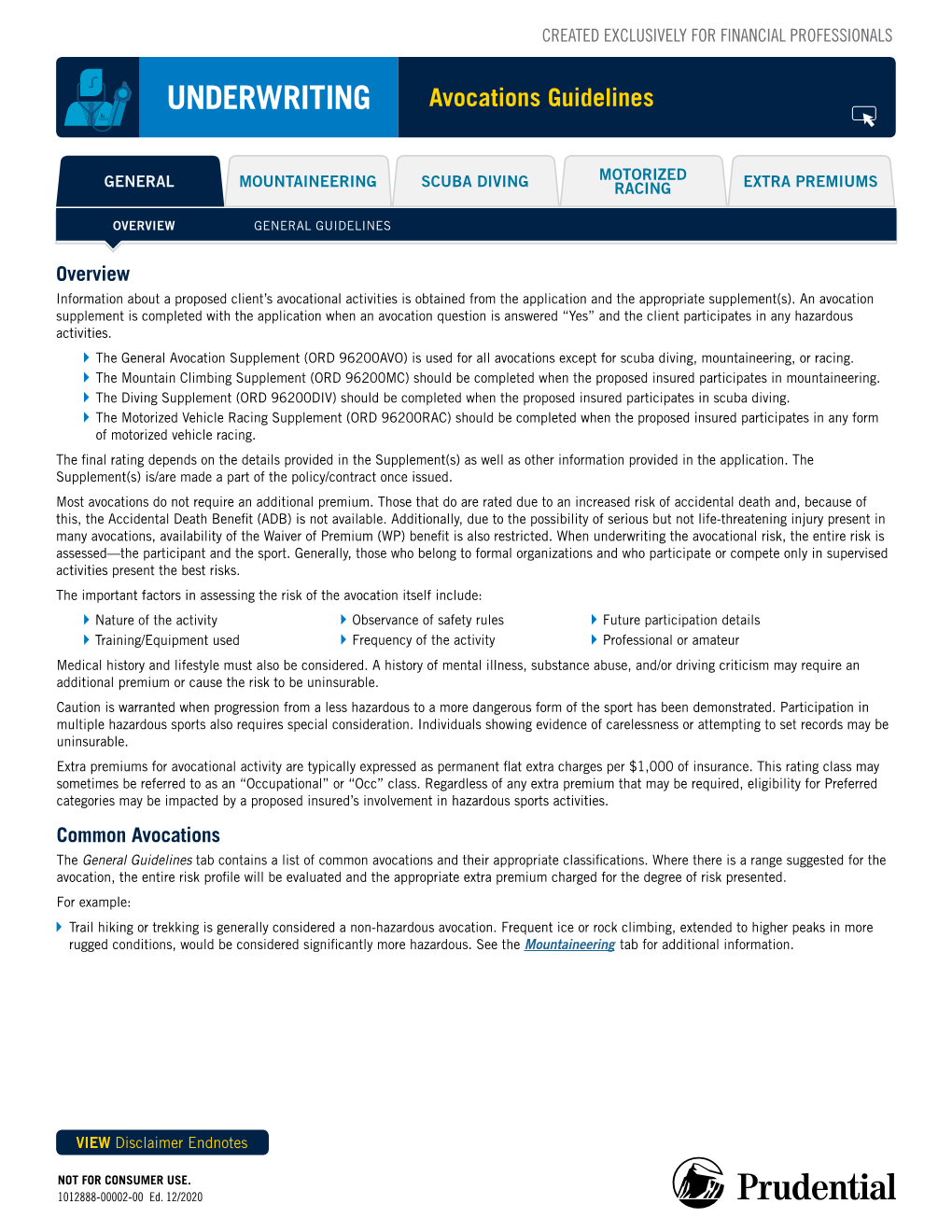

UNDERWRITING Avocations Guidelines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Diving—A Sport, That Requires SKILL, GRACE, COURAGE and STRENGTH!

