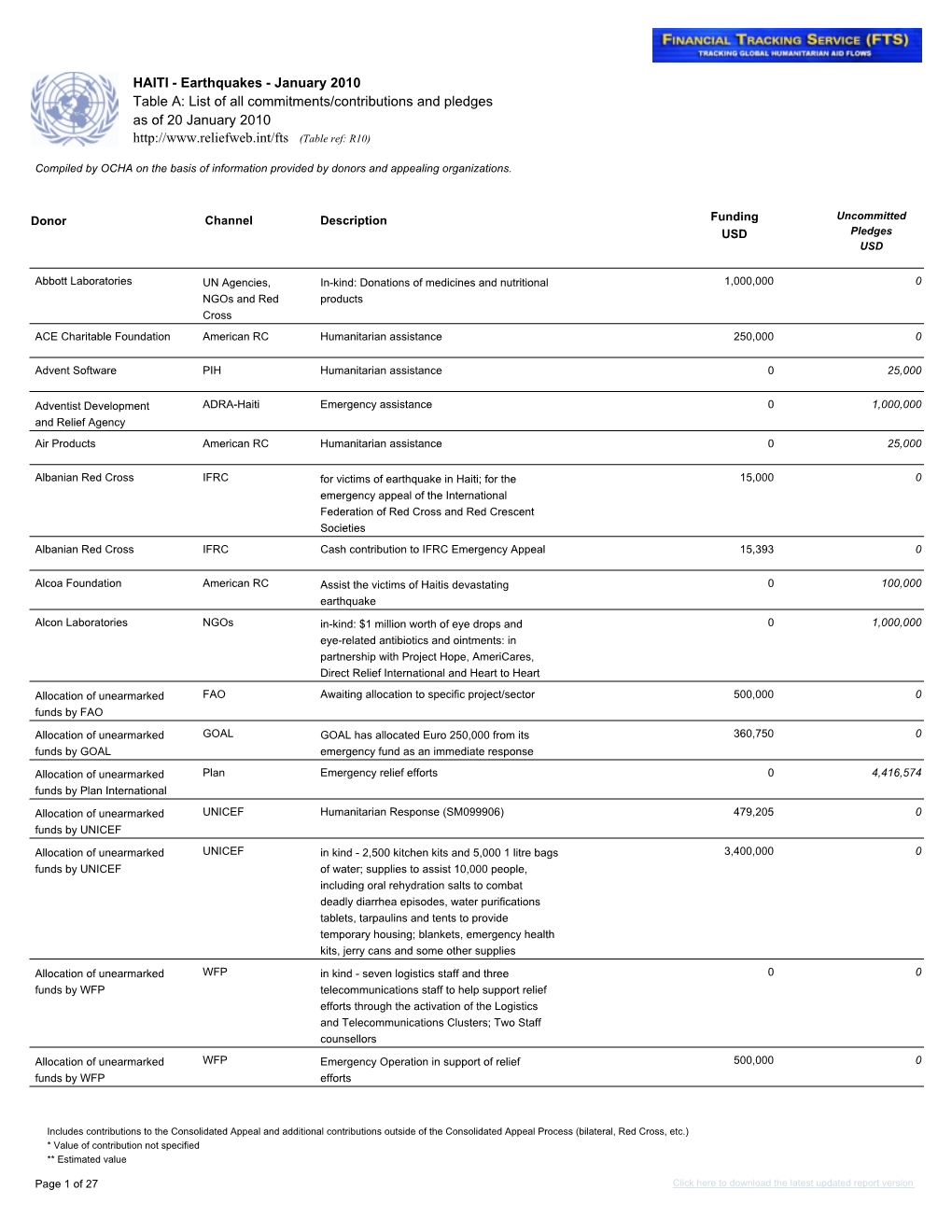

HAITI - Earthquakes - January 2010 Table A: List of All Commitments/Contributions and Pledges As of 20 January 2010 (Table Ref: R10)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Part of the Disease Or Part of the Cure: the Financial Crisis and the Community Reinvestment Act

