IMAX Corporation (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

IMAX China Holdings Soft Momentum After Avengers

14 June 2018 Hong Kong EQUITIES IMAX China Holdings 1970 HK Neutral Soft momentum after Avengers Price (at 06:39, 13 Jun 2018 GMT) HK$27.60 Valuation HK$ 26.00-29.00 Key points - PER Downgrade to Neutral with TP lowered to HK$27.77 12-month target HK$ 27.77 We expect IMAX China’s BO growth to slow down after Avengers with its Upside/Downside % +0.6 network expansion peaking 12-month TSR % +1.8 We expect earnings to drop by 4% YoY in 2H18, with a 4% 18-20E CAGR Volatility Index High GICS sector Media Market cap HK$m 9,903 Event Market cap US$m 1,246 Downgrade to Neutral. IMAX China’s share price has rallied by 45% from the Free float % 32 trough earlier this year (vs +4% for HSI), on the good box office (BO) 30-day avg turnover US$m 5.1 performance of Avengers and strong 1Q. However, we expect the earnings Number shares on issue m 358.8 growth momentum going forward to inevitably slow down on the expected soft film slate and more importantly, the peaking of network installations. We expect Investment fundamentals its earnings to decline by 4% YoY in 2H18, after a +36% YoY in 1H18E, with a Year end 31 Dec 2017A 2018E 2019E 2020E Revenue m 126.5 138.6 146.9 150.7 4% 18-20E earnings CAGR. Downgrade to Neutral from Outperform. EBIT m 57.3 65.1 68.7 70.4 EBIT growth % 20.7 13.5 5.6 2.4 Impact Reported profit m 43.7 49.0 51.8 53.1 Softer momentum after Avengers. -

Print Pageааclose Window Press Release IMAX CORPORATION

Print Page Close Window Press Release IMAX CORPORATION REPORTS SECOND QUARTER 2015 FINANCIAL RESULTS HIGHLIGHTS Record box office of $343 million in Q2 2015 results in over a half a billion of IMAX global box office generated in the first half of the year Stellar global per screen average of $415 thousand in Q2 2015, driven by a 41% increase in domestic and 33% increase in international per screen averages compared to Q2 2014 Company increases annual installation guidance to 120 new theatres after another above target quarter of 35 new commercial installations in Q2 2015 $107.2 million of revenues in Q2, IMAX's highest revenue generating quarter ever, was up 35% from same period last year, driving adjusted EPS of $0.40, 60% growth over Q2 2014 NEW YORK, July 23, 2015 /PRNewswire/ IMAX Corporation (NYSE: IMAX) today reported second quarter 2015 revenues of $107.2 million, adjusted EBITDA as calculated in accordance with the Company's credit facility of $50.4 million, adjusted net income after noncontrolling interest of $28.7 million, or $0.40 per diluted share, and reported net income after noncontrolling interest of $24.4 million, or $0.34 per diluted share. The Company also reported a very strong second quarter global per screen average of $414,600. "The second quarter of 2015 was one of the strongest in IMAX's history, delivering our highest revenue ever, growing adjusted EPS by 60% compared to the same period last year, record box office and quarterly per screen averages that we have not seen since Avatar in 2010," stated IMAX CEO Richard L. -

Ironwood Football Stadium Renamed After Late Football Coach, Mr. Esquivel

The Ironwood High School Glendale, Arizona Eagle’s Eye Volume 32 Issue 2 October 13, 2017 What’s inside? News Read about how minimum wage is affecting teens getting jobs on... Page 2 Feature Did you tune into Ironwood’s Homecoming? Sarah Saunders Furthermore, Ironwood’s clubs ber said, “It’s a lot of fun, but sought after Homecoming crowns Staff Reporter were tasked with representing kind of stressful putting it all to- were awarded to the deserving Crowns. Carnivals. Football. themselves in a creative way to gether.” Their work did not go un- Homecoming king and queen. It That is right, once again Home- show on display for appreciated. Each club and sport was now that the long awaited for Know what the recent fall play is coming has occurred and the an- As stated by Ironwood.com, was represented given credit. Homecoming dance would com- about on... nual event did not disappoint the Wednesday brought each club The festivities and must-do ac- mence the next night. Page 4 community and high-school stu- together for the Homecoming pa- tivities did not end in the morn- It was Saturday morning that dents of Ironwood. rade from 2:00 PM to 2:20 PM. ing. Once the sun went down, the Eagles Eye fulfilled their an- Entertainment From October The floats were a success, and Ironwood came to life on nual task of decorating second to Octo- thankfully not many incidents the football field. Students, for the Homecom- ber seventh, ensued. staff, and parents all came ing dance. the week However, Thursday was to the Varsity football game Their efforts was filled jampacked with prepara- to cheer on the Eagles. -

