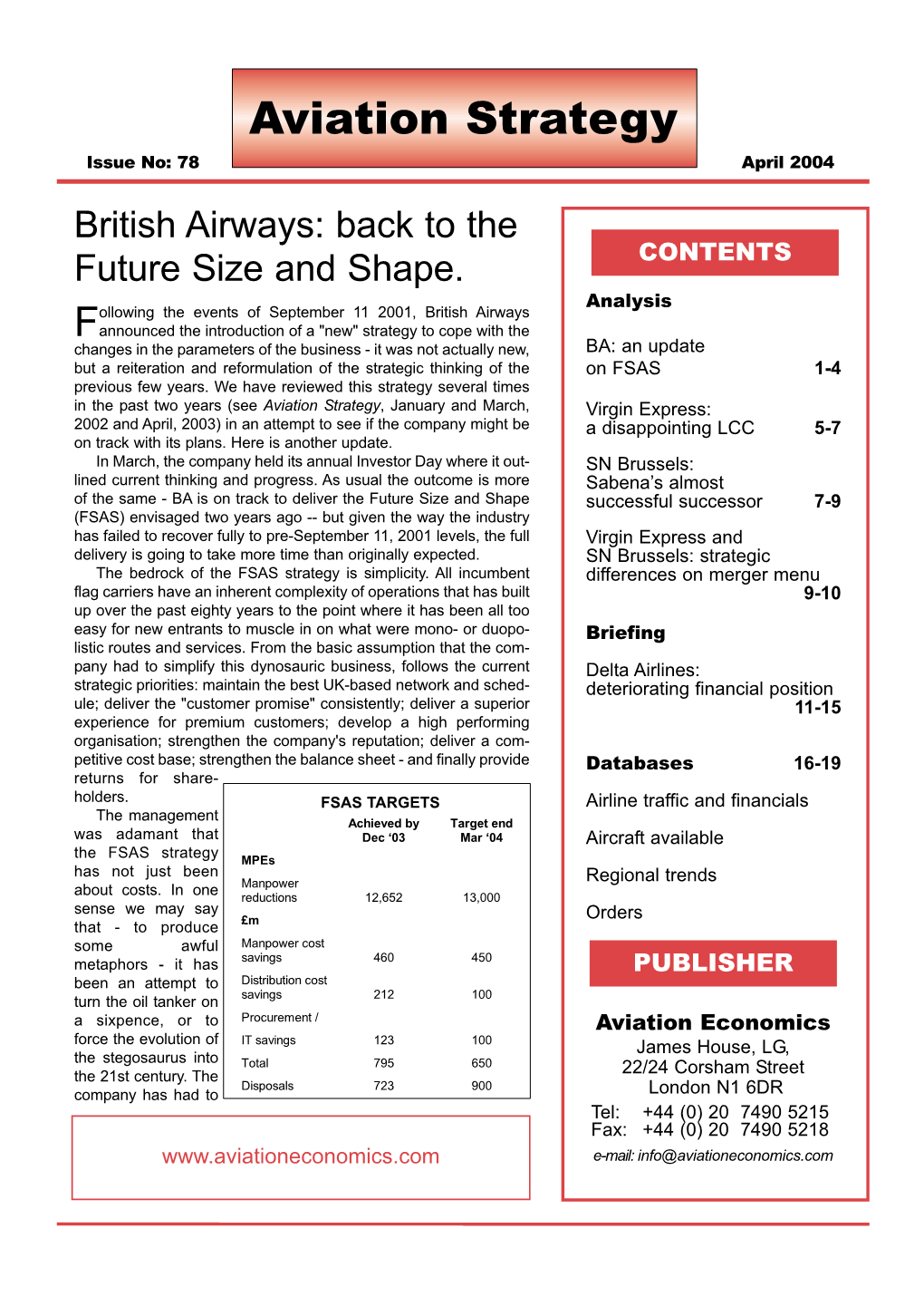

April 2004 British Airways: Back to the Future Size and Shape

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

EVAIR Safety Bulletin No 4

Cooperative Network Design EVAIR Safety Bulletin No 4 Summer Seasons 2006-2009 Evolution EUROCONTROL EVAIR_bulletin04.indd 1 15/02/10 14:15 EUROCONTROL VOLUNTARY ATM INCIDENT Data providers REPORTING (EVAIR) The number of EVAIR ATM incident data providers among commer- cial airlines has been increasing year on year. By the end of 2009, 63 SUMMER SEASONS 2006-2009 EVOLUTION airlines were providing ATM incident reports to EVAIR. The airlines which contribute to EVAIR account for 50% of the overall European EXECUTIVE SUMMARY air traffic. The statistics in the EVAIR Safety Bulletin No 4 cover the summer Main trends periods (April - September) 2006 to 2009. The statistics are based Eight main ATM contributors are used as the basis for monitoring: on the ATM/CNS incident reports collected manually and ACAS RAs collected automatically from one Mode-S radar station. The 1. Mistakes; main data providers are commercial airlines and ANSPs providing 2. Spoken Communication; feedback to airlines’ incident reports and the ACAS RAs from the 3. Operational Communication; Mode-S radar station. 4. Traffic and Airspace problems; 5. Traffic Information; Data collection 6. Lapses; Through the manual data provision (commercial airlines and feed- 7. ATC Clearance; back from ANSPs) EVAIR collected approximately 1500 reports for 8. Coordination. the summer seasons from 2006 to 2009. For the same period, 2637 valid ACAS RAs were collected automatically from the Mode S radar During the summer periods 2006-2009 in absolute figures, Mistakes station. with 27%, Spoken communication with 19%, Operational Communi- cation and Traffic information with 11% each make almost 70% of the The number of reports EVAIR collects has grown each year. -

Commission Hearing on the Preparation for RP3 Commission Hearing on the Preparation for RP3 Agenda

Commission hearing on the preparation for RP3 Commission hearing on the preparation for RP3 agenda TIMINGS DESCRIPTION 09:30 Welcome from the Commission Maurizio Castelletti, Head of Unit, Single European Sky 09:40 Keynote address Henrik Hololei, Director General of DG Move 09:50 PRB White Paper – objective and options for RP3 Peter Griffiths, Chairman of the PRB 10:00 Performance policy panel session (Panel 1) See panel members below 12:30 Lunch 14:00 Measuring performance panel session (Panel 2) See panel members below 16:30 Conclusions and meeting close 2 Commission hearing on the preparation for RP3 