Read Full Report (PDF)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

When the Balls Touch They Splode

FOR IMMEDIATE RELEASE When the Balls Touch They Splode ZEN Studios & Twisted Pixel Announce a Big Science Project: Ms. Splosion Man is Coming to Pinball FX2 LOS ANGELES – July 7, 2011 – ZEN Studios & Twisted Pixel today announced a Ms. Splosion Man themed pinball table is coming to Pinball FX2 on Xbox LIVE® Arcade this summer. Sploding with energy and full of punchy surprises, Ms. Splosion Man pinball represents the passion of two of Xbox Live’s finest independent studios collaborative efforts, and the result is an insane level of fun. “We told the Twisted Pixel crew we were going to break in and steal all the Ms. Splosion Man stuff so we could make a pinball table for them. We put our super stealth ZEN sniper on the project and what can I say, mission accomplished,” boasts Mel Kirk, ZEN Studios Vice President of Marketing and Public Relations. “Twisted Pixel struck back by stealing some Pinball FX2 assets and building a pinball machine in the arcade area of Ms. Splosion Man, due out on July 13th. Set in the crazy labs of Big Science, the latest tests in experimental science have gone all wrong, and Ms. Splosion Man must splode her way through obstacles utilizing the latest in tech gadget innovation in her quest to free Splosion Man from the grips of evil scientists. Featuring plenty of interactive 3D characters and objects pulled directly from the Ms. Splosion Man game, players will complete sets of sploding missions and combos, culminating in a final battle with Mighty Eternal. “Turns out, sploding is a GREAT mechanic on a pinball table and the evil geniuses at ZEN took the idea and ran with it!” explains Twisted Pixel CEO Michael Wilford. -

Read Full Report (PDF)

