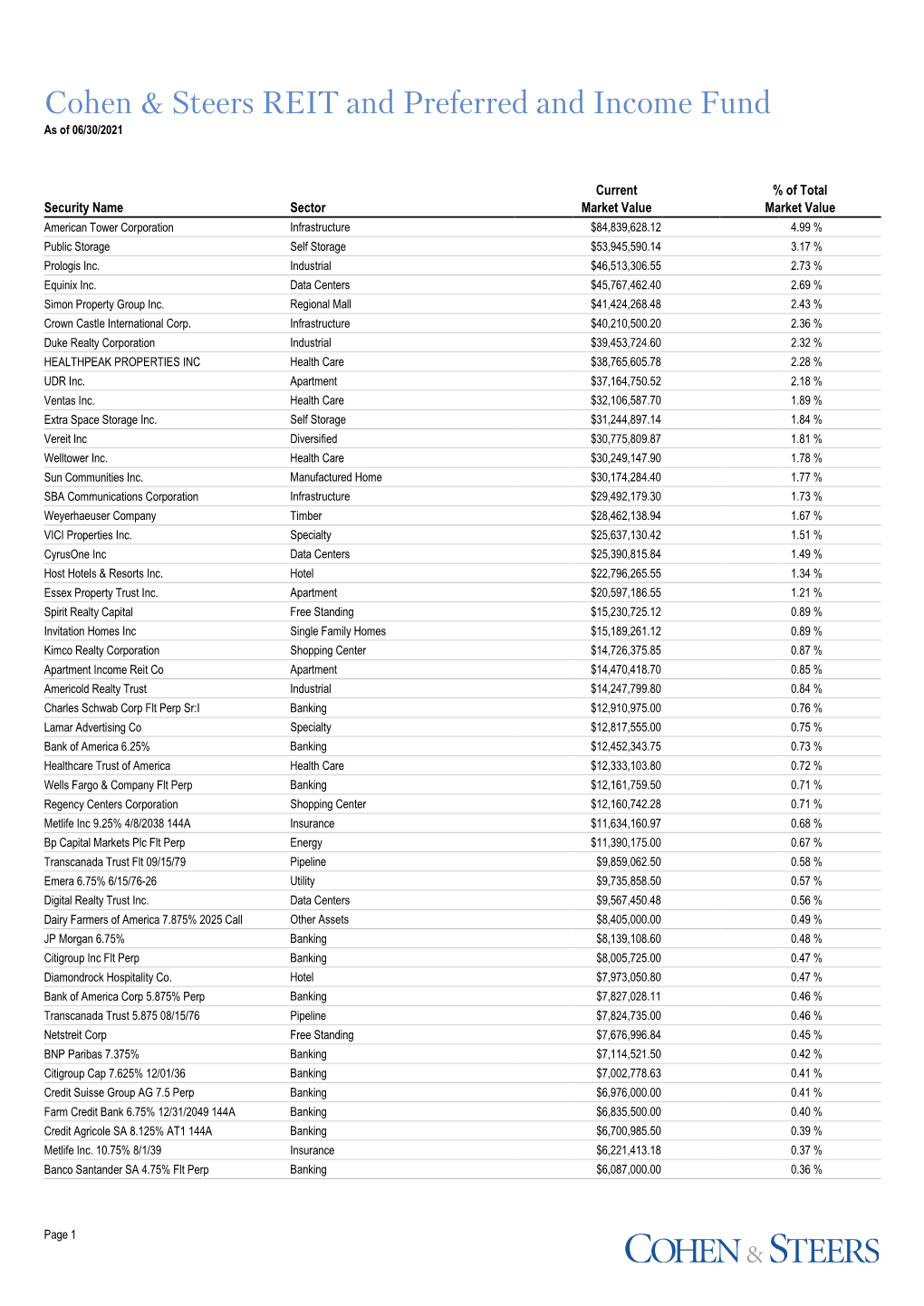

Cohen & Steers REIT and Preferred and Income Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fidelity® Real Estate Index Fund

