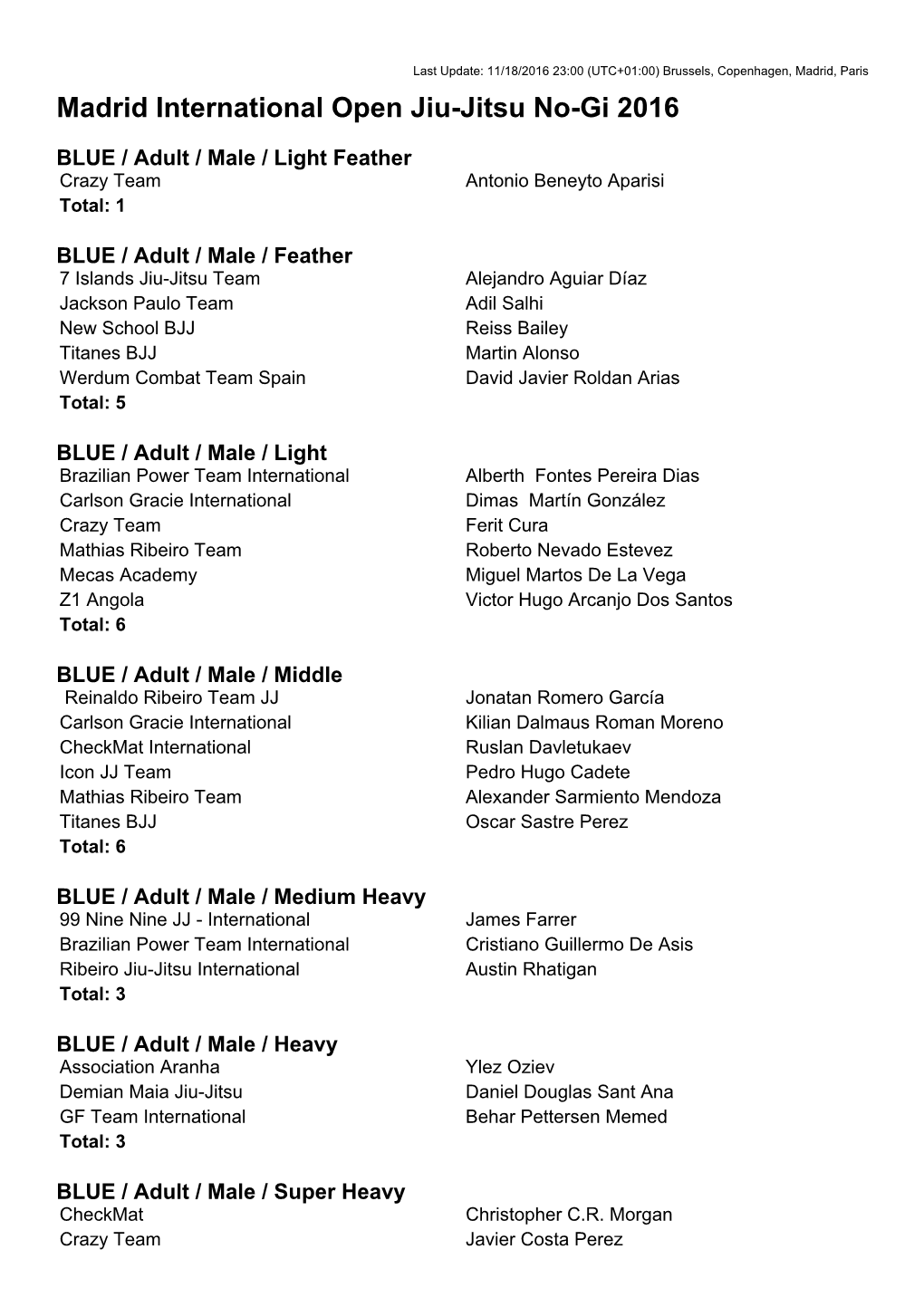

Madrid International Open Jiu-Jitsu No-Gi 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

