Pasifika Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Where Are the Audiences?

WHERE ARE THE AUDIENCES? Full Report Introduction • New Zealand On Air (NZ On Air) supports and funds audio and visual public media content for New Zealand audiences. It does so through the platform neutral NZ Media Fund which has four streams; scripted, factual, music, and platforms. • Given the platform neutrality of this fund and the need to efficiently and effectively reach both mass and targeted audiences, it is essential NZ On Air have an accurate understanding of the current and evolving behaviour of NZ audiences. • To this end NZ On Air conduct the research study Where Are The Audiences? every two years. The 2014 benchmark study established a point in time view of audience behaviour. The 2016 study identified how audience behaviour had shifted over time. • This document presents the findings of the 2018 study and documents how far the trends revealed in 2016 have moved and identify any new trends evident in NZ audience behaviour. • Since the 2016 study the media environment has continued to evolve. Key changes include: − Ongoing PUTs declines − Anecdotally at least, falling SKY TV subscription and growth of NZ based SVOD services − New TV channels (eg. Bravo, HGTV, Viceland, Jones! Too) and the closure of others (eg. FOUR, TVNZ Kidzone, The Zone) • The 2018 Where Are The Audiences? study aims to hold a mirror up to New Zealand and its people and: − Inform NZ On Air’s content and platform strategy as well as specific content proposals − Continue to position NZ On Air as a thought and knowledge leader with stakeholders including Government, broadcasters and platform owners, content producers, and journalists. -

New TT Channel Guide-2020

channel guide 1 Catch 1 725 Hit List 405 Warner Channel 502 CNN HLN 3 Catch 3 700 BET 2 Catch 2 726 Pop Adult 418 Universal Channel 503 CNNi 416 Lifetime Real Women 701 BET Her 100 ABC- WPLG 727 Standards 419 SyFy 505 BBC America 427 E! (LatAm) 702 BET Gospel 101 CBS- WFOR 728 Jukebox Oldies 425 TBS 507 One America Network 431 Comedy TV 705 MTV 2 102 NBC-WTVJ 729 Flashback 70’S 426 E! (US) 509 MSNBC 432 I-Sat 709 BET JAMS 103 FOX-WSVN 730 Everything 80’S 428 Game Show Network 510 Euronews 435 AWE TV 710 BET Soul 104 WWOR - TV 731 Nothin’ But 90’S 429 Paramount 512 CaribVision 436 AXS TV 712 VH1 105 PBS-WPBT 732 Maximum Party 430 Comedy Central 513 One Caribbean Weather 438 Classic Arts Showcase 715 Revolt 107 City TV 733 Dance Classics 433 Tru TV 514 WeatherNation 439 Outdoor Channel 108 CBC Toronto 734 Dance Clubbn' 437 Pixl 516 NHK World 441 FYI 506 Bloomberg 109 CTV 735 Holiday Hits 449 Bravo 517 Al Jazeera (Eng) 444 ESTV 511 CNBC 523 Discovery Channel 736 Classic Rock 526 Investigation Discovery 535 VICELAND 515 France 24 (Eng) 524 Animal Planet 737 Rock Alternative 527 Discovery Science 536 Pets TV 301 SportsMax 1 525 TLC 738 Rock 529 Discovery Home & 539 Cooking Channel 305 ESPN 2 534 History Channel 739 Hard Rock Health 541 Recipe TV 302 SportsMax 2 308 Flow Sports 538 HGTV 740 Alt Rock Classics 531 NatGeo HD 543 My Destination TV 306 Fox Soccer Plus 311 Trace Sports TV 540 Food Network 741 The Blues 532 Nat Geo Wild 307 Fox Sports 2 313 NBA TV 555 EWTN 742 Adult Alternative 533 Discovery Civilization 310 NBC Sports Network 317 -

