Research Relocations Dominate Leasing in November

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FLI Schedules - 1-16-07 in Re: FABRIKANT-LEER INTERNATIONAL, LTD., Debtor

United States Bankruptcy Court Southern District of New York In re: FABRIKANT-LEER INTERNATIONAL, LTD., Debtor. Case No. 06-12739 (SMB) Chapter 11 SUMMARY OF SCHEDULES Indicate as to each schedule whether that schedule is attached and state the number of pages in each. Report the totals from Schedules A, B, D, E, F, I, and J in the boxes provided. Add the amounts of all claims from Schedules A and B to determine the total amount of the debtor’s assets. Add the amounts of all claims from Schedules D, E, and F to determine the total amount of the debtor’s liabilities. Individual debtors must also complete the “Statistical Summary of Certain Liabilities and Related Data” if they file a case under chapter 7, 11, or 13. ATTACHED NO. OF NAME OF SCHEDULE ASSETS LIABILITIES OTHER (Yes/No) SHEETS A - Real Property Yes 1 $ 0 B - Personal Property Yes 4 149,451,077 C - Property Claimed as Exempt Yes 1 D - Creditors Holding Secured Claims Yes 1 $ 161,947,902 E - Creditors Holding Unsecured Priority Claims (Total of Claims of Yes 2 390,177 Schedule E) F - Creditors Holding Unsecured Yes 2 119,861,635 Non Priority Claims G - Executory Contracts and Yes 1 Unexpired Leases H - Codebtors Yes 1 I - Current Income of Individual Debtor(s) Yes 1 N/A J - Current Expenditures of Individual Yes 1 N/A Debtor(s) TOTAL 15 $149,451,077.20 $282,199,714.42 FLI Schedules - 1-16-07 In re: FABRIKANT-LEER INTERNATIONAL, LTD., Debtor. Case No. 06-12739 (SMB) Chapter 11 SCHEDULE A - REAL PROPERTY Except as directed below, list all real property in which the debtor has any legal, equitable, or future interest, includingall property owned as a co-tenant, community property, or in which the debtor has a life estate. -

The New Executive Offices Represent the New Standard for Boutique Office Space in New York City

The new Executive Offices represent the new standard for boutique office space in New York City. The entry features an iconic 93-foot glass totem that reflects the spirit and design of the soaring 96-story residential tower at 432 Park Avenue. The offices are exceptionally spacious, with large column-free spans, flexible floor plates and ceiling heights of more than fifteen feet. Uninterrupted floor-to-ceiling windows allow for an abundance of natural light to illuminate each space. Strong, expansive and sleek, the floors offer the highest-quality office space for the most demanding tenants. 432 Park Avenue Executive Offices & Retail Entry Diagram Angled Entry & Iconic Glass Totem Private Lobby Angled Entry & Iconic Glass Totem Reception Private Corner Office Analysts/Trading Conference Room Collaborative Seating Area Analysts/Trading/Support Abundant Natural Light 12'-6" 15'-6" Vision Finished Slab to Slab Glass Ceiling Height 9'-0" 10'-6" Vision Finished Slab to Slab Glass Ceiling Height 432 Park Avenue Executive Offices Traditional Office Typical Section at Curtain Wall Typical Section at Curtain Wall with Perimeter PTAC Building Facts Location Floor Sizes Electrical Located at the base of 432 Park 4 levels of 17,600+ RSF per floor Approximately 12 watts per sq ft Avenue Tower, the Western exclusive of base building load; 460 Hemisphere’s tallest residential Finished Ceiling Heights volt, 3 phase main service with building at 1,396' tall 12'-6" redundant Con Edison feeds Design Slab to Slab Heights HVAC Iconic entry design with 93' tall cut 15'-6" Roof mounted 675 ton cooling tower out and glass totem for condenser water system dedicated Column Spacing Modern private lobby featuring for commercial/retail units. -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): June 6, 2008 BOSTON PROPERTIES LIMITED PARTNERSHIP (Exact name of registrant as specified in its charter) Delaware 0-50209 04-3372948 (State or other jurisdiction (Commission File Number) (IRS Employer of incorporation) Identification No.) 800 Boylston Street, Suite 1900, Boston, Massachusetts 02199-8103 (Address of principal executive offices) (Zip Code) (617) 236-3300 (Registrant’s telephone number, including area code) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 1.01. Entry into a Material Definitive Agreement. Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. On June 6, 2008, Boston Properties Limited Partnership (the “Company”) a Delaware limited partnership and the entity through which Boston Properties, Inc. conducts substantially all of its business, utilized an accordion feature under its Fifth Amended and Restated Revolving Credit Agreement with a consortium of lenders to increase the current maximum borrowing amount under the facility from $605 million to $923.3 million, and the Company expects to further increase the maximum borrowing amount to $1 billion in the near future. -

