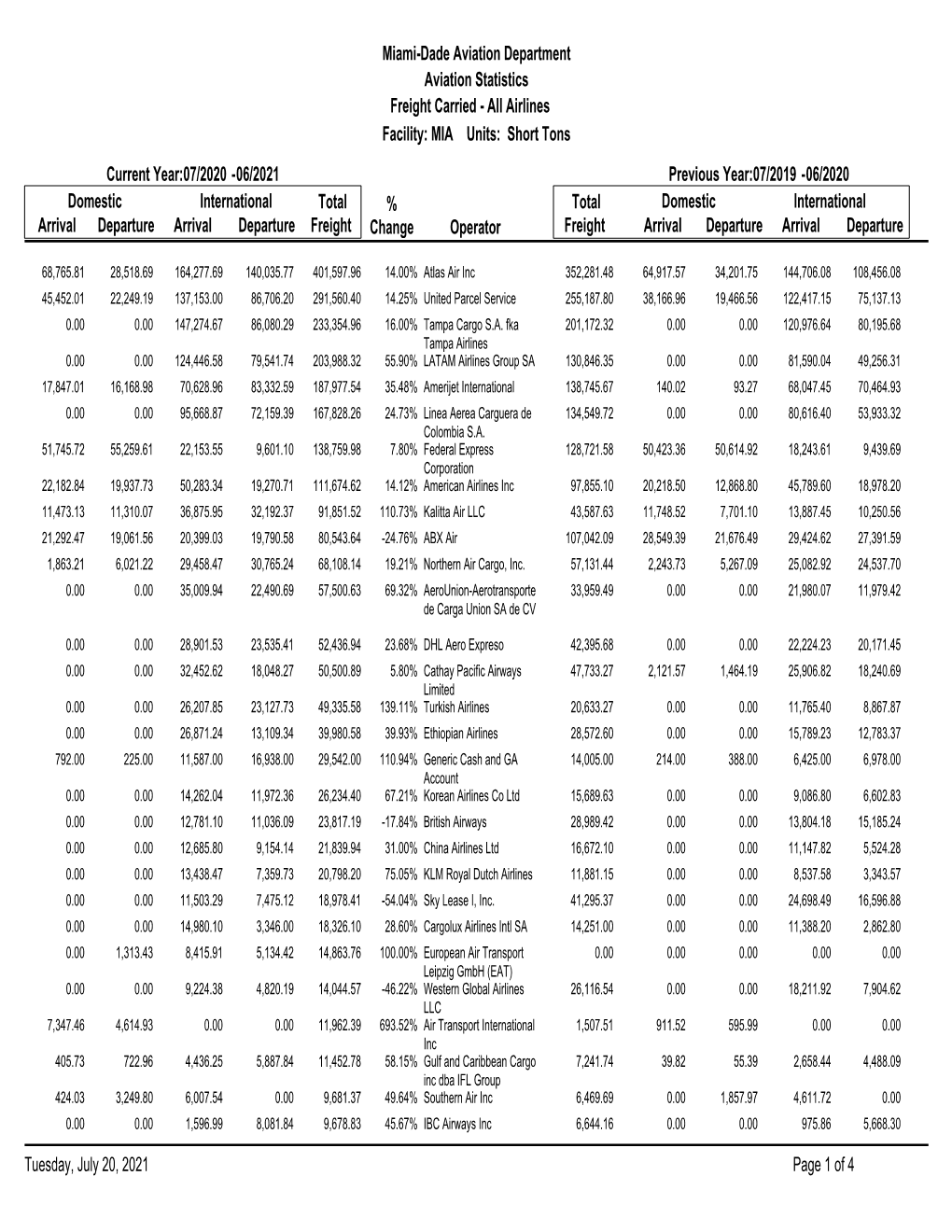

Short Tons Freight Carried Miami-Dade Aviation Department

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

G410020002/A N/A Client Ref

Solicitation No. - N° de l'invitation Amd. No. - N° de la modif. Buyer ID - Id de l'acheteur G410020002/A N/A Client Ref. No. - N° de réf. du client File No. - N° du dossier CCC No./N° CCC - FMS No./N° VME G410020002 G410020002 RETURN BIDS TO: Title – Sujet: RETOURNER LES SOUMISSIONS À: PURCHASE OF AIR CARRIER FLIGHT MOVEMENT DATA AND AIR COMPANY PROFILE DATA Bids are to be submitted electronically Solicitation No. – N° de l’invitation Date by e-mail to the following addresses: G410020002 July 8, 2019 Client Reference No. – N° référence du client Attn : [email protected] GETS Reference No. – N° de reference de SEAG Bids will not be accepted by any File No. – N° de dossier CCC No. / N° CCC - FMS No. / N° VME other methods of delivery. G410020002 N/A Time Zone REQUEST FOR PROPOSAL Sollicitation Closes – L’invitation prend fin Fuseau horaire DEMANDE DE PROPOSITION at – à 02 :00 PM Eastern Standard on – le August 19, 2019 Time EST F.O.B. - F.A.B. Proposal To: Plant-Usine: Destination: Other-Autre: Canadian Transportation Agency Address Inquiries to : - Adresser toutes questions à: Email: We hereby offer to sell to Her Majesty the Queen in right [email protected] of Canada, in accordance with the terms and conditions set out herein, referred to herein or attached hereto, the Telephone No. –de téléphone : FAX No. – N° de FAX goods, services, and construction listed herein and on any Destination – of Goods, Services, and Construction: attached sheets at the price(s) set out thereof. -

