Schedule to the Rules

Total Page:16

File Type:pdf, Size:1020Kb

Load more

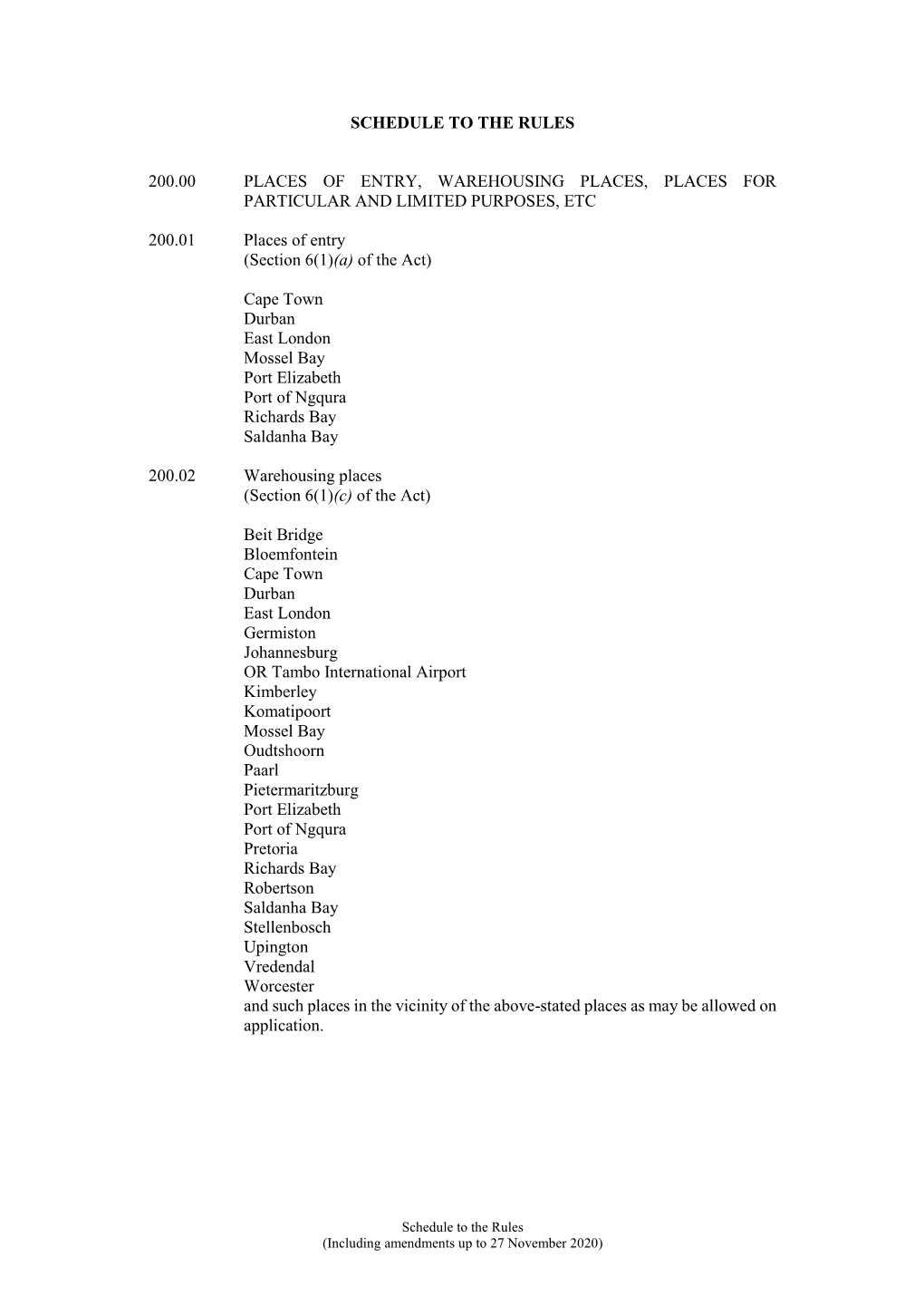

Recommended publications

-

Aviation Rankings' Misjudgment: Inspiration of Egypt Air and Cairo International Airport Cases

