GENERAL MOTORS COMPANY (Exact Name of Registrant As Specified in Its Charter) ______

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 CHEVROLET CAMARO LS & LT FAST FACT Camaro Was

2018 CHEVROLET CAMARO LS & LT FAST FACT Camaro was introduced in 1967 and was selected as the official Indianapolis 500 pace car that year. VEHICLE CLASS Coupe or Convertible VEHICLE HIGHLIGHTS • Offered in LS, LT (1LT and 2LT), SS (1SS and 2SS) and ZL1 models – all available as a coupe or convertible (see separate pages for complete SS and ZL1 details) • Camaro LS and LT offered with a standard 2.0L turbo or an available 3.6L V-6 engine • Standard LED daytime running lamps • Redline Edition offered on LS and LT. Content includes black front and rear bowtie emblems, red-accented grille, hash mark graphic, decklid blackout graphic, dark-finish taillamps, black outside mirrors, 20-inch black aluminum wheels with red accents and more • RS package offered on LS and LT. Content includes 20-inch aluminum wheels, HID headlamps, LED taillamps, RS-specific upper and lower grilles and rear spoiler • 1LE package offered on Camaro LT, featuring track-tested Camaro SS components, specific technologies – including FE3 suspension, Brembo brakes and heavy-duty cooling – and enabling an estimated 0.97 g in cornering grip. Available on 1LT and 2LT with 3.6L V-6 and manual transmission • Driver Mode Selector enables the driver to tailor the look, sound and feel of the vehicles to his or her preferences and driving conditions • Available Brembo front brake package • Chevrolet MyLink with a 7-inch-diagonal color touchscreen is standard on 1LT. • Chevrolet MyLink with an 8-inch-diagonal color touchscreen is standard on 2LT and available on LS and 1LT • All -

Knowing Where It's Going Before It Gets There

Knowing where it’s going before it gets there. Innovation. It starts with a strategy. From customer-led innovation to creating a corporate culture of innovation, the key to success begins with a well-defined innovation strategy. It can mean the difference between being a leader or falling behind. Today’s fast-paced technological advancements and business model innovations are changing the way companies bring value to their customers. Automotive companies that learn to industrialize innovation to create repeated, scalable breakthroughs will be the front runners in the global marketplace—from talent acquisition to commercialization. To gain additional insight on innovation strategies for your organization and other issues important to your company or see the latest automotive innovation study The highway to growth: Strategies for automotive innovation, visit www.pwc.com/auto. © 2013 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/ structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. Knowing where it’s going before it gets there. Innovation. It starts with a strategy. From customer-led innovation to creating a corporate culture of innovation, the key to success begins with a well-defined innovation strategy. It can mean the difference between being a leader or falling behind. Today’s fast-paced technological advancements and business model innovations are changing the way companies bring value to their customers. Automotive companies that learn to industrialize innovation to create repeated, scalable breakthroughs will be the front runners in the global marketplace—from talent acquisition to commercialization. -

2012 Annual Report Gener Al Mo T Ors 20 12 Annu Al Repor T

GENERAL MOTORS 2012 ANNUAL REPORT ANNUAL 2012 GENERAL MOTORS COMPANY 2012 ANNUAL REPORT 300 Renaissance Center P.O. Box 300 Detroit, MI 48265-3000 Printed on paper that consists of at least 10% www.gm.com post-consumer fiber 70021_Cover.indd 1 4/9/13 3:23 PM GENERAL MOTORS 2012 ANNUAL REPORT ANNUAL 2012 GENERAL MOTORS COMPANY 2012 ANNUAL REPORT 300 Renaissance Center P.O. Box 300 Detroit, MI 48265-3000 Printed on paper that consists of at least 10% www.gm.com post-consumer fiber 70021_Cover.indd 1 4/9/13 3:23 PM GENERAL INFORMATION COMMON STOCK For other information, GM CUSTOMER GM common stock, $0.01 par stockholders may contact: ASSISTANCE CENTERS value, is listed on the New York GM Stockholder Services Satisfaction with your entire owner- Stock Exchange and the Toronto General Motors Company ship experience is important to us. Stock Exchange. Mail Code 482-C25-A36 To request product information or to 300 Renaissance Center receive assistance with your vehicle, Ticker symbol: P.O. Box 300 please contact the appropriate GM - New York Stock Exchange Detroit, Ml 48265-3000 brand via phone or Twitter: GMM - Toronto Stock Exchange 313-667-1500 Buick: 800-521-7300 PREFERRED STOCK ELECTRONIC DELIVERY OF or @BuickCustCare 4.75% GM Series B mandatory ANNUAL MEETING MATERIALS convertible junior preferred stock, Stockholders may consent to Cadillac: 800-458-8006 $0.01 par value receive their GM annual report and or @CadillacCustSvc proxy materials via the Internet. Ticker symbol: GM PR B - Chevrolet: 800-222-1020 Stockholders of record may enroll New York Stock Exchange or @ChevyCustCare at www.computershare.com/gm. -

