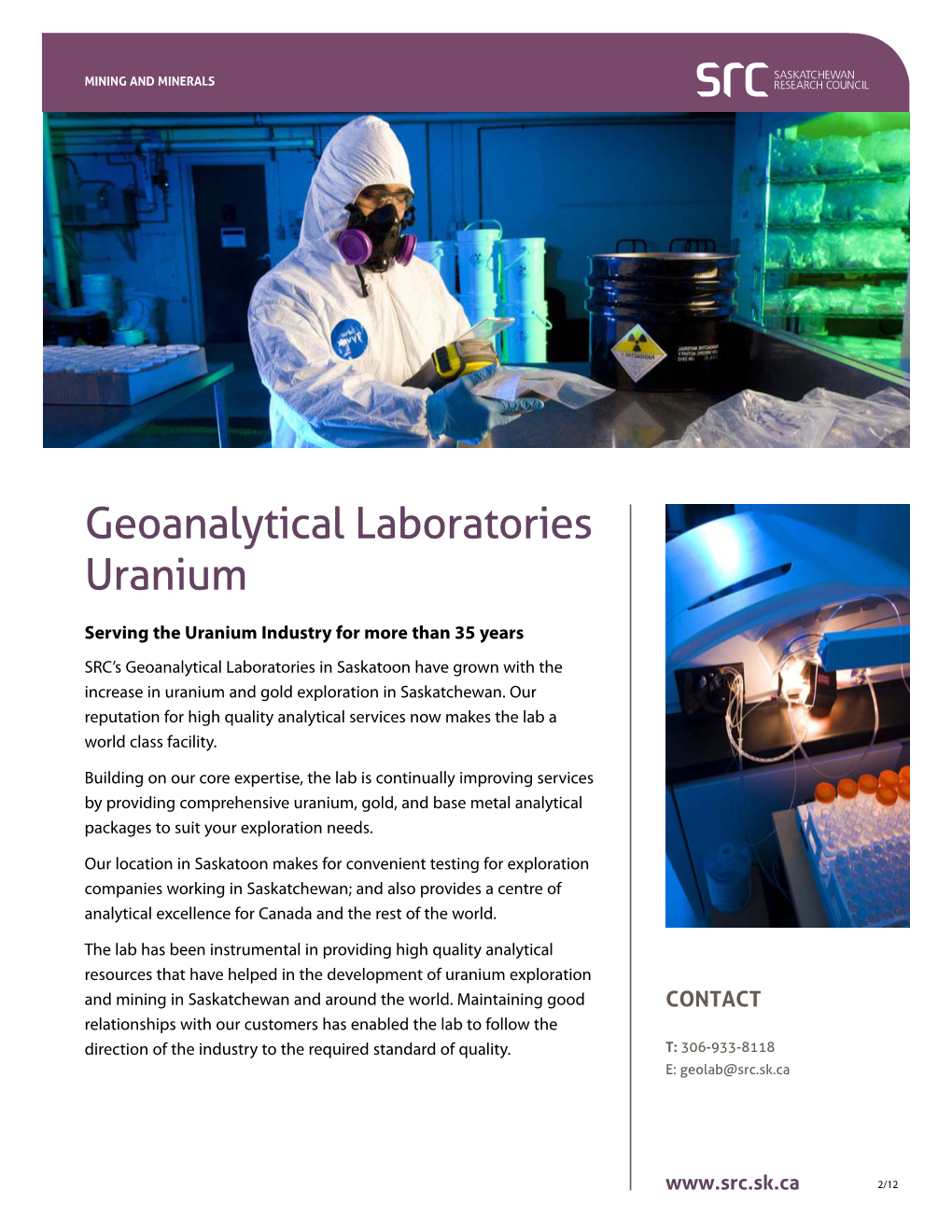

Geoanalytical Laboratories Uranium Fact Sheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fs and Sentiments Will Continue to Impact These Target Commodities

