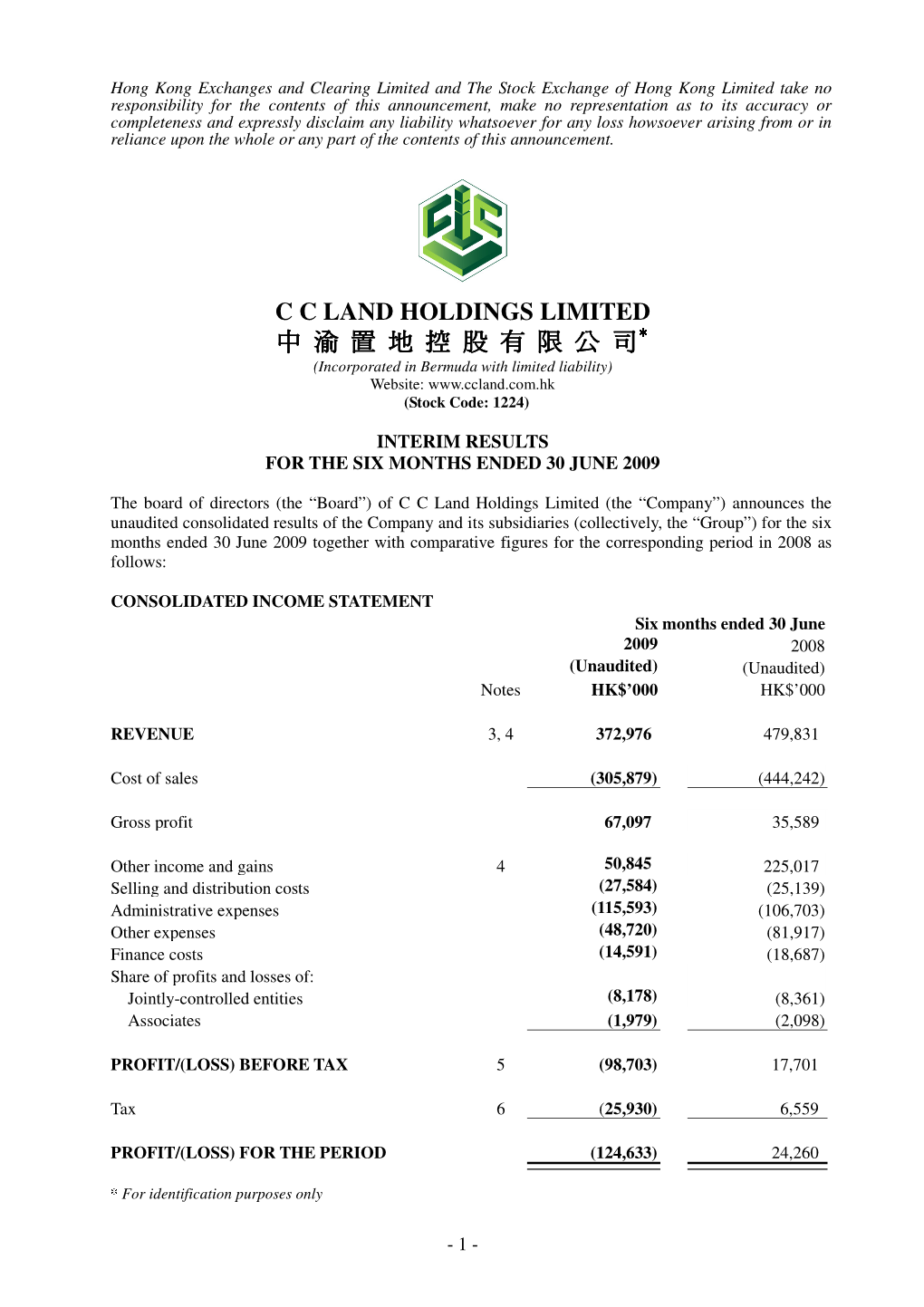

C C LAND HOLDINGS LIMITED 中 渝 置 地 控 股 有 限 公 司*** (Incorporated in Bermuda with Limited Liability) Website: (Stock Code: 1224)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2018

