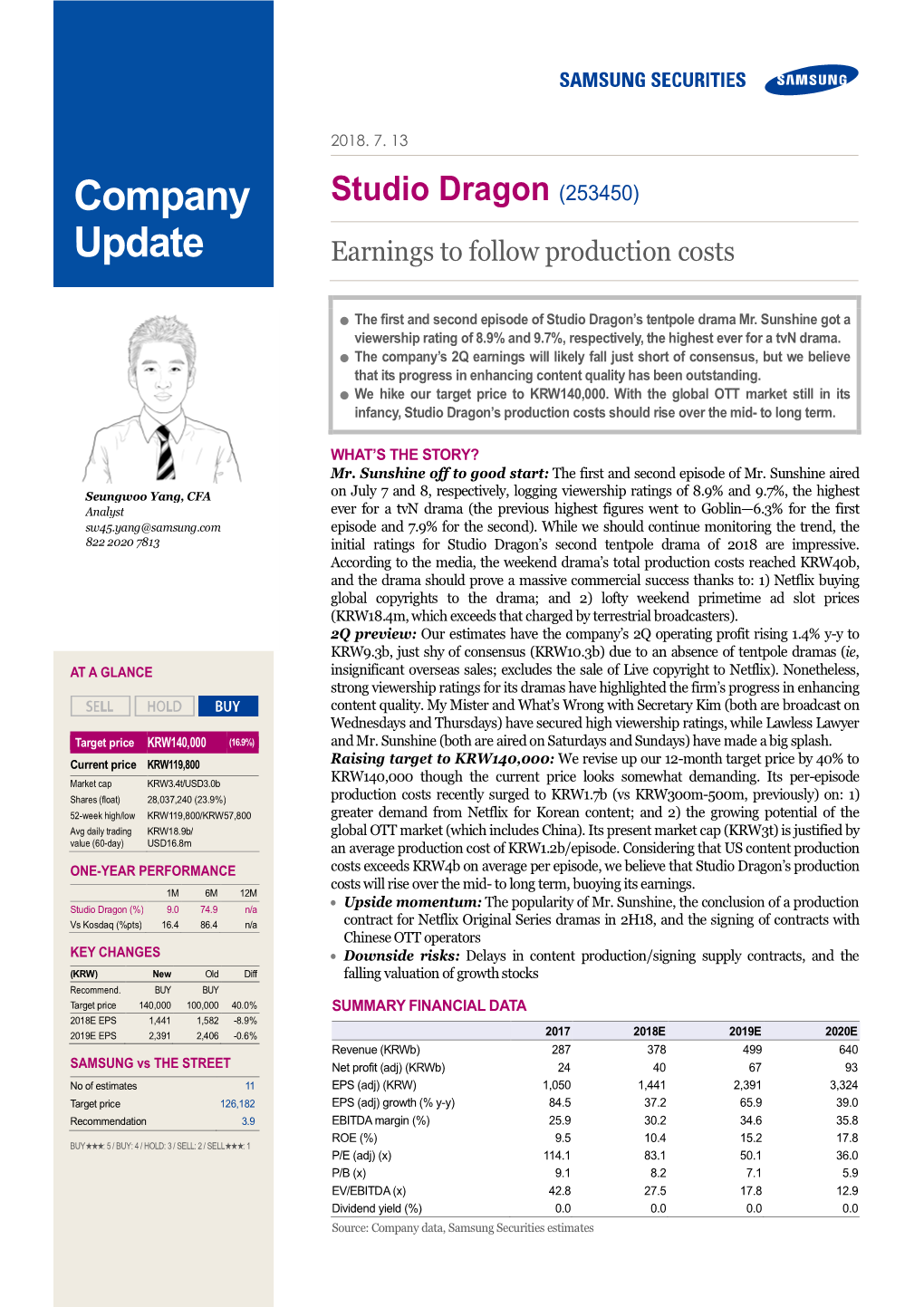

Earnings to Follow Production Costs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Definitive Guide to the Downfall of P&W

