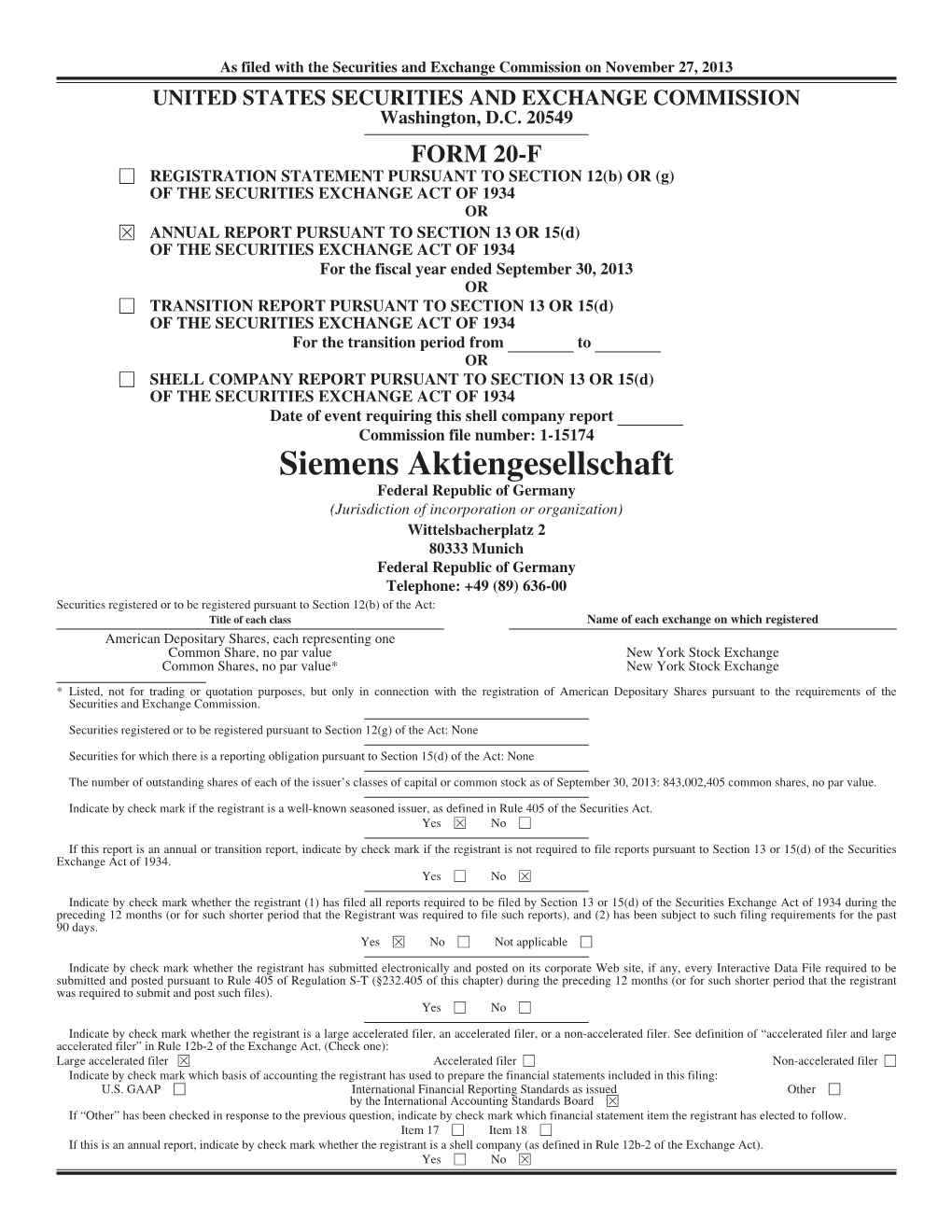

Siemens Aktiengesellschaft

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Qualitative and Quantitative Analysis of Siemens Ag

