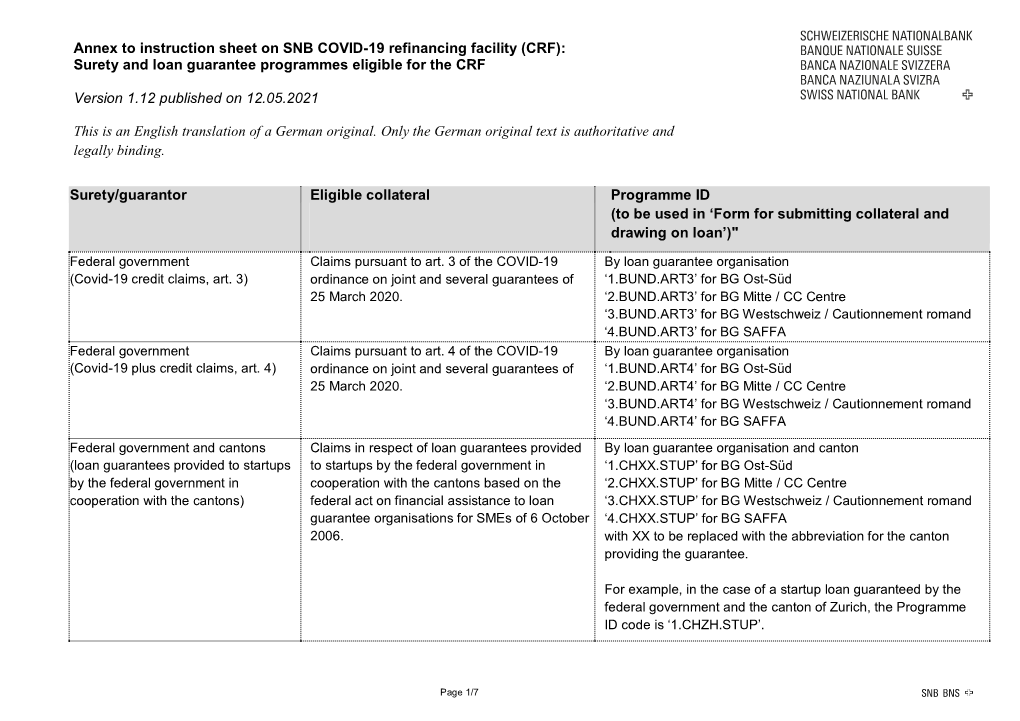

Surety and Loan Guarantee Programmes Eligible for the CRF

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Guide to the Canton of Lucerne

Languages: Albanian, Arabic, Bosnian / Serbian / Croatian, English, French, German, Italian, Polish, Portuguese, Spanish, Tamil, Tigrinya Sprache: Englisch Acknowledgements Edition: 2019 Publisher: Kanton Luzern Dienststelle Soziales und Gesellschaft Design: Rosenstar GmbH Copies printed: 1,800 Available from Guide to the Canton of Lucerne. Health – Social Services – Workplace: Dienststelle Soziales und Gesellschaft (DISG) Rösslimattstrasse 37 Postfach 3439 6002 Luzern 041 228 68 78 [email protected] www.disg.lu.ch › Publikationen Health Guide to Switzerland: www.migesplus.ch › Health information BBL, Vertrieb Bundes- publikationen 3003 Bern www.bundespublikationen. admin.ch Gesundheits- und Sozialdepartement Guide to the Canton of Lucerne Health Social Services Workplace Dienststelle Soziales und Gesellschaft disg.lu.ch Welcome to the Canton Advisory services of Lucerne An advisory service provides counsel- The «Guide to the Canton of Lucerne. ling from an expert; using such a Health – Social Services – Workplace» service is completely voluntary. These gives you information about cantonal services provide information and and regional services, health and support if you have questions that need social services, as well as information answers, problems to solve or obliga- on topics related to work and social tions to fulfil. security. For detailed information, please consult the relevant websites. If you require assistance or advice, please contact the appropriate agency directly. Some of the services described in this guide may have changed since publication. The guide does not claim to be complete. Further information about health services provided throughout Switzerland can be found in the «Health Guide to Switzerland». The «Guide to the Canton of Lucerne. Health – Social Services – Work- place» is closely linked to the «Health Guide to Switzerland» and you may find it helpful to cross-reference both guides. -

Swiss Economy Cantonal Competitiveness Indicator 2019: Update Following the Swiss Tax Reform (STAF)

