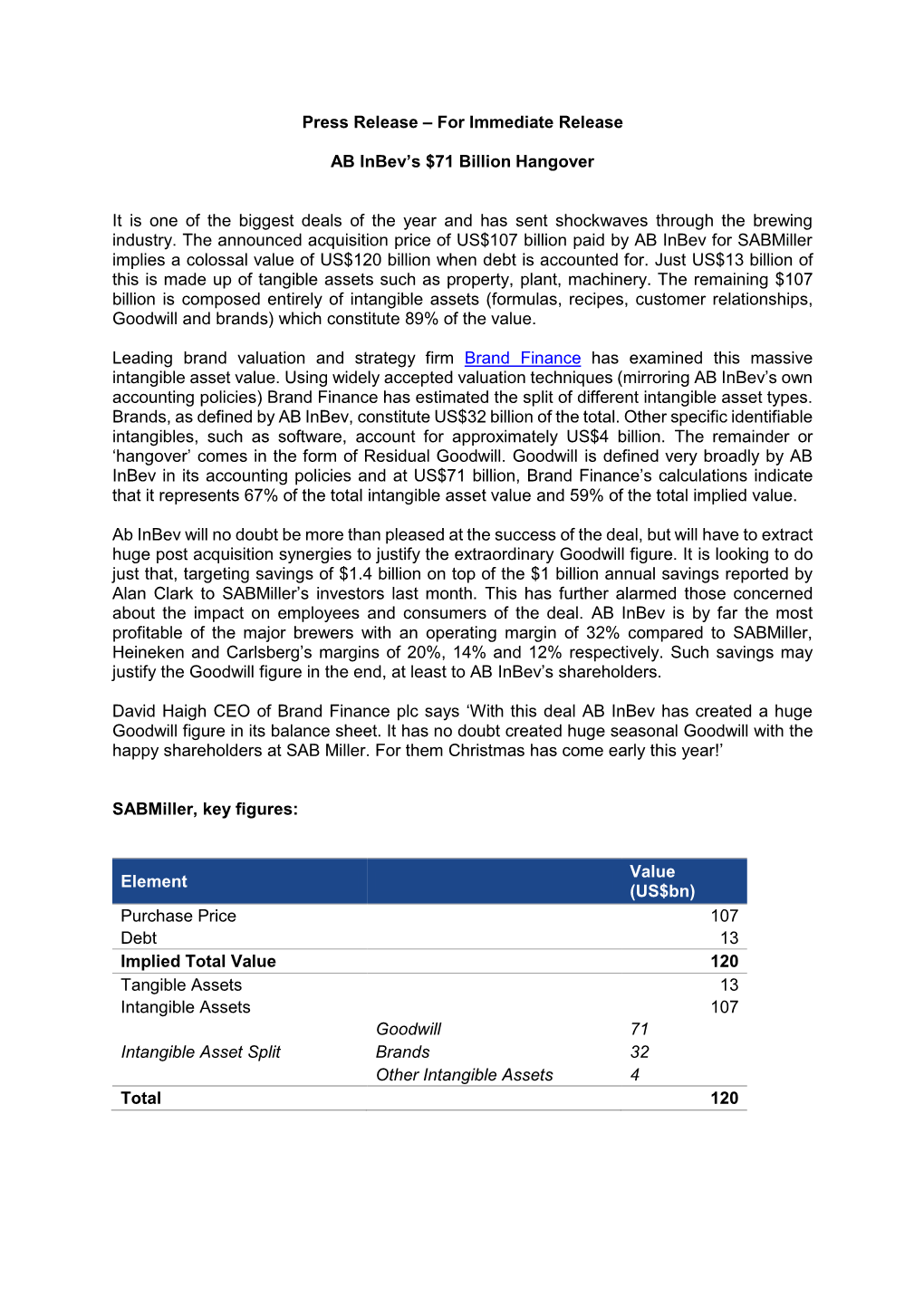

For Immediate Release AB Inbev's $71 Billion Hangover It Is One of the Biggest Deals of the Year and Has