Journal of the Faculty of Tourism and Hotels-University of Sadat City, Vol. 4, Issue (2/1), December, 2020 Aviation Rankings' Misjudgment: Inspiration of Egypt Air and Cairo International Airport Cases 1Farouk Abdelnabi Hassanein Attaalla 1Faculty of Tourism and Hotels, Fayoum University Abstract This study aims to make a comprehensive assessment of the three most popular aviation rankings; Skytrax, AirHelp and TripAdvisor from a critical perspective supported by a global field study conducted in the same methodology as these three rankings have been done. This study is based on the descriptive statistics to analyze field data gathered about EgyptAir and other airlines, Cairo International Airport and other airports and comparing these results with what is published in these three rankings in 2018. The current study reveals that the results of these three global rankings are characterized by shortcomings and lack of value and unfairness. Finally, the study suggests a model for fairness and equity in the rankings of airlines and airports. Keywords: Air Rankings, Egypt Air, Cairo International Airport, Equity. 1- Introduction Through scanning the international airlines and airports rankings for the recent five years from 2013 to 2018, it is found that no understandable and embarrassing absence for Egypt Air (MS) and Cairo International Airport (CAI). However, Arabic airlines and Airports such as Qatar Airways, Emirates Airways, Oman Air, Etihad Airways, Saudia Airlines, Royal Jordanian and Air Maroc, Hamad International Airport and Queen Alia International Airport have occupied different ranks through these years. Their ranks may be one of the top 10 airline and airport positions, while others occupy one of the top 100 airlines and airports in the world. -

Competitive Strategies and Entry Strategies of Low Cost Airline Incumbent 1Time Airline

Competitive Strategies and Entry Strategies of Low Cost Airline Incumbent 1time Airline A dissertation submitted in partial fulfilment of the requirements for the degree of Masters in Business Administration of Rhodes University by Diane Potgieter January 2007 Abstract This dissertation reports on the factors that contributed to the successful entry strategy of 1time Airline, a low cost carrier, into the South African airline industry as well as its competitive strategies within this context. Research interviews were conducted in November 2005 and research material gathered until end January 2006. Key issues include an evaluation of 1time's business model in relation to other low cost entrants as well as against material sourced through interviews with 1time Airline management, employees and consumers of the airline's product. Porter's Generic Strategies and Five Forces model are used as a framework in evaluating the airline. It is found that Nohria, Joyce and Robertson's "4+2 Formula" is effectively implemented at the airline, but that further implementation of Game Theory in terms of alliances should be investigated for continued success and sustainability. " \ I Contents Chapter 1 Context ...... ... ....................... ............................. ... .. .................................. 1 1.1 Introduction ................................................. .. .... .................. .. ................ .............. .. ... 1 1.2 The global airline industry ......................................... .. .. ...... .. .. .. ................... -

Fact Finding Airports Southern Africa

2015 FACT FINDING SOUTHERN AFRICA Advancing your Aerospace and Airport Business FACT FINDING SOUTHERN AFRICA SUMMARY GENERAL Africa is home to seven of the world’s top 10 growing economies in 2015. According to UN estimates, the region’s GDP is expected to grow 30 percent in the next five years. And in the next 35 years, the continent will account for more than half of the world’s population growth. It is obvious that the potential in Africa is substantial. However, African economies are still to unlock their potential. The aviation sector in Africa faces restrictive air traffic regimes preventing the continent from using major economic benefits. Aviation is vital for the progress in Africa. It provides 6,9 million jobs and US$ 80 million in GDP with huge potential to increase. Many African governments have therefore, made infrastructure developments in general and airport related investments in particular as one of their priorities to facilitate future growth for their respective country and continent as a whole. Investment is underway across a number of African airports, as the region works to provide the necessary infrastructure to support the continent’s growth ambitions. South Africa is home to most of the airports handling 1+ million passengers in Southern Africa. According to international data 4 out of 8 of those airports are within South African Territory. TOP 10 AIRPORTS [2014] - AFRICA CITY JOHANNESBURG, SOUTH AFRICA 19 CAIRO, EGYPT 15 CAPE TOWN, SOUTH AFRICA 9 CASABLANCA, MOROCCO 8 LAGOS, NIGERIA 7,5 HURGHADA, EGYPT 7,2 ADDIS -

