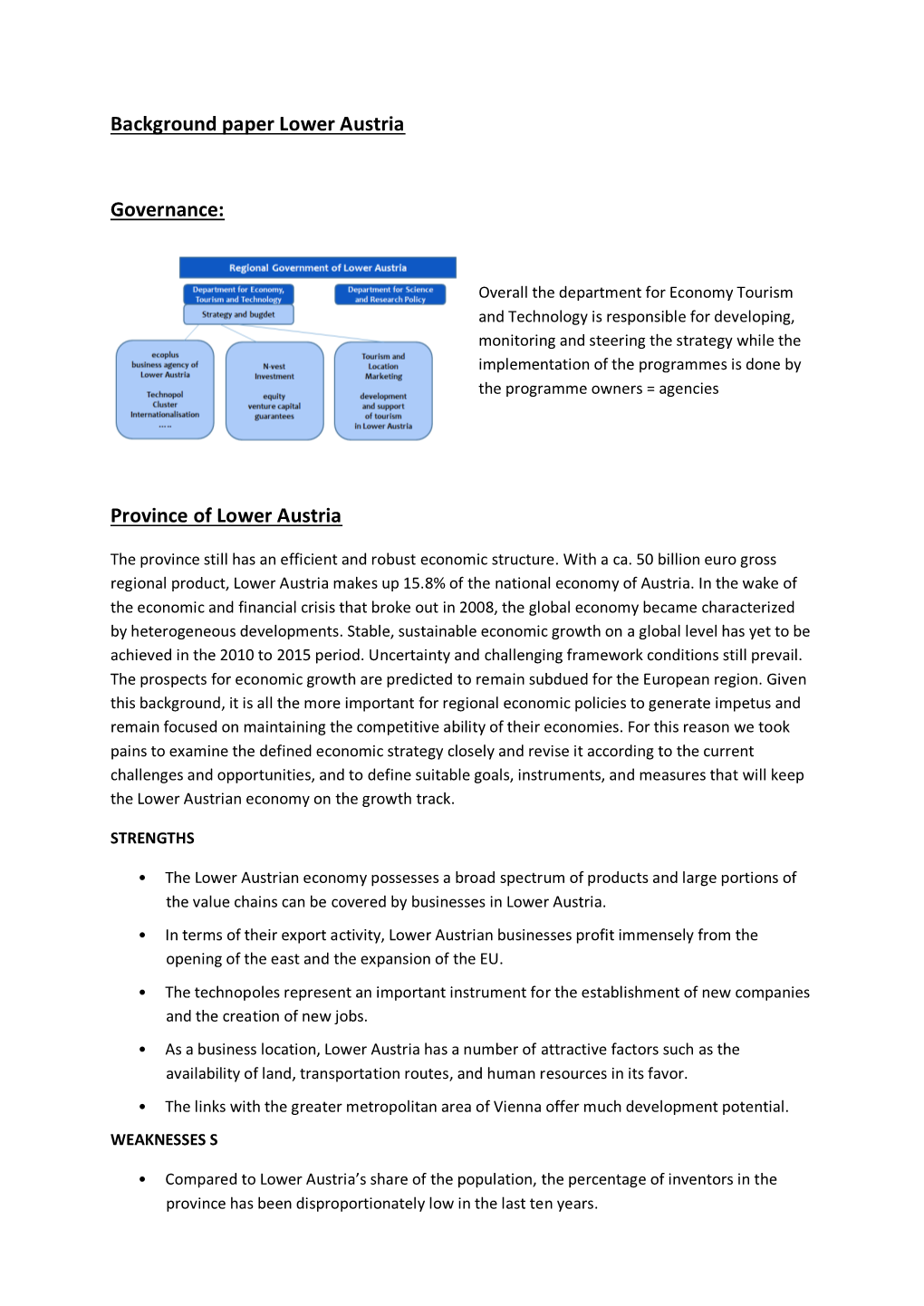

Background Paper Lower Austria Governance: Province of Lower Austria

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wiener Neustadt in MOTION!