Swiss economy Cantonal Competitiveness Indicator 2019: Update following the Swiss tax reform (STAF) Chief Investment Office GWM | 23 May 2019 3:12 pm BST | Translation: 23 May 2019 Katharina Hofer, Economist, [email protected]; Matthias Holzhey, Economist, [email protected]; Maciej Skoczek, CFA, CAIA, Economist, [email protected] Cantonal Competitiveness Indicator 2019 Following the adoption of the tax reform (STAF) on 19 • 1 ZG 0 = rank change versus previous year 100.0 May 2019, the canton of Zug remains the most competitive 2 BS +1 90.6 canton, as in 2018. Basel-Stadt has overtaken the canton of 3 ZH - 1 90.1 Zurich. 4 VD +3 75.2 5 AG - 1 74.3 • The cantons of Appenzell Innerrhoden and Glarus boast the 6 NW +2 72.4 most attractive cost environments. The canton of Bern has 7 SZ - 2 71.3 lost some of its tax appeal. 8 LU - 2 71.2 9 BL 0 71.1 • The tax reform burdens cantons' finances to different 10 GE +1 69.8 extents. In the near term, the cantons of Geneva and Basel- 11 TG - 1 66.7 Stadt are likely to lose revenue from profit tax. 12 SH 0 66.1 13 FR +1 62.9 14 SG - 1 62.8 Following the approval of tax reforms (STAF) in a recent referendum, 15 OW +3 58.6 cantons now need to make changes to their profits taxes. Although 16 AR +1 57.3 some cantons announced considerable cuts to profit taxes prior to 17 SO - 1 55.8 18 GL +4 55.5 the voting, others were more reluctant. -

Swiss Single Market Law and Its Enforcement

Swiss Single Market Law and its Enforcement PRESENTATION @ EU DELEGATION FOR SWITZERLAND NICOLAS DIEBOLD PROFESSOR OF ECONOMIC LAW 28 FEBRUARY 2017 overview 4 enforcement by ComCo 3 single market act . administrative federalism . principle of origin . monopolies 2 swiss federalism 1 historical background 28 February 2017 Swiss Single Market Law and its Enforcement Prof. Nicolas Diebold 2 historical background EEA «No» in December 1992 strengthening the securing market competitiveness of access the swiss economy 28 February 2017 Swiss Single Market Law and its Enforcement Prof. Nicolas Diebold 3 historical background market access competitiveness «renewal of swiss market economy» § Bilateral Agreements I+II § Act on Cartels § Autonomous Adaptation § Swiss Single Market Act § Act on TBT § Public Procurement Acts 28 February 2017 Swiss Single Market Law and its Enforcement Prof. Nicolas Diebold 4 swiss federalism 26 cantons 2’294 communities By Tschubby - Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=12421401 https://upload.wikimedia.org/wikipedia/commons/3/3e/Schweizer_Gemeinden.gif 28 February 2017 Swiss Single Market Law and its Enforcement Prof. Nicolas Diebold 5 swiss federalism – regulatory levels products insurance banking medical services energy mountaineering legal services https://pixabay.com/de/schweiz-alpen-karte-flagge-kontur-1500642/ chimney sweeping nursing notary construction security childcare funeral gastronomy handcraft taxi sanitation 28 February 2017 Swiss Single Market Law and its Enforcement Prof. Nicolas Diebold 6 swiss federalism – trade obstacles cantonal monopolies cantonal regulations procedures & fees economic use of public domain «administrative federalism» public public services procurement subsidies 28 February 2017 Swiss Single Market Law and its Enforcement Prof. -

The Swiss Parliament: a Hybrid System Based on the Idea of Changing Majorities

The Swiss Parliament: A hybrid system based on the idea of changing majorities By Andreas Ladner © Parlamentsdienste 3003 Bern The Swiss Parliament – or better the Federal Assembly – was installed in 1848 when the former confederation of 25 independent cantons became a federal nation state. The form and organization of the Parliament was one of the main points of discussion while drafting the Constitution. Those in favour of a strong nation state - the liberal and predominantly protestant cantons which won the short civil war (“Sonderbund War”) - wanted a National Assembly with a composition reflecting the prevailing population proportions of the cantons. This would have put the smaller predominantly conservative and catholic cantons at a considerable disadvantage. They wanted a revised form of the Federal Diet (the legislative and executive council of the Swiss confederacy prior to 1848) representing the cantons equally. This, however, would have prevented the Liberals who were in the majority and located in the larger cantons of the Central Lowlands from building a more centralized and unified nation state. After laborious discussions a compromise was reached in the form of a two-chamber system following the model of the United States of America: a smaller chamber representing the cantons and a bigger chamber representing the citizens. The two Chambers were given equal power. In a comparative perspective Swiss bicameralism is therefore similar to countries like the United States, Canada, Australia and Germany since the two chambers are of equal importance (symmetric) and they are elected differently (incongruent). The Council of States (The Chamber of the Cantons, the upper house) consists of 46 seats. -