2020 CHEVROLET CAMARO LS & LT FAST FACT Camaro Was

2020 CHEVROLET CAMARO LS & LT FAST FACT Camaro was introduced in 1967 and was selected as the official Indianapolis 500 pace car that year. STARTING MSRP $25,995 – LS coupe (incl. DFC)1 $26,495 – LT coupe (incl. DFC)1 $32,495 – LT convertible (incl. DFC)1 EPA VEHICLE CLASS Coupe or Convertible NEW FOR 2020 • 10-speed automatic transmission available with the 3.6L V-6 • Rear spoiler available • Black Bowtie emblems available on LT • Camaro fender badges available on LT • Dark-tinted taillamps available on LS and LT • Red- or orange-painted brake calipers available on LT • New 20-inch 5-split-spoke polished forged aluminum wheel design available on LT (requires RS package) • Available red seat belts • Available interior trim package • RECARO performance seats available on LT • Sueded microfiber steering wheel and shifter available LT • Alloy pedals available LT • Exterior color: Rally Green Metallic • Tire Fill Alert VEHICLE HIGHLIGHTS • Offered in LS, LT (1LT, 2LT and 3LT), LT1, SS (1SS and 2SS) and ZL1 models (see separate pages for complete LT1/SS and ZL1 details) • Convertible available on LT, LT1, SS and ZL1 • Camaro LS and LT offered with a standard 2.0L turbo; with an available 3.6L V-6 engine offered on LT • RS package offered on LT. Content includes 20-inch aluminum wheels (with all-season tires), HID headlamps, LED taillamps, RS-specific upper and lower grilles and rear spoiler • 1LE package offered on Camaro LT, featuring track-tested Camaro SS components, specific technologies – including FE3 suspension, Brembo front brakes and heavy-duty cooling – and enabling an estimated 0.97 g in cornering grip. -

Documento Di Offerta Pubblica Di Scambio General

DOCUMENTO DI OFFERTA PUBBLICA DI SCAMBIO AI SENSI DELL’ARTICOLO 102 DEL D. LGS. N. 58 DEL 24 FEBBRAIO 1998 AVENTE AD OGGETTO I TITOLI INDICATI NEL RETROCOPERTINA DEL PRESENTE DOCUMENTO D’OFFERTA (le “Obbligazioni”) OFFERENTE ED EMITTENTE GENERAL MOTORS CORPORATION (con sede legale in 300 Renaissance Center Detroit, Michigan 48265-3000, USA) OFFERENTE È ANCHE, IN RELAZIONE A DUE SERIE DI OBBLIGAZIONI, LA CONTROLLATA GM NUOVA SCOZIA, GENERAL MOTORS NOVA SCOTIA FINANCE COMPANY (con sede legale in Purdy’s Wharf Tower II, 1300-1969 Upper Water Street, Halifax, Nova Scotia, B3J 3R7) CORRISPETTIVO OFFERTO Il corrispettivo offerto è pari a n. 225 azioni ordinarie di nuova emissione di General Motors Corporation per ogni 1.000 dollari statunitensi di valore nominale delle Obbligazioni (o equivalente nella valuta di denominazione delle stesse, determinato applicando il tasso di cambio rilevato – secondo le modalità indicate nel presente Documento d’Offerta - il giorno lavorativo antecedente la data di chiusura del periodo di adesione). Inoltre, sarà corrisposto il rateo degli interessi maturati sulle Obbligazioni tra la più recente data di stacco cedola e la data di regolamento dell’Offerta. PERIODO DI ADESIONE Il periodo di adesione in Italia, come concordato con la CONSOB, ha inizio in data 6 maggio 2009. Le adesioni dovranno pervenire entro le ore 23:59, ora di New York, del 26 maggio 2009, salvo proroga. Le adesioni non potranno essere revocate dopo le ore 23:59, ora di New York, del 26 maggio 2009, fatti salvi alcuni casi descritti nel presente Documento d’Offerta. Al fine di garantire agli intermediari un tempo sufficiente per completare le procedure di adesione o di revoca, gli obbligazionisti sono invitati a contattare il proprio intermediario con congruo anticipo. -

