Net Oil Exports and the "Iron Triangle"

Total Page:16

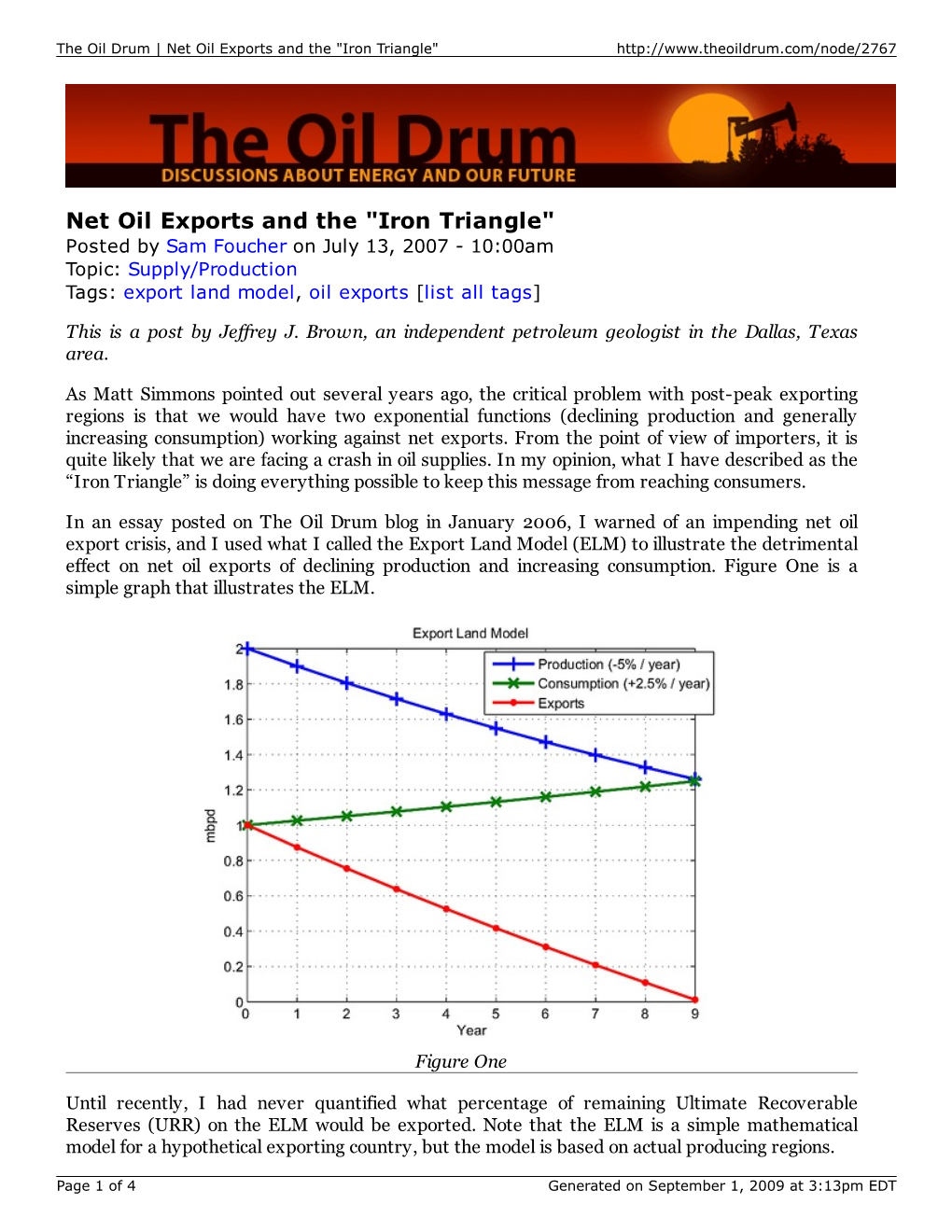

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Combined Wind/Pumped Hydro Energy System in WNY As An

