FLT 2015 AGM Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Out and About Because Teachers and Schools Matter

Out and About Because teachers and schools matter Tourism websites Out & About - UK British Tourist Authority Travelling around the UK is easy to do on a budget. Check out the tourist websites for www.visitbritain.com low-cost attractions and events, cheap accommodation and free days out. England Tourist Authority To help you plan those weekends away, there are a number of free online route and www.travelengland.org.uk journey planners; www.traveline.org.uk Irish Tourist Board www.transportdirect.info www.ireland.travel.ie www.journeyplanner.org. Scottish Tourist Board Take the Train www.visitscotland.com travelling up and down the country a great option. Tickets booked in advance are Wales Tourist Board good value. Visit www.nationalrail.co.uk for more information about operators, www.tourism.wales.gov.uk timetables and tickets. If you are 25 or under you will be eligible for a 16-25 Railcard, it costs just £26 and it’ll save you 1/3 on rail fares throughout Great Britain for a whole year. Car Hire Websites Coach or Bus If you want to get off the beaten track Coaches are often the cheapest way of getting around the UK. The National Express then think about hiring a car coaches operate to 1000 destinations and also serve the major UK airports. It is best to make advanced bookings as seats go quickly at weekends and at holiday times. If Avis you’re aged 16-26 you can take advantage of some fantastic discounts and promotions www.avis.com with a CoachCard. For more information visit: www.nationalexpress.com/coach/. -

Update to FAA Historical Chronology, 1997-2011

1997-2014 Update to FAA Historical Chronology: Civil Aviation and the Federal Government, 1926-1996 (Washington, DC: Federal Aviation Administration, 1998) 1997 January 2, 1997: The Federal Aviation Administration (FAA) issued an airworthiness directive requiring operators to adopt procedures enabling the flight crew to reestablish control of a Boeing 737 experiencing an uncommanded yaw or roll – the phenomenon believed to have brought down USAir Flight 427 at Pittsburgh, Pennsylvania, in 1994. Pilots were told to lower the nose of their aircraft, maximize power, and not attempt to maintain assigned altitudes. (See August 22, 1996; January 15, 1997.) January 6, 1997: Illinois Governor Jim Edgar and Chicago Mayor Richard Daley announced a compromise under which the city would reopen Meigs Field and operate the airport for five years. After that, Chicago would be free to close the airport. (See September 30, 1996.) January 6, 1997: FAA announced the appointment of William Albee as aircraft noise ombudsman, a new position mandated by the Federal Aviation Reauthorization Act of 1996 (Public Law 104-264). (See September 30, 1996; October 28, 1998.) January 7, 1997: Dredging resumed in the search for clues in the TWA Flight 800 crash. The operation had been suspended in mid-December 1996. (See July 17, 1996; May 4, 1997.) January 9, 1997: A Comair Embraer 120 stalled in snowy weather and crashed 18 miles short of Detroit [Michigan] Metropolitan Airport, killing all 29 aboard. (See May 12, 1997; August 27, 1998.) January 14, 1997: In a conference sponsored by the White House Commission on Aviation Safety and Security and held in Washington, DC, at George Washington University, airline executives called upon the Clinton Administration to privatize key functions of FAA and to install a nonprofit, airline-organized cooperative that would manage security issues. -

Distribution Channels

Distribution Channels Travel agencies (TAs) Group 5 Laura Comella Anna Espadaler Mariya Podokshik Junko Yamazaki What is a Travel agency? A business that helps to make arrangements for people who want to travel ✈ Travel agents can arrange all types of domestic and international travel, from hotel and resort accommodations to air and ground transportation, including car rental needs and tour packages. ✈ They can also provide assistance with travel insurance protection, passport and visa applications, inoculation procedures and other foreign travel requirements. Where do TA’s stand within the distribution channel chain? B2C (Business to Consumer) ✈ Travel agencies are businesses who distribute travel links and tourism services on behalf of suppliers (hotels, tour companies, airlines, etc.) to customers (travellers, tourists, etc.) ✈ They are an indirect form of a distribution channel - as travel agents act as the “middleman” Advantages and disadvantages of using TAs ADVANTAGES DISADVANTAGES ● Comfort in the country of destination – you are mostly provided with transfer to hotel and the representative of the agency can ● It’s not always cheap solve any of your problems. ● You have some limitations such as restrictions on which hotel you stay, ● Your vacation is organized. duration of your stay, excursions, etc ● You don’t need to worry about buying ● You can encounter commission and hidden fees tickets and booking hotels. that are not always explained. Therefore, although some things you get a good deal on, ● They have more expertise and connections- other things you may be overcharged for. opening up new deals for you. ● Once the office closes, you are on your own ● Travel agents usually work with other experts in the field so if your agent is only a certain location, it is likely they have a colleague that can give professional consulting on another destination Example 1: A Girl’s Gotta Go, LLC. -