QUALITATIVE AND QUANTITATIVE ANALYSIS OF SIEMENS AG Authors (Universitat de Barcelona): Patrícia Amor Agut Clara Valls Moreno Gemma Casserras EDITOR: Jordi Marti Pidelaserra (Dpt. Comptabilitat, Universitat Barcelona) 1 Patrícia Amor 14961785 Clara Valls 14959906 Gemma Casserras 14965090 Alessandra Cortegiani (Bloc 3) 14991480 2 BLOC 1: SIEMENS AG BLOC 2: Risk Analysis BLOC 3: Profitability Analysis 3 BLOC 1 SIEMENS AG BASIC INFORMATION 4 Index 1. Introduction 2. Company History 3. Vision, Mission and Strategy 3.1. Vision 3.2. Mission 3.3. Strategy 4. Company Structure 4.1. Board of directors 4.2. Management by sector 5. Company Sectors 5.1. Energy Sector 5.2. Industry Sector 5.3. Healthcare Sector 5.4. Infrastructure and cities Sector 5.5. Financial Services 5.6. Other activities 5.7. Revenues importance 6. Shareholders 7. Stakeholders 8. Competitors 5 1. Introduction: Siemens AG is a German multinational engineering and electronics conglomerate company headquartered in Munich, Germany. It is the largest based in Europe. Founded to manufacture and install telegraphic systems, Germany-based Siemens AG has prospered and grown over 165 years to become a multifaceted electronics and electrical engineering enterprise, and one of the most international corporations in the world. Founded to manufacture and install telegraphic systems, Germany-based Siemens AG has prospered and grown over 165 years to become a multifaceted electronics and electrical engineering enterprise, and one of the most international corporations in the world. The Siemens name has been synonymous with cutting-edge technologies and continuous growth in profitability. With their wide array of products, systems and services, they are world leaders in information and communications, automation and control, power, medical solutions, transportation and lighting. -

VARIAN MEDICAL SYSTEMS, INC. (Exact Name of Registrant As Specified in Its Charter)

FINANCIAL HIGHLIGHTS Dollars in millions, except per share amounts 2016 2015 2014 REVENUES $ 3,218 $ 3,099 $ 3,050 GROSS MARGIN $ 1,361 $ 1,283 $ 1,302 OPERATING EARNINGS $ 551 $ 549 $ 571 OPERATING EARNINGS (as a percentage of revenues) 17.1% 17.7% 18.7% NET EARNINGS ATTRIBUTABLE TO VARIAN $ 402 $ 411 $ 404 NET EARNINGS PER DILUTED SHARE $ 4.19 $ 4.09 $ 3.83 GROSS ORDERS $ 3,400 $ 3,619 $ 3,527 BACKLOG $ 3,453 $ 3,475 $ 3,170 ORDERS & REVENUES COMBINED BUSINESSES ONCOLOGY SYSTEMS IMAGING COMPONENTS OTHER BUSINESS 4000 3000 800 350 3500 700 300 2500 3000 600 250 2000 2500 500 200 2000 1500 400 150 1500 300 1000 100 1000 200 500 50 500 100 0 0 0 0 FY16 FY15 FY14 FY16 FY15 FY14 FY16 FY15 FY14 FY16 FY15 FY14 Gross Orders Revenues EARNINGS BACKLOG 600 3500 500 400 300 3000 200 100 0 2500 FY16 FY15 FY14 Q1 Q2 Q3 Q4 Operating Earnings 2016 2015 2014 Net Earnings Attributable to Varian TO OUR STOCKHOLDERS Fiscal year 2016 was exciting for Varian. In May, we announced plans to separate our Imaging Components business into Varex Imaging Corporation, a new independent public company, through a distribution to Varian stockholders early in fiscal year 2017. Our intent with this separation is to enable our oncology and imaging components businesses to optimize their operations and focus more sharply on the unique needs of customers in their respective markets. You may recall that Varian Medical Systems is itself the product of a successful spin-off that unlocked a tremendous amount of value in three businesses. -