August 2020 9/22/2020

JOHN GLENN COLUMBUS INTERNATIONAL AIRPORT Monthly Activity Report | August 2020 9/22/2020 PASSENGERS Total Passengers - Monthly Total Passengers - Year to Date Actual Percent Actual Percent Airline 2020 2019 2020 2019 Change Change Change Change Air Canada Express - 6,881 -6,881 -100.0% 9,500 49,873 -40,373 -81.0% Alaska 4,983 8,321 -3,338 -40.1% 32,191 48,081 -15,890 -33.0% American 54,615 178,793 -124,178 -69.5% 539,521 1,364,292 -824,771 -60.5% Delta 39,530 169,765 -130,235 -76.7% 414,257 1,219,149 -804,892 -66.0% Frontier 4,127 11,314 -7,187 -63.5% 31,578 79,074 -47,496 -60.1% Southwest 83,081 227,487 -144,406 -63.5% 828,263 1,891,271 -1,063,008 -56.2% Spirit 19,723 33,135 -13,412 -40.5% 161,028 308,445 -147,417 -47.8% United 25,420 100,227 -74,807 -74.6% 262,542 737,649 -475,107 -64.4% AIRLINES TOTALS 231,479 735,923 -504,444 -68.5% 2,278,880 5,697,834 -3,418,954 -60.0% CHARTER TOTALS 617 1,517 -900 -59.3% 9,291 28,997 -19,706 -68.0% AIRPORT TOTALS 232,096 737,440 -505,344 -68.5% 2,288,171 5,726,831 -3,438,660 -60.0% CARGO Total Cargo (Freight and Mail) - Monthly Total Cargo (Freight and Mail) - Year-To-Date Actual Percent Actual Percent Airline 2020 2019 2020 2019 Change Change Change Change Alaska 51,752 35,047 16,705 47.7% 115,122 173,379 -58,257 -33.6% American 34,506 145,812 -111,306 -76.3% 516,109 1,189,222 -673,113 -56.6% Delta 109,455 189,574 -80,119 -42.3% 854,336 1,356,604 -502,268 -37.0% Southwest 236,161 424,511 -188,350 -44.4% 2,386,755 3,157,189 -770,434 -24.4% United 11,804 101,862 -90,058 -88.4% 243,792 786,206 -542,414 -