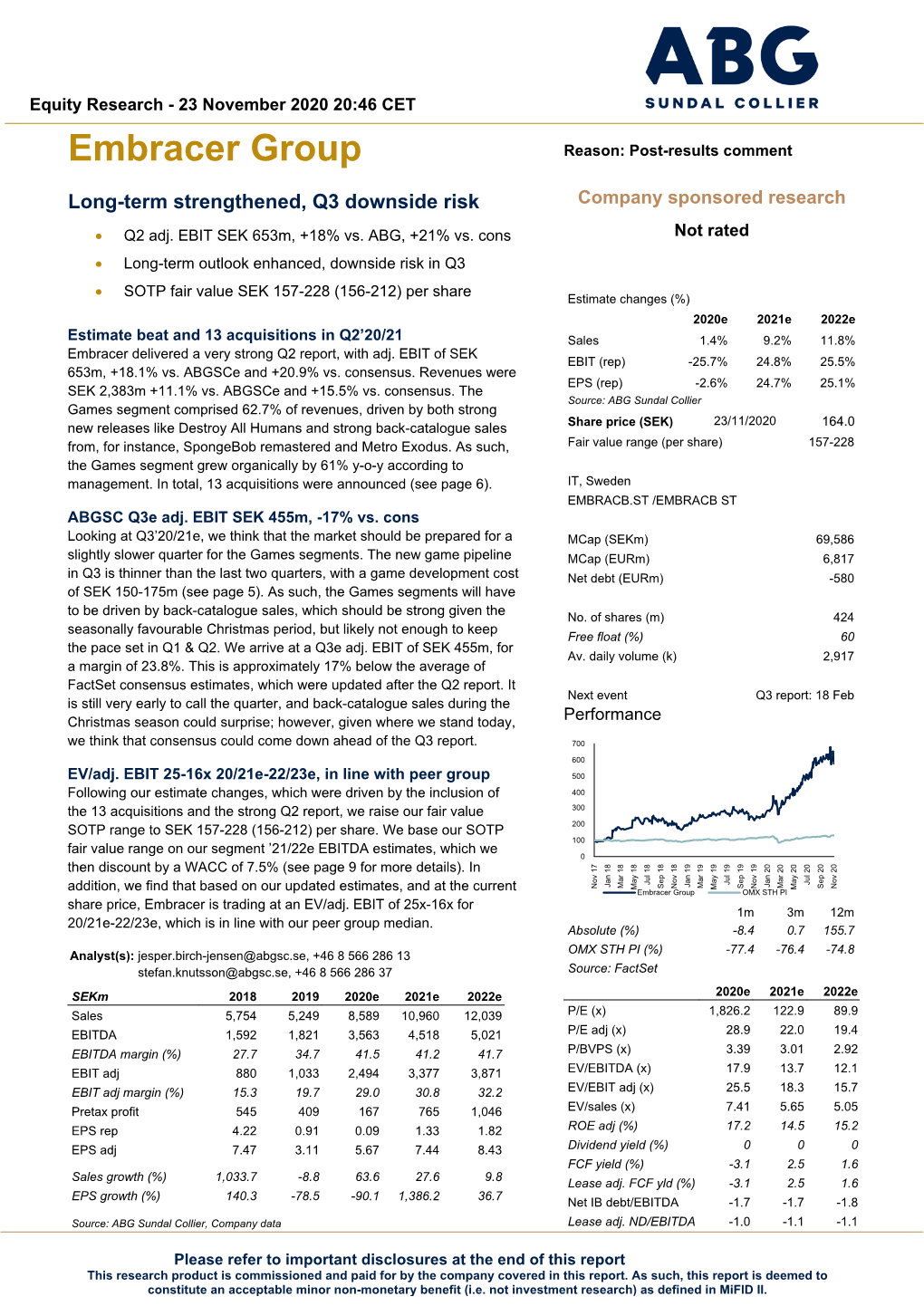

Equity Research - 09 August 2021 21:00 CET Embracer Group Reason: Preview of results Plenty to like despite negative sentiment Company sponsored research ABGSC Q1e adj. EBIT SEK 1,137m, -9% vs. consensus Not rated Raising adj. EPS by 1-5% ’21/22e-’23/24e on M&A Raising fair value to SEK 225-350 (225-345) per share Estimate changes (%) 2021e 2022e 2023e Q1’21/22e sales of SEK 3,249m, +57% y-o-y (~19% organic) Sales 7.3% 12.7% 13.9% For Q1’21/22e, we factor in sales of SEK 3,249m (-2.3% vs. FactSet EBIT (rep) -62.5% nm nm consensus), for total y-o-y growth of 57.1%, but organic growth of 19.5% EPS (rep) -49.1% nm nm when adjusting for M&A and FX. We consider this a strong performance Source: ABG Sundal Collier in the 2021 quarter facing the toughest COVID-19-boosted comparables. 09/08/2021 The largest revenue driver in the quarter is Biomutant by our estimate, Share price (SEK) 188.0 where we factor in ~1.4mn copies sold across all platforms. Given the Fair value range (per share) 225-350 economics of the game (internally developed & published on an own IP) this yields net sales of ~SEK 314m with a gross margin of 90.2%. Other IT, Sweden notable drivers include Metro Exodus Enhanced edition on PC and next- EMBRACB.ST/EMBRACB ST gen consoles, and SnowRunner on Steam/Switch. Overall, we estimate that Games will generate 80.9% of sales, driving a strong gross margin MCap (SEKm) 92,344 of 59.8% in the quarter. -

Conference Program Draft 2019

Conference Program Draft 2019 Game Design Indiana Jones and the Last Crusade: The Graphic Adventure – Classic Post Mortem by: ▪ David Fox - Co-Designer & Programmer ▪ Noah Falstein - Co-Designer & Programmer Wonderboy meets Monsterboy – Meet two Generations of Developers - with: ▪ Ryuichi Nishizawa - Freelance Game Designer and creator of “Wonderboy” ▪ Philipp Döschl - Co-Founder / Executive Producer at FDG Entertainment ▪ Fabien Demeulenaere - Studio Manager at Game Atelier Learning for the Future: Tom Clancy’s The Division 2 – by: ▪ Cristian Pana – Senior Producer at Ubisoft Massive What Comes After “My Child Lebensborn” – by: ▪ Catharina Bohler – CEO and Co-Founder of Sarepta Studio Connecting the Dots – Everspace Post Mortem – by: ▪ Michael Schade – CEO & Co-Founder at ROCKFISH Games Culturalization in Games – by: ▪ Kate Edwards – CEO & Principal Consultant Geogrify A Big Stage Fireside Chat – with: ▪ Goichi “SUDA51” Suda – CEO & Game Designer at Grasshopper Manufacture ▪ Hiromi Ishikawa – Chairman at Vantan Game Academy ▪ Marco Accordi Rickards – Executive Director at Vigamus Academy Essence of Play: Accessible Player Experience – by: ▪ Marc Barlet (Founder & Executive Director at The AbleGamers Charity) Player Dreams: Designing the Dictator Fantasy in “Tropico 6” – by: ▪ Johannes Reithmann – Design Director at Limbic Entertainment Designing Farming Simulator – A Lesson in Balancing Realism – by: ▪ Renzo Thönen – Co-Owner and Level Designer at GIANTS Software Hyper-personalization Fueled by Psychometrics – by: ▪ Bastian Bergmann -