Macalester College DigitalCommons@Macalester College English Honors Projects English Department 5-3-2010 The efinitD ive Guide to the Downfall of P&W Alice M. Anigacz Macalester College, [email protected] Follow this and additional works at: http://digitalcommons.macalester.edu/english_honors Part of the Other Arts and Humanities Commons Recommended Citation Anigacz, Alice M., "The efinitD ive Guide to the Downfall of P&W" (2010). English Honors Projects. Paper 15. http://digitalcommons.macalester.edu/english_honors/15 This Honors Project - Open Access is brought to you for free and open access by the English Department at DigitalCommons@Macalester College. It has been accepted for inclusion in English Honors Projects by an authorized administrator of DigitalCommons@Macalester College. For more information, please contact [email protected]. Economics Department Honors Projects Macalester College Year The Definitive Guide to the Downfall of P&W Alice M. Anigacz Macalester College, [email protected] This paper is posted at DigitalCommons@Macalester College. http://digitalcommons.macalester.edu/economics honors projects/1 Macalester College April 25th, 2010 The Definitive Guide to the Downfall of P&W Alice M. Anigacz Advisor: Professor Peter Bognanni Abstract: This honors thesis is a fictional work that tells of the downfall of P&W DNA. It utilizes multiple narrators, including a blonde bombshell, a deceptive recent P&W hire, and a rabbit, to show how a combination of flawed personalities led to the demise of a corrupt DNA testing company. The plot mostly follows Aaron Kelley, a P&W-agent- cum-detective, who is attempting to avenge his partner’s death by taking down gubernatorial candidate Lyle Saunders. -

THE ST. JOHNS NEWS. Mm

THE ST. JOHNS NEWS. VOLUME XXI—NO. 23 •T. JOHm. mCH^ THUS8DAT AFTERNOOW,—JANUARY 13, 1910. TEN PAGES. OHBDOLLARA KPOLEMESnflOFFBB MSOUTV FaWtllM Wit mm •'<>*« am isTiTifiE IT FK IN C.AtTCiHT IN DRYINCi R( iMl NilURrHI XHVNM&G WIU. (tfVK HRMTHKIID FMn?imiN. i mnanEss DHMIiTTBG At the regular moashljr iMMtaaaa aad MAN <*RA.NrK AT Mm. tmMW A.ND RVnjMNCs IMtMJ social meelliMl of the Womea'a Racial IM»AIUI Of' Ml PKRVUHHIM HKIJ) ZbysMlo. the Polish alant. arho Iff liAROBl For soma Hms last night savernl UK* NorwRHRrANDiiia .-ama to tlMa c>»ua*ry to "sat" Prank peopis notlesd what they took to b# ovKR THiH wnam. Tl MRUAV Al LNODK. Inc. the members entartalnad aa thnir yir THUt Gotch. the t-hamplon wresdler of the guests, their husbands, hrothars or aisam lostting from the Hand Lmui - world. Is to be In Detroit on the Shth I sweethearts and a most enjoynhls sir- . dry on Higham otrset. Mr. Goodrich, where he will take un U.iner s and lening was spent. An Interesting lit- the proprietor had loTt the building MeaRsr. both pood men. the aame erary and rousicai program waa amll but a abort time bofore. MMK w W mMI DUPKHHS ■( ■: niRlK. ffFOIT 10 GMIBi carrted out. a number of the gantle- An Inveetlgatlon proved that amoks RUHK g IIK IRmBn Ashed K he arould give Penby a . men making short addreasss. fkipper instead of steam w«a w4iat had at --------------- ! iry.he said with a sneer that he wonJd. I waa served In the dining room, and tracted attention and an alarm waa Not only that, hut he says he arlll ptve ' the fe—t was followed by a eodal time turned In. -

