Introduction

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Star Textile Mills LTD. A-41 SITE, Karachi

S# M # Company Name Mailing Address Tel # Fax # Name of Authorized Representative Designation Mobile-1 Email-1 NIC # NTN ST # 1 0026 Star Textile Mills LTD. A-41 SITE, Karachi. 32561127-29, 3251149 32580836 Mian MUHAMMAD ZAHID Law Consultant 0300-9243820 [email protected] 42201-6422669-5 069845-9 02-02-5111-019-19 2 0028 A. B. (Al-Hashmi Brothers) (PVT) LTD. H-6 SITE, Karachi. 32572963 Syed Shakir Hashmi Director 0333-2283020 [email protected] 42000-7647196-1 0704163-2 02-02-2811-003-55 3 0041 KOHINOOR CHEMICAL CO. (PVT) LIMITED 9TH FLOOR, TIBBET CENTRE, M. A. JINNAH ROAD, KHI 32564553, 32563425, 32563730, 32570144-6, 32571127 Mr. Aslam Allawala 0300-2150567 [email protected] 0710919-9 02-06-3302-001-91 4 0043 AHMED FOODS (PVT) LTD. D-112, AHMED HOUSE, SITE, KARACHI 111-987-789, 32563520-4 32578196 SYED HASIB AHMED Executive Director 0300-8269430 [email protected] 42101-0715400-3 0704016-4 02-06-2100-002-37 5 0046 HELIX PHARMA (PVT) LIMITED A-56, SITE, KARACHI 32562507, 32563856, 32563882, 32570182-3 32564393 TANWEER AHMED GM-HR & Admin 0333-0202206 [email protected] 42201-0793883-7 0710606-8 11-01-7010-002-46 6 0049 INDUS PENCIL INDUSTRIES (PVT) LIMITED B-54, SITE, KARACHI 32573214-7 32564931 MR. NAEEM AKHTAR YOUSUF 0300-8221852 [email protected] 42201-0468514-1 0710696-3 02-02-3208-016-64 7 0052 EXIDE PAKISTAN LIMITED A-44, SITE, Karachi 32578061-4, 32574610 32591679 SYED ZULQARNAIN SHAH GM 0333-2244702 [email protected] 42000-0479156-9 0676659-5 02-01-8507-001-64 8 0061 PAKISTAN CABLES LIMITED B-21, SITE, KARACHI 32561170-5 32564614 Aslam Sadruddin 0300-9227015 [email protected] 42301-4759734-3 0711509-1 02-02-7605-001-82 9 0067 Pakistan Paper Products Limited D-58 SITE, Karachi. -

Directors Training Programme Module 1: September 18 - 19, 2015 Module II: October 2 - 3, 2015 Serial # Participant Name Company Name Email City Education Status

Enhancing Board Effectiveness - Directors Training Programme Module 1: September 18 - 19, 2015 Module II: October 2 - 3, 2015 Serial # Participant Name Company Name Email City Education Status 1 Muhammad Usman Hanif Fatima Group (Reliance Sacks) [email protected] Lahore Cantt Chartered Accountancy Certified Director 2 Firasat Ali Habib Metropolitan Bank Limited Karachi [email protected] Karachi MA Agricultural Economics Certified Director 3 Haider Zaidi Haris Enterprises [email protected] Islamabad BE Certified Director 4 Irshad Ali S. Kassim Karam Ceramics Limited [email protected] Karachi Master of Business Administration Certified Director 5 Dr. Khurram Tariq Kay & Emms (Private) Limited [email protected] Faisalabad MBBS Certified Director 6 Zahid Wazir Khan KIPS [email protected] Lahore B.Sc Mechanical Engg Certified Director 7 Muhammad Samiullah Siddiqui Linde Pakistan Limited. [email protected] Karachi Bachelor of Commerce Certified Director 8 Nasir Ali Zia Masood Textile Mills Limited [email protected] Faisalabad MPA Certified Director Fellow member of Institute of Chartered 9 Kamran Nishat Muller & Phipps Pakistan (Private)Limited [email protected] Karachi Certified Director Accountants of Pakistan (FCA) Pak Brunei - Primus Investment Management Company 10 Ahmed Ateeq [email protected] Karachi Master Of Business Administration Certified Director Limited 11 Masood Tahir Pak Elektron Limited Lahore FCA Certified Director 12 Awais Yasin Punjab Saaf Pani Co [email protected] Lahore ACMA/LLB Certified Director 13 Mohammad Kashif Punjab Saaf Pani Co [email protected] Lahore M. Sc. Certified Director 14 Irfan Rahman Malik Rahman Sarfaraz Rahim Iqbal Rafiq, Chartered Accountants [email protected] Lahore NA Certified Director 15 Mohammad Azeem Rashid RS Equities (Private) Limited [email protected] Lahore Bachelors in Business Adminstration Certified Director 16 Abid Ur Rehman Samsons Group [email protected] Lahore Doctor of Medicine Certified Director 17 M. -