Combined Wind/Pumped Hydro Energy System in WNY as an Alternative to Peak Oil Induced NY State Socioeconomic Disaster Derek Bateman [email protected] David Bradley [email protected] Submitted to the ESSCCA Conference, Buffalo, NY on April 1, 2001 1 Abstract The economy on which our civilization is based is both environmentally and economically unsustainable. Two obvious examples are the pending economic dislocation that will inevitably take place as a result of “Peak Oil” and Global Climate Change. For huge sectors of the economy many or most business models will no longer work when we are paying $5.00 to $20.00 a gallon for transportation fuel. What examples from social science research are available to prepare our society to avoid economic depression if not societal collapse? This paper will show how “Renewable Energy Feed-In Laws” (REFILs) can offer an approach to addressing Peak Oil and fossil fuel induced Global Climate Change, as well as Peak Oil induced economic damage. It also will focus on how wind turbines along with pumped hydroelectric energy storage and biomass for WNY/NY State can help address energy shortages that will result from Peak Oil while providing jobs and maximizing social cohesion. Summary • Global Warming and Peak Oil are related items • Oil combustion and oil consumption related infrastructure (e.g. cars, sub- urbs, car-centric shopping centers/malls, etc) are major emitters and/or causes of CO2 pollution, the major cause of Global Warming • Global Warming and Peak Oil have different time scales for noticeable effects and the timing of their impacts will often differ • Global Warming is mostly a weather, climate, rainfall, and ocean level phenomena, plus the effects of those on humans and their societies • Peak Oil is mostly an economic phenomena, and transportation (of goods and people) related • Peak Oil is a liquid fuels problem – liquid fuels have unique properties • Peak Oil is really a Peak World Oil Export problem for the U.S. -

Global Oil Risks in the Early 21St Century

CORE Metadata, citation and similar papers at core.ac.uk Provided by Munich RePEc Personal Archive MPRA Munich Personal RePEc Archive Global oil risks in the early 21st century Dean Fantazzini and Mikael Hook and Andr´e Angelantoni Moscow School of Economics, Moscow State University, Russia, Uppsala University, Global Energy Systems, Department of Physics and Astronomy, Uppsala, Sweden, www.PostPeakLiving.com (USA) 1. February 2011 Online at https://mpra.ub.uni-muenchen.de/33825/ MPRA Paper No. 33825, posted 30. September 2011 17:16 UTC Global oil risks in the early 21st Century Dean Fantazzini∗ Mikael H¨o¨ok† Andr´eAngelantoni‡ Abstract The Deepwater Horizon incident demonstrated that most of the oil left is deep offshore or in other difficult to reach locations. Moreover, obtaining the oil remaining in currently producing reservoirs requires additional equipment and technology that comes at a higher price in both capital and energy. In this regard, the physical limitations on producing ever-increasing quantities of oil are highlighted as well as the possibility of the peak of production occurring this decade. The economics of oil supply and demand are also briefly discussed showing why the available supply is basically fixed in the short to medium term. Also, an alarm bell for economic recessions is shown to be when energy takes a disproportionate amount of total consumer expenditures. In this context, risk mitigation practices in government and business are called for. As for the former, early education of the citizenry of the risk of economic contraction is a prudent policy to minimize potential future social discord. -

The End of Growth: Adapting to Our New

Advance Praise for The End of Growth Heinberg draws in the big three drivers of inevitable crisis—resource constraints, environmental impacts, and financial system overload—and explains why they are not individual challenges but one integrated system- ic problem. By time you finish this book, you will have come to two conclusions. First, we are not facing a re- cession—this is the end of economic growth. Second, this is not our children’s problem—it is ours. It’s time to get ready, and reading this book is the place to start. — PAUL GILDING, author, The Great Disruption, Former head of Greenpeace International Richard has rung the bell on the limits to growth. This is real. The consequences for economics, finance, and our way of life in the decades ahead will be greater than the consequences of the industrial revolution were for our recent ancestors. Our coming shift from quantity of con- sumption to quality of life is the great challenge of our generation—frightening at times, but ultimately freeing. — JOHN FULLERTON, President and Founder, Capital Institute Why have mainstream economists ignored environ- mental limits for so long? If Heinberg is right, they will 3/567 have a lot of explaining to do. The end of conventional economic growth would be a shattering turn of events—but the book makes a persuasive case that this is indeed what we are seeing. — LESTER BROWN, Founder, Earth Policy Institute and author, World on the Edge Heinberg shows how peak oil, peak water, peak food, etc. lead not only to the end of growth, and also to the beginning of a new era of progress without growth. -

