THE GAP, INC. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Retail Leakage Report

Table of Contents Introduction .......................................................................................................................... 4 Overview ............................................................................................................................... 5 Gap Analysis .......................................................................................................................... 6 Supply and Demand .......................................................................................................................6 Methodology .................................................................................................................................9 Forney Demographic Overview .................................................................................................... 11 Recruiting Retailers ...................................................................................................................... 12 Site Selection Criteria by Type of Retail ................................................................................ 14 Car Dealerships ................................................................................................................... 14 Site Selection ............................................................................................................................... 14 Retailer Profile ............................................................................................................................. 16 Vehicle Parts Dealers -

2015 Proxy Statement

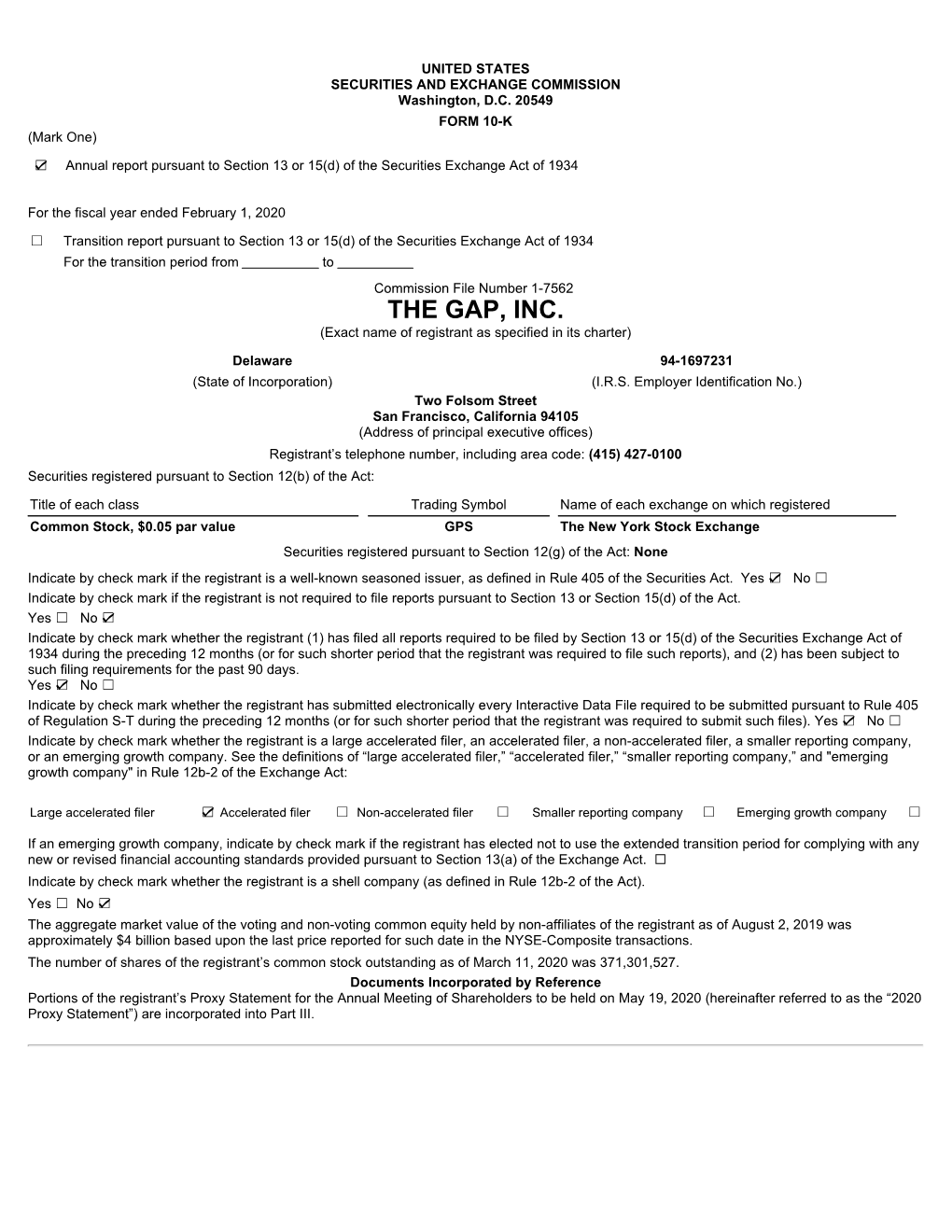

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A (Rule 14a-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant x Filed by a Party other than the Registrant ¨ Check the appropriate box: ¨ Preliminary Proxy Statement ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) x Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Pursuant to § 240.14a-12 THE GAP, INC. (Name of Registrant as Specified in Its Certificate) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) Payment of Filing Fee (Check the appropriate box): x No Fee Required. ¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: ¨ Fee paid previously with preliminary materials. ¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. -

