Reagan Roundtable

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

California Standards

-p -- .. California Standards History-Social Science 11.8 Students analyze the economic boom and social transformation of post-World War II America. 11.9 Students analyze U.S. foreign policy since World War II. 11.11 Students analyze the major social problems and domestic policy issues in contemporary American society. September 1981 Sandra Day O'Connor becomes Reagan loved a crowd, and the crowds loved first female U.S. him. His vitality, gentle humor, and dynamic Supreme Court Justice. speaking style charmed even his opponents. In his journey from actor to president, Reagan used all his skills to reach out to voters and 1980 Lech Walesa's persuade America to move in a new direction. Solidarity trade Interpreting Visuals What can you infer about union leads World Reagan 's personality from this photograph? protests in Poland. See Skills Handbook, p. H30 1982 Deepest U.S. November 1985 January recession since Reagan and Gorbachev 1989 February 1991 the Great meet in the first of George H. W. In First Gulf War, U.S. Depression their arms reduction Bush becomes Ied coalition ousts begins. summits. president. Iraq from Kuwait. October 1983 March 1985 June 1989 November Suicide Mikhail Gorbachev China crushes 1989 bombers becomes leader of pro-democracy Berlin Wall falls attack U.S. the Soviet Union. protests in as protests bring peacekeepers Tiananmen down Communist in Lebanon, Square. regimes in killing 241. Eastern Europe. 693 [4;l cm;:J 11.9.3 Trace the geo BEFORE You READ political consequences of the Cold War and contain MAIN IDEA READING FOCUS KEY TERMS AND PEOPLE ment policy. -

HPI Analysis: Rokita's Senate Edge

V23, N15 Tuesday, Nov. 28, 2017 HPI Analysis: Rokita’s Senate edge While no one has GOP race locked up, Rokita is closer than many might think By MARK SOUDER FORT WAYNE – Obviously, Congressman Todd Rokita has not locked up the Republican nomination for Senate yet, but he is closer than most think. It is no surprise that Rokita has a significant early lead. He has twice run and won statewide for secretary of state, as well as serving as a congressman. Rokita’s district, like that of his fellow Wabash College graduate, Congressman Luke Messer, includes important parts of the Indianapolis metro area (the U.S. Rep. Todd Rokita brandishing his “defeat the elite” campaign at the State- heavily Republican donut). In a statewide Repub- house last summer. (HPI Photo by Brian A. Howey) lican primary election, the Indianapolis metro area dominates. received publicity in the Indianapolis market over mul- As media fragments, the difficulty of establish- tiple years is critical. Beyond that, in addition to Rokita’s ing name identification exponentially increases. The fact secretary of state advertising and statewide travels, he that Rokita and Messer have purchased advertising and Continued on page 3 Tax reform, Reagan style By BRIAN A. HOWEY NASHVILLE, Ind. – Step aboard Howey’s Way Back Machine to 1985 and 1986, when it was morning in America and President Ronald Reagan wielded moral authority and an ability for cutting deals to achieve great “We will use a healthy dialogue outcomes. The Way Back Machine with the people of Indiana to reveals that the Tax Reform Act of 1986, which simplified the form the basis for proposals we income tax code, broadened the will be advancing during the 2018 tax base and eliminated many tax shelters, was sponsored by General Assembly and beyond.” Democrats Richard Gephardt in - House Minority Leader the House and Bill Bradley in the Senate. -

Executive Orders & Proclamations of General Applicability, and Statements Issued by the Governor Pursuant to Ars § 41-1013(B)