C NTENT 2018 L

17-30 SEPTEMBER C NTENT 2018 www.contentasia.tv l www.contentasiasummit.com Sony kicks off new HBO counts down to 7 Oct horror debut AGT season Series goes live with int’l film fest stamp of approval David Foster, Anggun & Jay Park return Folklore: Tatami (Japan) David Foster, Anggun and Jay Park Three international film festivals – includ- Ratanaruang (Samui Song). Sony Pictures Television Networks Asia ing the Toronto International Film Festival Folklore: A Mother’s Love is about a kicked off the third season of Asia’s Got (TIFF) – have given their stamp of ap- single mother and her young son who Talent at the weekend with a Facebook proval to HBO Asia’s original Asian horror discover dirty and underfed children liv- Live judges session at the Pinewood Is- series, Folklore, which premieres on the ing in a mansion’s attic. Returning them kandar Malaysia Studios. All three judges regional service on Sunday, 7 October to their families stirs the wrath of their from last year – David Foster, Anggun and at 10pm. adopted mother, Wewe Gombel. Jay Park – are back, along with hosts Alan The six episodes of the anthology, each Folklore: Pob is about a journalist who Wong and Justin Bratton. helmed by a different director, debuted meets with Thai ghost Pob, who con- The show airs on AXN across Asia in in pairs at three festivals. In addition fesses to a murder. Finally finding an early 2019. to TIFF, which wrapped this weekend, outlet for complaint, Pob explains how The announcement of this year’s judges episodes will screen at Spain’s SITGES the murder happened. -

Investor Relations 2019

Investor Relations 2019 Citi Conference, March 2019 Disclaimer This financial information in this document are consolidated earnings results based on K-IFRS. This document is provided for the convenience of investors only, before the external audit on our 4Q 2018 and 2018 financial results is completed. The audit outcomes may cause some parts of this document to change. In addition, this document contains “forward-looking statements” – that is, statements related to future, not past, events. In this context, “forward-looking statements” often address our expected future business and financial performance, and often contain words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks” or “will”. Our actual results to be materially different from those expressed in this document due to uncertainties. Investor Relations 2019 TABLE OF CONTENTS I Studio Dragon at a Glance II 2018 Earnings Release III 2019 Growth Strategy Appendix I Studio Dragon at a Glance 1. Highlights 2. Comprehensive Studio 3. Studio Dragon at a Glance 4. Studio Centered Industry Change 5. No.1 Studio in Korea We Create New Culture 1 Highlights DOMESTIC M/S REVENUE GROWTH INTL. REVENUE CREATORS 27% 32% 29% 158People +4Titles +64.1% +16.0% +11.9% +1.6%p 110.2 26 51.8 40.1 5.0 35.9 44.7 22 67.2 3.4 2017 2018 2017 2018 2017 2018 2017 2018 2017 2018 Production Trend International Revenue Domestic VOD Payment to Creators Viewer Rating (1) (Titles) (Wbn) (Wbn) (Wbn) (%) Note (1) Refers to household average viewer ratings; Excludes Olive’s series <Dear My Room> 5 | Investor Relations 2019 – I. -

Assessment Component of the California New Teacher Project: Evaluation of Existing Teacher Assessment Practices. INSTITUTION Far West L '

