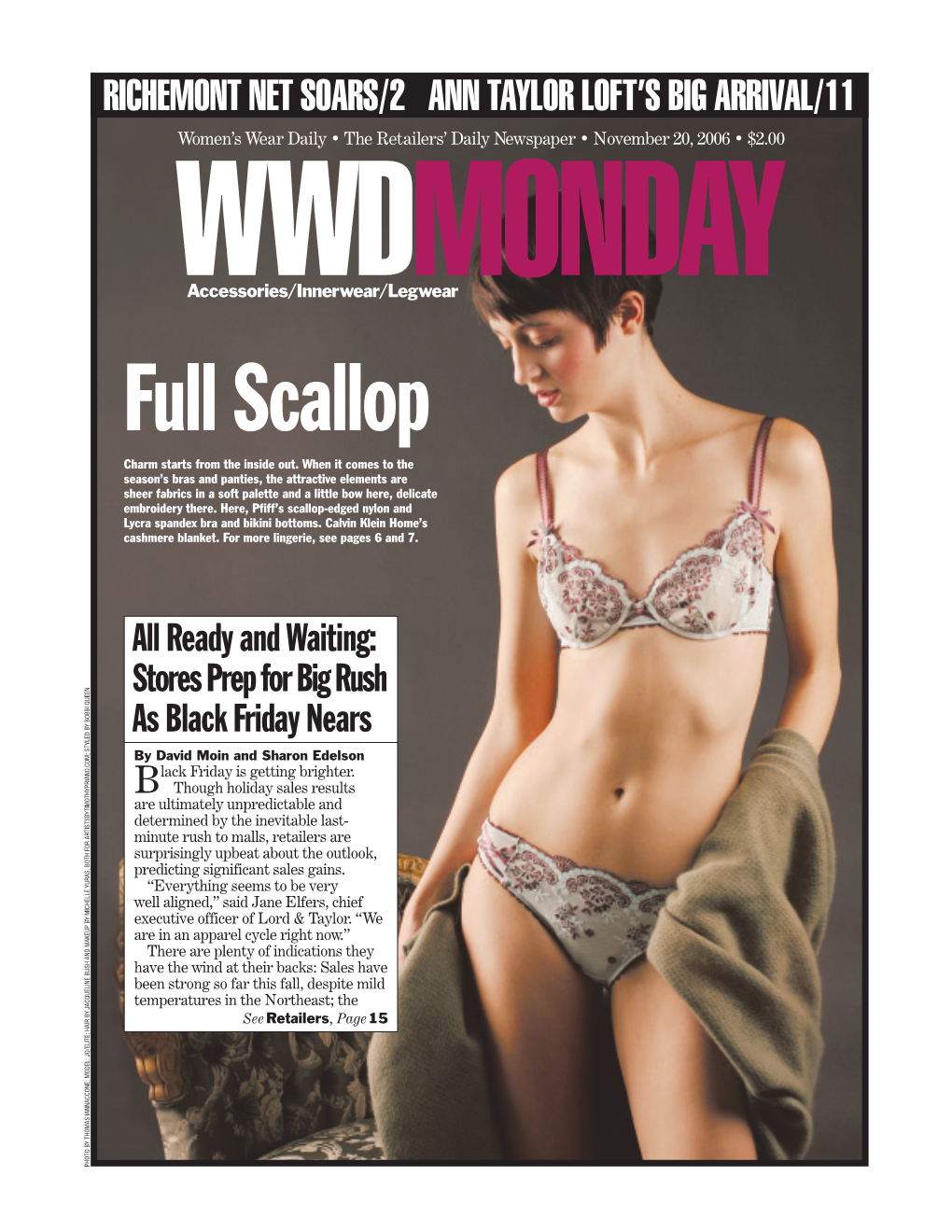

Full Scallop Charm Starts from the Inside Out

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Guide to the Preparation of an Area of Distribution Manual. INSTITUTION Clemson Univ., S.C