Tate Report 08-09

Tate Report 08–09 Report Tate Tate Report 08–09 It is the Itexceptional is the exceptional generosity generosity and and If you wouldIf you like would to find like toout find more out about more about PublishedPublished 2009 by 2009 by vision ofvision individuals, of individuals, corporations, corporations, how youhow can youbecome can becomeinvolved involved and help and help order of orderthe Tate of the Trustees Tate Trustees by Tate by Tate numerousnumerous private foundationsprivate foundations support supportTate, please Tate, contact please contactus at: us at: Publishing,Publishing, a division a divisionof Tate Enterprisesof Tate Enterprises and public-sectorand public-sector bodies that bodies has that has Ltd, Millbank,Ltd, Millbank, London LondonSW1P 4RG SW1P 4RG helped Tatehelped to becomeTate to becomewhat it iswhat it is DevelopmentDevelopment Office Office www.tate.org.uk/publishingwww.tate.org.uk/publishing today andtoday enabled and enabled us to: us to: Tate Tate MillbankMillbank © Tate 2009© Tate 2009 Offer innovative,Offer innovative, landmark landmark exhibitions exhibitions London LondonSW1P 4RG SW1P 4RG ISBN 978ISBN 1 85437 978 1916 85437 0 916 0 and Collectionand Collection displays displays Tel 020 7887Tel 020 4900 7887 4900 A catalogue record for this book is Fax 020 Fax7887 020 8738 7887 8738 A catalogue record for this book is available from the British Library. DevelopDevelop imaginative imaginative education education and and available from the British Library. interpretationinterpretation programmes programmes AmericanAmerican Patrons Patronsof Tate of Tate Every effortEvery has effort been has made been to made locate to the locate the 520 West520 27 West Street 27 Unit Street 404 Unit 404 copyrightcopyright owners ownersof images of includedimages included in in StrengthenStrengthen and extend and theextend range the of range our of our New York,New NY York, 10001 NY 10001 this reportthis and report to meet and totheir meet requirements. -

DISCOVER NEW WORLDS with SUNRISE TV TV Channel List for Printing

DISCOVER NEW WORLDS WITH SUNRISE TV TV channel list for printing Need assistance? Hotline Mon.- Fri., 10:00 a.m.–10:00 p.m. Sat. - Sun. 10:00 a.m.–10:00 p.m. 0800 707 707 Hotline from abroad (free with Sunrise Mobile) +41 58 777 01 01 Sunrise Shops Sunrise Shops Sunrise Communications AG Thurgauerstrasse 101B / PO box 8050 Zürich 03 | 2021 Last updated English Welcome to Sunrise TV This overview will help you find your favourite channels quickly and easily. The table of contents on page 4 of this PDF document shows you which pages of the document are relevant to you – depending on which of the Sunrise TV packages (TV start, TV comfort, and TV neo) and which additional premium packages you have subscribed to. You can click in the table of contents to go to the pages with the desired station lists – sorted by station name or alphabetically – or you can print off the pages that are relevant to you. 2 How to print off these instructions Key If you have opened this PDF document with Adobe Acrobat: Comeback TV lets you watch TV shows up to seven days after they were broadcast (30 hours with TV start). ComeBack TV also enables Go to Acrobat Reader’s symbol list and click on the menu you to restart, pause, fast forward, and rewind programmes. commands “File > Print”. If you have opened the PDF document through your HD is short for High Definition and denotes high-resolution TV and Internet browser (Chrome, Firefox, Edge, Safari...): video. Go to the symbol list or to the top of the window (varies by browser) and click on the print icon or the menu commands Get the new Sunrise TV app and have Sunrise TV by your side at all “File > Print” respectively. -

Ethnic Migrant Media Forum 2014 | Curated Proceedings 1 FOREWORD

Ethnic Migrant Media Forum 2014 CURATED PROCEEDINGS “Are we reaching all New Zealanders?” Exploring the Role, Benefits, Challenges & Potential of Ethnic Media in New Zealand Edited by Evangelia Papoutsaki & Elena Kolesova with Laura Stephenson Ethnic Migrant Media Forum 2014. Curated Proceedings is licensed under a Creative Commons Attribution- NonCommercial 4.0 International License. Ethnic Migrant Media Forum, Unitec Institute of Technology Thursday 13 November, 8.45am–5.45pm Unitec Marae, Carrington Road, Mt Albert Auckland, New Zealand The Introduction and Discussion sections were blind peer-reviewed by a minimum of two referees. The content of this publication comprises mostly the proceedings of a publicly held forum. They reflect the participants’ opinions, and their inclusion in this publication does not necessarily constitute endorsement by the editors, ePress or Unitec Institute of Technology. This publication may be cited as: Papoutsaki, E. & Kolesova, E. (Eds.) (2017). Ethnic migrant media forum 2014. Curated proceedings. Auckland, New Zealand. Retrieved from http://unitec. ac.nz/epress/ Cover design by Louise Saunders Curated proceedings design and editing by ePress Editors: Evangelia Papoutsaki and Elena Kolesova with Laura Stephenson Photographers: Munawwar Naqvi and Ching-Ting Fu Contact [email protected] www.unitec.ac.nz/epress Unitec Institute of Technology Private Bag 92025, Victoria Street West Auckland 1142 New Zealand ISBN 978-1-927214-20-6 Marcus Williams, Dean of Research and Enterprise (Unitec) opens the forum -