Columbus Regional Airport Authority

COLUMBUS REGIONAL AIRPORT AUTHORITY - PORT COLUMBUS INTERNATIONAL AIRPORT TRAFFIC REPORT June 2014 7/22/2014 Airline Enplaned Passengers Deplaned Passengers Enplaned Air Mail Deplaned Air Mail Enplaned Air Freight Deplaned Air Freight Landings Landed Weight Air Canada Express - Regional 2,377 2,278 - - - - 81 2,745,900 Air Canada Express Totals 2,377 2,278 - - - - 81 2,745,900 AirTran 5,506 4,759 - - - - 59 6,136,000 AirTran Totals 5,506 4,759 - - - - 59 6,136,000 American 21,754 22,200 - - - 306 174 22,210,000 Envoy Air** 22,559 22,530 - - 2 ,027 2 ,873 527 27,043,010 American Totals 44,313 44,730 - - 2,027 3,179 701 49,253,010 Delta 38,216 36,970 29,594 34,196 25,984 36,845 278 38,899,500 Delta Connection - ExpressJet 2,888 2,292 - - - - 55 3,709,300 Delta Connection - Chautauqua 15,614 14,959 - - 640 - 374 15,913,326 Delta Connection - Endeavor 4 ,777 4,943 - - - - 96 5,776,500 Delta Connection - GoJet 874 748 - - 33 - 21 1,407,000 Delta Connection - Shuttle America 6,440 7,877 - - 367 - 143 10,536,277 Delta Connection - SkyWest 198 142 - - - - 4 188,000 Delta Totals 69,007 67,931 29,594 34,196 27,024 36,845 971 76,429,903 Southwest 97,554 96,784 218,777 315,938 830 103,146,000 Southwest Totals 97,554 96,784 - - 218,777 315,938 830 103,146,000 United 3 ,411 3,370 13,718 6 ,423 1 ,294 8 ,738 30 3,990,274 United Express - ExpressJet 13,185 13,319 - - - - 303 13,256,765 United Express - Mesa 27 32 - - - - 1 67,000 United Express - Republic 4,790 5,133 - - - - 88 5,456,000 United Express - Shuttle America 9,825 9,076 - - - - 151 10,919,112 -

First Name Last Name Company Job Title Neel Jones Shah Able Freight Services, Inc

First Name Last Name Company Job Title Neel Jones Shah Able Freight Services, Inc. Chief Commercial Officer Orlando Wong Able Freight Services, Inc. Owner/ Vice President Helmut Berchtold adi Management Consult President & CEO Anne Marie Mac Carthy Aer Lingus Cargo Global Sales Manager Peter O'Neill Aer Lingus Cargo Director Willie Mercado Aer Lingus Cargo Cargo Sales & Res Mgr. - NA Luis Fernando Paredes AEROEXPRESS / AEH GROUP S.A. PRESIDENT & CEO Antonio Gomez Elorduy Aeromexico Cargo Ditector USA, Asia & Canada Mauricio Nieto Martinez Aeromexico Cargo CEO Pedro Rogelio Anza Bourlon Aeromexico Cargo VP International Sales Jennifer Carter Aeroterm Leasing Director Eastern Region Michael Minear Aeroterm Executive Vice President Dustin Gillioz Aeroterm Leasing Director Western Region Greg Murphy Aeroterm Executive Vice President Erin Gruver Aeroterm Executive Vice President Alejandro Arellano AEROUNION GDL Sales Manager Jorge Rivera AEROUNION SENIOR VICEPRESIDENT Reyes De La Torre Guillermo AEROUNION MEX SALES MANAGER Luis Jr Ramos AEROUNION GATEWAY MANAGER Erik Varwijk AFKL Managing Director KLM Senior Vice President Sales & Distribution Mattijs Ten Brink AFKLMP AFKLMP Jan Krems AF-KL-MP Cargo VP Americas Arthur Brown AF-KL-MP Cargo Dir, Key Accts Rich Haus AF-KL-MP Cargo Dir, Key Accts Jean-Jacques Castillo AF-KL-MP Cargo VP USA Arthur Leeds AF-KL-MP Cargo Dir, Key Accts Lorena Murray AGI/Alliance Airlines Director, North American Accounts Roman Streule Agility Vice President Airfreight Americas Karen Rondino Agility Logistics Director -