GM 2007 Annual Report

General Motors Corporation 2007 Annual Report next 100 YEARS of leadership. 100 YEARS of innovation. General Motors Corporation 1 100 YEARS of putting people on wheels. 2 General Motors Corporation And we’re just getting started. We’re making the best cars and trucks we ever have. And we’re selling them in more parts of the world than ever before. We’re very proud of our past, but even more excited about our future. We’re focused on what’s next: building the best General Motors yet. General Motors Corporation 3 Bob Lutz Vice Chairman, Global Product Development Fritz Henderson Rick Wagoner GM’s senior leadership in the President & Chairman & Cadillac Display at the 2008 Chief Operating Offi cer Chief Executive Offi cer North American International Auto Show in Detroit, Michigan. 4 General Motors Corporation DEAR STOCKHOLDERS: A century is a long time to be in business. For General Motors, it’s been a century of leadership and achievements, of challenges and opportunities. A centennial is a great time to refl ect on and celebrate the past. But for us, it’s more than that…it’s an oppor- tunity to look forward to our next 100 years. GM’s centennial comes at an exciting time for the 2007 YEAR IN REVIEW auto industry, as we move aggressively to realize the 2007 was another year of important progress for GM, potential of two huge trends that are transforming the as we implemented further signifi cant structural cost global auto industry and society itself. The fi rst trend is reductions in North America, grew aggressively in emerg- the rapidly growing role, and importance, of emerging ing markets, negotiated an historic labor contract with markets. -

18.01.2017 Notice Filed Under Sub-Section (2) of Se

Fair Competition For Greater Good COMPETITION COMMISSION OF INDIA (Combination Registration No. C-2016/12/468) 18.01.2017 Notice filed under sub-section (2) of Section 6 of the Competition Act, 2002 given by General Motors (Hong Kong) Company Limited CORAM: Mr. S. L. Bunker Member Mr. Sudhir Mital Member Mr. Augustine Peter Member Mr. U. C. Nahta Member Mr. G. P. Mittal Member Legal Representative: Shardul Amarchand Mangaldas Order under sub-section (1) of Section 31 of the Act 1. On 26.12.2016, the Competition Commission of India (“Commission”) received a notice under sub-section (2) of Section 6 of the Competition Act, 2002 (“Act”) given by General Page 1 of 4 Fair Competition For Greater Good Motors (Hong Kong) Company Limited (“GMHK”/ “Acquirer”). The notice was filed pursuant to the execution of Share Sale Term Sheet Agreement (Binding Term Sheet), dated 01.12.2016, entered into between SAIC Motor Corporation Limited (“SAIC”) and General Motors International Operations Pte. Ltd. (“GMIO”). 2. GMHK proposes to acquire 9.2% shares of SAIC General Motors Investment Limited (“HKJV”/ “Target”) from SAIC Motor HK Investment Limited (“SAIC HK”/ “Seller”) (Hereinafter Acquirer, Seller and Target are collectively referred to as the “Parties”). At the same time, GMIO will acquire one share each of the two subsidiaries of HKJV, i.e., General Motors India Private Limited (“GMI”) and Chevrolet Sales India Private Limited (“CSIPL”) from SAIC HK (“Proposed Combination”). As a result, SAIC HK will exit from HKJV and its subsidiaries, GMI and CSIPL. 3. GMHK, belonging to General Motors group, is a wholly owned subsidiary of General Motors China, Inc. -

