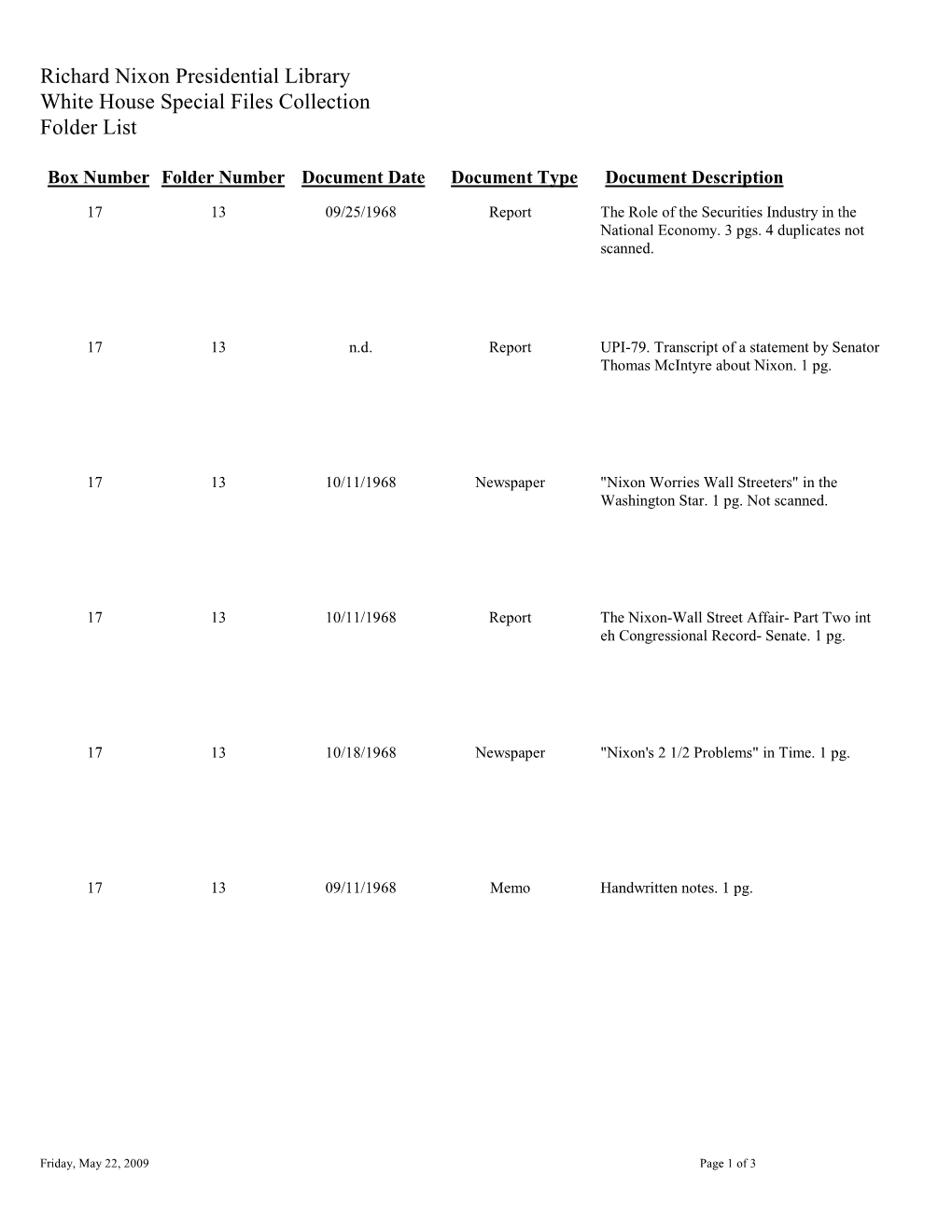

White House Special Files Box 17 Folder 13

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Macarthur, DOUGLAS: Papers, 1930-41