Arizona Administrative Register / Secretary of State Semiannual Index EXECUTIVE ORDERS & PROCLAMATIONS OF GENERAL APPLICABILITY, AND STATEMENTS ISSUED BY THE GOVERNOR PURSUANT TO A.R.S. § 41-1013(B)(2) AND (3) The Administrative Procedure Act requires all Executive Orders and Proclamations of General Applicability issued by the Governor to be published in the Arizona Administrative Register. In addition, the Register shall include each statement filed by the Governor in granting a commutation, pardon or reprieve, or stay or suspension of execution where a sentence of death is imposed. Spelling, grammar, and punctuation of these orders has been reproduced as submitted. Governor’s Executive Orders and Proclamations of general applicability are on file with the Office of the Secretary of State and are available for public viewing from the Public Services Division between 8:00 a.m. and 5:00 p.m., Monday through Friday (except state holidays) at 1700 W. Washington St., 7th Floor in Phoenix. Call (602) 542-4086 for more information. EXECUTIVE ORDERS FILED JANUARY 1 THROUGH JUNE 30, 2013 Volume, Issue, and Page Executive Title No. Published in the File Order No. Administrative Register No. Vol. 19, Semiannual Index, 2013-01 Workforce Arizona Council June 30, 2013, p. 102 M13-83 Vol. 19, Semiannual Index, 2013-02 Establishing the Arizona Natural Resources Review Council June 30, 2013, p. 104 M13-81 Vol. 19, Semiannual Index, 2013-03 Establishing Arizona’s Master Energy Plan June 30, 2013, p. 105 M13-82 Vol. 19, Semiannual Index, 2013-04 Establishing the Governor’s Task Force on Human Trafficking June 30, 2013, p. -

Ronald Reagan

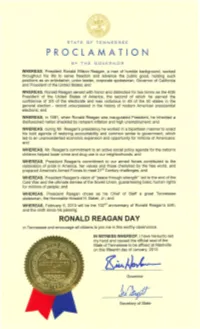

STATE OF TENNESSEE PROCLAMATION BY THE GOVERNOR WHEREAS, President Ronald Wilson Reagan, a man of humble background, worked throughout his life to serve freedom and advance the public good, holding such positions as an entertainer, union leader, corporate spokesman, Governor of California and President of the United States; and WHEREAS, Ronald Reagan served with honor and distinction for two terms as the 40th President of the United States of America, the second of which he earned the confidence of 3/5 of the electorate and was victorious in 49 of the 50 states in the general election - record unsurpassed in the history of modern American presidential elections; and WHEREAS, in 1981, when Ronald Reagan was inaugurated President, he inherited a disillusioned nation shackled by rampant inflation and high unemployment; and WHEREAS, during Mr. Reagan's presidency he worked in a bipartisan manner to enact his bold agenda of restoring accountability and common sense to government, which led to an unprecedented economic expansion and opportunity for millions of Americans; and WHEREAS, Mr. Reagan's commitment to an active social policy agenda for the nation's children helped lower crime and drug use in our neighborhoods; and WHEREAS, President Reagan's commitment to our armed forces contributed to the restoration of pride in America, her values and those cherished by the free world, and prepared America's Armed Forces to meet 21st Century challenges; and WHEREAS, President Reagan's vision of "peace through strength" led to the end of the Cold War and the ultimate demise of the Soviet Union, guaranteeing basic human rights for millions of people; and WHEREAS, President Reagan chose as his Chief of Staff a great Tennessee statesman, the Honorable Howard H. -