Reimbursement of Excessive Premiums

Federal Department of Home Affairs FDHA Federal Office of Public Health FOPH Health and Accident Insurance Division Federal Office of Public Health, Insurance Supervision Division, August 2018 Reimbursement of excessive premiums Article 17 of the Federal Act on the Oversight of Social Health Insurance (Health Insurance Oversight Act HIOA; SR 832.12) governs the reimbursement of excessive income from insurance premiums. In- surers can apply to the FOPH for permission to reimburse income from a particular canton if this signif- icantly exceeds the accumulated annual costs in that canton. During the 2017 financial year, three insurers applied to the FOPH for permission to reimburse excessive income from premiums in the cantons listed below: Genossenschaft Glarner Krankenversicherung in the canton of Glarus (GL) Kranken- und Unfallkasse Einsiedeln in the canton of Schwyz (SZ) Vivao Sympany AG in the cantons of Aargau (AG), Bern (BE), Basel-Landschaft (BL), Basel- Stadt (BS), Fribourg (FR), Lucerne (LU) and Solothurn (SO) In its ruling of 8 August 2018, the FOPH approved Genossenschaft Glarner Krankenversicherung’s ap- plication as follows: Canton of Glarus: Reimbursement of CHF 80.03 per insured person Everyone insured by Genossenschaft Glarner Krankenversicherung in the above-mentioned canton on 31 December 2017 will be reimbursed the relevant amount before the end of 2018. In its ruling of 8 August 2018, the FOPH approved Kranken- und Unfallkasse Einsiedeln’s application as follows: Canton of Schwyz: Reimbursement of CHF 130 per insured person Everyone insured by Kranken- und Unfallkasse Einsiedeln in the above-mentioned canton on 31 De- cember 2017 will be reimbursed the relevant amount before the end of 2018. -

Local and Regional Democracy in Switzerland

33 SESSION Report CG33(2017)14final 20 October 2017 Local and regional democracy in Switzerland Monitoring Committee Rapporteurs:1 Marc COOLS, Belgium (L, ILDG) Dorin CHIRTOACA, Republic of Moldova (R, EPP/CCE) Recommendation 407 (2017) .................................................................................................................2 Explanatory memorandum .....................................................................................................................5 Summary This particularly positive report is based on the second monitoring visit to Switzerland since the country ratified the European Charter of Local Self-Government in 2005. It shows that municipal self- government is particularly deeply rooted in Switzerland. All municipalities possess a wide range of powers and responsibilities and substantial rights of self-government. The financial situation of Swiss municipalities appears generally healthy, with a relatively low debt ratio. Direct-democracy procedures are highly developed at all levels of governance. Furthermore, the rapporteurs very much welcome the Swiss parliament’s decision to authorise the ratification of the Additional Protocol to the European Charter of Local Self-Government on the right to participate in the affairs of a local authority. The report draws attention to the need for improved direct involvement of municipalities, especially the large cities, in decision-making procedures and with regard to the question of the sustainability of resources in connection with the needs of municipalities to enable them to discharge their growing responsibilities. Finally, it highlights the importance of determining, through legislation, a framework and arrangements regarding financing for the city of Bern, taking due account of its specific situation. The Congress encourages the authorities to guarantee that the administrative bodies belonging to intermunicipal structures are made up of a minimum percentage of directly elected representatives so as to safeguard their democratic nature. -

