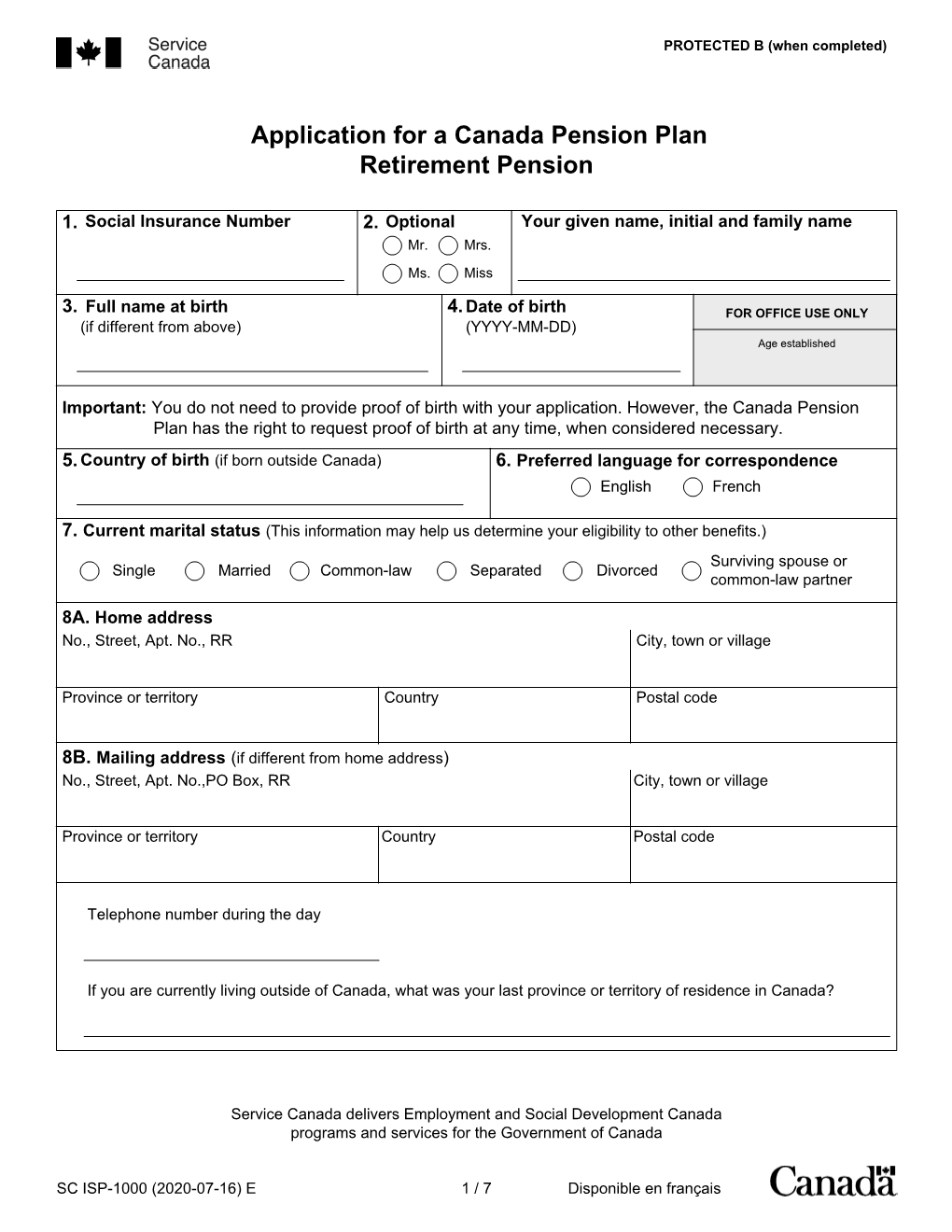

Application for a Canada Pension Plan Retirement Pension

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Information Sheet for the Canada Pension Plan Retirement Pension