Quarterly Holdings Report for Fidelity® Real Estate Index Fund April 30, 2021 URX-QTLY-0621 1.929338.109 Schedule of Investments April 30, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.7% Shares Value Equity Real Estate Investment Trusts (REITs) – 94.9% REITs – Apartments – 11.1% American Campus Communities, Inc. 266,266 $ 12,037,886 American Homes 4 Rent Class A 524,309 19,420,405 Apartment Investment & Management Co. Class A 302,004 2,095,908 AvalonBay Communities, Inc. 261,116 50,134,272 Camden Property Trust (SBI) 185,080 22,298,438 Centerspace 24,624 1,733,283 Equity Residential (SBI) 695,240 51,607,665 Essex Property Trust, Inc. 122,923 35,711,590 Independence Realty Trust, Inc. 226,163 3,808,585 Invitation Homes, Inc. 1,048,447 36,758,552 Mid‑America Apartment Communities, Inc. 216,558 34,071,025 UDR, Inc. 555,083 25,783,605 295,461,214 REITs – Diversified – 24.0% Alexander & Baldwin, Inc. 146,620 2,687,545 American Finance Trust, Inc. 230,424 2,306,544 Apartment Income (REIT) Corp. 290,475 13,114,946 Apple Hospitality (REIT), Inc. 426,311 6,761,292 Armada Hoffler Properties, Inc. 138,398 1,886,365 CatchMark Timber Trust, Inc. 130,180 1,513,993 Colony Capital, Inc. 1,014,741 7,103,187 CorePoint Lodging, Inc. 137,734 1,375,963 Cousins Properties, Inc. 286,533 10,507,165 Crown Castle International Corp. 758,119 143,329,978 Digital Realty Trust, Inc. 498,451 76,915,974 Duke Realty Corp. -

Reits by Property Type

Trim Size: 6in x 9ink kelly c05.tex V3 - 07/26/2016 9:20am Page 55 CHAPTER5 REITs by Property Type As discussed in the first chapter, one of the primary ways to clas- sify REITs is by the type of property in which they invest. This chapter provides a basic overview of the major property types owned by equity REITs, as well as detail on mortgage REITs. This chapter also pro- k vides sublists of the 181 equity REITs and 42 mortgage REITs that k compose the FTSE NAREIT All REITs Index, sorted according to NAREIT’s property sector and subsector classifications. (Appendix C presents additional information on each company, including website addresses.) Each type of real estate is associated with distinct supply-and- demand fundamentals that in turn assign certain risks and rewards to the landlords’ expected income. Although these risks and rewards become most apparent during times of economic boom or bust, they constantly govern the profitability of different property types and by extension affect stock-price performance. This chapter also highlights economic factors that influence demand for each property type; Chapter 7 provides a more in-depth discussion of the links between current economic news such as changes in interest rates or employment trends, and their effects on the stock prices of different types of REITs. Diversified and Specialized REITs Diversified REITs are equity REITs that invest in two or more types of commercial property (see Table 5.1). On the opposite end of the property spectrum are specialty REITs (Table 5.2), which own 55 The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment Trusts, Stephanie Krewson-Kelly and R. -

Equinix Inc (Eqix) 10-Q

EQUINIX INC (EQIX) 10-Q Quarterly report pursuant to sections 13 or 15(d) Filed on 04/27/2012 Filed Period 03/31/2012 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 2012 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 000-31293 EQUINIX, INC. (Exact name of registrant as specified in its charter) Delaware 77-0487526 (State of incorporation) (I.R.S. Employer Identification No.) One Lagoon Drive, Fourth Floor, Redwood City, California 94065 (Address of principal executive offices, including ZIP code) (650) 598-6000 (Registrant's telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) Yes x No ¨ and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

Global Fund Finance Symposium

8TH ANNUAL Global Fund Finance Symposium MARCH 21, 2018 NAME _________ GRAND HYATT, NEW YORK 8TH ANNUAL Global Fund Finance Symposium TABLE OF CONTENTS Letter from the Chairman ...3 Agenda at a Glance ............. 4 Session Details .................... 5 Sponsors ............................ 13 Speakers ............................ 31 FFA Leadership .................. 78 2 LETTER FROM THE CHAIRMAN Industry colleagues, The WFF committees have a great set of events planned for As I sit here on a Sunday night, with a glass of pinot in hand, 2018, and a special thanks to each of the firms that are helping trying to think of how to best encapsulate the feeling of the to sponsor these events. To help broaden the audience to 2017 market, my mind keeps wandering off to the pleading include more male participation, we’ve structured a great words of RiRi….. feature panel here today as part of the symposium. It’s my early favorite for winner of Best Panel of the day. “Please don’t stop the, please don’t stop the, please don’t stop the music” Couple of housekeeping notes - this year, we’ll be hosting our Rihanna 2007 (…and investors everywhere in 2017) Sponsor Dinner in London prior to the European symposium. Markets across the board were up, volatility was low, three The European fund finance market continues to grow, and the quarters of global GDP saw a pick-up in year-on-year terms in Board is looking forward to an evening there to both thank 2017, and the IMF is projecting stronger global GDP growth in our participating sponsors, but importantly provide a forum 2018 & 19 than 2017. -

