AAE Example, 466–467, 476 Aborting Games, 188, 190 Adaptive Behavior, 81 Adaptive Limited-Supply Auction, 424–427 Adoption A

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Game-Based Verification and Synthesis

Downloaded from orbit.dtu.dk on: Sep 30, 2021 Game-based verification and synthesis Vester, Steen Publication date: 2016 Document Version Publisher's PDF, also known as Version of record Link back to DTU Orbit Citation (APA): Vester, S. (2016). Game-based verification and synthesis. Technical University of Denmark. DTU Compute PHD-2016 No. 414 General rights Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. Users may download and print one copy of any publication from the public portal for the purpose of private study or research. You may not further distribute the material or use it for any profit-making activity or commercial gain You may freely distribute the URL identifying the publication in the public portal If you believe that this document breaches copyright please contact us providing details, and we will remove access to the work immediately and investigate your claim. Ph.D. Thesis Doctor of Philosophy Game-based verification and synthesis Steen Vester Kongens Lyngby, Denmark 2016 PHD-2016-414 ISSN: 0909-3192 DTU Compute Department of Applied Mathematics and Computer Science Technical University of Denmark Richard Petersens Plads Building 324 2800 Kongens Lyngby, Denmark Phone +45 4525 3031 [email protected] www.compute.dtu.dk Summary Infinite-duration games provide a convenient way to model distributed, reactive and open systems in which several entities and an uncontrollable environment interact. -

Survey of the Computational Complexity of Finding a Nash Equilibrium

Survey of the Computational Complexity of Finding a Nash Equilibrium Valerie Ishida 22 April 2009 1 Abstract This survey reviews the complexity classes of interest for describing the problem of finding a Nash Equilibrium, the reductions that led to the conclusion that finding a Nash Equilibrium of a game in the normal form is PPAD-complete, and the reduction from a succinct game with a nice expected utility function to finding a Nash Equilibrium in a normal form game with two players. 2 Introduction 2.1 Motivation For many years it was unknown whether a Nash Equilibrium of a normal form game could be found in polynomial time. The motivation for being able to due so is to find game solutions that people are satisfied with. Consider an entertaining game that some friends are playing. If there is a set of strategies that constitutes and equilibrium each person will probably be satisfied. Likewise if financial games such as auctions could be solved in polynomial time in a way that all of the participates were satisfied that they could not do any better given the situation, then that would be great. There has been much progress made in the last fifty years toward finding the complexity of this problem. It turns out to be a hard problem unless PPAD = FP. This survey reviews the complexity classes of interest for describing the prob- lem of finding a Nash Equilibrium, the reductions that led to the conclusion that finding a Nash Equilibrium of a game in the normal form is PPAD-complete, and the reduction from a succinct game with a nice expected utility function to finding a Nash Equilibrium in a normal form game with two players. -

Equilibrium Computation in Normal Form Games

Tutorial Overview Game Theory Refresher Solution Concepts Computational Formulations Equilibrium Computation in Normal Form Games Costis Daskalakis & Kevin Leyton-Brown Part 1(a) Equilibrium Computation in Normal Form Games Costis Daskalakis & Kevin Leyton-Brown, Slide 1 Tutorial Overview Game Theory Refresher Solution Concepts Computational Formulations Overview 1 Plan of this Tutorial 2 Getting Our Bearings: A Quick Game Theory Refresher 3 Solution Concepts 4 Computational Formulations Equilibrium Computation in Normal Form Games Costis Daskalakis & Kevin Leyton-Brown, Slide 2 Tutorial Overview Game Theory Refresher Solution Concepts Computational Formulations Plan of this Tutorial This tutorial provides a broad introduction to the recent literature on the computation of equilibria of simultaneous-move games, weaving together both theoretical and applied viewpoints. It aims to explain recent results on: the complexity of equilibrium computation; representation and reasoning methods for compactly represented games. It also aims to be accessible to those having little experience with game theory. Our focus: the computational problem of identifying a Nash equilibrium in different game models. We will also more briefly consider -equilibria, correlated equilibria, pure-strategy Nash equilibria, and equilibria of two-player zero-sum games. Equilibrium Computation in Normal Form Games Costis Daskalakis & Kevin Leyton-Brown, Slide 3 Tutorial Overview Game Theory Refresher Solution Concepts Computational Formulations Part 1: Normal-Form Games -