COMPETITION TRIBUNAL REPUBLIC of SOUTH AFRICA Case No: 77/LM/Oct02

COMPETITION TRIBUNAL REPUBLIC OF SOUTH AFRICA Case No: 77/LM/Oct02 In the large merger between: South African Airways (Pty) Ltd and Air Chefs (Pty) Ltd _______________________________________________________________________ Reasons _______________________________________________________________________ Approval The Competition Tribunal issued a Merger Clearance Certificate on 25 October 2002 approving the merger without conditions. The reasons are set out below. The merger The transaction South African Airways (Pty) Ltd (ªSAAº) is buying all the remaining shares in Air Chefs (Pty) Ltd. This is a vertical merger where the customer, SAA, is acquiring an upstream service provider, Air Chefs. The parties to the transaction Transnet Ltd, a public company of which the South African Government is the sole shareholder, controls SAA. The primary target firm is Air Chefs (Pty) Ltd., a joint venture established between Transnet Ltd (holding 51% of the issued share capital) and Fedics Strategic Investments (Pty) Ltd (holding the remaining 49%). An evergreen management agreement vested control of Air Chefs with Fedics. Rational for the transaction SAA is concerned that it was paying too much for the catering services supplied by Air Chefs due to the Evergreen Management agreement, which contains a cost-plus 250% mechanism. It was also not satisfied with the service levels, that Air Chefs supplied. The Cabinet sub-committee on Restructuring recommended that the most viable restructuring option for SAA would be the acquisition of Air Chefs by SAA. Evaluating the merger Relevant market SAA operates in the airline passenger services market, with a generally limited accompanying freight and cargo service. SAA is the largest domestic airline in the country. Air Chefs operates in a market upstream from that of SAA, providing in-flight catering services to domestic, regional and international airlines, which entails, inter alia, the provision of meals, loading services, stock storage, chilling facilities and sanitation. -

Map Above Indicates Locations of the Major Aiports Across South Africa

LESSON 8 SOUTH AFRICAN INTERNATIONAL AND NATIONAL AIPORTS The map above indicates locations of the major aiports across South Africa. Looking at the international status of South Africa’s major Airports they handle both passengers have a cargo. Passengers are transported in the upper part of an aircraft called CABIN, the passengers luggages /baggages are carried on the belly space of the airline. South African Airways has cargo division where it uses passengers aircraft for cargo and has 4 aircraft that transport cargo only. South Africa has 9 airports that handle international passengers, these international airports have custom and immigration facilities with passport control. 9 SA INTERNATIONAL AIRPORTS 1. O.R TAMBO INTERNATIONAL AIRPORT--------GAUTENG PROVINCE 2. CAPE TOWN INTERNATIONAL AIRPORT-------WESTERN CAPE 3. KING SHAKA INTERNATIONAL AIRPORT-------KWAZULU NATAL 4. PORT ELIZABETH INTERNATIONAL--------------EASTERN CAPE 5. UPINGTON INTERNATIONAL------------------------NORTHERN CAPE 6. KRUGER NATIONAL INTERNATIONAL-----------MPUMALANGA 7. LANSERIA INTERNATIONAL-------------------------NORTH WEST 8. POLOKWANE INTERNATIONAL--------------LIMPOPO 9. BRAM FISHER INTERNATIONAL------------- FREE STATE In SA the ACSA ( AIRPORT COMPANY OF SA) manages all 9 provincial international airports, it was formed in 1993 when government transferred all airports to ACSA management. It is the largest aiport authority in SA. Below are international airports managed by ACSA: 1. O.R TAMBO INTERNATIONAL O.R is the largest and busiest airport formerly known as Jan Smuts Airport, then changed to be Johannesburg International airport. The name changed to be known as O.R Tambo in 2006. ORTIA abbreved by tourist is an essential part of the transport infrastructure of Gauteng and plays an important role in the economy of Gauteng province and SA as a whole. -

