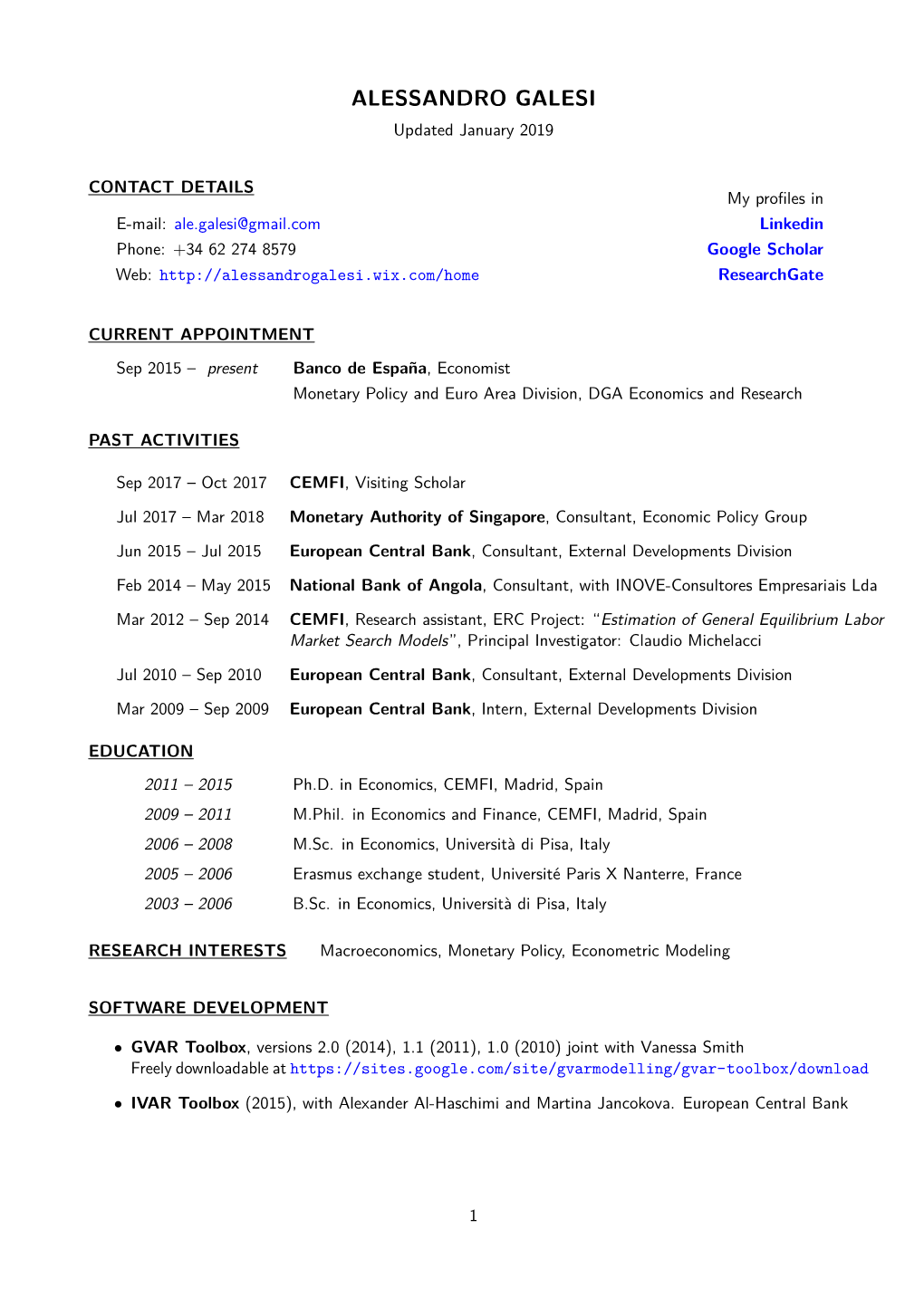

ALESSANDRO GALESI Updated January 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Certain Foreign Institutions Classified As Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms

NOT FOR PUBLICATION DEPARTMENT OF THE TREASURY JANUARY 2001 Revised Aug. 2002, May 2004, May 2005, May/July 2006, June 2007 List of Certain Foreign Institutions classified as Official for Purposes of Reporting on the Treasury International Capital (TIC) Forms The attached list of foreign institutions, which conform to the definition of foreign official institutions on the Treasury International Capital (TIC) Forms, supersedes all previous lists. The definition of foreign official institutions is: "FOREIGN OFFICIAL INSTITUTIONS (FOI) include the following: 1. Treasuries, including ministries of finance, or corresponding departments of national governments; central banks, including all departments thereof; stabilization funds, including official exchange control offices or other government exchange authorities; and diplomatic and consular establishments and other departments and agencies of national governments. 2. International and regional organizations. 3. Banks, corporations, or other agencies (including development banks and other institutions that are majority-owned by central governments) that are fiscal agents of national governments and perform activities similar to those of a treasury, central bank, stabilization fund, or exchange control authority." Although the attached list includes the major foreign official institutions which have come to the attention of the Federal Reserve Banks and the Department of the Treasury, it does not purport to be exhaustive. Whenever a question arises whether or not an institution should, in accordance with the instructions on the TIC forms, be classified as official, the Federal Reserve Bank with which you file reports should be consulted. It should be noted that the list does not in every case include all alternative names applying to the same institution. -

Tax Relief Country: Italy Security: Intesa Sanpaolo S.P.A

Important Notice The Depository Trust Company B #: 15497-21 Date: August 24, 2021 To: All Participants Category: Tax Relief, Distributions From: International Services Attention: Operations, Reorg & Dividend Managers, Partners & Cashiers Tax Relief Country: Italy Security: Intesa Sanpaolo S.p.A. CUSIPs: 46115HAU1 Subject: Record Date: 9/2/2021 Payable Date: 9/17/2021 CA Web Instruction Deadline: 9/16/2021 8:00 PM (E.T.) Participants can use DTC’s Corporate Actions Web (CA Web) service to certify all or a portion of their position entitled to the applicable withholding tax rate. Participants are urged to consult TaxInfo before certifying their instructions over CA Web. Important: Prior to certifying tax withholding instructions, participants are urged to read, understand and comply with the information in the Legal Conditions category found on TaxInfo over the CA Web. ***Please read this Important Notice fully to ensure that the self-certification document is sent to the agent by the indicated deadline*** Questions regarding this Important Notice may be directed to Acupay at +1 212-422-1222. Important Legal Information: The Depository Trust Company (“DTC”) does not represent or warrant the accuracy, adequacy, timeliness, completeness or fitness for any particular purpose of the information contained in this communication, which is based in part on information obtained from third parties and not independently verified by DTC and which is provided as is. The information contained in this communication is not intended to be a substitute for obtaining tax advice from an appropriate professional advisor. In providing this communication, DTC shall not be liable for (1) any loss resulting directly or indirectly from mistakes, errors, omissions, interruptions, delays or defects in such communication, unless caused directly by gross negligence or willful misconduct on the part of DTC, and (2) any special, consequential, exemplary, incidental or punitive damages. -