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Beer Everyday

Beer Everyday Boags Prem Lager Bt 375ml Ctn $59.99 Brookvale Ginger Bt 500ml Ctn $79.99 Byron Brewery Premium Lager Ctn $54.99 Carlton Draught Bt 375ml Ctn $63.99 Carlton Dry Bt 355ml Ctn $54.99 Coopers Pale Bt 375ml Ctn $53.99 WAS $54.99 Coopers Pale Bt 750ml Ctn $64.99 Coopers Pale Cans 24pk Carton $53.99 WAS $54.99 Coopers Session 375ml Carton $59.99 Coopers Spark Ale Bt 375ml Ctn $61.99 Coopers Spark Ale Bt 750ml Ctn $61.99 Coopers Stout Bt 375ml Carton $74.99 Coopers XPA Cans Carton $59.99 Coopers XPA CTN $59.99 Crown Lager Bt 375ml Ctn $64.99 Great Northern Bt 330ml 24pk Carton $54.99 Hahn Super Dry Bt 330ml Ctn $54.99 James Squire 150 Lashes 30pk Can Ctn $72.99 James Squire 150 Lashes Bt 330ml Ctn $57.99 WAS $62.99 Matsos Ginger 330ml Carton $92.99 Melbourne Bitter Bt 375ml Ctn $69.99 Pure Blonde Bt 355ml Ctn $53.99 WAS $56.99 Tooheys Extra Dry Bt 345ml Ctn $49.99 Tooheys New Bt 375ml Ctn $52.99 Tooheys New Bt 750ml Ctn $63.99 Tooheys New Can 375ml 30pk $62.99 Tooheys Old Black Bt 375ml Ctn $59.99 Victoria Bitter Bt 375ml 24pk Ctn $54.99 WAS $56.99 Victoria Bitter Bt 750ml Ctn $63.99 Victoria Bitter Can 375ml 30pk $63.99 Beer Craft 4 Pines SCHWARZBIER Ctn $79.99 Bakalar Non Alcoholic Ctn $39.99 Balter Captain Sensible 16pk Ctn $54.99 Balter Dimples Ctn $130.00 Balter IPA 16pk Ctn $69.99 Balter Lager Ctn $59.99 Balter XPA Ctn $59.99 Bentspoke Barley Griffin Ctn $99.99 Bentspoke Hows it Gosen Ctn $80.00 Big Head Ctn $79.99 Black Hops Hornet IPA 16pk Ctn $80.00 Black Hops Pale cans 16pk Ctn $64.99 Black Hops Tropic Like it Hot Ctn -

Cocktails Cocktail Classics Reds Whites Beer & Cider

SPARKLING & STICKY BEER & CIDER WHITES REDS COCKTAILS COCKTAIL CLASSICS SPARKLING Azahara NV Red Cliffs, Victoria 8.0 30.0 Villa Sandi Prosecco Veneto, Italy 9.5 40.0 Rumball Sparkling Shiraz Coonawarra, South Australia 42.0 Segura Viudas Cava Catalunya, Spain 43.0 Chandon Brut Yarra Valley, Victoria 65.0 Howard Park Grand Jeté Mount Barker, Western Australia 66.0 Bollinger NV Champagne, France 120.0 Mumm Cordon Rouge Brut Reims, France 120.0 Veuve Clicquot NV Reims, France 140.0 STICKY All Saints Rutherglen Tawny Rutherglen, Victoria 9.0 39.0 D’Arenberg Noble Mud Pie McLaren Vale, South Australia 41.0 Vasse Felix Cane Cut Margaret River, Western Australia 48.0 SPARKLING & STICKY ON TAP (425ml) Carlton Draught 4.6% 9.0 Pure Blonde 4.2% 9.0 Jack’s Pale Ale 5.0% 9.0 James Squire 150 Lashes 4.2% 9.5 Cheeky Monkey Blonde Capuchin Blonde Ale 4.9% 9.5 Peroni Leggera 3.5% 9.5 Lazy Yak 4.2% 10.0 Ruby Tuesday Amber Ale 4.7% 10.0 Peroni (500ml) 5.1% 12.5 Matilda Bay Dirty Granny Apple Cider 5.5% 10.0 BOTTLED BEER Cascade Premium Light 2.6% 6.5 Victoria Bitter 4.9% 7.5 Hahn Super Dry 4.6% 7.5 Fosters Lager 4.9% 8.0 Melbourne Bitter 4.6% 8.0 Redds Apple Ale 4.0% 8.0 Hoegaarden 4.9% 9.0 Corona 4.5% 9.0 Crown Lager 4.9% 9.0 Grolsch 5.0% 9.0 Matilda Bay ‘Beez Neez’ Honey Wheat Beer 4.7% 9.0 Pilsner Urquell 4.4% 9.0 Miller Genuine Draft 4.7% 9.0 Heineken 5.0% 9.5 Matso’s Ginger Beer 3.5% 10.0 Matso’s Mango Beer 4.5% 10.0 Matilda Bay ‘Dogbolter’ Dark Lager 5.2% 12.0 CIDER Bulmers Original 500ml 4.7% 13.0 Kopparberg Pear 330ml 4.5% 10.0 BEER & CIDER Tatachilla -