FORUM ENERGY METALS CORP. INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS For the six month periods ended May 31, 2020 and 2019 (Unaudited – Prepared by Management) (Stated in Canadian Funds) NOTICE OF NO REVIEW BY AUDITOR The accompanying unaudited interim condensed consolidated financial statements of Forum Energy Metals Corp. (“the Company”) have been prepared by management and have not been the subject of a review by the Company’s independent auditor. Forum Energy Metals Corp. (An Exploration Stage Company) Interim Condensed Consolidated Statements of Financial Position as at Canadian Funds Unaudited - prepared by management May 31, 2020 November 30, 2019 Note ($) ($) ASSETS Current assets Cash 4 275,970 131,308 Marketable securities 5 15,095 7,901 Receivables 6 66,771 26,032 Prepaid expenses and deposits 44,182 38,038 402,017 203,279 Equipment 1,988 2,316 Exploration and evaluation assets 7 2,671,010 2,671,010 3,075,014 2,876,605 LIABILITIES Current liabilities Accounts payable and accrued liabilities 21,567 263,649 Due to related parties 9 30,940 255,170 Promissory notes 7 82,722 79,806 135,229 598,625 Loan 8 40,000 - 175,229 598,625 SHAREHOLDERS’ EQUITY Capital stock 9 45,535,243 45,214,204 Allotted but not issued - - Contributed Surplus - Options 9 5,465,784 5,325,114 Contributed Surplus - Warrants 9 2,339,652 2,339,652 Accumulated deficit (50,440,893) (50,600,990) 2,899,786 2,277,980 3,075,014 2,876,605 Nature of Operations and Going Concern – Note 1 Subsequent Event – Note 12 Approved and authorized by the Board of Directors on July 27, 2020: ”Richard Mazur” “Larry Okada” Richard Mazur Larry Okada Director Director The accompanying notes are an integral part of these financial statements 2 | P a g e Forum Energy Metals Corp. -

A Preeminent Uranium Explorer in Canada's Athabasca Basin

A Preeminent Uranium Explorer in Canada’s Athabasca Basin TSX-V: SYH October 2021 Disclaimer This presentation has been prepared by Skyharbour Resources Ltd. (“SYH”) using its best efforts to realistically and factually present the information contained. However, subjective opinion, dependence upon factors outside SYH’s control and outside information sources unavoidably dictate that SYH cannot warrant the V: SYH | SKYHARBOURLTD.COM information contained to be exhaustive, complete or sufficient. In addition, many factors can effect the - presentation which could significantly alter the results intended by SYH, rendering the presentation TSX unattainable or substantially altered. Therefore, interested uses should conduct their own assessment and consult with their own professional advisors prior to making any investment decisions. This presentation does not constitute a prospectus or public offering for financing, and no guarantees are made or implied with regard to the success of SYH proposed ventures. Interested investors are advised to seek advice from the investment advisors. Some of the statements in this document may be deemed to be "forward-looking statements". All statements on in this document, other than statements of historical facts, that address events or developments that management of the Company expects, are forward-looking statements. Although management believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, and actual results or developments may differ materially from those in the forward-looking statements. The Company undertakes no obligation to update these forward- looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause actual results to differ materially from those in forward-looking statements, include market prices, exploration and development successes, continued availability of capital and financing, and general economic, market or business conditions. -

Cameco Corporation Announces Intention to Acquire Hathor Exploration Limited Conference Call Friday, August 26, 2011 – 9:00 AM ET

Cameco Corporation Announces Intention to Acquire Hathor Exploration Limited Conference Call Friday, August 26, 2011 – 9:00 AM ET CORPORATE PARTICIPAN TS With us are Tim Gitzel, Cameco’s President and CEO, and Ken Seitz, Cameco’s Senior Vice-President of Rachelle Girard Marketing and Business Development. Tim will begin with Manager, Investor Relations brief comments on the proposed takeover bid and the benefits it provides for Hathor shareholders. Then we’ll Tim Gitzel open it up for your questions. President & Chief Executive Officer Today’s conference call is open to all members of the Ken Seitz investment community. The media is also invited to ask Senior Vice-President, Marketing & Business questions but we would ask that you reserve your Development questions for the end of the call to allow the investment community the opportunity to ask their questions first. During the Q&A session please limit yourself to two questions then return to the queue. CONFERENCE CALL PART ICIPANTS Please note that this conference call and webcast will Adam Schatzker include forward-looking information and statements, RBC Capital Markets which involve risk and uncertainty. Certain material factors or assumptions were applied in drawing the Greg Barnes conclusions or making the forecasts or projections TD Securities reflected in them and actual results could differ materially. Additional information about these material factors and Terry Ortslan assumptions is contained in our press release dated TSO & Associates August 26, 2011 and in Cameco’s and Hathor’s most recent annual information form and MD&A. Ben Elias Sterne Agee With that I’ll turn it over to Tim. -