Well-Supported Vs. Approximate Nash Equilibria: Query Complexity of Large Games∗

Well-Supported vs. Approximate Nash Equilibria: Query Complexity of Large Games∗ Xi Chen†1, Yu Cheng‡2, and Bo Tang§3 1 Columbia University, New York, USA [email protected] 2 University of Southern California, Los Angeles, USA [email protected] 3 Oxford University, Oxford, United Kingdom [email protected] Abstract In this paper we present a generic reduction from the problem of finding an -well-supported Nash equilibrium (WSNE) to that of finding an Θ()-approximate Nash equilibrium (ANE), in large games with n players and a bounded number of strategies for each player. Our reduction complements the existing literature on relations between WSNE and ANE, and can be applied to extend hardness results on WSNE to similar results on ANE. This allows one to focus on WSNE first, which is in general easier to analyze and control in hardness constructions. As an application we prove a 2Ω(n/ log n) lower bound on the randomized query complexity of finding an -ANE in binary-action n-player games, for some constant > 0. This answers an open problem posed by Hart and Nisan [23] and Babichenko [2], and is very close to the trivial upper bound of 2n. Previously for WSNE, Babichenko [2] showed a 2Ω(n) lower bound on the randomized query complexity of finding an -WSNE for some constant > 0. Our result follows directly from combining [2] and our new reduction from WSNE to ANE. 1998 ACM Subject Classification F.2 Analysis of Algorithms and Problem Complexity Keywords and phrases Equilibrium Computation, Query Complexity, Large Games Digital Object Identifier 10.4230/LIPIcs.ITCS.2017.57 1 Introduction The celebrated theorem of Nash [29] states that every finite game has an equilibrium point. -

Succinct Counting and Progress Measures for Solving Infinite Games

Succinct Counting and Progress Measures for Solving Infinite Games Katrin Martine Dannert September 2017 Masterarbeit im Fach Mathematik vorgelegt der Fakult¨atf¨urMathematik, Informatik und Naturwissenschaften der Rheinisch-Westf¨alischen Technischen Hochschule Aachen 1. Gutachter: Prof. Dr. Erich Gr¨adel 2. Gutachter: Prof. Dr. Martin Grohe Eigenst¨andigkeitserkl¨arung Hiermit versichere ich, die Arbeit selbstst¨andigverfasst und keine anderen als die angegebenen Quellen und Hilfsmittel benutzt zu haben, alle Stellen, die w¨ortlich oder sinngem¨aßaus anderen Quellen ¨ubernommen wurden, als solche kenntlich gemacht zu haben und, dass die Arbeit in gleicher oder ¨ahnlicher Form noch keiner Pr¨ufungsbeh¨ordevorgelegt wurde. Aachen, den Katrin Dannert Contents Introduction . .4 1 Basics and Conventions 5 1.1 Conventions and Notation . .5 1.2 Basics on Games and Complexity Theory . .6 1.3 Parity Games . .8 1.4 Muller Games . 18 1.5 Streett-Rabin Games . 24 1.6 Modal µ-Calculus . 33 2 Two Quasi-Polynomial Time Algorithms for Solving Parity Games 41 2.1 Succinct Counting . 41 2.2 Succinct Progress Measures . 52 2.3 Comparing the two methods . 71 3 Solving Streett-Rabin Games in FPT 80 3.1 Succinct Counting for Streett Rabin Games with Muller Conditions . 80 3.2 Succinct Counting for Pair Conditions . 86 4 Applications to the Modal µ-Calculus 92 4.1 Solving the Model Checking Game with Succinct Counting . 92 4.2 Solving the Model Checking Game with Succinct Progress Measures . 94 Conclusion . 97 References . 98 Introduction In this Master's thesis we will take a look at infinite games and at methods for deciding their winner. -

