Council Tax Base 2020-21 Contains Confidential Or Exempt Information?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

18 July 2013 MAIDENHEAD the Appeals Listed Below Have Been

Planning Appeals Received 21 June 2013 - 18 July 2013 MAIDENHEAD The appeals listed below have been received by the Council and will be considered by the Planning Inspectorate. Further information on planning appeals can be found at www.planningportal.gov.uk/pcs Should you wish to make comments in connection with an appeal, please use the PIns reference number and write to the relevant address, shown below. Enforcement appeals: The Planning Inspectorate, Room 3/26 Wing, Temple Quay House, 2 The Square, Temple Quay, Bristol, BS1 6PN Other appeals: The Planning Inspectorate, Room 3/10b Kite Wing, Eagle, Temple Quay House, 2 The Square, Temple Quay, Bristol, BS1 6PN or email [email protected] Parish/Ward: Appeal Ref.: 13/60072/REF Planning 13/00325/FULL PIns APP/T0355/D/13/2199525 Ref.: Ref.: Date 27 June 2013 Comments Not Applicable Received: Due: Type: Refusal Appeal Type: Householder Description: Installation of front automated vehicle entrance and pedestrian gate Location: 230A Courthouse Road Maidenhead SL6 6HE Appellant: Mr William Argles 230A Courthouse Road Maidenhead SL6 6HE Parish/Ward: Appeal Ref.: 13/60074/REF Planning 13/00782/FULL PIns APP/T0355/A/13/2200114 Ref.: Ref.: Date 28 June 2013 Comments Due: 9 August 2013 Received: Type: Refusal Appeal Type: Written Representation Description: Side and front extensions, raising of main roof, insertion of dormers to provide first floor accommodation. Conversion into a pair of semi-detached dwellings, changes to the fenestration (including alterations to dormers, new bay window and side entrance door and porch) removal of garage and new dropped kerb. -

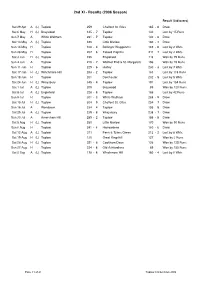

2Nd XI - Results (2006 Season)

2nd XI - Results (2006 Season) Result (Ltd overs) Sat29 Apr A (L) Taplow 259 Chalfont St. Giles 185 - 8 Draw Sat6 May H (L) Braywood 145 - 7 Taplow 130 Lost by 15 Runs Sun7 May A White Waltham 261 - 7 Taplow 142 - 6 Draw Sat13 May A (L) Taplow 185 Little Marlow 160 - 7 Draw Sun14 May H Taplow 168 - 4 Ballinger Waggoners 169 - 8 Lost by 2 Wkts Sun28 May H Taplow 207 - 6 Tabard Pilgrims 211 - 7 Lost by 3 Wkts Sat3 Jun H (L) Taplow 195 Englefield 116 Won by 79 Runs Sun4 Jun A Taplow 215 - 7 Widmer End & St. Margarets 196 Won by 19 Runs Sun11 Jun H Taplow 229 - 6 Hurley 230 - 3 Lost by 7 Wkts Sat17 Jun H (L) Winchmore Hill 283 - 2 Taplow 165 Lost by 118 Runs Sun18 Jun H Taplow 201 Dorchester 202 - 5 Lost by 5 Wkts Sat24 Jun H (L) Wraysbury 345 - 4 Taplow 191 Lost by 154 Runs Sat1 Jul A (L) Taplow 209 Braywood 89 Won by 120 Runs Sat8 Jul A (L) Englefield 228 - 8 Taplow 186 Lost by 42 Runs Sun9 Jul H Taplow 301 - 5 White Waltham 268 - 9 Draw Sat15 Jul H (L) Taplow 304 - 9 Chalfont St. Giles 254 - 7 Draw Sun16 Jul A Wendover 234 - 4 Taplow 155 - 8 Draw Sat29 Jul A (L) Taplow 239 - 8 Wraysbury 238 - 7 Draw Sun30 Jul A Amersham Hill 289 - 2 Taplow 185 - 8 Draw Sat5 Aug H (L) Taplow 260 Little Marlow 170 Won by 90 Runs Sun6 Aug H Taplow 241 - 6 Harrowdene 160 - 6 Draw Sat12 Aug A (L) Taplow 211 Penn & Tylers Green 213 - 2 Lost by 8 Wkts Sat19 Aug H (L) Taplow 130 Great Kingshill 127 Won by 3 Runs Sat26 Aug H (L) Taplow 251 - 6 Cookham Dean 126 Won by 125 Runs Sun27 Aug H Taplow 224 - 8 Old Ashfordians 69 Won by 155 Runs Sat2 Sep A (L) Taplow 178 - 8 Winchmore Hill 180 - 4 Lost by 6 Wkts Page 11 of 23 Taplow Cricket Club 2006 2nd XI - Playing Record (2006 Season) Played Won Draw Lost Tied Abandoned Saturday (League) 15 5 4 6 Sunday 11 2 5 4 26 7 9 10 - - 26.92% 34.62% 38.46% - - Highest Scores For Against 304 - 9 2ndv Chalfont St. -