DOCUMENT RESUME ED 355 195 SP 034 281 AUTHOR Izu, Jo Ann; And Others TITLE Assessment Component of the California New Teacher Project: Evaluation of Existing Teacher Assessment Practices. INSTITUTION Far West L '. for Educational Research and Developmen.., San Francisco, Calif. SPONS AGENCY California Commission of Teacher Credentialing, Sacramento.; California State Dept. of Education, Sacramento. PUB DATE Feb 92 CONTRACT TCC-0O21 NOTE 246p.; For related documents, see ED 323 197, ED 342 761, and SP 034 278-282. PUB TYPE Reports Research/Technical (143) EDRS PRICE MF01/PC10 Plus Postage. DESCRIPTORS Beginning Teachers; *Board of Education Policy; *College Outcomes Assessment; Elementary Secondary Education; Evaluation Criteria; Evaluation Methods; Evaluation Research; Higher Education; Inservice Teacher Education; *Needs Assessment; Policy Formation; Preservice Teacher Education; Research Design; *State Standards; Teacher Certification; *Teacher Evaluation IDENTIFIERS *Assessments of Performance in Teaching; *California New Teacher Project; Knowledge Base for Teaching; Reform Efforts ABSTRACT This document reports on the third year of the assessment component of the California New Teacher Project (CNTP). In the first 2 years, research focused on pilot testing innovative forms of new teacher assessment. Part of the thirdyear study was a careful review of the state of assessment practices in California. Thestudy was designed to yield information about existing assessment practices at the college and university level, the local school district level, and the State level within the context of the legal, social, and economic situation facing California educational systems andto provide information that would lead to the conceptual base and design of a new system of support and assessment for beginning teachers in California. -

Studio Dragon Corporation (253450 KQ ) Temporary Lull

Studio Dragon Corporation (253450 KQ ) Temporary lull Media 2Q18 review: Temporary lull due to absence of tentpoles For 2Q18, Studio Dragon delivered consolidated revenue of W74.3bn (+19.6% YoY ) and operating profit of W7.3bn (-17.6% YoY). Revenue was 8% above the consensus Company Report (W68.5bn), but operating profit missed the consensus (W9.3bn) by 21%. Licensing sales August 9, 2018 were tepid, as 2Q18 was the only quarter of the year with no tentpole titles (i.e., those with production cost of W1bn per episode). Meanwhile, pro duction costs for regular titles increased, which was good for revenue, but bad for margins. That said, we view the 2Q18 profit figure as the minimum level of profits that can be expected, regardless of the commercial success of the company’s titles. (Maintain) Buy Programming revenue was strong, growing 41.1% YoY to W34.1bn, thanks to budget increases. All of the company’s six titles in 2Q18 were aired on captive channels. Target Price (12M, W) Following the success of Live and My Mister in March, dramas like What’s Wrong with 150,000 Secretary Kim (June) also did well, both critically and commercially (average ratings: +1.5%p). Licensing sales grew 9.5% YoY to W28.8bn. Despite the absence of tentpoles, Share Price (08/08/18, W) 96,000 overseas sales continued. The company also recognized some VoD sales of regular titles, sales of older titles, and part of the licensing sales for Live from Netflix (sold in 1Q18). Other revenue slipped 1.9% YoY to W11.4bn. -

PRECIOUS BANE a Musical Adapted from the Novel by Mary Webb

PRECIOUS BANE A Musical Adapted from the novel by Mary Webb Copyright 2009 PRECIOUS BANE Page 2 Act 1, Prologue------ Listen to The Sounds of Sarn Mere (Music #1 Listen to the Sounds of Sound Mere) Track 1 Projection of the Mere. If we could see into its deep, there is the bell tower of a drowned Church in it. Four church bells sound. Then four muffled bells, which seem to be coming from the Mere. The CHORUS sings Ah-ah-ah- from offstage. PRUE FOUR METAL BELLS FROM THE CHURCH YARD . THEN FOUR DISTANT BELLS FROM THE DEEP . IN THE WATER - THE SOUND OF A VILLAGE THAT DROWN 'D - VOICES OF THE GHOSTS WHO WAKE AND SLEEP . DO YOU HEAR ? CAN YOU HEAR ? LISTEN TO THE SOUNDS OF SARN MERE ! This is the story of Sarn Mere, and of us who lived there-- on the banks of its haunted waters. Of Mother and my brother Gideon; and Jancis that was so beautiful; and how I learned to read and write, and if times were troublous I wrote that down, and was eased. And any merry time or good fortune, too: like the first day that I saw Kester the Weaver-- but that's not the beginning… In the beginning, I was born: (Spot up on MOTHER on the settle, having just given birth to PRUE. FATHER stands beside her. MISSIS BEGUILDY has wrapped the babe in a blanket.) MISSIS BEGUILDY (gives MOTHER the baby) Missis Sarn-- It's a girl. MOTHER (smiling with pleasure at first) A girl! (shock) What's that? What's the matter with her lip? MISSIS BEGUILDY Never mind, m' dear. -