Wiener Neustadt Discover. Experience. Live. CITY IN MOTION! ATTRACTIONS AND TOURS EVERYTHING IS NEW IN WIENER NEUSTADT The birthplace of Emperor Maximilian I, Wiener Neustadt is of great historical significance. The history of Wiener Neustadt, spanning centu- ries, is so exciting that it is quite surprising that the gates to the important sights were not opened much earlier. However, because of this, the Lower Austrian Provincial Exhibition 2019 sparked an CONTENTS initial, veritable rush to visit these, difficult to access, historical locations. Here you will find a complete overview of the Attractions ...........................................Page 4 sights and museums of Wiener Neustadt. Freely accessible highlights ................... Page 15 Culinary delights are not to be neglected either. Museums .............................................Page 18 Wiener Neustadt has an extraordinary variety of bars and restaurants to offer: from the rustic Getting there and parking ...................... Page 28 Stadtheurigen to the Beisl and Gasthaus with Useful contacts ....................................Page 32 everything to home-style cooking to top level cui- Town map .............................................Page 34 sine. Numerous coffee houses line the entire city center, inviting you to linger. 2 3 SIGHTSEEING THERESIAN MILITARY ACADEMY The castle was built about 50 years after the city was founded in 1192 as a military base for the last Babenberger, Friedrich II. Over the centuries the castle has been expanded and been given various new purposes. Emperor Friedrich III. had the castle fundamentally rebuilt, largely giving it its current appearance. Emperor Maximilian I was born and baptized in the castle in Wiener Neustadt and spent his youth here. From here the Holy Roman Empire was expanded. The empire grew so large that “the sun never set“. -

Understanding Urban Sprawl and Identifying New Planning Solutions

photo: DB AG/Axel Hartmann 2nd Newsletter | May 2011 Understanding urban sprawl Catch-MR (Cooperative approaches to trans- and identifying new planning port challenges in Metropolitan Regions) is an INTERREG IVC projekt running from solutions – The second work- January 2010 until December 2012 with a total budget of approximately Euro 2 million. shop in Vienna, Austria In the context of the first phase of the Catch-MR project, experts from seven Workshop from European metropolitan regions were given an opportunity to meet for an 29 September to intensive thematic exchange and to discuss issues of transport and regional 1 October 2010 in Vienna. planning. Traffic and land use planning – Understanding urban sprawl The Vienna workshop was jointly organised by the Lower Austrian and Viennese project partners as part of a series of seven Catch-MR events addressing three thematic areas. In the course of the workshop held in the Contacts: Austrian capital, the phenomenon of urban sprawl was analysed in depth while various co-operative structures to simplify the collaboration of planning actors were likewise presented and discussed. Government of Lower Austria Norbert Ströbinger Regional development planner Phone: +43 (0)2742/9005 15573 [email protected] Vienna City Administration Gregory Telepak Transportation planner Phone: +43 (0)1 4000/88833 [email protected] 2nd NEWSLETTER | May 2011 Page Contents What is Catch-MR? Catch-MR (Cooperative Approaches to Transport 2 What is Catch-MR? Challenges in Metropolitan Regions) is an INTER- REG IVC project running from January 2010 until De- 3 Urban sprawl in metropolitan cember 2012 and mainly financed by the European regions Regional Development Fund (ERDF). -

Supplement to the Lower Austrian Strategie for Art and Culture European Capital of Culture 2024

Supplement to the Lower Austrian Strategie for Art and Culture European Capital of Culture 2024 St. Pölten’s Bid for ECoC 2024 The Resolutions Passed by the City of St. Pölten and the Province of Lower Austria The Culture Region St. Pölten European Capital of Culture and the Strategy for Art and Culture Innovation in Art and Culture – The Focus on Children St. Pölten – A Hub of History and of Stories The Culture Region St. Pölten and the Cultural Legacy European Capital of Culture as a Historic Opportunity for the Provincial Capital St. Pölten, the Culture Region and Lower Austria SUPPLEMENT European Capital of Culture St. Pölten’s Bid for ECoC 2024 When the Lower Austrian Provincial Government As a “typical mid-size city”, the provincial capital passed its Art and Culture Strategy on 5 July 2016, the bid St. Pölten boasts a great number of cultural institutions by a Lower Austrian city for the title of European Capital of thriving on lively exchange such as the Festspielhaus St. Culture 2024 was not yet on the table, at least as far as the Pölten, the Bühne im Hof, the Landestheater Niederöster- Province of Lower Austria was concerned. Judging by what reich, the Museum Niederösterreich in conjunction with the can still be seen more than three years later, there was not Haus für Natur and the Haus der Geschichte, the Provincial even the vaguest mention of such a bid at the conception Library and the Provincial Archive. Additional significant phase of the province’s culture strategy. This conception contributions come from municipal institutions such as the phase was overseen by Lower Austria’s Department of Art Municipal Museum St. -