panel members PANEL SESSION 1 WOLFGANG SCHEEL - AIRSPACE USERS Wolfgang is the Senior Manager Worldwide Air Naviagation Charges at Deutsche Lufthansa AG. Joined Lufthansa Group in 1984. Since 1988 he has been responsible for Airport and ANS Charges with changing priorities between Airports and ATC. During the last 10 years, he has focussed on Air Navigations Charges, especially in Europe with responsibilities covering ATC-charges polices, company strategy on charges, defining targets, long and short term cost planning, and leading invoice reconciliation team. Wolfgang is a long-term member of the IATA User Charges Panel, serving as Chairman, re- spectively Vice-Chairman for many years and is a regular advisor to the MoT Germany in ICAO Charges meetings. alessandro ghilari - canso Alessandro Ghilari started his career in the Italian Air Force in 1991, became an ATCO (TWR and APP) in 1997 and joined ENAV in 2002. He worked as operational ATCO at the Milan Area Control Centre till 2008. From 2008 he works at the ENAV International Strategies, being in charge of the Internation- al Policy and Regulations Unit. -

TED STEVENS ANCHORAGE INTERNATIONAL AIRPORT Anchorage, Alaska

TED STEVENS ANCHORAGE INTERNATIONAL AIRPORT Anchorage, Alaska PFC Quarterly Report - Receipts Collected For the Quarter Ended March 31,2009 (Application No. 1 ) Application #99-01-C-00-ANC & 99-01-C-01-ANC $22,000,000.00 0.00 Total Collection Authority $22,000,000.00 PFC Revenue Received Air Carriers Current Quarter Previous Quarters Cumulative Aces Airlines 32.12 32.12 Aer Lingus 317.44 317.44 Aerovias De Mexico 122.58 122.58 Aero Mexico 98.53 98.53 Air Canada 136,476.21 136,476.21 Air France 1,764.99 1,764.99 Air New Zealand 2,094.33 2,094.33 Air Pacific 8.67 8.67 Airlines Services Corporation 37.96 37.96 Air Wisconsin Airlines 46.54 46.54 Alaska Airlines 11,024,874.06 11,024,874.06 Alitalia Airlines 1,051.51 1,051.51 All Nippon Airways Co 1,905.64 1,905.64 Aloha Airlines 7,152.82 7,152.82 America Central Corp 23.36 23.36 America West Airlines 228,474.04 228,474.04 American Airlines 509,508.22 509,508.22 American Trans Air 6,513.14 6,513.14 Asiana Airlines 2,125.95 2,125.95 Atlantic Coast Airline 96.36 96.36 Avianca 8.76 8.76 Big Sky Airlines 87.36 87.36 British Airways 12,272.36 12,272.36 Canada 3000 10,999.72 10,999.72 Cathay Pacific Airways 271.27 271.27 China Airlines 78,473.09 78,473.09 Condor Flugdienst, GMBH 63,889.95 63,889.95 Continental Airlines 1,380,859.31 1,380,859.31 Czech Airlines 348.36 348.36 Delta Airlines 1,673,182.33 1,673,182.33 Elal Israel Airlines 110.74 110.74 Emirates 14.57 14.57 Era Aviation, Inc. -

