Consumer Staples Dr Pepper Snapple Group, Inc. (NYSE: DPS)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Top 5G Stock to Buy in 2019 the 5G Stock We Love for 2019 Is Canada-Based Telus Corp

Contents INTRODUCTION Page i 2019 Will Bring Unprecedented Moneymaking Opportunities CHAPTER 1 Page 1 The Seven “No-Brainer” Stocks to Buy in 2019 – Plus Our “Wild Card” Pick CHAPTER 2 Page 12 The Only Stock to Own Ahead of the $1.3 Trillion 5G Revolution CHAPTER 3 Page 17 How to Turn Water Scarcity into a 40% – Plus Gain CHAPTER 4 Page 22 The Secret Way to Profit from the 11 “Unicorn” IPOs Slated for 2019 CHAPTER 5 Page 35 The Cryptocurrency with 1,000% Growth Potential CHAPTER 6 Page 40 Five Income Stocks with Double-Digit Growth Ahead CHAPTER 7 Page 47 Bank 145% Gains in the Biggest Year Yet for Cannabis Investors CHAPTER 8 Page 52 The Three Trendy Stocks to Avoid in 2019 MONEY MORNING THE ULTIMATE MONEY MAKING GUIDE FOR 2019 Introduction: 2019 Will Bring Unprecedented Moneymaking Opportunities Here at Money Morning, we have one goal: to make investing profitable. In 2018 alone, our readers had the chance to book gains of 333%, 440%, and even 478% on stock trades that came from our research. We also kept our readers at the forefront of the hottest investing trends, like cannabis legalization. After we told Money Morning subscribers about top cannabis pick Tilray Inc., the stock soared 262%. But you wouldn’t know these opportunities were out there from listening to mainstream financial news… Cable news focused on the trade war as major indexes struggled to stay in the black. And Wall Street pundits couldn’t stop talking about the evils of Facebook as it slid 24% this year. -

Keurig to Acquire Dr Pepper Snapple for $18.7Bn in Cash

Find our latest analyses and trade ideas on bsic.it Coffee and Soda: Keurig to acquire Dr Pepper Snapple for $18.7bn in cash Dr Pepper Snapple Group (NYSE:DPS) – market cap as of 17/02/2018: $28.78bn Introduction On January 29, 2018, Keurig Green Mountain, the coffee group owned by JAB Holding, announced the acquisition of soda maker Dr Pepper Snapple Group. Under the terms of the reverse takeover, Keurig will pay $103.75 per share in a special cash dividend to Dr Pepper shareholders, who will also retain 13 percent of the combined company. The deal will pay $18.7bn in cash to shareholders in total and create a massive beverage distribution network in the U.S. About Dr Pepper Snapple Group Incorporated in 2007 and headquartered in Plano (Texas), Dr Pepper Snapple Group, Inc. manufactures and distributes non-alcoholic beverages in the United States, Mexico and the Caribbean, and Canada. The company operates through three segments: Beverage Concentrates, Packaged Beverages, and Latin America Beverages. It offers flavored carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs), including ready-to-drink teas, juices, juice drinks, mineral and coconut water, and mixers, as well as manufactures and sells Mott's apple sauces. The company sells its flavored CSD products primarily under the Dr Pepper, Canada Dry, Peñafiel, Squirt, 7UP, Crush, A&W, Sunkist soda, Schweppes, RC Cola, Big Red, Vernors, Venom, IBC, Diet Rite, and Sun Drop; and NCB products primarily under the Snapple, Hawaiian Punch, Mott's, FIJI, Clamato, Bai, Yoo- Hoo, Deja Blue, ReaLemon, AriZona tea, Vita Coco, BODYARMOR, Mr & Mrs T mixers, Nantucket Nectars, Garden Cocktail, Mistic, and Rose's brand names. -

Dr Pepper Snapple Group Transforms Its Category Management Process

Case study Allocation and Space Dr Pepper Snapple Group Transforms Its Category Management Process On the category management improvement “Our space methodology paired with Blue Yonder’s space planning capability optimizes days of supply and increases inventory turns on an item-by-item basis, which results in a reduction in excess inventory and a boost in cash 99% flow for the retailer. We can also reset our retail customers’ planograms improved accuracy twice a year or more, which many of our competitors just can’t handle.” - Director, Category Management, Dr Pepper Snapple Group Challenges • Dr Pepper Snapple Group (DPS) is one of North America’s leading refreshment beverage companies. The company sells its diverse and 15x popular soft drinks to top franchise businesses like Coca-Cola, Pepsi and reduction in labor hours other independent bottling companies throughout North America. With to maintain and update category management a core competency, the beverage company’s space, planograms assortment and speed-to-insight capabilities are continuously evolving. • DPS was challenged to mass produce store-specific planograms on a large scale to meet the changing needs of their retail customers without draining their time and resources. • The company’s goals were to improve the accuracy rate, increase efficiency, boost retail partnerships without increasing headcount and reducing excess inventory to achieve increased cash flow. On speeding up planogram production The Category Manager stated, “In order to increase our retail partnerships and categories without increasing headcount, we implemented proven solutions that would support our new approach to space management and help us speed up the planogram creation process.” The Blue Yonder solution automated the large-scale production of Blue Yonder’s expertise optimized, store-specific planograms, increasing Dr Pepper Snapple Group’s accuracy rate to 99 percent. -