July 01, 2021

July 01, 2021 East Building, PHH-30 U.S. Department 1200 New Jersey Avenue S.E. of Transportation Washington, D.C. 20590 Pipeline and Hazardous Materials Safety Administration DOT-SP 11110 (TWENTY-FOURTH REVISION) EXPIRATION DATE:2022-05-31 (FOR RENEWAL, SEE 49 CFR 107.109) 1. GRANTEE: United Parcel Service Co. (UPSCO) Louisville, KY FAA Certificate Number: IPXA097B (Part 121) 2. PURPOSE AND LIMITATION: a. This special permit authorizes the transportation in commerce of certain hazardous materials in an inaccessible location aboard an aircraft in quantities exceeding those authorized by § 175.75 subject to the conditions and limitations provided herein. This special permit authorizes the hazardous materials identified in paragraph 6 below, which are otherwise permitted to be carried aboard passenger-carrying aircraft, to be loaded: (1) In any inaccessible cargo compartment; (2) In any freight container within an accessible cargo compartment; and (3) In any accessible cargo compartment in a cargo- only aircraft in a manner that makes them inaccessible in flight. This special permit provides no relief from the Hazardous Materials Regulations (HMR) other than as specifically stated herein. The most recent revision supersedes all previous revisions. b. The safety analyses performed in development of this special permit only considered the hazards and risks associated with transportation in commerce. Continuation of DOT-SP 11110 (24th Rev.) Page 2 July 01, 2021 c. No party status will be granted to this special permit. 3. REGULATORY SYSTEM AFFECTED: 49 CFR Parts 106, 107 and 171- 180. 4. REGULATIONS FROM WHICH EXEMPTED: 49 CFR § 171.8 (modified) and § 175.75 in that quantity limitations are exceeded. -

Facility: MIA Units: Flight Operations Miami-Dade Aviation Department

Miami-Dade Aviation Department Aviation Statistics Flight Ops - All Airlines Facility: MIA Units: Flight Operations Current Year:10/2020 -11/2020 Prior Year:10/2019 -11/2019 Domestic International % Domestic International Arrival Departure Arrival Departure Total Change Operator Total Arrival Departure Arrival Departure 4,143 4,125 2,825 2,848 13,941 -49.86% American Airlines Inc 27,805 7,957 8,395 5,943 5,510 1,708 1,709 424 425 4,266 -54.36% Envoy Air Inc 9,348 4,013 4,339 672 324 1,322 1,550 534 300 3,706 -16.76% Generic Cash and GA 4,452 1,719 2,038 525 170 Account 846 845 2 1 1,694 -41.42% Delta Air Lines Inc 2,892 1,337 1,335 109 111 363 372 447 439 1,621 7.49% United Parcel Service 1,508 314 314 442 438 5 3 752 757 1,517 195.71% LATAM Airlines Group SA 513 0 0 258 255 673 668 0 1 1,342 1.13% United Airlines, Inc 1,327 663 664 0 0 291 279 206 218 994 -3.12% Atlas Air Inc 1,026 325 275 195 231 195 193 296 297 981 65.43% Amerijet International 593 14 13 283 283 0 0 393 392 785 17.51% Tampa Cargo S.A. fka 668 0 0 333 335 Tampa Airlines 18 15 305 307 645 6.26% IBC Airways Inc 607 12 15 291 289 259 257 47 49 612 5.15% Federal Express 582 239 239 52 52 Corporation 7 6 266 265 544 7.30% Linea Aerea Carguera de 507 0 0 254 253 Colombia S.A. -

City of Phoenix Aviation Department Sky Harbor International Airport Financial Management Division Monthly Statistical Reports - November 2016 Table of Contents

City of Phoenix Aviation Department Sky Harbor International Airport Financial Management Division Monthly Statistical Reports - November 2016 Table of Contents Reports: Graphs: 1 Passengers, Cargo, and Aircraft Operations 1 Domestic Enplaned I Deplaned Passengers Terminal 2 2 Passenger Activity Report 2 Domestic Enplaned I Deplaned Passengers Terminal 3 3 Passenger and Activity Worksheet November 2016 3 Domestic Enplaned I Deplaned Passengers Terminal 4 4 Passenger and Activity Worksheet November 2015 4 Total Domestic Enplaned I Deplaned Passengers 5 Enplaned Passengers by Carrier for Fiscal Year 2016/17 5 Total International Enplaned I Deplaned Passengers 6 Deplaned Passengers by Carrier for Fiscal Year 2016/17 6 Total Enplaned I Deplaned Passengers 7 Total Passengers by Carrier for Fiscal Year 2016/17 7 Total Enplaned I Deplaned Cargo (in Tons) 8 Enplaned Passengers by Carrier for Calendar Year 2016 8 Sky Harbor International Airport Aircraft Operations 9 Deplaned Passengers by Carrier for Calendar Year 2016 9 Deer Valley Airport Aircraft Operations 10 Total Passengers by Carrier for Calendar Year 2016 1O Goodyear Airport Aircraft Operations 11 Airline Landing Weights -All Airlines for Fiscal Year 2016/17 12 Airline Landing Weights - Rates & Charges Airlines Only for Fiscal Year 2016/17 PASSENGERS, CARGO, AND AIRCRAFT OPERATIONS AT PHOENIX AIRPORTS: November 2016 Fis cal YTD Fis ca l YTD Calenda r YTD ___ _ _._ 2016 2015 %Cha ___. _. ___._. __ %Chg I I 201 6 T2 153,849 149,936 2.6% 646,914 592,535 9.2% 1,585,013 1,359,302 16.6% T3 -

