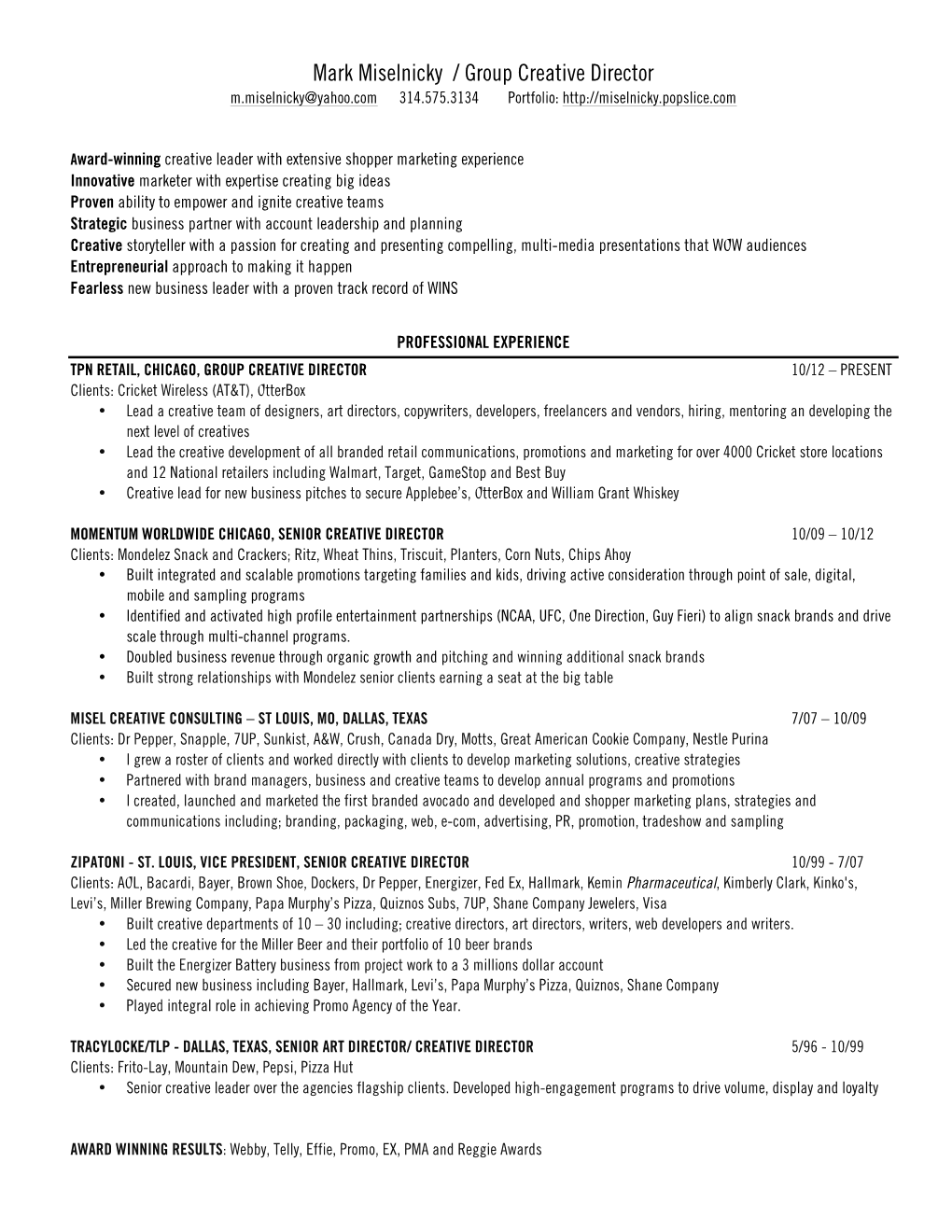

Mark Miselnicky / Group Creative Director [email protected] 314.575.3134 Portfolio