Pegi Annual Report

PEGI ANNUAL REPORT ANNUAL REPORT INTRODUCTION 2 CHAPTER 1 The PEGI system and how it functions 4 AGE CATEGORIES 5 CONTENT DESCRIPTORS 6 THE PEGI OK LABEL 7 PARENTAL CONTROL SYSTEMS IN GAMING CONSOLES 7 STEPS OF THE RATING PROCESS 9 ARCHIVE LIBRARY 9 CHAPTER 2 The PEGI Organisation 12 THE PEGI STRUCTURE 12 PEGI S.A. 12 BOARDS AND COMMITTEES 12 THE PEGI CONGRESS 12 PEGI MANAGEMENT BOARD 12 PEGI COUNCIL 12 PEGI EXPERTS GROUP 13 COMPLAINTS BOARD 13 COMPLAINTS PROCEDURE 14 THE FOUNDER: ISFE 17 THE PEGI ADMINISTRATOR: NICAM 18 THE PEGI ADMINISTRATOR: VSC 20 PEGI IN THE UK - A CASE STUDY? 21 PEGI CODERS 22 CHAPTER 3 The PEGI Online system 24 CHAPTER 4 PEGI Communication tools and activities 28 Introduction 28 Website 28 Promotional materials 29 Activities per country 29 ANNEX 1 PEGI Code of Conduct 34 ANNEX 2 PEGI Online Safety Code (POSC) 38 ANNEX 3 The PEGI Signatories 44 ANNEX 4 PEGI Assessment Form 50 ANNEX 5 PEGI Complaints 58 1 INTRODUCTION Dear reader, We all know how quickly technology moves on. Yesterday’s marvel is tomorrow’s museum piece. The same applies to games, although it is not just the core game technology that continues to develop at breakneck speed. The human machine interfaces we use to interact with games are becoming more sophisticated and at the same time, easier to use. The Wii Balance Board™ and the MotionPlus™, Microsoft’s Project Natal and Sony’s PlayStation® Eye are all reinventing how we interact with games, and in turn this is playing part in a greater shift. -

Embracer Group Förvärvar Flying Wild Hog

EJ FÖR OFFENTLIGGÖRANDE, PUBLICERING ELLER DISTRIBUTION, HELT ELLER DELVIS, DIREKT ELLER INDIREKT, INOM ELLER TILL USA, AUSTRALIEN, KANADA, NYA ZEELAND, HONGKONG, JAPAN, SYDAFRIKA ELLER I NÅGON ANNAN JURISDIKTION DÄR SÅDANT OFFENTLIGGÖRANDE, PUBLICERING ELLER DISTRIBUTION SKULLE VARA I STRID MED GÄLLANDE REGLER ELLER KRÄVA YTTERLIGARE REGISTRERING ELLER ANDRA ÅTGÄRDER. Pressmeddelande Karlstad, 18 november 2020 Embracer Group förvärvar Flying Wild Hog Embracer Group AB ("Embracer"), genom sitt helägda dotterbolag Koch Media GmbH, har idag ingått avtal om förvärv av 100 procent av aktierna i det Polen- baserade Flying Wild Hog ("FWH") från Supernova Capital LLP. Flying Wild Hog är en välrenommerad och växande oberoende polsk utvecklare av AA+ spel för PC och konsol, såsom den kritikerrosade Shadow Warrior-serien. FWH arbetar för närvarande på fyra projekt tillsammans med andra välrenommerade externa förläggare. Genom förvärvet välkomnar Embracer ett ansett team om över 260 anställda i tre studios i Polen som bidrar med en solid plattform i en viktig och växande hubb för spelutveckling i Europa. Den initiala köpeskillingen uppgår till 135,2 och motsvarar 137,2 MUSD på en kassa och skuldfri basis och betalas kontant till Supernova Capital, som är en välkänd private equity-firma i spelbranschen. Därutöver har ett incitamentsprogram för ledningspersoner etablerats för att förena intressena framgent. Incitamentsprogrammet uppgår till totalt 7,1 MUSD i B-aktier i Embracer och är föremål för uppfyllande av överenskomna milstolpar och åtaganden att kvarstå i FWH under de kommande fem åren. “Flying Wild Hog har varit på vår radar under många år på grund av deras talang men också på grund av deras förmåga att skala upp med fortsatt hög kvalitet. -