Factsheet for Work and Residence Permits

BUSINESS BUSINESS Approval procedure Applicant Canton of Lucerne, State Secretariat for (Employer & Office for Migration, Migration, Employee Lucerne Bern Compilation of dossier Submission of Receipt of dossier dossier Evaluation of Dossier Receipt / Decision evaluation of Dossier Information Decision about decision Permit All countries EU/EFTA States Non-EU/EFTA States Wirtschaftsförderung Luzern Alpenquai 30 CH-6005 Luzern Phone +41 41 367 44 00 [email protected] 02/2021 BUSINESS BUSINESS Residence and work permit EU/EFTA states Non-EU/EFTA states Residence and employment in Switzerland Residence and employment in Switzerland Pursuant to the bilateral agreements between Switzerland and the For citizens of non-EU/EFTA states only limited numbers of executives, EU, it is possible for all citizens of EU-26/EFTA states to work and live specialists and well qualified persons are admitted subject to quotas. in Switzerland. Citizens of Croatia will remain subject to admission Furthermore, the employer must prove by means of extensive search restrictions until 31 December 2023. These include maximum figures efforts that he could not find any persons prioritised for recruitment and labour market regulations (priority of domestic workers and con- (nationals and persons from EU/EFTA states). Salary and working con- trol of salary and working conditions). ditions customary in the place and industry are assumed. Residence without employment in Switzerland Residence without employment in Switzerland All citizens of EU-26/EFTA are entitled to residence permit if they can Residency in Switzerland can be granted to citizens of non-EU/EFTA prove that they have sufficient financial means to live in Switzerland states who have reached the age of 55, have particular personal ties and also to pay for the mandatory health insurance. -

On the Way to Becoming a Federal State (1815-1848)

Federal Department of Foreign Affairs FDFA General Secretariat GS-FDFA Presence Switzerland On the way to becoming a federal state (1815-1848) In 1815, after their victory over Napoleon, the European powers wanted to partially restore pre-revolutionary conditions. This occurred in Switzerland with the Federal Pact of 1815, which gave the cantons almost full autonomy. The system of ruling cantons and subjects, however, remained abolished. The liberals instituted a series of constitutional reforms to alter these conditions: in the most important cantons in 1830 and subsequently at federal level in 1848. However, the advent of the federal state was preceded by a phase of bitter disputes, coups and Switzerland’s last civil war, the Sonderbund War, in 1847. The Congress of Vienna and the Restoration (1814–1830) At the Congress of Vienna in 1814 and the Treaty of Paris in 1815, the major European powers redefined Europe, and in doing so they were guided by the idea of restoration. They assured Switzerland permanent neutrality and guaranteed that the completeness and inviolability of the extended Swiss territory would be preserved. Caricature from the year 1815: pilgrimage to the Diet in Zurich. Bern (the bear) would like to see its subjects Vaud and Aargau (the monkeys) returned. A man in a Zurich uniform is pointing the way and a Cossack is driving the bear on. © Historical Museum Bern The term “restoration”, after which the entire age was named, came from the Bernese patrician Karl Ludwig von Haller, who laid the ideological foundations for this period in his book “Restoration of the Science of the State” (1816). -

National Review of Educational R&D SWITZERLAND

National Review of Educational R&D SWITZERLAND 2 – TABLE OF CONTENTS Table of Contents OVERVIEW ...........................................................................................................................................3 Procedure ..............................................................................................................................................3 Definitions ............................................................................................................................................4 ANALYTICAL FRAMEWORK ..........................................................................................................7 I. CONTEXTUAL ISSUES .................................................................................................................11 1. The context of the country ..............................................................................................................11 2. Switzerland’s aspirations and strategies for educational development...........................................14 3. The nature of Swiss educational R&D............................................................................................18 4. Major contemporary challenges to educational R&D.....................................................................23 II. STRATEGIC AWARENESS .........................................................................................................25 1. Management of information about the education system ...............................................................25 -