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Top 5G Stock to Buy in 2019 the 5G Stock We Love for 2019 Is Canada-Based Telus Corp

Contents INTRODUCTION Page i 2019 Will Bring Unprecedented Moneymaking Opportunities CHAPTER 1 Page 1 The Seven “No-Brainer” Stocks to Buy in 2019 – Plus Our “Wild Card” Pick CHAPTER 2 Page 12 The Only Stock to Own Ahead of the $1.3 Trillion 5G Revolution CHAPTER 3 Page 17 How to Turn Water Scarcity into a 40% – Plus Gain CHAPTER 4 Page 22 The Secret Way to Profit from the 11 “Unicorn” IPOs Slated for 2019 CHAPTER 5 Page 35 The Cryptocurrency with 1,000% Growth Potential CHAPTER 6 Page 40 Five Income Stocks with Double-Digit Growth Ahead CHAPTER 7 Page 47 Bank 145% Gains in the Biggest Year Yet for Cannabis Investors CHAPTER 8 Page 52 The Three Trendy Stocks to Avoid in 2019 MONEY MORNING THE ULTIMATE MONEY MAKING GUIDE FOR 2019 Introduction: 2019 Will Bring Unprecedented Moneymaking Opportunities Here at Money Morning, we have one goal: to make investing profitable. In 2018 alone, our readers had the chance to book gains of 333%, 440%, and even 478% on stock trades that came from our research. We also kept our readers at the forefront of the hottest investing trends, like cannabis legalization. After we told Money Morning subscribers about top cannabis pick Tilray Inc., the stock soared 262%. But you wouldn’t know these opportunities were out there from listening to mainstream financial news… Cable news focused on the trade war as major indexes struggled to stay in the black. And Wall Street pundits couldn’t stop talking about the evils of Facebook as it slid 24% this year. -

Manitoba Liquor & Lotteries Category Price List Effective July 1, 2021

COMPUTER PRICE LIST BY BRAND CATEGORY Effective: July 1, 2021 LISTE DES PRIX PREPAREE PAR ORDINATEUR Entrée en vigueur le 1 juillet, 2021 TABLE OF CONTENTS MANITOBA LIQUOR & LOTTERIES PRICE LIST – BRAND CATEGORY - July 1, 2021 BEER WINE - CANADIAN Manitoba Liquor & Lotteries Distributed 136-143 Canadian Bulk Wine / Vin en Bloc 40 Canadian Flavoured Wine / Vins Aromatises 40 Canadian Fruit Wine / Vins de fruits-canadien 41 REFRESHMENT BEVERAGES Canadian Icewine / Vins de Glace 41-42 Cider / Cidres 123-126 Canadian Sparkling Wine / Vins Mousseaux-Canadien 43 Coolers - Wine and Spirit Based / à Base de Vin et D'Alcool 126-136 Canadian Red Wine / Vins Rouges-Canadien 43-49 Ready to Drink Non Alcohol/Prêt à boire non alcoolisée 136 Canadian Rosé Wine / Vin de Table-Rose Canadien 49-50 Canadian White Wine / Vins Blanc-Canadien 50-55 Canadian Miscellaneous Wine / Vins Divers-Canadien 42-43 LIQUEUR/LIQUOR (listed in alphabetical order by flavour) 5-12 WINE - IMPORTED SPIRITS Imported Bulk Wine / Vin en Bloc 55-56 Brandy / Eau-de Vie 1-2 Flavoured Wines / Vins Aromatises 56-57 Gin - Dry /Gin sec & Gin-Geneva/Gin geneve 2-4 Imported Fruit Wines / Vins de Fruits-Importes 57 Miscellaneous Spirits / Spiritueux divers 12-13 Imported Sparkling Wine /Vins Mousseaux-Importée 58-64 Rum / Rhum 13-17 Imported Red Table Wine /Vins Rouges-Importée 64-96 Tequila / Mezcal / Mezcal 17-20 Imported Rosé Wine / Vin de Table-Rose Importée 96-101 Vodka 20-26 Imported White Table Wine / Vins Blanc-Importée 101-118 Whiskey - Bourbon / Whiskey- bourbon 28-29 Imported -