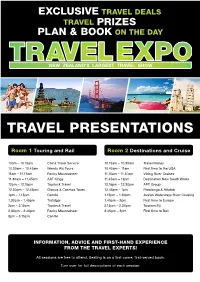

Travel Presentations

ExclUsive travel deals travel PRIZES PLAN & BOOK ON THE DAY NEW ZEALAND’S LARGEST TRAVEL SHOW TRAVEL PRESENTATIONS Room 1 Touring and Rail Room 2 Destinations and Cruise 10am – 10.15am China Travel Service 10.15am – 10.30am Travel Money 10.30am – 10.45am Wendy Wu Tours 10.45am – 11am First time to the USA 11am – 11.15am Rocky Mountaineer 11.15am – 11.30am Viking River Cruises 11.30am – 11.45am AAT Kings 11.45am – 12pm Destination New South Wales 12pm – 12.15pm Topdeck Travel 12.15pm – 12.30pm APT Group 12.30pm – 12.45pm Globus & Cosmos Tours 12.45pm – 1pm Rarotonga & Aitutaki 1pm – 1.15pm Contiki 1.15pm – 1.30pm Avalon Waterways River Cruising 1.30pm – 1.45pm Trafalgar 1.45pm – 2pm First time to Europe 2pm – 2.15pm Topdeck Travel 2.15pm – 2.30pm Tourism Fiji 2.30pm – 2.45pm Rocky Mountaineer 2.45pm – 3pm First time to Bali 3pm – 3.15pm Contiki INFORMATION, ADVICE AND FIRST-HAND EXPERIENCE FROM THE TRAVEL EXPERTS! All sessions are free to attend. Seating is on a first-come, first-served basis. Turn over for full descriptions of each session. NEW ZEALAND’S LARGEST TRAVEL SHOW AAT Kings – Whether you’re looking for the perfect food and the world’s most awe-inspiring places while Cosmos offers the wine weekend, a bit of soft adventure in the Outback, a winter perfect blend of escorted and independent travel for savvy, escape to the warmth of Tropical North Queensland, or you just budget focused travellers. need to get away from the city for a few days, AAT Kings has the perfect break for you. -

Permanent Transfers and Localization of Expatriates in Singapore

Int. Studies of Mgt. & Org., vol. 44, no. 3, Fall 2014, pp. 80–95. © 2014 M.E. Sharpe, Inc. All rights reserved. Permissions: www.copyright.com. ISSN 0020–8825 (print)/ISSN 1558–0911 (online) DOI: 10.2753/IMO0020-8825440305 ELISE TAIT, HELEN DE CIERI, AND YVONNE MCNULTY The Opportunity Cost of Saving Money An Exploratory Study of Permanent Transfers and Localization of Expatriates in Singapore Abstract: In this exploratory study we draw on interviews with 12 expatriate staff, seven of whom are permanent transfers to a Singapore-based subsidiary of a global knowledge-based firm. Using goal congruence theory as an extension of agency theory, we compare the motivation, adjustment, retention, and careers of permanent transferees who subsequently localize in the host location to those of traditional expatriates in the same location. Our findings show that expatriates who are expected to work as “locals” in a host country not only receive less compensation, but also receive less preparation and support than traditional expatriates despite the fact that both groups of employees work under similar conditions and face similar challenges. Our study has important implications for research and practice in the planning and management of global mobility programs. Global mobility research has been dominated over the past two decades by a focus on long-term expatriates and the various challenges they present to multinational Downloaded by [Monash University Library] at 16:20 30 January 2015 corporations (MNCs) in terms of adjustment (Black, Mendenhall, and Oddou 1991), turnover (Shaffer and Harrison 1998), and job performance (Lee and Donohue 2012). Recently, scholars have turned their attention to other types of interna- Elise Tait is a trip leader at Topdeck Travel and an honours graduate in management of Monash University, Sir John Monash Drive, Caulfield East, Victoria, 3145, Australia; tel.: 0402405251; e-mail: [email protected]. -