DOCUMENT RESUME ID 087 919 CB 001 018 AUTHOR Hayes, Philip TITLE Guide to the Preparation of an Area of Distribution Manual. INSTITUTION Clemson Univ., S.C. Vocational Education Media Center.; South Carolina State Dept. of Education, Columbia. Office of Vocational Education. PUB DATE 72 NOTE 100p. EDRS PRICE MF-$0.75 HC-$4.20 DESCRIPTORS Business Education; Clothing Design; *Distributive Education; *Guides; High School Curriculum; Manuals; Student Developed Materials; *Student Projects IDENTIFIERS *Career Awareness; South Carolina ABSTRACT This semester-length guide for high school distributive education students is geared to start the student thinking about the vocation he would like to enter by exploring one area of interest in marketing and distribution and then presenting the results in a research paper known as an area of distribution manual. The first 25 pages of this document pertain to procedures to follow in writing a manual, rules for entering manuals in national Distributive Education Clubs of America competition, and some summary sheet examples of State winners that were entered at the 25th National DECA Leadership Conference. The remaining 75 pages are an example of an area of distribution manual on "How Fashion Changes Relate to Fashion Designing As a Career," which was a State winner and also a national finalist. In the example manual, the importance of fashion in the economy, the large role fashion plays in the clothing industry, the fast change as well as the repeating of fashion, qualifications for leadership and entry into the fashion world, and techniques of fabric and color selection are all included to create a comprehensive picture of past, present, and future fashion trends. -

Fashion Awards Preview

WWD A SUPPLEMENT TO WOMEN’S WEAR DAILY 2011 CFDA FASHION AWARDS PREVIEW 053111.CFDA.001.Cover.a;4.indd 1 5/23/11 12:47 PM marc jacobs stores worldwide helena bonham carter www.marcjacobs.com photographed by juergen teller marc jacobs stores worldwide helena bonham carter www.marcjacobs.com photographed by juergen teller NEW YORK LOS ANGELES BOSTON LAS VEGAS MIAMI DALLAS SAO PAULO LONDON PARIS SAINT TROPEZ BRUSSELS ANTWERPEN KNOKKE MADRID ATHENS ISTANBUL MOSCOW DUBAI HONG KONG BEIJING SHANGHAI MACAU JAKARTA KUALA LUMPUR SINGAPORE SEOUL TOKYO SYDNEY DVF.COM NEW YORK LOS ANGELES BOSTON LAS VEGAS MIAMI DALLAS SAO PAULO LONDON PARIS SAINT TROPEZ BRUSSELS ANTWERPEN KNOKKE MADRID ATHENS ISTANBUL MOSCOW DUBAI HONG KONG BEIJING SHANGHAI MACAU JAKARTA KUALA LUMPUR SINGAPORE SEOUL TOKYO SYDNEY DVF.COM IN CELEBRATION OF THE 10TH ANNIVERSARY OF SWAROVSKI’S SUPPORT OF THE CFDA FASHION AWARDS AVAILABLE EXCLUSIVELY THROUGH SWAROVSKI BOUTIQUES NEW YORK # LOS ANGELES COSTA MESA # CHICAGO # MIAMI # 1 800 426 3088 # WWW.ATELIERSWAROVSKI.COM BRAIDED BRACELET PHOTOGRAPHED BY MITCHELL FEINBERG IN CELEBRATION OF THE 10TH ANNIVERSARY OF SWAROVSKI’S SUPPORT OF THE CFDA FASHION AWARDS AVAILABLE EXCLUSIVELY THROUGH SWAROVSKI BOUTIQUES NEW YORK # LOS ANGELES COSTA MESA # CHICAGO # MIAMI # 1 800 426 3088 # WWW.ATELIERSWAROVSKI.COM BRAIDED BRACELET PHOTOGRAPHED BY MITCHELL FEINBERG WWD Published by Fairchild Fashion Group, a division of Advance Magazine Publishers Inc., 750 Third Avenue, New York, NY 10017 EDITOR IN CHIEF ADVERTISING Edward Nardoza ASSOCIATE PUBLISHER, Melissa Mattiace ADVERTISING DIRECTOR, Pamela Firestone EXECUTIVE EDITOR, BEAUTY Pete Born PUBLISHER, BEAUTY INC, Alison Adler Matz EXECUTIVE EDITOR Bridget Foley SALES DEVELOPMENT DIRECTOR, Jennifer Marder EDITOR James Fallon ASSOCIATE PUBLISHER, INNERWEAR/LEGWEAR/TEXTILE, Joel Fertel MANAGING EDITOR Peter Sadera EXECUTIVE DIRECTOR, INTERNATIONAL FASHION, Matt Rice MANAGING EDITOR, FASHION/SPECIAL REPORTS Dianne M. -

THE POLITICS of Fashion Throughout History, the First Lady’S Style Has Made a Statement