Gap Inc. 2008 Annual Report

!NNUAL2EPORT )LOOKATRUNNINGASTORELIKEPLAYINGAGAME ±9OUWANTTOWIN $ON&ISHER ² -ORETHANANYTHING )´MPROUDOFHOW ±MANYLIVESWE´VETOUCHED7EAREASTORE WITHAHEART $ORIS&ISHER ² 2ESPONSESTOEMPLOYEEQUESTIONSDURING'APSTOREMANAGERMEETING *ANUARY Dear Shareholders, In 1969, a brand was born that changed the retail landscape. The Gap, founded by Doris and Don Fisher, filled a hole in the market. It was modern. It was clean. And it was revolutionary. Over the 40 years since then, we’ve grown to include five brands with more than 3,100 stores around the world. We’ve experienced both breakthrough successes and challenging times, such as today’s uncertain economic environment. The 134,000 people who make up Gap Inc. are inspired by our past and passionate about winning. We were determined to make this past year a turning point. Few companies matched our 2008 financial accomplishments as our earnings improved by 16 percent year-over-year. And as a result of our financial discipline, we reduced operating expenses by about $500 million and ended the year virtually debt-free with nearly $2 billion in cash. But beyond these results, our company stands for creativity and ingenuity. In the pages of this report, we celebrate this four- decade legacy. Our focus going forward is to make more progress, especially in delivering innovative products, so that we continue to get back to where we belong in the hearts and minds of our customers. As we know, it all started with the Gap. Gap Clean. Classic. American design. These words described Gap four decades ago and still hold true today. At our best, we inspire customers with individual style and make classics relevant for today through our use of bold color, emotional details and great fits. -

2006 Annual Report

2006 Annual Report Gap is an iconic apparel brand recognized throughout the world for its casual American classics—great knits, khakis, t-shirts and of course, denim. Through GapKids, babyGap, Gap maternity, and GapBody we build on the power of the brand by dressing our customers throughout the different stages of their lives. With its modern interpretations of classic fashion for men and women through elevated design and luxurious fabrics, Banana Republic has come to define accessible luxury suitable for the workplace to social gatherings. Based on positive customer response, we continue expanding the brand into product categories such as handbags, fragrance and an upcoming line of eyewear and sunglasses in 2007. Old Navy offers modern apparel and accessories for adults and children, at a surprising value, all in a fun energizing shopping environment. Customers count on Old Navy to deliver what they want—and need. From Old Navy’s Item of the Week—a special item at a special price each week—to its eye popping deals and promotions, Old Navy strives to be the place to go for the newest fashion at amazing prices. www.gap.com www.oldnavy.com www.bananarepublic.com Gap In c.Direct Gap Inc. Direct—Gap Inc.’s e-commerce division—gives customers a convenient way to shop our brands online. With Gap Online, Old Navy Online and Banana Republic Online, Gap Inc. Direct is one of the largest specialty e-commerce apparel retailers in the U.S. In 2006, our online sales increased 23 percent. We also launched Piperlime, a fresh online shoe shop featuring a growing number of popular brands. -