SYSCO VANCOUVER PRODUCT LISTING GUIDE Updated: February 2019

SYSCO VANCOUVER PRODUCT LISTING GUIDE updated: February 2019 ARDENT MILLS - updated April 2018 ManufacturerSkuBrand Description PackSizeText DistributorSku StockingStatus 10030 Robin Hood All - O - Wheat Whole Wheat Flour 1/20 KG 6413045 A 10082 Robin Hood Bakers Hood All Purpose Flour UB 1/20 KG 6518496 A 10089 Robin Hood Bakers Hood Bleached All Purpose 1/20 KG 6416800 A 10090 Robin Hood Bakers Hood All Purpose Flour 2/10 KG 6417693 A 10092 Robin Hood Bakersource All Purpose Flour 1/20 KG 9665589 A 10134 Primo Mulino Neapolitan Style Pizza Flour 1/20 KG 1922867 A 10287 Robin Hood Wheatlets 2 Coarse Wheat Granules 1/20 KG 6416337 A 10450 Arrezzio Pizza Flour UB 1/20 KG 9665480 A 10472 Robin Hood Bakersource Classic Strong Bakers 1/20 KG 9665605 A 10496 Robin Hood Keynote 45 Strong Bakers UB 1/20 KG 6429821 A 11013 Robin Hood Brodie Self Rising Flour 1/20 KG 6416719 A 11066 Robin Hood Peach Pastry Cake & Pastry Flour 1/20 KG 6429835 A 11810 Robin Hood Red River Cereal Oats 1/10 KG 6429783 A 11895 Robin Hood Light Rye 1/20 KG 6426466 SO 13505 Robin Hood Classic Custard Mix 1/10 KG 3214196 A 13211 Robin Hood Classic Scone Mix 1/20 KG 6429801 A 13215 Robin Hood Scone Mix Reduced Sodium 1/20 KG 1206665 SO 13323 Robin Hood Bran Muffin Mix LFC Free 1/10 KG 6398271 A 13575 Robin Hood Tea Biscuit Mix 1/10 KG 6429817 A 13602 Robin Hood Corn Bread/Muffin Mix 1/10 KG 6403721 A 13614 Robin Hood Variety Cookie Base Mix 1/20 KG 6412680 SO 13626 Robin Hood Plain Muffin Mix 1/20 KG 6410569 A 13637 Robin Hood Deluxe Bran Muffin 1/20 KG 6410528 A 13788 -

Avril - April 2015 Conagra Maître Saladier Pogo À Table Saucisses Sur Bâtonnet Salade De Chou Wieners on a Stick ¢ Blanche Crémeuse 120 Un