Commercial and Federal Litigation Section Newsletter a Publication of the Commercial and Federal Litigation Section of the New York State Bar Association

NYSBA FALL 2001 | VOL. 7 | NO. 1 Commercial and Federal Litigation Section Newsletter A publication of the Commercial and Federal Litigation Section of the New York State Bar Association A Message from the A Message from the Outgoing Chair Incoming Chair I welcome the opportunity, As your incoming Chair, I through this newsletter, to keep want to share with you the the 1,800 Section members excitement I feel about our Sec- informed about Section news tion in the coming year. Thanks and provide information that is to the groundwork done by helpful in daily practice, as the Sharon Porcellio, the Section is dedicated and energetic 2001- in its strongest position in years. 2002 officers assume their new Moreover, I want you to be roles. This issue contains an aware of the dedication and update on Section activities, energy exhibited by the individ- recent CPLR amendments, and uals whom you selected to serve Executive Committee Meeting as officers with me. In addition, summaries. For additional information, including the there are numerous people on the Executive Committee Commercial Division Law Report, please visit the Section who have volunteered and are working hard to make Web site at http://www.nysba.org/sections/comfed. this a great year for our Section. On behalf of the Section, I appreciate your support and This incoming message will have several purposes: welcome your involvement at every level—from read- to recognize certain people, to advise you of new offer- ing the Section’s publications and attending CLE pro- ings by our Section, and to discuss with you certain grams to active committee involvement. -

“The 1961 New York City Zoning Resolution, Privately Owned Public

“The 1961 New York City Zoning Resolution, Privately Owned Public Space and the Question of Spatial Quality - The Pedestrian Through-Block Connections Forming the Sixth-and-a-Half Avenue as Examples of the Concept” University of Helsinki Faculty of Arts Department of Philosophy, History, Culture and Art Studies Art History Master’s thesis Essi Rautiola April 2016 Tiedekunta/Osasto Fakultet/Sektion – Faculty Laitos/Institution– Department Humanistinen tiedekunta Filosofian, historian, kulttuurin ja taiteiden tutkimuksen laitos Tekijä/Författare – Author Essi Rautiola Työn nimi / Arbetets titel – Title The 1961 New York City Zoning Resolution, Privately Owned Public Space and the Question of Spatial Quality - The Pedestrian Through-Block Connections Forming the Sixth-and-a-Half Avenue as Examples of the Concept Oppiaine /Läroämne – Subject Taidehistoria Työn laji/Arbetets art – Level Aika/Datum – Month and year Sivumäärä/ Sidoantal – Number of pages Pro gradu Huhtikuu 2016 104 + 9 Tiivistelmä/Referat – Abstract Tutkielma käsittelee New Yorkin kaupungin kaavoituslainsäädännön kerrosneliöbonusjärjestelmää sekä sen synnyttämiä yksityisomisteisia julkisia tiloja ja niiden tilallista laatua nykyisten ihanteiden valossa. Esimerkkitiloina käytetään Manhattanin keskikaupungille kuuden korttelin alueelle sijoittuvaa kymmenen sisä- ja ulkotilan sarjaa. Kerrosneliöbonusjärjestelmä on ollut osa kaupungin kaavoituslainsäädäntöä vuodesta 1961 alkaen ja liittyy olennaisesti New Yorkin kaupungin korkean rakentamisen perinteisiin. Se on mahdollistanut ylimääräisten -

NY Business Law Journal a Publication of the Business Law Section of the New York State Bar Association Inside Headnotes 6 (David L