VARIAN MEDICAL SYSTEMS JP Morgan Healthcare Conference - Dow Wilson, CEO

VARIAN MEDICAL SYSTEMS JP Morgan Healthcare Conference - Dow Wilson, CEO January 13, 2015 January 2015 © 2015 VARIAN MEDICAL SYSTEMS. ALL RIGHTS RESERVED. Forward-Looking Statements • Forward-Looking Statements • Except for historical information, this presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements concerning industry outlook, including growth drivers; the company’s future orders, revenues, backlog, or earnings growth; future financial results; market acceptance of or transition to new products or technology such as our Edge™ radiosurgery system, TrueBeam™ and radiographic flat panel detectors, image-guided radiation therapy, stereotactic radiosurgery, filmless X-rays, proton therapy, and security and inspection, and any statements using the terms “could,” “believe,” “expect,” “outlook,” or similar statements are forward-looking statements that involve risks and uncertainties that could cause the company’s actual results to differ materially from those anticipated. Such risks and uncertainties include global economic conditions; the impact of the Affordable Health Care for America Act (including excise taxes on medical devices) and any further healthcare reforms (including changes to Medicare and Medicaid), and/or changes in third-party reimbursement levels; currency exchange rates and tax rates; demand for the company’s products; the company’s ability to develop, commercialize, and deploy new products; the company’s ability to meet Food and Drug -

Horns Rev 2 Offshore Wind Farm Main Suppliers and Partners

Horns Rev 2 Offshore Wind Farm Main suppliers and partners About Ørsted Ørsted has a vision of creating a world that runs entirely on green energy. Ørsted develops, builds and operates offshore wind farms, bioenergy plants and innovative solutions that convert waste into energy and supplies its customers with intelligent energy products. Ørsted has 5,600 employees and is headquartered in Denmark. Read more at orsted.com Energinet Owner of offshore substation and export cable Siemens Gamesa Renewable Energy Supplier of wind turbines Aarsleff/Bilfinger Berger J.V. I/S (Bladt Industries A/S) Supplier of foundations A2SEA A/S Supplier of vessels for installation of wind turbines and foundations Semco Maritime A/S Supplier of accommodation platform Nexans Deutschland Industries GmbH & Co. KG Supplier of cables Visser & Smit Hanab bv (Global Marine Systems Ltd.) Supplier of cable installation Port of Esbjerg Installation and service harbour Ørsted Horns Rev 2 Offshore Wind Farm Contact us Kraftværksvej 53, Skærbæk Fiskerihavnsgade 8 Tel. +45 99 55 11 11 7000 Fredericia 6700 Esbjerg [email protected] Denmark Denmark www.orsted.com Horns Rev 2 Offshore Wind Farm 7 We want a world that runs entirely on green energy 93 metres 114 metres Cable station Blåbjerg 68 metres Technical key data Wind turbine type Siemens Gamesa Renewable Weight, nacelle 80 tonnes Energy, SWT 2.3-93 Weight, tower 92 tonnes Number of wind turbines 91 Weight, foundation 150-200 tonnes Wind turbine capacity 2.3MW Total weight of each wind turbine approx 400 tonnes Total wind -

Siemens Annual Report 2020

Annual Report 2020 Table of A. contents Combined Management Report A.1 Organization of the Siemens Group and basis of presentation 2 A.2 Financial performance system 3 A.3 Segment information 6 A.4 Results of operations 18 A.5 Net assets position 22 A.6 Financial position 23 A.7 Overall assessment of the economic position 27 A.8 Report on expected developments and as sociated material opportunities and risks 29 A.9 Siemens AG 46 A.10 Compensation Report 50 A.11 Takeover-relevant information 82 B. Consolidated Financial Statements B.1 Consolidated Statements of Income 88 B.2 Consolidated Statements of Comprehensive Income 89 B.3 Consolidated Statements of Financial Position 90 B.4 Consolidated Statements of Cash Flows 92 B.5 Consolidated Statements of Changes in Equity 94 B.6 Notes to Consolidated Financial Statements 96 C. Additional Information C.1 Responsibility Statement 166 C.2 Independent Auditor ʼs Report 167 C.3 Report of the Super visory Board 176 C.4 Corporate Governance 184 C.5 Notes and forward-looking s tatements 199 PAGES 1 – 86 A. Combined Management Report Combined Management Report A.1 Organization of the Siemens Group and basis of presentation A.1 Organization of the Siemens Group and basis of presentation Siemens is a technology company that is active in nearly all Reconciliation to Consolidated Financial Statements is countries of the world, focusing on the areas of automation Siemens Advanta, formerly Siemens IoT Services, a stra- and digitalization in the process and manufacturing indus- tegic advisor and implementation partner in digital trans- tries, intelligent infrastructure for buildings and distributed formation and industrial internet of things (IIoT). -