South Carolina Law Review Volume 60 Issue 3 Article 4 Spring 2009 Part of the Disease or Part of the Cure: The Financial Crisis and the Community Reinvestment Act Raymond H. Brescia Albany Law School Follow this and additional works at: https://scholarcommons.sc.edu/sclr Part of the Law Commons Recommended Citation Raymond H. Brescia, Part of the Disease or Part of the Cure: The Financial Crisis and the Community Reinvestment Act, 60 S. C. L. Rev. 617 (2009). This Symposium Paper is brought to you by the Law Reviews and Journals at Scholar Commons. It has been accepted for inclusion in South Carolina Law Review by an authorized editor of Scholar Commons. For more information, please contact [email protected]. Brescia: Part of the Disease or Part of the Cure: The Financial Crisis and PART OF TIE DISEASE OR PART OF TIE CURE: THE FINANCIAL CRISIS AND TIE COMMUNITY REINVESTMENT ACT RAYMOND H. BRESCIA* I. IN TRO D UCTIO N .......................................................................................... 6 18 II. THE SUBPRIME MORTGAGE MELTDOWN .................................................. 620 III. THE CRA: HISTORY, PURPOSE, AND IMPACT ............................................ 627 IV. THE CRA AND SUBPRIME LENDING: REGULATIONS, REGULATORS, AND THE COURTS ...................................... 642 A . The Scope of the CRA ......................................................................... 642 B. Efforts to Change the Regulations and Broaden the CRA 's Scop e ..................................................................................................64 -

JP Morgan Chase Sofya Frantslikh Pace University

Pace University DigitalCommons@Pace Honors College Theses Pforzheimer Honors College 3-14-2005 Mergers and Acquisitions, Featured Case Study: JP Morgan Chase Sofya Frantslikh Pace University Follow this and additional works at: http://digitalcommons.pace.edu/honorscollege_theses Part of the Corporate Finance Commons Recommended Citation Frantslikh, Sofya, "Mergers and Acquisitions, Featured Case Study: JP Morgan Chase" (2005). Honors College Theses. Paper 7. http://digitalcommons.pace.edu/honorscollege_theses/7 This Article is brought to you for free and open access by the Pforzheimer Honors College at DigitalCommons@Pace. It has been accepted for inclusion in Honors College Theses by an authorized administrator of DigitalCommons@Pace. For more information, please contact [email protected]. Thesis Mergers and Acquisitions Featured Case Study: JP Morgan Chase By: Sofya Frantslikh 1 Dedicated to: My grandmother, who made it her life time calling to educate people and in this way, make their world better, and especially mine. 2 Table of Contents 1) Abstract . .p.4 2) Introduction . .p.5 3) Mergers and Acquisitions Overview . p.6 4) Case In Point: JP Morgan Chase . .p.24 5) Conclusion . .p.40 6) Appendix (graphs, stats, etc.) . .p.43 7) References . .p.71 8) Annual Reports for 2002, 2003 of JP Morgan Chase* *The annual reports can be found at http://www.shareholder.com/jpmorganchase/annual.cfm) 3 Abstract Mergers and acquisitions have become the most frequently used methods of growth for companies in the twenty first century. They present a company with a potentially larger market share and open it u p to a more diversified market. A merger is considered to be successful, if it increases the acquiring firm’s value; m ost mergers have actually been known to benefit both competition and consumers by allowing firms to operate more efficiently. -

A Guide to Enforcing the Community Reinvestment Act Richard Marisco New York Law School