Spackmanentertainmentgroup

spackmanentertainmentgroup NEWS RELEASE NETFLIX’S K-DRAMA KINGDOM, STARRING KOREAN ICONIC STAR BAE DOONA OF SBD ENTERTAINMENT, UNDER SPACKMAN MEDIA GROUP, AN ASSOCIATED COMPANY OF SPACKMAN ENTERTAINMENT GROUP, TO BE EXHIBITED AT THE 48TH INTERNATIONAL EMMY AWARDS Singapore, 21 May 2020 – Spackman Entertainment Group Limited (“Spackman Entertainment Group” or the “Company” and together with its subsidiaries, the “Group”), wishes to announce that Netflix’s K-drama, KINGDOM Season 1, featuring Korea’s top actress Bae Doona of SBD Entertainment Inc., a wholly-owned subsidiary of the Group’s associated company, Spackman Media Group Limited, will be exhibited at the International Emmy Awards, a world-renowned drama award event. KINGDOM is a historical drama where Bae Doona plays a Joseon doctor named Seo-bi investigating the mystery of a pestilence that threatens the whole country. The drama is written by Kim Eun-hee, who is known for SIGNAL (2016), PHANTOM (2012), and SIGN (2011), and directed by Kim Seong-hun of TUNNEL (2016) and A HARD DAY (2014). KINGDOM Season 1 and 2 were released on 25 January 2019 and 13 March 2020 respectively on Netflix. 2020 marks the 22nd year in Bae Doona’s illustrious career, which includes starring roles in several of Korea’s all-time highest grossing films including TUNNEL (2016) and THE HOST (2006). She is also one of Korea’s leading international icons, having starred in the Wachowskis siblings’ CLOUD ATLAS, JUPITER RISING and SENSE8 and chosen as the face of Louis Vuitton’s Series 4 global campaign. - End - About Spackman Entertainment Group Limited Spackman Entertainment Group Limited (“SEGL” or the “Company”), and together with its subsidiaries, (the “Group”), one of Korea’s leading entertainment production groups, is primarily engaged in the independent development, production, presentation, and financing of theatrical motion pictures in Korea. -

THE GLOBAL APPEAL of KOREAN TELEVISION DRAMAS a Thesis Submitted to the Faculty of the Graduate

MELODRAMATIC AND FORMULAIC: THE GLOBAL APPEAL OF KOREAN TELEVISION DRAMAS A Thesis submitted to the FAculty of the Graduate School of Arts and Sciences of Georgetown University in partiAl fulfillment of the requirements for the degree off MAster of Arts in CommunicAtion, Culture and Technology By KAthryn Grace HArtzell, B.A. WAshington, D.C. April 16, 2019 Copyright 2019 by KAthryn Grace HArtzell All Rights Reserved ii MELODRAMATIC AND FORMULAIC: THE GLOBAL APPEAL OF KOREAN TELEVISION DRAMAS KAthryn Grace HArtzell, B.A. Thesis Advisor: MAtthew Tinkcom, Ph.D. ABSTRACT International fervor for KoreAn pop culture has constituted a contra-flow against Western mediA hegemony. Since 1997, the global rise of South KoreA’s entertAinment industries has come to be known as the KoreAn WAve, or Hallyu. Contra-flows—subaltern cultural exchanges that move in opposition to Western hegemonic mediA (Thussu 2007, 11)—Are complex, under-investigated, And controversiAl in their importAnce as they exhibit what Arjun Appadurai describes as “disjunctures between economy, culture, and politics” (Appadurai 1996, 33). In contra-flow, cApitAlist power structures are insufficient to understAnd why mediA texts are disseminated across borders, cultures, or lAnguage. This study expands on the investigation of the KoreAn WAve by examining one of its central entertAinment exports—KoreAn dramAs—for their exhibition of hybridized and glocAlized genre conventions. I employ a multimethod approach to both estAblish the cinemAtic lAnguage through which KoreAn dramAs tell their stories and to test the sAlience of this framework with non-KoreAn audiences. First, I anAlyze five KoreAn dramAs populAr with English-speAking viewers—utilizing a close reAding—for their use of a melodramAtic narrative mode. -