SPÉCIMEN Snack-Bar Avril - April 2015 Conagra Maître Saladier Pogo À Table Saucisses sur bâtonnet Salade de chou Wieners on a stick ¢ blanche crémeuse 120 un. 50 Creamy white coleslaw ¢ 5 kg 20 Skoulakis Lanières de poulet précuit Parmalat assaisonnées Mozzabene Precooked seasoned Fromage râpé style pub chicken strips $ Pub-style grated cheese $ 2 x 2,5 kg 1 4 x 2,27 kg 1 Menu Original Philly Rondelles d’oignon Boeuf tranché Onion rings ¢ Sliced beef ¢ 4 kg 25 40 x 110 g 25 Nachos triangulaires Weston Triangular nachos ¢ Pepe’s 6 x 454 g 25 Tortillas 10” ¢ Burgers de boeuf 12 x 12 un. 35 Beef burgers ¢ 56 x 91 g 25 Unilever Krispy Kernels Hellmann’s Vinaigrette / Dressing Arachides salées Salade de chou crémeuse Salted peanuts ¢ Creamy coleslaw ¢ 108 x 60 g 20 2 x 3,78 L 35 Yum Yum Croustilles / Chips BBQ ¢ 30 x 65 g 20 Lafleur Saucisses fumées, 6” Wieners, 6” 12 / lb ¢ 2 x 3 kg 60 Pour plus d’informations, contactez votre représentant. For more informations, contact your representative. Lassonde Kellogg’s Everfresh Frosted Flakes Jus d’orange concentré, 3 + 1 Céréales en sac Concentrated orange juice, Cereal in bag ¢ 3 + 1 ¢ 6 x 950 g 50 12 x 1 L 50 Dare Tropical Oasis Simple Plaisirs Jus de fraises surgelé Biscuits / Cookies Frozen strawberry juice ¢ 200 x 2 un. ¢ 12 x 960 ml 50 50 Agropur Louis Dreyfus Whole Sun Natrel Jus d’orange surgelé Crème, 10 % / Cream, 10% Frozen orange juice ¢ Portions ¢ 48 x 170 ml 25 200 x 15 ml 30 Canada Dry-Motts Mondelez– Christie Garden Cocktail Biscuits Thé social Cocktail de légumes Social Tea cookies ¢ Vegetable cocktail ¢ 200 x 2 un. -

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance NORTH AMERICA’S LEADING FLAVORED BEVERAGE COMPANY More than 50 brands of juices, teas and carbonated soft drinks with a heritage of more than 200 years NINE OF OUR 12 LEADING BRANDS ARE NO. 1 IN THEIR FLAVOR CATEGORIES Named Company of the Year in 2010 by Beverage World magazine CEO LARRY D. YOUNG NAMED 2010 BEVERAGE EXECUTIVE OF THE YEAR BY BEVERAGE INDUSTRY MAGAZINE OUR VISION: Be the Best Beverage Business in the Americas STOCK PRICE PERFORMANCE PRIMARY SOURCES & USES OF CASH VS. S&P 500 TWO-YEAR CUMULATIVE TOTAL ’09–’10 JAN ’10 MAR JUN SEP DEC ’10 $3.4B $3.3B 40% DPS Pepsi/Coke 30% Share Repurchases S&P Licensing Agreements 20% Dividends Net Repayment 10% of Credit Facility Operations & Notes 0% Capital Spending -10% SOURCES USES 2010 FINANCIAL SNAPSHOT (MILLIONS, EXCEPT EARNINGS PER SHARE) CONTENTS 2010 $5,636 NET SALES +2% 2009 $5,531 $ 1, 3 21 SEGMENT +1% Letter to Stockholders 1 OPERATING PROFIT $ 1, 310 Build Our Brands 4 $2.40 DILUTED EARNINGS +22% PER SHARE* $1.97 Grow Per Caps 7 Rapid Continuous Improvement 10 *2010 diluted earnings per share (EPS) excludes a loss on early extinguishment of debt and certain tax-related items, which totaled Innovation Spotlight 23 cents per share. 2009 diluted EPS excludes a net gain on certain 12 distribution agreement changes and tax-related items, which totaled 20 cents per share. See page 13 for a detailed reconciliation of the Stockholder Information 12 7 excluded items and the rationale for the exclusion. -