Information Sheet for the Canada Pension Plan Retirement Pension This information sheet provides step-by-step information on how to complete the application for a Canada Pension Plan (CPP) retirement pension. You can receive your pension anytime after the month of your th 60 birthday. For information on Canada's public pensions and for help estimating how much income you may need for your retirement, according to your personal financial situation, you can use the Canadian Retirement Income Calculator. This online tool is available at www.servicecanada.gc.ca. For More Information To learn more about Canada Pension Plan, Old Age Security Program and Service Canada online services, please visit our Web site at: www.servicecanada.gc.ca. In Canada and the United States, call English: 1-800-277-9914 French: 1-800-277-9915 TTY: 1-800-255-4786 From all other countries: 613-957-1954 (we accept collect calls) (Please have your Social Insurance Number ready when you call.) This information sheet contains general information concerning the Canada Pension Plan (CPP) retirement pension. If there are any differences between what is in the information sheet and the CPP legislation, the legislation is always right. Service Canada delivers Employment and Social Development Canada programs and services for the Government of Canada SC ISP-1000A (2020-07-16) E 1 / 8 Disponible en français Information Sheet for the Canada Pension Plan Retirement Pension Question 4: Proof of Birth You do not need to provide proof of birth with your application. However, the Canada Pension Plan has the right to request proof of birth at any time, when considered necessary. -

The CPP Take-Up Decision: Risks and Opportunities

Aging and Retirement The CPP Take-Up Decision Risks and Opportunities July 2020 2 The CPP Take-Up Decision Risks and Opportunities AUTHORS Principal Investigator: SPONSORS Canadian Institute of Actuaries Bonnie-Jeanne MacDonald, PhD, FSA, FCIA Society of Actuaries Director of Financial Security Research National Institute on Ageing Ryerson University Co-Investigators: Richard Morrison, PhD Employment and Social Development Canada (formerly HRSDC) (retired) Marvin Avery Employment and Social Development Canada (formerly HRSDC) (retired) Project Oversight Group: Keith Ambachtsheer Bob Baldwin Robert Brown Doug Chandler Peter Hayes Ben Marshall Bernard Morency Lars Osberg Richard Shillington Steven Siegel Michel St-Germain Michael Wolfson Malcolm Hamilton External Reviewers: Neal Leblanc Adam Kehler Barbara Sanders Kevin Moore Jean-Claude Ménard Caveat and Disclaimer The opinions expressed and conclusions reached by the authors are their own and do not represent any official position or opinion of the Canadian Institute of Actuaries, the Society of Actuaries, or their respective members. The Canadian Institute of Actuaries and Society of Actuaries make no representation or warranty to the accuracy of the information. Copyright © 2020 by the Canadian Institute of Actuaries and Society of Actuaries. All rights reserved. Copyright © 2020 Canadian Institute of Actuaries and Society of Actuaries 3 CONTENTS Executive Summary .................................................................................................................................................. -

REDUCING POVERTY 1952-1967 Summary

REDUCING POVERTY 1952-1967 Summary Old Age Security (OAS), the first universal pension for Canadians, was introduced in 1952: · The maximum pension was $40 per month or $480 per year. · The pension was available to Canadians 70 years of age and over who had lived in Canada for at least 20 years. · Status Indians were included. · For the first time, Canadian seniors could receive a pension without undergoing a “means test1 ”. However, retirement still meant a drastically reduced standard of living for many people. There was growing public and political support for a universal, employment-based pension plan that would be portable from job to job. The provinces agreed to another Constitutional amendment to extend federal government powers beyond legislati that applied only to old age. As a result, the contributory Canada Pension Plan (CPP) and Quebec Pension Plan (QPP)2 were established in 1966: 1 The "Means Test" The "means test" was used to determine a senior's income, or means. The test involved provincial pension authorities calculating all aspects of a senior's income (e.g., pensions, income from boarding house operations, etc.) as well as the value of "perks" they received, such as free room and board. The means test, however, did not take into account how much money a person needed to pay for food, shelter, clothing, fuel, utilities or household supplies. If a senior's annual income, including pensions, was greater than $365, he or she was not eligible for the Old Age Pension. The income each received determined the amount of assistance to which he or she was entitled. -