NYSBA FALL 2008 | VOL. 12 | NO. 2 NY Business Law Journal A publication of the Business Law Section of the New York State Bar Association Inside HeadNotes 6 (David L. Glass) Internet Banking and the Community Reinvestment Act: An Examination of the Proposals to Establish Compliance 8 (Anthony D. Altamuro, Law Student Writing Competition First Place Winner) Auction Rate Securities: Mechanics and Turmoil 16 (Sachin Raval, Law Student Writing Competition Second Place Winner) The Lawyers’ Foreclosure Intervention Network: Addressing Mortgage Foreclosure in New York City 25 (Thomas C. Baxter, Jr. and Michael V. Campbell) Tugboats, Glaucoma and the Check Collection Process 32 (Jay L. Hack) Wrestling the Fire: Climate Change Law in New York State 34 (Nathan Whitehouse) New York Employment Law Update 42 (James R. Grasso) Ethical Issues for Business Lawyers Documents and Lawyers: Oil and Water? 46 (C. Evan Stewart) Intellectual Property in Various Types of Business Transactions 50 (Ralph J. Scola) Preventing the Inevitable: How Thinking About What Might Happen Can Help Ensure That It Won’t 55 (Victoria A. Cundiff) Getting Ready to Sell a Small Business: A Conversation with a Client 71 (Miriam V. Gold) The Role of the Corporate Secretary in Corporate Governance: The View from a U.S. Subsidiary of a Japanese Insurance Company 75 (Yoshikazu Koike) Committee Reports 82 Your key to professional success… A wealth of practical resources at www.nysba.org • Downloadable Forms organized into common The NY Business Law Journal is practice areas also available online • Comprehensive practice management tools • Forums/listserves for Sections and Committees • More than 800 Ethics Opinions • NYSBA Reports – the substantive work of the Association • Legislative information with timely news feeds • Online career services for job seekers and employers • Free access to several case law libraries – exclusively for members Go to www.nysba.org/BusinessLawJournal to access: The practical tools you need. -

Q4 10 Supplemental.Xlsm

Supplemental Operating and Financial Data for the Quarter Ended December 31, 2010 Boston Properties, Inc. Fourth Quarter 2010 Table of Contents Page Company Profile 3 Investor Information 4 Research Coverage 5 Financial Highlights 6 Consolidated Balance Sheets 7 Consolidated Income Statements 8 Funds From Operations 9 Reconciliation to Diluted Funds From Operations 10 Funds Available for Distribution and Interest Coverage Ratios 11 Capital Structure 12 Debt Analysis 13-15 Unconsolidated Joint Ventures 16-17 Value-Added Fund 18 Portfolio Overview-Square Footage 19 In-Service Property Listing 20-22 Top 20 Tenants and Tenant Diversification 23 Office Properties-Lease Expiration Roll Out 24 Office/Technical Properties-Lease Expiration Roll Out 25 Retail Properties - Lease Expiration Roll Out 26 Grand Total - Office, Office/Technical, Industrial and Retail Properties 27 Greater Boston Area Lease Expiration Roll Out 28-29 Washington, D.C. Area Lease Expiration Roll Out 30-31 San Francisco Area Lease Expiration Roll Out 32-33 Midtown Manhattan Area Lease Expiration Roll Out 34-35 Princeton Area Lease Expiration Roll Out 36-37 CBD/Suburban Lease Expiration Roll Out 38-39 Hotel Performance and Occupancy Analysis 40 Same Property Performance 41 Reconciliation to Same Property Performance and Net Income 42-43 Leasing Activity 44 Capital Expenditures, Tenant Improvements and Leasing Commissions 45 Acquisitions/Dispositions 46 Value Creation Pipeline - Construction in Progress 47 Value Creation Pipeline - Land Parcels and Purchase Options 48 Definitions 49-50 This supplemental package contains forward-looking statements within the meaning of the Federal securities laws. You can identify these statements by our use of the words "assumes," "believes," "estimates," "expects," "guidance," "intends," “plans,” “projects,” and similar expressions that do not relate to historical matters. -

Egps Welcomes To

EGPS WELCOMES TO N YC Welcome to New York City! On behalf of the members of the Eastern Group Psychotherapy Society (EGPS), we would like to welcome you to New York City for AGPA Connect 2020. (64th Annual Institute and 77th Annual Conference) of the American Group Psychotherapy Association. New York City has something for everyone from restaurants, museums, theatre, shopping, parks, and historical sites. We hope you take some time during your stay to visit “the city that never sleeps.” Our Hospitality Guide offers you a quick and handy resource with some of EGPS members’ favorite spots. As an island with excellent public transportation, Manhattan offers you easy access to countless activities. We are located centrally in Midtown at the Sheraton Towers, near 5th Avenue's upscale shopping and the Theatre District, Carnegie Hall, Museum of Modern Art and Rockefeller Center. If you head downtown, you can visit SoHo's wonderful art galleries and restaurants. Greenwich Village has delightful coffee shops, restaurants, bookstores, movie theaters and nightclubs. You may enjoy wandering through Tribeca, with its artists' lofts, cobblestone streets, and neighborhood cafés. Little Italy and Chinatown offer shops and markets and restaurants that are definitely worth exploring. You will find all kinds of information on neighborhoods, landmark buildings, sightseeing, entertainment and museums at EGPS’ Hospitality Booth. We are here to provide help and advice from our friendly EGPS members and Hosting Task Force at the booth. We look forward to greeting you and sharing information. Stop by the booth and say hello. Our Hosting Task Force chaired by Kathie Ault, Leah Slivko and assisted by Jan Vadell, our EGPS Administrator and Hosting Task Force Consultant. -

