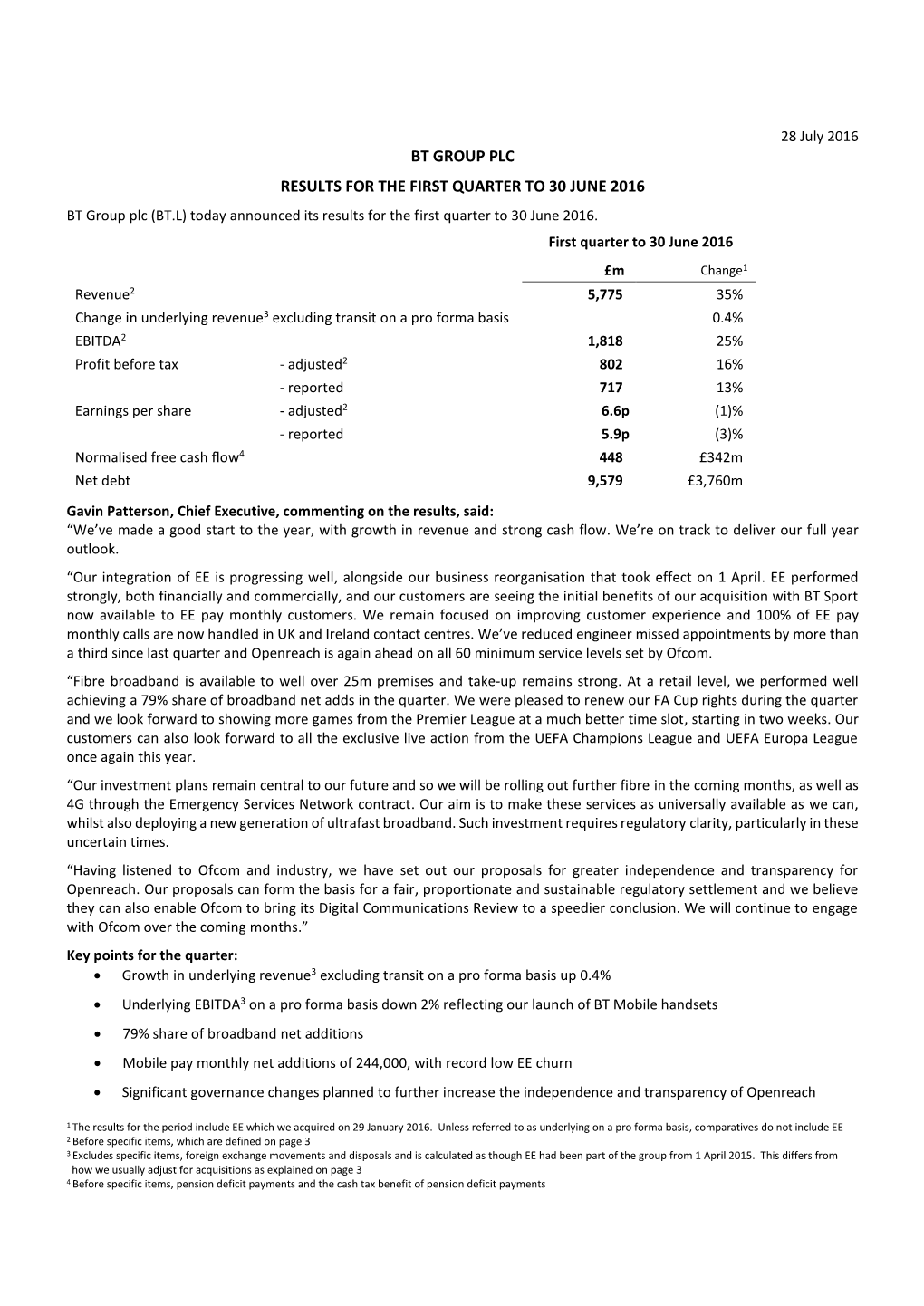

BT GROUP PLC RESULTS for the FIRST QUARTER to 30 JUNE 2016 BT Group Plc (BT.L) Today Announced Its Results for the First Quarter to 30 June 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