Journal of the Senate 92Nd Legislature REGULAR SESSION of 2004

No. 89 STATE OF MICHIGAN Journal of the Senate 92nd Legislature REGULAR SESSION OF 2004 Senate Chamber, Lansing, Wednesday, September 15, 2004. 10:00 a.m. The Senate was called to order by the President, Lieutenant Governor John D. Cherry, Jr. The roll was called by the Secretary of the Senate, who announced that a quorum was present. Allen—present Emerson—present Olshove—present Barcia—present Garcia—present Patterson—present Basham—present George—present Prusi—present Bernero—present Gilbert—present Sanborn—present Birkholz—present Goschka—present Schauer—present Bishop—present Hammerstrom—present Scott—present Brater—present Hardiman—present Sikkema—present Brown—present Jacobs—present Stamas—present Cassis—present Jelinek—present Switalski—present Cherry—present Johnson—present Thomas—present Clark-Coleman—present Kuipers—present Toy—present Clarke—present Leland—present Van Woerkom—present Cropsey—present McManus—present 1880 JOURNAL OF THE SENATE [September 15, 2004] [No. 89 Senator Kenneth R. Sikkema of the 28th District offered the following invocation: Lord, as we begin our session here in the Michigan Senate, we come before You with a spirit of thankfulness. We thank You for the rich bounty You’ve given this country and this generation. We thank You for the opportunity You’ve given each one of us to serve our fellow citizens. It is an honor and a privilege, and we recognize that. Help us to be mindful, though, of our obligations and our responsibility; to consider the needs of not just our own constituents and our own districts, but consider the needs of the entire state of Michigan, both now and into the future. -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 108 CONGRESS, SECOND SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 108 CONGRESS, SECOND SESSION Vol. 150 WASHINGTON, WEDNESDAY, JUNE 9, 2004 No. 80 House of Representatives The House met at 10 a.m. Mr. GREEN of Texas led the Pledge ald Reagan. His decisive leadership The Chaplain, the Reverend Daniel P. of Allegiance as follows: during the twilight years of the Cold Coughlin, offered the following prayer: I pledge allegiance to the Flag of the War indeed made him a beacon of hope Throw open the great doors. Let the United States of America, and to the Repub- for freedom-loving people throughout standard bearers raise their flags. lic for which it stands, one nation under God, the world. Mount the steps of this city built indivisible, with liberty and justice for all. Our thoughts and prayers and our around the Hill, for he comes. f love go out to Mrs. Reagan and the en- Prepare the Rotunda. Command the tire family. Because of Ronald Reagan MESSAGE FROM THE SENATE military to stand at attention. Let the our Nation is stronger and our future is people of the Nation and the world A message from the Senate by Mr. more free. Here we honor him and are gather, for he comes. Monahan, one of its clerks, announced continually working toward the Human mortality and dignity is that the Senate has passed a concur- dreamed-of-day he spoke of when no framed for us at this moment, Lord, as rent resolution of the following title in one wields a sword and no one drags a a great man awakens from his sleep which the concurrence of the House is chain. -

REAGAN Also by Marc Eliot

This book has been optimized for viewing at a monitor setting of 1024 x 768 pixels. REAGAN Also by Marc Eliot Jimmy Stewart A Biography Cary Grant A Biography Song of Brooklyn An Oral History of America’s Favorite Borough Death of a Rebel Starring Phil Ochs and a Small Circle of Friends Rockonomics The Money Behind the Music Down Thunder Road The Making of Bruce Springsteen Walt Disney Hollywood’s Dark Prince The Whole Truth To the Limit The Untold Story of the Eagles Down 42nd Street Sex, Money, Culture, and Politics at the Crossroads of the World REAGAN The Hollywood Years MARC ELIOT Harmony Books New York Copyright © 2008 by Rebel Road, Inc. All rights reserved. Published in the United States by Harmony Books, an imprint of the Crown Pub- lishing Group, a division of Random House, Inc., New York. www.crownpublishing.com Harmony Books is a registered trademark and the Harmony Books colophon is a trademark of Random House, Inc. Library of Congress Cataloging-in-Publication Data Eliot, Marc. Reagan: the Hollywood years / Marc Eliot. Includes bibliographical references and index. 1. Reagan, Ronald. 2. Actors—United States—Biography. I. Title. PN2287.R25E45 2008 973.927092—dc22 [B] 2008014974 eISBN: 978-0-307-44996-2 Design by Lauren Dong v1.0 Previous page: Early publicity photo. Rebel Road Archives For baby cocoa bear CONTENTS Introduction 1 Chapter One THE NEXT VOICE YOU HEAR 11 Chapter Two FROM MUGS TO THE MOVIES 37 Chapter Three THE IRISH MAFIA 55 Chapter Four DUTCH AND BUTTON-NOSE 79 Chapter Five THE GAMUT FROM A TO B 103 Chapter Six KINGS ROW 125 Chapter Seven THIS IS THE ARMY 159 Photo Insert Chapter Eight MR. -