Fordham Urban Law Journal Volume 20 | Number 2 Article 2 1993 A Guide to Enforcing the Community Reinvestment Act Richard Marisco New York Law School Follow this and additional works at: https://ir.lawnet.fordham.edu/ulj Part of the Property Law and Real Estate Commons Recommended Citation Richard Marisco, A Guide to Enforcing the Community Reinvestment Act, 20 Fordham Urb. L.J. 165 (1993). Available at: https://ir.lawnet.fordham.edu/ulj/vol20/iss2/2 This Article is brought to you for free and open access by FLASH: The orF dham Law Archive of Scholarship and History. It has been accepted for inclusion in Fordham Urban Law Journal by an authorized editor of FLASH: The orF dham Law Archive of Scholarship and History. For more information, please contact [email protected]. A GUIDE TO ENFORCING THE COMMUNITY REINVESTMENT ACT Richard Marsico* TABLE OF CONTENTS I. Introduction ........................................... 170 II. Step One: Assessing Community Credit Needs .......... 180 A. Defining the Community ........................... 180 B. Gathering Socioeconomic Data about the Community's Residents ............................. 180 1. Demographic Data ............................. 181 2. Income and Employment Data .................. 181 3. Business D ata .................................. 181 4. Housing Data .................................. 182 5. Quality of Life Data ............................ 182 6. Community Outreach Data ..................... 182 C. Preparing a Community Credit Needs Statement .... 182 1. Socioeconomic Profile ........................... 183 2. Credit Needs Statement ......................... 184 III. Step Two: Gathering Information about a Bank's CRA R ecord ................................................ 185 A. Choosing a Bank to Evaluate ....................... 185 B. Locating Information about the Bank's CRA Record ... ......................................... 186 1. The Bank ...................................... 186 a. CRA Disclosure Requirements .............. 186 b. The Home Mortgage Disclosure Act ....... -

California Reinvestment Committee

q d CALIFORNIA REINVESTMENT COMMITTEE GkDQE.Loaey presidino officer Boanl of Governors Federal RiServc system Washington, DC. 20551 RE: cdifornfa Rchrm Committee tcdmony for Citkorp I Trsvelem -. TkcalifomiaRein- committeelcgrets it c9nnot presenttlb testimonyio person We authorize the her City Press I Community on the Move tn enter our testimony into the record, and request your consent on this matter. -- ; Testimony of the California Reinvestment Committee RE: Citicorp / Tra~krs Merger June 25, 19y8 Panel Eight we would like to exrend OUI pppno;mon to the Federal Reserve for inviting public comment on tbc Citiuxpffravekn proposed merger. J am repnxnting the Cahfomia Rciovestrnent Committee (CRC) !ium San Franciscu. California. We regret that we cannot attend in person and with our coahtion embers. who represent nearly 200 communiry-based organizations around California. For a number Of crilkal rcasor& described below, we urgently request that th: Federal Re&zrvc deny Travelers applkation to acquire Ciricorp Tk cmx of our argument rests on thz records Travkrs and Citicorp have established in wmmunities of color. and on how thir merger win adversely affect low-hum communitks. As you have heard or may bear in subsequent testimony from othx groups, both Travelers and Ciikorp have programs supporting community investment and charitabk giving Yet both groups also ban poor histories of serving pcopk of color, and of underserving low-inconr communitks. In addition, tk annouuced 0115 b&on dollar CRA pkdgc lacks scope, size, and detail fnr an instimtion ti tire and scope of the proposed Citigroup. Citibank has one of the worst reinvestment programs for a maJor California financial insritution The tank has a record of scvercly undcrscrving Hispanics in the state. -

Onewest/CIT Merger Fabricated Email Inquiry Freedom of Information Act (FOIA) Response

OneWest/CIT Merger Fabricated Email Inquiry Freedom of Information Act (FOIA) Response DOCUMENTS OBTAINED BY CRC AND INNER CITY PRESS SHOW BANK WHICH FORECLOSED ON 36,000 CALIFORNIA HOUSEHOLDS DOES NOT EXPLAIN HOW FABRICATED LETTERS OF SUPPORT FOR BANK MERGER WERE GENERATED New information obtained from the regulator of national banks, the Office of the Comptroller of the Currency (OCC), raises a number of questions about the agency’s oversight of OneWest Bank, which was acquired by CIT Bank in 2015 in a merger approved by the OCC and the Federal Reserve Board of Governors. The data, obtained via a Freedom of Information Act (FOIA) request, show evidence of fraudulent email letters of support for the merger, and other troubling information about the bank. Information provided by the OCC confirms that the national bank regulator was aware that certain letters of support for the OneWest/CIT bank merger were fabricated, and sought a response from the bank and its counsel. The FOIA response did not include any answer from the Bank to the OCC’s question. The FOIA response also indicated certain consumer complaints and improper foreclosures practices. Perhaps most striking is that amount of information requested that was not provided. Attachments: 1. CRC/Inner City Press FOIA request letter to OCC (July 10, 2017) 2. OCC response letter and substantiating documentation (Feb 21, 2018) 3. “OneWest CIT Bank Merger Fabricated Comment Letters” The last correspondence we received from the OCC on CRC’s FOIA request was dated September 20, 2018. We continue to seek additional information from the OCC. -