Product Guide Product

PRODUCT GUIDE PRODUCT 800.356.8881 [email protected] www.cdccoffee.com UNITS / UNIT CASE CODE PRODUCT DESCRIPTION CATEGORY CASE PRICE PRICE 27910 Café Bustelo Cool Café Con Leche Cans 12/8 Oz 1 $28.95 BEVERAGES: BOTTLES & CANS - COFFEE-BASED DRINKS 39290 Illy Issimo Cappuccino Coffee Drink 12/11.5 Oz 1 $38.48 BEVERAGES: BOTTLES & CANS - COFFEE-BASED DRINKS 5128 Starbucks Coffee Frappuccino Drink Bottles 15/9.5 Oz 1 $44.85 BEVERAGES: BOTTLES & CANS - COFFEE-BASED DRINKS 5127 Starbucks Doubleshot Espresso Drink Cans 12/6.5 Oz 1 $44.45 BEVERAGES: BOTTLES & CANS - COFFEE-BASED DRINKS 5131 Starbucks Mocha Frappuccino Drink Bottles 15/9.5 Oz 1 $44.85 BEVERAGES: BOTTLES & CANS - COFFEE-BASED DRINKS 5133 Starbucks Vanilla Frappuccino Drink Bottles 15/9.5 Oz 1 $44.85 BEVERAGES: BOTTLES & CANS - COFFEE-BASED DRINKS 5483 Diet Red Bull Cans 24/8.4 Oz 1 $64.95 BEVERAGES: BOTTLES & CANS - ENERGY & SPORTS DRINKS 4999 Gatorade Cool Blue Bottles 24/20 Oz 1 $38.45 BEVERAGES: BOTTLES & CANS - ENERGY & SPORTS DRINKS 7525 Gatorade Fruit Punch Bottles 24/12 Oz 1 $30.45 BEVERAGES: BOTTLES & CANS - ENERGY & SPORTS DRINKS 5001 Gatorade Fruit Punch Bottles 24/20 Oz 1 $38.45 BEVERAGES: BOTTLES & CANS - ENERGY & SPORTS DRINKS 4871 Gatorade Fruit Punch Cans 24/11.6 Oz 1 $20.95 BEVERAGES: BOTTLES & CANS - ENERGY & SPORTS DRINKS 4996 Gatorade Fruit Punch G2 Bottles 24/20 Oz 1 $38.45 BEVERAGES: BOTTLES & CANS - ENERGY & SPORTS DRINKS 9004 Gatorade Glacier Freeze G2 Bottles 24/12 Oz 1 $30.45 BEVERAGES: BOTTLES & CANS - ENERGY & SPORTS DRINKS 4997 Gatorade Grape G2 -

Keurig Dr Pepper Annual Report 2021

Keurig Dr Pepper Annual Report 2021 Form 10-K (NASDAQ:KDP) Published: February 25th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO COMMISSION FILE NUMBER 001-33829 kdp-20201231_g1.jpg Keurig Dr Pepper Inc. (Exact name of registrant as specified in its charter) Delaware 98-0517725 (State or other jurisdiction of incorporation or organization) (I.R.S. employer identification number) 53 South Avenue Burlington, Massachusetts 01803 (Address of principal executive offices) (781) 418-7000 (Registrant's telephone number, including area code) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

Dr Pepper Snapple Group, Inc

A NEW COMPANY with a heritage spanning centuries… Our brands have been synonymous with refreshment, revitalization, fun and fl avor for generations. In 2008, those 50-plus brands became Dr Pepper Snapple Group, the oldest new company traded on the New York Stock Exchange. We may be a new player in the equity markets, but the equity of our brands is unmistakably strong and growing. Th is report illustrates the power and potential of great brands and great people to produce great results. EXPERIENCED LEADERSHIP Dr Pepper Snapple Group is an integrated refreshment beverage business serving consumers across the U.S., Canada, Mexico and the Caribbean. Our business is led by an experienced management team that is focused on building capabilities to support growth and create shareholder value. With 200 years of collective food and beverage industry experience, this team has worked with top consumer brands, managed complex supply chains and developed strong relationships with key players in the industry. From left to right: Larry D. Young, President & Chief Executive Offi cer; Tina S. Barry, Senior Vice President, Corporate Affairs; John O. Stewart, Executive Vice President & Chief Financial Offi cer; James L. Baldwin, Jr., Executive Vice President, General Counsel; Rodger L. Collins, President, Packaged Beverages; Pedro Herrán Gacha, Executive Vice President, Strategy & President, Mexico & Caribbean; Derry L. Hobson, Executive Vice President, Supply Chain; James J. Johnston, Jr., President, Beverage Concentrates; Lawrence N. Solomon, Executive Vice President, Human Resources; David J. Thomas, Ph.D., Senior Vice President, Research & Development; Jim R. Trebilcock, Executive Vice President, Marketing Dr Pepper is served for Jean Jacob Schweppe Mott’s brand starts as the fi rst time at the Charles Grigg invents 7UP Peñafi el, Mexico’s oldest perfects a process for a line of apple cider and Old Corner Drug Store mineral water, is founded making carbonated water vinegar offerings in Waco, Texas in Puebla 1783 1842 1885 1929 1948 DPS at-a- GLANCE • No. -