Dr Pepper Snapple Group, Inc. – Name/Symbol/Cusip Change Futures Symbol: Dps1d New Symbol: Kdp1d Date: 7/10/18

#43331 DATE: JULY 9, 2018 SUBJECT: DR PEPPER SNAPPLE GROUP, INC. – NAME/SYMBOL/CUSIP CHANGE FUTURES SYMBOL: DPS1D NEW SYMBOL: KDP1D DATE: 7/10/18 The Options Clearing Corporation (OCC) has been informed that Dr Pepper Snapple Group, Inc. (DPS) will change its name, trading symbol and CUSIP to Keurig Dr Pepper Inc. (KDP), CUSIP 49271V100. As a result, futures symbol DPS1D will also change to KDP1D effective at the opening of business on July 10, 2018. All other terms will not change. Clearing Member input to OCC must use the new futures symbol KDP1D commencing July 10, 2018. DATE: July 10, 2018 FUTURES SYMBOL: DPS1D changes to KDP1D UNDERLYING SECURITY: DPS changes to KDP MULTIPLIER: 100 (e.g. 1 equals $100) NUMBER OF CONTRACTS: Unchanged DELIVERABLE PER CONTRACT: 100 Keurig Dr Pepper Inc. (KDP) Common Shares CUSIP: (New) 49271V100 DISCLAIMER This Information Memo provides an unofficial summary of the terms of corporate events affecting listed options or futures prepared for the convenience of market participants. OCC accepts no responsibility for the accuracy or completeness of the summary, particularly for information which may be relevant to investment decisions. Option or futures investors should independently ascertain and evaluate all information concerning this corporate event(s). The determination to adjust options and the nature of any adjustment is made by a panel of The OCC Securities Committee pursuant to OCC By-Laws, Article VI, Sections 11 and 11A. The adjustment panel is comprised of representatives from OCC and each exchange which trades the affected option. The determination to adjust futures and the nature of any adjustment is made by OCC pursuant to OCC By- Laws, Article XII, Sections 3, 4, or 4A, as applicable. -

Introducing Keurig Dr Pepper

Introducing Keurig Dr Pepper Investor Presentation Creating a New Challenger In the Beverage Industry Highly Confidential January 2018 Forward Looking Statements Certain statements contained herein are “forward-looking statements” within the meaning of applicable securities laws and regulations. These forward-looking statements can generally be identified by the use of words such as “anticipate,” “expect,” “believe,” “could,” “estimate,” “feel,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “should,” “will,” “would,” and similar words, phrases or expressions and variations or negatives of these words, although not all forward-looking statements contain these identifying words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements regarding the estimated or anticipated future results of the combined company following the proposed merger, the anticipated benefits of the proposed merger, including estimated synergies, the expected timing of completion of the proposed merger and related transactions and other statements that are not historical facts. These statements are based on the current expectations of Keurig Green Mountain Parent Holdings Corp. and Dr Pepper Snapple Group, Inc. management and are not predictions of actual performance. These forward-looking statements are subject to a number of risks and uncertainties regarding the combined company’s business and the proposed merger and actual results may differ materially. These risks and uncertainties -