Download Download

PROFESSIONAL VS NON-PROFESSIONAL TRANSLATION OF KOREAN TV DRAMAS Jessica Hall Abstract Can non-professional subtitles be a successful replacement for professional subtitles? The purpose of this study is to examine the differences in the English subtitles of Korean TV drama series between those written by paid translators for Netflix, and those by volunteer fansubbers for Rakuten Viki. This study will explore the main differences between the two styles of subtitling, the potential reasons for these differences, and the reception of both kinds of subtitles among audiences by reviewing opinions shared on online discussion forums such as Reddit and Viki Discussions. These forums will also be used to explore online public opinions about the ethics of Viki as a fansubbing platform and the implication of unpaid translation for the industry. Chapter 1: Introduction 1.1 Fansubbing Fansubbing, short for fan-subtitling, is a unique style of subtitling in which overseas media content is translated by untrained fans over the internet. Fansubbing began in the 1980s with the translation of Japanese anime into English by fan groups in the USA due to a lack of access to content, as well as a desire for a more source-oriented approach to its cultural aspects (Perego & Pacinotti, 2020). Due to these origins, fansubbing has been most often associated with Japanese anime. In 2006, Díaz-Cintas and Muñoz Sánchez defined fansubs as, “fan-produced, translated, subtitled version of a Japanese anime programme,” (2006:37). But as global interest and technology developed, the practice expanded to include other languages as well as other types of audiovisual content such as films, so that fansubbing now describes the unpaid creation of subtitles for films or TV series from or to any source or target language. -

![[Tvn] Directv Schedule (5.14~5.20)](https://docslib.b-cdn.net/cover/5589/tvn-directv-schedule-5-14-5-20-4825589.webp)

[Tvn] Directv Schedule (5.14~5.20)

[tvN] DirecTV Schedule (5.14~5.20) Time Time 5/14/Mon 5/15/Tue 5/16/Wed 5/17/Thu 5/18/Fri 5/19/Sat 5/20/Sun KOR WT ET WT ET KOR Street Food Fighter Taste of Wednesday Comedy Big League Hot Taste of Wednesday Comedy Big League Hot Comedy Big League Hot Café Amor Hot Clips 19 3 6 Hot Clips Clips Hot Clips Clips Clips 3 6 19 30 (선다방) (스트리트 푸드 파이터 30 (수요미식회 맛집안내서) (코미디빅리그 핫클립) (수요미식회 맛집안내서) (코미디빅리그 핫클립) (코미디빅리그 핫클립) 7 미식로드) A Bird That Doesn't Sing A Bird That Doesn't Sing A Bird That Doesn't Sing A Bird That Doesn't Sing (울지 않는 새) (울지 않는 새) (울지 않는 새) (울지 않는 새) 80 81 82 83 Mix & Mash Saturdays Thrifters' Guide to 20 4 7 30 4 7 20 Cheers to My Life (놀라운 토요일) Luxurious Travels 30 A Bird That Doesn't Sing A Bird That Doesn't Sing A Bird That Doesn't Sing A Bird That Doesn't Sing (인생술집) 6 (짠내투어) (울지 않는 새) (울지 않는 새) (울지 않는 새) (울지 않는 새) 71 24 81 82 83 84 21 5 8 30 30 5 8 21 Worldwide 9: Nine Time Travels 9: Nine Time Travels 9: Nine Time Travels 9: Nine Time Travels 9: Nine Time Travels Little Cabin in the Correspondence (나인) (나인) (나인) (나인) (나인) Woods (외계통신) 2 3 4 5 6 (숲속의 작은 집) 4 22 6 9 30 7 30 6 9 22 Stranger Stranger Stranger Stranger Stranger Lawless Lawyer (비밀의 숲) (비밀의 숲) (비밀의 숲) (비밀의 숲) (비밀의 숲) (무법 변호사) 23 7 10 30 2 3 4 5 6 My Mister 3 30 7 10 23 (나의 아저씨) 15 Let's Eat 2 Let's Eat 2 Let's Eat 2 Let's Eat 2 Let's Eat 2 Mix & Mash Saturdays 24 8 11 30 8 11 24 (식샤를 합시다 2) (식샤를 합시다 2) (식샤를 합시다 2) (식샤를 합시다 2) (식샤를 합시다 2) (놀라운 토요일) 30 13 14 15 16 17 7 My Mister (나의 아저씨) 16 1 9 12 30 Emergency Couple Emergency Couple 30 9 12 1 The Incomplete The -