Understanding the Regulatory Framework Governing Private and Public Pensions

fraserinstitute.org Contents Executive summary / iii 1. Introduction / 1 2. Basics of pension plans / 3 3. What laws govern pension plans? / 13 4. Regulatory differences between CPP and other pension plans / 18 5. Concluding thoughts and future research / 20 References / 21 Appendix: Characteristics of various private and public pension plans / 24 About the authors / 44 Acknowledgments / 44 Publishing information / 45 Supporting the Fraser Institute / 46 Purpose, funding, & independence / 46 About the Fraser Institute / 47 Editorial Advisory Board / 48 fraserinstitute.org / i fraserinstitute.org Executive summary A common argument made to expand the Canada Pension Plan (CPP) is that it is cheap to administer. While many studies have cast doubt on this claim, why would a public pension plan be cheaper to administer than a private one? Many factors affect the cost of running a pension plan, but a crucial yet over- looked factor is the regulatory landscape that private pension plan managers must adhere to and the regulations that their public sector counterparts are exempt from. This paper examines the regulatory requirements among various types of public and private pension plans to determine whether private pension plans are at a cost disadvantage with respect to public ones, with a specific focus on the CPP. In short, the paper finds that the CPP—due to its charac- teristics and legal obligations—enjoys a marked cost advantage over other pension plans. First, consider the legal responsibilities of the various plan administra- tors. Broadly speaking, private pension plans are subject to a variety of statu- tory and common law regulations. These require the pension plan admin- istrators to act as fiduciaries. -

The Evolution of the Canadian Pension Model

The Evolution of the Canadian Pension Model Practical Lessons for Building World-class Pension Organizations © 2017 International Bank for Reconstruction and Development / The World Bank 1818 H Street NW, Washington DC 20433 Telephone: 202-473-1000; Internet: www.worldbank.org This work is a product of the staff of The World Bank with external contributions. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. Rights and Permissions The material in this work is subject to copyright. Because the World Bank encourages dissemination of its knowledge, this work may be reproduced, in whole or in part, for noncommercial purposes as long as full attribution to this work is given. All queries on rights and licenses should be addressed to the Office of the Publisher, The World Bank, 1818 H Street NW, Washington, DC 20433, USA; fax: 202-522-2625; e-mail: [email protected]. Design & Layout: Aichin Lim Jones and Amy Quach Photo Credits: Shutterstock Table of Contents Acknowledgments .......................................................................................................................... -

Geared for Growth

2017 Annual Report Geared for growth Building what matters Financial highlights 2 President’s message 4 Leadership team 7 Chairman’s message 8 Board of directors 9 Scorecard 10 2017 highlights 12 Offering and services 14 Company structure 16 Capital 17 Infrastructure 18 Power 20 Oil & Gas 22 Mining & Metallurgy 24 Atkins 26 New configuration 28 2017 Management’s discussion and analysis 29 Information for shareholders 222 Values that guide us The benefits we bring Our values are the essence of our For over 100 years, we’ve been company’s identity. They represent developing and delivering the right how we act, speak and behave together, projects to our clients and their and how we engage with our clients customers. Our effective execution and stakeholders. strategies allow us to expertly manage project risk and ensure our clients’ Safety return on investment. Today, we’re We put safety at the heart of everything we do, recognized for our sustainable project to safeguard people, assets and the environment. execution and tangible contributions Integrity to improving people’s lives around We do the right thing, no matter what, and are accountable for our actions. the world. Collaboration We work together and embrace each other’s unique contribution to deliver amazing results for all. Helping build what Innovation matters in communities We redefine engineering by thinking boldly, proudly and differently. around the world. The Pierre Lassonde pavilion of the Musée national des beaux-arts du Québec – Canada SNC-Lavalin 2017 Annual Report 1 Financial highlights 2017 revenues BY BY INDUSTRY GEOGRAPHIC SEGMENT AREA 36% Oil & Gas 14% Power 52% Americas 14% Asia-Pacific Mining & Middle East Infrastructure Europe 23% 5% Metallurgy 23% & Africa 11% 19% Atkins 3% Capital SNC-Lavalin is a partner of the Signature on the Saint Lawrence consortium responsible for the design, construction, and operations and maintenance of the New Champlain Bridge Corridor Project under a public-private partnership with the Government of Canada. -