Newsletter 74

Quarterly Newsletter Central Depository Company A RICH NATION Gems Mining Gold Mining Salt Mining Coal Mining Nature has bestowed Pakistan with generous treasures of size emeralds in South Asia. Recently, a 2500 year old earring gemstones which make Pakistan prominent in the mineral was found in France to have an emerald that originated most world. The world's most desired colored gemstones, such as likely in these Mingora mines. Sometimes locals have also Ruby, Emerald, Sapphire, Topaz, Aquamarine, Peridot, found this gemstone in the Swat River. Amethyst, Morganite, Zoisite, Spinel, Sphene, and Tourmaline, are found in Pakistan. The northern and northwestern parts of Being the sole depository in Pakistan, established and Pakistan are shrouded by the three world-famous mountain functioning since the last two decades, CDC has a scintillating ranges of Hindukush, Himalaya, and Karakorum. In these prominence in the Capital Market of Pakistan. It is undoubtedly mountains are found nearly all the minerals Pakistan currently a precious gemstone of the Capital Market infrastructure, with offers to the world market, including these precious gemstones. an excellent reputation and legacy of upholding the principles of reliability, trust and integrity. CDC’s perseverance to One of these enthusiastically glittering gems, Swat Emerald, is maintain and ensure complete investor confidence and its hexagonal in shape and has transparent, deep sea green colour. providence to stay abreast with technological advancement The Mingora mines in Swat Valley host some of the best, small makes it a unique gemstone of the Pakistan Capital Market. Head Office: Lahore Branch: CDC House, 99-B, Block ‘B’, S.M.C.H.S., Main Mezzanine Floor, South Tower, LSE Plaza, 19 Shahrah-e-Faisal, Karachi - 74400. -

First Quarter Report 2006

QUARTERLY REPORT Unaudited First Quarter Ended March 31, 2006 Packages Limited Contents Company information 2 Directors’ review 3 Balance sheet 6 Profit and loss account 8 Cash flow statement 9 Statement of changes in equity 10 Selected notes to the financial statements 11 Packages Group consolidated financial statements 15 Directors’ review on consolidated financial statements 17 Consolidated balance sheet 18 Consolidated profit and loss account 20 Consolidated cash flow statement 21 Consolidated statement of changes in equity 22 Selected notes to the consolidated financial statements 23 COMPANY INFORMATION Board of Directors Bankers Asadullah Khawaja ABN Amro Bank (Chairman) Allied Bank Limited Kamal Afsar Askari Commercial Bank Limited Khalid Yacob Bank Al-Habib Limited Kirsten Rausing Citi Bank N.A. Crescent Commercial Bank Limited Markku Juha Pentikainen Deutsche Bank A.G. Mujeeb Rashid Faysal Bank Limited Shamim Ahmad Khan Habib Bank Limited Syed Hyder Ali Habib Bank A.G. Zurich (Managing Director & Chief Executive) MCB Bank Limited Syed Shahid Ali NIB Bank Limited Tariq Iqbal Khan PICIC Commercial Bank Limited Standard Chartered Bank Advisor Union Bank Limited Syed Babar Ali United Bank Limited Head Office & Works Company Secretary Shahrah-e-Roomi Adi J. Cawasji P.O. Amer Sidhu Lahore - 54760, Pakistan Executive Committee PABX : (042) 5811541-46, 5811191-94 Syed Hyder Ali - Chairman Cable : PACKAGES LAHORE Mujeeb Rashid - Member Fax : (042) 5811195, 5820147 Khalid Yacob - Member Karachi Factory Plot No. 6 & 6/1, Sector 28 Audit Committee Korangi Industrial Area, Shamim Ahmad Khan - Chairman Karachi-74900, Pakistan (Non-Executive Director) Tel. : (021) 5045320, 5045310 Tariq Iqbal Khan - Member Fax : (021) 5045330 (Non-Executive Director) Registered Office & Regional Sales Office Syed Shahid Ali - Member 4th Floor, The Forum (Non-Executive Director) Suite No. -