THE POLITICS OF Fashion Throughout history, the first lady’s style has made a statement By Johanna Neuman rom the beginning, we have obsessed new country’s more egalitarian inclinations. Martha about their clothes, reading into the Washington dressed simply, but her use of a gilded sartorial choices of America’s first la- coach to make social calls led critics to lament that dies the character of a nation and the she was acting like a queen. Abigail Adams, who had expression of our own ambitions. “We cultivated an appreciation for French fashion, was want them to reflect us but also to reflect glamour,” careful to moderate her tastes but failed to protect Fobserves author Carl Sferrazza Anthony, who has John Adams from criticism that he was a monarchist; studied fashion and the first ladies. “It is always he was defeated for re-election by Thomas Jefferson. said that Mamie Eisenhower reflected what many “These Founding Fathers had deep ancestral and in- Americans were, and Jackie Kennedy reflected what tellectual ties to countries where government lead- many American women wanted to be.” ers’ dress was explicitly understood to In a nation born in rebellion against Jackie Kennedy in Ottawa, reflect and represent their august posi- the king, the instinct among public fig- Canada, in an outfit tions,” says historian Caroline Weber, ures to dress regally clashed with the designed by Oleg Cassini author of Queen of Fashion: What PAUL SCHUTZER—TIME & LIFE PICTURES/GETTY IMAGES SPECIAL COLLECTOR’S EDITION 77 AMERICA’S FIRST LADIES Marie Antoinette Wore to the Revolution (2008). -

Vogue Magazine the Glossy Has Spawned an Industry of Imitators, Two Documentaries, a Major Hollywood Film And, Perhaps Most Enduringly, a Modern Dance Craze

Lookout By the Numbers Vogue Magazine The glossy has spawned an industry of imitators, two documentaries, a major Hollywood film and, perhaps most enduringly, a modern dance craze. Itís also gone through some serious changes over the course of its 121 years in print. In recent years, the fashion bible has traded willowy models for celebrities of all kinds, a trend that reached its apex in April when the left-leaning, Chanel-shaded Brit Anna Wintour (the magazineís seventh editor in chief) decided to put ó gasp! ó a reality star on its cover. But even with young upstarts nipping at its Manolos, the periodical that popularized tights and the L.B.D. continues to thrive under its time-tested principle. That is, while other magazines 15 teach women whatís new in fashion, Vogue teaches them whatís in vogue. Approx. age at which Anna Wintour Here, a look at the facts and figures behind fashionís foremost franchise. — JEFF OLOIZIA established her signature bob $200,000 13% Wintour’s rumoredored annual clothing allowance of covers featuring celebrities during Wintour’s first five years 916 PagesP in the Favorite cover model by editor: SeptemberSepte 2012 issue, Anna Wintour: Vogue’sVogue largest to date 93% AMBER VALLETTA Vogue’sVoVogue’gue’ longest tenuredd editors:editors: of covers featuringg celebritiesc 17x over the last five years (still on the masthead)d) Diana Vreeland: Anna Wintour – 29 years A samplingsampling BRIGITTE BAUER Phyllis Posnick – 27 years of the 19 exotic exotic & animalsanimalsimals in fashionfashi on JEAN SHRIMPTON Grace Coddington – 26 years 19x each spreadsspreads Hamish Bowles – 22 years alongsideala ongside famous famous Reigning cover queen ladies:ladies:dies: 37 CheetahC (Kim Basinger, April ‘88) Number of years the longest ElephantEle (Keira Knightley, June ‘07) 26 reigning editor in chief served (Edna Woolman Chase, 1914-1951) SkunkSk (Reese Witherspoon, June ‘03) Number of times Lauren Hutton has fronted the magazine GibbonGi (Marisa Berenson, March ‘65) 8 (Nastassja Kinski, Oct. -