CHONGQING MACHINERY & ELECTRIC CO., LTD. CHONGQING MACHINERY (a joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock Code: 02722 ANNUAL REPORT 2018 ANNUAL REPORT 2018 ANNUAL REPORT CONTENTS Corporate Information 2 Financial Highlights 4 Group Structure 5 Results Highlights 6 Chairman’s Statement 7 Management’s Discussion and Analysis 20 Directors, Supervisors and Senior Management 39 Report of the Board of Directors 54 Report of the Supervisory Committee 80 Corporate Governance Report 83 Risk and Internal Control and Governance Report 102 Environmental, Social and Governance Report 110 Independent Auditor’s Report 134 Consolidated Balance Sheet 149 Balance Sheet of the Company 153 Consolidated Income Statement 156 Income Statement of the Company 159 Consolidated Statement of Changes in Equity 161 Statement of Changes in Equity of the Company 167 Consolidated Statement of Cash Flows 171 Cash Flows Statement of the Company 174 Notes to the Consolidated Financial Statements 176 Supplementary Information to Consolidated Financial Statements 475 Corporate Information DIRECTORS COMMITTEES UNDER BOARD OF DIRECTORS Executive Directors Members of the Audit and Risk Management Mr. Wang Yuxiang (Chairman) Committee Ms. Chen Ping Mr. Yang Quan Mr. Lo Wah Wai (Chairman) Mr. Jin Jingyu Non-executive Directors Mr. Liu Wei CHONGQING MACHINERY LTD & ELECTRIC CO., Mr. Huang Yong Members of the Remuneration Committee Mr. Dou Bo Mr. Wang Pengcheng Mr. Ren Xiaochang (Chairman) Mr. Lo Wah Wai Independent Non-executive Directors Mr. Jin Jingyu Mr. Huang Yong Mr. Lo Wah Wai Mr. Ren Xiaochang Members of the Nomination Committee Mr. Jin Jingyu Mr. Liu Wei Mr. -

Best-Performing Cities: China 2018

Best-Performing Cities CHINA 2018 THE NATION’S MOST SUCCESSFUL ECONOMIES Michael C.Y. Lin and Perry Wong MILKEN INSTITUTE | BEST-PERFORMING CITIES CHINA 2018 | 1 Acknowledgments The authors are grateful to Laura Deal Lacey, executive director of the Milken Institute Asia Center, Belinda Chng, the center’s director for policy and programs, and Ann-Marie Eu, the Institute’s senior associate for communications, for their support in developing this edition of our Best- Performing Cities series focused on China. We thank the communications team for their support in publication as well as Kevin Klowden, the executive director of the Institute’s Center for Regional Economics, Minoli Ratnatunga, director of regional economic research at the Institute, and our colleagues Jessica Jackson and Joe Lee for their constructive comments on our research. About the Milken Institute We are a nonprofit, nonpartisan think tank determined to increase global prosperity by advancing collaborative solutions that widen access to capital, create jobs, and improve health. We do this through independent, data-driven research, action-oriented meetings, and meaningful policy initiatives. About the Asia Center The Milken Institute Asia Center promotes the growth of inclusive and sustainable financial markets in Asia by addressing the region’s defining forces, developing collaborative solutions, and identifying strategic opportunities for the deployment of public, private, and philanthropic capital. Our research analyzes the demographic trends, trade relationships, and capital flows that will define the region’s future. About the Center for Regional Economics The Center for Regional Economics promotes prosperity and sustainable growth by increasing understanding of the dynamics that drive job creation and promote industry expansion. -