Flood Action Plan for Austrian Danube

!£¥©ØÆ 0 °≠ • /¶ ®• )• °©°¨ # ©≥≥© ¶ ®• 0 •£© ¶ ®• $°• 2©• ¶ 3≥°©°¨• &¨§ 0 •£© 4®• $°• 3°≥© ¶ ®• !≥ ©° $°• !£¥© 0≤Øß≤°≠≠• /¶ ®• )• °©°¨ # ©≥≥© ¶ ®• 0 •£© ¶ ®• $°• 2©• ¶ 3≥°©°¨• &¨§ 0 •£© 32• ®• $°• 3°≥© !≥ ©° $°• 2 4°¨• ¶ #•≥ 1 Introduction.................................................................................................................... 5 1.1 Reason for the study ........................................................................................ 5 1.2 Aims and Measures of the Action Programme................................................ 6 1.3 Aim of the “Austrian Danube” Sub-Report ..................................................... 7 2 Characterisation of the Current Situation .................................................................... 8 3 Target Settings..............................................................................................................12 3.1 Long-Term Flood Protection Strategy............................................................12 3.2 Regulations on Land Use and Spatial Planning............................................16 3.3 Reactivation of former, and creation of new, retention and detention capacities.........................................................................................................24 3.4 Technical Flood Protection .............................................................................27 3.5 Preventive Actions – Optimising Flood Forecasting and the Flood Warning System.............................................................................................................42 -

Austrian Federalism in Comparative Perspective

CONTEMPORARY AUSTRIAN STUDIES | VOLUME 24 Bischof, Karlhofer (Eds.), Williamson (Guest Ed.) • 1914: Aus tria-Hungary, the Origins, and the First Year of World War I War of World the Origins, and First Year tria-Hungary, Austrian Federalism in Comparative Perspective Günter Bischof AustrianFerdinand Federalism Karlhofer (Eds.) in Comparative Perspective Günter Bischof, Ferdinand Karlhofer (Eds.) UNO UNO PRESS innsbruck university press UNO PRESS innsbruck university press Austrian Federalism in ŽŵƉĂƌĂƟǀĞWĞƌƐƉĞĐƟǀĞ Günter Bischof, Ferdinand Karlhofer (Eds.) CONTEMPORARY AUSTRIAN STUDIES | VOLUME 24 UNO PRESS innsbruck university press Copyright © 2015 by University of New Orleans Press All rights reserved under International and Pan-American Copyright Conventions. No part of this book may be reproduced or transmitted in any form, or by any means, electronic or mechanical, including photocopy, recording, or any information storage nd retrieval system, without prior permission in writing from the publisher. All inquiries should be addressed to UNO Press, University of New Orleans, LA 138, 2000 Lakeshore Drive. New Orleans, LA, 70148, USA. www.unopress.org. Printed in the United States of America Book design by Allison Reu and Alex Dimeff Cover photo © Parlamentsdirektion Published in the United States by Published and distributed in Europe University of New Orleans Press by Innsbruck University Press ISBN: 9781608011124 ISBN: 9783902936691 UNO PRESS Publication of this volume has been made possible through generous grants from the the Federal Ministry for Europe, Integration, and Foreign Affairs in Vienna through the Austrian Cultural Forum in New York, as well as the Federal Ministry of Economics, Science, and Research through the Austrian Academic Exchange Service (ÖAAD). The Austrian Marshall Plan Anniversary Foundation in Vienna has been very generous in supporting Center Austria: The Austrian Marshall Plan Center for European Studies at the University of New Orleans and its publications series. -