We Rank the Top 20 Beer Wholesalers in the United States. 20 Ranked by Case Volume

Beverage Executive’s Distribution We rank the top 20 beer wholesalers in the United States. 20 Ranked by case volume Reyes Beverage Group Leading Suppliers/Brands: Boston Beer, growth throughout 2011 with the 1 (RBG) Crown Imports, Diageo-Guinness acquisition of The Schenck Co. in 6250 N. River Road, Rosemont, IL 60018 USA, Dogfish Head, Heineken USA, Orlando, Fla., early in the year. Tel: 847.227.6500, reyesbeveragegroup.com MillerCoors, Mike’s Hard Lemonade Co., New Belgium, Sierra Nevada, Silver Eagle CV 93.0 MIL DS $1.9 BIL Yuengling 2 Distributors, L.P. Number of Employees: 2,000 The Details: The beer division of Reyes 7777 Washington Ave., Houston, TX Principals: Chris Reyes, co-chairman, Holdings collected more accolades 77007 Tel: 713.869.4361, silvereagle.com, Reyes Holdings, LLC; Jude Reyes, wideworldofbud.com, craftbrewers.com co-chairman, Reyes Holdings, LLC; Duke Reyes, CEO, Reyes Beverage CV 45.6 MIL DS $821.0 MIL Group; Ray Guerin, COO, Reyes Number of Employees: 1,200+ Beverage Group; Jimmy Reyes, director, Principals: John Nau III, majority Reyes Holdings, LLC; Tom Reyes, owner, president & CEO; Robert president, Harbor Distributing, LLC Boblitt Jr., minority owner, executive and Gate City Beverage; Jim Doney, vice president, COO, CFO; John president, Chicago Beverage Systems; Johnson, minority owner, executive John Zeltner, president, Premium vice president, corporate sales and Distributors of Virginia, Maryland marketing and Washington, D.C.; Bob Johnston, Other Locations: Conroe, Cypress, president, Florida Distributing Rosenberg and San Antonio, Texas Co.; Patrick Collins, president, Lee Leading Suppliers/Brands: ABInBev, Distributors; Steve Sourapas, president, Crown Imports, Green Mountain Bev, Crest Beverage Inc., North American Breweries, Phusion Other Locations: Anaheim, Calif., and acquisitions over the past year. -