December 2015 Diving—A sport, that requires SKILL, GRACE, COURAGE AND STRENGTH! A warm welcome to all our Learn To Dive athletes and their Families! We hope you have enjoyed our Fall session and are keen to register for the fast approaching Winter Ses- sion, starting January 4th 2016. Use this link to get to the registration page! http://forestcitydiving.com/? page_id=669 Check it out and secure a spot for your aspiring diver! For current divers, please, do not miss registration for Mini Meet, held on December 19th! Also to plan ahead, please, register for our March Break Camp—a great way to spend the holidays and 2015/2016 Precompetitive and Competitive FCDC -Team work on those dives! Registration Link: http://forestcitydiving.clubhost.ca/Classes.asp? Session=March%20Break%202016 Coach’s Corner We are now three months into the new season and I am very happy how all my athletes are performing. There are always many things to work on to get everybody ready for the first competition. Especially as some of our divers have changed age groups. Important FCDC Dates I have exciting news to share with you! January is going to be a Dec. 2nd to 5thCAMO Competition busy month for us ! Dec 12th FCDC Christmas Party Katelyn is invited by Dive Canada to participate in a High Perfor- December 19th LTD Mini Meet mance Athlete Development Camp! Al’x, Faith, Anika, Josh and Camryn as well as myself are invited to a Dive Ontario Canada December 23rd Last Day of Fall Games Training Camp! Also in January these six competitive divers Session from FCDC and myself will be part of an 18 diver group from Canada January 4th 2016 First Day of Win- to train in China for two weeks. -

Mid-Atlantic Coastal and Ocean Recreation Study

1ŋ),%ŋŋČŋŋ1ŋ ,-3ŋŋČŋŋ&1,ŋŋČŋŋ ,3&(ŋŋČŋŋ#,!#(# MID-ATLANTIC COASTAL AND OCEAN RECREATION STUDY The Surfrider Foundation, in partnership with Point 97, The Nature Conservancy, and Monmouth University’s Urban Coast Institute, (the Team), and in collaboration with the Mid-Atlantic Regional Council on the Ocean (MARCO), conducted a Coastal and Ocean Recreation Study (Study) for the Mid-Atlantic region in 2013-2014. The Study engaged recreational users and the public in providing data on “non-consumptive” recreational use, including surfing, diving, kayaking, beach going, and wildlife viewing. This data was previously unavailable and fills a key gap in our understanding of coastal and ocean uses in the Mid-Atlantic. METHODS The Team used a web-based survey accessible by mobile phones, tablets, or desktop/laptop computers to collect data from respondents on recreational use patterns, trip expenditures, and demographics. To obtain this data, the survey included a series of questions and an easy-to-use interactive mapping tool, where respondents could mark the places they went to recreate over the last year. The Team then analyzed the resulting spatial data to develop maps indicating intensity of use for recreational activities in the region (see map insert). To promote participation in the Study, the Team conducted outreach to over 300 recreational groups and businesses throughout the Mid- Atlantic region. In total, Mid-Atlantic respondents completed nearly 1,500 surveys resulting in over 22,000 unique data points. STUDY FINDINGS Coastal and ocean recreation encompasses a popular and diverse group of activities in the Mid-Atlantic (see graphic below), resulting in major economic and social benefits to coastal communities. -