Kifayah Market Insights 28 April 2021

DAILY MARKET INSIGHTS 28-Apr-2021 Change Index points KMI 30 INDEX PERFORMANCE OVERVIEW PKR % Change Closing KMI 30 Index (437) 72,955 Contributing shares Closing Price - Rs. Oil & Gas Development Company Limited (2.42) (2.56) (135.40) 92.29 Pakistan Petroleum Limited (1.56) (1.84) (90.14) 83.19 Lucky Cement Limited (6.05) (0.70) (67.87) 854.12 KMI 30 INDEX VOLUMES Today 42 5 days average 58 59 14 days average Millions Source: https://formerdps.psx.com.pk/ & Calculations of Kifayah Investment Management Limited Top most buyer Top most seller PORTFOLIO INVESTMENT SUMMARY Other Organization Foreign Corporates Amount (Net) 566,619,364 (592,631,016) Buying / Selling sector wise composition Commercial Banks 85.94% 61.50% All other Sectors 5.20% 0.63% Technology and Communication 3.03% 8.32% Cement 0.13% 13.06% Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily FOREIGN PORTFOLIO INVESTMENT TREND Today (242) (163) 5 days average 20 14 days average Millions Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily & Calculations of Kifayah Investment Management Limited MATERIAL INFORMATION Disclosure of Interest by a Substantial Shareholder, bought 3,950 shares at the average Packages Limited price of Rs. 473.19 each on 27 April 2021. The Company is pleased to announce the facility registration of its two new facilities from U.S. Food & Drug Administration duly verified by Registrar Corp, Virginia, USA. The Searle Company Limited This registration will enable Searle Company to export its consumer products, Dietary and Nutritional Supplements to the USA Makret. -

Details of Ordinary & Preference Shares

DETAILS OF ORDINARY & PREFERENCE SHARES Paid-up Capital/Total % of Shares available Paid-up Capital/Total Shares in CDS % of Shares available with ref: to Short Issue incl. GOP holding with ref: to paid up Issue excl. GOP holding S. No. Security Id Security Name Live / Setup Date paid up capital excluding GoP Name capital including GoP holding Available Market Value Shares/Units holding Shares/Units 1 PK0015401018 AGRO ALLIANZ LIMITED - FREEZE *** AAL 7/Aug/2014 - - 1,183,294 - 1,183,294 - 2 PK0021701013 FATIMA ENTERPRISES LIMITED - FREEZE *** FAEL 23/Sep/2016 - - 14,231,052 - 14,231,052 - 3 PK0042301017 DADABHOY CONSTRUCTION TECHNOLOGY LIMITED - FREEZE *** DCTL 17/Aug/2018 - - 2,322,800 - 2,322,800 - 4 PK0075701018 SG ALLIED BUSINESSES LIMITED - FREEZE *** SGABL 10/Apr/2006 - - 15,000,000 - 15,000,000 - 5 PK0084101010 PAKARAB FERTILIZERS LIMITED PFL 16/Jul/2005 - - 450,000,000 - 450,000,000 - 6 PK0095901010 ALPHA BETA CAPITAL (PRIVATE) LIMITED ABCPL 26/May/2009 - - 875,000 - 875,000 - 7 PK0100301016 HABIB MANAGEMENT (PVT.) LIMITED HMPL 26/Aug/2010 - - 1,500,000 - 1,500,000 - 8 PK0105601014 SSGC LPG (PVT.) LIMITED ◘◘ SSGCLPG 27/Dec/2012 - - 100,000,000 - 100,000,000 - 9 PK0110501019 E2E LOGISTICS (PRIVATE) LIMITED ◘◘ E2EL 19/Aug/2015 - - 21,993,579 - 21,993,579 - 10 PK0112401010 ANS CAPITAL (PRIVATE) LIMITED ANSCPL 25/Apr/2016 - - 68,412,100 - 68,412,100 - 11 PK0112501017 ADIL TEXTILE MILLS LIMITED - FREEZE*** ADTM 17/Aug/2016 - - 7,725,800 - 7,725,800 - 12 PK0116301018 BOTTLECO (PRIVATE) LIMITED BCPL 17/May/2018 - - 8,750,000 - 8,750,000 -

