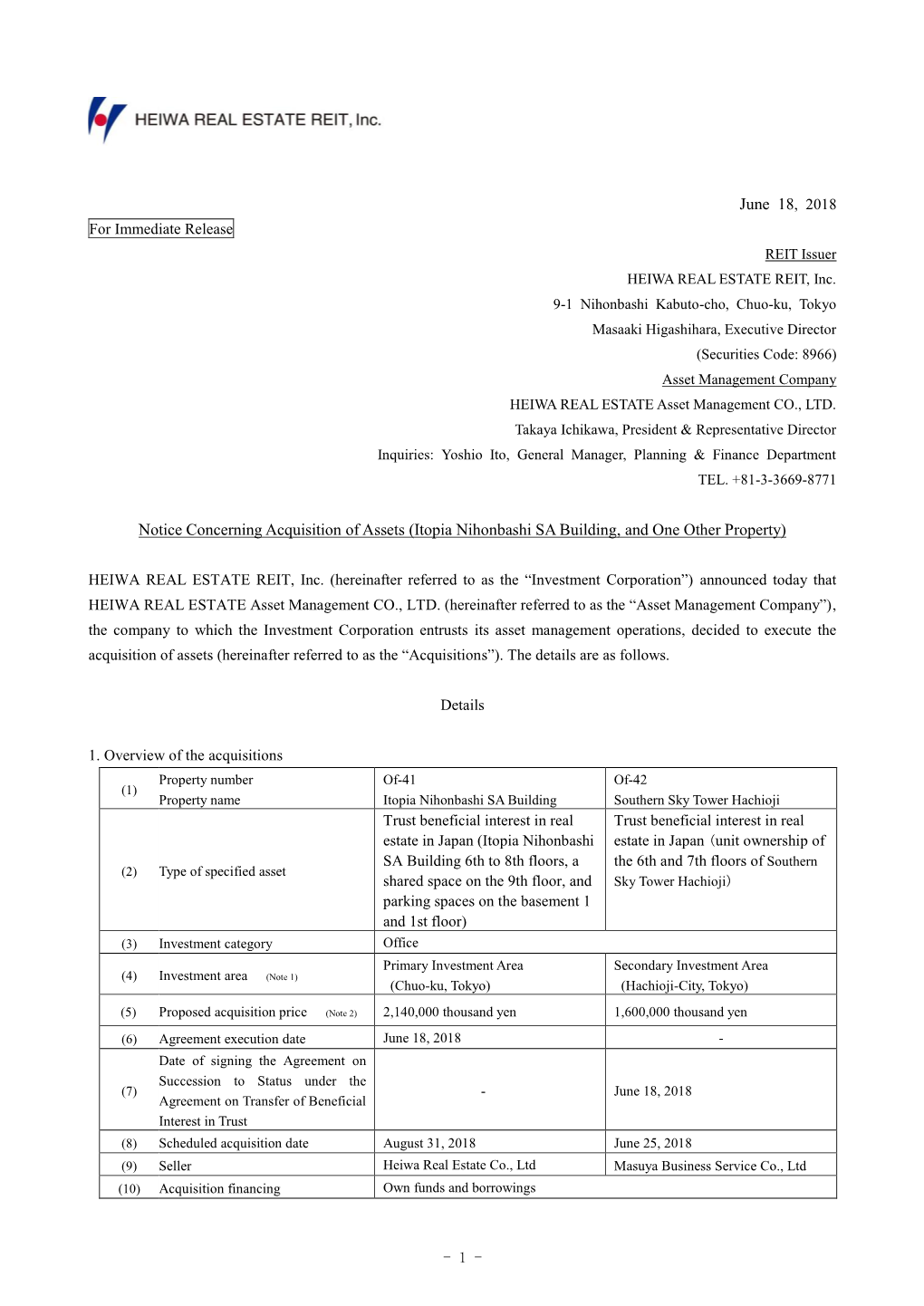

Itopia Nihonbashi SA Building, and One Other Property)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

This Press Release Is Not an Offer to Sell Or a Solicitation of Any Offer to Buy the Securities of Kenedix Realty Investment