President Ronald Reagan Day; and Urging Oklahoma Citizens to Participate in This Observance

ENROLLED HOUSE RESOLUTION NO. 1007 By: Peterson A Resolution recognizing President Ronald Reagan Day; and urging Oklahoma citizens to participate in this observance. WHEREAS, President Ronald Wilson Reagan, a man of humble background, worked throughout his life serving freedom and advancing the public good, having been employed as an entertainer, union leader, corporate spokesman, Governor of California and President of the United States; and WHEREAS, Ronald Reagan served with honor and distinction for two terms as the 40th President of the United States of America; in the second election he earned the confidence of 3/5 of the electorate and was victorious in 49 of the 50 states in the general election – a record unsurpassed in the history of American Presidential elections; and WHEREAS, when Ronald Reagan was inaugurated President in 1981, he inherited a disillusioned nation shackled by rampant inflation and high unemployment, and inspired the nation with his enduring optimism and his unfailing pride in the American people – and it was Mr. Reagan himself who said, “What I’d really like is to go down in history as the President who made Americans believe in themselves again”; and WHEREAS, during Mr. Reagan’s Presidency, he worked to restore common sense to all areas of government, which led to unprecedented economic expansion and opportunity for millions of Americans; and WHEREAS, as President, Mr. Reagan also continually strove to lessen the burden of an overreaching government on Americans, and it was he who said, “Man is not free unless -

Congressional Record United States Th of America PROCEEDINGS and DEBATES of the 108 CONGRESS, SECOND SESSION

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 108 CONGRESS, SECOND SESSION Vol. 150 WASHINGTON, WEDNESDAY, JUNE 9, 2004 No. 80 House of Representatives The House met at 10 a.m. Mr. GREEN of Texas led the Pledge ald Reagan. His decisive leadership The Chaplain, the Reverend Daniel P. of Allegiance as follows: during the twilight years of the Cold Coughlin, offered the following prayer: I pledge allegiance to the Flag of the War indeed made him a beacon of hope Throw open the great doors. Let the United States of America, and to the Repub- for freedom-loving people throughout standard bearers raise their flags. lic for which it stands, one nation under God, the world. Mount the steps of this city built indivisible, with liberty and justice for all. Our thoughts and prayers and our around the Hill, for he comes. f love go out to Mrs. Reagan and the en- Prepare the Rotunda. Command the tire family. Because of Ronald Reagan MESSAGE FROM THE SENATE military to stand at attention. Let the our Nation is stronger and our future is people of the Nation and the world A message from the Senate by Mr. more free. Here we honor him and are gather, for he comes. Monahan, one of its clerks, announced continually working toward the Human mortality and dignity is that the Senate has passed a concur- dreamed-of-day he spoke of when no framed for us at this moment, Lord, as rent resolution of the following title in one wields a sword and no one drags a a great man awakens from his sleep which the concurrence of the House is chain. -

Ronald Reagan Day' in the State of Delaware

SPONSOR: Sen. Bonini On behalf of all Senators DELAWARE STATE SENATE 143rd GENERAL ASSEMBLY SENATE RESOLUTION NO. 17 DESIGNATING FEBRUARY 6, 2006 AS "RONALD REAGAN DAY' IN THE STATE OF DELAWARE 1 WHEREAS, President Ronald Wilson Reagan, a man of humble background, worked throughout his life serving freedom and advancing 2 the public good, having been employed as an entertainer, Union leader, corporate spokesman, Governor of California and President of the United 3 States; and 4 WHEREAS, Ronald Reagan served with honor and distinction for two terms as the 40th President of the United States of America; the 5 second of which saw him victorious in 49 of the 50 states in the general election – a record unsurpassed in the history of American presidential 6 elections; and 7 WHEREAS, in 1981, when Ronald Reagan was inaugurated President, he inherited a disillusioned nation shackled by rampant inflation 8 and high unemployment; and 9 WHEREAS, during Mr. Reagan’s presidency he worked in a bipartisan manner to enact his bold agenda of restoring accountability and 10 common sense to Government which led to an unprecedented economic expansion and opportunity for millions of Americans; and 11 WHEREAS, Mr. Reagan’s commitment to an active social policy agenda for the nation’s children helped lower crime and drug use in 12 our neighborhoods; and 13 WHEREAS, President Reagan’s commitment to our armed forces contributed to the restoration of pride in America, her values and 14 those cherished by the free world, and prepared America’s Armed Forces to meet 21st Century challenges; and 15 WHEREAS, February 6, 2006 will be the 95th anniversary of Ronald Reagan’s birth, and the second since his passing; 16 NOW THEREFORE: 17 BE IT RESOLVED by the Senate of the 143rd General Assembly of the State of Delaware, that February 6, 2006 is hereby designated as 18 “Ronald Reagan Day” in Delaware, and we urge all citizens of Delaware to recognize this event and participate fittingly in its observance. -