Solar-Powered

Solar Skyways Network Energy: The Key to Entitlements for Podcar Networks Ron Swenson November 6, 2015 International Institute of Sustainable Transportation www.inist.org We are organizing a network of universities to create sane transit networks around the world We are organizing a network of universities to create sane transit networks around the world • Solar-powered … We are organizing a network of universities to create sane transit networks around the world • Solar-powered … • Automated … We are organizing a network of universities to create sane transit networks around the world • Solar-powered … • Automated … • Nonstop … We are organizing a network of universities to create sane transit networks around the world • Solar-powered … • Automated … • Nonstop … • Elevated … We are organizing a network of universities to create sane transit networks around the world • Solar-powered … • Automated … • Nonstop … • Elevated … for transportation beyond oil SANE Transportation Networks are unique & robust SANE Transportation Networks are unique & robust • Small, driverless vehicles SANE Transportation Networks are unique & robust • Small, driverless vehicles • Exclusive, grade- separated guideway SANE Transportation Networks are unique & robust • Small, driverless vehicles • Exclusive, grade- separated guideway • Off-line stations: non-stop from origin to destination SANE Transportation Networks are unique & robust • Small, driverless vehicles • Exclusive, grade- separated guideway • Off-line stations: non-stop from origin to destination • -

Peak Everything Runningrunning Outout Ofof Commoditiescommodities Inin Aa Crowdedcrowded Worldworld

Pollution Ocean Stocks Food Decline Peak Everything RunningRunning OutOut ofof CommoditiesCommodities inin aa CrowdedCrowded WorldWorld Desertification Climate Change GaryGary McMurtryMcMurtry Social Unrest Peak Oil Extinctions History of Earth’s Human Population Graph Credit: Dr. William Stanton From: Nate Hagens; http://www.theoildrum.com/node/4450 Peak Oil, Carrying Capacity & Overshoot: From: http://canada.theoildrum.com/node/2516 (Paul Chefurka) Peak Oil, Carrying Capacity & Overshoot: From: http://canada.theoildrum.com/node/2516 (Paul Chefurka) Peak Oil, Carrying Capacity & Overshoot: You Are Here From: http://canada.theoildrum.com/node/2516 (Paul Chefurka) USA Oil Production History & Projection The US lower-48 production peak (Texas + Rest of USA) occurred in 1970; In 1956, M. King Hubbert predicted this outcome to within a few years. Where the USA Currently Gets Its Imported Oil (>60%) Cantarell Giant Oil Field, Mexico -20% ! Export Land Model Jeffery Brown and Sam Foucher - www.theoildrum.com Hubbert’s Predictions Exxon Mobile data M. King Hubbert 1903-1989 From: K. S. Deffeyes, Hubbert’s Peak (2001) Hubbert’s Global Production Predictions, 1970 Predictive Global Models from “WebHubbleTelescope”, TheOilDrum.com Production “Rug Pushing” 40 years Extended Plateau Cliff! Source: http://www.theoildrum.com/node/2376 and links therein. World Liquids Production, 1980-2008 From: EIA data; http://www.theoildrum.com/node/3720 Crude Oil Production by Country 2001-2008 Bottom-Up (Mega-Projects) Prediction Possible future supply capacity scenario for crude oil and NGL based on the Wikipedia Oil Megaproject database. The resource base post-2002 decline rate is a linearly increasing rate from 0% to 4.5% between 2003 and 2008 then constant at 4.5% afterward. -

Peak Oil and Growth

Die approbierte Originalversion dieser Diplom-/Masterarbeit ist an der Hauptbibliothek der Technischen Universität Wien aufgestellt (http://www.ub.tuwien.ac.at). The approved original version of this diploma or master thesis is available at the main library of the Vienna UniversityMSc of Technolo Programgy (http://www.ub.tuwien.ac.at/englweb/). Renewable Energy in Central & Eastern Europe Peak Oil and Growth. The challenges and opportunities posed by the finite character of the fossil fuels to the world economic order. Master’s Thesis submitted for the degree of “Master of Science” supervised by Ao. Univ. Prof. Dipl.-Ing. Dr. techn. Reinhard Haas Daniel Olev Student ID: 0929414 14.10.2012, Vienna Affidavit I, Daniel Olev , hereby declare 1. that I am the sole author of the present Master Thesis, "Peak Oil and Growth. The challenges and opportunities posed by the finite character of the fossil fuels to the world economic order.", 85 pages, bound, and that I have not used any source or tool other than those referenced or any other illicit aid or tool, and 2. that I have not prior to this date submitted this Master Thesis as an examination paper in any form in Austria or abroad. Vienna, _______________ ___________________________ Date Signature -- ii-- Master Thesis MSc Program Renewable Energy in Central & Eastern Europe Abstract Did you know that, if all oil, consumed in 2011, to put on one train, its tail will encompass the earth equator almost 17 times, making it 85 meters wide steel belt of 120 tone cistern cars. Author. (BP, 2012) In this work I have tried to demonstrate the fundamental difficulties our society faces as we are confronted by the imperative to transition our economy to low carbon future. -

