Maquetación 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lehman Brothers

Lehman Brothers Lehman Brothers Holdings Inc. (Pink Sheets: LEHMQ, former NYSE ticker symbol LEH) (pronounced / ˈliːm ə n/ ) was a global financial services firm which, until declaring bankruptcy in 2008, participated in business in investment banking, equity and fixed-income sales, research and trading, investment management, private equity, and private banking. It was a primary dealer in the U.S. Treasury securities market. Its primary subsidiaries included Lehman Brothers Inc., Neuberger Berman Inc., Aurora Loan Services, Inc., SIB Mortgage Corporation, Lehman Brothers Bank, FSB, Eagle Energy Partners, and the Crossroads Group. The firm's worldwide headquarters were in New York City, with regional headquarters in London and Tokyo, as well as offices located throughout the world. On September 15, 2008, the firm filed for Chapter 11 bankruptcy protection following the massive exodus of most of its clients, drastic losses in its stock, and devaluation of its assets by credit rating agencies. The filing marked the largest bankruptcy in U.S. history.[2] The following day, the British bank Barclays announced its agreement to purchase, subject to regulatory approval, Lehman's North American investment-banking and trading divisions along with its New York headquarters building.[3][4] On September 20, 2008, a revised version of that agreement was approved by U.S. Bankruptcy Judge James M. Peck.[5] During the week of September 22, 2008, Nomura Holdings announced that it would acquire Lehman Brothers' franchise in the Asia Pacific region, including Japan, Hong Kong and Australia.[6] as well as, Lehman Brothers' investment banking and equities businesses in Europe and the Middle East. -

Robert Lehman Papers

Robert Lehman papers Finding aid prepared by Larry Weimer The Robert Lehman Collection Archival Project was generously funded by the Robert Lehman Foundation, Inc. This finding aid was generated using Archivists' Toolkit on September 24, 2014 Robert Lehman Collection The Metropolitan Museum of Art 1000 Fifth Avenue New York, NY, 10028 [email protected] Robert Lehman papers Table of Contents Summary Information .......................................................................................................3 Biographical/Historical note................................................................................................4 Scope and Contents note...................................................................................................34 Arrangement note.............................................................................................................. 36 Administrative Information ............................................................................................ 37 Related Materials ............................................................................................................ 39 Controlled Access Headings............................................................................................. 41 Bibliography...................................................................................................................... 40 Collection Inventory..........................................................................................................43 Series I. General -

Merchants Go to Market

CHAPTER 10 Merchants Go to Market November 2009 Mary A. O’Sullivan The Wharton School University of Pennsylvania 1. INTRODUCTION The period from the late nineteenth century through the beginning of the Depression was one of dramatic change in America’s retail industry. In 1885, mass retailers – department stores, mail order firms, and chains ‐‐ were of limited importance as a share of retail sales but, by 1930, they had emerged as the most powerful players in a sector that itself had grown much larger. Traditional retailers persisted, of course, even if they accounted for a decreasing share of the retail industry, but they too made important changes in how they did business, partly in reaction to competition from mass retailers, but also in response to broader changes in their environment. Overall, this was a period of great change in American retailing even if there is debate about the economic benefits of some of the developments that occurred. Retailers were rather late arrivals on the nation’s securities markets, making an appearance only in 1901 when department stores issued securities to the public for the first time. The early issuers were department stores in pursuit of consolidation and recapitalisation. However, in the mid‐teens, major financial problems at some of the leading players soured the markets’ appetite for department store securities. Other mass retailers issued securities, in some cases to raise growth finance and in others for recapitalisation and consolidation. Overall, however, securities issues played a rather limited role in the development of the U.S. retail industry through the end of the First World War. -