Translation of Japanese Original July 5, 2011 To All Concerned Parties REIT Issuer: Kenedix Realty Investment Corporation 2-2-9 Shimbashi, Minato-ku, Tokyo Taisuke Miyajima, Executive Director (Securities Code: 8972) Asset Management Company: Kenedix REIT Management, Inc. Taisuke Miyajima, CEO and President Inquiries: Masahiko Tajima Director / General Manager, Financial Planning Division TEL.: +81-3-3519-3491 Notice Concerning Acquisitions of Properties (Conclusion of Agreements) (Total of 4 Office Buildings) Kenedix Realty Investment Corporation (“the Investment Corporation”) announced its decision on July 5, 2011 to conclude agreements to acquire 4 office buildings. Details are provided as follows. 1. Outline of the Acquisition (1) Type of Acquisition : Trust beneficiary interests in real estate (total of 4 office buildings) (2) Property Name and : Details are provided in the chart below. Planned Acquisition Price Anticipated Acquisition Price Property No. Property Name (In millions of yen) A-71 Kyodo Building (Iidabashi) 4,670 A-72 P’s Higashi-Shinagawa Building 4,590 A-73 Nihonbashi Dai-2 Building 2,710 A-74 Kyodo Building (Shin-Nihonbashi) 2,300 Total of 4 Office Buildings 14,270 *Excluding acquisition costs, property tax, city-planning tax, and consumption tax, etc. Each aforementioned building shall hereafter be referred to as “the Property” or collectively, “the Four Properties.” (3) Seller : Please refer to Item 4. “Seller’s Profile” for details. The following (4) through (9) applies for each of the Four Properties. This press release is not an offer to sell or a solicitation of any offer to buy the securities of Kenedix Realty Investment Corporation in the United States or elsewhere. -

Tokyo Sightseeing Route

Mitsubishi UUenoeno ZZoooo Naationaltional Muuseumseum ooff B1B1 R1R1 Marunouchiarunouchi Bldg. Weesternstern Arrtt Mitsubishiitsubishi Buildinguilding B1B1 R1R1 Marunouchi Assakusaakusa Bldg. Gyoko St. Gyoko R4R4 Haanakawadonakawado Tokyo station, a 6-minute walk from the bus Weekends and holidays only Sky Hop Bus stop, is a terminal station with a rich history KITTE of more than 100 years. The “Marunouchi R2R2 Uenoeno Stationtation Seenso-jinso-ji Ekisha” has been designated an Important ● Marunouchi South Exit Cultural Property, and was restored to its UenoUeno Sta.Sta. JR Tokyo Sta. Tokyo Sightseeing original grandeur in 2012. Kaaminarimonminarimon NakamiseSt. AASAHISAHI BBEEREER R3R3 TTOKYOOKYO SSKYTREEKYTREE Sttationation Ueenono Ammeyokoeyoko R2R2 Uenoeno Stationtation JR R2R2 Heeadad Ofccee Weekends and holidays only Ueno Sta. Route Map Showa St. R5R5 Ueenono MMatsuzakayaatsuzakaya There are many attractions at Ueno Park, ● Exit 8 *It is not a HOP BUS (Open deck Bus). including the Tokyo National Museum, as Yuushimashima Teenmangunmangu The shuttle bus services are available for the Sky Hop Bus ticket. well as the National Museum of Western Art. OkachimachiOkachimachi SSta.ta. Nearby is also the popular Yanesen area. It’s Akkihabaraihabara a great spot to walk around old streets while trying out various snacks. Marui Sooccerccer Muuseumseum Exit 4 ● R6R6 (Suuehirochoehirocho) Sumida River Ouurr Shhuttleuttle Buuss Seervicervice HibiyaLine Sta. Ueno Weekday 10:00-20:00 A Marunouchiarunouchi Shuttlehuttle Weekend/Holiday 8:00-20:00 ↑Mukojima R3R3 TOKYOTOKYO SSKYTREEKYTREE TOKYO SKYTREE Sta. Edo St. 4 Front Exit ● Metropolitan Expressway Stationtation TOKYO SKYTREE Kaandanda Shhrinerine 5 Akkihabaraihabara At Solamachi, which also serves as TOKYO Town Asakusa/TOKYO SKYTREE Course 1010 9 8 7 6 SKYTREE’s entrance, you can go shopping R3R3 1111 on the first floor’s Japanese-style “Station RedRed (1 trip 90 min./every 35 min.) Imperial coursecourse Theater Street.” Also don’t miss the fourth floor Weekday Asakusa St. -