Saskatchewan Exploration and Development Highlights 2016 Miscellaneous Report 2016 4

Saskatchewan Exploration and Development Highlights 2016 PDAC Edition (March 2017) Compiled by Staff of the Saskatchewan Ministry of the Economy Miscellaneous Report 2016-4 Saskatchewan Exploration and Development Highlights Updates October 11, 2016 – February 10, 2017 • Uranium production in 2016 from Saskatchewan’s three operations totaled 36.4 million (M) pounds (lb) triuranium octoxide (U3O8) including 18 M lb U3O8, from the McArthur River mine - Key Lake mill, 17.3 M lb U3O8, from the Cigar Lake mine – McLean Lake mill and 1.1 M lb U3O8 from Rabbit Lake operation which was put in care and maintenance in April 2016. Production for 2017 is forecasted to be 36 M lb U3O8 with 18 M lb coming from each of the two active operations. • The southwest part of the Athabasca Basin is the focus of several substantive winter exploration programs including: o Nexgen Energy Ltd.’s 35 000 metre (m) drill program at its Rook 1 property, designed to further delineate the extents of the Arrow deposit; o Fission Uranium Corp. has planned over 19 000 m of drilling at its Patterson Lake South property where the company will continue to delineate the Triple R deposit as well as explore high-priority regional exploration targets; and, o Purepoint Uranium Group Inc. (partners AREVA Resources Canada Inc. (AREVA) and Cameco Corp. (Cameco)) is undertaking approximately 12 000 m of drilling at its Hook Lake project where the company is delineating the Spitfire zone. • Uranium exploration programs are also occurring on the east side of the basin including: o at the Wheeler River Joint Venture project where Denison Mines Corp. -

ORE Magazine

THE OFFICIAL PUBLICATION OF THE SASKATCHEWAN MINING AssOCIATION $43 BILLION You’re standing on it. REAL WEALTH OUR “HAVE PROVINCE” HAS MORE THAN MOST OF US REALIZE. LEARNING TO HANDLE DEMAND WANTED: 18,000 SKILLED woRKERS. CAN WE GROW OUR OWN? POTASH: WORTH THE FIGHT ON PACE TO HIT 7 BILLION THIS YEAR, THE woRLD POPULATION DOESN’T JUST WANT POTASH. IT NEEDS IT. SPRING/SUMMER 2011 $6.95 ORE | THE OFFICIAL PUBLICATION OF THE SASKATCHEWAN MINING AssOCIATION SPRING/SUMMER 2011 CONTENTS ORE is produced solely by the Saskatchewan Mining PotasH : LE ARNING Association. COVER stORY WORTH THE to HANDLE HEAD OFFICE FIGHT DEMAND Suite 1500 $43 BILLION 2002 Victoria Avenue Investing here – The world wants Education and industry Regina, Saskatchewan what we have. are working S4P 0R7 big time. together. Telephone: (306) 757-9505 Fax: (306) 569-1085 16 10 22 www.saskmining.ca Messages from Executive Director CONTACT FOR and SMA President 2 ADVERTISERS Tap Communications Inc. 505-230 22nd Street East Message From the Premier 3 Saskatoon, Saskatchewan S7K 0E9 What to Watch For 4 Telephone: (306) 373-7330 [email protected] 2011 SMA Calendar of Events 7 Real Wealth An Interview with Neil McMillan, Claude Resources 8 T The New Silk Road 26 ABLE OF Safety and the Environment: Facts and Figures 28 CON All rights reserved. The contents Our CEOs – Beyond the Bio T of this publication may not be EN Jerry Grandey, Cameco CEO 30 TS reproduced in whole or part without consent of the copyright owner. Tagging Along Mosaic’s Jessica Theriault 32 1 ORE | THE OFFICIAL PUBLICATION OF THE SASKATCHEWAN MINING AssOCIATION SPRING/SUMMER 2011 ORE | THE OFFICIAL PUBLICATION OF THE SASKATCHEWAN MINING AssOCIATION SPRING/SUMMER 2011 WELCOME! PREMIER’S MESSAGE A MESSAGE FROM On behalf of the Government We are expanding more than 30,500 direct of Saskatchewan, it is exploration and developing and indirect jobs, and in SMA EXECUTIVE DIRECTOr – PAM SCHWANN my pleasure to welcome our geological potential for jobs induced by the mining readers to the inaugural diamonds, rare earth metals, sector. -