Microsoft Outlook

Bruce Baker From: [email protected] Sent: Sunday, 25 May 2008 10:44 AM To: [email protected] Subject: mauldin - What the Export Land Model Means for Energy Prices What the Export Land Model Means for Energy Prices Posted May 19 2008, 05:10 PM by John Mauldin Goldman Sachs recently forecasted that oil would be at $141 a barrel by the end of the year, and rising to $200 a barrel in the not too distant future. I have seen other forecasts calling for oil to slip significantly under $100 a barrel before starting yet another bull market. I have written for years that we are not going to run out of oil or energy, just cheap oil. I was just in South Africa, where much of their gas and diesel comes from coal gasification. At one time this was an expensive way to make gas, and South Africans had to pay more for their gas than the rest of the world. Now, it is getting close to "par" to the cost of gas in the US, and is cheaper than gas in Europe. In this week's Outside the Box, my friend David Galland at Casey Research presents some very troubling thoughts on why oil may rise higher than we think in the next few years. Many of the countries from which the US gets its oil are seeing production fall, not rise. Some of it is political ineptitude, but much of it is from oil production peaking. Yes, we can move to coal gasification, and the US has centuries of coal for such purposes, but building such plants takes time and capital and political will, the latter of which is in short supply. -

The Pros & Cons of Peak

Yardeni Research, Inc. In this Topical Study, I reprint my analysis of the Peak Oil Theory from our Morning Briefings since the start of this year. January 10, 2008 Are high oil prices causing high oil prices? This may explain the super-spike in the price of crude oil from $25 a barrel in April 2003 to $100 a barrel late last week. Instead of stimulating more supply and less demand, high oil prices seem to be depressing supply and boosting demand. On the supply side, Baker Hughes keeps a monthly tally of how many rigs are active around the world. The rig count peaked at 6,231 in December 1981. In December 2007 it was just 3,125. Time (5/31/07) reported that in January 1981, as gasoline prices set all-time highs in the wake of the Iran-Iraq war, Exxon announced that it would pour $11 billion into capital investment and exploration over the course of the year. That was a 35% increase over 1980 and a tripling of the budget from 1973, the year when the Arab oil embargo first sent prices skyrocketing. The $11 billion was almost three times the company’s profit in 1979. “Today, though, prices at the pump in the US, adjusted for inflation, are approaching those record 1981 levels for the first time. The company now called ExxonMobil turned a profit of $39.5 billion last year (on sales of $365.4 billion), more than any other corporation ever. Yet it isn't making nearly the investment in finding new oil that it did in 1981. -

Toil for Oil Spells Danger for Majors Unsustainable Dynamics Mean Oil Majors Need to Become “Energy Majors”

15 September 2014 Energy transition & climate change Toil for oil spells danger for majors Unsustainable dynamics mean oil majors need to become “energy majors” Oil and stranded assets: gauging the risk from higher long-term prices Until now, concern over new high-cost oil projects potentially becoming stranded in future has focused on the downside risk to oil prices, a concern that will only increase if oil prices – already down by nearly USD20/bbl since June on demand worries – fall further near term. However, there is another dimension to stranded-asset risk, largely ignored in this debate so far, namely the risk posed by a scenario of sustained higher oil prices over the longer term. And when looking at the risk of stranded assets it is the long term – i.e. beyond 2025 – that counts. Dynamics of oil majors’ upstream capex increasingly unsustainable Despite oil prices averaging close to USD110/bbl since mid-2011, the majors have seen their capital productivity decline sharply in recent years, prompting them to announce cuts to future capex in Q1 of this year. This is a clear sign they need higher prices for their higher-cost new projects. For this and many other reasons, we think that whatever happens in the near term, sustained higher prices will ultimately be necessary to bring on the supply projected in the IEA’s base-case scenario out to 2035. But with our Energy Return on Capital Invested (EROCI) analysis suggesting that renewables are already surprisingly competitive with marginal new oil projects, and with renewables set to see further cost reductions over the next two decades, higher long-term oil prices will be no guarantee against asset-stranding beyond 2025 for marginal new projects. -