Airlines Codes

Airlines codes Sorted by Airlines Sorted by Code Airline Code Airline Code Aces VX Deutsche Bahn AG 2A Action Airlines XQ Aerocondor Trans Aereos 2B Acvilla Air WZ Denim Air 2D ADA Air ZY Ireland Airways 2E Adria Airways JP Frontier Flying Service 2F Aea International Pte 7X Debonair Airways 2G AER Lingus Limited EI European Airlines 2H Aero Asia International E4 Air Burkina 2J Aero California JR Kitty Hawk Airlines Inc 2K Aero Continente N6 Karlog Air 2L Aero Costa Rica Acori ML Moldavian Airlines 2M Aero Lineas Sosa P4 Haiti Aviation 2N Aero Lloyd Flugreisen YP Air Philippines Corp 2P Aero Service 5R Millenium Air Corp 2Q Aero Services Executive W4 Island Express 2S Aero Zambia Z9 Canada Three Thousand 2T Aerocaribe QA Western Pacific Air 2U Aerocondor Trans Aereos 2B Amtrak 2V Aeroejecutivo SA de CV SX Pacific Midland Airlines 2W Aeroflot Russian SU Helenair Corporation Ltd 2Y Aeroleasing SA FP Changan Airlines 2Z Aeroline Gmbh 7E Mafira Air 3A Aerolineas Argentinas AR Avior 3B Aerolineas Dominicanas YU Corporate Express Airline 3C Aerolineas Internacional N2 Palair Macedonian Air 3D Aerolineas Paraguayas A8 Northwestern Air Lease 3E Aerolineas Santo Domingo EX Air Inuit Ltd 3H Aeromar Airlines VW Air Alliance 3J Aeromexico AM Tatonduk Flying Service 3K Aeromexpress QO Gulfstream International 3M Aeronautica de Cancun RE Air Urga 3N Aeroperlas WL Georgian Airlines 3P Aeroperu PL China Yunnan Airlines 3Q Aeropostal Alas VH Avia Air Nv 3R Aerorepublica P5 Shuswap Air 3S Aerosanta Airlines UJ Turan Air Airline Company 3T Aeroservicios -