Financial Innovations for Biodiversity: the Swiss

FINANCIAL INNOVATIONS FOR BIODIVERSITY: THE SWISS EXPERIENCE Two Examples of the Swiss Experience: Ecological Direct Payments as Agri-Environmental Incentives & Activities of the Foundation for the Conservation of Cultural Landscapes (Fonds Landschaft Schweiz) by Oliver Schelske Institute for Environmental Sciences University of Zurich presented at a workshop on Financial Innovations for Biodiversity Bratislava, Slovakia 1-3 May 1998 overview. In Switzerland, the issue of biodiversity protection is addressed through several sectoral policies. This paper analyzes two cases of sectoral policies: ecological direct payments, which are within the realm of Swiss agricultural policy; and the activities of the Swiss Foundation for the Conservation of Cultural Landscapes (Fonds Landschaft Schweiz, FLS) which is within the realm of Swiss conservation policy. Both cases represent examples of the use of financial instruments for the protection of biodiversity. One of the most highly regulated and controlled sectors in Swiss economy, Swiss agriculture was reformed in 1992 due to the GATT Uruguay Round. Agricultural price and income policies were separated and domestic support prices were decreased. Swiss agriculture became multi-functional. Its objectives are now to ensure food supply for the national population, to protect natural resources (especially biodiversity), to protect traditional landscapes and to contribute to the economic, social and cultural life in rural areas. On one hand, direct payments are used to ease the transition of Swiss agriculture toward global and free market conditions. On the other hand, direct payments are offered to those farmers who are willing to use more ecological and biodiversity-sound management practices. This paper shows the design and success of these direct payments. -

Participation of Children and Parents in the Swiss Child Protection System in the Past and Present: an Interdisciplinary Perspective

social sciences $€ £ ¥ Article Participation of Children and Parents in the Swiss Child Protection System in the Past and Present: An Interdisciplinary Perspective Aline Schoch 1,*, Gaëlle Aeby 2,* , Brigitte Müller 1, Michelle Cottier 2, Loretta Seglias 3, Kay Biesel 1, Gaëlle Sauthier 4 and Stefan Schnurr 1 1 Institute for Studies in Children and Youth Services, School of Social Work, University of Applied Sciences Northwestern Switzerland FHNW, 4132 Muttenz, Switzerland; [email protected] (B.M.); [email protected] (K.B.); [email protected] (S.S.) 2 Centre for Evaluation and Legislative Studies, Faculty of Law, University of Geneva, 1211 Geneva, Switzerland; [email protected] 3 Independent researcher, 8820 Wädenswil, Switzerland; [email protected] 4 Centre for Children’s Rights Studies, University of Geneva, 1950 Sion, Switzerland; [email protected] * Correspondence: [email protected] (A.S.); [email protected] (G.A.) Received: 6 July 2020; Accepted: 12 August 2020; Published: 18 August 2020 Abstract: As in other European countries, the Swiss child protection system has gone through substantial changes in the course of the 20th century up to today. Increasingly, the needs as well as the participation of children and parents affected by child protection interventions have become a central concern. In Switzerland, critical debates around care-related detention of children and adults until 1981 have led to the launch of the National Research Program ‘Welfare and Coercion—Past, Present and Future’ (NRP 76), with the aim of understanding past and current welfare practices. This paper is based on our research project, which is part of this national program. -

Behavioral Responses to Wealth Taxes: Evidence from Switzerland*

Behavioral Responses to Wealth Taxes: Evidence from Switzerland* Marius Brülhart† Jonathan Gruber‡ Matthias Krapf§ University of Lausanne MIT University of Lausanne Kurt Schmidheiny¶ University of Basel October 10, 2019 Abstract We study how reported wealth responds to changes in wealth tax rates. Exploiting rich intra-national variation in Switzerland, the country with the highest revenue share of an- nual wealth taxation in the OECD, we find that a 1 percentage point drop in the wealth tax rate raises reported wealth by at least 43% after 6 years. Administrative tax records of two cantons with quasi-randomly assigned differential tax reforms suggest that 24% of the effect arise from taxpayer mobility and 20% from house price capitalization. Savings re- sponses appear unable to explain more than a small fraction of the remainder, suggesting sizable evasion responses in this setting with no third-party reporting of financial wealth. * Previous versions of this paper circulated under the titles ‘The Elasticity of Taxable Wealth: Evidence from Switzerland’ and ‘Taxing Wealth: Evidence from Switzerland’. This version is significantly extended in terms of both data and estimation methods. We are grateful to Jonathan Petkun for excellent research assistance, to Etienne Lehmann, Jim Poterba, Emmanuel Saez, and seminar participants at the Universities of Barcelona, Bristol, ETH Zurich, GATE Lyon, Geneva, Kentucky, Konstanz, Mannheim, MIT, Yale and numerous conferences for helpful comments, to the tax administrations of the cantons of Bern and Lucerne for allowing us to use anonymized micro data for the purpose of this research, to Raphaël Parchet, Stephan Fahrländer and the Lucerne statistical office (LUSTAT) for sharing valuable complementary data, and to Nina Munoz-Schmid and Roger Amman of the Swiss Federal Tax Administration for useful information.