DINESH KUMAR BISHNOI Mobile No: +91 9892136994 [email protected] Linkedin.Com/In/Dinesh3007

DINESH KUMAR BISHNOI Mobile No: +91 9892136994 [email protected] linkedin.com/in/dinesh3007 https://www.imdb.com/name/nm4402352/ Currently working on a Department Supervisor(Assistant HOD) position in Matchmove, Double Negative, Mumbai, India. I began my career studying VFX specialization at Bangalore Takshaa academe of the artist, in 2005. I managed to finish the course just as the industry began to collapse in 2009. Like many Visual effect artists at that time, I made the switch to camera tracking working for Hollywood Movies and commercials. One of the initial movies I worked on was X-Men Origins: Wolverine (2009). Later on, I have joined MPC in 2010 as a Junior matchmove artist and from there onwards I have moved to Prime focus and then Dneg. EXPERIENCE APR 2017 – PRESENT MATCMOVE DEPT. SUPERVISOR(ASSISTANT HOD), DNEG (Formerly known as Assistant Head of Camera) (Formerly Overall Department Supervisor) What I do So in a nutshell I'm here to make the working life of a Double negative camera track as efficient as possible. My job is to make sure that the pipeline is as camera-track-friendly as possible. My role is to liaise with the camera track and body track, Camera Supervisors, Discipline Supervisors, Production and Production Technology to improve what doesn't work for us in the pipe, suggest better methods to improve workflow and consult on the development and completion of those improvements. On a Show level and a SITE level, my aim is to make sure camera track artist and sups spend their time delivering work on time with good quality, Also my job is to bridge the communication gap between the client's vision and the camera track team. -

Massive Movie Waves and the Anthropic Ocean

SSI0010.1177/0539018418783073Social Science InformationHelmreich 783073research-article2018 Special Issue Social Science Information 2018, Vol. 57(3) 494-521 1 –28 Massive movie waves and © The Author(s) 2018 Reprints and permissions: the anthropic ocean sagepub.co.uk/journalsPermissions.nav https://doi.org/10.1177/0539018418783073DOI: 10.1177/0539018418783073 journals.sagepub.com/home/ssi Stefan Helmreich Massachusetts Institute of Technology, USA Abstract This article examines representations of ocean waves in disaster and science fiction movies, reading these for what they can indicate about shifting ideological accounts of human–ocean relations. I track the technical conjuring of such on-screen waves – made using everything from scale model wave tanks to computer-generated imagery (CGI) – and explicate how these enable waves’ narrative purposes and effects. I argue that towering waves in film have operated as emblems of (a) the elemental power of cosmic, inhuman, arbitrary forces, (b) the return of the social-environmental repressed, and (c) the power and limits of cinematic media themselves. The most recent fantastical waves, rendered digitally, I suggest, now generate reflexive usages that underwrite either optimistic aesthetics of a nature crafted in partnership with humanity or ironic pessimism about human enterprise in the face of looming ecological disaster. Keywords Anthropocene, animation, disaster, film, waves Résumé Cet article examine les représentations des vagues océaniques dans les films catastrophes et de science-fiction, afin d’appréhender les changements idéologiques inhérents aux relations Homme–océan. J’examine les aspects techniques de ces ondes océaniques à l’écran – du modèle réduit de réservoir à vagues à l’imagerie générée par ordinateur (3D) – et analyse les effets narratifs de ces dites-vagues. -