British Telecommunications Plc Annual Report

wholly-owned subsidiary of BT Group plc, British Telecommunications plc meets the conditions set forth in General set the conditions plc meets Telecommunications plc, British Group subsidiary wholly-owned of BT a As Form 20-F with filing this 20-F and is therefore reports on Form 10-K as applied to of Form Instruction (I) (1)(a) and (b) format. disclosure the reduced 2018 Form 20-F Form Report & Report Annual BRITISH TELECOMMUNICATIONS plc BRITISH TELECOMMUNICATIONS BRITISH TELECOMMUNICATIONS plc 2018 THE StratEGIC REPOrt GOVERNANCE FINANCIAL statEMENts ADDITIONAL INFORMatION Contents The Strategic Report Our strategy Our strategy in a nutshell How we’re doing – Delivering great customer experience 3 – Investing for growth 4 – Transforming our costs 5 Key performance indicators 6 Our non-financial performance 8 Our evolving strategy 10 Our business model Our business model 12 What we do 14 Our resources and culture Financial strength 16 Our networks and physical assets 16 Properties 17 Research and development 17 Brand and reputation 19 Our culture / The BT Way 20 Respecting human rights 21 Our stakeholders Our people 22 Customers 25 Communities and society 25 Lenders 26 Pension schemes 26 Suppliers 27 HM Government 27 Regulators 28 The environment 31 Our risks Our approach to risk management 33 Our principal risks and uncertainties 34 Operating review BT Consumer 48 EE 55 Business and Public Sector 59 Global Services 64 Wholesale and Ventures 69 Openreach 73 Technology, Service and Operations 79 Group performance Group performance 82 Governance 89 Financial statements 95 Additional information 208 Overview British Telecommunications plc (‘the group’ or ‘the company’ ) is the principal operating subsidiary of BT Group plc. -

View Annual Report

BT Group plc Annual Report & Form 20-F 2017 Welcome to BT Group plc’s Annual Report and Form-20F for 2017 Where to find more information www.btplc.com www.bt.com/annualreport Delivering our Purpose Report We’re using the power of communications to make a better world. That’s our purpose. Read our annual update. www.btplc.com/purposefulbusiness Delivering our Purpose Report Update on our progress in 2016/17 THE STRATEGIC REPORT GOVERNANCE FINANCIAL STATEMENTS ADDITIONAL INFORMATION The strategic report 2 Contents Review of the year 3 How we’re organised 8 An introduction from our Chairman 10 A message from our Chief Executive 12 This is the BT Annual Report for the year ended Operating Committee 14 31 March 2017. It complies with UK regulations Our strategy Our strategy in a nutshell 16 and comprises part of the Annual Report and How we’re doing Form 20-F for the US Securities and Exchange – Delivering great customer experience 17 – Investing for growth 18 Commission to meet US regulations. – Transforming our costs 19 Key performance indicators 20 This is the third year that we’ve applied an Our business model Integrated Reporting (IR) approach to how Our business model 22 we structure and present our Annual Report. What we do 24 Resources, relationships and sustainability IR is an initiative led by the International Integrated Reporting – Financial strength 26 Council (IIRC). Its principles and aims are consistent with UK – Our people 26 regulatory developments in financial and corporate reporting. – Our networks and physical assets 30 We’ve reflected guiding principles and content elements from the – Properties 31 IIRC’s IR Framework in preparing our Annual Report. -

Narrowband Market Review

Narrowband Market Review Consultation on the proposed markets, market power determinations and remedies for wholesale call termination, wholesale call origination and wholesale narrowband access markets Consultation Publication date: 1 December 2016 Closing Date for responses: 28 February 2017 1 About this document The Narrowband Market Review 2017 covers five wholesale markets that underpin the delivery of retail fixed voice telephone services in the UK. The outcomes from this review are designed to promote competition and further the interests of residential and business consumers. We are reviewing three access markets: wholesale fixed analogue exchange lines (the standard fixed lines used by residential and business consumers) and two markets that enable the delivery of digital telephone services to businesses to support applications such as call centre operations. The two digital exchange line markets are ISDN30 and ISDN2. In addition, we are reviewing wholesale call origination – a complementary service to the provision of analogue and digital exchange lines, which enables consumers to make calls over those lines. This review also includes wholesale call termination, a connection service provided by a fixed telecoms provider when their customer receives a call. If consumers call a UK geographic number (a number starting 01 or 02), their provider pays the terminating provider a wholesale charge, called a fixed termination rate. This consultation considers the level of competition in each of these five wholesale markets. Where competition is not working effectively, we propose regulation that should apply for the period 1 October 2017 to 30 September 2020. We will take all responses to this consultation into account before reaching our final conclusions, which we plan to publish in a statement in September 2017. -