A Hole So Wide You Could Drive a Moving Truck Through It: An

Fake It Till They Make It: How Bad Actors Use Astroturfing to Manipulate Regulators, Disenfranchise Consumers and Subvert the Rulemaking Process Written Testimony of Paulina Gonzalez-Brito Executive Director California Reinvestment Coalition Before the United States House of Representatives Financial Service Committee, Subcommittee on Oversight and Investigations February 6, 2020 1 Chairman Green, Ranking Member Barr and Members of the Subcommittee, thank you for holding this important hearing today and for inviting the California Reinvestment Coalition (CRC) to testify. Paulina Gonzalez-Brito and CRC My name is Paulina Gonzalez-Brito. I am the Executive Director of the CRC. The California Reinvestment Coalition builds an inclusive and fair economy that meets the needs of communities of color and low-income communities by ensuring that banks and other corporations invest and conduct business in our communities in a just and equitable manner. We envision a future in which people of color and low-income people live and participate fully and equally in financially healthy and stable communities without fear of displacement, and have the tools necessary to build household and community wealth. Over the last 30 years, CRC has grown into the largest statewide reinvestment coalition in the country, with a membership of 300 organizations that serve low-income communities and communities of color. CRC has our main office in San Francisco, and an office in Los Angeles. Introduction In this testimony, I wish to highlight to following points: 1. The ability of communities to have their voices heard through a fair and transparent public comment process is central to the Community Reinvestment Act and its effective implementation. -

W O R K S 6 NCRC Annual Conference Draws Hundreds of Advocates

Summer 2007 A Publication of the National Community Reinvestment Coalition PAGE Visit us on the web at www.ncrc.org Senator Hillary Rodham Clinton speaks Reinvestment at NCRC annual conference WORKS 6 NCRC Annual Conference Draws Hundreds of Advocates Presidential candidates, civil rights leaders, housing advo- 30 Years of CRA cates, CRA groups, bankers, lenders, community activists This year’s national conference celebrated and organizers all converged on Washington DC this spring the 30 year anniversary of the passage of for NCRC’s 2007 annual event. This year’s conference, the Community Reinvestment Act (CRA). “Broken Economies: Making Markets and Governments After 30 years, CRA is an especially Work for All Communities” was attended by over 600 people effective and resilient piece of legisla- between March 14-17 at the Hyatt Regency on Capitol Hill. tion, having survived significant political NCRC’s annual conferences each year are the nation’s largest challenges that were designed to weaken gatherings of economic justice proponents and supporters and even eliminate it. Since the passage of the Community Reinvestment Act (CRA) as a tool for of CRA in 1977, lenders and community economic development. Members, allies and others enjoyed organizations have signed CRA agree- opportunities to network with each other, contribute to the ments totaling more than $4.7 trillion in debate over national and international initiatives, and to reinvestment dollars. hear from nationally known speakers. continued on p. 6 Over 600 advocates met in Washington DC for NCRC’s annual conference. James Carr Joins A Call to Action from NCRC President NCRC Staff as and CEO John Taylor Chief Operating Dear NCRC members and allies: step in the Senate and can provide a platform to leverage stronger legislation. -