C. Ziari{Ti Sportivi

C. ZIARI{TI SPORTIVI ALBULESCU, VALENTIN (1925), `n special, din handbal [i fotbal. A desf\[urat o intens\ n. la Bac\u. Economist. A debutat activitate ca redactor la ziarul „Sportul” [i „Scânteia `n presa sportiv\ `n 1966, rea- Tineretului”, fiind prezent la numeroase ac]iuni inter- lizând reportaje, comentarii, `n na]ionale desf\[urate atât `n ]ar\, cât [i `n str\in\tate. principal din lumea baschetului. Dup\ 1989 a devenit redactor-[ef adjunct la ~n anii 1966-1975 a semnat `n pu- „Tineretul Liber”, apoi redactor-[ef la „Curierul blica]iile „Via]a Studen]easc\”, Na]ional”, din 1994 director general al cotidianului „Informa]ia Bucure[tiului” [i „Cronica Român\”, iar din 2001, director general al „Scânteia Tineretului”. Tot despre cotidianului „Independent”. Abandonând oarecum baschet a scris 4 c\r]i: Cu baschetbali[tii români `n problematica sportiv\, s-a lansat `n comentarii Finlanda, De la Napoli la Essen, Baschet. Mic\ enci- politice, realizând numeroase emisiuni televizate la clopedie [i Baschet românesc. Autorul f\cea o incursi- posturile „Antena 1” sau „Prima TV”. ~n perioada `n une `n evolu]ia baschetului din ]ar\ [i din str\in\tate, de care a fost reporter a scris mai multe lucr\ri, din care la `nceputuri pân\ `n acel moment. Din anul 1986 a ini- amintim: Olimpiada californian\ [i Steaua, cam- ]iat [i a realizat un program de fotbal la clubul „Sportul pioana Europei. Din anul 2001 este director general Studen]esc”, denumit Regia fotbalistic\. ~n 1991 a `n- al cotidianului „Independent”. fiin]at, `mpreun\ cu Radu Cosa[u, Gheorghe Laz\r, Radu Timofte [i Eugen Petrescu, prima revist\ de fotbal ALEXANDRESCU, TOMA (1914-1989), n. -

The Tallinn Diplomatic List

THE TALLINN DIPLOMATIC LIST 24 July, 2017 MINISTRY OF FOREIGN AFFAIRS OF THE REPUBLIC OF ESTONIA STATE PROTOCOL DEPARTMENT Islandi väljak 1 15049 Tallinn, Estonia Tel: (372) 637 7500 Fax: (372) 637 7099 E-mail: [email protected] Homepage: www.mfa.ee The Tallinn Diplomatic List will be updated regularly The Heads of Missions are kindly requested to communicate to the State Protocol Department all changes related to their diplomatic staff members (with spouses), contacts (address; phone and fax numbers; e-mail; address; homepage) and other relevant information. ___________________________________________________________ * – not residing in Estonia VM | VM ORDER OF PRECEDENCE AMBASSADORS 6 DIPLOMATIC MISSIONS 11 ALBANIA* 14 ALGERIA* 15 ANDORRA* 16 ANGOLA* 17 ARGENTINA* 19 ARMENIA* 20 AZERBAIJAN 21 AUSTRALIA* 22 AUSTRIA 23 BANGLADESH* 24 BELARUS 25 BELGIUM* 26 BENIN* 28 BOLIVIA* 29 BOSNIA and HERZEGOVINA* 30 BOTSWANA* 31 BRAZIL 32 BULGARIA* 33 BURKINA FASO* 34 CAMBODIA* 35 CANADA* 36 CHILE* 38 PEOPLE'S REPUBLIC OF CHINA 39 COLOMBIA* 41 CROATIA* 42 CUBA* 43 CYPRUS* 44 CZECH REPUBLIC 45 DENMARK 46 ECUADOR* 47 EGYPT* 48 EL SALVADOR* 49 ETHIOPIA* 50 FINLAND 52 FRANCE 54 ___________________________________________________________ * – not residing in Estonia VM | VM GEORGIA 56 GERMANY 57 GHANA* 59 GREECE 61 GUATEMALA* 62 GUINEA* 63 HOLY SEE* 64 HONDURAS* 65 HUNGARY* 66 ICELAND* 67 INDIA* 68 INDONESIA* 69 IRAN* 70 IRAQ* 71 IRELAND 72 ISRAEL* 73 ITALY 74 JAPAN 75 JORDAN* 76 KAZAKHSTAN* 77 REPUBLIC OF KOREA* 79 KOSOVO* 80 KUWAIT* 81 KYRGYZSTAN* 83 LAO* -