Anna Wintour: the Truth Behind the Bob

Katie Coon Marisa Kurtz Tyler Goodson Christina Karem Anna Wintour: The Truth Behind the Bob Kloeppel’s original article—Anna Table of Contents Wintour: The Truth Behind The Bob Pg 3: Letter from The Editor Pg 4: Celebrity as Rhetoric Pg 5: Language of Fashion Pg 6: Popular Philanthropy Pg 7: Politics en Vogue Pg 8: Aesthetics Pg 9: Conclusion Pg 10: Works Cited THESIS Kloeppel’s article outlines how Anna Wintour uses celebrity driven rhetoric to further her own celebrity, and while her ar- gument is valid, Kloeppel’s article is unsuccessful as a web- text because of it’s disorganization, lack of interactive ele- ments, and it’s navigation difficulties. Letter from the Editor “Letter From The Editor” serves as more than just a premise upon which to introduce the work of the author. The “Letter From The Editor”—where the author’s professor explains and examines the academic environment in which her students completed scholastically rigorous course projects, where she illuminates the highly successful outcome of her student’s rhe- torical and multimedia skills through the outcome of such projects, broad- casting Tara Kloeppel (the author of the piece to follow) as exemplary of such. The “Letter From The Editor” serves not only to promote authorial credibility (as it does successfully), but also to present an important com- ponent of the medium, a component at the heart of her student’s argument, the editorial letter present in every successful magazine. As the “Letter” begins, Greer—the author of the introduction and professor of Women in the Nineteenth Century at UMKC—jumps right into the pool of credibility and makes a “Wow” worthy splash as soon as the article begins. -

The Ethics of the International Display of Fashion in the Museum, 49 Case W

CORE Metadata, citation and similar papers at core.ac.uk Provided by Case Western Reserve University School of Law Case Western Reserve Journal of International Law Volume 49 | Issue 1 2017 The thicE s of the International Display of Fashion in the Museum Felicia Caponigri Follow this and additional works at: https://scholarlycommons.law.case.edu/jil Part of the International Law Commons Recommended Citation Felicia Caponigri, The Ethics of the International Display of Fashion in the Museum, 49 Case W. Res. J. Int'l L. 135 (2017) Available at: https://scholarlycommons.law.case.edu/jil/vol49/iss1/10 This Article is brought to you for free and open access by the Student Journals at Case Western Reserve University School of Law Scholarly Commons. It has been accepted for inclusion in Case Western Reserve Journal of International Law by an authorized administrator of Case Western Reserve University School of Law Scholarly Commons. Case Western Reserve Journal of International Law 49(2017) THE ETHICS OF THE INTERNATIONAL DISPLAY OF FASHION IN THE MUSEUM Felicia Caponigri* CONTENTS I. Introduction................................................................................135 II. Fashion as Cultural Heritage...................................................138 III. The International Council of Museums and its Code of Ethics .....................................................................................144 A. The International Council of Museums’ Code of Ethics provides general principles of international law...........................................146 B. The standard that when there is a conflict of interest between the museum and an individual, the interests of the museum should prevail seems likely to become a rule of customary international law .................................................................................................149 IV. China: Through the Looking Glass at The Metropolitan Museum of Art.......................................................................162 A. -

Council of Fashion Designers of America

Council of Fashion Designers of America ANNUAL REPORT 2017 The mission of the Council of Fashion Designers of America is to strengthen the impact of American fashion in the global economy. B 1 Letter from the Chairwoman, Diane von Furstenberg, and the President and Chief Executive Officer, Steven Kolb In fashion, we respond to the world we live in, a point that was powerfully driven home in 2017. We were excited to see talents with broad cultural backgrounds and political ideas begin to express their experiences and beliefs through their collections. Diversity moved into the spotlight in ways we have never seen before. Designers embraced new approaches to business, from varying show formats to disruptive delivery cycles. It was also the year to make your voices heard, and CFDA listened. We engaged in civic initiatives important to our industry and partnered with Planned Parenthood, the ACLU, and FWD.us. We also relaunched our CFDA Health Initiative with guidelines to help those impacted by sexual assault or other forms of abuse. There’s no going back. In 2018, CFDA is moving ahead at full speed with an increased focus on inclusivity and women in fashion, the latter through an exciting new study with Glamour magazine. We may be a reflection of the world we live in, but we also work hard to make that world a better place. Altruism, after all, never goes out of style. 3 CFDA STRENGTHENED PILLARS WITH MISSION-DRIVEN ACTIONS MEMBERSHIP Fashion Professional Fashion Civic+ Retail Partnership Week + Market Development Supply Chain Philanthropy Opportunities SUSTAINABILITY INDUSTRY ENGAGEMENT SOCIAL AND EDITORIAL MARKETING AND EVENTS KEY UNCHANGED MODIFIED NEW PROVIDED INITIATIVES RELEVANT TO DESIGNERS EMERITUS AT EVERY STAGE OF CAREER DESIGNERS • Board Engagement • Philanthropy and Civic ICONIC Responsibility DESIGNERS • Mentorship • Editorial Visibility • Board Engagement • Fashion Week • Philanthropy and Civic ESTABLISHED Responsibility DESIGNERS • Mentorship • Editorial Visibility • NETWORK. -