Teaming up for Success

. Real business . Real people . Real experience Teaming Up for Success Reward Advisory Services AFGHANISTAN: Remuneration Benchmarking Survey 2007 February 2007 A. F. Ferguson & Co. , A member firm of Chartered Accountants 2 AFGHANISTAN Remuneration Benchmarking Survey 2007 PwC would like to invite your organization to participate in the Remuneration Benchmarking Survey 2007 which will be conducted once every year. This survey will cover all multinational organizations and local companies in AFGHANISTAN, regardless of any particular industry/ sector. This effort is being formulated so as to bring organizations at par with other players in market-resulting by bringing sanity to management and HRM practice in Afghanistan especially during reconstruction era. The survey will comprise of two parts: • Part A – remuneration to personnel in managerial and executive cadres (excluding CEOs/ Country Heads) • Part B – remuneration to CEOs/ Country Heads (international and local nationals separately) • Part C – remuneration to non-management cadre Each report is prepared separately, and participants may choose to take part in either one or all three sections of the survey. Job benchmarking and data collection from the participating organizations will be done through personal visits by our consultants. A structured questionnaire will be used to record detailed information on salaries, allowances, all cash and non-cash benefits and other compensation policies. The collected information will be treated in strict confidence and the findings of the survey will be documented in the form of a report, which will be coded. Each participating organization will be provided a code number with which they can identify their own data and the report will only be available to the participant pool. -

Daily Market Insights

DAILY MARKET INSIGHTS 12-May-2020 Change Index points KSE 100 INDEX PERFORMANCE OVERVIEW PKR % Change Closing KSE 100 Index 319 33,603 Contributing shares Closing Price - Rs. Lucky Cement Limited. 17.33 4.00 49.56 450.76 Engro Corporation Limited. 4.47 1.47 31.32 307.87 Habib Bank Limited. 1.78 1.87 28.86 97.01 KSE 100 INDEX VOLUMES Today 149 5 days average 116 139 14 days average Millions Source: https://formerdps.psx.com.pk/ & Calculations of Kifayah Investment Management Limited Top most buyer Top most seller PORTFOLIO INVESTMENT SUMMARY Individuals Insurance Companies Amount (Net) 398,643,902 (455,862,901) Buying / Selling sector wise composition Cement 47.33% 52.86% All other Sectors 25.75% 35.67% Oil and Gas Marketing Companies 6.08% 9.57% Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily FOREIGN PORTFOLIO INVESTMENT TREND Today (243) (399) 5 days average (424) 14 days average Millions Source: https://www.nccpl.com.pk/en/market-information/fipi-lipi/fipi-normal-daily & Calculations of Kifayah Investment Management Limited MATERIAL INFORMATION According to the relaxation given by the Government to the Agricultural and related activities, Health and related services, Utilities, Transportation of Goods and Public & Private Telecom, the Management of the Company has decided to support Agriculture, Atlas Battery Limited Health & other above mentioned sectors, and accordingly has resumed its operations including factory and regional offices from May 12, 2020 with all precautionary measures aimed at preventing pandemic's spread. Disclosure of interest by Non-Executive Director, purchased 11,550 shares at an Millat Tractors Limited average price of Rs. -