Notice of Filing and Service

1 Donald K. Dankner (No. 0186536) Thomas F. Blakemore (No. 03121566) 2 Stacy Justic (No. 6277752) 3 WINSTON & STRAWN LLP 1! 35 West Wacker, Suite 4200 '50 4 Chicago, IL 60601 1 O3 7-3 312-558-5600 (Phone) 5 312-558-5700 (Facsimile) Counsel to Debtors and Debtors in Possession 6 UNITED STATES BANKRUPTCY COURT 7 8 NORTHERN DISTRICT OF CALIFORNIA 9 SAN FRANCISCO DIVISION 10 In re Case No. 01-30923 DM 11 PACIFIC GAS AND ELECTRIC Chapter 11 Case COMPANY, a California corporation, 12 [No Hearing Scheduled] Debtor. 13 Federal I.D. No. 94-0742640 - 14 NOTICE OF FILING AND SERVICE 15 16 To: Parties Listed on Attached Certificate of Service 17 PLEASE TAKE NOTICE that Winston & Strawn LLP has, as of the date below, served 18 the attached Cover Sheet Application For Allowance And Payment Of Interim 19 20 Compensation And Reimbursement Of Expenses For The Period June 1, 2003 through 21 June 30, 2003 on the attached Special Notice List and filed this Notice with the United States 22 Bankruptcy Court for the Northern District of California, San Francisco Division, 235 Pine 23 Street, 19th Floor, San Francisco, California 94104. 24 25 Dated: July A, 2003 WINSTON & STRAWLP Chicago, Illinois 26 By 27 3g7Conse TotheDebtors and Motrs n Pssession 28 CHI:1238539.1 bR21 I I Donald K. Dankner (No. 0186536) Thomas F. Blakemore (No. 03121566) 2 Stacy D. Justic (No. 6277752) 3 WINSTON & STRAWN LLP 35 West Wacker Dr. 4 Chicago, IL 60601 Phone: 312-558-5600 5 Facsimile: 312-558-5700 Counsel to Debtor and Debtor in Possession 6 7 8 UNITED STATES BANKRUPTCY COURT 9 10 NORTHERN DISTRICT OF CALIFORNIA 11 SAN FRANCISCO DIVISION 12 In re Case No. -

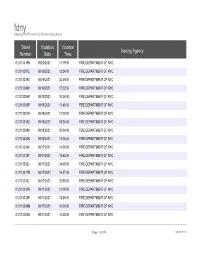

Ticket Number Violation Date Violation Time Issuing Agency

fdny Based on OATH Hearings Division Case Status Ticket Violation Violation Issuing Agency Number Date Time 012113419N 09/20/2021 11:19:00 FIRE DEPARTMENT OF NYC 012113307Z 09/19/2021 12:34:00 FIRE DEPARTMENT OF NYC 012113319X 09/19/2021 02:49:00 FIRE DEPARTMENT OF NYC 012113299H 09/19/2021 17:22:00 FIRE DEPARTMENT OF NYC 012113306R 09/18/2021 10:26:00 FIRE DEPARTMENT OF NYC 012113305P 09/18/2021 11:48:00 FIRE DEPARTMENT OF NYC 012113301H 09/18/2021 12:29:00 FIRE DEPARTMENT OF NYC 012113315Z 09/18/2021 08:24:00 FIRE DEPARTMENT OF NYC 012113308K 09/18/2021 00:04:00 FIRE DEPARTMENT OF NYC 012113320N 09/18/2021 12:26:00 FIRE DEPARTMENT OF NYC 012113316K 09/17/2021 14:09:00 FIRE DEPARTMENT OF NYC 012113318Y 09/17/2021 12:52:00 FIRE DEPARTMENT OF NYC 012113302J 09/17/2021 04:58:00 FIRE DEPARTMENT OF NYC 012113317M 09/17/2021 16:57:00 FIRE DEPARTMENT OF NYC 012113310J 09/17/2021 22:55:00 FIRE DEPARTMENT OF NYC 012113314R 09/17/2021 01:08:00 FIRE DEPARTMENT OF NYC 012113313P 09/17/2021 18:39:00 FIRE DEPARTMENT OF NYC 012113309M 09/17/2021 10:04:00 FIRE DEPARTMENT OF NYC 012113304N 09/17/2021 12:40:00 FIRE DEPARTMENT OF NYC Page 1 of 956 09/25/2021 fdny Based on OATH Hearings Division Case Status Violation Location Respondent First Name Respondent Last Name Balance Due (Borough) MSMC RESIDENTIAL REALTY 0.00 MANHATTAN DENIHAN OWNERSHIP COMPANY LLC 0.00 MANHATTAN OHI ASSET NY 2ND AVENUE LLC 0.00 MANHATTAN ENCES AT WORLDWIDE P BOARD OF MANAGERS OF THE RESID 0.00 MANHATTAN N COURT CONDOMINIUM THE BOARD OF MANAGERS OF BEACO 0.00 MANHATTAN 237 WEST -