Interconnection

Interconnection 101 As cloud usage takes off, data production grows exponentially, content pushes closer to the edge, and end users demand data and applications at all hours from all locations, the ability to connect with a wide variety of players becomes ever more important. This report introduces interconnection, its key players and busi- ness models, and trends that could affect interconnection going forward. KEY FINDINGS Network-dense, interconnection-oriented facilities are not easy to replicate and are typically able to charge higher prices for colocation, as well as charging for cross-connects and, in some cases, access to public Internet exchange platforms and cloud platforms. Competition is increasing, however, and competitors are starting the long process of creating network-dense sites. At the same time, these sites are valuable and are being acquired, so the sector is consolidating. Having facili- ties in multiple markets does seem to provide some competitive advantage, particularly if the facilities are similar in look and feel and customers can monitor them all from a single portal and have them on the same contract. Mobility, the Internet of Things, services such as SaaS and IaaS (cloud), and content delivery all depend on net- work performance. In many cases, a key way to improve network performance is to push content, processing and peering closer to the edge of the Internet. This is likely to drive demand for facilities in smaller markets that offer interconnection options. We also see these trends continuing to drive demand for interconnection facilities in the larger markets as well. © 2015 451 RESEARCH, LLC AND/OR ITS AFFILIATES. -

March 31, 2021

Units Cost Market Value US Equity Index Fund US Equities 95.82% Domestic Common Stocks 10X GENOMICS INC 126 10,868 24,673 1LIFE HEALTHCARE INC 145 6,151 4,794 2U INC 101 5,298 4,209 3D SYSTEMS CORP 230 5,461 9,193 3M CO 1,076 182,991 213,726 8X8 INC 156 2,204 4,331 A O SMITH CORP 401 17,703 28,896 A10 NETWORKS INC 58 350 653 AAON INC 82 3,107 5,132 AARON'S CO INC/THE 43 636 1,376 ABBOTT LABORATORIES 3,285 156,764 380,830 ABBVIE INC 3,463 250,453 390,072 ABERCROMBIE & FITCH CO 88 2,520 4,086 ABIOMED INC 81 6,829 25,281 ABM INDUSTRIES INC 90 2,579 3,992 ACACIA RESEARCH CORP 105 1,779 710 ACADIA HEALTHCARE CO INC 158 8,583 9,915 ACADIA PHARMACEUTICALS INC 194 6,132 4,732 ACADIA REALTY TRUST 47 1,418 1,032 ACCELERATE DIAGNOSTICS INC 80 1,788 645 ACCELERON PHARMA INC 70 2,571 8,784 ACCO BRANDS CORP 187 1,685 1,614 ACCURAY INC 64 483 289 ACI WORLDWIDE INC 166 3,338 6,165 ACTIVISION BLIZZARD INC 1,394 52,457 133,043 ACUITY BRANDS INC 77 13,124 14,401 ACUSHNET HOLDINGS CORP 130 2,487 6,422 ADAPTHEALTH CORP 394 14,628 10,800 ADAPTIVE BIOTECHNOLOGIES CORP 245 11,342 10,011 ADOBE INC 891 82,407 521,805 ADT INC 117 716 1,262 ADTALEM GLOBAL EDUCATION INC 99 4,475 3,528 ADTRAN INC 102 2,202 2,106 ADVANCE AUTO PARTS INC 36 6,442 7,385 ADVANCED DRAINAGE SYSTEMS INC 116 3,153 13,522 ADVANCED ENERGY INDUSTRIES INC 64 1,704 7,213 ADVANCED MICRO DEVICES INC 2,228 43,435 209,276 ADVERUM BIOTECHNOLOGIES INC 439 8,321 1,537 AECOM 283 12,113 17,920 AERIE PHARMACEUTICALS INC 78 2,709 1,249 AERSALE CORP 2,551 30,599 31,785 AES CORP/THE 1,294 17,534 33,735 AFFILIATED -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

PORTFOLIO of INVESTMENTS CTIVP® – Centersquare Real Estate Fund, March 31, 2021 (Unaudited) (Percentages Represent Value of Investments Compared to Net Assets)