Abelag Aviation Aigle Azur Transports Aeriens Air

COMITÉ DE COORDINATION DES AÉROPORTS FRANÇAIS FRENCH AIRPORTS COORDINATION COMMITTEE Membres au 1er septembre 2016 Members on September 1st 2016 Transporteurs aériens - Air carriers : AAF ABELAG AVIATION AAL AIGLE AZUR TRANSPORTS AERIENS AAR AIR ATLANTIQUE ABW AMERICAN AIRLINES ACA AMSTERDAM AIRLINES ADR ASIANA AIRLINES AEA AFRIQIYAH AIRWAYS AEE AIR ATLANTA ICELANDIC AFL AIR CONTRACTORS LTD AFR AIRBRIDGE CARGO AHY ABX AIR AIC AIR ARABIA AIZ AIR CANADA ALK AIR ORIENT AMC ITALI AIRLINES AMX ANTONOV AIRLINES ANA AIR ONE ANE ALYZIA ASSISTANCE ADP ASL ADRIA AIRWAYS AUA AIR EUROPA AUI AEGEAN AIRLINES AZA AIR ITALY POLSKA BAW STEVE TEST TO KEEP BCS ASTRAEUS BEE AEROSVIT AIRLINES BEL AIR ITALY BER AIR FRANCE HANDLING BIE AEROFLOT RUSSIAN AIRLINES BMR AIR FRANCE BMS AZERBAIJAN AIRLINES BOS AVIES BRU AIRBUS INDUSTRIE BTI AIR INDIA CAI AIR GABON INTERNATIONAL CAJ ARKIA ISRAELI AIRLINES CCA YAK SERVICE AIRLINES CCM SRILANKAN AIRLINES CES HEWA BORA CFE ALYSAIR aviation generale CHH AIR MALTA CLG AMERICAN TRANSAIR CPA AMC AVIATION CRC AEROMEXICO CRL ALL NIPPON AIRWAYS CSA AIR NOSTRUM CSN AIR NIGERIA CTN YANAIR CUB AIR NEW ZEALAND DAH AEOLIAN AIRLINES DAL CODE ASSISTANT AVIAPARTNER DJT ARIK INTERNATIONAL DLH ATA AEROCONDOR DTH AEROLINEAS ARGENTINAS EIN AIR ARMENIA ELL SMARTLYNX ITALIA ELY ARAVCO LTD ETD AirSERBIA ETH AVANTI AIR EVA AUSTRIAN AIRLINES EWG AUGSBURG AIRWAYS EZE UKRAINE INTL AIRLINES EZS AURIGNY AIR SERVICES EZY TITAN AIRWAYS FDX US AIRWAYS FHY AIR INDIA EXPRESS FIN AIR EXPLORE FPO ATLANT-SOYUZ FWI ALITALIA GFA ARCUS AIR GMI ASTRA AIRLINES -

Economic Importance of Air Transport and Airport Activities in Belgium – Report 2009

Economic Importance of Air Transport and Airport Activities in Belgium – Report 2009 Working Paper Document by Xavier Deville and Saskia Vennix December 2011 No 218 Editorial Director Jan Smets, Member of the Board of Directors of the National Bank of Belgium Statement of purpose: The purpose of these working papers is to promote the circulation of research results (Research Series) and analytical studies (Documents Series) made within the National Bank of Belgium or presented by external economists in seminars, conferences and conventions organised by the Bank. The aim is therefore to provide a platform for discussion. The opinions expressed are strictly those of the authors and do not necessarily reflect the views of the National Bank of Belgium. Orders For orders and information on subscriptions and reductions: National Bank of Belgium, Documentation - Publications service, boulevard de Berlaimont 14, 1000 Brussels Tel +32 2 221 20 33 - Fax +32 2 21 30 42 The Working Papers are available on the website of the Bank: http://www.nbb.be © National Bank of Belgium, Brussels All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged. ISSN: 1375-680X (print) ISSN: 1784-2476 (online) NBB WORKING PAPER No. 218 - DECEMBER 2011 ABSTRACT This study assesses the economic importance of air transport and airport activities in Belgium in terms of employment, value added and investment over the period 2007 - 20091. The sector considered embraces not only the activities directly connected with air transport, but also all the activities which take place on site at the six Belgian airports (Antwerp, Brussels, Charleroi, Kortrijk, Liège, Ostend). -

Hubert Horan 3:00 - 5:00 Pm

Transportation Center Icarus Society presents…… “Economics of Airline Industry Consolidation” Speaker: Thurs. May 17, 2012 Hubert Horan 3:00 - 5:00 pm Aviation Expert and Independent Location: The Transportation Center Chambers Hall _ Lower Level Airline Consultant 600 Foster, Evanston Hubert Horan will provide insights into the future of the airline industry with special focus on alliances, metal neutrality and airlines mergers – now and in the future – drawing on his extensive expertise and experience in the aviation industry. Bio: Hubert Horan’s 25 year aviation career has been evenly split between consulting and airline management positions. He has been directly involved with multiple waves of airline mergers, alliances and industry restructuring, and since 2002 has been an independent consultant based in Phoenix. He has been directly involved with most of the major changes in international aviation since deregulation. In the 1980s he developed the original plan for the TWA-Ozark merger and also participated in the USAir– Piedmont and Continental-People Express mergers. He worked on a series of projects with Lufthansa and Alitalia to help them prepare for liberalization within Europe, and prepared the original plan for a Qantas- Australian-Air New Zealand merger. While at Northwest he led a massive international route network restructuring that drove the airline’s late 90s financial turnaround. He was responsible for the original development of the KLM-Northwest alliance network that served as the template for all subsequent immunized alliances. He spent four years in Zurich grappling with Swissair-Sabena, Europe’s first cross-border merger, and Swissair’s alliances with Delta and American. -