ALTA Press Release

ALTA’s Aviation Law Americas Conference Taking Place September 6 – 8, 2017 in Bogota, Colombia Registration now open at ALTA Aviation Law Americas Miami, Florida (April 25, 2017) – ALTA’s (Latin American and Caribbean Air Transport Association) 11th annual Aviation Law Americas Conference is taking place September 6 – 8, 2017 in Bogota, Colombia. ALTA’s Aviation Law Americas is the region's premier legal conference focused specifically on the aviation industry. Attended by top law firms, aviation industry experts and airlines from throughout the Americas, the two-day conference brings together legal decision makers for meetings in one location to focus on exchanging views, ideas, and best practices on legal, finance and aero-political issues and challenges that the industry is currently facing in the region. ALTA’s Legal and Aeropolitical Committee meeting together with the IATA-ALTA Aeropolitical Forum is also held at this conference to discuss emerging challenges and to coordinate actions before civil aviation authorities, governmental agencies, airport administrations, and international and multilateral organizations. “ALTA’s Aviation Law Americas provides the ideal venue for aviation legal and finance executives to meet in one place for face-to-face discussions on current and upcoming topics of key importance for the air transport industry,” said Gonzalo Yelpo, ALTA’s Chief Legal Counsel and Chair of the Aviation Law Americas Conference. Past conferences have focused on topics such as the economic outlook, aviation in a competitive environment, the environment, recent case studies in litigation and liability, passenger rights, aircraft financing, and more. For complete details and to register, visit Aviation Law Americas. -

NACC Contact List July 2015 Update

ID POC Name POC Email Office Cell Filer Other Comments ABS Jets (Czech Republic) ABS Michal Pazourek (Chf Disp) [email protected] +420 220 111 388 + 420 602 205 (LKPRABPX & LKPRABY) [email protected] 852 ABX Air ABX Alain Terzakis [email protected] 937-366-2464 937-655-0703 (800) 736-3973 x62450 KILNABXD Ron Spanbauer [email protected] 937-366-2435 (937) 366-2450 24hr. AeroMexico AMX Raul Aguirre (FPF) [email protected] 011 (5255) 9132-5500 (281) 233-3406 Files thru HP/EDS Air Berlin BER Recep Bayindir [email protected] 49-30-3434-3705 EDDTBERA [email protected] AirBridgeCargo Airlines ABW Dmitry Levushkin [email protected] Chief Flight Dispatcher 7 8422 590370 Also see Volga-Dnepr Airlines Volga-Dnepr Airlines 7 8422 590067 (VDA) Air Canada ACA Richard Steele (Mgr Flt Supt) [email protected] 905 861 7572 647 328-3895 905 861 7528 CYYZACAW thru LIDO Rod Stone [email protected] 905 861 7570 Air China CCA Weston Li (Mgr. American Ops) [email protected] 604-233-1682 778-883-3315 Zhang Yuenian [email protected] Air Europa AEA Bernardo Salleras [email protected] Flight Ops [email protected] 34 971 178 281 (Ops Mgr) Air France AFR Thierry Vuillaume Thierry Vuillaume <[email protected]> +33 (0)1 41 56 78 65 LFPGAFRN Air India AIC Puneet Kataria [email protected] 718-632-0125 917-9811807 + 91-22-66858028 KJFKAICO [email protected] 718-632-0162direct Use SABRE for flights Files thru HP/EDS arriving/departing USA Air New Zealand -