The White House L Colne Way, Wraysbury, Berkshire, TW19

The White House l Colne Way, Wraysbury, Berkshire, TW19 The White House l Colne Way, Wraysbury, Berkshire, TW19 THE PROPERTY The White House is a beautiful five bedroom detached family home built in 1920, with over 3100 sq feet of accommodation. The current owners have retained several of the original features, including the entrance gate, front door and several stained glass windows. On the ground floor there is a study and formal sitting room which has double doors leading out to the mature garden. The luxury fitted kitchen has been extended to provide fantastic open plan dining and living area, an excellent space for any family and there is also a utility room. The galleried staircase leads up to the first floor landing leading to the five bedrooms. There are four double bedrooms, two are serviced by a ‘Jack n Jill’ bathroom, there is also a single room and the master with built in wardrobes, ensuite bathroom and spectacular views across the rear garden. There is also a further family bathroom. OUTSIDE The property is located in a quiet Cul-De-Sac and set behind electric gates on three quarters of an acre plot in an idyllic location bordering the Colne. In addition to the house, there are numerous outbuildings including a garage, games room, summerhouse, shed, two carports and three garages. The larger garage and yard have certified commercial use (proven since October 1994, granted 2004). The private mature garden is an excellent location for hosting family events. THE LOCATION Colne Way is ideally placed for Staines-Upon-Thames, Windsor, Wraysbury and just a short drive from the M25, ten minutes from Terminal 5, blending rural living with commuter lifestyle. -

Freehold - £425,000

ESTATE AGENTS • VALUERS 24 Kiln Hill, Shottesbrooke, Maidenhead, Berkshire SL6 3SN Ref: 4691 Freehold - £425,000 ENTRANCE HALL GROUND FLOOR BATHROOM KITCHEN / BREAKFAST ROOM LIVING ROOM THREE BEDROOMS FIRST FLOOR SHOWER ROOM DETACHED GARAGE APPROXIMATELY 150FT / 45M LONG REAR GARDEN JOINT SOLE AGENTS A charming and characterful semi detached property, understood to date back to the 1820’s, with later additions and providing scope for some updating. The cottage occupies an appealing partially wooded setting in Shottesbrooke which is a rural hamlet abutting White Waltham which boasts a popular primary school, historic church and the village pub opposite the cricket pitch. Maidenhead and Twyford railway stations are equidistant. 43 Thames Street, Windsor, Berkshire SL4 1PR Tel : 01753 856 683 Fax: 01753 854 945 e.mail: [email protected] www.lsandm.co.uk The accommodation is arranged on two floors as follows: GROUND FLOOR COVERED ENTRANCE: with front door leading to small: ENTRANCE HALL: tiled floor; cupboard housing fuse box and electricity meter; sliding door to the Kitchen / Breakfast Room and door to: BATHROOM: suite of panelled bath, pedestal wash basin and low level w.c.; heated towel rail; frosted window. KITCHEN / BREAKFAST ROOM: 18’10 x 11’9 (5.7m x 3.6m) narrowing to 8’ (2.4m); secondary glazed Georgian style window overlooking the rear garden; extensive range of limed oak fronted base and eye level units; 1½ bowl stainless steel sink unit; space and plumbing for washing machine; space and plumbing for dishwasher; space for tumble dryer; built-in four ring electric hob with hood over; built-in Hotpoint double oven with cupboards above and below; cupboard housing water tank; storage heater; study area; part glazed door to: LIVING ROOM: 21’6 x 15’ (6.6m x 4.6m); a pretty double aspect room; exposed beams; brick fireplace; original leaded window to front and secondary glazed Georgian style windows to side; further small original window; two storage heaters; telephone point. -