Borderlands 3 the Surge 2 Victorian Masterminds Mortal Gods Bernhard

WWW.ZAUBERWELTEN-ONLINE.DE Aus der Redaktion der Herbst 2019 Abwechslungsreicher Shooter Borderlands 3 Hardcore-Rollenspiel The Surge 2 Schurken mit Dampfmaschinen Victorian Masterminds Tabletop im antiken Griechenland Mortal Gods Bestsellerautor Bernhard Hennen im Interview Game of Thrones Die Storyboards 1920er und Ganoven Immertreu u. v. m. Phantastischer Herbst DER WEG EINES HELDEN ZUR MACHT Das packende Finale der Bestseller-Trilogie »Königsfall braucht »Je Wheeler hat den Vergleich mit wunderbar lebendige Game of rones Figuren erscha en.« nicht zu scheuen.« Publishers Weekly Booklist NEU Band 1 Band 2 Band 3 464 Seiten · Klappenbroschur · € 14,99 [D] ISBN 978-3-453-32018-5 Auch als E-Book wen Kiskaddon ist zum mächtigsten Offi zier am Hofe von Königsfall aufgestiegen. Nachdem er sowohl Oseinen Mentor als auch seine große Liebe Elysabeth verloren hat, muss er sich alleine dem Wankelmut König Severns stellen. Als er im benachbarten Königreich einen Krieg anzetteln soll, begegnet er dort dessen Herrscherin, deren magische Fähigkeiten sogar noch Owens eigene übertreff en. Gemeinsam schmieden die bei- den einen riskanten Plan, um Severns grausame Herrschaft über Königsfall zu beenden ... Leseproben auf heyne.de Inhalt DIGITALE WELTEN SPIELWELTEN Games am Horizont – Spieleneuheiten Herbst 2019 .............. 9 Vorschau Winter 2019/2020 .............. 3 Victorian Masterminds – Borderlands 3 – Reichlich Abwechslung Superschurken im Dampfzeitalter ....... 10 im Lootshooter-Universum ............... 4 Mortal Gods – „Hier werden wir kämpfen, -

Weekly News Digest #47

INVESTGAME Nov 16 — Nov 22, 2020 Weekly News Digest #47 Hi everyone, Last week we decided to create the archive of the weekly newsletter for your convenience — click here to access it. Roblox to go public on the New York Stock Exchange CAbased video game platform Roblox has filed its S1 registration documents targeting an IPO on NYSE before the end of this year. Roblox has neither disclosed the sum it’s planning to raise, nor the valuation of the company. Founded in 2004, Roblox Corporation has raised $335.9m investments over the course of 8 rounds with the most recent Series G round closed in Feb 2020 — raising $150m at a $4B postmoney valuation. Just eight months later in Oct 2020, Roblox’s rumored potential IPO valuation was said to be $8B. Such an impressive valuation enhancement could be explained by the strong demand for entertainment content due to COVID19 and shelterinplace orders (Roblox’s DAUs increased by 90% from 19.1m in Q4’19 to 36.2m DAU in Q3’20). The company’s financial results over the last twelve months ending 30 Sep 2020 are: > $1,477m Bookings vs. $727m Revenue — Roblox gradually recognizes revenue over the average lifetime of a paying user; > ($245m) Loss from operations vs. +$301m Free cash flow. Roblox is an operationally profitable business (taking into account bookings numbers), and we consider the rumored $8B as a probable valuation at IPO. The valuation multiples in such case would be 5.4x Bookings, 11.0x Revenue, and 27x Free cash flow. -