DWIGHT D. EISENHOWER LIBRARY ABILENE, KANSAS MacARTHUR, DOUGLAS: Papers, 1930-41 Accession: 03-17 Processed by: TB Date Completed: June 24, 2003 The microfilm copy of the papers of Douglas MacArthur, 1935-41 were deposited in the Eisenhower Library by the General Douglas MacArthur Memorial Archives and Library in June, 2003. Approximate number of items: 3 reels of microfilm The original documents remain with the General Douglas MacArthur Memorial Archives and Library of Norfolk, Virginia as RG-1 Records of the U.S. Military Advisor to the Philippine Commonwealth, 1935-1941. Researchers should contact that repository directly regarding copyright restrictions. SCOPE AND CONTENT NOTE This collection consists of microfilm copies of correspondence, orders, speeches, reports, newspaper clippings and other printed material relating to MacArthur’s work as military adviser to the Philippine Commonwealth during 1935-41. This collection contains materials relating to the creation of a Philippine Army, Philippine Defense, Philippine politics, and general correspondence with MacArthur’s contemporaries. This collection is described at the document or case file level; each folder description contains many individual entries. Reels 1 and 2 contain documents within the MacArthur papers; some of these letters and telegrams are authenticated copies, and not originals. Reel 3 contains photocopies of selected documents from the Official Military Personnel File of Douglas MacArthur, also known as a “201” file. The original documents currently are held by the National Archives and Records Administration at the National Personnel Records Center in St. Louis, Missouri, but the documents contained in this microfilm were copied when the file was housed at the Washington National Record Center in Suitland, Maryland. -

I Was Happy and Flattered to Be Invited to Deliver This Lecture Because Like So Many Others Who Knew Michael Quinlan I Was an Impassioned Admirer

I was happy and flattered to be invited to deliver this lecture because like so many others who knew Michael Quinlan I was an impassioned admirer. Yet I cannot this evening avoid being a little daunted by the memory of an occasion twenty years ago, when we both attended a talk given by a general newly returned from the Balkans. Michael said to me afterwards: ‘Such a pity, isn’t it, when a soldier who has done really quite well on a battlefield simply lacks the intellectual firepower to explain coherently afterwards what he has been doing’. Few of us, alas, possess the ‘intellectual firepower’ to meet Michael’s supremely and superbly exacting standard. I am a hybrid, a journalist who has written much about war as a reporter and commentator; and also a historian. I am not a specialist in intelligence, either historic or contemporary. By the nature of my work, however, I am a student of the intelligence community’s impact upon the wars both of the 20th century and of our own times. I have recently researched and published a book about the role of intelligence in World War II, which confirmed my impression that while the trade employs some clever people, it also attracts some notably weird ones, though maybe they would say the same about historians. Among my favourite 1939-45 vignettes, there was a Japanese spy chief whose exploits caused him to be dubbed by his own men Lawrence of Manchuria. Meanwhile a German agent in Stockholm warned Berlin in September 1944 that the allies were about to stage a mass parachute drop to seize a Rhine bridge- the Arnhem operation. -

The Ideology of the John Birch Society

Utah State University DigitalCommons@USU All Graduate Theses and Dissertations Graduate Studies 5-1966 The Ideology of the John Birch Society Max P. Peterson Utah State University Follow this and additional works at: https://digitalcommons.usu.edu/etd Part of the Political Science Commons Recommended Citation Peterson, Max P., "The Ideology of the John Birch Society" (1966). All Graduate Theses and Dissertations. 7982. https://digitalcommons.usu.edu/etd/7982 This Thesis is brought to you for free and open access by the Graduate Studies at DigitalCommons@USU. It has been accepted for inclusion in All Graduate Theses and Dissertations by an authorized administrator of DigitalCommons@USU. For more information, please contact [email protected]. THEIDEOLOGY OFTHE JOHN BIRCH SOCIETY by Y1ax P. Peterson A thesis submitted in partial fulfillment of the requirements for the degree of MASTEROF SCIENCE in Political Science Approved: Major Professor Head of Department Dean of Graduate Studies UTAH STATE UNIVERSITY Logan, Utah 1966 ACKNOWLEDGMENTS I wish to express my appreciation to Dr. Milton C. Abrams for the many hours of consultation and direction he provided throughout this study. To Dr. M. Judd Harmon, I express thanks, not only for his constructive criticism on this work, but for the constant challenge he offers as a teacher. A very special thanks is given my wife, Karen, for her countless hours of typing, but first and foremost for the encouragement, u nderstanding, and devotion that she has given me throu ghout my graduate studies. TABLE OF CONTENTS Introduction 1 Chapter I. The Background and Organization of the John Birch Society 4 The Beginning 4 The Symbol 7 The Founder 15 Plan of Action 21 Organizational Mechanics 27 Chapter II. -