Bernard Berenson and the Robert Lehman Collection

BERNARD BERENSON AND THE ROBERT LEHMAN COLLECTION by HILLARY BARRON A thesis submitted to the Department of Ait History in confomiity with the requirements for the degree of Master of Arts Queen's University Kingston, Ontario, Canada June 2000 Copyright Q Hillary Barron. June 2000 National Library Bibliothèque nationale If1 of Canada du Canada Acquisitions and Acquisitions et Bibliographie Services services bibliographiques 395 Wellington Street 395. rue Wdlington OnawaON K1A ON1 Ottawa ON K1A üN4 Canada Canada The author has granted a non- L'auteur a accordé une licence non exclusive licence allowing the exclusive permettant à la National Library of Canada to Bibliothèque nationale du Canada de reproduce, loan, distribute or sell reproduire, prêter, distribuer ou copies of this thesis in microforni, vendre des copies de cette thèse sous paper or electronic formats. la forme de microfiche/film, de reproduction sur papier ou sur format électronique. The author retains ownership of the L'auteur conserve la propriété du copyright in this thesis. Neither the droit d'auteur qui protège cette thèse. thesis nor substantial extracts Grom it Ni la thèse ni des extraits substantiels may be printed or otherwise de celle-ci ne doivent être imprimés reproduced without the author's ou autrement reproduits sans son permission. autorisation. In this thesis, I intend to argue that the connoisseurship of Bernard Berenson significantly irnpacted the art collecting strategies of New York financiers Philip and Robeit Lehman. In the late nineteenth century, Berenson and the Lehmans were equally influenced by America's growing fascination with European culture. specifically that of the Italian Renaissance. -

John L. Loeb Collection

/) 374 L« C» L eX \c c fi) * A Act M J,[- . I U^^.^ £*w'/* 4'r«< m fi* h 1 Arthur Maluda. ml Matthew '994 Charlotte 1991 lilt Xuhard 1973 9 Btniairuit (9S< Sharon "4* Janus HamiKOiui tori ofSondes Cabntla 9H Jeremy fMT Ww 1 Darnel 1971 Votes Tkwut mz mil Susan Hatttwald TJenry Lehman 18Z2 1S6S JUayer Lehman 1830 Emanuel Lehman 18Z5 Babette Wewgass 1858 Rosa iVolff Ttudine Sondheim ^ Lehman Tamily 1TT8-1995 Lthtntuv hashj ComfUtd by TdOh JHerbert, Uhman> dlQtndy LEHMAN phafhic [-ausrN TMlOH BY JAKirTE AIIL Abraham Lehman 1TT8 Eva JZvsenheirn 1T80 The Lehman Family Directory 1995 Compiled by Wendy Lehman Lash Edited by Robert A. Klein The Lehman Family Directory 1995 Compiled by Wendy Lehman Lash Edited by Robert A. Klein Emanuel and Pauline Lehman I Descendents of ,. - Evelyn Lehman and Jules Ehrich I V B Ehrich Descendents of: Evelyn and Jules Ehrich Descendents of: Evelyn and Jules Mayer, Dale Shoup Ebrich, Evelyn Lehman Mayer, Donald Snedden Ehrich, Jules Mayer, Dorothy Ehrich Ehrich, May Mayer, Douglas Ehrich Field, Anthony E. Mayer, Ellen Ruth Field, Daniel M. Mayer, John C. Field, David B. Mayer, John Eric Field, David John Mayer, Meredith Nevins Field, Dorothy Manion Mayer, Michele Roberts Field, Harold C. Mayer, Noah John Field, Jane Katz Mayer, Steven Allan Field, Jane Mayer Mayer, Trevor Roberts Field, John Alexander Mayer, William R Field, Peter J. Pittman, Genevra Mayer Friedman, Abigail Sarah Pittman, Nicholas Mayer Friedman, Daniel Jeremy Pittman, HI, Malcolm Galusha Friedman, Ethan Jared Shenker, Bruce Friedman, Isabelle Schumann Shenker, Elizabeth Field Friedman, Peter Shenker, Joanna Claudia Field Friedman, Ralph Der Vegt, Cicely Friedman, Robert E. -

The Lehman Family in 1928, Pranklin 1. Roosevelt Was Elected Governor of the State of New York. the Man Who Ran with Him For