Airport Initiatives Brochure

East London Airport www.airports.co.za 2 EAST LONDON AIRPORT 3 If South Africa has been through enormous change over the past twenty years, much the same is true of the aviation industry. Michael Kernekamp, Airport Manager at East London Airport, on the Eastern Cape, has witnessed the transformation of both and the impact this On the has on a growing airport. runway to the nation’s future The SA–Mag September 2012 www.thesa–mag.com The SA–Mag September 2012 4 East London Airport East London Airport 5 Business continues as usual at East London despite its R180 million runway upgrades ernekamp joined East London Airport as a junior fireman and has worked his way up the ladder to his current role, overseeing all operational aspects at this busy Klocation: “We are the gateway to this area and today, with globalisation an important factor in the new South Africa, we play a critical role for the economy of the Eastern Cape,” he affirms. He says that his experience over the last two decades has taught him valuable lessons as he plans operations today; “I have been in my current position for coming up to four years and working my way up the chain gave me a good foundation for what is required on the operational side of aviation. Today we train our staff to multi–skill (something Kernekamp had learnt to do) and this gives our people good exposure to various elements of the airport operation. “Since I first came here there have been many changes in the airport infrastructure and we’ve seen significant changes in capacity for the new terminal building which is certainly a lot more aesthetically pleasing for passengers,” he adds. -

Bidvest Car Rental Branch Details - November 2020

Bidvest Car Rental Branch Details - November 2020 WESTERN CAPE DROP BRANCH BRANCH CODE TEL CONTACT PERSON AFTER HOURS GDS GPS COORDINATES VOUCHER/EMAIL STR ADDRESS HOURS BOX AFTER HOURS (X - LONGITUDE) (Y - LATITUDE) WEEK SAT SUN PUB HOL Cape Town City Centre SS (021) 418 5232 Christo Stander 082 828 8872 CPTC01 18.420972 -33.918675 [email protected] Cnr of Bree & Riebeek St (33 Bree St) Cape Town 08:00-17:00 08:00-13:00 No Cape Town Intl Airport, Unit BG12 Central Car Rental Building, Tower Cape Town Intl Airport DM (021) 927 2750 Ashley Adonis 082 828 8639 CPTT01 18.594962 -33.969987 [email protected] 06:00-22:00 Road, Matroosfontein Yes 18.594962 -33.969987 [email protected] Cape Town Intl Airport, Unit BG12 Central Car Rental Building, Tower 06:00-22:00 Cape Town Deliveries CD (021) 927 2750 Ashley Adonis 082 828 8639 N/A Road, Matroosfontein N/A Khayelitsha Travel KH (021) 361 4505 Loyiso Mfuku 073 766 2078 CPTE04 18.655672 -34.045080 [email protected] Lookout Hill, 1 Spine Rd, Ilitha Park, Khayelitsha 09:00-17:00 09:00-12:00 per prior arrangement No Stellenbosch – City Centre SP (021) 887 6935/6/7 Richard Jafta 082 828 8638 CPTE01 18.856235 -33.923913 [email protected] Unit 11, Adam Tas Business Park, 4 Bell Street, Stellenbosch, 7600 08:00-17:00 08:00-13:00 per prior arrangement Yes Ricado Van Der Heyden 079 384 7155 Hermanus HM (028) 313 0526 Eleanor van Zyl 082 399 5251 CPTC04 19,237433 -34,419504 [email protected] 34 Main Rd, -