The US Occupation and Japan's New Democracy

36 Educational Perspectives v Volume 0 v Number 1 The US Occupation and Japan’s New Democracy by Ruriko Ku�ano Introduction barking on world conquest,” (2) complete dismantlement of Japan’s Education, in my view, is in part a process through which war–making powers, and (3) establishment of “freedom of speech, important national values are imparted from one generation to of religion, and of thought, as well as respect for the fundamental the next. I was raised in affluent postwar Japan, and schooled, human rights.”2 like others of my generation, to despise the use of military force The Potsdam Declaration was unambiguous—the Allied and every form of physical confrontation. The pacifist ideal of powers urged the Japanese to surrender unconditionally now or face peace was taught as an overriding value. I was told that as long as “utter destruction.”3 But because it failed to specify the fate of the Japan maintained its pacifism, the Japanese people would live in emperor, the Japanese government feared that surrender might end peace forever. My generation were raised without a clear sense of the emperor’s life. The Japanese government chose to respond with duty to defend our homeland—we did not identify such words as “�okusatsu”—a deliberately vague but fateful word that literally “patriotism,” “loyalty,” and “national defense” with positive values. means “kill by silence”4— until the Allied powers guaranteed the Why? Postwar education in Japan, the product of the seven–year emperor’s safety. US occupation after WWII, emphasizes pacifism and democracy. I Unfortunately, the Allied powers interpreted Japanese silence, came to United States for my graduate studies in order to study how with tragic consequences, as a rejection of the declaration. -

General Curtis Lemay and General Thomas Power

SUBSCRIBE NOW AND RECEIVE CRISIS AND LEVIATHAN* FREE! “The Independent Review does not accept “The Independent Review is pronouncements of government officials nor the excellent.” conventional wisdom at face value.” —GARY BECKER, Noble Laureate —JOHN R. MACARTHUR, Publisher, Harper’s in Economic Sciences Subscribe to The Independent Review and receive a free book of your choice* such as the 25th Anniversary Edition of Crisis and Leviathan: Critical Episodes in the Growth of American Government, by Founding Editor Robert Higgs. This quarterly journal, guided by co-editors Christopher J. Coyne, and Michael C. Munger, and Robert M. Whaples offers leading-edge insights on today’s most critical issues in economics, healthcare, education, law, history, political science, philosophy, and sociology. Thought-provoking and educational, The Independent Review is blazing the way toward informed debate! Student? Educator? Journalist? Business or civic leader? Engaged citizen? This journal is for YOU! *Order today for more FREE book options Perfect for students or anyone on the go! The Independent Review is available on mobile devices or tablets: iOS devices, Amazon Kindle Fire, or Android through Magzter. INDEPENDENT INSTITUTE, 100 SWAN WAY, OAKLAND, CA 94621 • 800-927-8733 • [email protected] PROMO CODE IRA1703 ETCETERAS . On “Winning the War” —————— ✦ —————— ROBERT HIGGS With fire and sword the country round Was wasted far and wide, And many a childing mother then, And new-born baby died; But things like that, you know, must be At every famous victory. —Robert Southey (1774–1843), “The Battle of Blenheim” eneral Thomas Power, commander in chief of the Strategic Air Command (SAC) from 1957 to 1964 and director of the Joint Strategic Target Planning GStaff from 1960 to 1964, ranked near the top of the U.S. -

Unconditional Surrender, the Emperor and the Tokyo Trial 59

View metadata, citation and similar papers at core.ac.uk brought to you by CORE Unconditional Surrender, the Emperor and the Tokyo Trial 59 Unconditional Surrender, the Emperor and the Tokyo Trial: Implications for the Present-Day Japan-US Alliance Kazuhiko TOGO 無条件降伏・天皇・東京裁判: 現在の日米同盟に対して有する意味合い 東 郷 和 彦 <Abstract> In August 1945, when Japan was on the brink of total defeat, opinions among Japanese top leaders on when and how to surrender were divided, although everyone agreed that one condition would have to be met before any surrender: the preservation of the Imperial House. The Potsdam Declaration had been formulated in such a manner that this issue was left ambiguous. The final US reply, however, allowed sufficient room for the interpre- tation that the Imperial House would be preserved. So the Japanese Government surrendered. Since the surrender was only based on this interpretation, the defeated Government’s immediate efforts were concentrated on realiz- ing this condition through the establishment of a new Constitution (Article One) and the Tokyo Trial (not indicting the Emperor). Thus the final and only condition of the falling Empire was met. However, the crucial aspect of “honoring the commitment” was forgotten through a prevailing notion that Japan had made an unconditional surrender and that the US occupation was using the Emperor for the expediency of its occupation policy. After the signing of the San Francisco Peace Treaty even the Japanese Government itself began to acknowledge that Japan had indeed made an unconditional surrender. It is time to go back into history and recall this forgotten commit- ment in order to consolidate the contemporary Japan-US alliance. -