Contribution by the Austrian Länder Burgenland, Lower Austria, Upper Austria and Vienna to the EU Strategy

Contribution by the Austrian Länder Burgenland, Lower Austria, Upper Austria and Vienna to the EU Strategy for the Danube Region 07.12.2009 Overall editorial coordination: Kurt Puchinger, Magistrat der Stadt Wien Otto Frey, Magistrat der Stadt Wien Contact persons in the involved Austrian Länder: wHR Dr. Heinrich Wedral, Amt der Burgenländischen Landesregierung [email protected] Peter de Martin, Amt der Niederösterreichischen Landesregierung [email protected] Dipl.-Ing. Robert Schrötter, Amt der Oberösterreichischen Landesregierung [email protected] Dipl.-Ing. Dr. Kurt Puchinger, Amt der Wiener Landesregierung [email protected] Contents 1 EU Strategy for the Danube Region............................................................................................ 5 1.1 Context......................................................................................................................................................... 5 1.2 Objectives of an EU Strategy for the Danube Region ..................................................................................... 5 2 The Danube Region in the Limelight .......................................................................................... 6 2.1 Definition and Affiliation.............................................................................................................................. 6 2.2 Transnational Development Issues of Special Significance for Austria............................................................ 6 2.2.1 The Danube Region -

Disposition of Remains Report 2021

Revised and updated February 2021 New update will be released in January 2024 MEMORANDUM DATE: February 1, 2021 FROM: American Embassy Consular Section Vienna, Austria SUBJECT: CASC: Disposition of Remains Report 2021 TO: Department of State (CA/OCS/ACS/EUR) REF: (a) 7 FAM 260; (b) Disposition Remains Report 2017 Since there has been no change in Austrian regulations and procedures concerning the disposition of human remains, we are submitting below only a revised list of costs. The prices quoted are based on exchange rate of US $ 1.00 equals Euro 0.90. a. LOCAL BURIAL (with ten year lease on grave, renewable) City of Vienna $ 6500 Lower Austria $ 4800 - 7200 Upper Austria $ 4800 - 8400 Styria $ 4200 - 5000 Carinthia $ 4800 - 6000 Burgenland $ 4200 - 6000 Salzburg $ 6000 - 7200 Tyrol $ 6000 Vorarlberg $ 6700 - 8400 b. PREPARATION OF REMAINS FOR SHIPMENT TO THE UNITED STATES Vienna $ 6000 Lower Austria $ 6000 - 8900 Upper Austria $ 6000 - 8400 Styria $ 6000 - 8400 Carinthia $ 4800 - 6000 Burgenland $ 4800 - 7200 Salzburg $ 6000 Tyrol $ 6000 Vorarlberg $ 8900 c. COST OF SHIPPING PREPARED REMAINS TO THE UNITED STATES East Coast $ 2900 South Coast $ 2900 Central $ 2900 West Coast $ 3200 Shipping costs are based on an average weight of the casket with remains to be 150 kilos. d. CREMATION AND LOCAL BURIAL OF URN Vienna $ 5800 Lower Austria $ 9000 Upper Austria $ 3400 - 6700 Styria $ 4200 - 5000 Carinthia $ 5000 Burgenland $ 4200 - 5900 Salzburg (city) $ 4200 - 5900 Salzburg (province) $ 5500 Tyrol $ 5900 Vorarlberg $ 8400 e. CREMATION AND SHIPMENT OF URN TO THE UNITED STATES Vienna $ 3600 Lower Austria $ 4800 Upper Austria $ 3600 Styria $ 3600 Carinthia $ 4800 Burgenland $ 4800 Salzburg $ 3600 Tyrol $ 4200 Vorarlberg $ 6000 e. -