PORTFOLIO OF INVESTMENTS CTIVP® – CenterSquare Real Estate Fund, March 31, 2021 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 99.7% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Real Estate 99.7% SL Green Realty Corp. 6,143 429,949 Diversified REITs 5.8% Total Office REITs 19,092,263 American Assets Trust, Inc. 80,702 2,617,973 Residential REITs 22.9% Broadstone Net Lease, Inc. 126,350 2,312,205 American Campus Communities, Inc. 157,850 6,814,385 Empire State Realty Trust, Inc., Class A 67,411 750,284 AvalonBay Communities, Inc. 46,044 8,495,578 STORE Capital Corp. 91,666 3,070,811 Equity Residential 106,770 7,647,935 VEREIT, Inc. 164,169 6,340,207 Essex Property Trust, Inc. 24,980 6,790,563 Total Diversified REITs 15,091,480 Invitation Homes, Inc. 420,210 13,442,518 Health Care REITs 10.6% Mid-America Apartment Communities, Inc. 18,140 2,618,690 Diversified Healthcare Trust 159,230 761,119 Sun Communities, Inc. 42,930 6,441,217 Healthpeak Properties, Inc. 77,720 2,466,833 UDR, Inc. 158,253 6,940,977 Medical Properties Trust, Inc. 226,490 4,819,707 Total Residential REITs 59,191,863 Sabra Health Care REIT, Inc. 179,910 3,123,238 Retail REITs 10.6% Ventas, Inc. 65,400 3,488,436 Acadia Realty Trust 145,280 2,755,962 Welltower, Inc. 180,691 12,942,896 Agree Realty Corp. 66,639 4,485,471 Total Health Care REITs 27,602,229 Brixmor Property Group, Inc. -

Signature Bank: Fasten Your Seat Belts; It's Going to Be a Bumpy Taxi

Signature Bank | March 31, 2016 MORGAN STANLEY RESEARCH March 31, 2016 MORGAN STANLEY & CO. LLC Ken A Zerbe, CFA Signature Bank [email protected] +1 212 761-7417 Adam Jonas, CFA Fasten Your Seat Belts; It's Going to Be a [email protected] +1 212 761-1726 Steven M Wald Bumpy Taxi Ride … but Worth It [email protected] +1 212 761-0474 Neel Mehta Industry View Stock Rating Price Target [email protected] +1 212 761-8582 In-Line Overweight $163.00 Signature Bank ( SBNY.O, SBNY US ) The negative impact of ride-sharing on the taxi industry should not Midcap Banks / United States of America be underestimated, and could drive sharply higher credit losses in Stock Rating Overweight Industry View In-Line SBNY's taxi portfolio (we estimate a 25% cumulative loss). We Price target $163.00 explore both the risks and offsets to taxi lending, and why SBNY Shr price, close (Mar 30, 2016) $138.26 Mkt cap, curr (mm) $7,038 remains a key Overweight. 52-Week Range $163.15-119.60 Ride-sharing companies pose a significant threat to the taxi industry Fiscal Year Ending 12/15 12/16e 12/17e 12/18e and, by default, to the creditworthiness of taxi medallion borrowers. Our work ModelWare EPS ($) 7.30 8.17 9.36 10.86 with our Autos and Shared Mobility colleague Adam Jonas highlights how Prior ModelWare EPS - 8.27 9.42 10.60 ($) rapidly ride-sharing companies have overtaken taxis in less dense urban Consensus EPS ($)§ 7.21 8.29 9.50 11.00 markets, with more drivers who also broadly earn more per hour than their P/E 21.0 16.9 14.8 12.7 taxi counterparts. -

GRESB Real Estate 2016 Results | 2017 Outlook

0 GRESB Real Estate 2016 Results | 2017 Outlook 1 Strong Industry Support All major industry associations globally Increasing Participant Members GRESB members include 150+ private equity firms / REITs globally Institutional Investor Members New in Integrate ESG data | utilize GRESB analytic tools 2017 4 GRESB Participation Total participants (year-on-year) 5 Global Scope 2016 industry coverage 759 Entities | 63 Countries | 66,000 Assets Geographic Distribution Global response rate 7 Investment Capital Assets under management [$B] Response Rate North America United States and Canada : 2013 to current 9 Response Rate North America United States :: Listed Companies Alexandria Real Estate Kilroy Realty Equities Kimco Realty Corporation AvalonBay Communities, Inc. LaSalle Investment Boston Properties Management Brandywine Realty Trust Liberty Property Trust Camden Property Trust Monogram Residential COPT Paramount Group Cousins Properties Parkway Properties DiamondRock Hospitality Post Properties Equity One Prologis Equity Residential Public Storage Essex Property Trust Regency Centers Federal Realty Investment Simon Property Group Trust Taubman First Industrial Realty Trust The Macerich Company Forest City Enterprises TIER REIT Franklin Street Properties Ventas, Inc. General Growth Properties Vornado Realty Trust Government Properties Trust Washington REIT HCP, Inc. Weingarten Realty Hersha Hospitality Trust Welltower, Inc Host Hotels & Resorts 10 INP Retail 2016 Results North America 11 2016 Results US REITs over time 12 # Participants per -