2019 Winners & Finalists

2019 WINNERS & FINALISTS Associated Craft Award Winner Alison Watt The Radio Bureau Finalists MediaWorks Trade Marketing Team MediaWorks MediaWorks Radio Integration Team MediaWorks Best Community Campaign Winner Dena Roberts, Dominic Harvey, Tom McKenzie, Bex Dewhurst, Ryan Rathbone, Lucy 5 Marathons in 5 Days The Edge Network Carthew, Lucy Hills, Clinton Randell, Megan Annear, Ricky Bannister Finalists Leanne Hutchinson, Jason Gunn, Jay-Jay Feeney, Todd Fisher, Matt Anderson, Shae Jingle Bail More FM Network Osborne, Abby Quinn, Mel Low, Talia Purser Petition for Pride Mel Toomey, Casey Sullivan, Daniel Mac The Edge Wellington Best Content Best Content Director Winner Ryan Rathbone The Edge Network Finalists Ross Flahive ZM Network Christian Boston More FM Network Best Creative Feature Winner Whostalk ZB Phil Guyan, Josh Couch, Grace Bucknell, Phil Yule, Mike Hosking, Daryl Habraken Newstalk ZB Network / CBA Finalists Tarore John Cowan, Josh Couch, Rangi Kipa, Phil Yule Newstalk ZB Network / CBA Poo Towns of New Zealand Jeremy Pickford, Duncan Heyde, Thane Kirby, Jack Honeybone, Roisin Kelly The Rock Network Best Podcast Winner Gone Fishing Adam Dudding, Amy Maas, Tim Watkin, Justin Gregory, Rangi Powick, Jason Dorday RNZ National / Stuff Finalists Black Sheep William Ray, Tim Watkin RNZ National BANG! Melody Thomas, Tim Watkin RNZ National Best Show Producer - Music Show Winner Jeremy Pickford The Rock Drive with Thane & Dunc The Rock Network Finalists Alexandra Mullin The Edge Breakfast with Dom, Meg & Randell The Edge Network Ryan -

Bringing the Future Faster

6mm hinge Bringing the future faster. Annual Report 2019 WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Bringing the future faster Spark New Zealand Annual Report 2019 Bringing the future faster Contents Build customer intimacy We need to understand BRINGING THE FUTURE FASTER and anticipate the needs of New Zealanders, and Spark performance snapshot 4 technology enables us Chair and CEO review 6 to apply these insights Our purpose and strategy 10 to every interaction, Our performance 12 helping us serve our Our customers 14 customers better. Our products and technology 18 Read more pages 7 and 14. Our people 20 Our environmental impact 22 Our community involvement 24 Our Board 26 Our Leadership Squad 30 Our governance and risk management 32 Our suppliers 33 Leadership and Board remuneration 34 FINANCIAL STATEMENTS Financial statements 38 Notes to the financial statements 44 Independent auditor’s report 90 OTHER INFORMATION Corporate governance disclosures 95 Managing risk framework roles and 106 responsibilities Materiality assessment 107 Stakeholder engagement 108 Global Reporting Initiative (GRI) content 109 index Glossary 112 Contact details 113 This report is dated 21 August 2019 and is signed on behalf of the Board of Spark New Zealand Limited by Justine Smyth, Chair and Charles Sitch, Chair, Audit and Risk Management Committee. Justine Smyth Key Dates Annual Meeting 7 November 2019 Chair FY20 half-year results announcement 19 February 2020 FY20 year-end results announcement 26 August 2020 Charles Sitch Chair Audit and Risk Management Committee WorldReginfo - 7329578e-d26a-4187-bd38-e4ce747199c1 Create New Zealand’s premier sports streaming business Spark Sport is revolutionising how New Zealanders watch their favourite sports events. -