(FLT) Ha Sector by Investing in United

STATEMENT TO AUSTRALIAN SECURITIES EXCHANGE - August 27, 2014 FLIGHT CENTRE TRAVEL GROUP EXTENDS RELATIONSHIP WITH TOPDECK TOURS THE Flight Centre Travel Group (FLT) has increased its presence in the tour operating sector by investing in United Kingdom-based Topdeck Tours. The travel retailer has today agreed to add a 90% holding in Topdeck to its long-standing 67% interest in Back-Roads Touring, another UK-based coach tour operator. Topdeck managing director James Nathan, FLT's partner in the Back-Roads business, will hold the remaining 10% interest in Topdeck and will continue to oversee both businesses. FLT chief operating officer Melanie Waters-Ryan said the investment would deliver benefits to both FLT and Topdeck in the short and long-term. "From a Flight Centre perspective, we are investing in an iconic and profitable business that we know well," Mrs Waters-Ryan said. "This investment gives us a new revenue stream, thereby enhancing our diversity, and creates opportunities to develop differentiated products for customers, in line with our strategy of manufacturing and launching unique product. "There will, of course, also be synergies between Topdeck and Back-Roads. "We are pleased to extend our relationship with James and look forward to working together to grow this business, which was effectively the predecessor to Flight Centre." Both Topdeck and Back-Roads will continue as standalone businesses, with the current senior leadership structure to remain in place. "This investment cements the long-standing relationship between our two companies and is a logical progression," Mr Nathan said. "FLT's founders created Topdeck and were integral to its early success, before returning to the business in 2003 and contributing to its more recent growth and development. -

Flight Centre Travel Group Performing in Line with Expectations but Monitoring Coronavirus Impacts on Early Second Half Trading

STATEMENT TO AUSTRALIAN SECURITIES EXCHANGE – February 7, 2020 FLIGHT CENTRE TRAVEL GROUP PERFORMING IN LINE WITH EXPECTATIONS BUT MONITORING CORONAVIRUS IMPACTS ON EARLY SECOND HALF TRADING Key Points Underlying first half (1H) profit before tax (PBT) likely to be slightly above the mid-point of guidance ($90million-$110million) for the period Record sales – circa 11% total transaction value (TTV) growth in challenging global trading conditions – pointing to market-share gains Coronavirus affecting early 2H travel patterns, particularly in Asia – too early to judge full year impact but will make it more difficult to achieve 2020 fiscal year (FY20) guidance As announced previously, statutory 1H PBT will be lower than underlying 1H result and will include adjustments for Topdeck impairment (confirmed today), supplier collapse, Upside investment, accounting standard changes THE Flight Centre Travel Group (FLT) today updated the market in relation to its 1H results and its FY20 outlook. The update comes as the company continues to monitor the coronavirus’s impacts on its Greater China and Singapore corporate travel businesses in the near-term and its potential impacts on broader leisure and corporate travel patterns in the upcoming months, which are traditionally the year’s peak booking periods. Although FLT has achieved record TTV and an underlying PBT slightly above the mid-point of its targeted range for the six months to December 31 2020 ($90million-$110million), the virus’s emergence has inevitably made it more difficult to deliver the strong 2H earnings weighting implied in full year guidance ($310million-$350million). Coronavirus Impact Being Felt in Asia Managing director Graham Turner said, while it was too early to predict the virus’s overall impact, it had already adversely affected FLT’s small corporate travel operations in China, Singapore and Malaysia, which together generated about $625million in TTV during FY19 (about 2.5% of group TTV). -