Consultation Statement 2020

Datchet Design Guide Supplementary Planning Document Consultation Statement 2020 November 2020 Datchet Design Guide – Consultation Statement Page left intentionally blank 2 Datchet Design Guide – Consultation Statement Contents 1. Introduction ................................................................................................................................................4 2. Regulation 12 Consultation ........................................................................................................................5 Consultation Methodology .........................................................................................................................5 Material consulted on .................................................................................................................................6 Responding to the consultation ..................................................................................................................7 3. The consultation response..........................................................................................................................8 Number of Representors ............................................................................................................................8 Number of Representations & Representation Points ...............................................................................8 4. Summary of main issues raised in response to the consultation…………………………………………………………..9 Appendix 1: List Of Statutory Consultees consulted -

Horton and Wraysbury Character Assessment

Horton and Wraysbury Character Assessment June 2015 Horton and Wraysbury Parish Councils Contents 1. Introduction 2. Landscape Setting 3. Townscape Character Appendix 1: RBWM Landscape Character Assessment, 2004 - Extracts Relevant to Horton and Wraysbury 1 INTRODUCTION About this document This document, prepared by Horton and Wraysbury Parish Councils, provides an overview of the character and key qualities that define the built up areas of the parishes of Horton and Wraysbury. It has been produced as one part of a larger project – the Horton and Wraysbury Neighbourhood Development Plan. Once adopted, the Neighbourhood Development Plan will be used by the Royal Borough of Windsor and Maidenhead when considering planning applications which are submitted within the designated area. This Character Assessment supports the design and character policies progressed within the Neighbourhood Development Plan, and will help to ensure that development proposals are designed in a manner which is complimentary to and reinforces the distinct and special character of Horton and Wraysbury. 2 LANDSCAPE SETTING An aquatic landscape The Parishes of Horton and Wraysbury lie in a landscape which is largely shaped and characterised by water features. These water features take a variety of forms, and include: The River Thames; Wraysbury Reservoir and the Queen Mother Reservoir; and ‘Man-made’ lakes formed from disused gravel pits. The River Thames lies to west of Wraysbury, and in this area diverges into the New Cut, the Colne Brook and some unnamed tributaries. Lakes of varying sizes, originating from former gravel workings are a particular feature (during the 1930’s, due to the presence of huge quantities of gravel in this area, farming started to give way to the minerals extraction industry). -

A404 Bisham Roundabout Improvement Public Consultation Report Published October 2015

A404 Bisham Roundabout Improvement Public Consultation Report * A404 Bisham Roundabout Improvement Public Consultation Report Published October 2015 Registered office Bridge House, 1 Walnut Tree Close, Guildford GU1 4LZ Highways England Company Limited registered in England and Wales number 09346363 A404 Bisham Roundabout Improvement Public Consultation Report Document Control Document Title A404 Bisham Roundabout Improvement Public Consultation Report Author Owen Brickell Owner Highways England Document Status FINAL Reviewer List Name Role Matthew Salt Assistant Project Engineer Tom Proudfoot Roads Design Manager Approvals Name Signature Title Date of Issue Version Surinder Bhangu Asset Manager October 2015 FINAL John Henderson Asset Manager October 2015 FINAL The original format of this document is copyright to the Highways England. October 2015 Page 2 of 69 Highways England A404 Bisham Roundabout Improvement Public Consultation Report Executive Summary Highways England promoted a scheme to improve A404 Bisham Junction in the Government’s Pinch Point Programme. However, following initial consultation, it was decided that no scheme should be taken forward without further development work and a full consultation involving local residents, stakeholders and motorists. A public consultation was held between the 19 June 2015 and the 12 September 2015 on three options. It gave an opportunity for all to express their views on the proposed improvement options. The three options were: Option 1: Partial Signalised Roundabout Option 2: Left In/Left Out Option 3: Signalised Junction This report outlines how the public consultation was planned, carried out and its feedback reviewed. Exhibitions were held locally over 2 days with; one day at Bisham Abbey and the second at Bisham Church of England (C of E) Primary School. -