Informe Anual Annual Report

Informe Anual Annual Report 2015 Índice Index Acerca de Avianca Holdings S.A. 7 About Avianca Holdings S.A Países donde están incorporadas las Aerolíneas 9 Airlines’ Countries of Organization Historia de las Aerolíneas integradas en la Compañía Holding 11 History of the Holding’s Airlines Norte Estratégico 20 Strategic Focus Objetivos Corporativos 21 Board of Directors Junta Directiva 22 Carta del Presidente a los Señores Accionistas 32 CEO’s Letter to the Shareholders Informe de Gestión 2015 35 Management Report 2015 Entorno mundial del mercado de transporte aéreo 35 Global air transport market Desempeño 2015 de Avianca Holdings S.A. 37 Avianca Holdings S.A. Performance 2015 Resultados Financieros y Operativos 37 Financial and Operating Results Indicadores operacionales de las Aerolíneas de Pasajeros 37 Operational Indicators of the Passenger Airlines Resultados de la línea de inversión en aerolíneas de pasajeros 38 Results of the line of investment in passenger airlines Renovación de flota 41 Fleet Renewal Seguridad – Nuestro Compromiso 42 Safety – Our commitment Talento Humano 45 Human Talent Las Aerolíneas integradas mejoran su posición en los mercados 47 The member Airlines improved their position in the markets Destinos, Red de Rutas y Alianzas 48 Destinations, Network of Routes and Alliances Avances en la homologación de procesos 51 Progress in the standardization of processes Resultados de la línea de inversión en aerolíneas de transporte de carga y mensajería 54 Results in the investmens in cargo transport and courier Transporte de Carga 54 Freight transportation Unidad de negocios Deprisa 58 Deprisa Business Unit Resultados en otras líneas del negocio 61 Results in other lines of business LifeMiles B.V. -

Anuario CANAERO 2016-2017

Aniversario ANUARIO 2016-2017 A I R L I N E S Colombia Royal Duch Airlines Servicio Técnico Aéreo de México, S.A. de C. V. Av. Paseo de la Reforma No.379 Piso 4, Col. Cuauhtémoc, Del. Cuauhtémoc C.P. 06500, Ciudad de México. Teléfonos: +52 (55) 5286.3515 | (55) 5286.4000 | (55) 5286.4005 | (55) 5286.6262 | [email protected] ÍNDICE 1. Sobre CANAERO 3 Nosotros Carta del Director General SOBRE Mesa Directiva 2017 Ejes Estratégicos 2017 CANAERO 2. Comités De Trabajo 13 3. Actividades 27 4. La Industria en Cifras 41 La Aviación en el mundo México en Cifras Mercado Transfronterizo Turismo Aéreo 5. Miembros Afiliados 75 Aerolíneas Nacionales Taxis Aéreos Aerolíneas Trasatlánticas Aerolíneas Transpacíficas Aerolíneas Americanas Aerolíneas Centroamericanas Aerolíneas Sudamericanas Empresas de Carga Aérea Prestadores de Servicios Patrocinadores 2 SOBRE CANAERO NOSOTROS Nosotros Actividades La Cámara Nacional de Aerotransportes Asimismo, la Cámara se encuentra afiliada a los es una institución autónoma de interés organismos empresariales más reconocidos Representar a sus afiliados ante el público integrada por más de 60 miembros, del país como la CONCAMIN, CNET y Congreso de la Unión, autoridades agrupando a aerolíneas nacionales e CMET; y mantiene alianzas estratégicas con y organismos públicos: SCT, DGAC, internacionales, empresas cargueras, taxis asociaciones internacionales de transporte INM, SAT, PROFECO, ASA, SENEAM, aéreos y prestadores de servicios en México, aéreo, tales como la Asociación Internacional SECTUR y GACM, entre otros. entre otros. del Transporte Aéreo (IATA) y la Asociación Monitorear y dar seguimiento a la Latinoamericana de Transporte Aéreo (ALTA). actividad legislativa en el Congreso de A más de 50 años de su fundación, la la Unión relacionada con la Industria CANAERO se ha transformado en una entidad Aérea y otros sectores vinculados.