A Crude Awakening

Dedicated to the inspiration of Jeffrey Reynolds ISBN 0 9527593 9 X Published by Global Witness Ltd P O Box 6042, London N19 5WP,UK Telephone:+ 44 (0)20 7272 6731 Fax: + 44 (0)20 7272 9425 e-mail: [email protected] a crude awakening The Role of the Oil and Banking Industries in Angola’s Civil War and the Plunder of State Assets http://www.oneworld.org/globalwitness/ 1 a crude awakening The Role of the Oil and Banking Industries in Angola’s Civil War and the Plunder of State Assets “Most observers, in and out of Angola, would agree that “There should be full transparency.The oil companies who corruption, and the perception of corruption, has been a work in Angola, like BP—Amoco, Elf,Total and Exxon and the critical impediment to economic development in Angola.The diamond traders like de Beers, should be open with the full extent of corruption is unknown, but the combination of international community and the international financial high military expenditures, economic mismanagement, and institutions so that it is clear these revenues are not syphoned corruption have ensured that spending on social services and A CRUDE AWAKENING A CRUDE development is far less than is required to pull the people of off but are invested in the country. I want the oil companies Angola out of widespread poverty... and the governments of Britain, the USA and France to co- operate together, not seek a competitive advantage: full Our best hope to ensure the efficient and transparent use of oil revenues is for the government to embrace a comprehensive transparency is in our joint interests because it will help to program of economic reform.We have and will continue to create a more peaceful, stable Angola and a more peaceful, encourage the Angolan Government to move in this stable Africa too.” direction....” SPEECH BY FCO MINISTER OF STATE, PETER HAIN,TO THE ACTION FOR SECRETARY OF STATE, MADELEINE ALBRIGHT, SUBCOMMITTEE ON FOREIGN SOUTHERN AFRICA (ACTSA) ANNUAL CONFERENCE, SCHOOL OF ORIENTAL OPERATIONS, SENATE COMMITTEE ON APPROPRIATIONS, JUNE 16 1998. -

Annual Report'16

Annual Report’1 6 BFA has pressed ahead on a steady growth path throughout 2016, reporting financial performance indicators, which once again strengthen our financial identity. – The BFA Fortress. 2016 in Review +23% Market leader in banking Number of BFA Employees services offering in December rose from 2016, with the following market shares: 1.365 First Digital Annual Report issued in Angola 2.610 in December 2015 Transactions registered on BODIVA 24,4% to Share of Debit Cards 26,3% 2.632 +64% eFormar Share of POS terminals In December 2016 increase over 2015 BFA secured 67% of the market share of registered 4.332 Hours of Training 56,0% +0,8% conducted via the eLearning Share of Visa Cards Growth rate over 2015 transactions in 2016. platform: eFormar +8,4% AKZ +6,8% Net profit increase of Number of Customers BFA is the bank of choice of Sirius award in the in December 2016 “Best Financial Sector Company” reached 24.046 60,0% category. Amount stated in AOA million The Banker magazine Award for of Private Customers, “Bank of the Year in Angola 2016”. 1.571.107 according to the national +63,5% Customer Satisfaction Growth over 2015 EMEA Finance Award for survey. “Most Innovative Bank 2016”. BFA Annual Report AKZ Public access to BFA’s Annual Report Increase of can be done through laptop or tablet. Asset Portfolio Growth to A Customer growth of with This Annual Report can be downloaded at 108.939 www.bfa.ao in AOA million in securities (TBonds and TBills) BFA Net Service The Bank keeps its buying 1.312.880 position with respect to securities, -

Download PDF (675.1

-33- References Aguilar, Renato, 1994, "Informe de Consultoria. Inflacion en Angola", Mimeo. Barro, Robert, 1995, "Inflation and Economic Growth", NBER Working Paper No. 5326. Berg, Andrew, and Eduardo Borensztein, 2000, "The Choice of Exchange Rate Regime and Monetary Target in Highly Dollarized Economies", Journal of Applied Economics, Vol. 3, No. 2. Briault, Clive, 1995, "The Costs of Inflation", Bank of England Quarterly Bulletin, No, 35, Calvo, Guillermo, and Carlos Vegh, 1999, "Inflation Stabilization and BOP Crises in Developing Countries", NBER Working Paper No. 6925. Dickey, D.A. and W.A. Fuller, 1979, "Distribution of the Estimators for Autoregressive Time Series with a Unit Root", Journal of the American Statistical Association, 74. Driffill, John, Grayham Mizon, and Alistar Ulph, 1990, "Costs of Inflation" in Friedman and Kahn, eds. Handbook of Monetary Economics, Vol. 2. Fischer, Stanley, Ratna Sahay, and Carlos Vegh, 2002, "Modern Hyper and High Inflations", NBER Working Paper No. 8930. Ghosh, Atish, and Steven Phillips, 1998, "Warning: Inflation May Be Harmful to Your Growth", IMF Staff Paper, Vol. 45, No. 4. Ize, Alain, Magnus Alvesson, Hernan Mejia, Jorge Perez, and Gonzalo Sanhueza, 2001, "Angola. Monetary and Foreign Exchange Policy Framework in Support of an Effective Disinflation Strategy", International Monetary Fund, Unpublished Document. Ize, Alain, Pedro Albuquerque, Carlos Perez Verdia, and Martin Naranjo, 2002, "Angola. Further Progress Towards Stabilization", International Monetary Fund, Document. Johansen, S0ren, 1991, "Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models", Econometrica, 59. Perron, Phillips, 1997, "Further Evidence on Breaking Trend Functions in Macroeconomic Variables", Journal of Econometrics 80. Reinhart, Carmen, and Keneth Rogoff, 2002, "FDI to Africa: The Role of Price Stability and Currency Instability", International Monetary Fund, Mimeo. -