Arthur Kemp Papers

http://oac.cdlib.org/findaid/ark:/13030/kt758040hv No online items Inventory of the Arthur Kemp papers Finding aid prepared by Dale Reed Hoover Institution Library and Archives © 2012, 2015 434 Galvez Mall Stanford University Stanford, CA 94305-6003 [email protected] URL: http://www.hoover.org/library-and-archives Inventory of the Arthur Kemp 62017 1 papers Title: Arthur Kemp papers Date (inclusive): 1918-1959 Collection Number: 62017 Contributing Institution: Hoover Institution Library and Archives Language of Material: English Physical Description: 58 manuscript boxes, 1 oversize box(25.1 Linear Feet) Abstract: Correspondence, writings, memoranda, notes, typed copies of documents, and printed matter, relating to Herbert Hoover, American foreign policy and domestic policies during and after the presidential administration of Franklin D. Roosevelt, World War II, international relief and reconstruction, and communism. Used as research material for writing projects of Herbert Hoover. Includes draft writings by Hoover. Creator: Hoover, Herbert, 1874-1964 Creator: Kemp, Arthur, 1916-2002 Hoover Institution Library & Archives Access The collection is open for research; materials must be requested at least two business days in advance of intended use. Publication Rights For copyright status, please contact the Hoover Institution Library & Archives. Acquisition Information Acquired by the Hoover Institution Library & Archives in 1962. Preferred Citation [Identification of item], Arthur Kemp papers, [Box no., Folder no. or -

Confidence Men the Mediterranean Double-Cross System, 1941-45 By

Confidence Men The Mediterranean Double-Cross System, 1941-45 by Brett Edward Lintott A thesis submitted in conformity with the requirements for the Degree of Doctor of Philosophy, Graduate Department of History, in the University of Toronto © Copyright by Brett Edward Lintott, 2015 Abstract Confidence Men The Mediterranean Double-Cross System, 1941-45 Brett Edward Lintott Doctor of Philosophy Department of History University of Toronto, 2015 This dissertation provides an analysis of the Mediterranean double-cross system of the Second World War, which was composed of a number of double agents who were turned by the Allies and operated against their ostensible German spymasters. Utilizing many freshly released archival materials, this study assesses how the double-cross system was constructed, why it was an effective instrument, and how it contributed to Allied success in two areas: security and counter-intelligence, and military deception. The focus is thus on both organization and operations. The chapters cover three chronological periods. In the first — 1941-42 — the initial operational usage of a double agent is assessed, along with the development of early organizational structures to manage and operate individual cases as components of a team of spies. The second section, covering 1943, assesses three issues: major organizational innovations made early that year; the subsequent use of the double agent system to deceive the Germans regarding the planned invasion of Sicily in July; and the ongoing effort to utilize double agents to ensure a stable security and counter-intelligence environment in the Mediterranean theatre. The third and final section analyzes events in 1944, with a focus on double-cross deception in Italy and France, and on the emergence of more systematic security and counter-intelligence double-cross operations in Italy and the Middle East. -

Reviewed by John Ferris, University of Calgary

2008 h-diplo H-Diplo Article Review Managing Editor: Diane N. H-Diplo Article REVIEWS Labrosse http://www.h-net.org/~diplo/reviews/ H-Diplo Article Review General Editor and Web No. 199 Editor: George Fujii Published on 4 November 2008 C.J. Jenner. “Turning the Hinge of Fate: “Good Source” and the UK-U.S. Intelligence Alliance, 1940-1942.” Diplomatic History 32:2 (April 2008): 165-205. DOI: 10.1111/j.1467- 7709.2008.00688.x. URL: http://www.h-net.org/~diplo/reviews/PDF/Ferris-Jenner.pdf Reviewed by John Ferris, University of Calgary Assessing the Impact of Intelligence: The “Good Source” and Anglo-American Intelligence in the Second World War and After he study of intelligence during the Second World War rests on a large and fairly complete documentary base in the public domain and a long and lively debate Tbetween specialists. The lessons it teaches are balance, patience, and precision. The declassification of the Ultra secret forced a reconsideration of operations in the Second World War, yet in hindsight, even the best first-generation studies in the field overestimated the significance of their topic. The more enthusiastic the account, the more misleading it is. Contrary to a well-known statement by Sir Michael Howard, the history of the Second World War has not had to be rewritten simply because Ultra was unveiled, but it did have to be rethought. Non-specialist academics routinely exaggerate the effect of intelligence on the war and its literature. Some specialists do the same. The mere act of incorporating intelligence into an analysis does not automatically improve its quality. -