Packages Limited Annual Report 2019

Packages Limited Annual Report 2019 Contents 2 Company Information Directors’ Report on the Consolidated 4 Core Values 152 Financial Statements 5 Six Years at a Glance Directors’ Report on the Consolidated 6 Horizontal and Vertical Analysis 156 Financial Statements-Urdu 10 Value Added and its Distribution Auditors’ Report to the Members on the 11 Sources and Application of Funds 161 Consolidated Financial Statements 12 Corporate Social Responsibility 170 Consolidated Financial Statements 19 Notice of Annual General Meeting 273 Video Link Facility 25 Notice of Annual General Meeting- Urdu 274 Video Link Facility- Urdu 30 Chairman’s Review Report 275 Electronic Transmission Consent 31 Directors’ Report to the Shareholders 276 Electronic Transmission Consent-Urdu 42 Directors’ Report to the Shareholders-Urdu 277 Form of Proxy 52 Shareholders’ Information 278 Form of Proxy-Urdu Statement of Compliance with Listed 279 Electronic Credit Mandate Form 63 Companies Regulations, 2019 280 Electronic Credit Mandate Form-Urdu Review Report on Statement of Compliance Contained in Listed 66 Companies Regulations, 2019 67 Auditors’ Report to the Members 76 Financial Statements Packages Limited – Annual Report 2019 1 COMPANY INFORMATION Board of Directors Company Secretary Adi J. Cawasji Towfiq Habib Chinoy (Chairman) Rating Agency (Non-Executive Director) PACRA Syed Hyder Ali (Chief Executive & Managing Director) Company Credit Rating (Executive Director) Long-Term AA Short-Term A1+ Asghar Abbas (Executive Director) Auditors A.F. Ferguson & Co. Atif Aslam Bajwa Chartered Accountants (Independent Director) Legal Advisors Imran Khalid Niazi Hassan & Hassan - Lahore (Non-Executive Director) Orr, Dignam & Co. – Karachi Josef Meinrad Mueller (Non-Executive Director) Shares Registrar FAMCO Associates (Pvt.) Ltd Shamim Ahmad Khan 8-F, Next to Hotel Faran (Non-Executive Director) Nursery, Block 6, P.E.C.H.S. -