TAP Sale Progress After Avianca Emerges As Sole Buyer

ISSN 1718-7966 OCTOBER 22, 2012 / VOL. 361 WEEKLY AVIATION HEADLINES Read by thousands of aviation professionals and technical decision-makers every week www.avitrader.com WORLD NEWS Synergy Aerospace, parent Tyler praises Gulf airlines company of Speaking at the World Passenger Colombia’s Symposium in Abu Dhabi, IATA Avianca, boss Tony Tyler praised the Mid- will gain dle East’s aviation industry as one a valuable European of the ‘bright spots’ in a difficult foothold if it year. He said airlines in the region succeeds in posted international passenger taking over growth of 16.9% to August 2012, Portugal’s compared to a global average of indebted TAP 6.6%, and profits should reach $1bn in 2013, up from $700m this TAP year. The region’s governments were praised for their ‘business TAP sale progress after Avianca emerges as sole buyer friendly environment’ in contrast to Europe, which fails to ‘under- European airline consolidation falters as investment dries up stand the industry’ through its Portugal came one step closer to of the domestic market and 2% economy in crisis have devastat- controversial emissions scheme. divesting itself of its loss-laden of international traffic into Brazil. ed the finances of smaller state- flag carrier, TAP Portugal, this backed and privately-owned car- Sumitomo in merger move A link between the two carriers week when it selected Synergy riers in recent months. Sumitomo Mitsui Bank is to merge would give Avianca a valuable en- Aerospace, a holding company aircraft leasing unit SMBC Avia- try point to Europe and beyond - Spanair, Spain’s second-larg- controlled by German Efromo- tion Capital with other Sumitomo TAP has an enviable network of 74 est carrier, and Hungary’s state- vich, chair of Colombian airline aircraft lessors to form the fourth- owned Malev both ceased flying Avianca, as the sole bidder. -

Study on Generation Z Travellers Study on Generation Z Travellers

ETC MARKET STUDY STUDY ON GENERATION Z TRAVELLERS STUDY ON GENERATION Z TRAVELLERS A handbook produced for the European Travel Commission (ETC) by TOPOSOPHY Ltd. Brussels, July 2020 ETC Market Intelligence Copyright © 2020 European Travel Commission (ETC) Study on Generation Z Travellers All rights reserved. The contents of this report may be quoted, provided the source is given accurately and clearly. Distribution or reproduction in full is permitted for own or internal use only. While we encourage distribution via publicly accessible websites, this should be done via a link to ETC’s corporate website, www.etc-corporate.org Data sources: This report is based on research conducted by TOPOSOPHY Ltd (www.toposophy.com/) and should be interpreted by users according to their needs. Published by the European Travel Commission Rue du Marché aux Herbes, 61, 1000 Brussels, Belgium Website: www.etc-corporate.org Email: [email protected] ISBN No: 978-92-95107-35-9 Design: TOPOSOPHY Ltd Cover photo: Young adult friends on a hike celebrate reaching a summit near the coast together. Image ID: 1454373050 Copyright: Shutterstock / Monkey Business Images TABLE OF CONTENTS ACKNOWLEDGEMENTS 06 FOREWORD 07 EXECUTIVE SUMMARY 08 1 INTRODUCTION 10 1.1 Defining Generation Z 11 1.2 Why younger travellers matter 12 1.3 Understanding Generation Z 12 1.4 The demographics of Generation Z 15 1.5 Issues and values shaping Generation Z’s global outlook 19 1.6 Generation Z: Technology and travel 23 1.7 Market focus 26 1.8 Special section on the impact of Covid-19 30 2 GEN Z TRAVEL TRENDS 35 2.1 Primary research – overview 36 2.2 Key motivations for travelling to/within europe and in-destination choices 36 2.3 Post-trip appraisal of european travel 51 2.4 Technology use and booking preferences 53 2.5 Consumer values and interests 65 2.6 Sustainable travel choices 71 2.7. -