Kenedix Realty Investment Corporation 2-2-9 Shimbashi, Minato-Ku, Tokyo Taisuke Miyajima, Executive Director (Securities Code: 8972)

Translation Purpose Only November 10, 2010 To All Concerned Parties REIT Issuer: Kenedix Realty Investment Corporation 2-2-9 Shimbashi, Minato-ku, Tokyo Taisuke Miyajima, Executive Director (Securities Code: 8972) Asset Management Company: Kenedix REIT Management, Inc. Taisuke Miyajima, CEO and President Inquiries: Masahiko Tajima Director / General Manager, Financial Planning Division TEL.: +81-3-3519-3491 Notice Concerning Acquisition of Properties (Kyodo Building (Ginza No.8) ・Kyodo Building (Honcho 1chome)) Kenedix Realty Investment Corporation (“the Investment Corporation”) announced its decision on November 10, 2010 to acquire the two office buildings. Details are provided as follows. 1. Outline of the Acquisition (1) Type of Acquisition : Trust beneficiary interest in real estate (2) Property Name : ①Kyodo Building (Ginza No.8) ②Kyodo Building (Honcho 1chome) (3) Acquisition Price : ①¥4,300,000,000 ②¥4,000,000,000 (excluding acquisition costs, property tax, city-planning tax, and consumption tax, etc.) (4) Seller : Nihonbashi Investment TMK (Refer to Item 4. Seller’s Profile for details) (5) Date of Contract : November 10, 2010 (6) Scheduled Date of November 12, 2010 Acquisition (7) Acquisition Funds : Debt financing and cash on hand (8) Settlement Method : Payment in full on settlement (9) Source of Acquisition : Original network of Kenedix REIT Management, Inc. (“the Asset Management Company”) (Direct Acquisition) Each aforementioned building shall hereafter be referred to as “the Property” or “the two Properties” collectively. 2. Reason for Acquisition The acquisition of the two Properties are made to raise the investment ratio of office buildings, and to further enhance and stabilize the Investment Corporation’s overall investment portfolio, in accordance with its Articles of Incorporation and fundamental investment policies. -

Kenedix Realty Investment Corporation (8972) 11Th Period Results (Ended October 2010)

Kenedix Realty Investment Corporation (8972) 11th Period Results (ended October 2010) December 14, 2010 Kenedix REIT Management, Inc. http://www.kdx-reit.com/eng/ Flexible management taking market environment into consideration: Stable growth of portfolio Future Crisis response Re-growth and continuous growth management (2008~2009/10) (2009/11~) strategy Opportunities Competitive Disposal of 4 properties:¥4.65B to investment Acquisition of 8 mid-sized environment in Total asset size: ¥400B (Average size is ¥1.16B) new assets office buildings:¥26.78B property Portfolio focusing on acquisition office buildings ・2009/4 sold 2 offices ・2009/11,12 acquired 4 offices ・Expand / deepening original network Property ・ ・2009/6,8 sold 2 residentials 2010/2 acquired 1 office ・Variety of means of investment transactions ・2010/11,12 acquired 3 offices (diversified investment including TK, etc.) Total asset size ¥244.4B Removing Improvement in ・2009/4 refinancing Raised ¥24.7B debt financing Variety in fund raising Smooth refinance by (consideration for capital structure) collateralizing a part of portfolio risk to support external growth ・2009/10,11 ・2009/11 Raised equity (¥8.1B) ・Improve in lending conditions Finance Repayment of borrowing by ・2010/2 New borrowings (¥7.0B) ・Investment bond issuing using cash on hand ・2010/11 New borrowings (¥9.5B) ・Equity financing LTV approximately 43%(note) Note: As of 2010/12/13, based on the data as of the end of 11th fiscal period (October 31, 2010) 1 The contents are provided solely for informational purposes and not intended for the purpose of soliciting investment in, or as a recommendation to purchase or sell, any specific products. -