Saskatchewan Exploration and Development Highlights 2018 Compiled by Sta of the Saskatchewan Ministry of Energy and Resources

Saskatchewan Exploration and Development Highlights 2018 Compiled by Sta of the Saskatchewan Ministry of Energy and Resources Miscellaneous Report 2018-2 Although the Saskatchewan Ministry of Energy and Resources has exercised all reasonable care in the compilation, interpretation and production of this report, it is not possible to ensure total accuracy, and all persons who rely on the information contained herein do so at their own risk. The Ministry of Energy and Resources and the Government of Saskatchewan do not accept liability for any errors, omissions or inaccuracies that may be included in, or derived from, this report. Information from this publication may be used if credit is given. It is recommended that reference to this publication be made in the following form: Saskatchewan Ministry of Energy and Resources (2018): Saskatchewan Exploration and Development Highlights 2018; Saskatchewan Geological Survey, Saskatchewan Ministry of Energy and Resources, Miscellaneous Report 2018-2, 17p. To use information from one of the tables, reference to the table should be made in the following form: Saskatchewan Ministry of Energy and Resources (2018): Production totals for current gold mining operations and published Reserves/Resources for selected gold deposits in Saskatchewan; Table 3 in Saskatchewan Exploration and Development Highlights 2018, Saskatchewan Geological Survey, Saskatchewan Ministry of Energy and Resources, Miscellaneous Report 2018-2, p.9. Cover photo courtesy of Star Diamond Corp.: Photo shows a Trench Cutter Sampling Rig on Star Diamond Corp.’s Star-Orion South Kimberlite project in the Fort à la Corne diamond district east of Prince Albert, Saskatchewan. The Trench Cutter Sampling Rig consists of a Bauer BC 50 Cutter mounted on a Bauer MC 128 Duty-cycle Crane. -

Saskatchewan Exploration and Development Highlights 2008

19 48 SaskatchewanSaskatchewan ExplorationExploration andand DevelopmentDevelopment HighlightsHighlights 20082008 (PDAC Edition) CompiledCompiled byby StaffStaff ofof thethe SaskatchewanSaskatchewan MinistryMinistry ofof EnergyEnergy andand ResourcesResources Updates on Saskatchewan Exploration and Development Activity as of February 11, 2009 • As of January 31, 2009, there were: 6,898 active mineral dispositions totalling 10 354 422 hectares (ha) and five pending dispositions totalling 1836 ha; 191 active potash dispositions totalling 4 465 141 ha and five pending applications covering another 98 986 ha; and 4,725 active coal dispositions totalling 2 963 135 ha with an additional 1,441 pending coal applications covering 919 049 ha. • Joint venture partners AREVA (operator), Denison, and OURD Co. announced that they have postponed development of the Midwest deposit due to the current financial conditions. • UEX announced the results of their NI 43-101–compliant resource estimate for the Raven deposit. It contains 9.15 million (M) lb. U3O8 in the Indicated category and a further 1.13 M lb. in the Inferred category. The overall grade is just above 0.1% U3O8. • UEX announced that it and operator AREVA have identified a zone of continuous unconformity mineralisation between the Kianna and Anne deposits with a strike length of at least 900 m. • Claude Resources reported final 2008 gold production results for the Seabee Mine, including ore from the satellite Santoy 7 deposit, of 45,466 oz., 13,551 oz. of which was in the fourth quarter. • Golden Band Resources Inc. announced the completion of an independent pre- feasibility study for its La Ronge Gold Project. The independent consultants concluded that the operating plan for the proposed four-year project is economically viable based on the open pit mining of the Komis and EP gold deposits, underground mining of the Bingo gold deposit, and use of the existing Jolu mill. -