The Lehman Family In 1928, Pranklin 1. Roosevelt was elected Governor of the State of New York. The man who ran with him for Lieutenant- Governor was little mentioned at the time. Pour year? later, when Franklin I). Roosevelt was elected President of the United States the people of the State chose this Lieutenant-Governor to fill the vacancy in Albany. In 1938, the people confirmed the same man for four more years in office. Thus, he achieved a feat which ncjbne else accomplished before him. The man who rose so high in the political life of the United States is Herbert Henry Lehman. He is the son of Mayer * ; Lehman who came to this country from Prussia in the middle l& of the last century. N~" "* As many other German jews who distinguished themselves later in the United States - e.g. the Straus's, the Er- langerfs - Mayer Lehman did not stay in New York but moved to the South. In Montgomery, Alabama, he opened a cotton business which attained a large significance during the time of the Civil Tar. Montgomery was then capital of the South^ and cotton its main article of export. Mayer Lehman's business flourished, and his prestige in the city and the South grew equally. Jefferson JDavis, President of the Con- federate States of America, was one of his friends. After the Civil Tar was over the merchant was attracted hy the new metropolis of commerce, Hew York. Here it was that Mayer Lehman, with his brother Emmanuel, founded the banking house of Lehman Brothers which has developed since to one of the biggest private banking institutions in the United States. -