The Gap, Inc. Subsidiary List As of February 1, 2020 Athleta (ITM) Inc

Exhibit 21 The Gap, Inc. Subsidiary List as of February 1, 2020 Athleta (ITM) Inc. California Athleta LLC Delaware Athleta, Inc. Delaware Banana Republic (Apparel), LLC California Banana Republic (ITM) Inc. California Banana Republic (Japan) Y.K. Tokyo, Japan Banana Republic, LLC Delaware Corporate HQ Support Mexico, S. de R.L. de C.V. Mexico Direct Consumer Services, LLC California Forth & Towne (Japan) Y.K. Tokyo, Japan Gap (Apparel), LLC California Gap (Beijing) Commercial Co., Ltd. Beijing, China Gap (Canada) Inc. Canada Gap (France) SAS Paris, France Gap (Italy) Srl. Milan, Italy Gap (ITM) Inc. California Gap (Japan) K.K. Tokyo, Japan Gap (Puerto Rico), Inc. Puerto Rico Gap (RHC) B.V. Amsterdam, The Netherlands Gap (Shanghai) Commercial Co., Ltd. Shanghai, China Gap (UK Holdings) Limited England and Wales Gap Europe Limited England and Wales Gap International Sales, Inc. Delaware Gap International Sourcing (Americas) LLC California Gap International Sourcing (California), LLC California Gap International Sourcing (Holdings) Limited Hong Kong Gap International Sourcing (India) Private Limited New Delhi, India Gap International Sourcing (JV), LLC California Gap International Sourcing (U.S.A.) Inc. California Gap International Sourcing (Vietnam) Limited Liability Company Vietnam Gap International Sourcing Limited Hong Kong Gap International Sourcing Pte. Ltd. Singapore Gap International Sourcing, Inc. California Gap IT Services India Private Limited India Gap Limited Hong Kong Gap Services, Inc. California Gap Stores (Ireland) Limited Dublin, Ireland Gap Taiwan Limited Taipei, Taiwan GPS (Great Britain) Limited England and Wales GPS Consumer Direct, Inc. California GPS Corporate Facilities, Inc. California GPS Import Services, S. de R.L. de C.V. -

History Gap, Inc.: Has the Retailer Lost Its Style?

Gap, Inc.: Has the Retailer Lost Its Style? Richard Joslin, Peter Lueck, Chad Martino, Melissa Rhoads, Brian Wachter, Robin Chapman, Gail Christian / Arizona State University Used by permission. The authors would like to of debt. The two former CEOs could not have thank Professors Robert E. White and Robert E. been more different. Drexler possessed the fashion Hoskisson for their support and under whose direc- instincts that built the Gap brand and image into tion the case was developed. The authors do not a destination for multiple target customer groups. intend to illustrate either effective or ineffective However, his style lacked the financial rigor and dis- handling of a managerial situation. The case solely cipline that a company the size of Gap, Inc. requires. provides material for class discussion. Although this played to the strength of Pressler, he was not able to balance the discipline of running Introduction a multi-tiered global operation with the artistry required to be successful in the highly fickle retail “Alongside some of the most talented people in environment. the apparel industry, we’ll work to reestablish each When Glenn Murphy embarked on this chal- brand’s leadership position and set the company lenge, he was faced with the daunting task of chart- along a path of sustained earnings performance,” ing a course back to market competitiveness, a task said Glenn Murphy, Chairman and Chief Executive that has not yet been fully accomplished during the Officer, Gap, Inc. economic downturn. Under Murphy, Gap reduced In July 2007, Gap, Inc. announced the appoint- its U.S. -

Gap Inc. 2007 Annual Report We Love Designing Clothes That Are Fun to Wear

We are Gap Inc. 2007 Annual Report We love designing clothes that are fun to wear. For me, inspiration comes from everywhere—shops, art exhibits, travel, pop culture and even my own daughter. It’s what I love most about this job: I get to bring together all of my interests and loves—a passion for creativity, color and design and, of course, my daughter. When we design for GapKids and toddlers, we have to make two people happy: mom and kid. On one hand we want mom to feel good about what she is buying—but, of course, we also want kids to say “hey, cool!” That’s the fantastic thing about Gap brand; it makes both moms and kids feel and look great. – Jennifer Giangualano Thomasine Dolan Jennifer Giangualano Banana Republic Jewelry Design Director Gap Vice President of Design for Kids and Toddler 13 years 3 years Must-have jewelry for Spring: Favorite Gap item: babyGap rainbow stripe bathing suit Banana Republic’s “Calder bib” that she couldn’t wait for her daughter to grow into necklace and “skipper’s” necklace We enjoy finding the perfect look for our customers. To me, it’s important to get to know a customer because everybody comes to Banana Republic for something different. Sometimes they want to have an outfit to make a statement at work or an amazing dress for a first date. So I like to talk to them to learn about their lives, what their taste is like…and then I help the customer pick an outfit that really says something about them.