When Minority Government Worked: the Pearson Legacy

WHEN MINORITY GOVERNMENT WORKED: THE PEARSON LEGACY Tom Kent As senior policy adviser to the prime minister, our Founding Editor was closely involved in the minority governments of the tumultuous Pearson era from 1963 to 1968. After a bungled first year in office, as Tom Kent recalls here, the achievements of the next four years include the Canada-Quebec Pension Plan, universal health care, and others in this era of “co-operative federalism,” all of them adopted in a minority House. “The fundamentals that worked then,” he concludes, “firm objectives, sensitivity to the great needs of the times, co- operative federalism, cabinet government — are as necessary today.” À titre de conseiller principal en politiques du premier ministre, notre rédacteur fondateur Tom Kent s’est trouvé de 1963 à 1968 aux premières loges de la période agitée des gouvernements minoritaires de Lester B. Pearson. Il rappelle ici qu’après une première année bousillée, les quatre suivantes ont produit des réalisations majeures, notamment le Régime de pensions Canada-Québec, le programme universel de soins de santé et plusieurs autres mesures clés attribuables au « fédéralisme coopératif » cher à Pearson, toutes adoptées par un Parlement minoritaire. « Les principes fondamentaux qui ont inspiré ces actions — fermeté des objectifs, sensibilité aux grands besoins de l’époque, fédéralisme coopératif et gouvernement par l’exécutif — restent aujourd’hui tout aussi nécessaires », conclut-il. he Pearson-led Liberals of the 1960s could not win a First, in the 1960s the Liberals had firm, coherent objec- parliamentary majority. In four years the two minor- tives. They knew what they wanted to do for Canada. -

Proxy Circular and Navigation and Task Buttons Notice of Annual Meeting of Shareholders

Welcome to SNC-Lavalin’s Management Proxy Circular and Navigation and Task buttons Notice of Annual Meeting of Shareholders. This pdf version of the Circular has been enhanced with navigation and Close Document task buttons to help you navigate through the document and Search find the information you want more quickly. The table of contents and URLs link to pages and sections within the document as well Print as to outside websites. The task buttons provide quick access to Save to Disk search, print, save to disk and view options, but may not work on all browsers or tablets. Two Page View Single Page View Table of Contents Next Page Previous Page Last Page Visited Table of Contents INVITATION TO SHAREHOLDERS 3 / NOTICE OF 2018 ANNUAL MEETING OF SHAREHOLDERS AND NOTICE OF AVAILABILITY OF MEETING MATERIALS 4 / VOTING INFORMATION 6 / BUSINESS OF THE 2018 ANNUAL MEETING OF SHAREHOLDERS 9 / INFORMATION ON OUR DIRECTOR NOMINEES 11 / DIRECTORS’ COMPENSATION DISCUSSION AND ANALYSIS 18 / BOARD COMMITTEE REPORTS 22 / EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS 29 / STATEMENT OF CORPORATE GOVERNANCE PRACTICES 50 / OTHER INFORMATION 63 / SCHEDULE A – SHAREHOLDER PROPOSALS 64 / SCHEDULE B – MANDATE OF THE BOARD OF DIRECTORS 67 / SCHEDULE C – SUMMARY OF LEGACY LONG-TERM INCENTIVE PLANS 70 Glossary of Terms AIF Annual Information Form Executive Committee A committee established by AIP Annual Incentive Plan management comprised of the President and CEO and eleven (11) other Senior Officers Atkins WS Atkins plc G&E Committee Governance and Ethics Committee -

Canadian Pension System: Problems and Reform by Mengxue Zhang

Canadian Pension System: Problems and Reform by Mengxue Zhang Thesis submitted in partial fulfillment of the requirements for the Degree of Bachelor of Arts with Honours in Economics Acadia University April, 2011 © Copyright by Mengxue Zhang, 2011 This thesis by Mengxue Zhang is accepted in its present form by the Department of Economics as satisfying the thesis requirements for the degree of Bachelor of Arts with Honours Approved by the Thesis Supervisors __________________________ ____________________ Dr. Burc Kayahan Date __________________________ ____________________ Dr. Xiaoting Wang Date Approved by the Head of the Department __________________________ ____________________ Dr. Paul Hobson Date Approved by the Honours Committee __________________________ ____________________ Dr. Sonia Hewitt Date ii I, Mengxue Zhang, grant permission to the University Librarian at Acadia University to reproduce, loan or distribute copies of my thesis in microform, paper or electronic formats on a non-profit basis. I, however, retain the copyright in my thesis. _________________________________ Signature of Author _________________________________ Date iii Acknowledgements The completion of this thesis would not have been possible without the assistance of many special and wonderful individuals. Foremost, I would like to thank my dear supervisors, Dr. Burc Kayahan and Dr. Xiaoting Wang. Their guidance and supports greatly helped me to overcome the difficulties that I faced in completing this thesis. Thanks for their patience in reading and editing my drafts; it must have been an excruciating experience. I would also like to thank Dr. Paul Hobson, for encouraging me to make this writing decision and sparing time to give me his insightful comments. Special thanks to our department secretary Ms. -