LILLY, EDWARD P.: Papers, 1928-1992

DWIGHT D. EISENHOWER LIBRARY ABILENE, KANSAS LILLY, EDWARD P.: Papers, 1928-1992 Accession: 01-10 and 02-15 Processed by: DJH Date Completed: November 2005 The Papers of Edward P. Lilly were deposited in the Eisenhower Library by his son Frank Lilly in two shipments in 2001 and 2002. The Library staff returned a small quantity of personal material to Mr. Frank Lilly at his request. Linear Feet: 24 Approximate Number of Pages: 46,100 Approximate Number of Items: 35,000 Mr. Frank Lilly signed an instrument of gift for the Papers of Edward P. Lilly on October 7, 1982. Literary rights in the unpublished writings of Edward P. Lilly in this collection and in any other collections of papers received by the United States government are given to the public. Under terms of the instrument of gift, the following classes of items are withheld from research use: 1. Papers and other historical materials the disclosure of which would constitute a clearly unwarranted invasion of personal privacy of a living person. 2. Papers and other historical materials that are specifically authorized under criteria established by statute or executive order to be kept secret in the interest of national defense or foreign policy, and are in fact properly classified pursuant to such statute or executive order. SCOPE AND CONTENT NOTE Edward P. Lilly was born October 13, 1910 in Brooklyn, New York, the son of Joseph T. and Jennie Lilly. After graduating from Brooklyn Preparatory School in1928, Lilly attended the College of the Holy Cross in Worcester, Massachusetts where he received a Bachelor’s of Arts degree with a major in philosophy and a minor in history. -

The American Right Wing; a Report to the Fund for the Republic, Inc

I LINO S UNIVERSITY OF ILLINOIS AT URBANA-CHAMPAIGN PRODUCTION NOTE University of Illinois at Urbana-Champaign Library Large-scale Digitization Project, 2007. ps.7 University of Illinois Library School OCCASIONAL PAPERS Number 59 November 1960 THE AMERICAN RIGHT WING A Report to the Fund for the Republic, Inc. by Ralph E. Ellsworth and Sarah M. Harris THE AMERICAN RIGHT WING A Report to the Fund for the Republic, Inc. by Ralph E. Ellsworth and Sarah M. Harris Price: $1. 00 University of Illinois Graduate School of Library Science 1960 L- Preface Because of the illness and death in August 1959 of Dr. Sarah M. Harris, research associate in the State University of Iowa Library, the facts and inter- pretations in this report have not been carried beyond the summer of 1958. The changes that have occurred since that time among the American Right Wing are matters of degree, not of nature. Some of the organizations and publications re- ferred to in our report have passed out of existence and some new ones have been established. Increased racial tensions in the south, and indeed, all over the world, have hardened group thinking and organizational lines in the United States over this issue. The late Dr. Harris and I both have taken the position that our spirit of objectivity in handling this elusive and complex problem will have to be judged by the report itself. I would like to say that we started this study some twelve years ago because we felt that the American Right Wing was not being evaluated accurately by scholars and magazine writers. -

Japanese Codes and the Election of 1944 During 1944'S America

New Twists on Old Tales: Crypto Triumphs and Political Meddling: Japanese Codes and the Election of 1944 Colin B Burke, April 2017 During 1944’s American presidential contest the nation’s top military leader took an unprecedented and constitutionally dangerous step. In September 1944 he secretly interfered in the campaign. His intrusion didn’t remain a secret for very long, however. Shortly after World War II General George C. Marshall’s action became public knowledge with emotional tales appearing about his sending a special emissary to Thomas E. Dewey, the Governor of New York and the Republican Party’s candidate, with a letter meant to persuade Dewey from mentioning something that might well have led to the defeat of the Democrat’s Franklin D. Roosevelt in his run for a fourth term as president. Colonel Carter Clarke, Marshall’s envoy, had been ordered to deliver a message intended to convince Dewey to remain silent about the United States and England’s ability to read Japan’s coded diplomatic messages long before the 1941 attack on Pearl Harbor--and about other Allied codebreaking efforts after the United States entered World War II. The story of Marshall’s letter and Clarke’s visit and their repercussions has been told and retold. As early as 1945 major popular magazines, such as Time and Life, ran features on the penetration of Japan’s diplomatic codes and the surprise attack at Pearl Harbor and on the related Marshall-Dewey affair. The stories included mentions of the “break-in” and “ransacking” of the Lisbon, Portugal offices