The Deity's Beer List.Xls

Page 1 The Deity's Beer List.xls 1 #9 Not Quite Pale Ale Magic Hat Brewing Co Burlington, VT 2 1837 Unibroue Chambly,QC 7% 3 10th Anniversary Ale Granville Island Brewing Co. Vancouver,BC 5.5% 4 1664 de Kronenbourg Kronenbourg Brasseries Stasbourg,France 6% 5 16th Avenue Pilsner Big River Grille & Brewing Works Nashville, TN 6 1889 Lager Walkerville Brewing Co Windsor 5% 7 1892 Traditional Ale Quidi Vidi Brewing St. John,NF 5% 8 3 Monts St.Syvestre Cappel,France 8% 9 3 Peat Wheat Beer Hops Brewery Scottsdale, AZ 10 32 Inning Ale Uno Pizzeria Chicago 11 3C Extreme Double IPA Nodding Head Brewery Philadelphia, Pa. 12 46'er IPA Lake Placid Pub & Brewery Plattsburg , NY 13 55 Lager Beer Northern Breweries Ltd Sault Ste.Marie,ON 5% 14 60 Minute IPA Dogfishhead Brewing Lewes, DE 15 700 Level Beer Nodding Head Brewery Philadelphia, Pa. 16 8.6 Speciaal Bier BierBrouwerij Lieshout Statiegeld, Holland 8.6% 17 80 Shilling Ale Caledonian Brewing Edinburgh, Scotland 18 90 Minute IPA Dogfishhead Brewing Lewes, DE 19 Abbaye de Bonne-Esperance Brasserie Lefebvre SA Quenast,Belgium 8.3% 20 Abbaye de Leffe S.A. Interbrew Brussels, Belgium 6.5% 21 Abbaye de Leffe Blonde S.A. Interbrew Brussels, Belgium 6.6% 22 AbBIBCbKE Lvivske Premium Lager Lvivska Brewery, Ukraine 5.2% 23 Acadian Pilsener Acadian Brewing Co. LLC New Orleans, LA 24 Acme Brown Ale North Coast Brewing Co. Fort Bragg, CA 25 Actien~Alt-Dortmunder Actien Brauerei Dortmund,Germany 5.6% 26 Adnam's Bitter Sole Bay Brewery Southwold UK 27 Adnams Suffolk Strong Bitter (SSB) Sole Bay Brewery Southwold UK 28 Aecht Ochlenferla Rauchbier Brauerei Heller Bamberg Bamberg, Germany 4.5% 29 Aegean Hellas Beer Atalanti Brewery Atalanti,Greece 4.8% 30 Affligem Dobbel Abbey Ale N.V. -

2018 Annual Report

AB InBev annual report 2018 AB InBev - 2018 Annual Report 2018 Annual Report Shaping the future. 3 Bringing People Together for a Better World. We are building a company to last, brewing beer and building brands that will continue to bring people together for the next 100 years and beyond. Who is AB InBev? We have a passion for beer. We are constantly Dreaming big is in our DNA innovating for our Brewing the world’s most loved consumers beers, building iconic brands and Our consumer is the boss. As a creating meaningful experiences consumer-centric company, we are what energize and are relentlessly committed to inspire us. We empower innovation and exploring new our people to push the products and opportunities to boundaries of what is excite our consumers around possible. Through hard the world. work and the strength of our teams, we can achieve anything for our consumers, our people and our communities. Beer is the original social network With centuries of brewing history, we have seen countless new friendships, connections and experiences built on a shared love of beer. We connect with consumers through culturally relevant movements and the passion points of music, sports and entertainment. 8/10 Our portfolio now offers more 8 out of the 10 most than 500 brands and eight of the top 10 most valuable beer brands valuable beer brands worldwide, according to BrandZ™. worldwide according to BrandZTM. We want every experience with beer to be a positive one We work with communities, experts and industry peers to contribute to reducing the harmful use of alcohol and help ensure that consumers are empowered to make smart choices. -

Blue Moon Belgian White Witbier / 5.4% ABV / 9 IBU / 170 CAL / Denver, CO Anheuser-Busch Bud Light Lager

BEER DRAFT Blue Moon Belgian White Pint 6 Witbier / 5.4% ABV / 9 IBU / 170 CAL / Denver, CO Pitcher 22 Blue Moon Belgian White, Belgian-style wheat ale, is a refreshing, medium-bodied, unfiltered Belgian-style wheat ale spiced with fresh coriander and orange peel for a uniquely complex taste and an uncommonly... Anheuser-Busch Bud Light Pint 6 Lager - American Light / 4.2% ABV / 6 IBU / 110 CAL / St. Louis, Pitcher 22 MO Bud Light is brewed using a blend of premium aroma hop varieties, both American-grown and imported, and a combination of barley malts and rice. Its superior drinkability and refreshing flavor... Coors Coors Light Pint 5 Lager - American Light / 4.2% ABV / 10 IBU / 100 CAL / Pitcher 18 Golden, CO Coors Light is Coors Brewing Company's largest-selling brand and the fourth best-selling beer in the U.S. Introduced in 1978, Coors Light has been a favorite in delivering the ultimate in... Deschutes Fresh Squeezed IPA Pint 7 IPA - American / 6.4% ABV / 60 IBU / 192 CAL / Bend, OR Pitcher 26 Bond Street Series- this mouthwatering lay delicious IPA gets its flavor from a heavy helping of citra and mosaic hops. Don't worry, no fruit was harmed in the making of... 7/2/2019 DRAFT Ballast Point Grapefruit Sculpin Pint 7 IPA - American / 7% ABV / 70 IBU / 210 CAL / San Diego, CA Pitcher 26 Our Grapefruit Sculpin is the latest take on our signature IPA. Some may say there are few ways to improve Sculpin’s unique flavor, but the tart freshness of grapefruit perfectly.. -