Flight of Fancy When It Comes to Bridal, Romance Is Always in Style

EYE: Partying with ▲ RETAIL: Chanel, page 4. Analyzing ▲ FASHION: Wal-Mart’s Donatella China sourcing talks New initiative, NEWS: Leslie York and page 13. Wexner is “feeling politics, good” despite the ▲ page 8. economy, page 5. WWDWomen’s Wear Daily • TheTHURSDAY Retailers’ Daily Newspaper • October 23, 2008 • $2.00 Sportswear Flight of Fancy When it comes to bridal, romance is always in style. Take, for example, this Carolina Herrera gown in silk habotai with swirls cascading from the hip and over one shoulder — a look that is as effortless as it is dreamy. For more, see pages 6 and 7. Palin’s Fashion-Gate: A Big Boost for Style, But Not for the GOP By WWD Staff At least someone is shopping: the Republicans and Sarah Palin. Given the beleaguered state of American retailing in the downward spiraling economy, stores such as Neiman Marcus, Saks Fifth Avenue, Barneys New York and Macy’s no doubt welcomed the Republican National Committee’s shopping spree on behalf of Palin with open arms. In some cases, it may even have helped goose their September same-store sales. And in this day and age, anything that boosts the profile of fashion and retailing can only be a good thing. Not that one would know it from the furor Palin’s wardrobe, hair and makeup created on Wednesday — even if the result has turned her into a politician admired for her style and See Palin’s, Page9 PHOTO BY ROBERT MITRA ROBERT PHOTO BY WWD.COM WWDTHURSDAY Sportswear FASHION Designers went in several directions for spring, ™ 6 and the best gowns had special details such as A weekly update on consumer attitudes and behavior based crystal beading, fl ower corsages or prints. -

Fashion Voices FBS C19 Issue 5: 05.06.20

Fashion’s Key People; Fashion Voices FBS C19 Issue 5: 05.06.20 Fashion Voices in the Time of COVID19: Although, as we go to press with Issue 5, events of major importance to the world are happening, these reports are not the place to engage in political conversations or debate, however, the fashion world has immediately responded to the murder of George Floyd !"# $%&#'()#'*'*)#+"#$+"",%-!.+/)#$+"",/!0%# and the subsequent global outcry. Editor Anna Wintour, PR Karla Otto, Christian Dior, and make artist Pat McGrath are just some of the fashion voices to be heard. We support their words against racism in any form. Thank You. How is coronavirus impacting the global fashion and clothing industry? We summarise real time industry themes that are emerging across the planet in response to the COVID19 pandemic and its effect on fashion retailers, brands, supply chains and the wider fashion industry. Crafting A New Sustainable Glamorous Path: Kevin Germanier; an individual voice as a sustainable designer of glamour. The Paris-based designer is known for redefining sustainable fashion by using only upcycled materials creating ‘high-octane, unapologetically glamorous dresses and separates’all of which are made entirely from materials that otherwise would have been contributed to landfill. ! ! Germanier’s pieces are worn by celebrities such as Lady Gaga, Björk and K-pop sensation Sunmi, helping to promote his particular brand of sustainable luxe into the spotlight and proving there’s far more to eco-friendly fashion than organic linen. Germanier's creations have been featured in Dazed and Confused, Vogue Germany and Numero Russia, and was worn by Björk on the cover of the Guardian’s 'New Review'. -