Insight's Domestic Debut

www.traveldaily.com.au Tuesday 23rd June 2020 SQ transit channels Today’s issue of TD Insight’s domestic debut SINGAPORE Airlines and Travel Daily today has seven EXCLUSIVE full refund. SilkAir have today begun pages of news including our INSIGHT Vacations is set to Comprehensive health and operating a limited number PUZZLE page. roll out a new range of “Local hygiene measures are being of two-way transit channels introduced on the trips, including Pullmantur rejig Escapes,” allowing travel agents through Singapore Changi Airport to book their clients on itineraries a maximum of 22 passengers per between selected countries, ROYAL Caribbean Cruises has offering them “everything they full size coach and close liaison including to Australia and NZ. confirmed its Pullmantur Cruises know and love about Insight, now with suppliers to ensure safety. The move is an expansion from Spanish joint venture has filed for closer to home”. Deveson said a recent survey the one-way transit channel reorganisation under the terms of Insight MD Karen Deveson told confirmed significant pent-up approved earlier this month (TD Spanish insolvency laws. Travel Daily the new offering had demand from Insight clients. 11 Jun) and will allow customers The Spanish cruise line’s board been developed in collaboration With just over 1,000 responses to book return journeys. said that “the headwinds caused with sister The Travel Corporation from customers, about 90% were Singapore Airlines Regional VP by the pandemic are too strong brand Inspiring Journeys as well not concerned about money or South West Pacific Philip Goh for Pullmantur to overcome as Insight’s European travel the economy as a factor in their said the channels will allow for without a reorganization”. -

Bus Tour Travel

Bus Tour Travel MARKET RESEARCH www.bizzbeesolutions.com February, 2018 Page | 1 CONTENTS Introduction ..................................................................................................................................... 3 Market Overview ............................................................................................................................ 4 Travel Trends .............................................................................................................................. 8 Consumer Market Segmentation..................................................................................................... 9 Target Market – Potential Costumers ....................................................................................... 10 Consumer preferences ............................................................................................................... 11 Competition................................................................................................................................... 12 Direct Competition.................................................................................................................... 12 Indirect Competition ................................................................................................................. 20 Governmental Regulations............................................................................................................ 21 Private Bus Transportation .................................................................................................... -

TRAVEL PRESENTATIONS Sunday 26 February 2017

NEW ZEALAND’S LARGEST TRAVEL SHOW TRAVEL PRESENTATIONS Sunday 26 February 2017 Presentation Room 1 Presentation Room 2 10.00am – 10.15am Wendy Wu Tours 10.15am – 10.30am Norwegian Cruise Line 10.30am – 10.45am Globus, Cosmos & 10.45am – 11.00am Tourism Western Australia Monograms 11.15am – 11.30am Flight Centre MasterCard 11.00am – 11.15am CTS Tours 11.45am – 12.00pm Sydney.com 11.30am – 12.15pm The Travel Corporation 12.15pm – 12.30pm MSC Cruises (Trafalgar, Insight Vacations, Uniworld, AAT Kings, 12.45pm – 1.00pm First time to Europe Luxury Gold, CostSaver) 1.15pm – 1.30pm Adventure World 12.30pm – 12.45pm Rocky Mountaineer 1.45pm – 2.00pm Cook Islands 1.00pm – 1.15pm APT River Cruising 2.15pm – 2.30pm Avalon Waterways 1.30pm – 1.45pm Topdeck Travel 2.45pm – 3.00pm P & O Cruises 2.00pm – 2.15pm DriveAway Holidays 2.30pm – 2.45pm Contiki INFORMATION, ADVICE & FIRST HAND EXPERIENCES FROM THE TRAVEL EXPERTS! All sessions are free to attend. Seating is on a first-come, first-served basis. TRAVEL PRESENTATIONS Adventure World – Walking and Cycling in Europe. P&O Cruises – P&O offers a wide range of cruises departing Auckland and Australia to the South Pacific, Australia and beyond. They offer APT River Cruising – Embark on APT’s ever popular Magnificent fantastic value and are perfect for first time cruisers as well as groups Europe River Cruise. Discover the natural splendour of the Rhine, Rhone of friends and family. Come and check out the new ship for Auckland - and Moselle or the Douro cruise through Spain and Portugal.