1 Skydance Media Acquires Global Live Action Rights to “Sword Art

Skydance Media Acquires Global Live Action Rights To “Sword Art Online” Phenomenon Studio Fast-Tracks Launch of All-New Franchise with First-Ever Live Action TV Series Santa Monica, CA, August 2, 2016 – Skydance Media, a diversified media company that creates elevated, event-level entertainment for global audiences, today announced that it has acquired the global live action rights to Sword Art Online (SAO), the smash hit Japanese novel and anime franchise, in partnership with KADOKAWA Corporation. Skydance plans to fast-track the launch of an all-new franchise by developing and producing the first-ever live action SAO TV series. Laeta Kalogridis (Avatar, Shutter Island, Terminator Genisys) will write the pilot episode and serve as an executive producer alongside David Ellison, Dana Goldberg and Marcy Ross. SAO is a global franchise based on the popular light novel series of 22 books by author Reki Kawahara, which have collectively sold over 19 million print copies worldwide. The novels have been spun off into nine comic adaptations, two anime television series, a video game and merchandise program, and – most recently – an animated film set to be released in Japan in 2017. The all-new Skydance Television series will follow a brilliant young beta tester Kirito and his group of friends when they are trapped – alongside 10,000 other people – in a next-generation virtual reality online role-playing game. The game is a world unto itself: filled with sword fighting, monsters, magic and mystery, where the stakes are life and death. Kirito and an ensemble of diverse characters must fight their way through this hostile environment while making lives for themselves in the fantastical world that is Sword Art Online. -

More at Sutv.Nova.Edu! Follow Us @Sutvch96

Watch all these movies and more at sutv.nova.edu! Movie Show Times: February 1-28, 2018 (954) 262-2602 [email protected] www.nova.edu/sutv Date 12:30a 2:30a 4:30a 6:30a 8:30a 11:00a 1:00p 3:30p 5:30p 8:00p 10:00p The Killing of a Happy Death Thank You for I, Daniel Blake So B It Brad’s Status American Made Breathe The Bachelors Loving Vincent The Foreigner 1-Feb Sacred Deer Day Your Service My Little Pony: The Killing of a Love Beats Blade Runner Brad’s Status Marshall Geostorm Polina It Overdrive The Snowman 2-Feb The Movie Sacred Deer Rhymes 2049 Love Beats My Little Pony: Thank You for Breathe The Bachelors The Foreigner Loving Vincent So B It The Snowman I, Daniel Blake American Made 3-Feb Rhymes The Movie Your Service The Killing of a Happy Death Blade Runner The Bachelors Marshall Breathe Polina Geostorm Overdrive It Brad’s Status 4-Feb Sacred Deer Day 2049 Blade Runner My Little Pony: Love Beats Thank You for Polina Loving Vincent Marshall So B It The Snowman I, Daniel Blake Geostorm 5-Feb 2049 The Movie Rhymes Your Service The Killing of a Thank You for So B It Overdrive Loving Vincent Brad’s Status The Foreigner Breathe American Made The Bachelors It 6-Feb Sacred Deer Your Service The Killing of a My Little Pony: Blade Runner Love Beats Happy Death I, Daniel Blake Overdrive Geostorm Marshall It Polina 7-Feb Sacred Deer The Movie 2049 Rhymes Day My Little Pony: Happy Death Thank You for Brad’s Status I, Daniel Blake Breathe American Made The Bachelors Loving Vincent So B It The Foreigner 8-Feb The Movie Day Your Service Love Beats -

View Full Catalog of Encoded Compatible Content

D-BOX HOME ENTERTAINEMENT IMMERSIVE EXPERIENCES (Hold the Ctrl keyboard key and press the F (Ctrl+F) to search for a specific movie) HaptiCode Release Date RECENTLY ADDED (Year-Month-Day) Star Wars: The Bad Batch - 1st Season EP11 2021-07-09 Black Widow 2021-07-09 Lupin 1st Season EP 6,7 2021-07-07 Loki 1st Season EP 4 2021-07-06 Ace Venture - When Nature Calls 2021-07-06 Ace Ventura - Pet Detective 2021-07-06 Star Wars: The Bad Batch - 1st Season EP10 2021-07-02 Lupin 1st Season EP 4,5 2021-06-30 Loki 1st Season EP 3 2021-06-29 Star Wars: The Bad Batch - 1st Season EP9 2021-06-25 Always 2021-06-23 Lupin 1st Season EP 2,3 2021-06-23 Loki 1st Season EP 2 2021-06-22 Jack Ryan - 2nd Season EP 7,8 2021-06-22 Star Wars: The Bad Batch - 1st Season EP8 2021-06-18 Astérix - The Mansion of the Gods 2021-06-17 Lupin 1st Season EP 1 2021-06-16 Wandavision 1st Season EP 9 2021-06-16 Loki 1st Season EP 1 2021-06-15 Jack Ryan - 2nd Season EP 5,6 2021-06-15 Star Wars: The Bad Batch - 1st Season EP7 2021-06-11 In the Heights 2021-06-11 Wandavision 1st Season EP 7,8 2021-06-09 Jack Ryan - 2nd Season EP 3,4 2021-06-08 Star Wars: The Bad Batch - 1st Season EP6 2021-04-06 Conjuring : The Devil Made Me Do It 2021-06-04 Wandavision 1st Season EP 5,6 2021-06-02 Jack Ryan - 2nd Season EP 1,2 2021-06-01 Star Wars: The Bad Batch - 1st Season EP5 2021-05-28 Cruella 2021-05-28 Star Wars: The Clone Wars S07 EP 9,10,11,12 2021-05-27 Wandavision 1st Season EP 3,4 2021-05-26 Get Him to the Greek 2021-05-25 Jack Ryan 1st Season EP 7,8 2021-05-25 Star Wars: The Bad Batch -