Fordham Journal of Corporate & Financial

Fordham Journal of Corporate & Financial Law Volume 13 Issue 4 Article 6 2008 Bank Merger Reform Takes an Extended Philadelphia National Bank Holiday Edward Pekarek Michela Huth Follow this and additional works at: https://ir.lawnet.fordham.edu/jcfl Part of the Banking and Finance Law Commons, and the Business Organizations Law Commons Recommended Citation Edward Pekarek and Michela Huth, Bank Merger Reform Takes an Extended Philadelphia National Bank Holiday, 13 Fordham J. Corp. & Fin. L. 595 (2008). Available at: https://ir.lawnet.fordham.edu/jcfl/vol13/iss4/6 This Article is brought to you for free and open access by FLASH: The Fordham Law Archive of Scholarship and History. It has been accepted for inclusion in Fordham Journal of Corporate & Financial Law by an authorized editor of FLASH: The Fordham Law Archive of Scholarship and History. For more information, please contact [email protected]. BANK MERGER REFORM TAKES AN EXTENDED PHILADELPHIA NATIONAL BANK HOLIDAY By Edward Pekarek and Michela Huth* * Edward Pekarek holds an LL.M. degree in Corporate, Banking and Finance Law from Fordham University School of Law, a J.D., Cleveland Marshall College of Law, and a B.A. from the College of Wooster. Michela Huth holds a J.D., Cleveland Marshall College of Law and a B.A. from the College of Wooster. The Authors wish to thank Fordham University School of Law Banking Professor Carl Felsenfeld, for his kind support and sage guidance. The foregoing opinions, conclusions, and perhaps errors and omissions, are solely those of the Authors. Comments and questions should be directed to the Authors at [email protected]. -

Report-Ncrc.Pdf

The National Community Reinvestment Coalition The National Community Reinvestment Coalition (NCRC) is the nation’s trade association for economic justice whose members consist of local community based organizations. Since its inception in 1990, NCRC has spearheaded the economic justice movement. NCRC’s mission is to build wealth in traditionally underserved communities and bring low- and moderate-income populations across the country into the financial mainstream. NCRC members have constituents in every state in America, in both rural and urban areas. The Board of Directors would like to express their appreciation to the NCRC professional staff who contributed to this publication and serve as a resource to all of us in the public and private sector who are committed to responsible lending. For more information, please contact: John Taylor, President and CEO David Berenbaum, Executive Vice President Joshua Silver, Vice President, Policy and Research Alyssa Torres, Research Analyst Noelle Melton, Research & Policy Analyst Milena Kornyl, Research Analyst Summer 2005 National Community Reinvestment Coalition * http://www.ncrc.org * (202) 628-8866 Table of Contents Introduction 1 CRA Dollar Commitments Since 1977: By State 6 Provision of CRA Commitments 13 Housing 16 Business and Economic Development 34 Consumer Loans 41 Farm Loans 42 Building Community Capacity 43 Banking Services, Branch and Staff Policies 46 Needs Assessment, Marketing and Outreach, and Accountability to the Community 52 National Community Reinvestment Coalition * http://www.ncrc.org * (202) 628-8866 CRA AGREEMENTS INTRODUCTION The Community Reinvestment Act (CRA) has encouraged an extraordinary level of collaboration between community groups and banks across the country. One form of collaboration is known as a CRA agreement. -

Onewest/CIT Merger Fabricated Email Inquiry Freedom of Information Act (FOIA) Response