Chevrolet Enjoy

CHEVROLET ENJOY 1800 3000 8080 WWW.CHEVROLET.CO.IN ALSO VISIT WWW.FACEBOOK.COM/CHEVROLETINDIA 2013/04/01 ENJOY INTRODUCING CHEVROLET ENJOY A car that’s designed keeping you in mind. You play multiple roles in the game of life. You’re the loving spouse, the perfectionist at work, the doting parent and the friend-in-need. The Chevrolet Enjoy offers you all the support you need, to be what you need to be. It’s much more than just a car; it’s like the wind beneath your wings that drives you closer to your desires, is as versatile as you, with space for all your beautiful dreams. It is your perfect companion because multitasking is your routine and juggling roles, your second nature. That’s what you enjoy! Go ahead, live your life and make your dreams come true with the Chevrolet Enjoy! ENJOY-Style SWOOSH STYLE HEADLAMPS SPORTY REAR SPOILER LEAF STYLE FOG LAMPS Chevrolet Enjoy is packed with features that make it stand out from the other cars Swoosh style, clear-lens, jewel-effect, wrap-around headlamps adding the in its class. brilliance of sparkling diamonds to the style quotient of the Enjoy with the triple-pod design for turn indicator, high and low beam. Exterior Styling Chevrolet Enjoy’s front styling is defined by the signature Chevrolet golden bowtie Triple cluster silver surround instrument panel brings in sharp styling definition in the chrome surround three-dimensional grille and leaf style fog lamps. to the panoramic-view dashboard. Soothing blue night-time illumination of the This is accentuated by the chrome surround meshed air dam in the front bumper. -

Chevrolet Corvette Stingray – European Launch Editions

May 7, 2021 Chevrolet Corvette Stingray – European Launch Editions • Coupe and Convertible will arrive at showrooms in October • Fully homologated to meet and exceed Euro 6d standards • Available with left- or right-hand drive for the first time in Corvette’s history • 16 superbly equipped launch editions on offer • Launch edition prices for the coupe start in Germany at € 99,000 (in the UK at £ 81,700) ZURICH – The wait for the European versions of the new mid-engine Corvette Stingray is soon coming to an end. Customers of the US sportscar icon can now select among 16 highly equipped launch editions, eight coupes and eight convertibles featuring what are expected to become the most popular color and trim combinations. Supercar-level build quality, premium materials, new standards of performance and technology and exceptional attention to detail – these are the qualities that set the eighth-generation Corvette apart. It is the first ever mid-engined production version in this American sports car icon’s 67 year history and, to mark its European debut, Chevrolet is launching the new Corvette Stingray in an unmatched variety of trim combinations. From front- to mid-engine, a milestone in Corvette history “Moving the engine from front to centre and redesigning America’s most iconic sportscar from the ground up is a historic opportunity, something Chevrolet engineers and designers have desired for over 60 years,” emphasizes Conark Shah, Managing Director of Chevrolet Europe. “In terms of comfort and fun, the new mid-engine Stingray still looks and feels like a Corvette, but drives better than any vehicle in Corvette history. -

2018 Chevrolet Camaro Ls & Lt

2018 CHEVROLET CAMARO LS & LT FAST FACT Camaro was introduced in 1967 and was selected as the official Indianapolis 500 pace car that year. BASE PRICE (incl. destination) Camaro LS coupe – $26,900 Camaro LS convertible – $32,900 Camaro LT coupe – $27,695 Camaro LT convertible – $33,695 EPA VEHICLE CLASS Coupe or Convertible VEHICLE HIGHLIGHTS • Offered in LS, LT (1LT and 2LT), SS (1SS and 2SS) and ZL1 models – all available as a coupe or convertible (see separate pages for complete SS and ZL1 details) • Camaro LS and LT offered with a standard 2.0L turbo or an available 3.6L V-6 engine • Standard LED daytime running lamps • Redline Edition offered on LS and LT. Content includes black front and rear bowtie emblems, red-accented grille, hash mark graphic, decklid blackout graphic, dark-finish taillamps, black outside mirrors, 20-inch black aluminum wheels with red accents and more • RS package offered on LS and LT. Content includes 20-inch aluminum wheels, HID headlamps, LED taillamps, RS-specific upper and lower grilles and rear spoiler • 1LE package offered on Camaro LT, featuring track-tested Camaro SS components, specific technologies – including FE3 suspension, Brembo brakes and heavy-duty cooling – and enabling an estimated 0.97 g in cornering grip. Available on 1LT and 2LT with 3.6L V-6 and manual transmission • Driver Mode Selector enables the driver to tailor the look, sound and feel of the vehicles to his or her preferences and driving conditions • Available Brembo front brake package • Chevrolet MyLink with a 7-inch-diagonal color touchscreen is standard on 1LT. -