Annual Statistical Summary

2014 Annual Statistical Summary 2014 2013 Passenger Movements (Scheduled & non-Scheduled) 4,290,304 4,031,500 Quick Reference Aircraft Movements (Scheduled & non-Scheduled) 32,247 30,752 Cargo & Mail (Scheduled, non-Scheduled & General Aviation), in kilos 15,546,540 16,038,449 report 1 Monthly Summary of Pax, Movement, Cargo 2 International Monthly Totals for the last five years 3 Peaks 4 By the Hour 5 Monthly Totals by Main Countries / Regions 6 Monthly Totals by Country Passenger Movements 7 Monthly Totals by Airport of Destination / Origin 8 Airlines operating to/from Malta 9 Monthly Totals by Main Countries / Regions 10 Monthly Totals by Country Aircraft Movements 11 Monthly Totals by Airport of Destination / Origin 12 Airlines operating to/from Malta 13 Monthly Totals by Main Countries / Regions Cargo Movements 14 Monthly Totals by Airport of Destination / Origin 15 Airlines operating to/from Malta report 1 Monthly Summary of Pax, Movement, Cargo Passenger Movements Scheduled & Non-Scheduled Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 2014 Total 2013 Arrivals 98,786 99,898 133,999 195,325 204,260 215,227 263,103 265,333 230,289 205,139 120,718 112,116 2,144,193 2,016,196 Departures 100,568 93,432 129,534 181,610 197,991 209,102 248,308 286,117 232,926 216,584 135,543 114,396 2,146,111 2,015,304 Total [Scheduled & Non- Scheduled] 199,354 193,330 263,533 376,935 402,251 424,329 511,411 551,450 463,215 421,723 256,261 226,512 4,290,304 4,031,500 Transit [counted only on 22,314 departure] 3,319 3,147 3,757 3,084 3,101 2,875 -

1.4. Coding and Decoding of Airlines 1.4.1. Coding Of

1.4. CODING AND DECODING OF AIRLINES 1.4.1. CODING OF AIRLINES In addition to the airlines' full names in alphabetical order the list below also contains: - Column 1: the airlines' prefix numbers (Cargo) - Column 2: the airlines' 2 character designators - Column 3: the airlines' 3 letter designators A Explanation of symbols: + IATA Member & IATA Associate Member * controlled duplication # Party to the IATA Standard Interline Traffic Agreement (see section 8.1.1.) © Cargo carrier only Full name of carrier 1 2 3 40-Mile Air, Ltd. Q5 MLA AAA - Air Alps Aviation A6 LPV AB Varmlandsflyg T9 ABX Air, Inc. © 832 GB Ada Air + 121 ZY ADE Adria Airways + # 165 JP ADR Aegean Airlines S.A. + # 390 A3 AEE Aer Arann Express (Comharbairt Gaillimh Teo) 809 RE REA Aeris SH AIS Aer Lingus Limited + # 053 EI EIN Aero Airlines A.S. 350 EE Aero Asia International Ltd. + # 532 E4 Aero Benin S.A. EM Aero California + 078 JR SER Aero-Charter 187 DW UCR Aero Continente 929 N6 ACQ Aero Continente Dominicana 9D Aero Express Del Ecuador - Trans AM © 144 7T Aero Honduras S.A. d/b/a/ Sol Air 4S Aero Lineas Sosa P4 Aero Lloyd Flugreisen GmbH & Co. YP AEF Aero Republica S.A. 845 P5 RPB Aero Zambia + # 509 Z9 Aero-Condor S.A. Q6 Aero Contractors Company of Nigeria Ltd. AJ NIG Aero-Service BF Aerocaribe 723 QA CBE Aerocaribbean S.A. 164 7L CRN Aerocontinente Chile S.A. C7 Aeroejecutivo S.A. de C.V. 456 SX AJO Aeroflot Russian Airlines + # 555 SU AFL Aeroflot-Don 733 D9 DNV Aerofreight Airlines JSC RS Aeroline GmbH 7E AWU Aerolineas Argentinas + # 044 AR ARG Aerolineas Centrales de Colombia (ACES) + 137 VX AES Aerolineas de Baleares AeBal 059 DF ABH Aerolineas Dominicanas S.A. -