Proceedings the 16Th International Scientific Conference “Strategies Xxi”

“CAROL I” NATIONAL DEFENCE UNIVERSITY SECURITY AND DEFENCE FACULTY PROCEEDINGS THE 16TH INTERNATIONAL SCIENTIFIC CONFERENCE “STRATEGIES XXI” PROCEEDINGS STRATEGIC CHANGES IN SECURITY AND INTERNATIONAL RELATIONS “CAROL I” NATIONAL DEFENCE UNIVERSITY (Highly appreciated publishing house within “Military science, intelligence and public order” of Titles, Diploma and University Certificates Awards National Council) Scientific Editors: April 09-10, 2020 Brigadier General Dorin Corneliu PLEŞCAN Volume XVI, Part 3 Volume Colonel Professor Ion PURICEL, PhD Colonel Professor Daniel GHIBA, PhD ISSN 2668-1994 Colonel Professor Lucian Dragoş POPESCU, PhD ISSN-L 2668-1994 Colonel Professor Ioana ENACHE,VOLUMUL PhD Lieutenant-Colonel Professor Tudorel LEHACI, I PhD Volume XVI, 5 948490 380361 40002 Part 3 Volume XVI, Part 3 Scientific Editors: Brigadier General Dorin Corneliu PLEȘCAN Colonel Professor Ion PURICEL, PhD Colonel Professor Daniel GHIBA, PhD Colonel Professor Lucian Dragoș POPESCU, PhD Colonel Professor Ioana ENACHE, PhD Lieutenant-Colonel Professor Tudorel LEHACI, PhD April 09 - 10, 2020 Bucharest, Romania INTERNATIONAL SCIENTIFIC CONFERENCE STRATEGIES XXI „Carol I” National Defence University Bucharest, Romania, April 09 - 10, 2020 INTERNATIONAL SCIENTIFIC COMMITTEE Associate Professor Iulian CHIFU, PhD, (NDU) Brigadier General Dorin Corneliu PLEȘCAN (Rector of NDU) Associate Professor Florian BICHIR, PhD, (NDU) Colonel Professor Valentin DRAGOMIRESCU, PhD (NDU) Professor Constanţa Nicoleta BODEA, PhD (Academy of Economic Colonel Professor -