On the Frontier Between Eastern and Western Yiddish: Sources from Burgenland

European Journal of Jewish Studies 11 (2017) 130–147 brill.com/ejjs On the Frontier between Eastern and Western Yiddish: Sources from Burgenland Lea Schäfer* Abstract Burgenland, the smallest state of current Austria, located on the border with Hungary, once had seven vibrant Jewish communities under the protection of the Hungarian Eszterházy family. There is next to nothing known about the Yiddish variety spoken in these communities. This article brings together every single piece of evidence of this language to get an impression of its structure. This article shows that Yiddish from Burgenland can be integrated into the continuum between Eastern and Western Yiddish and is part of a gradual transition zone between these two main varieties. Keywords Yiddish dialectology and phonology – Jews in Austria and Hungary – Eastern and Western Yiddish transition zone Burgenland, the smallest state of Austria today, located on the border with Hungary, once had seven vibrant Jewish communities that stood under the protection of the Hungarian Eszterházy family. There is next to nothing known about the Yiddish variety spoken in these communities. Its geographical posi- tion, however, makes Burgenland interesting for Yiddish dialectology. As Dovid Katz has postulated, it is on the southern end of a transition zone between Eastern and Western Yiddish.1 This article will show that Yiddish * I would like to thank Jeffrey Pheiff, Oliver Schallert and Ricarda Scherschel for checking my English. I also want to thank the anonymous reviewers for their useful comments. 1 Dovid Katz, “Zur Dialektologie des Jiddischen,” in Dialektologie: Ein Handbuch zur deutschen und allgemeinen Dialektforschung 1.2., eds. -

The Lower Austria Avalanche Warning Service - the Youngest in the Alps

International Snow ScienceInternational Workshop, Snow Davos Science 2009, WorkshopProceedings Davos 2009 The lower Austria Avalanche Warning Service - the youngest in the Alps Arnold Studeregger, Hannes Rieder1,* and Fritz Salzer2 1 Institute of Meteorology and Geodynamic, Graz, Austria 2 Government of Lower Austria, St. Pölten, Austria ABSTRACT: The avalanche warning service was established by the government of lower Austria to- gether with the avalanche experts of the Institute for Meteorology and Geodynamics Costumer Service Styria in a very short time. The first regular season was winter 2006/07. KEYWORDS: Avalanche, Avalanche Warning Service, Alps 1 INTRODUCTION 2 METEOROLOGICAL CONDITIONS A c ommunication an d catastrophe manage- The avalanche and the slab avalanche situa- ment (headquarter f or warnings - hydrology – tion in the transnational area along the 160 km ZAMG – population) was arr anged. This ne w border between lower Austria and Styria shows system proved very ef fective in February 2009. major differences of avalanche building weather On February 23rd and 24th the lower Austria ava- situations. On the west side of the area between lanche s ervice i ssued th e hi ghest a valanche the Ybbstaler Alps to the Mürzsteger Alps there danger for the first time (5 - very high). In Feb- is a bi g a ltitude difference. The meteorological ruary 2009 the sum of fresh snow was over 500 conditions for fresh snow are coming fr om the cm on mount Hochkar! northwest to north. The east side of the Alps is influenced by the meteorological conditions from the east. Next to meteorological parameters, the cha- racter of the terr ain is important when it comes to avalanche building: Notorious are the extreme and more than 50 degrees sidewalls and chan- nels from the north of the limestone Alps. -

How Lower Austria Is Boosting Cross-Border Collaboration in Health

The Healthacross Initiative: How Lower Austria is Boosting Cross-border Collaboration in Health The Healthacross Initiative: How Lower Austria is Boosting Cross-border Collaboration in Health Abstract Cross-border collaboration in the field of health care can involve a transfer, movement or exchange of individuals, services or resources. It can comprise the sharing of health services, providers and expertise, as well as the provision of disease prevention, health promotion, curative and rehabilitative health services. This report tells the story of the cross-border collaboration in the field of health between Lower Austria and Czechia, and the beginning of collaboration with Slovakia. It focuses on the gradual provision of outpatient care and the exchange of medical expertise taking place in three border regions; documents the first large- scale effort to develop cross-border cooperation on health care between a long-standing and new European Union Member States; and provides information on how and why cross-border care started, mechanisms used to put it in place, key stakeholders and the lessons learned, including challenges and enabling factors. Keywords: International Cooperation Health Services Accessibility Delivery of Health Care Austria Czech Republic Address requests about publications of the WHO Regional Office for Europe to: Publications WHO Regional Office for Europe United Nations City, Marmorvej 51 DK-2100 Copenhagen Ø, Denmark Alternatively, complete an online request form for documentation, health information, or for permission to quote or translate, on the Regional Office website (http://www.euro.who.int/pubrequest). ISBN 978 92 890 5375 4 © World Health Organization 2018 All rights reserved. The Regional Office for Europe of the World Health Organization welcomes requests for permission to reproduce or translate its publications, in part or in full. -