Equity Research DENISON MINES CORP

June 3, 2013 Initiating Coverage DENISON MINES CORP. The next uranium M&A target? INVESTMENT THESIS Recommendation: BUY (Speculative) Denison Mines has actively re-shaped its corporate Symbol/Exchange: DML-TSX / DNN-NYSE focus given numerous asset divestments and Sector: Metals & Mining acquisitions over the past year. The company has All dollar values in C$ unless otherwise noted. transitioned from a U.S.-based, high-cost uranium Current price: $1.33; US$1.29 producer to a premier exploration company with One-year target: $1.60 world class assets and critical mass in the Return Target: 20.3% Athabasca Basin. It is the next likely target of Cash on hand: $39.9M significance for M&A activity in the uranium space. Company Summary VALUATION Shares O/S (M) 461.3 52-week range $1.06 - $1.68 Market cap ($M) $613.6 Avg. weekly vol. (M) 4.5 We are initiating coverage on Denison with a target Market float ($M) $532.6 Fiscal year-end 31-Dec price of $1.60 per share and a BUY (Speculative) Revenue Generating Assets recommendation. Our valuation is based on a 1.0x McLean Lake Mill multiple on conservative net asset value of Uranium Participation Management Contract Denison’s portfolio. Measured & Indicated Resource Tonnes U3O8 Grade Attrib Resource Gurvan Saihan JV 12,261,000 0.07% 16.81 M lbs FOCUS POINTS McClean Lake Deposits 778,700 2.44% 4.25 M lbs Midwest 818,000 4.91% 12.26 M lbs ▪ World-Class Portfolio: Denison’s impressive Mutanga 10,280,000 0.03% 7.81 M lbs portfolio includes the Wheeler River project, Waterbury Lake 307,000 1.52% 6.17 M lbs which contains the Phoenix deposit that is Wheeler River Project 152,400 15.60% 31.38 M lbs currently the highest grade uranium deposit in Inferred Resource U3O8 Grade Resource the world. -

'Basin-Related' Uranium Deposits

ReducingReducing MechanismsMechanisms PotentiallyPotentially InvolvedInvolved inin FormationFormation ofof AthabascaAthabasca BasinBasin UraniumUranium Deposits:Deposits: RelevanceRelevance toto ExplorationExploration GaryGary YeoYeo1 && EricEric PotterPotter2 1 Denison Mines Corp. 2 Geological Survey of Canada 1 Original Title – this would take a lot more than 20 minutes to cover! ReducingReducing MechanismsMechanisms PotentiallyPotentially InvolvedInvolved inin FormationFormation ofof ‘‘BasinBasin-- RelatedRelated’’ UraniumUranium Deposits:Deposits: RelevanceRelevance toto AthabascaAthabasca BasinBasin GaryGary YeoYeo1 && EricEric PotterPotter2 1 Denison Mines Corp. 2 Geological Survey of Canada 2 We’re just a couple of geologists Us geochemists? Narf! Note that this is not a geochemist’s review of the 3 Athabasca reductant problem 3 TheThe AthabascaAthabasca BasinBasin DepositDeposit ModelModel ThreeThree componentscomponents inin thethe conventionalconventional modelmodel forfor AthabascaAthabasca deposits:deposits: 1. At sub-Athabasca unconformity, 2. Associated with reverse faults 3. Associated with graphitic pelites QuestionQuestion (Mike(Mike Gunning):Gunning): AreAre graphiticgraphitic pelitespelites essentialessential toto thisthis model?model? If Yes: focus exploration along the Key Lake – Rabbit Lake corridor associated with basal Wollaston graphitic pelites; drill conductors If No: much more of Athabasca basin is prospective; deposits not necessarily associated with graphitic pelite conductors 4 From Cuney (2009) 5 HoeveHoeve -

Cameco Updates Hathor Shareholders on Status of Premium Offer

TSX: CCO website: cameco.com NYSE: CCJ currency: Cdn (unless noted) 2121 – 11th Street West, Saskatoon, Saskatchewan, S7M 1J3 Canada Tel: (306) 956-6200 Fax: (306) 956-6201 Cameco Updates Hathor Shareholders on Status of Premium Offer Saskatoon, Saskatchewan, Canada, October 17, 2011 . Cameco (TSX: CCO; NYSE: CCJ) today mailed to Hathor Exploration Ltd. (TSX: HAT) shareholders a letter from Tim Gitzel, president and CEO of Cameco. The letter should arrive in the next few days. The content of the letter follows: Dear Hathor Exploration shareholder: You have a unique opportunity to receive an immediate and substantial premium by tendering to Cameco’s offer to acquire Hathor for $3.75 per share. However, the October 31, 2011 5:00 p.m. (Vancouver time) deadline is quickly approaching. Hathor shareholders who wish to take advantage of the offer need to ensure they do so prior to the expiry time of the offer. While you need to make a decision regarding your Hathor shares, the reasons to accept our offer are straightforward. An Attractive Premium Offer Despite the recent turbulence in the markets and uncertainty about the future, Cameco’s offer has not been withdrawn or reduced and continues to offer an attractive premium of: 40% over Hathor’s closing share price on August 25, 2011 (the last trading day prior to the announcement of Cameco’s intention to make an offer) 33% over Hathor’s 20-day volume weighted average price as at August 25, 2011 31% over Hathor’s share price prior to the general decline in the share prices of uranium companies since March 2011. -