Surf-Skate Lesson Release Surf

LIABILITY RELEASE for OHANA SURF & SKATE EVENTS : SURF DOG 2017 DATE: 07/16/2017 Owner Name: Surf Dog Name: Age: Male / Female Address: City: State: Zip Code: Phone: This is an important document. You must read this agreement, understand it and sign it to be allowed to participate in the Ohana Surf & Skate Event activities. By signing this agreement, you waive certain legal rights, including the right to sue. I / Owner, affirm, acknowledge, and understand the inherent hazards and risks associated with skateboarding, surfing, skin-diving, skim boarding, body- boarding, and all the ocean and shore activities conducted by Ohana Surf & Skate Events. I understand the hazards and risks associated with such activities can lead to severe and permanent injury and even death. Despite the potential hazards and dangers associated with skateboarding, surfing, skin-diving, skim boarding, body-boarding, and all activities conducted by Ohana Surf & Skate Events, I wish to proceed and freely accept and expressly assume all risks, dangers and hazards which may arise from these activities and which could result in personal injury, death, and property damage to my child or ward. In consideration of being allowed to participate in Ohana Surf & Skate Events as well as being allowed to use of any of the facilities and equipment of the below listed releases, I hereby agree as follows: To waive and release any and all claims I may have in the future against any of the following unnamed persons or entities (hereinafter referred to as Releasees): all instructors, -

An Economy Where Home and Automobile Sales Have Fallen Through the Floor, and Credit Is Tighter Than the Tolerances in an F1

an economy where home and automobile sales have fallen guy who might have stepped up in the past is looking at his through the floor, and credit is tighter than the tolerances in boat and saying, ‘I might be better served to put my $5000 an F1 engine, it should come as no surprise to anyone that or $10,000 back into this boat and let it last me two or three new performance boats are not exactly flying off of showroom more years.’ So that segment of our market is strong...and floors. However, this trend holds its share of opportunities for there’s still opportunity.” racing entrepreneurs. Drag Boat Racers Unite! “Boats are definitely a luxury item, and we are seeing signif- By all accounts, despite record fuel prices and the economic icant cutbacks in OEM orders,” said Tom Veronneau at Livorsi downturn, marine racing left a very decent 2008 season in its Marine in Grayslake, Illinois, a supplier of gauges, dash panels, wake...and is looking forward to more of the same in 2009. controls, headers, and other products for the marine, off-road, Several sanctioning organizations had big news to report. and auto racing markets. “I almost feel guilty saying this, but we’re going into our As a direct result of those slowed sales, Veronneau and biggest year ever,” enthused Charlie Fegan of the International others we spoke with in the performance marine industry Hot Boat Association (IHBA) in Bosque Farms, New Mexico, reported upbeat news for the aftermarket as enthusiasts refur- who told us that all US drag boat racing has been united under bish and upgrade their existing craft for an additional year or the Lucas Oil Drag Boat Racing Series for 2009. -

Notice of Race 1

29th Athens International Sailing Week 2019 Winter Series Olympic and Parasailing Classes National Championships 2019 International Classes: Optimist, Laser 4.7, Techno293, Techno Plus and 420 Faliron Olympic Complex Marina Delta Kallithea’s 08 - 16 November 2019 Notice of Race 1. ORGANIZING AUTHORITY Hellenic Sailing Federation. 2. RULES The event will be governed by : o The Racing Rules of Sailing 2017-2020 (World sailing). o The prescriptions of the Hellenic National Authority will not apply, except N1: RRS 40 (PFD). All competitors, race officials and support personnel shall be required to wear an adequate personal floatation device at all times while afloat. o The National Authority prescriptions 2 and 3 shall apply for Greeks competing at the Athens International Sailing Week o The Class rules (unless otherwise modified by this Notice of Race and the Sailing Instructions). o The HSF 2019 racing programme concerning National Championships. o This Notice of Race. o The Sailing Instructions. o If there is a conflict between a rule in the Notice of Race and a rule in the Sailing Instructions, the rule in the Sailing Instructions shall take precedence. This changes RRS 63.7. o If there is a conflict between languages the English text shall take precedence. 3. ADVERTISING The World Sailing Advertising Code, Regulation 20 shall apply. Boats may be required to display a bow number and advertisement of the event sponsor on either side on the forward 25% of the hull. Sailboards may be required to display such number and advertising on either side of the sail above the wishbone. Boats authorized to have advertising must present the permission of their National Authority. -