OneWest/CIT Merger Fabricated Email Inquiry Freedom of Information Act (FOIA) Response DOCUMENTS OBTAINED BY CRC AND INNER CITY PRESS SHOW BANK WHICH FORECLOSED ON 36,000 CALIFORNIA HOUSEHOLDS DOES NOT EXPLAIN HOW FABRICATED LETTERS OF SUPPORT FOR BANK MERGER WERE GENERATED New information obtained from the regulator of national banks, the Office of the Comptroller of the Currency (OCC), raises a number of questions about the agency’s oversight of OneWest Bank, which was acquired by CIT Bank in 2015 in a merger approved by the OCC and the Federal Reserve Board of Governors. The data, obtained via a Freedom of Information Act (FOIA) request, show evidence of fraudulent email letters of support for the merger, and other troubling information about the bank. Information provided by the OCC confirms that the national bank regulator was aware that certain letters of support for the OneWest/CIT bank merger were fabricated, and sought a response from the bank and its counsel. The FOIA response did not include any answer from the Bank to the OCC’s question. The FOIA response also indicated certain consumer complaints and improper foreclosures practices. Perhaps most striking is that amount of information requested that was not provided. Attachments: 1. CRC/Inner City Press FOIA request letter to OCC (July 10, 2017) 2. OCC response letter and substantiating documentation (Feb 21, 2018) 3. “OneWest CIT Bank Merger Fabricated Comment Letters” For additional information, contact California Reinvestment Coalition at [email protected] CALIFORNIA -

FEDERAL RESERVE SYSTEM the Chase Manhattan Corporation New

FEDERAL RESERVE SYSTEM The Chase Manhattan Corporation New York, New York J.P. Morgan & Co. Incorporated New York, New York Order Approving the Merger of Bank Holding Companies, Merger of Banks, and Establishment of Branches The Chase Manhattan Corporation (“Chase”), a bank holding company within the meaning of the Bank Holding Company Act (“BHC Act”), has requested the Board’s approval under section 3 of the BHC Act (12 U.S.C. § 1842) to merge with J.P. Morgan & Co. Incorporated (“Morgan”) and thereby acquire Morgan’s subsidiary bank, Morgan Guaranty Trust Company of New York (“Morgan Guaranty”), New York, New York.1 Chase’s lead bank, The Chase Manhattan Bank, also in New York (“Chase Bank”), a state member bank, has applied under section 18(c) of the Federal Deposit Insurance Act (12 U.S.C. § 1828(c)) (the “Bank Merger Act”) to merge with Morgan Guaranty, with Chase Bank as the surviving institution. Chase Bank also has applied under section 9 of the 1 On consummation of the proposal, Chase would change its name to J.P. Morgan Chase & Co. Chase and Morgan also have each requested the Board’s approval to hold and exercise an option to acquire up to 19.9 percent of the other’s voting shares. These options would expire on consummation of the proposal. -1- Federal Reserve Act (12 U.S.C. § 321) to establish branches at the locations of the main office and branches of Morgan Guaranty. 2 In addition, Chase has requested the Board’s approval under sections 4(c)(8) and 4(j) of the BHC Act (12 U.S.C. -

Federal Reserve Board (FRB) Freedom of Information Act (FOIA) Case Logs 2016-2019

Description of document: Federal Reserve Board (FRB) Freedom of Information Act (FOIA) Case Logs 2016-2019 Requested date: 13-November-2020 Release date: 23-November-2020 Posted date: 11-January-2021 Source of document: Information Disclosure Section Board of Governors of the Federal Reserve System 20th & Constitution Avenue, NW, Washington, DC 20551 Fax: (202) 872-7565 Electronic Request Form The governmentattic.org web site (“the site”) is a First Amendment free speech web site and is noncommercial and free to the public. The site and materials made available on the site, such as this file, are for reference only. The governmentattic.org web site and its principals have made every effort to make this information as complete and as accurate as possible, however, there may be mistakes and omissions, both typographical and in content. The governmentattic.org web site and its principals shall have neither liability nor responsibility to any person or entity with respect to any loss or damage caused, or alleged to have been caused, directly or indirectly, by the information provided on the governmentattic.org web site or in this file. The public records published on the site were obtained from government agencies using proper legal channels. Each document is identified as to the source. Any concerns about the contents of the site should be directed to the agency originating the document in question. GovernmentAttic.org is not responsible for the contents of documents published on the website. BOARD CIF GOVERNORS OF" THE FECERAL RESERVE SYSTEM WASHINGTON , • . C. 20551 ADDRESS OFFI C IAL CORRESPONDENCE TO T H E BOARD November 23, 2020 Re: Freedom of Information Act Request No.