Geostorm Movie Review (By the FEDBP and INCPU News Teams)

GeoStorm movie review (by the FEDBP and INCPU News teams) www.incpu.org/GeoStorm-movie-review-FEDBP-INCPU.htm www.incpu.org/GeoStorm-movie-review-FEDBP-INCPU.pdf Hello brothers and sisters in Christ, and friends, Welcome to an FEDBP/INCPU analysis of the movie called “GeoStorm”. I apologize for its length, but my team and I believe that the info you will find in this report (and it’s not exhaustive) will help crack open the Follywood psyops campaigns to some extent as well as help honest followers of Christ catch on to GeoStorm’s NWO agendas and announcements. So, this report/article here is half FEDBP movie report, and half INCPU News report. The reason my team and I are analyzing this movie is because it is part of of the Rockefeller’s “Agenda 21” that is explained in short detail and 7 languages on the Rockefeller installed “Georgia Guidestones”. Even more incredible is why Mr Trump and team (jesuits and masons) think they can boast that no one can stop them and expect God to not reply or stand in their way. Apparently they haven’t ready God’s Word, and they obviously don’t know Jesus. Source: https://www.politico.com/story/2017/05/21/full-transcript-trumps-speech-to-the-arab- islamic-american-summit-238654 (if you look up the 3 speeches Trump made 1) Arab League, 2) Nato, 3) Rome, you find out he has a very different agenda. Alarming is putting it simply.) But the deeper reason we are reporting on this is because we see the huge need for Christians to stand against evil – according to Scripture, and right now, they prefer to stay quiet and not stand against evil, because it’s easier (or so they think). -

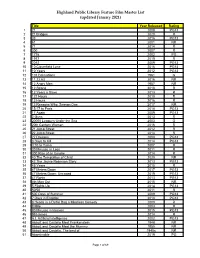

Highland Public Library Feature Film Master List (Updated January 2021)

Highland Public Library Feature Film Master List (updated January 2021) Title Year Released Rating 1 21 2008 PG13 2 21 Bridges 2020 R 3 33 2016 PG13 4 61 2001 NR 5 71 2014 R 6 300 2007 R 7 1776 2002 PG 8 1917 2019 R 9 2012 2009 PG13 10 10 Cloverfield Lane 2016 PG13 11 10 Years 2012 PG13 12 101 Dalmatians 1961 G 13 11.22.63 2016 NR 14 12 Angry Men 1957 NR 15 12 Strong 2018 R 16 12 Years a Slave 2013 R 17 127 Hours 2010 R 18 13 Hours 2016 R 19 13 Reasons Why: Season One 2017 NR 20 15:17 to Paris 2018 PG13 21 17 Again 2009 PG13 22 2 Guns 2013 R 23 20000 Leagues Under the Sea 2003 G 24 20th Century Women 2016 R 25 21 Jump Street 2012 R 26 22 Jump Street 2014 R 27 27 Dresses 2008 PG13 28 3 Days to Kill 2014 PG13 29 3:10 to Yuma 2007 R 30 30 Minutes or Less 2011 R 31 300 Rise of an Empire 2014 R 32 40 The Temptation of Christ 2020 NR 33 42 The Jackie Robinson Story 2013 PG13 34 45 Years 2015 R 35 47 Meters Down 2017 PG13 36 47 Meters Down: Uncaged 2019 PG13 37 47 Ronin 2013 PG13 38 4th Man Out 2015 NR 39 5 Flights Up 2014 PG13 40 50/50 2011 R 41 500 Days of Summer 2009 PG13 42 7 Days in Entebbe 2018 PG13 43 8 Heads in a Duffel Bag a Mindless Comedy 2000 R 44 8 Mile 2003 R 45 90 Minutes in Heaven 2015 PG13 46 99 Homes 2014 R 47 A.I. -