2017 AIBA Catalogue of Results

2017 CATALOGUE OF RESULTS The Royal Agricultural Society of Victoria (RASV) thanks the following partners and supporters for their involvement. PRESENTING PARTNERS MAJOR SPONSOR EVENT PARTNERS EVENT TICKETING PARTNERS TROPHY SPONSORS SUPPORTERS 2017 Catalogue of Results The Royal Agricultural Society of Victoria Limited ABN 66 006 728 785 ACN 006 728 785 Melbourne Showgrounds Epsom Road Ascot Vale VIC 3032 Telephone +61 3 9281 7444 Facsimile +61 3 9281 7592 www.rasv.com.au List of Office Bearers As at 01/02/2017 Patron Her Excellency the Honourable Linda Dessau AM – Governor of Victoria Board of Directors MJ (Matthew) Coleman CGV (Catherine) Ainsworth DS (Scott) Chapman D (Darrin) Grimsey AJ (Alan) Hawkes NE (Noelene) King OAM JA (Joy) Potter PJB (Jason) Ronald OAM SC (Stephen) Spargo AM Chairman MJ (Matthew) Coleman Chief Executive Officer M. O’Sullivan Company Secretary J. Perry Event Manager, Beverage Damian Nieuwesteeg Telephone: +61 3 9281 7461 Email: [email protected] Australian International 1 Beer Awards Australia’s finest beers begin with Australia’s finest malt. Barrett Burston Malting and Cryermalt A passion for the finest ingredients. bbmalt.com.au cryermalt.com.au Contents Message from the CEO 4 Message from the Head Judge 5 2017 Report on Entries 7 2017 Judging Panel 8 2017 Champion Trophy Winners 11 2017 Major Trophy Winners 15 2017 Results 19 Best Australian Style Lager Best European Style Lager Best International Lager Best Pilsner Best Amber / Dark Lager Best Australian Style Pale Ale Best New World Style Pale Ale Best -

A Confusing Sixer of Beer: Tales of Six Frothy Trademark Disputes

University of the Pacific Law Review Volume 52 Issue 4 Article 8 1-10-2021 A Confusing Sixer of Beer: Tales of Six Frothy Trademark Disputes Rebecca E. Crandall Attorney Follow this and additional works at: https://scholarlycommons.pacific.edu/uoplawreview Recommended Citation Rebecca E. Crandall, A Confusing Sixer of Beer: Tales of Six Frothy Trademark Disputes, 52 U. PAC. L. REV. 783 (2021). Available at: https://scholarlycommons.pacific.edu/uoplawreview/vol52/iss4/8 This Article is brought to you for free and open access by the Journals and Law Reviews at Scholarly Commons. It has been accepted for inclusion in University of the Pacific Law Review by an authorized editor of Scholarly Commons. For more information, please contact [email protected]. A Confusing Sixer of Beer: Tales of Six Frothy Trademark Disputes Rebecca E. Crandall* I. 2017 AT THE TTAB: COMMERCIAL IMPRESSION IN INSPIRE V. INNOVATION .. 784 II. 2013 IN KENTUCKY: CONFUSION WITH UPSIDE DOWN NUMBERS AND A DINGBAT STAR ...................................................................................... 787 III. 1960S IN GEORGIA: BEER AND CIGARETTES INTO THE SAME MOUTH ........ 790 IV. 2020 IN BROOKLYN: RELATED GOODS AS BETWEEN BEER AND BREWING KITS ....................................................................................... 792 V. 2015 IN TEXAS: TARNISHMENT IN REMEMBERING THE ALAMO .................. 795 VI. 2016 AT THE TTAB: LAWYERS AS THE PREDATORS ................................... 797 VII. CONCLUSION ............................................................................................ -

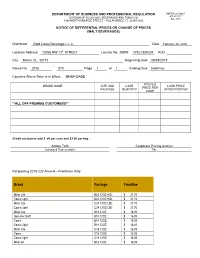

DEPARTMENT of BUSINESS and PROFESSIONAL REGULATION DBPR Form AB&T DIVISION of ALCOHOLIC BEVERAGES and TOBACCO 4000A-032E Rev