Royal Borough of Windsor and Maidenhead

Contents 1.0 FLOOD RISK MANAGEMENT 1.1 Strategic Flood Risk Assessment 1.2 Winter 2012 Floods 1.2.1 Maidenhead Windsor and Eton FAS 1.2.2 Temporary defences in Windsor 1.2.3 Old Windsor 1.2.4 Datchet 1.2.5 Wraysbury 1.3 Recovery Projects 1.3.1 Taplow Washout 1.3.2 Cookham and North Maidenhead Flood Wall Repairs 1.3.3 Black Potts Washout 1.3.4 Eton End School Bund, Datchet 1.3.5 Bund Removal, Datchet 1.4 Community Engagement 1.4.1 Cookham Parish 1.4.2 Bisham Flood Alleviation Scheme 1.4.3 Datchet 1.4.4 Wraysbury 1.4.5 Ham Island 1.4.6 River Level Data and ‘Parishes Live’ 1.4.7 Environment Agency.Gov Website Live 1.5 Insurance Related Information 1.6 River Maintenance 1.7 River Bed levels surveys 1.8 Flooded Land at Little Common Farm, Eton Wick 1.9 Flood and Water Management Act 2.0 PLANNING 2.1 Planning Charge 2.2 Maidenhead Waterways Restoration and Town Centre Regeneration 2.3 Travellers Site - Datchet 2.4 Bray Road Maidenhead – proposed school 2.5 RBWM Borough Local Plan 2014 Preferred options consultation 2.6 Position Statement for replacement dwellings 3.0 WASTE 3.1 Brayfield Farm 3.2 Horton Brook Quarry – Colnbrook 4.0 HYDROPOWER 5.0 WATERWAYS 5.1 Speed and Wash campaign 5.2 Waterways Volunteers 5.3 Magna Carta Celebrations 6.0 WATER FRAMEWORK DIRECTIVE 7.0 WATER RESOURCES 1 OFFICIAL 1.0 FLOOD RISK MANAGEMENT 1.1 Strategic Flood Risk Assessment We recently met to discuss the River Thames Scheme (Datchet to Teddington), which is included in the Royal Borough’s SFRA. -

Display PDF in Separate

NRA Thames 79 DATCHET, WRAYSBURY, STAINES AND CHERTSEY FLOOD STUDY AQUATIC BIOLOGY Baseline Survey Report VOLUME 2 April 1990 NRA National Rivers Authority Thames Region N,(VA"”6 a 'T DATCHET, WRAYSBURY, STAINES AND CHERTSEY FLOOD STUDY AQUATIC BIOLOGY Baseline Survey Report VOLUME 2 April 1990 Environmental Agncy Pond Action Thames Region c'o Biological and Molecular Sciences Library Catalogue Oxford Polytechnic ENVIRONMENT AGENCY Gipsy Lone Heodmgton Oxford 0X3 OBP 042409 YOnaQAiBJnemnt notQan?*' •UBotaiBO <!>' ©Vic ObotD^:.;:' THE DATCHET, WRAYSBURY, STAINES AND CHERTSEY FLOOD STUDY AQUATIC BIOLOGY - PART 2 A SURVEY OF THE WETLAND VEGETATION AND AQUATIC MACROINVERTEBRATES OF THE ABBEY RIVER AND CHERTSEY BOURNE POND ACTION C/0 BIOLOGICAL & MOLECULAR SCIENCES OXFORD POLYTECHNIC JANUARY 1990 GIPSY LANE HEADINGTON OXFORD 0X3 OBP SUMMARY Survey sites and dates of surveys Wetland vegetation and aquatic macroinvertebrates we re surveyed on the Abbey River and the Chertsey Bourne. The full length of the Abbey River (3.5km) was surveyed. The Chertsey Bourne was surveyed between the M3/M25 motorway interchange and its confluence with the River Thames (approximately 6.5km). Vegetation surveys were carried out between 10-14 November 1989. Macroinvertebrate surveys were carried out on 16 November 1989. Physical features The mean width and depth of the channel and the composition of the substrate were recorded at the macroinvertebrate survey sites. The Abbey River was 7-9m wide and 0.8-1.3m deep. Substrates were generally dominated by silt. The Chertsey Bourne was 4-8m wide and 0.6-lm deep. Substrates were more varied than in the Abbey River. Wetland plant communities The Abbey River supported a moderately rich plant community with 48 species, including four local species (one introduced) recorded. -

The Landmark Trust Shottesbrooke Maidenhead Berkshire SL6 3SW Charity Registered in England & Wales 243312 and Scotland SC039205

ASCOG HOUSE AND MEIKLE ASCOG, ISLE OF BUTE, ARGYLL AND BUTE The history of the Ascog demesne goes back further than either of the two houses on it. In 1312 Robert the Bruce is said to have given Ascog to the Bute family of Glass. In 1594, the estate, including a mill, Loch Ascog and Nether and Over Ascog, was bought by John Stewart of Kilchattan, a distant kinsman of the Stewarts of Bute who became Earls and later Marquesses of Bute. Ascog House - John Stewart may have built the first house at Ascog, replacing an older tower. Despite the date of 1678 above one of the dormer windows, the original Ascog House was built earlier than that. With its stair tower and cap-house, it is of a type commonly built around 1600. In addition, in the wall of the present kitchen is part of a grand chimneypiece. This belonged to a great hall whose floor and ceiling were both at a higher level than today. In 1673 John Stewart of Ascog, grandson of the first John Stewart, married Margaret Cunningharn and it is their initials that are engraved on the house. They must have carried out a major reconstruction, lowering the floors to create two main storeys, and adding the dormer windows. John Stewart was rich enough to lend the Earl of Bute £9,385 to help re-build Rothesay Castle after damage in the Civil War. He was also crowner or coroner of Bute from 1666-98. During the 18th century, the original mullion windows of Ascog House were enlarged and fitted with sash and casement frames. -