The ASPO-USA Conference - First Afternoon

The Oil Drum | The ASPO-USA Conference - First Afternoon http://www.theoildrum.com/node/7024 The ASPO-USA Conference - First Afternoon Posted by Heading Out on October 8, 2010 - 10:48am Topic: Miscellaneous Tags: aspo-usa, aspo-usa conference [list all tags] One of the speakers commented, just at the beginning of the ASPO 2010 Peak Oil Conference, that we would be subject to enough information that it would seem that we were standing under a fire hose. Well the Conference has had its first day, or at least afternoon, our first fire alarm (we got to the top of the stairs before being told it had been dealt with) and our first reception is over, as is the evening keynote session. He was right. I occasionally think that attending Conferences should be a biennial practice, since change in the papers is so slow – but so far that hasn’t been the case this year where the new information available is already evident, though some of the old lions are still roaring on the same topics. There were three concurrent sessions this afternoon, and so I can only report on one set – starting with the session on the Export Land Model (which just gets more worrisome); then the Oil Drum session (where I was a speaker) and then the session on Energy Alternatives (which mainly talked about EROI). This report is being written incrementally, and has been updated once, but I will add the evenings two sessions in a second post, given the length that this one has already. Jeff Brown began the session on the outlook for exports. -

Michael Ruppert - Wikipedia, the Free Encyclopedia Personal Tools Create Account Log In

Michael Ruppert - Wikipedia, the free encyclopedia Personal tools Create account Log in Michael RuppertNamespaces Views Article Read From Wikipedia, the free encyclopedia Main page Talk Edit ContentsNot to be confusedVariants with Michael Rupert. View history MichaelFeatured contentC. Ruppert (February 3, 1951 – April 13, 2014) was Actions Current events Michael C. Ruppert an American author,[1][2] a former Los Angeles Police Random article Search [3] [4] DepartmentDonate to Wikipedia officer, investigative journalist, political Search activistWikimedia[1] Shopand peak oil awareness advocate.[3][5][6][7][8] UntilInteraction 2006, he published and edited From The Wilderness, a Help newsletter and website covering a range of topics including About Wikipedia internationalCommunity portal politics, the C.I.A., peak oil, civil liberties, drugs, economicsRecent changes, corruption and the nature of the 9/11 conspiracy.Contact page[9][page needed] He served as president of Collapse Network,Tools Inc[10] until he resigned in May 2012, when he gave 35 Whatpercent links ofhere his 55 percent share back to the company's Related changes [11][12] [13] Born February 3, 1951 founders.Upload file He hosted The Lifeboat Hour on [14] Washington, D.C. ProgressiveSpecial pages Radio Network until 2014. He has been Died April 13, 2014 (aged 63) describedPermanent as link a conspiracy theorist by numerous mainstream Page information Calistoga, California media outlets. Data item Occupation Author, activist, radio talk show RuppertCite this was page the author -

Petroleum - Wikipedia Page 1 of 30

Petroleum - Wikipedia Page 1 of 30 Petroleum From Wikipedia, the free encyclopedia Petroleum (from Latin: petra: "rock" + oleum: "oil".[1][2][3]) is a naturally occurring, yellow-to- black liquid found in geological formations beneath the Earth's surface, which is commonly refined into various types of fuels. Components of petroleum are separated using a technique called fractional distillation. It consists of hydrocarbons of various molecular weights and other organic compounds.[4] The name petroleum covers both naturally occurring Proven world oil reserves, 2013. Unconventional reservoirs such as unprocessed crude oil and petroleum products natural heavy oil and oil sands are included. that are made up of refined crude oil. A fossil fuel, petroleum is formed when large quantities of dead organisms, usually zooplankton and algae, are buried underneath sedimentary rock and subjected to both intense heat and pressure. Petroleum has mostly been recovered by oil drilling (natural petroleum springs are rare). Drilling is carried out after studies of structural geology (at the reservoir scale), sedimentary basin analysis, and reservoir characterization (mainly in terms of the porosity and permeability of geologic reservoir structures) have been completed.[5][6] It is refined and separated, most easily by distillation, into a large number of consumer products, from gasoline (petrol) and kerosene to asphalt and chemical Pumpjack pumping an oil well near Lubbock, Texas reagents used to make plastics and pharmaceuticals.[7] Petroleum is used in manufacturing a wide variety of materials,[8] and it is estimated that the world consumes about 95 million barrels each day. Concern over the depletion of the earth's finite reserves of oil, and the effect this would have on a society dependent on it, is a concept known as peak oil.