![Tvn] Directv Schedule (2.11~2.17)](https://docslib.b-cdn.net/cover/3148/tvn-directv-schedule-2-11-2-17-6353148.webp)

Tvn] Directv Schedule (2.11~2.17)

[tvN] DirecTV Schedule (2.11~2.17) Time Time 2/11/Mon 2/12/Tue 2/13/Wed 2/14/Thu 2/15/Fri 2/16/Sat 2/17/Sun KOR WT ET WT ET KOR Comedy Big League Hot Thrifters' Guide to Mission Possible: English Clips Comedy Big League Hot brain Man Taste of Wednesday 20 3 6 30 Luxurious Travels 2 In-Laws in Practice 3 6 20 (코미디빅리그) (문제적 남자) (수요미식회) 30 (짠내투어) (나의 영어사춘기 100시간) (아찔한 사돈 연습) 299 194 194 Coffee Friends 62 9 20 (커피 프렌즈) 7 21 4 7 30 Family Secrets Family Secrets Family Secrets Family Secrets 30 4 7 21 (가족의 비밀) (가족의 비밀) (가족의 비밀) (가족의 비밀) Thrifters' Guide to Coffee Friends 14 15 16 17 Luxurious Travels (커피 프렌즈) (짠내투어) Family Secrets Family Secrets Family Secrets Family Secrets 6 Cheers to My Life 22 5 8 30 63 5 8 22 (가족의 비밀) (가족의 비밀) (가족의 비밀) (가족의 비밀) (인생술집) 30 15 16 17 18 110 Mix & Mash Saturdays Another Miss Oh Another Miss Oh Another Miss Oh Another Miss Oh Big Forest (놀라운 토요일) 23 6 9 30 30 6 9 23 (또 오해영) (또 오해영) (또 오해영) (또 오해영) (빅 포레스트) 46 15 16 17 18 1 Ugly Miss Young-Ae 17 (막돼먹은 영애씨 17) 2 24 7 10 30 7 10 24 Lawless Lawyer Lawless Lawyer Lawless Lawyer Lawless Lawyer Lawless Lawyer Touch Your Heart 30 (무법 변호사) (무법 변호사) (무법 변호사) (무법 변호사) (무법 변호사) (진심이 닿다) 9 10 11 12 13 3 In-Laws in Practice 1 8 11 30 8 11 1 (아찔한 사돈 연습) 30 Emergency Couple Emergency Couple Emergency Couple Emergency Couple Emergency Couple 19 (응급남녀) (응급남녀) (응급남녀) (응급남녀) (응급남녀) Touch Your Heart 14 15 16 17 18 2 9 12 (진심이 닿다) 9 12 2 30 4 30 My Friend From Top Star Yoo-Baek Top Star Yoo-Baek Top Star Yoo-Baek Top Star Yoo-Baek Encounter Another Century (톱스타 유백이) (톱스타 유백이) (톱스타