Innovative City in West China Chongqing

INNOVATIVE CITY IN WEST CHINA CHONGQING Jon Sigurdson Stockholm School of Economics, EIJS Krystyna Palonka Stockholm School of Economics, EIJS Working Paper 239 February 2008 Postal address: P.O. Box 6501, S-113 83 Stockholm, Sweden Office address: Holländargatan 30 Telephone: +46 8 736 93 60 Fax: +46 8 31 30 17 E-mail: [email protected] Internet: http://www.hhs.se/eijs 1 Innovative City in West China Chongqing Jon Sigurdson, Stockholm School of Economics, EIJS Krystyna Palonka, Stockholm School of Economics, EIJS Working Paper 239 February 2008 Postal address: P.O. Box 6501, S-113 83 Stockholm, Sweden. Office address: Sveavägen 65 Telephone: +46 8 736 93 60 Telefax: +46 8 31 30 17 E-mail: [email protected] Internet: http://www.hhs.se 2 Innovative City in West China Chongqing1 Jon Sigurdson, Stockholm School of Economics, EIJS Krystyna Palonka, Stockholm School of Economics, EIJS February 2008 Abstract This working paper offers insights on science and technology in China with supporting official and interview data. The paper, as evidenced from the title, is indicating the future role of Chongqing and its evolution primarily focusing on the period of rapid development of the Municipality after Chongqing became a political entity on the same level as provinces of China. This has coincided with the planning, construction and completion of the Three Gorges Dam Project involving the resettlement of 1,000,000 people – most them coming to the rural areas Chongqing Municipality. Three major sub-themes are highlighted. First, the city played important role during more than 2000 years of its history (in 1981, for example it became first inland port in China open for foreign commerce). -

Exhibits Directory

TECHNICAL EXHIBITS Amplitude Beijing Tide Pharmaceutical Co., Ltd. BOOTH #103 BOOTH #109 11 Cours Jacques Offenbach No. 8 East Rongjing St. Zone Mozart 2 Beijing Econnomic-Technological Development Area Valence 26000 Beijing 100176 FRANCE CHINA www.amplitude-ortho.com www.tidepharm.com [email protected] [email protected] Founded in 1997 in Valence, France, Amplitude is a leading Beijing Tide Pharmaceutical Co., Ltd. (Tide) is dedicated to French player on the global surgical technology market for developing, manufacturing and marketing chemical drugs lower-limb orthopedics and extremities, particularly foot and and biologicals. The company stands proudly among high- ankle surgery. tech Enterprises as the Iargest developer and manufacturer of targeted drugs. Arthrex, Inc. Beijing Yunkanghengye Biotech Inc. BOOTH #101 1370 Creekside Blvd. BOOTH #114 Naples, FL 34108 No. 85, Mulin Section of Shunjiao Rd. UNITED STATES Shunyi District www.arthrex.com Beijing 11100 [email protected] CHINA Arthrex, a global leader in product development and [email protected] medical education, has developed more than 9,500 products and surgical procedures to advance minimally Beijing WANJIE Medical Device invasive orthopaedics worldwide. Company, Ltd. BOOTH #113 Asia Healthcare Inc. Guogongzhuang Middle St. No. 20 BOOTH #111 Beijing Fangxiang Building B, Room 1306 Room 1602, Building 259 Fegntai District Shuangdan Rd. No. 1509 Beijing 100089 Jiading District CHINA Shanghai 201801 www.wanjiety.com.cn CHINA [email protected] www.ahi.com.tw Beijing WANJIE is a production, sales, foreign trade [email protected] high-tech enterprise. Exclusive agent of the French LARS Asia Healthcare Inc. was established in 2002. Our offices artificial ligament in China. -

Audited Financial Statements

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Chongqing Machinery & Electric Co., Ltd. (the “Company”), you should at once hand this circular to the purchaser or the transferees or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser(s) or the transferee(s). Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. Chongqing Machinery & Electric Co., Ltd.* (a joint stock limited company incorporated in the People’s Republic of China) (Stock Code: 2722) (1) REPORT OF THE BOARD OF DIRECTORS OF THE COMPANY IN 2020; (2) REPORT OF THE SUPERVISORY COMMITTEE OF THE COMPANY IN 2020; (3) AUDITED FINANCIAL STATEMENTS AND AUDITOR’S REPORT OF THE COMPANY AND ITS SUBSIDIARIES IN 2020; (4) PROFIT APPROPRIATION PROPOSAL FOR THE YEAR OF 2020 OF THE COMPANY; (5) 2021 ANNUAL BUDGET REPORT OF THE COMPANY; (6) APPOINTMENT OF THE COMPANY’S AUDITOR IN 2021; (7) CHANGE OF TWO NON-EXECUTIVE -