Announcement February 22, 2019

Announcement February 22, 2019 Indxx USA Regional Banking Index will be reconstituted after the close of trading hours on February 28, 2019. Listed below are the constituents that will be added to the existing index: S.No ISIN Company Name 1 US5116561003 Lakeland Financial Corporation 2 US42234Q1022 Heartland Financial USA, Inc. 3 US3369011032 1st Source Corporation 4 US89214P1093 TowneBank 5 US4461501045 Huntington Bancshares Incorporated 6 US1637311028 Chemical Financial Corporation 7 US2298991090 Cullen/Frost Bankers, Inc. 8 US1176651099 Bryn Mawr Bank Corporation 9 US72346Q1040 Pinnacle Financial Partners, Inc. 10 US90539J1097 Union Bankshares Corporation 11 US81768T1088 ServisFirst Bancshares Inc 12 US06652K1034 BankUnited, Inc. 13 US6952631033 PacWest Bancorp 14 US9897011071 Zions Bancorporation, N.A. 15 US05945F1030 BancFirst Corporation 16 US15201P1093 CenterState Bank Corporation Listed below are the constituents that will be deleted from the existing index: S.No ISIN Company Name 1 US03076K1088 Ameris Bancorp 2 US05561Q2012 BOK Financial Corporation 3 US1011191053 Boston Private Financial Holdings, Inc. 4 US1547604090 Central Pacific Financial Corp. 5 US1972361026 Columbia Banking System, Inc. 6 US2937121059 Enterprise Financial Services Corp 7 US3198291078 First Commonwealth Financial Corporation 8 US3202091092 First Financial Bancorp. 9 US3205171057 First Horizon National Corporation 10 US52471Y1064 LegacyTexas Financial Group, Inc. 11 US7838591011 S&T Bancorp, Inc. 12 US8404411097 South State Corporation 13 US84470P1093 Southside Bancshares, Inc. 14 US9027881088 UMB Financial Corporation 15 US9197941076 Valley National Bancorp Listed below are the new index constituents that will be effective at the close of trading hours on February 28, 2019. Weights as of S.No ISIN Company Name Feb 21, 2019 1 US1491501045 Cathay General Bancorp 2.00% 2 US8984021027 Trustmark Corporation 2.00% 3 US4590441030 International Bancshares Corporation 2.00% 4 US1266001056 CVB Financial Corp. -

CFPB Depository Institutions (CFPB DI's) Based on 9/30/12 Total Assets ID Institution City State 9/30/12 Total Assets (In Thousands)

CFPB Depository Institutions (CFPB DI's) Based on 9/30/12 Total Assets ID Institution City State 9/30/12 Total Assets (in thousands) 852218 JPMorgan Chase Bank, National Association COLUMBUS OH $1,850,218,000 480228 Bank of America, National Association CHARLOTTE NC $1,448,273,067 476810 Citibank, NA SIOUX FALLS SD $1,365,026,000 451965 Wells Fargo Bank, National Association SIOUX FALLS SD $1,218,796,000 504713 U.S. Bank National Association CINCINNATI OH $342,627,272 817824 PNC Bank, National Association WILMINGTON DE $292,503,471 541101 Bank of New York Mellon NEW YORK NY $264,966,000 35301 State Street Bank and Trust Company BOSTON MA $200,653,748 497404 TD Bank, N.A. WILMINGTON DE $200,546,165 413208 HSBC Bank USA, National Association MCLEAN VA $196,238,413 852320 Branch Banking and Trust Company WINSTON-SALEM NC $176,357,869 675332 SunTrust Bank ATLANTA GA $168,950,895 1830035 FIA Card Services, National Association WILMINGTON DE $161,897,626 112837 Capital One, National Association MCLEAN VA $161,283,387 233031 Regions Bank BIRMINGHAM AL $120,832,228 2182786 Goldman Sachs Bank USA NEW YORK NY $120,437,000 489913 Chase Bank USA, National Association NEWARK DE $115,931,571 723112 Fifth Third Bank CINCINNATI OH $114,987,769 3303298 RBS Citizens, National Association PROVIDENCE RI $107,214,881 2933616 ING Bank, FSB*** WILMINGTON DE $97,527,202 210434 Northern Trust Company CHICAGO IL $93,383,364 3284070 Ally Bank MIDVALE UT $92,765,825 75633 BMO Harris Bank, National Association CHICAGO IL $91,324,978 212465 Union Bank, National Association