6 September 2019

Planning Applications Decided Week Ending - 6 September 2019 The applications listed below have been DECIDED by the Council. Ward: Parish: Appn. Date: 8th August 2019 Appn No.: 19/30021 Type: Spheres of Mutual Interest Proposal: Extension to existing ferry landing and formation of seating area through bank excavation along with the provision of a berth pile 2.5m above water level. Location: Existing Jetty Adjacent To Runnymede Boathouse Windsor Road Egham Applicant: Ruth Menezes Decision Type: Delegated Decision: No Objection Date of Decision: 3 September 2019 HYM Ward: Ascot & Sunninghill Parish: Sunninghill And Ascot Parish Appn. Date: 29th May 2019 Appn No.: 19/01425 Type: Full Proposal: Single storey rear extension (retrospective). Location: Woodpeckers 13 Woodlands Close Ascot SL5 9HU Applicant: Mr And Mrs James c/o Agent: Mr Nigel Bush NHB Architectural Services Ltd St Marys House Point Mills Bissoe Truro TR4 8QZ Decision Type: Delegated Decision: Application Permitted Date of Decision: 4 September 2019 JS Ward: Ascot & Sunninghill Parish: Sunninghill And Ascot Parish Appn. Date: 18th June 2019 Appn No.: 19/01625 Type: Full Proposal: Change of use of the first floor from Class C3 (dwellinghouses) to Class B1 (offices) with side dormers and second floor roof terrace. Location: Annexe Kingswick House Kingswick Drive Ascot SL5 7BH Applicant: Mr Ewan Boyd c/o Agent: Mr Ewan Boyd Walker Graham Architects 44 Horton View Banbury OX16 9HP Decision Type: Delegated Decision: Application Withdrawn Date of Decision: 4 September 2019 JR Ward: Ascot & Sunninghill Parish: Sunninghill And Ascot Parish Appn. Date: 9th July 2019 Appn No.: 19/01774 Type: Cert of Lawfulness of Proposed Dev Proposal: Certificate of lawfulness to determine whether the proposed garage conversion is lawful. -

The Moat House SMEWINS ROAD • WHITE WALTHAM • MAIDENHEAD • BERKSHIRE • SL6 3SR

The Moat House SMEWINS ROAD • WHITE WALTHAM • MAIDENHEAD • BERKSHIRE • SL6 3SR The Moat House SMEWINS ROAD • WHITE WALTHAM MAIDENHEAD • BERKSHIRE • SL6 3SR A stunning Grade II Listed family home Entrance Hall • Family Room • Library • Sitting Room Kitchen/Breakfast Room • Utility • Guest Cloakroom Master Bedroom with En Suite Bathroom Guest Bedroom/Studio with En Suite Bathroom 2 Further Bedrooms both with En Suite Bathrooms Annexe with Kitchenette and Bathroom • Double Garage Gardens • Victorian Outbuilding Henley-on-Thames 8 miles • Maidenhead 5 miles Windsor 7 miles • M4 (J8/9) 4 miles (Distances approximate) These particulars are intended only as a guide and must not be relied upon as statements of fact. Your attention is drawn to the Important Notice on the last page of the text. The Moat House This stunning Grade II Listed family home was formerly known as Smewyns Manor and has a history that can be dated back to the 11th Century. It is believed to be the site where Anglo-Saxon Barnfield goldsmiths fashioned royal regalia. The original moat which Fairmile surrounds the property on three sides is a listed ancient monument. APPROXIMATE GROSS INTERNAL FLOOR AREA (No less than) The house is approached from Smewins Road through electric 302 sq.m (3,256 sq.ft) gates onto a gravel driveway with attractive barns on either side. Out Buildings The property as it exists today comprises a late medieval cross- (No less than) wing with 16th Century work at right angles and later additions and 88 sq.m (950 sq.ft) alterations. Its best features include the timber framing, both close studded and open boxed framed, the central brick Tudor chimney with wood burning stoves and the simple Georgian features of the parlour.