Assessment of Vessel Requirements for the U.S. Offshore Wind Sector

Assessment of Vessel Requirements for the U.S. Offshore Wind Sector Prepared for the Department of Energy as subtopic 5.2 of the U.S. Offshore Wind: Removing Market Barriers Grant Opportunity 24th September 2013 Disclaimer This Report is being disseminated by the Department of Energy. As such, the document was prepared in compliance with Section 515 of the Treasury and General Government Appropriations Act for Fiscal Year 2001 (Public Law 106-554) and information quality guidelines issued by the Department of Energy. Though this Report does not constitute “influential” information, as that term is defined in DOE’s information quality guidelines or the Office of Management and Budget's Information Quality Bulletin for Peer Review (Bulletin), the study was reviewed both internally and externally prior to publication. For purposes of external review, the study and this final Report benefited from the advice and comments of offshore wind industry stakeholders. A series of project-specific workshops at which study findings were presented for critical review included qualified representatives from private corporations, national laboratories, and universities. Acknowledgements Preparing a report of this scope represented a year-long effort with the assistance of many people from government, the consulting sector, the offshore wind industry and our own consortium members. We would like to thank our friends and colleagues at Navigant and Garrad Hassan for their collaboration and input into our thinking and modeling. We would especially like to thank the team at the National Renewable Energy Laboratory (NREL) who prepared many of the detailed, technical analyses which underpinned much of our own subsequent modeling. -

Pictures of the Future

Pictures of the Future The Magazine for Research and Innovation | Special Edition: Green Technologies www.siemens.com/pof Tomorrow’s Power Grids How Vehicles, Cities and Alterna- tive Energy Sources will Interact Energy Efficiency Renewable Energy Squeezing Better Results out of Today’s Technologies Solutions for a Sustainable, Low-Carbon Future Pictures of the Future Pictures of the Future | Editorial Contents n recent weeks there have been signs vehicles at night, when electricity is Energy Efficiency Ithat the world may have left the worst of cheaper, and sell it during the day at peak the financial and economic crisis behind — prices. Electric vehicles will also have an and already some people are playing down important stabilizing function. Just a few the causes of the worst crisis in 80 years. hundred thousand electric vehicles con- However, we shouldn't ignore a simple nected to the power grid would provide 66 Scenario 2025 fact: activities aimed exclusively at short- more “balancing power” than Germany Energy-Saving Sleuth term gains don't create long-term value! currently needs to cover its demand peaks. 68 Urban Energy Analysis This is particularly true when it comes The most reliable, cheapest, and most Cities: A Better Energy Picture to climate change. Current efforts to limit environmentally-friendly source of energy 71 Trends: Energy for Everyone warming are based on the expectation that is reduced consumption. That’s why there’s Light at the End of the Tunnel the global community will set course to- a huge need for energy-efficient technolo- 73 World’s Largest Gas Turbine ward a sustainable future. -