Manitoba Liquor & Lotteries Category Price List Effective July 1, 2021

COMPUTER PRICE LIST BY BRAND CATEGORY Effective: July 1, 2021 LISTE DES PRIX PREPAREE PAR ORDINATEUR Entrée en vigueur le 1 juillet, 2021 TABLE OF CONTENTS MANITOBA LIQUOR & LOTTERIES PRICE LIST – BRAND CATEGORY - July 1, 2021 BEER WINE - CANADIAN Manitoba Liquor & Lotteries Distributed 136-143 Canadian Bulk Wine / Vin en Bloc 40 Canadian Flavoured Wine / Vins Aromatises 40 Canadian Fruit Wine / Vins de fruits-canadien 41 REFRESHMENT BEVERAGES Canadian Icewine / Vins de Glace 41-42 Cider / Cidres 123-126 Canadian Sparkling Wine / Vins Mousseaux-Canadien 43 Coolers - Wine and Spirit Based / à Base de Vin et D'Alcool 126-136 Canadian Red Wine / Vins Rouges-Canadien 43-49 Ready to Drink Non Alcohol/Prêt à boire non alcoolisée 136 Canadian Rosé Wine / Vin de Table-Rose Canadien 49-50 Canadian White Wine / Vins Blanc-Canadien 50-55 Canadian Miscellaneous Wine / Vins Divers-Canadien 42-43 LIQUEUR/LIQUOR (listed in alphabetical order by flavour) 5-12 WINE - IMPORTED SPIRITS Imported Bulk Wine / Vin en Bloc 55-56 Brandy / Eau-de Vie 1-2 Flavoured Wines / Vins Aromatises 56-57 Gin - Dry /Gin sec & Gin-Geneva/Gin geneve 2-4 Imported Fruit Wines / Vins de Fruits-Importes 57 Miscellaneous Spirits / Spiritueux divers 12-13 Imported Sparkling Wine /Vins Mousseaux-Importée 58-64 Rum / Rhum 13-17 Imported Red Table Wine /Vins Rouges-Importée 64-96 Tequila / Mezcal / Mezcal 17-20 Imported Rosé Wine / Vin de Table-Rose Importée 96-101 Vodka 20-26 Imported White Table Wine / Vins Blanc-Importée 101-118 Whiskey - Bourbon / Whiskey- bourbon 28-29 Imported -

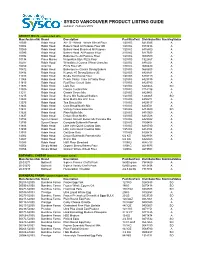

SYSCO VANCOUVER PRODUCT LISTING GUIDE Updated: February 2019

SYSCO VANCOUVER PRODUCT LISTING GUIDE updated: February 2019 ARDENT MILLS - updated April 2018 ManufacturerSkuBrand Description PackSizeText DistributorSku StockingStatus 10030 Robin Hood All - O - Wheat Whole Wheat Flour 1/20 KG 6413045 A 10082 Robin Hood Bakers Hood All Purpose Flour UB 1/20 KG 6518496 A 10089 Robin Hood Bakers Hood Bleached All Purpose 1/20 KG 6416800 A 10090 Robin Hood Bakers Hood All Purpose Flour 2/10 KG 6417693 A 10092 Robin Hood Bakersource All Purpose Flour 1/20 KG 9665589 A 10134 Primo Mulino Neapolitan Style Pizza Flour 1/20 KG 1922867 A 10287 Robin Hood Wheatlets 2 Coarse Wheat Granules 1/20 KG 6416337 A 10450 Arrezzio Pizza Flour UB 1/20 KG 9665480 A 10472 Robin Hood Bakersource Classic Strong Bakers 1/20 KG 9665605 A 10496 Robin Hood Keynote 45 Strong Bakers UB 1/20 KG 6429821 A 11013 Robin Hood Brodie Self Rising Flour 1/20 KG 6416719 A 11066 Robin Hood Peach Pastry Cake & Pastry Flour 1/20 KG 6429835 A 11810 Robin Hood Red River Cereal Oats 1/10 KG 6429783 A 11895 Robin Hood Light Rye 1/20 KG 6426466 SO 13505 Robin Hood Classic Custard Mix 1/10 KG 3214196 A 13211 Robin Hood Classic Scone Mix 1/20 KG 6429801 A 13215 Robin Hood Scone Mix Reduced Sodium 1/20 KG 1206665 SO 13323 Robin Hood Bran Muffin Mix LFC Free 1/10 KG 6398271 A 13575 Robin Hood Tea Biscuit Mix 1/10 KG 6429817 A 13602 Robin Hood Corn Bread/Muffin Mix 1/10 KG 6403721 A 13614 Robin Hood Variety Cookie Base Mix 1/20 KG 6412680 SO 13626 Robin Hood Plain Muffin Mix 1/20 KG 6410569 A 13637 Robin Hood Deluxe Bran Muffin 1/20 KG 6410528 A 13788 -

Avril - April 2015 Conagra Maître Saladier Pogo À Table Saucisses Sur Bâtonnet Salade De Chou Wieners on a Stick ¢ Blanche Crémeuse 120 Un