Drive Historic Southern Indiana

HOOSIER HISTORY STATE PARKS GREEK REVIVAL ARCHITECTURE FINE RESTAURANTS NATURE TRAILS AMUSEMENT PARKS MUSEUMS CASINO GAMING CIVIL WAR SITES HISTORIC MANSIONS FESTIVALS TRADITIONS FISHING ZOOS MEMORABILIA LABYRINTHS AUTO RACING CANDLE-DIPPING RIVERS WWII SHIPS EARLY NATIVE AMERICAN SITES HYDROPLANE RACING GREENWAYS BEACHES WATER SKIING HISTORIC SETTLEMENTS CATHEDRALS PRESIDENTIAL HOMES BOTANICAL GARDENS MILITARY ARTIFACTS GERMAN HERITAGE BED & BREAKFAST PARKS & RECREATION AZALEA GARDENS WATER PARKS WINERIES CAMP SITES SCULPTURE CAFES THEATRES AMISH VILLAGES CHAMPIONSHIP GOLF COURSES BOATING CAVES & CAVERNS Drive Historic PIONEER VILLAGES COVERED WOODEN BRIDGES HISTORIC FORTS LOCAL EVENTS CANOEING SHOPPING RAILWAY RIDES & DINING HIKING TRAILS ASTRONAUT MEMORIAL WILDLIFE REFUGES HERB FARMS ONE-ROOM SCHOOLS SNOW SKIING LAKES MOUNTAIN BIKING SOAP-MAKING MILLS Southern WATERWHEELS ROMANESQUE MONASTERIES RESORTS HORSEBACK RIDING SWISS HERITAGE FULL-SERVICE SPAS VICTORIAN TOWNS SANTA CLAUS EAGLE WATCHING BENEDICTINE MONASTERIES PRESIDENT LINCOLN’S HOME WORLD-CLASS THEME PARKS UNDERGROUND RIVERS COTTON MILLS Indiana LOCK & DAM SITES SNOW BOARDING AQUARIUMS MAMMOTH SKELETONS SCENIC OVERLOOKS STEAMBOAT MUSEUM ART EXHIBITIONS CRAFT FAIRS & DEMONSTRATIONS NATIONAL FORESTS GEMSTONE MINING HERITAGE CENTERS GHOST TOURS LECTURE SERIES SWIMMING LUXURIOUS HOTELS CLIMB ROCK WALLS INDOOR KART RACING ART DECO BUILDINGS WATERFALLS ZIP LINE ADVENTURES BASKETBALL MUSEUM PICNICKING UNDERGROUND RAILROAD SITE WINE FESTIVALS Historic Southern Indiana (HSI), a heritage-based -

Outlast Newsletter

Hello – With the first quarter of 2013 underway, we have many positive developments in the works to strengthen our brand positioning and continue to bring more products to market that feature the proactive benefits of our technology. We've rolled out our new brand identity that includes a refreshed logo. The new design pays respect to the strength and success of the Outlast brand as the global leader in phase change materials (PCMs) for the past 22 years, while encapsulating our relentless push for technological innovation in our field. To support this, our R&D team has introduced the world's first-ever polyester fiberfill with Outlast® technology - a development ideally suited for comforters, sleeping bags, jackets, etc. Outlast® Polyfill brings polyester fiber into the 21st century. Additionally, our partnerships continue to expand on the apparel front with a new women's boot to be introduced later this year from Papillon International. We're also working with Spanish company LS2 on new motorcycle racing helmets, as well as Ripzone™ on their line of Trilogy™ snowboarding jackets that will be lined with Outlast® technology for the 2013/2014 season. Our continued success, as always, is due in large part to our partnerships and relationships around the globe and everyone involved in our operations that contribute to expanded product offerings and applications. Warmest wishes to all of you in the New Year. Sincerely, Michael Coors CEO, Outlast Technologies Papillon International Introduces Women's Riding Boot - Fall Preview! We've partnered with Papillon International to bring to market women's riding boots for the fall 2013 season, featuring Outlast® technology in the ankle and foot lining, and the sock footbed. -