Smith Wins Award for His Dedication to Telehealth

NATION: Trump says plan will put $4K per year back into average households A4 HEALTH Rev up your metabolism to help burn fat TUESDAY, OCTOBER 17, 2017 | Serving South Carolina since October 15, 1894 75 cents A3 Smith wins award for his dedication to telehealth ADRIENNE SARVIS / THE SUMTER ITEM Keito Jordan, outreach coordinator for the Richland County site of the Midlands Father- hood Coalition, speaks Thursday at the group’s first graduation in Sumter. Coalition hosts 1st graduation in Sumter PHOTOS BY JIM HILLEY / THE SUMTER ITEM Father in program says let Medical University of South Carolina President Dr. David Cole, left, and CEO Dr. Patrick Cawley, right, present the MUSC struggles become your gift Healthy Communities Award to Rep. Murrell Smith Jr. on Monday at Palmetto Health Tuomey. BY ADRIENNE SARVIS MUSC Healthy Communities honor given to representative at hospital [email protected] BY JIM HILLEY ning,” Cole told Smith. Midlands Fatherhood Coalition held its [email protected] “We now see the fruits of that in- first graduation in Sumter on Thursday vestment,” he said. “Thank you for evening after establishing a site in the S.C. Rep. Murrell Smith Jr. re- helping us.” county two years ago. ceived the Medical University of In accepting the award, Smith The graduates, from Sumter, Lee and South Carolina Healthy Communi- said he was grateful to be able to re- Clarendon counties, who were recog- ties Award on Monday at a gather- ceive the award in Sumter, where nized on Thursday completed a six- ing at Palmetto Health Tuomey. he could be among his friends and month program that helps fathers be- According to a news release, colleagues who have been involved come more active in their children’s lives Smith was honored for his role in in health care. -

Ronald Reagan Day" in Tennessee

Filed for intro on 01/14/2002 SENATE JOINT RESOLUTION 494 By Burchett A RESOLUTION to designate February 6, 2002 as "Ronald Reagan Day" in Tennessee. WHEREAS, this General Assembly is proud to honor those august citizens who, throughout their exemplary lives, have committed themselves to public service of the highest order; and WHEREAS, President Ronald Wilson Reagan is one such distinguished public servant, a man of humble background, who worked throughout his life serving freedom and advancing the public good, having been employed as an entertainer, union leader, corporate spokesman, Governor of California and President of the United States; and WHEREAS, President Reagan served with honor and distinction for two terms as the 40th President of the United States; he was victorious in 49 of the 50 states in his re-election bid, earning the confidence of three-fifths of the electorate, a record unsurpassed in the history of American presidential elections; and WHEREAS, when Ronald Reagan was inaugurated President in 1981, he inherited a nation suffering from rampant inflation and high unemployment; and SJR0494 01048885 -1- WHEREAS, during Ronald Reagan's presidency, he worked in a bipartisan manner to enact his bold agenda of restoring accountability and common sense to government, which led to an unprecedented economic expansion and opportunity for millions of Americans; and WHEREAS, President Reagan's commitment to an active social policy agenda for the nation's children helped lower crime and drug use in our neighborhoods; and WHEREAS,