Schedule and Abstracts (PDF)

Combinatorial game Theory Jan. 9–Jan. 14 MEALS *Breakfast (Buffet): 7:00–9:30 am, Sally Borden Building, Monday–Friday *Lunch (Buffet): 11:30 am–1:30 pm, Sally Borden Building, Monday–Friday *Dinner (Buffet): 5:30–7:30 pm, Sally Borden Building, Sunday–Thursday Coffee Breaks: As per daily schedule, 2nd floor lounge, Corbett Hall *Please remember to scan your meal card at the host/hostess station in the dining room for each meal. MEETING ROOMS All lectures will be held in Max Bell 159 (Max Bell Building accessible by walkway on 2nd floor of Corbett Hall). LCD projector, overhead projectors and blackboards are available for presentations. Note that the meeting space designated for BIRS is the lower level of Max Bell, Rooms 155–159. Please respect that all other space has been contracted to other BanffCentre guests, including any Food and Beverage in those areas. SCHEDULE Sunday 16:00 Check-in begins (Front Desk - Professional Development Centre - open 24 hours) Lecture rooms available after 16:00 (if desired) 17:30–19:30 Buffet Dinner, Sally Borden Building 20:00 Informal gathering in 2nd floor lounge, Corbett Hall (if desired) Beverages and a small assortment of snacks are available on a cash honor system. Monday 7:00–8:45 Breakfast 8:45–9:00 Introduction and Welcome by BIRS Station Manager, Max Bell 159 9:00-9:10 Overview of the week’s activities 9:10-10:00 Olivier Teytaud, Monte Carlo Tree Search Methods. 10:00-10:30 Coffee 10:30-11:00 Angela Siegel, Distributive and other lattices in CGT. -

Computing Correlated Equilibrium and Succinct Representation of Games

Algorithmic Game Theory Computing Correlated Equilibrium and Succinct Representation of Games Branislav Boˇsansk´y Artificial Intelligence Center, Department of Computer Science, Faculty of Electrical Engineering, Czech Technical University in Prague [email protected] April 23, 2018 Correlated Equilibrium Correlated Equilibrium { a probability distribution over pure strategy profiles p = ∆(S) that recommends each player i to play 0 the best response; 8si; si 2 Si: X X 0 p(si; s−i)ui(si; s−i) ≥ p(si; s−i)ui(si; s−i) s−i2S−i s−i2S−i Coarse Correlated Equilibrium { a probability distribution over pure strategy profiles p = ∆(S) that in expectation recommends each player i to play the best response; 8si 2 Si: X 0 0 X 0 0 p(s )ui(s ) ≥ p(s )ui(si; s−i) s02S0 s02S0 Correlated Equilibrium The solution concept describes situations with a correlation device present in the environment. Correlated equilibrium is closely related to learning in competitive scenarios. (Coarse) Correlated equilibrium is often a result of a no-regret learning strategy in a game. Correlated Equilibrium Computing a CE in normal-form games: X X 0 0 p(si; s−i)ui(si; s−i) ≥ p(si; s−i)ui(si; s−i) 8si; si 2 Si s−i2S−i s−i2S−i Computation in succinct games: polymatrix games congestion games anonymous games symmetric games graphical games with a bounded tree-width Succinct Representations compact representation of the game with n = jN j players we want to reduce the input from jSjjN j to jSjd, where d jN j which succinct representations are we going to talk about: congestion games (network congestion games, ...) polymatrix games (zero-sum polymatrix games) graphical games (action graph games) Succinct Representations Definition (Papadimitriou and Roughgarden, 2008) A succinct game G = (I;T;U) is defined, like all computational problems, in terms of a set of efficiently recognizable inputs I, and two polynomial algorithms T and U. -