Geology of the Scimitar Lake Area

Review of Reducing Mechanisms Potentially Involved in the Formation of Unconformity-type Uranium Deposits and their Relevance to Exploration G.M. Yeo 1 and E.G. Potter 2 Yeo, G.M. and Potter, E.G. (2010): Review of reducing mechanisms potentially involved in the formation of unconformity-type uranium deposits and their relevance to exploration; in Summary of Investigations 2010, Volume 2, Saskatchewan Geological Survey, Sask. Ministry of Energy and Resources, Misc. Rep. 2010-4.2, Paper A-12, 13p. Abstract The essential ingredients for ‘basin-related’ uranium deposits are oxidizing, U 6+-bearing fluids and focussed reduction of mobile U 6+ to immobile U 4+. The more critical problem is the reducing mechanism, since it constrains exploration targeting (i.e., is graphitic metapelite essential in the basement of the Athabasca Basin, or is a broader range of basement rocks favourable?). Potential reducing systems in sedimentary basins may be carbon based (e.g., particulate organic material, fluid 2+ hydrocarbons, graphite or graphite-derived compounds) or inorganic (e.g., mineral surfaces, Fe or H2S from oxidation of sulphides, or Fe2+ from chloritization or illitization of ferromagnesian minerals). Microbial activity may be involved in both and more than one U 6+ reduction mechanism may have been responsible for development of the various Athabasca deposits. Plant fragments reduced many Phanerozoic sandstone-hosted uranium deposits. Oncoids and biolaminites in the basal Athabasca sandstones suggest widespread primary particulate organic material. Early diagenetic hematitization of the sandstone, however, would have oxidized this prior to formation of the uranium deposits >1590 Ma. Fluid hydrocarbons or related humates are also thought to have reduced some stratiform sandstone-hosted uranium deposits elsewhere. -

Company Report – Watch List August 10, 2020

Company Report – Watch List August 10, 2020 $0.30 1.40 CanAlaska Uranium Ltd. (TSXV: CVV) $0.25 1.20 Project generator mining company focused on a portfolio of Uranium 1.00 $0.20 projects in Saskatchewan and Nickel projects in Manitoba 0.80 $0.15 Price ($)Price 0.60 (M) Volume $0.10 COMPANY DESCRIPTION: 0.40 $0.05 0.20 CanAlaska Uranium Ltd. (“CanAlaska” or the “Company”) is a junior mineral $0.00 0.00 Aug-19 Oct-19 Dec-19 Feb-20 Apr-20 Jun-20 Aug-20 exploration and Project Generator company focused primarily on uranium, nickel and diamond projects in western Canada. Currently, the Company controls 132,300 REVISIONS Rev. Prior hectares across 9 uranium projects in northern Saskatchewan & Manitoba, 25,000 Rating Watch List hectares across 3 nickel projects in northern Manitoba and two base metal projects Target Price Watch List in northern Manitoba & B.C., and 2 diamond projects covering 57,752 hectares in Revenue F2020E (M) $0.0 Saskatchewan & Alberta. Revenue F2021E (M) $0.0 INVESTMENT THESIS AND UPCOMING CATALYSTS: MARKET DATA Portfolio of Energy Metal Projects in World Class Areas: CanAlaska has a Aug 7, 2020 Date: portfolio of uranium and nickel projects as nuclear power and battery technology Current Price (C$): $0.21 form part of the carbon-free energy solution. 52-Week Range: $0.09 / $0.29 Shares O/S (M): 57.6 Joint Venture with Cameco at West McArthur Lake has Large Halo and Mkt Cap ($M); $12.1 Plenty of Potential: $25 million was spent on exploration by Mitsubishi before EV ($M): $10.2 they retrenched from the region.