DEPARTMENT OF BUSINESS AND PROFESSIONAL REGULATION DBPR Form AB&T DIVISION OF ALCOHOLIC BEVERAGES AND TOBACCO 4000A-032E Rev. 5/04 1940 NORTH MONROE STREET • TALLAHASSEE, FL 32399-1022 NOTICE OF DIFFERENTIAL PRICES OR CHANGE OF PRICES (MALT BEVERAGES) Distributor Gold Coast Beverage L.L.C. Date February 26, 2016 Location Address 10055 NW 12th STREET License No. JDBW WSL2300224 KLD City Miami, FL 33172 Beginning Date 09/28/2015 - Notice No. 2016 074 Page 1 of 1 Ending Date Indefinite Counties Where Price is in Effect: MIAMI-DADE POSTED BRAND NAME SIZE AND CASE CASH PRICE PRICE PER PACKAGE QUANTITY AFTER POSTING CASE **ALL OFF PREMISE CUSTOMERS** Credit customers add $ .40 per case and $2.00 per keg. Amber Toth Corporate Pricing Analyst Authorized Representative Title Ref posting 2015-222 Amend – Frontlines Only Brand Package Frontline Miller Lite B24 12OZ HGL $ 21.70 Coors Light B24 12OZ HGL $ 21.70 Miller Lite C24 12OZ LSE $ 21.70 Coors Light C24 12OZ LSE $ 21.70 Miller Lite B18 12OZ $ 16.05 Genuine Draft B18 12OZ $ 16.05 Coors B18 12OZ $ 16.05 Coors Light B18 12OZ $ 16.05 Miller Lite C18 12OZ $ 16.05 Coors C18 12OZ $ 16.05 Coors Light C18 12OZ $ 16.05 Miller 64 B18 12OZ $ 16.05 Miller 64 C18 12OZ $ 16.05 Lite B24 12OZ 12P $ 21.80 Genuine Draft B24 12OZ 12P $ 21.80 Coors Light B24 12OZ 12P $ 21.80 Miller Lite C24 12OZ 12P $ 21.80 Coors Light C24 12OZ 12P $ 21.80 Coors Banquet C24 12OZ 12P $ 21.80 Coors Banquet Stubby B24 12OZ 12STB $ 21.80 Coors LT Citrus Radler C24 12OZ 12P $ 21.80 Miller Lite B24 12OZ 6P $ 22.40 Coors Light B24 12OZ -

FACTBOOK 2020 (Updated on August 6, 2020) Contents

FACTBOOK 2020 (Updated on August 6, 2020) Contents Asahi Group Philosophy Medium-Term Management Policy Soft Drinks Business Asahi Group Philosophy …………………… 2 Asahi Soft Drinks Co., Ltd. ………………………19 Medium-Term Management Policy ………… 3 Sales by Asahi Soft Drinks ………………………20 Domestic Soft Drinks Market Data ……………21 Corporate Data Food Business Company Overview …………………………… 4 Asahi Group Foods, Ltd. …………………… 23 Stock Information ……………………………… 5 Domestic Food Business Market Data … 24 Main Associate Companies ………………… 6 Corporate Governance Structure ………… 7 Overseas Business List of Group Production Facilities ……… 8 Company History ……………………………… 9 Overview of Overseas Business …………… 25 Global Beer Market …………………………… 26 Europe business ……………………………… 27 Financial and Management Indices Europe Beer Market …………………………… 28 Oceania Alcohol Beverages business ……… 29 Consolidated Financial Statements Oceania Alcohol Beverages Market ………… 30 (J GAAP / IFRS) ………………………………… 11 Oceania Non-Alcohol Beverages business … 31 Southeast Asia Beverages business 32 Group Businesses (Malaysia) ……… Asahi Group at a Glance ……………………… 12 Alcohol Beverages Business Asahi Breweries, Ltd. ………………………… 13 Beer-Type Beverages: Sales by Container Type and Market Channel …………………… 14 Sales Volume by Month in 2019 …………… 15 Sales Volume by Month in 2020 …………… 16 Domestic Alcohol Beverages Market Data 17 Liquor Tax ………………………………………… 18 1 Asahi Group Philosophy 2 Medium-Term Management Policy Medium-Term Management Policy Enhancing "Glocal Value Creation Management" based on Asahi Group -