Evolution Strategies for Approximate Solution of Bayesian Games

The Thirty-Fifth AAAI Conference on Artificial Intelligence (AAAI-21) Evolution Strategies for Approximate Solution of Bayesian Games Zun Li and Michael P. Wellman University of Michigan, Ann Arbor flizun, [email protected] Abstract vectors defining valuations for sets of goods, and strategies mapping such types to bids for these goods. We address the problem of solving complex Bayesian games, characterized by high-dimensional type and action spaces, A Bayesian-Nash equilibrium (BNE) is a configuration many (> 2) players, and general-sum payoffs. Our approach of strategies that is stable in the sense that no player can applies to symmetric one-shot Bayesian games, with no given increase the expected value of its outcome by deviating to analytic structure. We represent agent strategies in parametric another strategy. As our games are symmetric, it is natural form as neural networks, and apply natural evolution strategies to seek symmetric BNE, and to exploit symmetric repre- (NES) (Wierstra et al. 2014) for deep model optimization. For sentations for computational purposes. A classical approach pure equilibrium computation, we formulate the problem as (Milgrom and Weber 1982; McAfee and McMillan 1987) for bi-level optimization, and employ NES in an iterative algo- deriving pure symmetric BNE is to solve a differential equa- rithm to implement both inner-loop best response optimization tion for a fixed point of an analytical best response mapping. and outer-loop regret minimization. In simple games including first- and second-price auctions, it is capable of recovering However for many SBGs of interest, analytic solution is hin- known analytic solutions. For mixed equilibrium computation, dered by irregular type distributions and nonlinear payoffs, we adopt an incremental strategy generation framework, with and dimensionality of type and action spaces. -

Computational Complexity of Mixed Equilibria for Boolean Games

University of Oxford Department of Computer Science Complexity of mixed equilibria in Boolean games Author: Supervisor: Egor Ianovski Dr. Luke Ong arXiv:1702.03620v1 [cs.GT] 13 Feb 2017 Submitted in fulfilment of the requirements of the degree of Doctor of Philosophy in Computer Science, 3rd of March 2016 Egor Ianovski: Complexity of mixed equilibria in Boolean games © 3rd of March 2016 ABSTRACT Boolean games are a succinct representation of strategic games wherein a player seeks to satisfy a formula of propositional logic by selecting a truth assignment to a set of propositional variables under his control. The difficulty arises because a player does not necessarily control every variable on which his formula depends, hence the satisfaction of his formula will depend on the assignments chosen by other players, and his own choice of assignment will affect the satisfaction of other players’ formulae. The framework has proven popular within the multiagent community and the literature is replete with papers either studying the properties of such games, or using them to model the interaction of self-interested agents. However, almost invariably, the work to date has been restricted to the case of pure strategies. Such a focus is highly restrictive as the notion of randomised play is fundamental to the theory of strategic games – even very simple games can fail to have pure-strategy equilibria, but every finite game has at least one equilibrium in mixed strategies. To address this, the present work focuses on the complexity of algo- rithmic problems dealing with mixed strategies in Boolean games. The main result is that the problem of determining whether a two-player game has an equilibrium satisfying a given payoff constraint is NEXP- complete. -