The Clark Flyer October 2008

The Clark Flyer The official publication of the Clark County Radio Control Society. Volume 08, Issue 10, October, 2008 Editor: John Shirron [email protected] 2008 Club Officers The Clark Flyer President October 2008 Luis Munoz Well, I know it’s kraut; another oh so good! All and all, a [email protected] fall for two rea- very successful day was had by all at the sons. One, be- flying field. Vice President cause I just On another note, October, and November Dave Agar picked all the are nominations for club officers. All po- [email protected] gourds from my sitions are open for you to volunteer for, garden, and two, Secretary or to nominate someone for. If you want because I also Greg Agar to help the club by volunteering yourself just flew in our for a position, or know someone that [email protected] October Fest Fun Fly. There was a good would make a good nominee, just email Treasury turnout for the fun fly and fun was had by any of the officers or come to the No- all. The weather was perfect, a little cool Steve Piper vember meeting to make ideas know. It’s in the morning, and the sun in the after- [email protected] because of volunteers like you that make noon; perfect! I know that it was the first our club a fun and successfully group of Safety Director time I ever dropped a plastic Easter egg people to be a part of, along with provid- filled with flower and beans, and had it Ted Atmore ing the community with a good place to actually explode on impact; way cool. -

Discover Scuba / Try Diving Windsurfing

KANDOLHU MALDIVES Отель может вносить изменения без предварительного оповещения. DiscoverWindsurfing Scuba / Try Diving On request Windsurfing is a challenging and exhilarating sport that will get your heart beating from the work-out and the excitement, as you learn how to harness the energy of the wind and sail effortlessly through the ocean Windsurf Equipment Rental complimentary Windsurf Check complimentary The perfect “try diving” experience Windsurf Refresher 30-minutes $60++ for those 10 years or above. An introductory course that 1-hour Private Lesson $90++ includes a beautiful shallow dive2.5hrs on Private Lesson $150++ Kandolhu house reef. For further details please enquire with the Dive Team DiscoverCatamaran Scuba Sailing / Try Diving On request Sail out past the lagoon and enjoy a cool breeze and beautiful views from our catamaran. A quick check-out is available for those with experience, or why not sign up for private lessons?! If you are looking for something a little faster paced, Joy Rides are a brilliant opportunity to experience the catamaran at its best in high winds. One of our instructors will do all the work, while you relish the thrill! complimentary complimentary The perfect “try diving” experienceCatamaran Equipment Rental complimentary $60++ for those 10 years or above. Catamaran Check complimentary $90++ An introductory course that 1-hour Private Lesson $70++ $150++ includes a beautiful shallow diveJoyride on $40++ Kandolhu house reef. Sunset Sailing for Two (17:30-18:30) $49++ For further details please enquire with the Dive Team DiscoverKayaking Scuba / Try Diving On request Whether it be for a peaceful escape, outdoor enjoyment, mode of transport over our stunning house reef or the challenge, kayaking is a wonderful sport for all. -

Mid-Atlantic Coastal and Ocean Recreation Study

New Jersey MID-ATLANTIC COASTAL AND OCEAN RECREATION STUDY The Surfrider Foundation, in partnership with Point 97, The Nature Conservancy, and Monmouth University’s Urban Coast Institute, (the Team), and in collaboration with the Mid-Atlantic Regional Council on the Ocean (MARCO), conducted a Coastal and Ocean Recreation Study (Study) for the Mid-Atlantic region in 2013-2014. The Study engaged recreational users and the public in providing data on “non-consumptive” recreational use, including surfing, diving, kayaking, beach going, and wildlife viewing. This data was previously unavailable and fills a key gap in our understanding of coastal and ocean uses in New Jersey and the Mid-Atlantic. METHODS The Team used a web-based survey accessible by mobile phones, tablets, or desktop/laptop computers to collect data from respondents on recreational use patterns, trip expenditures, and demographics. To obtain this data, the survey included a series of questions and an easy-to-use interactive mapping tool, where respondents could mark the places they went to recreate over the last year. The Team then analyzed the resulting spatial data to develop maps indicating intensity of use for recreational activities in the region (see map insert). To promote participation in the Study, the Team conducted outreach to over 300 recreational groups and businesses throughout the Mid- Atlantic region. In total, Mid-Atlantic respondents completed nearly 1,500 surveys resulting in over 22,000 unique data points. NEW JERSEY: STUDY FINDINGS Coastal and ocean recreation encompasses a popular and diverse group of activities in New Jersey (see graphic below) resulting in major economic and social benefits to coastal communities. -