Zen Studios Adds Premium Classic Pinball to Its Iconic Pinball Library

Zen Studios adds Premium Classic Pinball to its Iconic Pinball Library Williams® and Bally® combine forces with the acclaimed creators of Pinball FX3 – and you’re invited to see how it’s done Video Announcement: YouTube | Download Pinball FX3 Williams™ Pinball Assets San Francisco, CA – September 04, 2018 – Zen Studios today announced it is bringing tables from the world-renowned Williams and Bally pinball collection to digital game stores. This global agreement grants Zen the digital rights to the full Williams and Bally pinball library, with the initial 2018 releases including Fish Tales, Junk Yard, Medieval Madness® and The Getaway® High Speed® II – all of which are now available in public beta form through Pinball FX3 on Steam. Committed to making pinball an exciting community experience, Zen also invites fans of all ages to its headquarters in Budapest, Hungary, to see this process in action with a studio tour. Known for its celebrated Pinball FX series, Zen has established itself as one of gaming’s all-time greatest digital pinball publishers, committed to pinball excellence over the last 11 years with more than 70 acclaimed tables to its credit. The addition of Scientific Games’ Williams and Bally tables will only strengthen this lineup that until now has been comprised entirely of designs created by Zen itself, including some inspired by powerhouse intellectual properties such as Marvel, Star Wars and Jurassic World. In addition to Steam, these tables will be available for PlayStation 4, Xbox One, Nintendo Switch, Windows 10 and MAC OSX. “Most of our developers grew up admiring Williams and Bally pinball machines, and we at Zen are devoted to treating these beloved tables with the respect they deserve for years to come in digital form,” said Zsolt Kigyossy, Zen Studios’ Managing Director. -

Family Friendly Magazine 129 in PDF Format

Family Friendly Gaming The VOICE of TM the FAMILY in GAMING Kingdom Hearts III, Ooblets, Monster Hunter World and more in this fabu- lous issue!! ISSUE #129 NI NO KUNI II REVENANT KING- DOM wants you to April 2018 role play. CONTENTS ISSUE #129 April 2018 CONTENTS Links: Home Page Section Page(s) Editor’s Desk 4 Female Side 5 Comics 7 Sound Off 8 - 10 Look Back 12 Quiz 13 Devotional 14 Helpful Thoughts 15 In The News 16 - 23 We Would Play That! 24 Reviews 25 - 37 Sports 38 - 41 Developing Games 42 - 67 Now Playing 68 - 83 Last Minute Tidbits 84 - 106 “Family Friendly Gaming” is trademarked. Contents of Family Friendly Gaming is the copyright of Paul Bury, and Yolanda Bury with the exception of trademarks and related indicia (example Digital Praise); which are prop- erty of their individual owners. Use of anything in Family Friendly Gaming that Paul and Yolanda Bury claims copyright to is a violation of federal copyright law. Contact the editor at the business address of: Family Friendly Gaming 7910 Autumn Creek Drive Cordova, TN 38018 [email protected] Trademark Notice Nintendo, Sony, Microsoft all have trademarks on their respective machines, and games. The current seal of approval, and boy/girl pics were drawn by Elijah Hughes thanks to a wonderful donation from Tim Emmerich. Peter and Noah are inspiration to their parents. Family Friendly Gaming Page 2 Page 3 Family Friendly Gaming Editor’s Desk FEMALE SIDE this instance I feel wonderful. God has given God is my prize and my goal. -

006NAG June 2013

SOUTH AFRICA’S LEADING GAMING, COMPUTER & TECHNOLOGY MAGAZINE Vol. 16 Issue THREE CALL OF DUTY: GHOSTS PC / PLAYSTATION / XBOX / NINTENDO We go to Los Angeles to stroke some beards and fi ddle PLEASE TRY TO with man stuff UNDERSTAND Intel IDF 2013 Beijing: 4th generation core technology We insert our probes deep into the soft meaty insides of 2K’s latest alien mystery Editor Michael “RedTide“ James [email protected] Contents Assistant editor Geoff “GeometriX“ Burrows Staff writer Dane “Barkskin “ Remendes Features Contributing editor Lauren “Guardi3n “ Das Neves 30 CALL OF DUTY:DU GHOSTS ComeCome on, you had to knowkno this was bound to happen. Technical writer 2013’s2013’s Call of Dutyy wantswant you to pay close attention Neo “ShockG“ Sibeko RegularsRegulars to its new enengine,gine, new sstoryline,t new player-triggered events andand new dogdog companion,com all so that when the International correspondent 1010 Ed’sEd’s NoteNote gamegame releases you’reyou’re readyrea for a bit of expectedly Miktar “Miktar” Dracon 12 InboxInbox familiar,familiar, ggoodood ol’ COD. 16 BytesBytes Contributors 53 home_codedhome_coded Rodain “Nandrew” Joubert Walt “Shryke” Pretorius 62 EverythingEverything elseelse 44 THE BUREAU:BUREA Miklós “Mikit0707 “ Szecsei XCOMXCOM DECLASSIFIEDDECLASS Pippa “UnexpectedGirl” Tshabalala It’sIt’s baaaaack! 2K2K Marin’sMarin’s XCOM has fl ipped itself on its Tarryn “Azimuth “ Van Der Byl head, adopting a diff erenteren approach in turning XCOM Adam “Madman” Liebman OpinionOpinion intointo a more hands-on, acaction-oriented alien-bashing Wesley “Cataclysm” Fick 16 I, GamGamerer experience with enoughenough tactical depth to satisfy anyoneanyone lookinlookingg for a bit more intelligence in their 1188 ThThee GaGameme SStalkertalker Art director shooters. -