Sub-National Constitutionalism in Austria: a Historical Institutionalist Perspective by Ferdinand Karlhofer

ISSN: 2036-5438 Sub-national Constitutionalism in Austria: a Historical Institutionalist Perspective by Ferdinand Karlhofer Perspectives on Federalism, Vol. 7, issue 1, 2015 Except where otherwise noted content on this site is licensed under a Creative Commons 2.5 Italy License E - 57 Abstract Austria’s federal system is determined by an apparent contrast between formal and real constitution having its roots in foundational defects shaping the system to the present day. As for the formal dimension, Austria has a rather uneven balance with regard to power- sharing. No wonder that, given the structural bias between central state and substates, informal forces are at work in order to make up for the shortcomings of the federal architecture. In this context, sub-national constitutionalism at first sight appears to be marginal. Astoundingly, though, in recent time a lot of constitutional changes and amendments, quite possibly paving the way for a sustainable redesign of the federation as a whole have taken place. The article starts with a historical outline of the Austrian federation’s origins. In chapter 2, the interplay of formal and informal rules and practices is discussed. Chapter 3 deals with scope, contents and dynamics of sub-national constitutionalism under the given framework. The article concludes with assessing the efficacy of subconstitutional politics in relation to the capacities of the federal constitution. Key-words Federalism, Subnational constitutionalism, Austria, Historical institutionalism Except where otherwise noted content on this site is licensed under a Creative Commons 2.5 Italy License E - 58 Given that federalism is essentially about the distribution of authority between a central government and state governments (Bednar 2011: 270), every two-tiered political system is defined through a “super-constitution” that regulates overlapping control of a single population by a superior state and a group of subordinate states. -

The Austrian Landscape of Health Care Providers in 2006 and 2007: the Province of Lower Austria As a Paradigm

DEXHELPP: Decision Support for Health Policy and Planning: Methods, Models and Technologies based on Existing Health Care Data Comet K-Project: 843550 Project 4: Pathways of Service Utilisation Deliverable 4.1: Report on Mapping of Service Providers The Austrian Landscape of Health Care Providers in 2006 and 2007: The Province of Lower Austria as a paradigm A compendium of health service providers according to type, geographical location and essential characteristics as a background for the interpretation of pathways of health care utilisation analyses derived from the GAP-DRG July 2015 Christa Straßmayr, Heinz Katschnig, Florian Endel with support of Gabriele Niedermayer and Simone Sauter IMEHPS.research GmbH Glasergasse 24/23, 1090 Wien www.imehps.at [email protected] 1 1. EXECUTIVE SUMMARY 4 2. INTRODUCTION 6 3. DEMOGRAPHIC AND ADMI NISTRATIVE DATA OF L OWER AUSTRIA IN 2006 AND 2007 8 4. THE GAP -DRG AND THE POPULATI ON INCLUDED IN IT 13 5. SERVICE MAPPING 16 5.1 Inpatient Care (stationäre Behandlung) 16 5.1.1 Hospitals reimbursed by the Lower Austrian Regional Fund (Landesgesundheitsfonds) included in the GAP-DRG in a linkable form 17 5.1.2 Hospitals not reimbursed by the Lower Austrian Regional Fund (Landesgesundheitsfonds) included in the GAP-DRG in a non-linkable form 30 5.1.3 Hospitals located in the Province of Lower Austria not included in the GAP-DRG 35 5.2 Day-care in hospitals (tagesklinische Behandlung) 37 5.3 Ambulatory care by self-employed doctors (“niedergelassene Ärzte”) (ambulante Behandlung) 39 5.3.1 General