Siemens Annual Report 2015, List of Subsidiaries and Associated

NOTE 34 List of subsidiaries and associated Equity interest companies pursuant to Section 313 September 30, 2015 in % para. 2 of the German Commercial Code Partikeltherapiezentrum Kiel Holding GmbH, Erlangen 100 11 Project Ventures Butendiek Holding GmbH, Erlangen 100 11 Projektbau-Arena-Berlin GmbH, Grünwald 100 11 R & S Restaurant Services GmbH, Munich 100 Equity interest September 30, 2015 in % REMECH Systemtechnik GmbH, Kamsdorf 100 11 Subsidiaries RHG Vermögensverwaltung GmbH, Berlin 100 Germany (113 companies) RISICOM Rückversicherung AG, Grünwald 100 Airport Munich Logistics and Services GmbH, Hallbergmoos 100 Samtech Deutschland GmbH, Hamburg 100 Alpha Verteilertechnik GmbH, Cham 100 11 Siemens Bank GmbH, Munich 100 Anlagen- und Rohrleitungsbau Ratingen GmbH, Ratingen 100 8 Siemens Beteiligungen Inland GmbH, Munich 100 11 Atecs Mannesmann GmbH, Erlangen 100 Siemens Beteiligungen Management GmbH, Grünwald 100 8 AXIT GmbH, Frankenthal 100 Siemens Beteiligungen USA GmbH, Berlin 100 11 Berliner Vermögensverwaltung GmbH, Berlin 100 11 Siemens Beteiligungsverwaltung GmbH & Co. OHG, Grünwald 100 10 BWI Services GmbH, Meckenheim 100 11 Siemens Campus Erlangen Grundstücks-GmbH & Co. KG, CAPTA Grundstücksgesellschaft mbH & Co. KG i.L., Grünwald 100 10 Grünwald 100 10 Capta Grundstücks-Verwaltungsgesellschaft mbH, Grünwald 100 Siemens Campus Erlangen Objekt 1 GmbH & Co. KG, Grünwald 100 10 DA Creative GmbH, Munich 100 Siemens Campus Erlangen Objekt 2 GmbH & Co. KG, Grünwald 100 10 Dade Behring Beteiligungs GmbH, Eschborn 100 Siemens Campus Erlangen Objekt 3 GmbH & Co. KG, Grünwald 100 10 Dade Behring Grundstücks GmbH, Marburg 100 Siemens Campus Erlangen Objekt 4 GmbH & Co. KG, Grünwald 100 10 D-R Holdings (Germany) GmbH, Oberhausen 100 Siemens Campus Erlangen Objekt 5 GmbH & Co. -

Offshore Wind in Europe Key Trends and Statistics 2019

Subtittle if needed. If not MONTH 2018 Published in Month 2018 Offshore Wind in Europe Key trends and statistics 2019 Offshore Wind in Europe Key trends and statistics 2019 Published in February 2020 windeurope.org This report summarises construction and financing activity in European offshore wind farms from 1 January to 31 December 2019. WindEurope regularly surveys the industry to determine the level of installations of foundations and turbines, and the subsequent dispatch of first power to the grid. The data includes demonstration sites and factors in decommissioning where it has occurred. Annual installations are expressed in gross figures while cumulative capacity represents net installations per site and country. Rounding of figures is at the discretion of the author. DISCLAIMER This publication contains information collected on a regular basis throughout the year and then verified with relevant members of the industry ahead of publication. Neither WindEurope nor its members, nor their related entities are, by means of this publication, rendering professional advice or services. Neither WindEurope nor its members shall be responsible for any loss whatsoever sustained by any person who relies on this publication. TEXT AND ANALYSIS: Lizet Ramírez, WindEurope Daniel Fraile, WindEurope Guy Brindley, WindEurope EDITOR: Colin Walsh, WindEurope DESIGN: Lin Van de Velde, Drukvorm FINANCE DATA: Clean Energy Pipeline and IJ Global All currency conversions made at EUR/ GBP 0.8777 and EUR/USD 1.1117 Figures include estimates for undisclosed values PHOTO COVER: Courtesy of Deutsche Bucht and MHI Vestas MORE INFORMATION: [email protected] +32 2 213 11 68 EXECUTIVE SUMMARY ..................................................................................................... 7 1. OFFSHORE WIND INSTALLATIONS ........................................................................... -