OECD International Network on Financial Education

OECD International Network on Financial Education Membership lists as at May 2020 Full members ........................................................................................................................ 1 Regular members ................................................................................................................. 3 Associate (full) member ....................................................................................................... 6 Associate (regular) members ............................................................................................... 6 Affiliate members ................................................................................................................. 6 More information about the OECD/INFE is available online at: www.oecd.org/finance/financial-education.htm │ 1 Full members Angola Capital Market Commission Armenia Office of the Financial System Mediator Central Bank Australia Australian Securities and Investments Commission Austria Central Bank of Austria (OeNB) Bangladesh Microcredit Regulatory Authority, Ministry of Finance Belgium Financial Services and Markets Authority Brazil Central Bank of Brazil Securities and Exchange Commission (CVM) Brunei Darussalam Autoriti Monetari Brunei Darussalam Bulgaria Ministry of Finance Canada Financial Consumer Agency of Canada Chile Comisión para el Mercado Financiero China (People’s Republic of) China Banking and Insurance Regulatory Commission Czech Republic Ministry of Finance Estonia Ministry of Finance Finland Bank -

Law of the National Bank of Angola

Law No. 16/10 Dated July 15 (DR Series I. No. 132) With the Constitution of the Republic of Angola taking effect, there is an urgent need to adapt the definition of the responsibilities of the National Bank of Angola, it becoming necessary to fit the definition of the responsibilities of the National Bank of Angola in the area of participation, definition of conduct and implementation of the country's monetary and foreign exchange policy to the new Constitutional-legal framework; Under the same circumstances, there is also the need to clarify the operational autonomy of the National Bank of Angola in order to better ensure the preservation of the national currency and ensure price stability and the national financial system; Thus, By mandate of the people, under the combined provisions of subparagraph b) of Article 161 and of paragraph 1 of Article 166, both from the Constitution of the Republic of Angola, the National Assembly approve the following: LAW OF THE NATIONAL BANK OF ANGOLA Chapter I Nature, Headquarters and purposes Article 1 (Nature) The National Bank of Angola is a legal entity of public law, endowed with administrative, financial and personal autonomy. Article 2 (Headquarters) 1 The National Bank of Angola has its headquarters in Luanda, and may have branches in other parts of the country, as well as any form of representation abroad. Article 3 (Main assignment and other functions) 1. As the central and issuing bank, the National Bank of Angola, ensures the preservation of the value of the national currency and participates in the definition of the monetary, financial and foreign exchange policies. -

Banking in the Portuguese Colonial Empire (1864-1975)