Keio Presso Inn Otemachi

KEIO PRESSO INN OTEMACHI TEL Check-in 3:00 p.m. 03-3241-0202 We may cancel your reservation, if you do not arrive at the indicated FAX 03-3241-0203 arrival time without any notice. URL www.presso-inn.com/otemachi/ Check-out 10:00 a.m. 4-4-1 Honkokucho, Nihombashi, Chuo-ku, Number of Guest Rooms 386 Tokyo 103-0021 Number Room Type Room Size Capacity of Rooms Single 363Rooms 12m2 1Person Double 11Rooms 18m2 1-2 Persons Twin 11Rooms 18m2 1-2 Persons (Example pictured above) Universal- Complimentary Breakfast 1Room 24m2 1-2 Persons Designed Twin 6:30a.m. 9:30a.m. Kanda Sta. JR Yamanote Line Kamakurabashi South Mizuho Shin-nihombashi Tozai Line Ueno Exit Sta. Chugoku Bank Ginza Line Exit2 Mitsukoshi-mae Sta. JR Chuo Line/ Muromachi Sobu Line Kanda 3 chome COREDO Muromachi Edo Dori MINI STOP Mitsukoshimae Hanzomon Line Bank of Japan, Otemachi Sta. Chiyoda Line Otemachi Sta. Mitsukoshi Marunouchi Line Head Office Shin- Nihombashi River jobanbashi Marunouchi Line Otemachi Kayabacho Jobanbashi Hanzomon Line Ginza Line ExitB1 Tokyo Hanzomon Mitsukoshi-mae Sta. Toei Asakusa Line Nihombashi Line Shutoko Circular LineNihombashi Sta. Chiyoda Line Kasumigaseki ExitA5 COREDO Nihombashi ExitB6 Tozai Line Roppongi Tozai Line Otemachi Sta. Eitai Dori Nihombashi Sta. Otemachi Sta. Sta. Nihombashi Hibiya Ginza Line Hibiya Line Toei Mita Line Marunouchi Gofukubashi Ginza Nihombashi Sotobori Dori Toei Mita Line Oazo Exit Takashimaya Tokaido Shinkansen Marunouchi Line JR Keiyo Line Tokyo Sta. Yaesu North Showa Dori Shinagawa Hamamatsucho Exit Chuo Dori Monorail Tokyo Marunouchi North Exit Daimaru Marunouchi Tokyo Yaesu Dori Building Sta. -

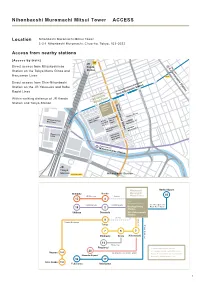

Nihonbacshi Muromachi Mitsui Tower ACCESS

Nihonbacshi Muromachi Mitsui Tower ACCESS Location Nihonbashi Muromachi Mitsui Tower 3-2-1 Nihonbashi Muromachi, Chuo-ku, Tokyo, 103-0022 Access from nearby stations [Access by train] Direct access from Mitsukoshimae Station on the Tokyo Metro Ginza and Hanzomon Lines Direct access from Shin-Nihonbashi Station on the JR Yokosuka and Sobu Rapid Lines Within walking distance of JR Kanda Station and Tokyo Station 1 Nihonbacshi Muromachi Mitsui Tower ACCESS Access by subway JR Shin-Nihonbashi Station~COREDO Muromachi Terrace After exiting the ticket gate, turn left, Turn left at the three-way junction, Turn to the right before reaching and proceed down the passage. and head toward Mitsukoshimae Mitsukoshimae Station to arrive at Station. COREDO Muromachi Terrace. Tokyo Metro Mitsukoshimae Station~COREDO Muromachi Terrace After exiting the Muromachi Face so that the ticket machines are Turn to the left at the Japan Railway 3-Chome ticket gate, head in the on your left, and proceed down the (JR) signboard to arrive at COREDO direction of Shin-Nihonbashi Station. passage. Muromachi Terrace. 2 Nihonbacshi Muromachi Mitsui Tower ACCESS COREDO Muromachi Terrace~Muromachi Mitsui Tower Office Entrance Pass through the COREDO Use the escalators at the end of the Proceed to the elevators on the Muromachi Terrace entrance, and passage to ascend to the Muromachi right-hand side, and ascend to the proceed directly down the passage. Mitsui Tower Office entrance (1F). Sky Lobby (5F). Access by car Pay-by-the-hour parking spaces are available on B2. 3. -