"Index." Fashion, History, Museums: Inventing the Display of Dress

Petrov, Julia. "Index." Fashion, History, Museums: Inventing the Display of Dress. London: Bloomsbury Visual Arts, 2019. 227–234. Bloomsbury Collections. Web. 24 Sep. 2021. <>. Downloaded from Bloomsbury Collections, www.bloomsburycollections.com, 24 September 2021, 22:37 UTC. Copyright © Julia Petrov 2019. You may share this work for non-commercial purposes only, provided you give attribution to the copyright holder and the publisher, and provide a link to the Creative Commons licence. INDEX archival methodology 5, 10, 191 121, 127, 142, 145, 149, 152, 153, artists and fashion 10, 15, 18, 36, 40, 156, 163, 179, 180 93–9, 116, 128 Costume Museum of Canada 125 Australia (fashion exhibitions in) 5, 20, 71, Cunnington, C. Willett 78, 171–2, 189 79, 89, 142, 170, 197 authenticity 25, 114, 120, 183 deathliness 1, 18, 137, 151, 168–9 Denver Art Museum 133 Barbican Art Gallery 59, 89 Beaton, Cecil 50, 54, 55, 111, 187, 190, exhibition design 1, 8, 9, 49, 50, 54, 59, 192 113, 120, 183, 196, 198 Beaudoin-Ross, Jacqueline 79 exhibitions as visual media 6–8, 11, 194 behind the scenes 13, 125, 129–31 Biba (designer) 39, 51 fashion 3, 9, 15, 26, 29, 35–6, 37, 160, Blum, Stella 163 186, 195 Bolton, Andrew 81, 192 fashion curation as team product 1, 5, Bowes Museum 59, 132 8, 183 Brett, Katherine B. 26, 97, 153, 164 Fashion Institute of Design and British Museum 32, 33, 118, 189 Merchandising (FIDM) Museum 55, Brooklyn Museum 4, 43, 47, 55, 67, 68, 73, 81 78, 81, 88, 99, 100, 106–7, 108, 109, Fashion Museum (Bath) 4, 26, 44, 48, 55, 126, 143, 145, 149, -

Studio 54: Night Magic, the First Exhibition to Explore the Trailblazing Aesthetics and Continuing Impact of New York City's L

Installation March Museum 13 ) –November 8 view, Studio , 2020. 54: Night Magic (Photo: Jonathan . Brooklyn Dorado Museum, , Brooklyn Studio 54: Night Magic, the First Exhibition to Explore the Trailblazing Aesthetics and Continuing Impact of New York City’s Legendary Nightclub, on View through November 8 Highlighting the revolutionary creativity, expressive freedom, and sexual liberation celebrated at the world-renowned nightclub, the exhibition will present over 650 objects ranging from fashion, photography, drawings, and film to stage sets and music Following the Vietnam War, and amid the nationwide Civil Rights Movement and fights for LGBTQ+ and women’s rights, a nearly bankrupted New York City hungered for social and creative transformation as well as a sense of joyous celebration after years of protest and upheaval. Low rents attracted a diverse group of artists, fashion designers, writers, and musicians to the city, fostering cultural change and the invention of new art forms, including musical genres such as punk, hip-hop, and disco. In a rare societal shift, people from different sexual, sociopolitical, and financial strata intermingled freely in the after-hours nightclubs of New York City. No place exemplified this more than Studio 54. Though it was open for only three years—from April 26, 1977, to February 2, 1980—Studio 54 was arguably the most iconic nightclub to emerge in the twentieth century. Set in a former opera house in Midtown Manhattan, with the stage innovatively re-envisioned as a dance floor, Studio 54 became a space of sexual, gender, and creative liberation, where every patron could feel like a star. -

Window Shopping: Commercial Inspiration for Fashion in the Museum." Fashion, History, Museums: Inventing the Display of Dress

Petrov, Julia. "Window Shopping: Commercial Inspiration for Fashion in the Museum." Fashion, History, Museums: Inventing the Display of Dress. London: Bloomsbury Visual Arts, 2019. 31–62. Bloomsbury Collections. Web. 30 Sep. 2021. <http://dx.doi.org/10.5040/9781350049024.ch-003>. Downloaded from Bloomsbury Collections, www.bloomsburycollections.com, 30 September 2021, 00:32 UTC. Copyright © Julia Petrov 2019. You may share this work for non-commercial purposes only, provided you give attribution to the copyright holder and the publisher, and provide a link to the Creative Commons licence. 2 WINDOW SHOPPING: COMMERCIAL INSPIRATION FOR FASHION IN THE MUSEUM In his work on the “exhibitionary complex,” Tony Bennett (1996) showed how nineteenth-century museums and galleries were intimately connected in their design and conception to the expanding commercial architecture of the same period. The technical possibilities and visual experiences of industrial exhibitions and shopping arcades found analogous applications in museum spaces. As Mackie noted, “Both the retail shop and the public repository are designed for the display of information that is predominantly visual: looking is a means for possession as well as knowledge” (1996: 325). This blurring of commercial and intellectual cultures within the museum continues to create unease and controversy, particularly in the case of fashion exhibitions (Anaya 2013; Gamerman 2014). This chapter investigates how the introduction of fashion—an increasingly important economic and social product in the industrial period—into museums created new connections and tensions between these two worlds. It was because of its position between the disciplines of economy and history that historical fashion entered and was interpreted in museums.