Business Profiles 28July 2

BUSINESS DELEGATES within the delegation Name Company Position 1 Zhou Defu Dajiang Industrial Group Vice Director Chongqing Machinery & Vice General 2 Gao Huaping Electronics Holding (Group) Co. Manager Ltd. Chongqing Machine Tool (Group) Chief 3 Liu Jingyu Co. Ltd. Representative Chongqing Hengtong Bus Co. Ltd. Vice General 4 Zhao Zhong Manager Chongqing Gangwu & Logistic 5 Liang Congyou Group Co. Ltd. Chairman Chongqing Tiema Industries General 6 Wang Xiaopeng Corporation Manager Qijiang Gear Transmission Co. Ltd. Vice General 7 Lai Yukun Engineer 8 Zuo Zongshen Zongshen Industrial Group Chairman Vice General 9 Cheng Jian Loncin Industrial Group manager 1 Chongqing Iron & Steel (Group) Vice General 10 Zhang Min Co. Ltd. Manager Southwest Aluminum (Group) Co. Chief 11 Hu Xiao Ltd. Representative Chongqing Polycomp International Chief 12 Li Xuesong Corp Representative 13 Li Xinming Chongqing New North Zone Deputy Director Chongqing Chemical Industrial General 14 Gou Hua Park Manager Chongqing Xiyong Microelectronic Vice General 15 Nie Hongyan Industrial Park Manager Chongqing Yixin Composite 16 Zhou Defu Vice Director Material Ware Limited Corporation 2 1 - Dajiang Industrial Group www.cqdjgy.com Situated in Yudong town, Ba’nan district, Chongqing Da-Jiang Industrial Group Co., Ltd, a large enterprise under NORINCO headquarter, is 24kmaway from downtown, on the Yangtze River to the north and on the freight area to the west, links National Highway 210 to the south and enjoys great traffic convenience. With a land areas of 4 square km and a total fined assets of 3 billion yuan (RMB), the company has more than 13000 staff and workers. The company has a complete product developing, producing and marketing system and has built product lines for the special purposes automobile, construction machinery, auto axle, redirector, gear, gear-box, cast iron and steel, forging, tools and moulds, heat treatment, surface processing, stamping and jointing. -

2020 Annual Report 2020 Contents

CHONGQING MACHINERY & ELECTRIC CO., LTD. CHONGQING MACHINERY (a joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock Code: 02722 ANNUAL REPORT 2020 ANNUAL REPORT 2020 ANNUAL REPORT CONTENTS Corporate Information 2 Financial Highlights 4 Group Structure 5 Results Highlights 6 Chairman’s Statement 7 Management’s Discussion and Analysis 24 Directors, Supervisors and Senior Management 45 Report of the Board of Directors 63 Report of the Supervisory Committee 90 Corporate Governance Report 93 Risk and Internal Control and Governance Report 112 Environmental, Social and Governance Report 120 Independent Auditor’s Report 150 Consolidated Statement of Financial Position 160 Statement of Financial Position of the Company 164 Consolidated Income Statement 167 Income Statement of the Company 170 Consolidated Statement of Cash Flows 172 Cash Flows Statement of the Company 175 Consolidated Statement of Changes in Equity 177 Statement of Changes in Equity of the Company 181 Notes to the Consolidated Financial Statements 185 Supplementary Information to Consolidated Financial Statements 471 Corporate Information DIRECTORS COMMITTEES UNDER BOARD OF DIRECTORS Executive Directors Members of the Audit and Risk Management Mr. Zhang Fulun (Chairman) Committee Ms. Chen Ping Mr. Yang Quan Mr. Lo Wah Wai (Chairman) Mr. Jin Jingyu Non-executive Directors Mr. Liu Wei Mr. Dou Bo Mr. Huang Yong Mr. Zhang Yongchao Members of the Remuneration Committee Mr. Dou Bo Mr. Wang Pengcheng Mr. Ren Xiaochang (Chairman) Mr. Lo Wah Wai Independent Non-executive Directors Mr. Jin Jingyu Mr. Huang Yong Mr. Lo Wah Wai Mr. Ren Xiaochang Members of the Nomination Committee Mr. Jin Jingyu Mr. -

BRAND WEB 001 ALL 02 EN This Privacy Notice Explains How Personal Data (“Data”) of Employees, Representatives and Collabora