Constantin Brâncuși” from Târgu-Jiu

University “Constantin Brâncuși” from Târgu-Jiu ~ Scientific Review ~ No. 1(9)/2015 March 2015 ISSN-p: 2247 – 4455 ISSN-e: 2285 – 9632 ISSN-L: 2247 – 4455 Târgu-Jiu 2015 Research and Science Today No. 1(9)/2015 Cover: Batcu Alexandru Editing: Mărcău Flavius-Cristian Director: Mărcău Flavius-Cristian Contact: Mail: [email protected] Tel: +40766665670 ACADEMICA BRÂNCUȘI PUBLISHING ADDRESS: REPUBLICII AVENUE, NO. 1 Târgu Jiu, Gorj Tel: 0253/218222 COPYRIGHT: Reproductions are authorized without charging any fees, on condition the source is acknowledged. Responsibility for the content of the paper is entirely to the authors. 2 March 2015 SCIENTIFIC COMMITTEE: Prof. univ. dr. Adrian Gorun, Secretary Prof. univ. dr. Cruceru Mihai, "Constantin General, National Commission for Prognosis. Brâncuși" University of Târgu-Jiu. Prof. univ. dr. ing. Ecaterina Andronescu, Prof. univ. dr. Gămăneci Gheorghe, University Politehnica of Bucharest. Universitatea "Constantin Brâncuși" din Prof. univ. dr. Michael Shafir, Doctoral Târgu-Jiu. School in International Relations and Prof. univ. dr. Ghimiși Ștefan Sorinel, Security Studies, ”Babes-Bolyai” University. "Constantin Brâncuși" University of Târgu- Prof. univ. dr. Nastasă Kovács Lucian, The Jiu. Romanian Academy Cluj-Napoca, "George Prof. univ. dr. Bîcă Monica Delia, Baritiu" History Institute. "Constantin Brâncuși" University of Târgu- Prof. univ. dr. Adrian Ivan, Doctoral Jiu. School in International Relations and Prof. univ. dr. Babucea Ana Gabriela, Security Studies, ”Babes-Bolyai” University. "Constantin Brâncuși" University of Târgu- Prof. Dr. Miskolczy Ambrus, Eotovos Jiu. Lorand Univeristy (ELTE), Hungary. C.S II Duță Paul, Romanian Diplomatic Dr. Gregg Alexander, University of the Free Institute. State, South Africa. Conf. univ. dr. Răzvan Cătălin Dobrea, Professor, dr. -

Undergraduate ECTS Study Guide

FACULTY OF PHYSICAL EDUCATION AND SPORTS Study Guide 2009‐2012 “Alexandru Ioan Cuza" of Iasi FACULTY OF PHYSICAL EDUCATION AND SPORTS STUDY GUIDE SERIES 2009 - 2012 Tradition Iasi, the oldest academic centre in the country, a precursor of many cultural activities since the last century, has trained specialists in our field of activity. Thus, in the year 1884, Vasile Negruzzi founded a "school" to prepare "the masters of gymnastics" that would run until 1924. The School provided for two-year attendance and it was founded by private initiative but it would further join the "Society of Gymnastics and Music" in Iasi established in 1902, to be later recognised by the Ministry of instruction in 1904. In his activity towards it, Vasile Negruzzi was supported especially by Theodor Berescu. Requisite Development and diversity of education at all levels in Romania of the sixth decade have required for increased training of teachers. Universities are provided with larger enrolment quotas, new faculties and departments are created, the three-year Pedagogic Institutes are founded within larger university centres, and the part-time education is developed. Establishment and Organization After a long lasting discontinuance, the tradition of training teachers in Iaşi would resume in the academic year 1960/1961 when the Faculty of Sports and Physical Education was founded within the Pedagogic Institute, and its main mission was both to train teachers for elementary schools and to meet requirements for developing mass sports and performance sports in villages and cities of Moldova. Faculty of Physical Education takes its first steps with the employment of three teachers in secondary education, and with course opening in early November 1960 for 47 students to full-time studies (length of study: 3 years) and 13 students to part-time studies (length of study: 3 and later 4 years). -

Diasporic Networks Narrate Social Suffering a Dissertation

UNIVERSITY OF CALIFORNIA Los Angeles Francophonie and Human Rights: Diasporic Networks Narrate Social Suffering A dissertation submitted in partial satisfaction of the requirements for the degree Doctor of Philosophy in Comparative Literature by Simona Liliana Livescu 2013 © Copyright by Simona Liliana Livescu 2013 ABSTRACT OF THE DISSERTATION Francophonie and Human Rights: Diasporic Networks Narrate Social Suffering by Simona Liliana Livescu Doctor of Philosophy in Comparative Literature University of California, Los Angeles, 2013 Professor Efrain Kristal, Co-Chair Professor Suzanne E. Slyomovics, Co-Chair This dissertation explores exilic human rights literature as the literary genre encompassing under its aegis thematic and textual concerns and characteristics contiguous with dissident literature, resistance literature, postcolonial literature, and feminist literature. Departing from the ethics of recognition advanced by literary critics Kay Schaffer and Sidonie Smith, my study explores how human rights and narrated lives generate larger discursive practices and how, in their fight for justice, diasporic intellectual networks in France debate ideas, oppressive institutions, cultural practices, Arab and European Enlightenment legacies, different traditions of philosophical and religious principles, and global transformations. I conceptualize the term francité d’urgence , definitory to the literary work and intellectual trajectories of those writers who, forced by the difficult political situation in their home countries, make a paradoxical aesthetic use of France, its ii territory, or its language to promote local, regional, and global social justice via broader audiences. The first chapter theorizes a comparative analysis of human rights literature produced at a global diasporic site by transnational authors circulating between several locations - Middle East, North Africa, Cuba, Eastern Europe, France and the United States - that inform their cultural identities and goals. -