6.5 X 11.5 Doublelines.P65

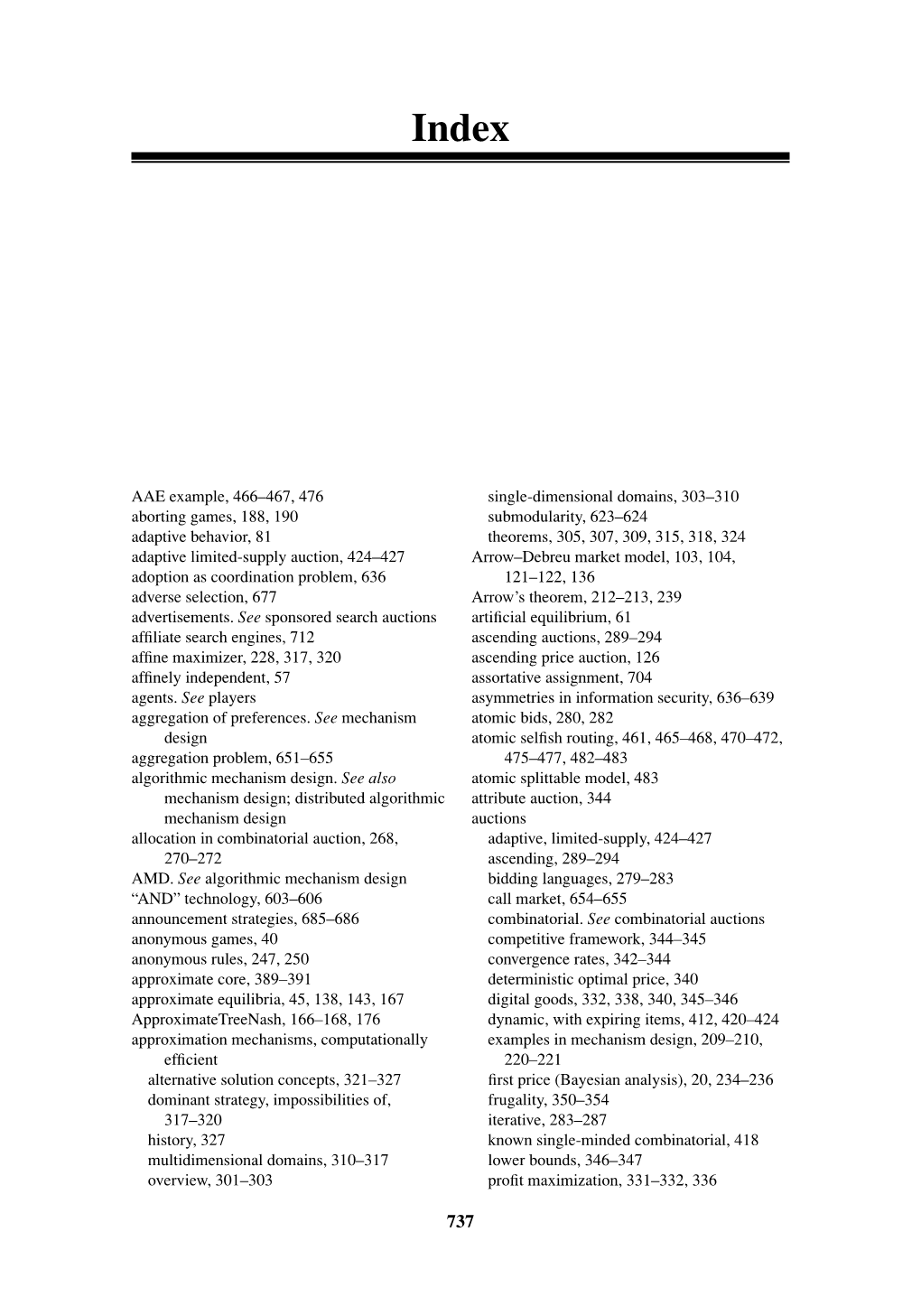

Cambridge University Press 978-0-521-87282-9 - Algorithmic Game Theory Edited by Noam Nisan, Tim Roughgarden, Eva Tardos and Vijay V. Vazirani Index More information Index AAE example, 466–467, 476 single-dimensional domains, 303–310 aborting games, 188, 190 submodularity, 623–624 adaptive behavior, 81 theorems, 305, 307, 309, 315, 318, 324 adaptive limited-supply auction, 424–427 Arrow–Debreu market model, 103, 104, adoption as coordination problem, 636 121–122, 136 adverse selection, 677 Arrow’s theorem, 212–213, 239 advertisements. See sponsored search auctions artificial equilibrium, 61 affiliate search engines, 712 ascending auctions, 289–294 affine maximizer, 228, 317, 320 ascending price auction, 126 affinely independent, 57 assortative assignment, 704 agents. See players asymmetries in information security, 636–639 aggregation of preferences. See mechanism atomic bids, 280, 282 design atomic selfish routing, 461, 465–468, 470–472, aggregation problem, 651–655 475–477, 482–483 algorithmic mechanism design. See also atomic splittable model, 483 mechanism design; distributed algorithmic attribute auction, 344 mechanism design auctions allocation in combinatorial auction, 268, adaptive, limited-supply, 424–427 270–272 ascending, 289–294 AMD. See algorithmic mechanism design bidding languages, 279–283 “AND” technology, 603–606 call market, 654–655 announcement strategies, 685–686 combinatorial. See combinatorial auctions anonymous games, 40 competitive framework, 344–345 anonymous rules, 247, 250 convergence rates, 342–344 approximate core, -

Constructive Game Logic ⋆

Constructive Game Logic ? Brandon Bohrer1 and André Platzer1;2 1 Computer Science Department, Carnegie Mellon University, Pittsburgh, USA {bbohrer,aplatzer}@cs.cmu.edu 2 Fakultät für Informatik, Technische Universität München, München, Germany Abstract. Game Logic is an excellent setting to study proofs-about- programs via the interpretation of those proofs as programs, because constructive proofs for games correspond to effective winning strategies to follow in response to the opponent’s actions. We thus develop Con- structive Game Logic, which extends Parikh’s Game Logic (GL) with constructivity and with first-order programs à la Pratt’s first-order dy- namic logic (DL). Our major contributions include: 1. a novel realizability semantics capturing the adversarial dynamics of games, 2. a natural de- duction calculus and operational semantics describing the computational meaning of strategies via proof-terms, and 3. theoretical results includ- ing soundness of