BRAND_WEB _001_ALL_02 EN This Privacy Notice explains how personal data (“Data”) of employees, representatives and collaborators of our Dealers (“Data Subjects”) is handled by Controllers of CNH Industrial Group (“we”, “us”, “our”, or the “Company”) in compliance with applicable laws and regulations. We are committed to protecting and respecting Data Subject’s privacy. 1. HOW WE OBTAIN DATA Data that may be collected, processed and stored are the following: a. Identification and Contact Data b. Professional Data c. Computer Device and Authentication Data The above list also includes Financial Account Data of Sole Traders in those countries where such data is considered as Personal Data. Ordinarily, Data will be provided to us by the Data Subject Employer, but in some cases, we may collect Data directly from the Data Subject, from a third party or from public records. We protect Data obtained from such third parties according to the practices described in this privacy notice. 2. HOW WE USE DATA Data collected may be processed by us for the following purposes: i. to fulfil our legitimate interests of allowing the execution of the activities related to agreements between us and our Dealer and of establishing, maintaining and improving our business relationship with our Dealer; ii. to fulfil our legitimate interests of allowing the Company to perform surveys on satisfaction related to the quality of goods, services and, in general, on our business relations with our Dealer; iii. to fulfil our legitimate interest of managing access to and security of our tools, systems, assets and data. Data may be processed electronically within IT systems, and manually, in paper form. -

2015 Annual Results Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 2015 ANNUAL RESULTS ANNOUNCEMENT HIGHLIGHTS The Board of Metallurgical Corporation of China Ltd.* (the “Company”) hereby announces the audited results of the Company and its subsidiaries for the year ended 31 December 2015. The highlights are as follows: • Operating revenue amounted to RMB217,324 million, representing a year-on- year increase of RMB1,538 million or 0.71% from RMB215,786 million in 2014. • Operating profit amounted to RMB5,939 million, representing a year-on-year increase of RMB649 million or 12.27% from RMB5,290 million in 2014. • Net profit amounted to RMB4,949 million, representing a year-on-year increase of RMB608 million or 14.01% from RMB4,341 million in 2014. • Net profit attributable to shareholders of the listed company amounted to RMB4,802 million, representing a year-on-year increase of RMB837 million or 21.11% from RMB3,965 million in 2014. • Basic earnings per share amounted to RMB0.24, and the basic earnings per share of 2014 amounted to RMB0.21. • As at 31 December 2015, total assets amounted to RMB343,763 million, representing an increase of RMB17,785 million or 5.46% from RMB325,978 million as at 31 December 2014. • As at 31 December 2015, total equity amounted to RMB71,155 million, representing an increase of RMB13,130 million or 22.63% from RMB58,025 million as at 31 December 2014. -

The Literary Design of Liu Yiqing's Qiantang Yishi And

THE POETICS OF MISCELLANEOUSNESS: THE LITERARY DESIGN OF LIU YIQING’S QIANTANG YISHI AND THE HISTORIOGRAPHY OF THE SOUTHERN SONG by Gang Liu A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy (Asian Languages and Cultures) In the University of Michigan 2010 Doctoral Committee: Professor Shuen-fu Lin, Chair Professor Yopie Prins Associate Professor David L. Rolston Assistant Professor Christian de Pee © Gang Liu 2010 To Wei and Ava ii ACKNOWLEDGEMENTS I owe my deepest gratitude to my adviser, Professor Shuen-fu Lin, whose unfailing support and incisive comments have made the writing of this dissertation such a pleasant and rewarding experience for me. Professor Lin is not only an inspiring mentor and teacher, but also an amiable person whom I have always been comfortable to work with. I am grateful to have him as my adviser during my graduate study. I also owe great debts of thanks to Professors David L. Rolston, Christian de Pee, and Yopie Prins, who are on my dissertation committee. Professors Rolston, de Pee, and Prins have all been very supportive and have helped me immeasurably throughout the entire course of this dissertation. They have been most willing to read and to offer me feedback from different perspectives (literary, historical and theoretical, etc.) on drafts of this dissertation at various stages. Without their support and insightful comments, this dissertation would never become possible. I would like to extend my thanks to Professors William Baxter, Miranda Brown, Xiaobing Tang, Jonathan Zwicker, Ken Ito, and Nancy Florida, who have showed enthusiastic interests in this dissertation and offered me invaluable suggestions on it. -