Millercoors V. Anheuser-Busch Cos., LLC

No Shepard’s Signal™ As of: May 28, 2019 12:50 PM Z Millercoors v. Anheuser-Busch Cos., LLC United States District Court for the Western District of Wisconsin May 24, 2019, Decided; May 24, 2019, Filed 19-cv-218-wmc Reporter 2019 U.S. Dist. LEXIS 88259 * comments during oral argument on that motion on May 16, 2019, and for the reasons more fully explained MILLERCOORS, LLC, Plaintiff, v. ANHEUSER-BUSCH below, the court will grant plaintiff a preliminary COMPANIES, LLC, Defendant. injunction, [*2] though more narrow in scope than that sought by plaintiff, enjoining defendant's use of the Counsel: [*1] For Millercoors, LLC, Plaintiff: Anita following statements: (1) Bud Light contains "100% less Marie Boor, Donald Karl Schott, LEAD ATTORNEYS, corn syrup"; (2) Bud Light in direct reference to "no corn Quarles & Brady, Madison, WI; Christopher A Cole, syrup" without any reference to "brewed with," "made Crowell & Moring LLP, Washington, DC; Raija Janelle with" or "uses"; (3) Miller Lite and/or Coors Light and Horstman, Crowell & Moring LLP, Los Angeles, CA. "corn syrup" without including any reference to "brewed For Anheuser-Busch Companies, LLC, Defendant: with," "made with" or "uses"; and (4) describing "corn 2 James Forrest Bennett, Megan Susan Heinsz, LEAD syrup" as an ingredient "in" the finished product. ATTORNEYS, Adam Joseph Simon, Dowd Bennett LLP, St. Louis, MO; Jennifer Lynn Gregor, Kendall W. Harrison, Godfrey & Kahn S.C., Madison, WI. Judges: WILLIAM M. CONLEY, United States District Judge. Opinion by: WILLIAM M. CONLEY Opinion OPINION AND ORDER During Super Bowl LIII, defendant Anheuser-Busch Companies, LLC, launched an advertising campaign highlighting plaintiff MillerCoors, LLC's use of corn syrup in brewing Miller Lite and Coors Light, as compared to Anheuser-Busch's use of rice in its flagship light beer, preliminary injunction based on the likelihood of plaintiff Bud Light. -

US V. Anheuser-Busch Inbev SA/NV and Sabmiller

Case 1:16-cv-01483 Document 2-2 Filed 07/20/16 Page 1 of 38 UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA UNITED STATES OF AMERICA, Plaintiff, Civil Action No. v. ANHEUSER-BUSCH InBEV SA/NV, and SABMILLER plc, Defendants. PROPOSED FINAL JUDGMENT WHEREAS, Plaintiff, United States of America (“United States”) filed its Complaint on July 20, 2016, the United States and Defendants, by their respective attorneys, have consented to entry of this Final Judgment without trial or adjudication of any issue of fact or law, and without this Final Judgment constituting any evidence against or admission by any party regarding any issue of fact or law; AND WHEREAS, Defendants agree to be bound by the provisions of the Final Judgment pending its approval by the Court; AND WHEREAS, the essence of this Final Judgment is the prompt divestiture of certain rights and assets to assure that competition is not substantially lessened; AND WHEREAS, this Final Judgment requires Defendant ABI to make certain divestitures for the purpose of remedying the loss of competition alleged in the Complaint; Case 1:16-cv-01483 Document 2-2 Filed 07/20/16 Page 2 of 38 AND WHEREAS, Plaintiff requires Defendants to agree to undertake certain actions and refrain from certain conduct for the purposes of remedying the loss of competition alleged in the Complaint; AND WHEREAS, Defendants have represented to the United States that the divestitures required below can (after the Completion of the Transaction) and will be made, and that the actions and conduct restrictions can and will be undertaken, and that Defendants will later raise no claim of hardship or difficulty as grounds for asking the Court to modify any of the provisions contained below; NOW THEREFORE, before any testimony is taken, without trial or adjudication of any issue of fact or law, and upon consent of the parties, it is ORDERED, ADJUDGED, AND DECREED: I.