20/21 Interim Report 3 Reg No

OCTOBER–DECEMBER 2020 EMBRACER GROUP AB (PUBL) 20/21 INTERIM REPORT 3 REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 100% TO SEK 603 MILLION THIRD QUARTER, OCTOBER–DECEMBER 2020 (COMPARED TO OCTOBER–DECEMBER 2019) > Net sales increased by 44% to SEK 2,168.1 million (1,508.5). Net sales of the Games busi- ness area increased by 62% to SEK 1,355.6 million (835.7). THQ Nordic SEK 379.8 million (333.0), Deep Silver SEK 496.9 million (466.6), Coffee Stain SEK 99.2 million (36.1), Saber Interactive SEK 307.0 million (-) and DECA Games SEK 72.7 million (-). > Net sales of Partner Publishing/Film business area increased by 21% to SEK 812.5 million (672.9). > EBITDA increased by 70% to SEK 878.7 million (518.4), corresponding to an EBITDA margin of 41%. > Operational EBIT increased by 100% to SEK 603.1 million (302.1) corresponding to an Operational EBIT margin of 28% (20%). > Cash flow from operating activities amounted to SEK 840.4 million (239.5). Investments in intangible assets amounted to SEK –557.7 million (–419.0). Free Cash Flow amounted to SEK 309.1 million (–207.3). > Adjusted earnings per share was SEK 1.06 (0.68). > Organic growth in constant currency for the Games Business Area amounted to 21% in the quarter. > Total game development projects increased 56% to 150 (96). Total headcount increased 93% to 5,730 (2,970) where total game developers increased 92% to 4,325 (2,258). Oct–Dec Oct–Dec Apr–Dec Apr–Dec Apr 2019– Key performance indicators, Group 2020 2019 2020 2019 Mar 2020 Net sales, SEK m 2,168.1 1,508.5 6,620.0 3,910.3 5,249.4 -

FGIR-2018-Report.Pdf

FRONT COVER Fingersoft • Hill Climb Racing 2 Futureplay • Battlelands Royale Next Games • The Walking Dead: Our World Rovio Entertainment • Angry Birds 2 Small Giant Games • Empires & Puzzles Supercell • Brawl Stars, Clash Royale, Clash of Clans and Hay Day BACK COVER Remedy Entertainment • Control Housemarque • Stormdivers SecretExit • Zen Bound 2 Rival Games • Thief of Thieves: Season One Superplus Games • Hills of Steel Critical Force • Critical Ops Frogmind • Badland Brawl Nitro Games • Heroes of Warland Kukouri Mobile Entertainment • Pixel Worlds Tree Men Games • PAKO Forever Publisher Neogames Finland ry (2019) Index 1. Introduction 2. The History of the Finnish Game Industry - From Telmac to Apple 3. The State of the Finnish Game Industry 4. Studios 5. Location of Companies and Clusters 6. Platforms 7. Developers & Diversity 8. Financial Outlook 9. Challenges and Strengths of the Finnish Game Industry 10. Trends and the Future 11. The Industry Support and Networks 12. Education 13. Regional Support 14. Studio Profiles Picture: Seriously | Best Fiends 3 ABOUT THIS REPORT Neogames Finland has been augmented by data from other sources. monitoring the progress of the Finnish This study is a continuation of similar Game Industry since 2003. During these studies conducted in 2004, 2008, 2010, fifteen years almost everything in the 2014 and 2016. industry has changed; platforms, Over 70 Game companies, members technologies, the business environment of Suomen Pelinkehittäjät ry (Finnish and games themselves. However, the Game Developers Association) are biggest change has taken place in the introduced on the company profile industry’s level of professionalism. pages as well as Business Finland and These days the level of professionalism the most relevant game industry in even a small start-up is on a level organizations and regional clusters.