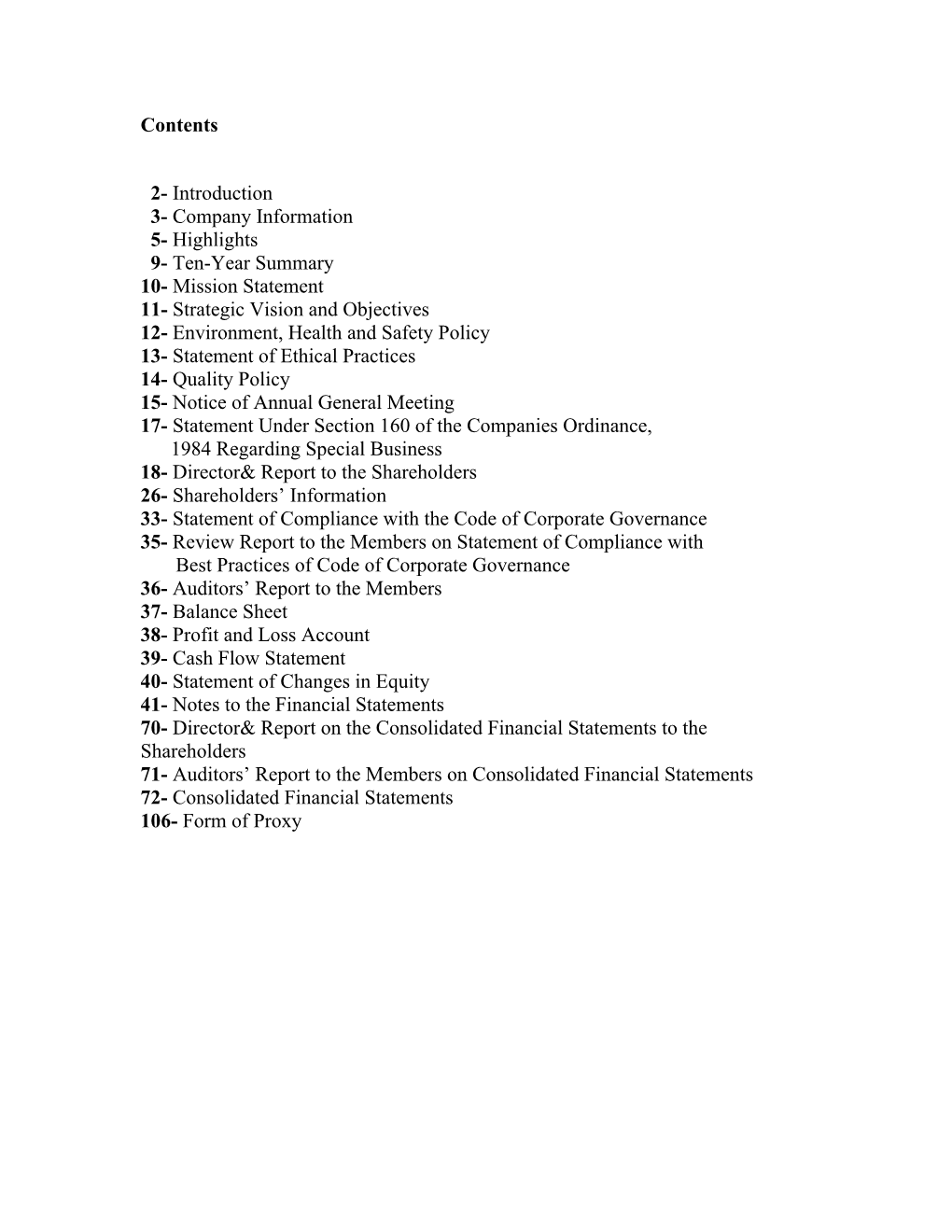

Annual Report 2008

Annual Report ‘08 Packages Limited Contents 02 Company Profile 43 Review Report to the Members on Statement of 05 Company Information Compliance with Best Practices of Code of 07 Corporate Structure Corporate Governance 08 Board of Directors 45 Auditors’ Report to the Members 10 Highlights 48 Balance Sheet 14 Ten Year Summary 50 Profit and Loss Account 19 Mission Statement & Vision and Objectives 51 Cash Flow Statement 21 Environment, Health and Safety Policy 52 Statement of Changes in Equity 23 Statement of Ethical Practices and Quality Policy 53 Notes to and Forming Part of the Financial 25 Notice of Annual General Meeting Statements 27 Directors’ Report to the Shareholders 88 Directors’ Report on the Consolidated Financial 33 Shareholders’ Information Statements 39 Statement of Compliance with the Code of 89 Auditors’ Report to the Members Corporate Governance 90 Consolidated Financial Statements Form of Proxy Contents 01 Company Profile Packages Limited was established in 1957 as a joint venture based on waste paper and agricultural by-products i.e. wheat between the Ali Group of Pakistan and Akerlund & Rausing of straw and river grass. The capacity has been increased Sweden, to convert paper and paperboard into packaging for eventually at 208,000 tonnes per year. consumer industry. In 1982, Tetra Pak Pakistan was formed as a joint venture Over the years, the company continued to enhance its facilities between Tetra Pak International and Packages Limited to to meet the growing demand of packaging products. Additional manufacture paperboard for liquid food packaging and to capital was raised from sponsors, International Finance market Tetra Pak packaging equipment. -