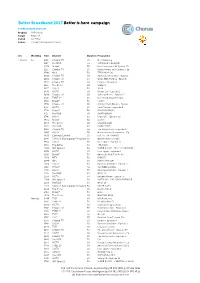

BB2017 Media Overview for Rsps

Better Broadband 2017 Better is here campaign TV PRE AIRDATE SPOTLIST Product All Products Target All 25-54 Period wc 7 May Source TVmap/The Nielsen Company w/c WeekDay Time Channel Duration Programme 7 May 17 Su 1112 Choice TV 30 No Advertising 7 May 17 Su 1217 the BOX 60 SURVIVOR: CAGAYAN 7 May 17 Su 1220 Bravo* 30 Real Housewives Of Sydney, Th 7 May 17 Su 1225 Choice TV 30 Better Homes and Gardens - Ep 7 May 17 Su 1340 MTV 30 TEEN MOM OG 7 May 17 Su 1410 Choice TV 30 American Restoration - Episod 7 May 17 Su 1454 Choice TV 60 Walks With My Dog - Episode 7 May 17 Su 1542 Choice TV 60 Empire - Episode 4 7 May 17 Su 1615 The Zone 60 SLIDERS 7 May 17 Su 1617 HGTV 30 16:00 7 May 17 Su 1640 HGTV 60 Hawaii Life - Episode 2 7 May 17 Su 1650 Choice TV 60 Jamie at Home - Episode 5 7 May 17 Su 1710 TVNZ 2* 60 Home and Away Omnibus 7 May 17 Su 1710 Bravo* 30 Catfish 7 May 17 Su 1710 Choice TV 30 Jimmy's Farm Diaries - Episod 7 May 17 Su 1717 HGTV 30 Yard Crashers - Episode 8 7 May 17 Su 1720 Prime* 30 RUGBY NATION 7 May 17 Su 1727 the BOX 30 SMACKDOWN 7 May 17 Su 1746 HGTV 60 Island Life - Episode 10 7 May 17 Su 1820 Bravo* 30 Catfish 7 May 17 Su 1854 The Zone 60 WIZARD WARS 7 May 17 Su 1905 the BOX 30 MAIN EVENT 7 May 17 Su 1906 Choice TV 60 The Living Room - Episode 37 7 May 17 Su 1906 HGTV 30 House Hunters Renovation - Ep 7 May 17 Su 1930 Comedy Central 30 LIVE AT THE APOLLO 7 May 17 Su 1945 Crime & Investigation Network 30 DEATH ROW STORIES 7 May 17 Su 1954 HGTV 30 Fixer Upper - Episode 6 7 May 17 Su 1955 The Zone 60 THE CAPE 7 May 17 Su 2000 -

AT a GLANCE As Reported May 5, 2015

AT A GLANCE As Reported May 5, 2015 BILLION MILLION AVERAGE CUMULATIVE INTERNATIONAL MILLION GLOBAL HD MARKETS NUMBER WORLDWIDE DISCOVERY CHANNEL OF CHANNELS IN MONTHLY SUBSCRIBERS SUBSCRIBERS 220 COUNTRIES STREAMS ONLINE 2.9 457 191 10 AND TERRITORIES 300 OWNERSHIP U.S. NETWORKS (MILLIONS) INTERNATIONAL NETWORKS (MILLIONS) Discovery Communications is publicly traded on Nasdaq under the symbols: DISCA, DISCB and DISCK. Subscribers Subscribers Discovery Channel ...........................................................96 Discovery Channel ........................................................361 TLC ......................................................................................94 NEW Animal Planet ..............................................................304 Animal Planet ...................................................................94 TLC ................................................................................. 302 Investigation Discovery ..................................................86 OWN: Oprah Winfrey Network .......................................82 Eurosport ...................................................................... 130 Science Channel ............................................................... 75 Investigation Discovery/ID Xtra ................................108 Discovery Family Channel ..............................................69 Switchover Media .......................................................... 101 In March, Discovery completed an acquisition of a Velocity ...............................................................................63 -