Chongqing Service Guide on 72-Hour Visa-Free Transit Tourists

CHONGQING SERVICE GUIDE ON 72-HOUR VISA-FREE TRANSIT TOURISTS 24-hour Consulting Hotline of Chongqing Tourism Administration: 023-12301 Website of China Chongqing Tourism Government Administration: http://www.cqta.gov.cn:8080 Chongqing Tourism Administration CHONGQING SERVICE GUIDE ON 72-HOUR VISA-FREE TRANSIT TOURISTS CONTENTS Welcome to Chongqing 01 Basic Information about Chongqing Airport 02 Recommended Routes for Tourists from 51 COUNtRIEs 02 Sister Cities 03 Consulates in Chongqing 03 Financial Services for Tourists from 51 COUNtRIEs by BaNkChina Of 05 List of Most Popular Five-star Hotels in Chongqing among Foreign Tourists 10 List of Inbound Travel Agencies 14 Most Popular Traveling Routes among Foreign Tourists 16 Distinctive Trips 18 CHONGQING SERVICE GUIDE ON 72-HOUR VISA-FREE TRANSIT TOURISTS CONTENTS Welcome to Chongqing 01 Basic Information about Chongqing Airport 02 Recommended Routes for Tourists from 51 COUNtRIEs 02 Sister Cities 03 Consulates in Chongqing 03 Financial Services for Tourists from 51 COUNtRIEs by BaNkChina Of 05 List of Most Popular Five-star Hotels in Chongqing among Foreign Tourists 10 List of Inbound Travel Agencies 14 Most Popular Traveling Routes among Foreign Tourists 16 Distinctive Trips 18 Welcome to Chongqing A city of water and mountains, the fashion city Chongqing is the only municipality directly under the Central Government in the central and western areas of China. Numerous mountains and the surging Yangtze River passing through make the beautiful city of Chongqing in the upper reaches of the Yangtze River. With 3,000 years of history, Chongqing, whose civilization is prosperous and unique, is a renowned city of history and culture in China. -

Attachment C

ATTACHMENT C ATTACHMENT C REPORT ON 2010 CHINESE NEW YEAR FESTIVAL MEDIA DELEGATION VISIT TO CHONGQING, CHINA 24 JANUARY – 1 FEBRUARY 2010 ATTACHMENT C Councillor Robert Kok City of Sydney Report on 2010 Chinese New Year Festival Media Delegation visit to Chongqing, China 24 January – 1 February 2010 Councillor Robert Kok – City of Sydney Jeff Lewis – Communications Manager, Office of the Lord Mayor Sasha Baroni – Senior Manager, Events Media Delegation Members • Carleen Frost – Journalist, Cumberland Newspaper Group • William Fisher – Journalist, Australian Associated Press • Josephine Tovey – Urban Affairs Reporter, Sydney Morning Herald • Carmel Melouney – Journalist, Sunday Telegraph • Joshua Martin – Senior Journalist, Network 10 • Matthew Marsic – Camera Operator, Network 10 ATTACHMENT C INTRODUCTION From 24 January – 1 February 2010, I travelled to Chongqing, China with a delegation of media and City of Sydney staff members on the invitation of the Chongqing Municipal People’s Government to cover Chongqing’s preparation for the participation in the Chinese New Year Festival and to give Chongqing media coverage prior to their arrival in Sydney. This will also serve to strengthen cultural and economic relationships between the Cities. I was accompanied by the City’s Communications Manager, Mr Jeff Lewis and Senior Program Manager, Ms Sasha Baroni. Mr. Vice Mayor Tan Qiwei and Deputy Director General, Ms. Wang Yin from the Information Office of the Chongqing People’s Municipal Government invited me to lead the media delegation. The Chongqing Municipal People’s Government had generously covered all the delegation’s travel and accommodation expenses for the media delegation and me to participate. This is in recognition of the good relations which began on the initial meeting when I made a side trip to Chongqing whilst attending the Sister Cities Conference in Guangzhou in November.