Table of Contents

Chapter 1 Introduction 1 1.1 Background In response to the request of the Government of the Republic of South Africa (hereinafter referred to as the "Government of South Africa"), the Government of Japan decided to implement the Study on Tourism Promotion and Development Plan in the Republic of South Africa (hereinafter referred to as "the Study"). In November 1999, the Japan International Cooperation Agency (hereinafter referred to as "JICA"), the official agency responsible for the implementation of technical cooperation programs, sent a Preparatory Study Team to hold discussions with the Department of Environmental Affairs & Tourism (hereinafter referred to as "DEAT") and South African Tourism (hereinafter referred to as "SA Tourism"). On February 7 2001, DEAT and JICA agreed upon the Scope of Work for the Study. In February 2001, JICA called for technical offers for the selection of a consultant to implement the Study. A team of experts organized by PADECO Co., Ltd. and Pacific Consultants International Co., Ltd. was selected and contracted as the JICA Study Team (hereinafter referred to as "the Study Team") in March 2001. The Study Team commenced work in South Africa in early May 2001. At the same time, JICA organized an advisory committee comprising tourism experts within the Government of Japan in order to advise JICA on technical as well as policy issues of the Study at critical junctures of the Study progress. Members of the Advisory Committee as well as the Study Team are shown in Appendix A. Since the Study commencement, four -

1958 1958. Mrs NJ Nolutshungu (EFF)

National of Assembly Question No: 1958 1958. Mrs N J Nolutshungu (EFF) to ask the Minister of Transport: (1) How far is the process of renaming the Cape Town International Airport and (b) what are the names that are being considered for renaming the airport; (2) whether he has found that renaming the specified airport as the Winnie Madikizela- Mandela International Airport would be supported; if not, what is the position in this regard; if so, what are the relevant details? NW2403E REPLY (1) The Airports Company South Africa (ACSA) embarked on a project to rename the following airports: Cape Town International Airport, East London Airport, Port Elizabeth International Airport and Kimberley Airport. This is in line with the South African Geographical Names Council Act of 1998 (Act No. 118 of 1998) and is part of the Transformation of Heritage Landscape Government Programme. According to the Act, the Minister of Arts and Culture is responsible for the approval of geographical names after receiving recommendations from the South African Geographical Names Council (SAGNC). The SAGNC is only responsible for geographical features of national concern including, but not limited to, towns/cities, suburbs and any form of human settlement, post offices, stations, highways, airports and government dams. SAGNC is also responsible for natural landforms like mountains, hills, rivers, streams, bays, headlands and islands. ACSA appointed an independent public participation consultant to facilitate a transparent public participation process. A report outlining the methodology undertaken in ensuring a transparent public participation process, as well as the outcome of proposals has been submitted to the Department of Transport and is being considered by the Department. -

Run Airports | Develop Airports | Grow Footprint ABBREVIATIONS

Physical address: Postal address: 24 Johnson Road PO Box 75480 The Maples Office Park Gardenview Bedfordview 2047 Johannesburg Tel: +27 (0)11 723 1400 | Fax: +27 (0)11 453 9353 AirportsCompanySA @Airports_ZA www.airports.co.za Run Airports | Develop Airports | Grow Footprint ABBREVIATIONS ACI Airports Council International MIAL Mumbai International Airport Private Limited ACSA Airports Company South Africa SOC Ltd NEHAWU National Education, Health and Allied Workers Union AMSIS Airport Management Share Incentive Scheme NICD National Institute of Communicable Diseases APEX Airport excellence in safety NUMSA National Union of Metalworkers of South Africa ASQ Airport Service Quality PFMA Public Finance Management Act, No. 1 of 1999 B-BBEE Broad-based black economic empowerment PIC Public Investment Corporation CEO Chief Executive Officer PPE Personal protective equipment CFO Chief Financial Officer (Pty) Ltd Proprietary Limited Companies Act Companies Act, No. 71 of 2008 ROCE Return on capital employed COO Chief Operating Officer ROE Return on equity DFI Development Finance Institution SAA South African Airways EBITDA Earnings before interest, tax, depreciation and amortisation SACAA South African Civil Aviation Authority ESAT Employee satisfaction survey SANDA South African National Deaf Association GDP Gross domestic product SANS South African National Standards GRU Guarulhos International Airport SAPS South African Police Service GruPar Guarulhos Participações S.A SED Socio-economic development IAR Integrated Annual Report SMMEs Small, -