Lehman Brothers

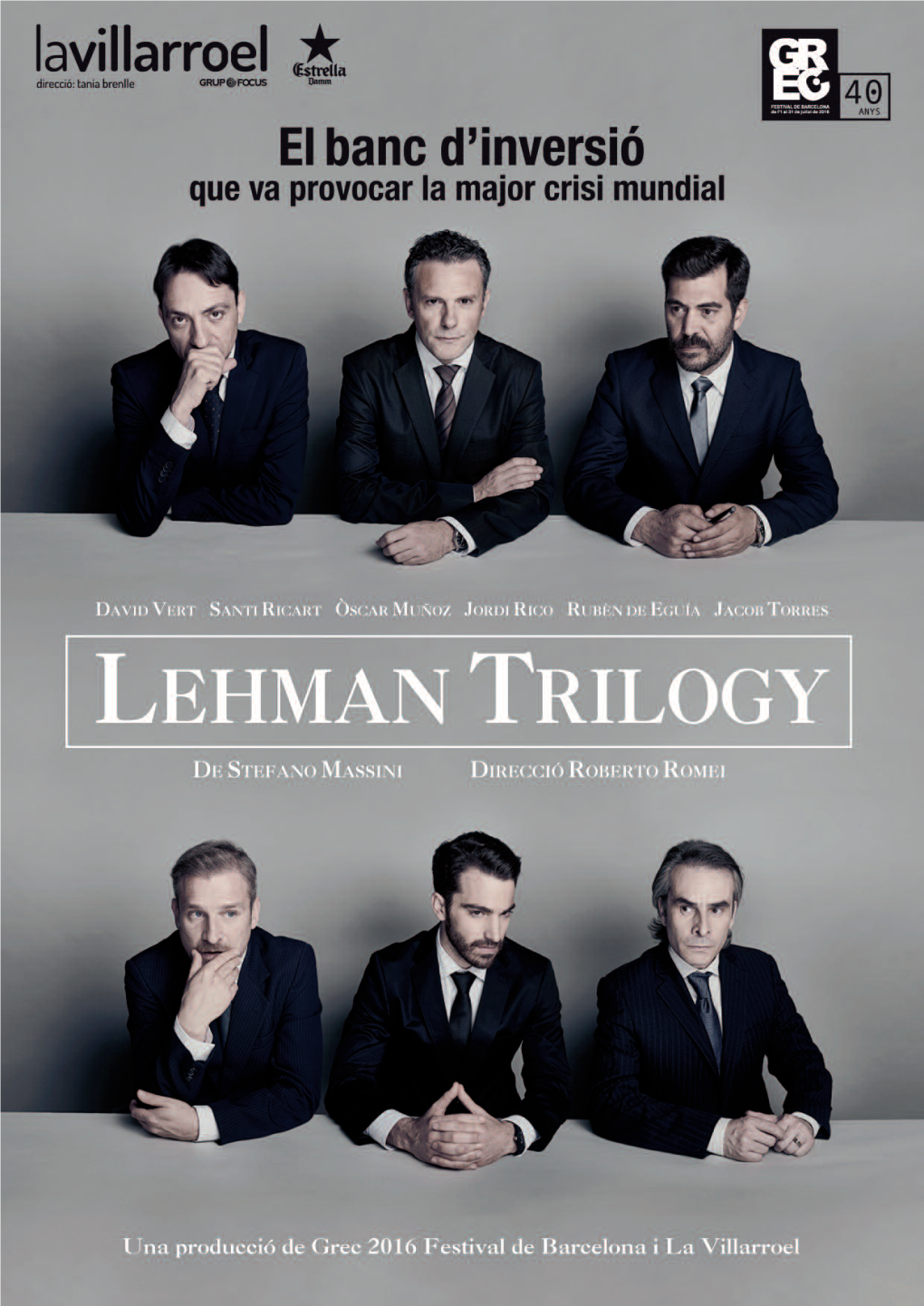

1 2 3 STEFANO MASSINI Lehman Brothers Lehman Trilogy 2012 itaalia keelest tõlkinud MARGUS ALVER Mängivad → GUIDO KANGUR kolm vaatust: MAIT MALMSTEN I Kolm venda PRIIT VÕIGEMAST II Isad ja pojad III Surematud Muusikud → JOEL REMMEL (klaver) HEIKKO REMMEL või lavastaja → HENDRIK TOOMPERE JR MIHKEL MÄLGAND (kontrabass) kunstnik → LAURA PÄHLAPUU AHTO ABNER (löökpillid) kostüümikunstnik → KÄRT OJAVEE valguskunstnik → PRIIDU ADLAS videokunstnik → ALYONA MOVKO helikujundaja → LAURI KALDOJA liikumisjuht → ÜÜVE-LYDIA TOOMPERE etenduse juht → JOHANNES TAMMSALU Esietendus 9. septembril 2020 suures saalis. 4 5 Ronconi assistendina. Seal hakkas ta nii lavastama kui ka Ronconi julgustusel 2005. aastast alates aktiivselt teatrile kirjutama ja algusest peale saatis teda edu. Tema looming on praeguseks pälvinud kõik olulisemad itaalia teatri- ja kirjandusauhinnad, mitmed neist korduvalt. Massini tegutseb mitmel alal, ta on kirjutanud näidendeid ja proosat, õpeta- nud Itaalia kõrgkoolides, juhtinud erinevaid teat- riprojekte ja telesaateid, lavastanud. Tema teoseid on tõlgitud ligi paarikümnesse keelde ja näidendeid lavastatud mitmetes maailma kõrgetasemelistes teatrites. Ta on öelnud, et kirjanikuna ei huvita teda paarisu- hete lood, vaid ajaloolistes sündmustes kajastuvad põhimõttelised eetilised küsimused. Nii on ta kirju- tanud mõrvatud vene ajakirjaniku Anna Politkovs- kaja tekstide põhjal temast dokumentaalnäidendi, endise Itaalia peaministri Aldo Moro pantvangikrii- sist, eaka Iraagi naise ja tema lapselapse 5000- kilomeetrisest põgenemisteekonnast Mosulist Läänemereni, Hannah Arendti ja Adolf Eichmanni dialoogi, Juuda evangeeliumi jm. Stefano Massini on intervjuudes rääkinud oma eripärasest kirjutamisviisist. Ta on nimelt igapäe- vane rattasõitja, 30-40-kilomeetristel ringidel oma kodu ümbruses Firenze ja Prato vahel räägib ta vahel oma tekstid kõva häälega ette ning salvestab telefoniga, hiljem kirjutab maha. See lisavat teatri- Stefano Massini. tekstile kõne loomulikkust ja voolavust. -