Nihonbashi Muromachi 3Rd District Project Association and Mitsui

March 28, 2019 For immediate release Nihonbashi Muromachi 3rd District Project Association Mitsui Fudosan Co., Ltd. Nihonbashi Muromachi 3rd District Project Association and Mitsui Fudosan Completed the Construction of Nihonbashi Muromachi Mitsui Tower on March 28, 2019 Grand opening for COREDO Muromachi Terrace to be held on September 27, 2019 Tokyo, Japan, March 28, 2019 - Nihonbashi Muromachi 3rd District Project Association and Mitsui Fudosan Co., Ltd., a leading global real estate company headquartered in Tokyo, announced today that construction was completed on Nihonbashi Muromachi Mitsui Tower in the A Zone of the Nihonbashi Muromachi 3rd District Project in Muromachi 3-Chome in Chuo-ku, Tokyo. Nihonbashi Muromachi 3rd District Project Association and Mitsui Fudosan also decided to hold the grand opening for the retail facility COREDO Muromachi Terrace on Friday, September 27, 2019. Summary of This Press Release 1. Construction was completed on March 28 for Nihonbashi Muromachi Mitsui Tower, the flagship project for Stage II of the Nihonbashi Revitalization Plan ―A new base in Nihonbashi; development of a mixed-use facility that creates prosperity for many different people, fusing both tangible and intangible aspects― 2. COREDO Muromachi Terrace, a retail facility with a collection of 31 stores, will have its grand opening on September 27 ―The facility will offer popular dining and select products from inside and outside Japan, with 2 stores making their debut in Japan, 10 stores making their debut at a retail facility, and 10 stores in new business formats― 3. Facility planning that makes various workstyles possible with cutting-edge infrastructural technology with the use of ICT, making it suitable as a base for advanced companies Under the concept of “creating while retaining and reviving,” Mitsui Fudosan has been promoting the Nihonbashi Revitalization Plan to bring prosperity back to Nihonbashi, which once served as the starting point for five Edo-era roads and flourished in economics and culture. -

Congres Square Nihonbashi

Congrès Square Nihonbashi, located near Nihonbashi intersection where innovation meets tradition, is directly connected to “Nihonbashi” station with several subway lines, and a 5-minute walk from “Tokyo” rail terminal. We're looking forward to serving you at this venue that offers great access from all points. CocoShiga ● 2 halls over 300㎡ each, dividable into 2 Nihonbashi Takashimaya Mitsui Bldg. Edobashi ● Multi-purpose foyer Itchome Intersection Nihonbashi ● 4 conference rooms for various occasions Takashimaya S.C. Congrès Square Nihonbashi Directly connected to Exit B9 of "Nihonbashi" station Tokyo-Tatemono Nihonbashi Bldg., (Tokyo Metro Ginza Line/Tozai Line/ Toei Asakusa Line) 1-3-13 Nihonbashi, Chuo-ku, Tokyo, 103-0027 5min. on foot from Tokyo Station (JR) 3min. on foot from Exit B5 of “Mitsukoshimae” station Official website: https://www.congres-square.jp (Tokyo Metro Hanzomon Line) Reservations / Inquiries Office hours: 10:00 – 18:00 (Weekdays) Email: [email protected] Congrès Square Nihonbashi Facility Outline F A spacious hall with a ceiling height of 4m and a foyer with a feeling 2 of openness welcome you Elevator Anteroom 1 Anteroom 2 Freight elevator (Direct to Nihonbashi station) Max. number of seats Ceiling Vending Area Room height School machine (㎡) Theater (m) 3 per desk 2 per desk Hall A+B(All span) 316 400 240 160 Hall A(Divided) 147 4.0 110 84 56 Hall B(Divided) 169 190 105 70 Hall B Hall A 2F Anteroom 1 8 - - - - Foyer Anteroom 2 8 - - - - Foyer 100 3.5 99 42 28 Reception 2F Foyer Hall A+B Anteroom F You can flexibly produce your event in line with whatever your purpose may be, 3 with our 307㎡ hall, 200㎡ foyer and several multifunctional conference rooms Elevator Max. -