Siemens Annual Report 2015

2015 Geschäftsbericht Annual Report 2015 siemens.com Table of contents . A B C Combined Management Report Consolidated Financial Statements Additional Information A.1 p 2 B.1 p 58 C.1 p 122 Business and economic environment Consolidated Statements Responsibility Statement of Income A.2 p 8 C.2 p 123 Financial performance system B.2 p 59 Independent Auditor ʼs Report Consolidated Statements A.3 p 10 of Comprehensive Income C.3 p 125 Results of operations Report of the Supervisory Board B.3 p 60 A.4 p 15 Consolidated Statements C.4 p 128 Net assets position of Financial Position Corporate Governance B.4 p 61 A.5 p 16 C.5 p 136 Financial position Consolidated Statements Notes and forward- looking of Cash Flows statements A.6 p 20 B.5 p 62 Overall assessment of the economic position Consolidated Statements of Changes in Equity A.7 p 21 B.6 p 64 Subsequent events Notes to Consolidated Financial Statements A.8 p 22 Report on expected developments and associated material opportunities and risks A.9 p 35 Siemens AG A.10 p 38 Compensation Report A.11 p 53 Takeover-relevant information A. Combined Management Report A.1 Business and economic environment A.1.1 The Siemens Group With Dresser- Rand on board, we have a comprehensive port- folio of equipment and capability for the oil and gas industry A.1.1.1 ORGANIZATION AND BASIS OF PRESENTATION and a much expanded installed base, allowing us to address We are a technology company with core activities in the fields the needs of the market with products, solutions and services. -

Annual Report 2018

Annual Report 2018 siemens-healthineers.com Table of contents Page 02 Report of the Supervisory Board Page 10 To our shareholders A. B. C. Combined Consolidated Additional management financial information report statements Page 16 Page 58 Page 104 A.1 Business environment B.1 Consolidated C.1 Responsibility statements of statement Page 18 income A.2 Economic environment Page 105 Page 59 C.2 Independent auditor’s Page 20 B.2 Consolidated report A.3 Financial performance statements of system comprehensive Page 110 income C.3 Corporate Governance Page 21 A.4 Results of operations Page 60 Page 118 B.3 Consolidated C.4 Notes and Page 23 statements of forward-looking A.5 Assets position financial position statements Page 24 Page 61 A.6 Financial position B.4 Consolidated statements of Page 26 cash flows A.7 Overall assessment of Page 62 the economic position B.5 Consolidated Page 27 statements of changes in equity A.8 Nonfinancial matters Page 63 Page 28 B.6 Notes to consolidated A.9 Report on expected financial statements developments Page 30 A.10 Report on material risks and opportunities Page 37 A.11 Siemens Healthineers AG Page 39 A.12 Remuneration report Page 52 A.13 Takeover-relevant information and explanatory report Siemens Healthineers Annual Report 2018 Report of the Supervisory Board “ Thanks to the depth and breadth of its portfolio, Siemens Healthineers is ideally positioned to meet the challenges of worldwide population growth and increasing life expectancies.” Michael Sen Chairman of the Supervisory Board 02 Siemens Healthineers Annual Report 2018 Report of the Supervisory Board Fiscal year 2018 represented a milestone in the corporate history of both, Siemens and Siemens Healthineers. -

VARIAN Medical Systems Inc(2).Pdf

Jefferies Conference November 2017 J. Michael Bruff Vice President Investor Relations [email protected] This presentation is intended exclusively for investors. It is not intended for use in Sales or Marketing. FORWARD-LOOKING STATEMENTS Except for historical information, this presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements concerning industry outlook, including growth drivers, future trends in cancer incidence and trends in cancer treatment needs, demand, innovation and growth opportunities; Varian Medical System, Inc.’s (”Varian” or the “company”) future orders, revenues, backlog or earnings growth; future financial results; market acceptance of or transition to new products or technology such as our EdgeTM radiosurgery system, TrueBeam®, HyperArcTM, 360 OncologyTM, HALCYONTM, image-guided radiation therapy, stereotactic radiosurgery and proton therapy, and any statements using the terms “could”, “believe”, “expect”, “outlook”, “anticipate”, ”vision”, “estimate”, “future”, “horizon”, “aiming”, “driving”, “target” or similar statements are forward-looking statements that involve risks and uncertainties that could cause the company’s actual results to differ materially from those anticipated. Such risks and uncertainties include global economic conditions and changes to trends for cancer treatment regionally; the impact of changes to the Affordable Health Care for America Act (including excise taxes on medical devices) and any further healthcare