Annual Report-2009

Pakistan Centre for Philanthropy 31-12-2009 Pakistan Centre for Philanthropy 1A, St.14, F-8/3, Islamabad Tel. (9251) 2855903-4, 2287077-37 Fax. (9251) 2855073 Annual Report [email protected], www.pcp.org.pk 2009 Our Board Dr. Shamsh Kassim-Lakha, H.I., S.I. Chairman, PCP Board of Directors, Former President, Aga Khan University, Karachi Civil Society Organisations Mr. Badaruddin F. Vellani Chairman, AKF National Committee Mr. Firoz Rasul President, Aga Khan University Mr. Shoaib Sultan Khan Chairman, National Rural Support Programme Syed Asaad Ayub Ahmed CEO, The Citizens Foundation Dr. Suleman Sheikh Chairman, Sindh Graduates Association Eminent Citizens Mr. Arshad Zuberi Chief Executive and Editor, Daily Business Recorder Dr. Attiya Inayatullah Member, National Assembly of Pakistan Mrs. Munawar Humayun Khan Chairperson, Sarhad Rural Support Programme Mr. Mueen Afzal, H.I. Former Secretary General, Finance & Economic Affairs. Mr. Mahomed J. Jaffer Senior Partner, M/S ORR, DIGNAM & Co., Mrs. Roshan Khursheed Bharucha Ex-Minister/Social Worker PCP reserves all rights of ownership of this document. Mr. Saeed Ahmed Qureshi Former Deputy Chairman, Planning Commission Mr. Zaffar A. Khan, S.I. Former CEO Engro Chemicals and Former Chairman PIA, PTCL, KSE Syed Hyder Ali Managing Director and CEO, Packages Limited Mr. Mohsin Nathani Country Head and Manging Director Barclays Bank PLC Printed by: Colorline-Islamabad Corporations Mr. Arif Habib President, Arif Habib Securities Limited, Karachi Cover desktop composition and production management: Aleeza Akbar Mr. Hussain Dawood Chairman Board Engro Pakistan Centre for Philanthropy, Islamabad Mian Ahsan M. Saleem Chief Executive, Crescent Steel & Allied Products Published in March 2010. -

Contents Company Information 3

Contents Company information 3 Directors’ report 5 Condensed interim balance sheet 8 Condensed interim profit and loss account 10 Condensed interim statement of comprehensive income 11 Condensed interim statement of changes in equity 12 Condensed interim cash flow statement 13 Notes to and forming part of the condensed interim financial information 14 Packages Group condensed consolidated interim financial information 27 Directors’ report 28 Condensed consolidated interim balance sheet 30 Condensed consolidated interim profit and loss account 32 Condensed consolidated interim statement of comprehensive income 33 Condensed consolidated interim statement of changes in equity 34 Condensed consolidated interim cash flow statement 35 Notes to and forming part of the condensed consolidated interim financial information 36 Blank Page 2 COMPANY INFORMATION Board of Directors System and Technology Towfiq Habib Chinoy - Chairman Committee (Non-Executive Director) Syed Aslam Mehdi - Chairman Syed Hyder Ali - Chief Executive & (Executive Director) (Executive Director) Managing Director Khalid Yacob - Member Khalid Yacob (Executive Director) (Executive Director) Suleman Javed - Member Matti Ilmari Naakka (Independent Director) Human Resource and Muhammad Aurangzeb Remuneration (HR & R) (Independent Director) Committee Shahid Aziz Siddiqui Towfiq Habib Chinoy - Chairman (Independent Director) (Non-Executive Director) Shamim Ahmad Khan Shahid Aziz Siddiqui - Member (Non-Executive Director) (Independent Director) Syed Aslam Mehdi Shamim Ahmad Khan - Member (Executive Director) (Non-Executive Director) Syed Shahid Ali Syed Hyder Ali - Member (Non-Executive Director) (Executive Director) Wazir Ali Khoja Syed Aslam Mehdi - Member (Independent Director) (Executive Director) Ali Aslam Asma Javed - Secretary (Alternate to Matti Ilmari Naakka) Rating Agency: PACRA Advisor Company Rating Syed Babar Ali Long-Term: AA Company Secretary Short-Term: A1+ Adi J.