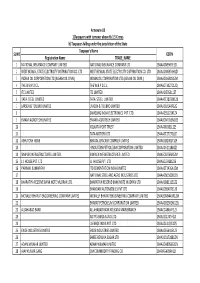

FINAL DISTRIBUTION.Xlsx

Annexure-1B 1)Taxpayers with turnover above Rs 1.5 Crores b) Taxpayers falling under the jurisdiction of the State Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 NATIONAL INSURANCE COMPANY LIMITED NATIONAL INSURANCE COMPANY LTD 19AAACN9967E1Z0 2 WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD 19AAACW6953H1ZX 3 INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) 19AAACI1681G1ZM 4 THE W.B.P.D.C.L. THE W.B.P.D.C.L. 19AABCT3027C1ZQ 5 ITC LIMITED ITC LIMITED 19AAACI5950L1Z7 6 TATA STEEL LIMITED TATA STEEL LIMITED 19AAACT2803M1Z8 7 LARSEN & TOUBRO LIMITED LARSEN & TOUBRO LIMITED 19AAACL0140P1ZG 8 SAMSUNG INDIA ELECTRONICS PVT. LTD. 19AAACS5123K1ZA 9 EMAMI AGROTECH LIMITED EMAMI AGROTECH LIMITED 19AABCN7953M1ZS 10 KOLKATA PORT TRUST 19AAAJK0361L1Z3 11 TATA MOTORS LTD 19AAACT2727Q1ZT 12 ASHUTOSH BOSE BENGAL CRACKER COMPLEX LIMITED 19AAGCB2001F1Z9 13 HINDUSTAN PETROLEUM CORPORATION LIMITED. 19AAACH1118B1Z9 14 SIMPLEX INFRASTRUCTURES LIMITED. SIMPLEX INFRASTRUCTURES LIMITED. 19AAECS0765R1ZM 15 J.J. HOUSE PVT. LTD J.J. HOUSE PVT. LTD 19AABCJ5928J2Z6 16 PARIMAL KUMAR RAY ITD CEMENTATION INDIA LIMITED 19AAACT1426A1ZW 17 NATIONAL STEEL AND AGRO INDUSTRIES LTD 19AAACN1500B1Z9 18 BHARATIYA RESERVE BANK NOTE MUDRAN LTD. BHARATIYA RESERVE BANK NOTE MUDRAN LTD. 19AAACB8111E1Z2 19 BHANDARI AUTOMOBILES PVT LTD 19AABCB5407E1Z0 20 MCNALLY BHARAT ENGGINEERING COMPANY LIMITED MCNALLY BHARAT ENGGINEERING COMPANY LIMITED 19AABCM9443R1ZM 21 BHARAT PETROLEUM CORPORATION LIMITED 19AAACB2902M1ZQ 22 ALLAHABAD BANK ALLAHABAD BANK KOLKATA MAIN BRANCH 19AACCA8464F1ZJ 23 ADITYA BIRLA NUVO LTD. 19AAACI1747H1ZL 24 LAFARGE INDIA PVT. LTD. 19AAACL4159L1Z5 25 EXIDE INDUSTRIES LIMITED EXIDE INDUSTRIES LIMITED 19AAACE6641E1ZS 26 SHREE RENUKA SUGAR LTD. 19AADCS1728B1ZN 27 ADANI WILMAR LIMITED ADANI WILMAR LIMITED 19AABCA8056G1ZM 28 AJAY KUMAR GARG OM COMMODITY TRADING CO. -

General Motors Strategic Audit

General Motors Strategic Audit Kellen Odom November 11, 2017 1 Table of Contents Introduction to the Organization ..................................................................................................... 3 Identification of the Industry and the Competitors ......................................................................... 8 Analysis of the Industry ................................................................................................................ 10 Analysis of the Macro-Environment ............................................................................................. 13 What is the organization’s measurement and control system? ..................................................... 15 Analysis of the Organization (Mission, Vision, Core Values, Operating Guidelines, Core Competencies, Goals) ................................................................................................................... 19 Analysis of the Organization – Organization-Level and Business Unit Strategies ...................... 22 Analysis of the Organization – Functional Strategies. .................................................................. 25 Analyze organization’s improvement/change initiatives .............................................................. 26 Conclusion and Future of Organization ........................................................................................ 27 References ....................................................................................................................................