the proof calculus w.r.t. realizability semantics, progress and preservation of the operational semantics of proofs, and Existential Properties on support of the extraction of computational artifacts from game proofs. Together, these results provide the most general account of a Curry-Howard interpretation for any program logic to date, and the first at all for Game Logic. Keywords: Game Logic, Constructive Logic, Natural Deduction, Proof Terms 1 Introduction Two of the most essential tools in theory of programming languages are program logics, such as Hoare calculi [29] and dynamic logics [45], and the Curry-Howard correspondence [17,31], wherein propositions correspond to types, proofs to func- tional programs, and proof term normalization to program evaluation. Their intersection, the Curry-Howard interpretation of program logics, has received surprisingly little study. -

Ebook Download Game Theory: Analysis of Conflict Pdf Free Download

GAME THEORY: ANALYSIS OF CONFLICT PDF, EPUB, EBOOK Roger B. Myerson | 600 pages | 15 Sep 1997 | HARVARD UNIVERSITY PRESS | 9780674341166 | English | Cambridge, Mass, United States Game Theory: Analysis of Conflict PDF Book Description , preview , Princeton, ch. Alfredo Sepulveda-Ximenez rated it really liked it Sep 03, Lists with This Book. It was shown that the modified optimization problem can be reformulated as a discounted differential game over an infinite time interval. In biology, game theory has been used as a model to understand many different phenomena. Evolutionary game theory studies players who adjust their strategies over time according to rules that are not necessarily rational or farsighted. By Kristoffer Arnsfelt Hansen. However, if you do persevere and get to master the notation if you are not put off by first chapter, you should have no problems with the rest Persevering with the notation has high payoffs: is one of the few textbooks with extended worked examples that really get into the nitty gritty. In project management, game theory is used to model the decision-making process of players, such as investors, project managers, contractors, sub-contractors, governments and customers. Most cooperative games are presented in the characteristic function form, while the extensive and the normal forms are used to define noncooperative games. Political Science. Therefore, the players maximize the mathematical expectation of the cost function. Normal form or payoff matrix of a 2- player, 2-strategy game. Stochastic outcomes can also be modeled in terms of game theory by adding a randomly acting player who makes "chance moves" " moves by nature ".