Bundaberg Ginger Beer, IZZE, Minute Maid Cherry Limeade Orig. & Light

The following beverages are NOT certified: Bundaberg Ginger Beer, IZZE, Minute Maid Cherry Limeade orig. & light, Dad’s Root Beer, Mike’s Hard Lemonade, Red Bull Cola, Snapple Fruit Punch, Monster Energy Drink, Kellogg’s Protein Water, Coke Products including Fanta bottled in Mexico, Hi-C Products in Cans, Bottles or Aseptic Packs. Additionally, this list is for fluid beverages only unless otherwise noted. There are many drink powders produced bearing commonly recognized names but are different formulations. Please Note: Reg. & diet are acceptable for any soda listed. This list is for soda produced and bottled in the USA only. 5- Hour Energy Drink - when bearing Star-K AHA - when bearing OU A&W - Cream Soda, Root Beer, Root Beer Ten, Root Beer w/ Aged Vanilla All Sport - when bearing OU America’s Choice - when bearing OU Aquafina (United States & Canada) Alive Enhance Water Sparkling - Black Cherry Dragonfruit, Lemon, Lemon Lime, Mango Pineapple, Orange Grapefruit, Peach Berry, Unsweetened Lemon, Unsweetened Lime, Unsweetened Raspberry, Unsweetened Strawberry, White Peach Apricot Arizona Iced Tea - when bearing OU Bai - when bearing OU Barq’s - French Vanilla Cream, Red Cream, Root Beer Ben & Jerry’s Milkshakes-when bearing KD (Dairy-non cholov yisroel) Cherry Garcia, Chocolate Fudge Brownie, Chunky Monkey Milkshake Big Red - Black Cherry, Blue, Cola, Lemon Lime, Orange, Peach, Pineapple, Red, Red Diet Caffeine free, Red Float, Root Beer Bubly Sparkling Water - Unsweetened Apple, Unsweetened Blackberry, Unsweetened Cherry, Unsweetened -

2020 Notice of Meeting and Information Circular 1.7Mb

NOTICE OF ANNUAL GENERAL MEETING AND MANAGEMENT INFORMATION CIRCULAR OF HARVEST ONE CANNABIS INC. to be held at 10:00 a.m. on Tuesday, December 8, 2020 at Suite 404, 999 Canada Place, Vancouver, BC HARVEST ONE CANNABIS INC. Suite 404, 999 Canada Place Vancouver, BC V6E 3E2 Phone: 604.449.9280 NOTICE OF ANNUAL GENERAL MEETING NOTICE IS HEREBY GIVEN that the annual general meeting of the shareholders ("Shareholders") of HARVEST ONE CANNABIS INC. (the "Company") will be held at Suite 404, 999 Canada Place, Vancouver, BC Canada, on Tuesday, December 8, 2020, at 10:00 a.m. (Vancouver time) (the “Meeting”), for the following purposes: 1. To receive the audited consolidated financial statements of the Company for the year ended June 30, 2020, and June 30, 2019, together with the auditors’ report thereon; 2. To fix the number of directors at four; 3. To elect directors for the ensuing year; 4. To appoint Davidson & Company LLP, Chartered Professional Accountants, as the auditors of the Company for the ensuing year and to authorize the directors of the Company to fix the remuneration of the auditors; and 5. To transact such other business as may properly be brought before the Meeting or any adjournment thereof. COVID-19 Plan: This year, to proactively deal with the unprecedented public health impact of the Coronavirus (COVID-19) pandemic and in order to mitigate potential risks to the health and safety of its shareholders, employees, communities and other stakeholders, the Company is encouraging shareholders to vote by proxy in advance of the meeting rather than attending in person. -