View Annual Report

BT ANNUAL REPORT AND FORM 20-F 2013 USER GUIDE Overview OVERVIEW Welcome to the BT Annual Report and Form 20– F 2013 . In this interactive pdf you can do many things to help you easily access the information that you want, whether that’s printing, searching for a section or website. These are explained below. Strategy 1. Document controls BUSINESS REVIEW Use the document controls located in the top right corner to help you navigate through this report. Search Print Go to Back/forward Fast link to contents one page previous page viewed Business 2. Links within this document Examples Throughout this report there are links to pages, other For further discussion of these items see pages 33 and 47 to 48. sections and web addresses for additional information. by line of business, and for the group, is provided in the table at the foot of pages 34 to 35. FINANCIAL REVIEW 3. Navigating with tabs Use the tabs to quickly go to the start of a Performance different section. Performance Governance Governance Financial statements Financial statements Additional information BT Group plc Annual Report & Form 20-F 2013 view VIEW BT Group plc Over Annual Report & OVER Form 20-F 2013 Strategy BUSINESS REVIEW Business FINANCIAL REVIEW Performance Governance BT Group plc Registered office: 81 Newgate Street, London EC1A 7AJ Registered in England and Wales No. 4190816 Produced by BT Group www.bt.com Financial statements PHME 67064 Printed in England by Pindar Scarborough Ltd Design by saslondon.com Typeset by RR Donnelley Printed on Amadeus 50 Silk which is made from 50% de-inked, post-consumer waste and 50% virgin fibre. -

Sensor Networks and Their Applications: Investigating the Role of Sensor Web Enablement

Sensor Networks and Their Applications: Investigating the Role of Sensor Web Enablement A Thesis submitted for the degree of Communications Engineering Doctorate (EngD) Jeffery George Foley Communications & Information Systems Research Group Department of Electronic & Electrical Engineering University College London BT Group plc, BT Centre, 81 Newgate Street, London EC1A 7AJ March 2014 Statement of Originality I, Jeffery George Foley, confirm that the work presented in this thesis is my own. Where information has been derived from other sources, I confirm that this has been indicated in the thesis. Signed: _______________________________ Date: ________________________________ 2 Abstract The Engineering Doctorate (EngD) was conducted in conjunction with BT Research on state-of-the-art Wireless Sensor Network (WSN) projects. The first area of work is a literature review of WSN project applications, some of which the author worked on as a BT Researcher based at the world renowned Adastral Park Research Labs in Suffolk (2004-09). WSN applications are examined within the context of Machine-to-Machine (M2M); Information Networking (IN); Internet/Web of Things (IoT/WoT); smart home and smart devices; BT’s 21st Century Network (21CN); Cloud Computing; and future trends. In addition, this thesis provides an insight into the capabilities of similar external WSN project applications. Under BT’s Sensor Virtualization project, the second area of work focuses on building a Generic Architecture for WSNs with reusable infrastructure and ‘infostructure’ by identifying and trialling suitable components, in order to realise actual business benefits for BT. The third area of work focuses on the Open Geospatial Consortium (OGC) standards and their Sensor Web Enablement (SWE) initiative. -

Procurementscotlandcatalogue

Identity Guidelines Restricted Commercial - Fixed Telephony | Page 2 Contents 1. Company overview 2. Details of key contacts 3. Products and services 4. Tariffs 5. Migration 6. Ordering and billing 7. Customer services and support 8. Service credits Procurement Scotland Telecoms Team. Call us on 0131 244 0453 or email [email protected] Restricted Commercial - Fixed Telephony | Page 3 1. Company overview Who we are More than just a supplier Telefonica ø UK Ltd is a leading communications We understand what’s important for you. We know company with over 20 million customers. ø your goals and can help you reach them. Thousands is part of Telefonica SA, the largest integrated of public sector clients already choose ø. We are Telecommunications Operator in the world by helping organisations like yours to take a look at how customer base. The Telefonica Group has a heritage they work and the technology they use to stay in touch of delivering innovative solutions to the public sector. - not just mobiles - and see how it can be improved. In the UK, ø has a dedicated local government team, They trust us. And as a Procurement Scotland Supplier which works closely with public sector organisations you can rely on us to give you just what you need. to understand their key drivers and needs. As an approved supplier to the Procurement Scotland Working for you Framework, ø offer a range of solutions for local How can we help? We can make a difference to your government designed to support more efficient and bottom line, make your technology work for you and effective services. -