GLOBAL LIFE SCIENCE HUB Opened in Nihonbashi Muromachi

For immediate release December 14, 2020 Mitsui Fudosan Co., Ltd. Life Science Innovation Network Japan Nihonbashi Tokyo Becomes 10th Life Science Base with Goal to Promote Global Collaboration GLOBAL LIFE SCIENCE HUB Opened in Nihonbashi Muromachi Mitsui Tower Creating New Knowledge and Innovation for Life Science, Accumulator of Academic and Venture Capital from Japan and Overseas Tokyo, Japan, December 14, 2020 - Mitsui Fudosan Co., Ltd., a leading global real estate company headquartered in Tokyo, has been working with Life Science Innovation Network Japan (LINK-J) to build an ecosystem to create new industries in the life science sector. Recently, as one aspect of that, GLOBAL LIFE SCIENCE HUB opened on the 7th Floor of Nihonbashi Muromachi Mitsui Tower as a new base accumulating life science players not only from Japan, but globally. This base, which will become the base for Mitsui Fudosan’s life science, is the 10th base in Nihonbashi, Tokyo. ■Summary of this release (1) Global Life Science Hub, the 10th life science base in the Nihonbashi area of Tokyo with the goal to promote global collaboration, opens on the 7th Floor of Nihonbashi Muromachi Mitsui Tower Facility equipped to accommodate global needs, including English-speaking receptionists (2) Promoting life science innovation with a particular focus on accumulating academia from Japan and overseas Decisions to use the base from academia have been made by Tohoku University Tohoku Medical Megabank Organization, Tohoku University Head Office for Open Innovation Strategy and Tohoku University Knowledge Cast Co., Ltd. in Japan, and the University of California San Diego of the US from overseas (3) Performing as a place to connect seeds from academia with funding from venture capital Already three venture capital companies from Japan and overseas have become tenants (MedVenture Partners, Inc. -

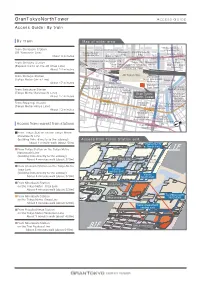

Formatted In

GranTokyoNorthTower Access Guide Access Guide│By train By train Map of wider area Hanzomon Line From Shinbashi Station Marunouchi Naka-dori Ave. Otemachi Sta. (JR Yamanote Line) Yurakucho Line Marunouchi Shin-Marunouchi Marunouchi Line Yurakucho Sta. bldg. bldg. About 4 minutes Bank of Tokyo Marunouchi Line Tozai Line Otemachi Sta. Mitsubishi UFJ, Tokyo Sta. Otemachi Sta. NTT bldg. head office bldg. Tokyo International Tokyo Sta. Marunouchi From Shinjuku Station Forum Tei-Park Tokyo Central (subway concourse) OAZO (Communications (Express trains on the JR Chuo Line) JRJR YurakuchoYurakucho Sta.Sta. Post Office Museum) About 14 minutes Tokyo Sta. Hotel JRJR KeiyoKeiyo LineLine TokyoTokyo Sta.Sta. From Shibuya Station JR Tokyo Sta. S Sapia Tower otobori-dori Ave. Hotel Metropolitan (Tokyo Metro Ginza Line) GranTokyo Nihon bldg. Marunouchi About 17 minutes Ka South Tower Marunouchi Yurakucho Line jiba Bank of Japan, Ginza-itchome Sta. Yaesu Book Center Trust Tower E s head office bldg. From Ikebukuro Station Av hi-dori Yanmar itai-do (Tokyo Metro Marunouchi Line) Tokyo bldg. Yaesu-do GranTokyo Nihonbashi About 17 minutes r Mitsui Tower North Tower Ave i Meidi-ya Store Mandarin e . Ginza Line OrientalTokyo . From Roppongi Station Ave. ri Nihonbashi Hanzomon Line Kyobashi Sta. C (Tokyo Metro Hibiya Line) huo-dori Plaza Tozai Line Mitsukoshimae Sta. Ave. Nihonbashi Sta. About 13 minutes Ginza Line Nihonbashi Sta. Toei Asakusa Line COREDO Takaracho Sta. Sh Takashimaya owa-dori Ave. department store Nihonbashi Nihonbashi 1-chome bldg. Access from nearest train stations Toei Asakusa Line Nihonbashi Sta. ■From Tokyo Station on the Tokyo Metro Marunouchi Line (building links directly to the subway) Access from Tokyo Station exit About 1 minute walk (about 50m) Marunouchi Marunouchi Marunouchi South Exit North-South central Exit North Exit ŝDpmkRmiwmQr_rgmlmlrfcRmiwmKcrpm passage 1F Central ýK_pslmsafgJglc South passage North ý&`sgjbglejgliqbgpcarjwrmrfcqs`u_w' passage passage ý?`msr2kglsrcqu_ji&_`msr10.k' JR Tokyo Sta. -