News Release from Lehman Brothers One William Street New York

NEWS RELEASE FROM LEHMAN BROTHERS ONE WILLIAM STREET NEW YORK r*C" LEHMAN BROTHERS CELEBRATE CENTENARY Investment Banking Firm Starts New Century With Faith in Future* Lehman Brothers, one of America's leading investment banking firms, today celebrates its 100th anniversary. The centennial is being marked by a 63-page book published by the firm, tracing its development since its founding in Montgomery, Alabama, in 1850» The book emphasizes the part the firm has played in gathering capital for the rapidly growing businesses of the United States and in broadening the ownership of their securities. The firm, under its century-old name of "Lehman Brothers", was founded by three brothers, Henry, Emanuel and Mayer Lehman, who migrated from the village of Rimpar in Bavaria during the middle of the 19th century. At the outset, grocery and dry goods were their stock in trade, but shortly the firm became a coinmodity house, predominately in cotton* With New York becoming the center of the cotton crop financing, the firm in 1858 established a New York office at 119 Liberty Street and Emanuel Lehman came to Manhattan to live* While the blockade of the Confederacy's ports brought the cotton business to a virtual halt, the Governor of Alabama charged Mayer Lehman with the task of persuading the Union authorities to grant permission for some 1500 bales to pass through the lines to be sold in the North for the benefit of Alabama prisoners in the Union prisons, a scheme that proved futile. After the Civil War Lehman Brothers business was resumed at 176 Fulton Street, and moved thence to 106 Water Street, and in 1867 to 153-155 Pearl Street, and again to 40 Exchange Place, the booming center of the cotton trade*. -

J. & W. Seligman & Company Building Designation Report

Landmarks Preservation Commission February 13, 1996, Designation List 271 LP-1943 J. & W. SELIGMAN & COMPANY BUILDING (later LEHMAN BROTHERS BUILDING; now Banca Commerciale Italiana Building), 1 William Street (aka 1-9 William Street, 1-7 South William Street, and 63-67 Stone Street), Borough of Manhattan. Built 1906-07; Francis H. Kimball and Julian C. Levi, architects; George A. Fuller Co., builders; South William Street facade alteration 1929, Harry R. Allen, architect; addition 1982-86, Gino Valle, architect. Landmark Site: Borough of Manhattan Tax Map Block 29, Lot 36. On December 12, 1995, the Landmarks Preservation Commission held a public hearing on the proposed designation as a Landmark of the J. & W. Seligman & Company Building (later Lehman Brothers Building; now Banca Commerciale Italiana Building) and the proposed designation of the related Landmark Site (Item No. 5). The hearing was continued to January 30, 1996 (Item No. 4). The hearing had been duly advertised in accordance with the provisions of law. Nine witnesses spoke in favor of designation, including representatives of Manhattan Borough President Ruth Messinger, Council Member Kathryn Freed, Municipal Art Society, New York Landmarks Conservancy, Historic Districts Council, and New York Chapter of the American Institute of Architects. In addition, the Commission has received a resolution from Community Board 1 in support of designation. Summary The rusticated, richly sculptural, neo-Renaissance style J. & W. Seligman & Company Building, designed by Francis Hatch Kimball in association with Julian C. Levi and built in 1906-07 by the George A. Fuller Co., is located at the intersection of William and South William Streets, two blocks off Wall Street. -

Annual Report

SERVICE The Mount Sinai XX • . 1 nospitai 1949 fete?/ I 97TH ANNUAL REPORT The Mount Sinai Hospital of the City of New York 1949 CONTENTS Page Administrators and Heads of Departments 179 Bequests and Donations Contributors to the Jacobi Library 144 Dedicated Buildings 92 Donations to Social Service 90 Donations in Kind 88 Establishment of Rooms 96 Establishment of Wards 04 Endowments for General Purposes 132 Endowments for Special Purposes 128 Special —For Purposes 75 (lifts to Social Service i^g Legacies and Bequests Life Beds I22 Life Members j^g Medical Research Funds 133 Memorial Beds I2o Miscellaneous Donations 89 Perpetual Beds I0g Special Funds of The School of Nursing ^6 Tablets ^g Committees Board of Trustees Medical Board j_j Endowments, Extracts from Constitution on 203 Financial — Statement Brief Summary Insert Graduate Medical Instruction, Department of Historical Note ^ House Staff (as of January 1, 1950) 20I House Staff, Graduates of jgg Medical Board *3o Medical and Surgical Staff ^ CONTENTS ( Continued) Page Neustadter Foundation, Officers and Directors 63 Officers and Trustees Since Foundation 183 Reports Laboratories 38 Professional Services 22 Neustadter Home for Convalescents 64 Out-Patient Department 35 President 14 School of Nursing ! 52 Social Service Department 58 School of Nursing—Officers and Directors 51 Social Service Department Social Service Auxiliary—Officers and Members 57 Social Service Auxiliary—Committees and Volunteers 180 Statistical Summary 9 Statistics, Comparative 1948-1949 10 Superintendents and Directors Since 1855 187 Treasurers' Reports 67 Hospital 68 Ladies' Auxiliary 74 School of Nursing 72 Social Service Auxiliary 73 Trustees, Board of 145 The Mount Sinai Hospital is a member of the Federation of Jewish Philanthropies of New Yorj^, and a beneficiary of its fund-raising campaigns. -