Thinktv FACT PACK NEW ZEALAND

ThinkTV FACT PACK JAN TO DEC 2017 NEW ZEALAND TV Has Changed NEW ZEALAND Today’s TV is a sensory experience enjoyed by over 3 million viewers every week. Powered by new technologies to make TV available to New Zealanders anywhere, any time on any screen. To help advertisers and agencies understand how TV evolved over the last year, ThinkTV has created a Fact Pack with all the stats for New Zealand TV. ThinkTV’s Fact Pack summarises the New Zealand TV marketplace, in-home TV viewing, timeshifted viewing and online video consumption. And, because we know today’s TV is powered by amazing content, we’ve included information on some top shows, top advertisers and top adverts to provide you with an insight into what was watched by New Zealanders in 2017. 2017 THE NEW ZEALAND TV MARKETPLACE BIG, SMALL, MOBILE, SMART, CONNECTED, 1. HD-capable TV sets are now in CURVED, VIRTUAL, 3D, virtually every home in New Zealand DELAYED, HD, 4K, 2. Each home now has on average ON-DEMAND, CAST, 7.6 screens capable of viewing video STREAM… 3. Almost 1 in every 3 homes has a internet-connected smart TV THE TV IS AS CENTRAL TO OUR ENTERTAINMENT AS IT’S EVER BEEN. BUT FIRST, A QUICK PEAK INSIDE NEW ZEALAND’S LIVING ROOMS • In 2015 New Zealand TV celebrated 55 years of broadcast with the first transmission on 1 June, 1960 • Today’s TV experience includes Four HD Free-to-air channels Two Commercial Free-to-Air broadcasters One Subscription TV provider • Today’s TV is DIGITAL in fact, Digital TV debuted in 2006 followed by multi-channels in 2007 • In its 58th year, New Zealand TV continues to change and evolve. -

Channel Guide August 2018

CHANNEL GUIDE AUGUST 2018 KEY HOW TO FIND WHICH CHANNELS YOU HAVE 1 PLAYER PREMIUM CHANNELS 1. Match your ENTERTAINMENT package 1 2 3 4 5 6 2 MORE to the column 100 Virgin Media Previews 3 M+ 101 BBC One If there’s a tick 4 MIX 2. 102 BBC Two in your column, 103 ITV 5 FUN you get that 104 Channel 4 6 FULL HOUSE channel ENTERTAINMENT SPORT 1 2 3 4 5 6 1 2 3 4 5 6 100 Virgin Media Previews 501 Sky Sports Main Event 101 BBC One HD 102 BBC Two 502 Sky Sports Premier 103 ITV League HD 104 Channel 4 503 Sky Sports Football HD 105 Channel 5 504 Sky Sports Cricket HD 106 E4 505 Sky Sports Golf HD 107 BBC Four 506 Sky Sports F1® HD 108 BBC One HD 507 Sky Sports Action HD 109 Sky One HD 508 Sky Sports Arena HD 110 Sky One 509 Sky Sports News HD 111 Sky Living HD 510 Sky Sports Mix HD 112 Sky Living 511 Sky Sports Main Event 113 ITV HD 512 Sky Sports Premier 114 ITV +1 League 115 ITV2 513 Sky Sports Football 116 ITV2 +1 514 Sky Sports Cricket 117 ITV3 515 Sky Sports Golf 118 ITV4 516 Sky Sports F1® 119 ITVBe 517 Sky Sports Action 120 ITVBe +1 518 Sky Sports Arena 121 Sky Two 519 Sky Sports News 122 Sky Arts 520 Sky Sports Mix 123 Pick 521 Eurosport 1 HD 132 Comedy Central 522 Eurosport 2 HD 133 Comedy Central +1 523 Eurosport 1 134 MTV 524 Eurosport 2 135 SYFY 526 MUTV 136 SYFY +1 527 BT Sport 1 HD 137 Universal TV 528 BT Sport 2 HD 138 Universal -

Quick Tips Simply More Ways to Enjoy Tv Channel Guide

QUICK TIPS SIMPLY MORE WAYS TO ENJOY TV Press the Main Menu button to access Add/Remove Channels from your the TV Guide, On Demand, My TV, Favourites CHANNEL GUIDE Search, Settings and My Account Highlight the channel you want to save in the TV guide, then press on your TV Press the TV Guide button to access remote. A heart icon will appear next GUIDE the programme menu and filter by to the channel. favourites or genre. Record a Show with your Video Press the i button to get information Recorder about the programme you are Storage space must be purchased to watching. house your recordings. Press the Red button on your remote while watching Use the CH+/CH- buttons to scroll the + a show or after selecting a programme channel lineup. – on the TV guide. Use the Right/Left arrow keys to see View Recordings what’s playing at a later date or time Press My TV on your remote and with the Mini-Guide. select recordings. Press OK to confirm any command on your TV guide. Pause & Rewind Live TV Press the Rewind button to go back + Use the VOL+/VOL- button to control up to two hours from the current TV the volume. guide time. Pres Play when ready – to watch. To return to live TV (current Press the TV Button to return to live programme schedule), simply press TV programming. Stop Press the Blue Button to help you Watch On Demand search the live TV or On-Demand Press the On Demand button on your programmes.