The Case of Powerboat Racing

Georgia Southern University Digital Commons@Georgia Southern Association of Marketing Theory and Practice Association of Marketing Theory and Practice Proceedings 2016 Proceedings 2016 An Examination of the Marketing of a Floundering Sport: The Case of Powerboat Racing Sam Fullerton Eastern Michigan University, Potchefstroom Business School, North-West University (South Africa) Follow this and additional works at: https://digitalcommons.georgiasouthern.edu/amtp- proceedings_2016 Part of the Marketing Commons Recommended Citation Fullerton, Sam, "An Examination of the Marketing of a Floundering Sport: The Case of Powerboat Racing" (2016). Association of Marketing Theory and Practice Proceedings 2016. 20. https://digitalcommons.georgiasouthern.edu/amtp-proceedings_2016/20 This conference proceeding is brought to you for free and open access by the Association of Marketing Theory and Practice Proceedings at Digital Commons@Georgia Southern. It has been accepted for inclusion in Association of Marketing Theory and Practice Proceedings 2016 by an authorized administrator of Digital Commons@Georgia Southern. For more information, please contact [email protected]. An Examination of the Marketing of a Floundering Sport: The Case of Powerboat Racing Sam Fullerton Eastern Michigan University Potchefstroom Business School, North-West University (South Africa) ABSTRACT A sample of 308 attendees at an APBA sanctioned powerboat race in July of 2015 provided insight regarding a number of key considerations germane to the decision to attend the race. Race organizers were seeking ways to reinvigorate interest in what they see as a floundering – if not sinking – sport. A self-administered survey was distributed at the race with those completing it having a chance to win a souvenir shirt from the races. -

MDC Physical Activity

MDC Physical activity 2015-11-26 Contents: Physical activity during leisure according to question 37 (version 1), question 75 (version 2) or question 32 (version 3) in the questionnaire. Number of minutes per week per season per activity (including to and from work), one type of activity per line. # lines: 107 189 records of 27 749 individuals # variables: 8 Source: Data have been derived from the Malmö Diet and Cancer Study questionnaire filled in by the individuals during the period 1991 03 18 - 1996 09 30. There are three versions of the questionnaire. Misc: Versions 2 and 3 of the questionnaire contains a check-box for all preprinted physical activity alternatives, the check-boxes should be filled in for those activities the individual seldom or never take part in. In versions 2 and 3, but not in version 1, some individuals have the value 0 for the variables 'spring' to 'winter'. A total score variable ("fa_total") for physical activity at leisure is given in the file "MDC Questionnaire". The score variable has been calculated from the data on number of minutes per week per activity, type of activity, and an activity specific factor List of variables Name Variable label Type Format Value label Male Female lopnrMKC Baseline sequence number in MDCS Numeric F5 45 184 62 005 (Numeric). Remarks: original variable name is [lopnr] (in Bodycomp [seqno]). udatum_fa Questioning date. Date SDATE10 45 184 62 005 Remarks:The variable 'udatum_fa' ought to be identical with the variable "udatum" in MDC baseline questionnaire, however the date differ for nine individuals, as a consequence the suffix "_fa" has been added to the variable name.