NINE BILLION OUNCES Copyright December 2005 Charles Savoie

NINE BILLION OUNCES Copyright December 2005 Charles Savoie (Partially reprinted by Silver Users Association in Washington Report, January 2006) “How can anyone talk about impending shortages of the white metal when such enormous supplies as we have just mentioned are available?” That was Walter Frankland of the Silver Users Association quoted in American Metal Market, April 12, 1988. His comment was in reference to a claim by Lehman Brothers that as of that date, the world contained 11 billion ounces of refined, above ground silver. Well golly gee-whiz, to quote Gomer Pyle, television’s wacky Marine. Statistics mainly from CPM Group show that from mid-1988 through 2005 projections, silver deficits totaled approximately 1,750 million to 1,800 million ounces. Walter, do you mean to tell us that only about 16 to 17 percent of the available silver in the world has gone to satisfy the deficit (caused entirely by suppressed low prices); and therefore, that silver investors in their mid-30s as of now could pass away waiting for silver to become scarce enough as to force prices to rise, overwhelming even gigantic short positions? Walter doesn’t seem to be broadcasting such a view, in light of the Silver Users Association’s recent stated opposition to a silver Exchange Traded Fund. The ETF would only require some 130 million ounces to be fully backed. Hell, that would increase the silver production to consumption deficit to a mere 1,930 million ounces at most, since Lehman’s 1988 claim of 11 billion ounces leaves around 9BOZ today---barely 17.5% of what they claimed was available has been consumed. -

History of Lehman Brothers

THE BEGINNINGS • Established in 1844, in Montgomery Alabama. • The sole founder, Henry Lehman created small shop specializing in dry goods merchandise. A SHIFT IN BUSINESS • In 1850 , Emanuel and Mayer Lehman joined what was now officially known as Lehman Brothers. • Lehman Brothers shifts attention from general merchandise business to commodities brokerage firm. SWIFT PARTNERSHIP • Business partnership formed with cotton merchant John Wesley Durr. • LEH. Bros moves headquarters to New York City in 1858. • In 1870, LEH Bros. lead New York Cotton Exchange. SO, WHAT’S THE NEW YORK COTTON EXCHANGE? • Founded in 1870, NY, NY. • A commodities exchange • an exchange for buying and selling commodities (e.g. cotton). • Lead and founded by a group of 100 merchants and brokers. ANOTHER TRANSITION? § 1887, LEH Bros. became member of the NYSE (New York Stock Exchange). § Business transitions again from commodities business to merchant-banking § Merchant banking = provides money to companies for stake in ownership instead of loans. NEW ALLIANCE, NEW VENTURE • 1906, Philip Lehman teams up with Henry Goldman of Goldman Sachs. • LEH Bros. places new emphasis on rising retail industry. THE DEPRESSION • LEH. Bros was not immune to the devastating effects of the Depression • LEH. Bros. creates private placement to encourage investment during these trying times. • Private placement = non-public offering of shares in a private company. NEW MERGER • 1984, Lehman Brothers acquired by American Express, now formed Shearson to form Shearson Lehman Brothers. • 1993, Shearson Lehman Brothers was again solely recognized as Lehman Brothers. DOWNFALL • 2008, Lehman Brothers entangled in subprime mortgage lending crisis • Subprime mortgage crisis = rise in subprime mortgage foreclosures, resulting in the decline of mortgage securities.