Executive Summary – the Liar's Ball

Executive Summary – The Liar’s Ball Preface and Intro: The author, Vicky Ward, begins by describing the Liar’s Ball (an annual gala held at the Hilton Hotel and attended by Ney York’s real estate elite) in addition to briefly introducing the key players who were involved in the development, sale and resale of the GM Building. She also explains her fascination with the numerous attendees at the event and her subsequent desire to uncover and understand their insecurities and successes. Chapter 1: Stealing the Spotlight The chapter start by describing the story of how the “Trump” letters (which were previously attached to the GM Building vanished overnight). It then goes on to mention one of Harry Macklowe’s murkier stories – the S.R.O. debacle of 1985. As the narrative goes, Harry’s company apparently demolished four S.R.O. buildings (with no permits in hand) in order to avoid a city moratorium which would come into force the following day, all the while forgetting to turn off the gas line! Ward also brings to light Harry Macklowe’s nuanced personality, citing examples of his grittiness and out the box thinking. Chapter 2: Alpha Males The chapter introduces Harry’s two right hand men, both of whom happened to be named “Rob”. It goes on to detail the groundwork Harry did prior to his bid for the GM Building, one aspect of which involved him purchasing a building at 125 West 55th Street for full value ($125m) merely to impress Eastdil (the broker on the GM deal in ‘03) and show that he could “close” deals. -

TICL Journal

TICL Journal Volume 31, No. 2 Fall 2002 Issue Copyright 2002 by the New York State Bar Association ISSN 1530-390X TORTS, INSURANCE AND COMPENSATION LAW SECTION EXECUTIVE COMMITTEE—2002-2003 SECTION CHAIR NINTH DISTRICT Dennis R. McCoy THIRD DISTRICT Thomas J. Burke 1100 M&T Center Edward B. Flink 10 Bank Street, Suite 1040 Three Fountain Plaza 7 Airport Park Boulevard White Plains, NY 10606 Buffalo, NY 14203 Latham, NY 12110 Hon. Anthony J. Mercorella 150 East 42nd Street VICE-CHAIR Christine K. Krackeler New York, NY 10017 Eric Dranoff 16 Sage Estate 331 Madison Avenue Menands, NY 12204 New York, NY 10017 TENTH DISTRICT FOURTH DISTRICT James J. Keefe, Jr. SECRETARY Paul J. Campito 1140 Franklin Avenue Eileen E. Buholtz 131 State Street P.O. Box 7677 250 Times Square Building P.O. Box 1041 Garden City, NY 11530 45 Exchange Street, Suite 250 Schenectady, NY 12305 Rochester, NY 14614 Arthur J. Smith Robert P. McNally 125 Jericho Turnpike Jericho, NY 11753 EXECUTIVE COMMITTEE 175 Ottawa Street Lake George, NY 12845 LIAISON ELEVENTH DISTRICT Edward S. Reich Edward H. Rosenthal 26 Court Street, Suite 606 FIFTH DISTRICT 125-10 Queens Boulevard Brooklyn, NY 11242 Timothy J. Fennell 26 East Oneida Street Kew Gardens, NY 11415 Oswego, NY 13126 DELEGATES TO THE TWELFTH DISTRICT HOUSE OF DELEGATES Lori E. Petrone Mitchell S. Cohen Louis B. Cristo 1624 Genesee Street 116 John Street, 33rd Floor 700 Reynolds Arcade Utica, NY 13502 New York, NY 10038 16 East Main Street Rochester, NY 14614 SIXTH DISTRICT Robert S. Summer John J. Pollock 714 East 241st Street Edward B.