Fsd Mar93.Pdf

During Adverse Conditions, Decelerating to Stop Demands More from Crew and Aircraft Hydroplaning, gusting cross winds and mechanical failures are only a few of the factors that contribute to runway overrun accidents and incidents after landing or rejecting a takeoff. Improvements in tire design, runway construction and aircraft systems reduce risks, but crew training remains the most important tool to stop safely. by Jack L. King Aviation Consultant Decelerating an aircraft to a stop on a runway traction during wet-weather operations and can become significantly more critical in ad- the use of anti-skid braking devices, coupled verse conditions, such as heavy rain in mar- with high-pressure tires, has reduced greatly ginal visibility with gusting cross winds. Add the risk of hydroplaning. Still, accident and the surprise of a malfunction, which requires incident statistics confirm that several major a high-speed rejected takeoff (RTO) or a con- runway overrun accidents each year are caused trolled stop after a touchdown on a slightly by unsuccessful braking involving either a high- flooded runway, and a flight crew is challenged speed landing or an RTO on a wet runway to prevent an off-runway excursion. surface; the factors involved in decelerating to a controlled stop are very similar in these Research findings and technological advances two situations. in recent years have helped alleviate, but not eliminate, the hazards associated with takeoff Overrun Accidents and landing in adverse weather. The U.S. Na- tional Aeronautics and Space Administration Continue to Occur (NASA) and the U.S. Federal Aviation Admin- istration (FAA) conducted specialized tests on A recent Boeing Company study reported that tire spin-up speeds after touchdown rather than during 30 years of jet transport service there spin-down speeds in rollout that confirm that have been 48 runway overrun accidents with hydroplaning occurs at substantially lower more than 400 fatalities resulting from RTOs speeds than noted previously. -

Improving Air Cargo Through Data Intelligence Supply Chain Conference - Big Data in Logistics

Click to edit title. IMPROVING AIR CARGO THROUGH DATA INTELLIGENCE SUPPLY CHAIN CONFERENCE - BIG DATA IN LOGISTICS Alban FRANCOIS – Vice President Cargo Brussels – 22 Nov 16 ClickBrussels to Airlines edit in atitle. nutshell Key numbers Key dates 49 95 Destinations • Creation of SN Brussels Airlines following 2002 Sabena bankruptcy Aircraft 3.500 19 2005-2006 • Merger Virgin Express – SN Brussels Direct jobs >40.000 Africa hub Airlines to become Brussels Airlines Tonnage 7,5 • Entry of Lufthansa in capital (45%) >10.000 €1,27 bn Mio 2009 • Entry into Star Alliance Indirect jobs Passengers Turnover Shareholding structure 2012 • Heavy restructuring (Plan Beyond 12/13) • Continuous transformation of the 2013-2016 company to build a new “no comprise” business model Click2014 – 2016:to editBuilding title. a new Brussels Airlines New set of products adapted Focus on loyalty Focus on our guests to guest needs Development of partnerships Investments in service & tools All translated in modern building on the Belgian touch brand Click to edit title.ON THE ROAD TO OUR 2018 AMBITION… 2013 2014 2015 2018 Revenue €1.1 bn €1.2 bn €1.27 bn €1.5 bn Guests 5.9 Mio 6.7 Mio > 7 Mio 10 Mio … SOF 67.4% 71.9% 75.4% 80% Profit - €22Mio - €4 Mio €41.3 Mio >€50Mio Click to edit title. BRUSSELS AIRLINES CARGO MISSION STATEMENT WE GO THE EXTRA SMILE. We want to be the preferred air cargo provider across our network, known for its reliable service & flexibility. Going beyond filling our bellies, we focus on delivering the right solution to our customers. -

Air Transport Industry

ANALYSIS OF THE EU AIR TRANSPORT INDUSTRY Final Report 2004 Contract no: TREN/05/MD/S07.52077 By Cranfield University CONTENTS GLOSSARY...........................................................................................................................................................6 1. AIR TRANSPORT INDUSTRY OVERVIEW ..................................................................................12 2. REGULATORY DEVELOPMENTS .................................................................................................18 3. CAPACITY ...........................................................................................................................................24 4. AIR TRAFFIC ......................................................................................................................................36 5. AIRLINE FINANCIAL PERFORMANCE .......................................................................................54 6. AIRPORTS............................................................................................................................................86 7. AIR TRAFFIC CONTROL ...............................................................................................................104 8. THE ENVIRONMENT......................................................................................................................114 9. CONSUMER ISSUES ........................................................................................................................118 10 AIRLINE ALLIANCES.....................................................................................................................126