Theme Rationale

THEME RATIONALE DELIVERING THE PROMISE, BUILDING THE FUTURE The 2004 Annual Report of Airports Company South Africa (ACSA) focused on “The ACSA Dynamic” – the role played by ACSA as a strategic provider of logistic platforms. In 2005, the ACSA annual report looked at how ACSA was mapping its future. Now, in 2006, the report looks at how effectively ACSA is following the map it has created for its future. It examines how the Company is adapting to changing circumstances and approaching events such as the 2010 Soccer World Cup and the imminent arrival of the giant A380 aircraft. It looks at the questions of whether and how ACSA is delivering on the undertakings made in previous years – undertakings such as high standards of accountability and responsibility in delivering on its obligations to stakeholders. Looking to the future, it examines whether ACSA is on track with its preparations for the 2010 Soccer World Cup and beyond. Finally, it seeks to answer the important fundamental question of the extent to which ACSA, as a state-owned enterprise, is assisting government to discharge its responsibility of growing the national economy of our developing nation. Airports Company South Africa 1 R5,2 BILLION CAPITAL EXPENDITURE PROGRAMME Over the financial years 2005 to 2009 Airports Company South Africa (ACSA) will be investing R5,2 billion in new and upgraded facilities – principally, but not exclusively, at its three international airports in Johannesburg, Cape Town and Durban. These artist’s impressions of the various projects show how determined ACSA is to give South African and foreign travellers, the expected 350 000 additional foreign visitors in 2010 and the huge number of visitors the country will receive in succeeding years, the world-class service they have come to expect. -

Regional Airports Make Significant Contribution to South Africa Economy

REGIONAL AIRPORTS MAKE SIGNIFICANT CONTRIBUTION TO SOUTH AFRICA ECONOMY Kimberley, 26 September 2018 – Airports Company South Africa (ACSA) regional airports in Kimberley, Upington, George, Port Elizabeth, Bloemfontein and East London are making a significant impact on the South African economy in the form of job creation, contributions to gross domestic product (GDP), tax revenues and investment into infrastructure development. In the last financial year (FY2017), ACSA and its nine South African airports contributed R9.5 billion towards GDP (0.3% of national GDP), supported 14,950 jobs (direct and indirect) and R2.8 billion of income to workers in South Africa. Said Senzeni Ndebele, Airports Company South Africa’s corporate affairs senior manager: “Airports have always had a significant role to play in enabling regional economic growth. They permit connections between cities, which catalyses economic activities through amenities and needs for non- residential passengers in transit, as well as supporting aviation-related services, co-located commercial developments and the provision of infrastructure.” Kimberley Airport has a direct, indirect and induced impact on the growth of the economy in the regional sector. In 2017 Kimberley Airport contributed 38 million rands towards GDP, which amounted to a 0.1% contribution to provincial GDP. The airport has also created 127 jobs in the region with a total income contribution of 23 million rands for employees in the regional sector. Airports Company South Africa is exploring regional partnerships that will result in route expansions and additional route options at each of its six regional airports, which in addition to Kimberley Airport include Upington International Airport, George Airport, Bram Fischer International Airport, Port Elizabeth International Airport and East London Airport.