this publication do not imply the expression of any opinion whatsoever on the part of the World Health Organization concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries. Dotted lines on maps represent approximate border lines for which there may not yet be full agreement. The mention of specific companies or of certain manufacturers’ products does not imply that they are endorsed or recommended by the World Health Organization in preference to others of a similar nature that are not mentioned. Errors and omissions excepted, the names of proprietary products are distinguished by initial capital letters. -

G Protein‐Coupled Receptors

S.P.H. Alexander et al. The Concise Guide to PHARMACOLOGY 2019/20: G protein-coupled receptors. British Journal of Pharmacology (2019) 176, S21–S141 THE CONCISE GUIDE TO PHARMACOLOGY 2019/20: G protein-coupled receptors Stephen PH Alexander1 , Arthur Christopoulos2 , Anthony P Davenport3 , Eamonn Kelly4, Alistair Mathie5 , John A Peters6 , Emma L Veale5 ,JaneFArmstrong7 , Elena Faccenda7 ,SimonDHarding7 ,AdamJPawson7 , Joanna L Sharman7 , Christopher Southan7 , Jamie A Davies7 and CGTP Collaborators 1School of Life Sciences, University of Nottingham Medical School, Nottingham, NG7 2UH, UK 2Monash Institute of Pharmaceutical Sciences and Department of Pharmacology, Monash University, Parkville, Victoria 3052, Australia 3Clinical Pharmacology Unit, University of Cambridge, Cambridge, CB2 0QQ, UK 4School of Physiology, Pharmacology and Neuroscience, University of Bristol, Bristol, BS8 1TD, UK 5Medway School of Pharmacy, The Universities of Greenwich and Kent at Medway, Anson Building, Central Avenue, Chatham Maritime, Chatham, Kent, ME4 4TB, UK 6Neuroscience Division, Medical Education Institute, Ninewells Hospital and Medical School, University of Dundee, Dundee, DD1 9SY, UK 7Centre for Discovery Brain Sciences, University of Edinburgh, Edinburgh, EH8 9XD, UK Abstract The Concise Guide to PHARMACOLOGY 2019/20 is the fourth in this series of biennial publications. The Concise Guide provides concise overviews of the key properties of nearly 1800 human drug targets with an emphasis on selective pharmacology (where available), plus links to the open access knowledgebase source of drug targets and their ligands (www.guidetopharmacology.org), which provides more detailed views of target and ligand properties. Although the Concise Guide represents approximately 400 pages, the material presented is substantially reduced compared to information and links presented on the website.