SPÉCIMEN Snack-Bar Avril - April 2015 Conagra Maître Saladier Pogo À Table Saucisses sur bâtonnet Salade de chou Wieners on a stick ¢ blanche crémeuse 120 un. 50 Creamy white coleslaw ¢ 5 kg 20 Skoulakis Lanières de poulet précuit Parmalat assaisonnées Mozzabene Precooked seasoned Fromage râpé style pub chicken strips $ Pub-style grated cheese $ 2 x 2,5 kg 1 4 x 2,27 kg 1 Menu Original Philly Rondelles d’oignon Boeuf tranché Onion rings ¢ Sliced beef ¢ 4 kg 25 40 x 110 g 25 Nachos triangulaires Weston Triangular nachos ¢ Pepe’s 6 x 454 g 25 Tortillas 10” ¢ Burgers de boeuf 12 x 12 un. 35 Beef burgers ¢ 56 x 91 g 25 Unilever Krispy Kernels Hellmann’s Vinaigrette / Dressing Arachides salées Salade de chou crémeuse Salted peanuts ¢ Creamy coleslaw ¢ 108 x 60 g 20 2 x 3,78 L 35 Yum Yum Croustilles / Chips BBQ ¢ 30 x 65 g 20 Lafleur Saucisses fumées, 6” Wieners, 6” 12 / lb ¢ 2 x 3 kg 60 Pour plus d’informations, contactez votre représentant. For more informations, contact your representative. Lassonde Kellogg’s Everfresh Frosted Flakes Jus d’orange concentré, 3 + 1 Céréales en sac Concentrated orange juice, Cereal in bag ¢ 3 + 1 ¢ 6 x 950 g 50 12 x 1 L 50 Dare Tropical Oasis Simple Plaisirs Jus de fraises surgelé Biscuits / Cookies Frozen strawberry juice ¢ 200 x 2 un. ¢ 12 x 960 ml 50 50 Agropur Louis Dreyfus Whole Sun Natrel Jus d’orange surgelé Crème, 10 % / Cream, 10% Frozen orange juice ¢ Portions ¢ 48 x 170 ml 25 200 x 15 ml 30 Canada Dry-Motts Mondelez– Christie Garden Cocktail Biscuits Thé social Cocktail de légumes Social Tea cookies ¢ Vegetable cocktail ¢ 200 x 2 un. -

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance NORTH AMERICA’S LEADING FLAVORED BEVERAGE COMPANY More than 50 brands of juices, teas and carbonated soft drinks with a heritage of more than 200 years NINE OF OUR 12 LEADING BRANDS ARE NO. 1 IN THEIR FLAVOR CATEGORIES Named Company of the Year in 2010 by Beverage World magazine CEO LARRY D. YOUNG NAMED 2010 BEVERAGE EXECUTIVE OF THE YEAR BY BEVERAGE INDUSTRY MAGAZINE OUR VISION: Be the Best Beverage Business in the Americas STOCK PRICE PERFORMANCE PRIMARY SOURCES & USES OF CASH VS. S&P 500 TWO-YEAR CUMULATIVE TOTAL ’09–’10 JAN ’10 MAR JUN SEP DEC ’10 $3.4B $3.3B 40% DPS Pepsi/Coke 30% Share Repurchases S&P Licensing Agreements 20% Dividends Net Repayment 10% of Credit Facility Operations & Notes 0% Capital Spending -10% SOURCES USES 2010 FINANCIAL SNAPSHOT (MILLIONS, EXCEPT EARNINGS PER SHARE) CONTENTS 2010 $5,636 NET SALES +2% 2009 $5,531 $ 1, 3 21 SEGMENT +1% Letter to Stockholders 1 OPERATING PROFIT $ 1, 310 Build Our Brands 4 $2.40 DILUTED EARNINGS +22% PER SHARE* $1.97 Grow Per Caps 7 Rapid Continuous Improvement 10 *2010 diluted earnings per share (EPS) excludes a loss on early extinguishment of debt and certain tax-related items, which totaled Innovation Spotlight 23 cents per share. 2009 diluted EPS excludes a net gain on certain 12 distribution agreement changes and tax-related items, which totaled 20 cents per share. See page 13 for a detailed reconciliation of the Stockholder Information 12 7 excluded items and the rationale for the exclusion. -

Dr Pepper Snapple Group Inc DPS (XNYS)