View Annual Report

BT Group plc Annual Report & Form 20-F 2016 Broadening and deepening our customer relationships Front cover and above image Bethany Johnson, BT apprentice Bethany’s Story The cover of our 2016 Annual Report features Bethany Johnson, a service delivery apprentice in her second year with the company. Working for Openreach, Bethany makes a difference to customers every day, helping them to get connected and making sure they’re happy with their service. For Bethany, her role is about earning the customers’ trust and doing a vital job right, the first time. Bethany is one of 1,700 apprentices and graduates that we’ve hired in the past two years, with a further 1,400 roles announced in February 2016. We’ll also have returned 2,000 contact centre roles to the UK as part of our commitment to answer more customer service calls within the UK. This is one Online Annual Report part of the investment we’re making to deliver superior customer service and www.bt.com/annualreport to grow our business. More than 25m businesses and homes now have access to superfast broadband and the UK has seen a massive increase in average broadband speed – from just 4Mbps in 2009 to almost 29Mbps in 2015. Together with the efforts we are making to transform our costs, our focus on investment and growth will deliver our strategy of broadening and deepening our customer relationships. Find out more throughout this Annual Report and on our website. Delivering our purpose update www.btplc.com/Purposefulbusiness Watch Bethany’s story online www.btplc.com/bethany Welcome to BT Group plc’s Annual Report 2016 This is the BT Annual Report for the year ended Contents 31 March 2016. -

View Annual Report

BT Group plc Annual Report & Form 20-F 2008 plc Annual Report & Form Group BT Annual Report & Form 20-F 2008 Keeping BT ahead of the game BT Group plc Annual Report & Form 20-F 2 Strategic and performance review 4 Our business in brief 6 Chairman’s message 8 Chief Executive’s statement Overview Welcome to our 2008 Annual Report. 11 Business review 37 Financial review We have divided the report into four sections: 58 Corporate governance Overview: this section contains a summary of the strategy, performance and activities of the group as well as messages from your Chairman and Chief Executive Report of the Directors: this section provides detailed information about what the businesses within BT do Report of the Directors and their financial performance in the year. The section also gives details of BT’s commitment to the wider community and how we govern ourselves 84 Statement of directors’ responsibilities Financial statements: this section includes the 85 Report of the independent auditors – consolidated financial statements, the notes to the consolidated financial statements financial statements and other useful summary 88 Consolidated financial statements financial information and operational statistics 139 Glossary of terms and US equivalents 140 Report of the independent auditors – Additional information: this section provides helpful parent company information for shareholders and a glossary and index 141 Financial statements of BT Group plc to make this report easier to navigate 144 Subsidiary undertakings and associate 145 Quarterly analysis of revenue and profit Financial statements 146 Selected financial data 150 Financial statistics BT Group plc is a public limited company registered in England and Wales and listed on the London and New York stock exchanges. -

View Annual Report

BT Group plc Annual Report and Form 20-F 2004 and Form Group plc Annual Report Delivering today Investing for tomorrow BT Group plc Registered office: 81 Newgate Street, London EC1A 7AJ Registered in England and Wales No. 4190816 Produced by BT Group Annual Report and Designed by Pauffley, London Typeset by Greenaways Printed in England by Pindar plc Form 20-F 2004 Printed on elemental chlorine-free paper sourced from sustainable forests www.bt.com BT is one of Europe’s leading providers of telecommunications services. Its principal activities include local, national and international telecommunications services, higher-value broadband and internet products and services, and IT solutions. In the UK, BT serves over 20 million business and residential customers with more than 29 million exchange lines, as well as providing network services to other operators. Contents Financial headlines 2 Chairman’s message 3 Chief Executive’s statement 4 Operating and financial review 6 Business review 6 Five-year financial summary 24 Financial review 26 Our commitment to society 47 Board of directors and Operating Committee 49 Report of the directors 51 Corporate governance 52 Report on directors’ remuneration 58 Statement of directors’ responsibility 72 Report of the independent auditors 73 Consolidated financial statements 74 United States Generally Accepted Accounting Principles 124 Subsidiary undertakings, joint ventures and associates 134 Quarterly analysis of turnover and profit 135 Financial statistics 136 Operational statistics 137 Risk factors 138 Additional information for shareholders 140 Glossary of terms and US equivalents 154 Cross reference to Form 20-F 155 Index 158 BT Group plc is a public limited company registered in England and Wales, with listings on the London and New York stock exchanges. -

Review of the Fixed Narrowband Services Markets Draft Statement on the Proposed Markets, Market Power Determinations and Remedies