Série Documentos de Trabalho Working Papers Series Banking in the Portuguese Colonial Empire (1864-1975) Ana Bela Nunes Carlos Bastien Nuno Valério Rita Martins de Sousa Sandra Domingos Costa DT/WP nº 41 ISSN 2183-1785 Instituto Superior de Economia e Gestão Universidade de Lisboa Documento de Trabalho/ Working Paper nº 41 BANKING IN THE PORTUGUESE COLONIAL EMPIRE (1864-1975) Ana Bela Nunes Carlos Bastien Nuno Valério Rita Martins de Sousa Sandra Domingos Costa GHES Gabinete de História Económica e Social Lisboa 2010 GHES - Série Documentos de Trabalho Publicação do GHES - Gabinete de História Económica e Social R. Miguel Lupi, nº 20 1249-078 Lisboa - Portugal Telf. 213925974 Fax. 213925940 e-mail: [email protected] Abstract This paper provides a general view of the evolution of banking in the Portuguese Colonial Empire between the founding of the first Portuguese colonial bank in 1864 and the independence of most Portuguese colonies in 1975. The text summarizes the legal background, presents the banks existing during that period, examines their businesses and discusses their contribution to the economic evolution of the territories under consideration. As the paper’s main conclusions, it may be said that: (i) Portuguese colonial banking followed the continental model of government initiative and tight control, not the British model of private initiative without much government control; (ii) the development of Portuguese colonial banking was always mainly a matter of profiting from the opportunities afforded by economic evolution rather than a matter of autonomously fostering the economic development of the territories. Key words: Clonial banks JEL classification : N23, N25, N27 2 Plan 1. -

Creating Markets in Angola : Country Private Sector Diagnostic

CREATING MARKETS IN ANGOLA MARKETS IN CREATING COUNTRY PRIVATE SECTOR DIAGNOSTIC SECTOR PRIVATE COUNTRY COUNTRY PRIVATE SECTOR DIAGNOSTIC CREATING MARKETS IN ANGOLA Opportunities for Development Through the Private Sector COUNTRY PRIVATE SECTOR DIAGNOSTIC CREATING MARKETS IN ANGOLA Opportunities for Development Through the Private Sector About IFC IFC—a sister organization of the World Bank and member of the World Bank Group—is the largest global development institution focused on the private sector in emerging markets. We work with more than 2,000 businesses worldwide, using our capital, expertise, and influence to create markets and opportunities in the toughest areas of the world. In fiscal year 2018, we delivered more than $23 billion in long-term financing for developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity. For more information, visit www.ifc.org © International Finance Corporation 2019. All rights reserved. 2121 Pennsylvania Avenue, N.W. Washington, D.C. 20433 www.ifc.org The material in this work is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. IFC does not guarantee the accuracy, reliability or completeness of the content included in this work, or for the conclusions or judgments described herein, and accepts no responsibility or liability for any omissions or errors (including, without limitation, typographical errors and technical errors) in the content whatsoever or for reliance thereon. The findings, interpretations, views, and conclusions expressed herein are those of the authors and do not necessarily reflect the views of the Executive Directors of the International Finance Corporation or of the International Bank for Reconstruction and Development (the World Bank) or the governments they represent. -

Classification of Accounts Guide Last Updated – January 2018

Classification of Accounts Guide Last updated – January 2018 Contents Part I: General introduction Part II: Residence Part III: Sector categories Part IV.1 – IV.2: Industrial classification Part IV.3: Relationship between sector and industrial classifications Part V.1: Sector components (ESA 10) and sub components Part V.2: List of countries 1 Part I Classification of Accounts Guide – General Introduction I.1 Foreword This guide is intended for all institutions completing a range of Bank of England statistical returns. It describes the two most important systems of classification used in compiling economic and financial statistics in the United Kingdom – the economic sector classification, and the industrial classification. This guide is intended to serve both as an introduction for newcomers and as a source of reference. The nomenclature in the sector classification is in line with international standards – in particular, the European System of National and Regional Accounts (abbreviated to ‘ESA10’). In addition, the analysis of industrial activity is in line with the 2007 standard industrial classification of economic activities (SIC) introduced by the Office for National Statistics. Those without knowledge of accounts classification are recommended to refer to the ‘Guide to Classification’ (Part I Section 3) which takes the reader through the main questions to be answered to help classify accounts correctly. The system of classification used in this guide is solely for statistical purposes. Parts II to IV of the guide describe the main aspects of the classification system in more detail, including lists of examples of institutions, or a web link reference, for many categories. I.2 An introduction to the classification of accounts Sector and industrial classification To understand the underlying behaviour which is reflected in movements in economic and financial statistics, it is necessary to group those entities engaged in financial transactions into broad sectors with similar characteristics. -