Morningstar Equity Analyst Report | Report as of 24 Oct 2014 | Page 1 of 8 Dr Pepper Snapple Group Inc DPS (XNYS) Morningstar Rating Last Price Fair Value Estimate Price/Fair Value Dividend Yield % Market Cap (Bil) Industry Stewardship QQ 66.69 USD 52.00 USD 1.39 2.40 13.06 Beverages - Soft Drinks Standard 24 Oct 2014 24 Oct 2014 24 Oct 2014 24 Oct 2014 Morningstar Pillars Analyst Quantitative Economic Moat Narrow Wide Dr Pepper's continued productivity initiatives should help offset end- Valuation QQ Overvalued Uncertainty Medium Medium market headwinds. Financial Health BBB+ Strong Adam Fleck, CFA, 24 October 2014 repurchases. Source: Morningstar Equity Research Investment Thesis Quantitative Valuation Dr Pepper Snapple’s (DPS) brands enjoy solid positions Adam Fleck, CFA, 23 October 2014 DPS USA s within their particular markets, but limited geographic Analyst Note reach, partial reliance on competitors for bottling and After reviewing narrow-moat Dr Pepper Snapple's Undervalued Fairly Valued Overvalued distribution, and an overall trailing position constrain our third-quarter results, we will probably raise our $48 per Current 5-Yr Avg Sector Country moat rating to narrow. share fair value estimate 5% to 10% to account for Price/Quant Fair Value 1.18 1.05 0.94 0.86 continued solid execution. Cost control remained strong Price/Earnings 18.5 14.9 19.3 20.0 Following its split from parent company Cadbury in the quarter. Core operating margins rose 70 basis points Forward P/E 17.7 — 16.9 15.0 Price/Cash Flow 13.3 11.0 12.0 12.0 Schweppes in 2008, DPS retained the U.S., Canadian, year over year to 20.1%, and combined with a slightly Price/Free Cash Flow 16.1 16.8 20.5 20.4 Mexican, and Caribbean rights to its core brands; outside lower expected tax rate and a beneficial raw material cost Dividend Yield % 2.40 2.47 1.97 2.08 these regions, competitors such as Coca-Cola and PepsiCo environment, management raised its full-year earnings Source: Morningstar own the rights. -

Broward County Public Schools Approved Smart Snacks Beverages

Updated October 25, 2019 Broward County Public Schools Approved Smart Snacks Beverages All Brands (water) MS/HS Unflavored water Any size Aquafina Flavor Splash (berry berry, Aquafina HS color me kiwi, really raspberry) 20 oz. Aquafina Flavor Splash sparkling Aquafina HS ( kiwi strawberry, orange citrus) 16.9 oz. Bubly HS Assorted Sparking Waters 12 oz. Campbell Soup Co. MS/HS V-8 Fusion 100 % Juice 8 oz. Canada Dry HS Canada Dry 10-Gingerale 12 oz. Canada Dry HS Diet Ginger Ale 12 oz. Sparkling Seltzer Water Canada Dry HS (Unflavored) 12 oz. Sparkling Seltzer Water (Raspberry, Canada Dry HS Strawberry) 12 oz. Clement Pappas & Co., Inc. MS/HS Fruit Punch-100% Juice 8 oz. Coca-Cola HS POWERADE ZERO Fruit Punch 12 oz. Coca-Cola HS Diet Barq's Beer 12 oz., 20 oz. Coca-Cola HS Cherry Zero, Vanilla Zero 12 oz., 20 oz. Coca-Cola HS Fresca-Original Citrus 12 oz., 20 oz. Coca-Cola HS Fanta Orange Zero 12 oz., 20 oz. Updated October 25, 2019 Broward County Public Schools Approved Smart Snacks Beverages Coca-Cola HS Coke Zero 12 oz., 20 oz. Coca-Cola HS Diet Coke 12 oz., 20 oz. Coca-Cola HS Glaceau vitaminwater 20 oz. Coca-Cola HS Glaceau smartwater 20 oz. Coca-Cola HS Mello-Yellow Zero 12 oz., 20 oz. Coca-Cola HS Pibb Zero 12 oz., 20 oz. Coca-Cola HS Sprite Zero 12 oz., 20 oz. Coca-Cola HS FRESCA 12 oz. Dasani HS Strawberry Dasani 20 oz. Dasani HS Lemon Dasani 20 oz. Dr. Pepper-Snapple HS A& W Root Beer 10 12 oz. -

Dr Pepper Snapple Group, Inc Annual Report 2018

Dr Pepper Snapple Group, Inc Annual Report 2018 Form 10-K (NYSE:DPS) Published: February 14th, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D. C. 20549 Form 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to C ommission file number 001-33829 (Exact name of Registrant as specified in its charter) Delaware 98-0517725 (State or other jurisdiction of (I.R.S. employer incorporation or organization) identification number) 5301 Legacy Drive, Plano, Texas 75024 (Address of principal executive offices) (Zip code) Registrant's telephone number, including area code: (972) 673-7000 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered COMMON STOCK, $0.01 PAR VALUE NEW YORK STOCK EXCHANGE Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yesx No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.