Optrust Employer Update #9

Employer update Issue Number 09 || November 28, 2002 OPSEU Pension Plan Improvements Now in Effect Improvements to the OPSEU Pension Plan “Points off” for early reduced pensions selected by OPSEU earlier this fall are now in extended effect. In September, OPSEU’s Executive Board The “points off” program for active members and chose to allocate $467 million in plan gains to pay deferred pensioners who choose to retire early for a package of temporary and permanent benefit with a reduced pension at age 55 or older has improvements, an extended contribution reduction been extended to December 31, 2005. Points off for members and a fund to stabilize member was previously scheduled to expire on November contributions in the future. Both plan sponsors – 30, 2004. OPSEU and the Government of Ontario – have now signed the plan amendments needed to Under this program, the pension reduction is implement these changes. based on the number of years the member would need to reach one of the of Plan’s permanent The $467 million represents the members’ and unreduced retirement options – Factor 90, the pensioners’ unallocated share of funding gains 60/20 option or age 65 – if he or she continued realized by the Plan in 1999, 2000 and 2001. In working. Under the Plan’s normal rules, the total, the Plan experienced gains of $867 million reduction is based on the number of years the for the period, which were shared between the member is from age 65. members and pensioners and the Government of Ontario. The province is still considering its CPP offset reduced options for the employer share of the gains. -

Canada Pension Plan Amended

became operational in 1951. It pays flat-rate benefits to all persons in Canada ‘aged 65 and Social Security Abroad over without regard to need and subject only to a residence requirement. The program is financed out of general revenue and does not involve a payroll tax. This universal benefit, initially set Caruda Pension Plan Amended* at $40 per month, has gradually been increased through cost-of-living adjustments to its present Legislative changes in the Canada Pension level of $123.42 per person *per month (April Plan (CPP) enacted by Parliament in November 1075). In 1067, an income-tested supplement, 1374 came into force January 1, 1975. These known as the guaranteed income supplement, was recent amendments include (1) a gradual increase added to the pension under the Old Age Security in tile earnings ceiling for social security con- Act for persons with little or no income beyond a tributions over the next several years to restore flat-rate benefit. For a single person or a married parity with the average wage in industry ; (2) a person whose spouse is not a pensioner, the sup- midcning of coverage through lowering of the plementation of income may be as much as $86.57 floor on the amount of earnings exempt from per month (April 1975). social security contributions; (3) the elimination The second tier is a national contributory of the earnings test for retired persons aged 65 earnings-related pension program known as the and over; and (4) the equalization of benefits CPP. This program, which came into effect in for widowers and widows with children. -

Public Pension Plans in the United States and Canada

Upjohn Institute Press Public Pension Plans in the United States and Canada Morley Gunderson University of Toronto Douglas Hyatt University of Toronto James E. Pesando University of Toronto Chapter 10 (pp. 381-411) in: Employee Benefits and Labor Markets in Canada and the United States William T. Alpert, and Stephen A. Woodbury, eds. Kalamazoo, MI: W.E. Upjohn Institute for Employment Research, 2000 DOI: 10.17848/9780880995511.ch10 Copyright ©2000. W.E. Upjohn Institute for Employment Research. All rights reserved. 10 Public Pension Plans in the United States and Canada Morley Gunderson University of Toronto Douglas Hyatt University of Toronto James E. Pesando University of Toronto Increased attention is being paid to the similarities and differences between Canada and the United States in a variety of areas of social policy. The similarities provide elements of a natural experiment to facilitate controlling for the myriad of observable and unobservable factors that can affect behavior. They also make it more likely that the experiences in one country have relevance for the other country. The differences provide variation in a number of factors that are of interest for their possible impact on behavior. The differences are especially of interest when they involve variables that are subject to a degree of pol icy control. These similarities and differences have been exploited in a number of areas of social policy. Card and Freeman (1993) analyzed the impact of differences in labor-market and social policies on various outcomes, including wage and income inequality, poverty, union den sity, unemployment, and immigration. Chiswick (1992) looked at the impact of differences in immigration and language policies on such factors as immigrant assimilation, fertility, domestic earnings, lan guage fluency, and the economic returns to that fluency.