A Brooding Presence at the South Eastern Corner of the Royal Victoria

PRODUCTION NOTES For additional publicity materials and artwork, please visit: http://lionsgatepublicity.com/theatrical/hunterkiller/ Rating: Rated R for violence and some language Run Time: 121 minutes U.S. Release Date: October 26, 2018 For more information, please contact: Liz Berger Lionsgate 2700 Colorado Avenue Santa Monica, CA 90404 P: 310-255-3092 E: [email protected] HUNTER KILLER SUMMIT PREMIERE Publicity Materials: http://lionsgatepublicity.com/theatrical/hunterkiller/ Hashtag: #HunterKiller Genre: Action Thriller Rating: Rated R for violence and some language U.S. Release Date: October 26, 2018 Run Time: 121 minutes Cast: Gerard Butler, Gary Oldman, Common, Linda Cardellini, and Toby Stephens Directed by: Donovan Marsh Screenplay by: Arne L. Schmidt and Jamie Moss Based on: The Novel “Firing Point” written by George Wallace and Don Keith Produced by: Neal H. Moritz and Toby Jaffe, Gerard Butler, Alan Siegel, Tucker Tooley, Mark Gill, John Thompson, Matt O’Toole, Les Weldon SYNOPSIS: Deep under the Arctic Ocean, American submarine Captain Joe Glass (Gerard Butler, Olympus Has Fallen, 300) is on the hunt for a U.S. sub in distress when he discovers a secret Russian coup is in the offing, threatening to dismantle the world order. With crew and country on the line, Captain Glass must now assemble an elite group of Navy SEALs to rescue the kidnapped Russian president and sneak through enemy waters to stop WWIII. Also starring Oscar® winner Gary Oldman (Best Actor, Darkest Hour, 2017), Common (John Wick: Chapter 2), Linda Cardellini (Avengers: Age of Ultron) and Toby Stephens (Die Another Day), HUNTER KILLER is a high-stakes thriller that unfolds both by land and sea. -

WARNER BROS. PICTURES E SKYDANCE Presentano

WARNER BROS. PICTURES e SKYDANCE presentano in collaborazione con RATPAC-DUNE ENTERTAINMENT una produzione SKYDANCE Un film di DEAN DEVLIN Con GERARD BUTLER JIM STURGESS ABBIE CORNISH ANDY GARCIA ED HARRIS Prodotto da DAVID ELLISON, p.g.a., DEAN DEVLIN, p.g.a. e DANA GOLDBERG, p.g.a. Sceneggiatura di DEAN DEVLIN & PAUL GUYOT Produttori esecutivi HERBERT W. GAINS, MARC ROSKIN e DON GRANGER Direttore della fotografia ROBERTO SCHAEFER, ASC, AIC Scenografie KIRK M. PETRUCCELLI Montaggio RON ROSEN, CHRIS LEBENZON, A.C.E., JOHN REFOUA, A.C.E. Musiche LORNE BALFE Distribuzione WARNER BROS. PICTURES Durata del film: 1h 49minuti Uscita italiana: 1 novembre 2017 Per informazioni stampa di carattere generale siete pregati di visitare: mediapass.warnerbros.com Ufficio Stampa Warner Bros. Entertainment Italia Riccardo Tinnirello [email protected] Cinzia Fabiani [email protected] Riccardo Mancini [email protected] Egle Mugno [email protected] Francesco Petrucci [email protected] !1 CHI HA IL CONTROLLO? In seguito a una terribile serie di disastri naturali senza precedenti che colpiscono il pianeta, i capi di stato delle maggiori potenze mondiali si riuniscono per definire la realizzazione di una complessa rete di satelliti in grado di controllare le condizioni climatiche e garantire la sicurezza dei cittadini. Ma ora qualcosa non va - il sistema elaborato per proteggere la Terra sta diventando la causa della sua distruzione e inizia una corsa contro il tempo per scoprire la vera minaccia, prima che una tempesta globale spazzi via tutto… e tutti. Dean Devlin (scrittore/produttore, “Independence Day”) fa il suo esordio alla regia con il suspense thriller “Geostorm”, con Gerard Butler (“Attacco al potere”, “300”), Jim Sturgess (“Cloud Atlas”), Abbie Cornish (“Limitless”), Alexandra Maria Lara (“Rush”), Daniel Wu (“L’uomo con i pugni di ferro”, “Warcraft: L’inizio”), Eugenio Derbez (“How to Be a Latin Lover”) e i candidati all’Oscar® Ed Harris (“The Hours”, “Apollo 13”) e Andy Garcia (“Il Padrino: Parte III”).