Banco Nacional De Angola

1 Banco Nacional de Angola Banco Nacional de Angola Avenida 4 de Fevereiro, 151 CP nº 1243 Luanda, República de Angola Fax: + 244 222 390579 Tel: + 244 222 339934/336664 1. History After Angola gained independence in 1975, the banking sector was nationalised and two major Angolan banks, namely Banco de Angola and Banco Commercial de Angola, changed their names to Banco Nacional de Angola (BNA) and Banco Popular de Angola (BPA) respectively. The BNA, according to the Organic Law 69/76, inherited the responsibilities of a central bank, bank of issue and commercial bank, as well as of being the only legal holder of foreign currency and responsible for all foreign transactions. In 1988, the government introduced a programme to transform the socialist centralised economy into a market-oriented economy. These changes also required the transformation of the banking sector, including the restriction of the BNA's role to being solely responsible for monetary policy and acting as issuing bank, banker of the Government and reserve bank. This was achieved by promulgating the new Organic Law 4/91, of 20 April, which transformed the BNA into a central bank. The opening of the economy for a liberal system of market, had induced to the necessity of deep alterations in the functional philosophy of the BNA, on the other hand, and of the economic Management of the country, on the other hand, from there elapsing, a redefinition of the functional and executive attributions of the BNA while Central banking, Bank of issue and exchange authority of the country. In the scope of the reorganization of the banking system, the approval in July of 1997, for the Parliament Assembly of the new Organic Law of the National bank of Angola, - Law n° 6/97, of 11 of July, and the exchange Law - Law n° 5/97, of 11 of July, had allowed that some embarrassments of legal origin were exceeded, being the BNA as Central banking, competed of bigger responsibility and autonomy stops with bigger property leading and executing the monetary and exchange politics in the country. -

Arms Brokering in Southern Africa Selected Case Studies Edited by Nelson Alusala and Mothepa Shadung

About this monograph ISS Pretoria Illicit arms brokering continues to be a challenge to many Block C, Brooklyn Court 361 Veale Street governments in the world, and more so in African countries, Arms brokering in New Muckleneuk where armed conflicts continue to threaten peace and Pretoria, South Africa security. This monograph presents an assessment of selected Tel: +27 12 346 9500 Southern Africa Southern African countries with regard to arms brokering, and Fax: +27 12 460 0998 Selected case studies concludes that the practice of illicit arms brokering presents in Southern Arms brokering Africa: selected case studies ISS Addis Ababa both legal and operational hurdles. This points to a need for 5th Floor, Get House Building countries to coordinate efforts through the implementation of Africa Avenue various arms control instruments. Addis Ababa, Ethiopia Tel: +251 11 515 6320 Fax: +251 11 515 6449 About the ISS ISS Dakar The Institute for Security Studies partners to build 4th Floor, Immeuble Atryum knowledge and skills that secure Africa’s future. It provides Route de Ouakam policy advice, practical training, technical assistance and Dakar, Senegal independent research. Tel: +221 33 860 3304/42 Fax: +221 33 860 3343 ISS Nairobi Acknowledgements Braeside Gardens This monograph was made possible with funding provided by off Muthangari Road the government of Norway. The ISS is also grateful for support Lavington, Nairobi, Kenya from the other members of the ISS Partnership Forum: the Cell: +254 72 860 7642 Hanns Seidel Foundation and the governments of Australia, Cell: +254 73 565 0300 Canada, Denmark, Finland, Japan, Netherlands, Sweden and the USA.