Sakura Fes Nihonbashi/Off to Meet

January 16, 2020 Nihonbashi Sakura Festival Executive Committee For immediate release Mitsui Fudosan Co., Ltd. An OFF TO MEET-Themed Spring Event SAKURA FES NIHONBASHI/OFF TO MEET Featuring artworks that can only be experienced “here and now” and special menus Hosted in the Nihonbashi, Yaesu and Kyobashi area from Sunday, March 15–Sunday, April 5, 2020 The Nihonbashi Sakura Festival Executive Committee will host SAKURA FES NIHONBASHI/OFF TO MEET in the Nihonbashi, Yaesu and Kyobashi area from Sunday, March 15–Sunday, April 5, 2020. Naoki Ono, editorial director of Kokoku magazine, has been welcomed as the creative director for this year’s festival, the seventh time the festival has been held. The festival will be held under the theme of OFF TO MEET and will roll out a variety of content enabling contact with real value that can only be experienced “here and now.” Moreover, Offline Nihonbashi will also be held on the weekend of March 28–29, coinciding with SAKURA FES NIHONBASHI/OFF TO MEET. This is a two-day special event where participants are urged to switch off their smartphones and put some distance between themselves and the digital world so they can feel real value throughout their entire bodies. Long-standing and famous establishments based in the foody neighborhood of Nihonbashi will hold a food market featuring special menus provided only on the weekend of the event, while there will be live concerts that can only be seen in the area and a number of various other events including a book market with the prospect of chance encounters. -

Recommended Places from Tokyo Chuo City Tourism Introduction Movie

Recommended places from Tokyo Chuo City tourism introduction movie People (人HITO) Name of place address Location A four-minute walk from Tsukiji Station Exit 1 on the Tokyo Metro Hibiya Line, or a three-minute Tsukiji DAISADA(Tamago-yaki) 4-13-11, Tsukiji walk from Tsukijishijo Station Exit A1 on the Toei Subway Oedo Line A four-minute walk from Tsukiji Station Exit 1 on the Tokyo Metro Hibiya Line, or a three-minute Shouwa Shokuhin(Himono of salmon) 4-13-11 Tsukiji walk from Tsukijishijo Station Exit A1 on the Toei Subway Oedo Line Tsukiji Tamasushi 1-9-4 Tsukiji A one-minute walk from Tsukiji Station on the Tokyo Metro Hibiya Line A five-minute walk from Exit D1 of Nihonbashi Station on the Tokyo Metro Ginza Line or Tozai Nihonbashi Yabuizu(Soba noodle) 3-15-7 Nihonbashi Line or Toei Subway Oedo Asakusa Line Tsukiji Edoichi(Tsukudani) 4-13-4, Tsukiji A five-minute walk from Tsukiji Station on the Tokyo Metro Hibiya Line A five-minute walk from Tsukiji Station on the Tokyo Metro Hibiya Line, or A five-minute walk Tsukiji Masamoto(Knives) 4-9-9, Tsukiji from Tsukijishijo Station on the Toei Subway Oedo Line A five-minute walk from Kodemmacho Station Exit 3 on the Tokyo Metro Hibiya Line, or a ten- Edoya(Edo brushes) 2-16, Nihonbashi Odemmacho minute walk from Shin-Nihonbashi Station on the JR Sobu Rapid Line A five-minute walk from Mitsukoshimae Station Exit A4 on the Tokyo Metro Ginza Line or IBASEN(Sensu) 4-1, Nihonbashi Kobunacho Hanzomon Line A one-minute walk from Mitsukoshimae Station Exit on the Tokyo Metro Ginza Line or Hanzomon Nihonbashi Mitsukoshi Main Store 1-4-1, Nihonbashi Muromachi Line A one-minute walk from Ningyocho Station Exit A1 on the Tokyo Metro Hibiya Line or the Toei Ningyocho Itakuraya(Ningyoyaki) 2-4-2, Nihonbashi Ningyocho Subway Asakusa Line Oedo Nihonbashitei【Mr.