Consumer Staples Dr Pepper Snapple Group, Inc. (NYSE: DPS)

Krause Fund Research Spring 2015 Consumer Staples Dr Pepper Snapple Group, Inc. (NYSE: DPS) Recommendation: HOLD April 21, 2015 April Analysts Current Price $77.79 Di Yan Target Price $79.95 [email protected] Leslie Wille DPS Is Worth Waiting! [email protected] Yuqing Fang Dr Pepper Snapple has stable revenue growth each year, [email protected] with an average increase of 2% from 2010-2014. Since the U.S. economy is healthy and experiencing an increasing demand in Company Overview the consumer staple sector due to the growing population nationwide, we expect a 1.27% increase in net sales in 2015. In Dr Pepper Snapple Group, Inc. (NYSE: DPS) is a leading addition, due to volatile commodity prices in recent months, we integrated brand owner, manufacturer, and distributor of non- expect approximately a 1% decrease in the proportion of the cost alcoholic beverages in the United States, Canada, and Mexico. of goods sold in sales in 2015. It is headquartered in Plano, Texas. In 2008, Dr Pepper Snapple Growth for beverage industry has been sluggish in recent was spun off from its parent company Cadbury Schweppes and years, thus we merely estimate a 1.4% continuing value growth started being publicly traded in the U.S. Dr Pepper Snapple has rate for Dr Pepper Snapple after 2019. three business segments including Beverage Concentrates, Since consumers are increasingly concerned about health Packaged Beverages, and Latin America Beverages. The and wellness, they are changing their preferences towards much Packaged Beverages segment has always been the chief healthier drinks. -

Food and Beverage Manufacturers in Canada: Policies and Commitments to Improve the Food Environment

Food and beverage manufacturers in Canada: Policies and commitments to improve the food environment BIA-Obesity Canada 2019 Report Authors Lana Vanderlee, PhD Laura Vergeer, BSc Gary Sacks, PhD Ella Robinson, MPH Mary L’Abbé, CM, PhD Acknowledgements The BIA-Obesity Canada study was led by Dr. Lana Vanderlee and Dr. Mary L’Abbé in the WHO Collaborating Centre on Nutrition Policy for Chronic Disease Prevention in the Department of Nutritional Sciences, University of Toronto, with research support from Laura Vergeer, Dr. Gary Sacks and Ella Robinson. The project forms part of INFORMAS (International Network for Food and Obesity/NCDs Research, Monitoring and Action Support), a global network of public-interest organizations and researchers that seek to monitor and benchmark public and private sector actions to create healthy food environments and reduce obesity and non-communicable diseases (NCDs) globally. We would like to gratefully acknowledge the support of the international INFORMAS research group, including Dr. Stefanie Vandevijvere and Prof. Boyd Swinburn. We would also like to extend our gratitude to the food companies who participated in the BIA-Obesity research process. Funding declaration This research was funded by a grant from the Canadian Institutes of Health Research (CIHR) (#343709) and a CIHR Banting Postdoctoral Fellowship to Dr. Vanderlee. Dr. Sacks is the recipient of an Australian Research Council Discovery Early Career Researcher Award (DE160100307) and a Heart Foundation Future Leader Fellowship from the National Heart Foundation of Australia. The L’Abbé Lab has received money from the Program for Food Safety, Nutrition, and Regulatory Affairs at the University of Toronto with support from Nestlé Canada, and students in the L’Abbé Lab have held MITACS internships with Nestlé Canada.