Review of the fixed narrowband services markets Draft statement on the proposed markets, market power determinations and remedies Redacted For Publication EMBARGOED COPY – for the European Commission and National Regulatory Authorities. Contains market sensitive information. Not for public release prior to publication by Ofcom at 0700 BST on 21 August 2013. Draft Statement Notified to the European 20 August 2013 Commission : Review of the fixed narrowband services markets Contents Section Page 1 Executive Summary 1 2 Background 7 3 Market overview and developments in the United Kingdom 19 4 Retail narrowband services in the Hull Area 29 5 Wholesale call origination 39 6 Wholesale fixed geographic call termination 143 7 Transit and conveyance services 183 8 Price regulation of wholesale call termination and origination markets: LRIC, common cost recovery, symmetry and APCCs 199 9 Cost modelling for the charge control on wholesale call termination and wholesale call origination 229 10 Interconnect circuits 237 11 Charge control specification 278 Annex Page 1 Proposals for SMP conditions excluding charge controls 295 2 Proposals for charge controls for call origination, call termination, interconnect circuits, and project management, policy and planning 334 3 Proposal for NTS retail uplift 359 4 [Draft] direction to provide interconnect circuit KPIs 369 5 Network and technology choice for the NCC 374 6 NCC model approach and design 404 7 CSMG report on NGN modules of NCC model 454 8 Network cost model outputs and crosschecks 455 9 Effective -

BT Group Plc Annual Report & Form 20-F 2009 BT GROUP PLC ANNUAL REPORT & FORM 20-F

BT Group plc Annual Report & Form 20-F 2009 BT GROUP PLC ANNUAL REPORT & FORM 20-F 2 Financial summary 3 Chairman’s message 4 Chief Executive’s statement 5 This is BT 6 How we are structured 8 Business review 26 Other matters 32 Financial review BT Group plc Annual Report & Form 20-F 2009 50 Board of Directors and Operating Committee 52 The Board 54 Report of the Audit Committee 56 Report of the Nominating Committee 56 Report of the Committee for Responsible and Sustainable Business 57 Report on directors’ remuneration 70 Directors’ information 71 Business policies 74 Shareholders and Annual General Meeting 76 Statement of directors’ responsibilities 77 Report of the independent auditors – consolidated financial statements 79 Consolidated financial statements 136 Glossary of terms and US equivalents 137 Report of the independent auditors – parent company BT Group plc is a public limited company registered in England and Wales and listed on the London and New York stock 138 Financial statements of BT Group plc exchanges. It was incorporated in England and Wales on 30 March 2001 as Newgate Telecommunications Limited with 141 Subsidiary undertakings and associate the registered number 4190816. Its registered office address is 81 Newgate Street, London EC1A 7AJ. The company 142 changed its name to BT Group plc on 11 September 2001. Following the demerger of O2 in November 2001, the Quarterly analysis of revenue and profit continuing activities of BT were transferred to BT Group plc. 143 Selected financial data British Telecommunications plc is a wholly owned subsidiary of BT Group plc and encompasses virtually all the 145 Financial statistics businesses and assets of the BT group. -

Annual Report & Form 20-F 2009

BT Group plc Annual Report & Form 20-F 2009 BT GROUP PLC ANNUAL REPORT & FORM 20-F 2 Financial summary 3 Chairman’s message 4 Chief Executive’s statement 5 This is BT 6 How we are structured 8 Business review 26 Other matters 32 Financial review BT Group plc Annual Report & Form 20-F 2009 50 Board of Directors and Operating Committee 52 The Board 54 Report of the Audit Committee 56 Report of the Nominating Committee 56 Report of the Committee for Responsible and Sustainable Business 57 Report on directors’ remuneration 70 Directors’ information 71 Business policies 74 Shareholders and Annual General Meeting 76 Statement of directors’ responsibilities 77 Report of the independent auditors – consolidated financial statements 79 Consolidated financial statements 136 Glossary of terms and US equivalents 137 Report of the independent auditors – parent company BT Group plc is a public limited company registered in England and Wales and listed on the London and New York stock 138 Financial statements of BT Group plc exchanges. It was incorporated in England and Wales on 30 March 2001 as Newgate Telecommunications Limited with 141 Subsidiary undertakings and associate the registered number 4190816. Its registered office address is 81 Newgate Street, London EC1A 7AJ. The company 142 changed its name to BT Group plc on 11 September 2001. Following the demerger of O2 in November 2001, the Quarterly analysis of revenue and profit continuing activities of BT were transferred to BT Group plc. 143 Selected financial data British Telecommunications plc is a wholly owned subsidiary of BT Group plc and encompasses virtually all the 145 Financial statistics businesses and assets of the BT group.