Trends in Environmental Tax Reforms in European Union

Recent Researches in Sociology, Financing, Environment and Health Sciences TRENDS IN ENVIRONMENTAL TAX REFORMS IN EUROPEAN UNION Maria Ramona Chivu, Elena Adelina Blăjanu, Dragoș Lucian Popescu, Marin Chivu Academy of Economic Studies [email protected] Abstract: This paper analyzes the evolution of ecological tax reform in European Union (EU). Ecological tax reform has become a topic discussed on a broad scale, both in economic policy and theory. Of course, the environment and taxation, taken individually, are complex issues and articulate, but it is clear that, when puting together, "environmental taxes" influence each other. EU member states have adopted these fiscal instruments in order to solve the problem of environmental pollution. They believe in this type of instrument, because it was shown that taxpayers, when they see their production increase in the benefit of the Treasury, tend to adapt to environmental policies Keywords: environmental taxes, energy taxes, transport taxes, pollution taxes, resource taxes 1. Introduction reduction and refund schemes has indeed been one of The introduction of environmental tax reforms gained the key features of the 'green' tax reforms that many increasing support during the 1990s. The basic idea was Member States have introduced over the last decade. to shift the tax burden from labour towards Green tax reforms, generally can consist of three environmentally harmful goods and activities. With the types of approaches: (Barde, 1999): publication of Jacques Delors' White Paper on Growth, - reduction or elimination of environmentally Competitiveness and Employment in 1993 the idea of harmful subsidies, exemptions in environmentally such a fiscal reform became politically attractive, as it related taxes potentially harmful for the environment; offered a means to promote simultaneously growth, jobs - restructuring of existing taxes according to and environmental protection, i.e. -

Budget and Development at the Beginning of the 21St Century

BUDGET AND DEVELOPMENT AT THE BEGINNING OF THE 21ST CENTURY. LET US UNDERSTAND THE PAST IN ORDER TO DESIGN THE FUTURE Rareş MĂNESCU, Ph.D. in Economy Institute for Liberal Studies [email protected] Abstract In order to formulate the governmental policies, it is important to understand the experience of the past and not to repeat the same errors. The Government needs to analyze the experience of the past in the budgetary field and design a wise policy in accordance with the acquired relevant experience. Exiting the crisis and re-launching the economic growth have been seen by most specialists as becoming possible first of all by means of budgetary policies. A part of them want to be analyzed the main components of budgetary policy from the perspective of the 19th and 20th century valuable thinking. Expansionist fiscal policy is a policy of reduction of taxes and feeds in order to reanimate the economy. It is particularly recommended for the economic re-launch in the conditions of crises such as the one started in 2008. The too high quotas of the taxes are useless and dangerous. They are useless because being too high they will not help equilibrating the budget, on the contrary. Key-words: budget, development, designing the future, taxes, Government JEL Classification: O23 Introduction The paper refers to the review of budgetary policies focused on development in the light of the experience provided by the economic thinking of the 19th and 20th centuries. One of the most debated economy topics at the beginning of the 21st century is represented by the budgetary policy in the context of the need for fast development. -

Independent 12 PAGIN M 00 LEI Riei Zbuciumate a Neamului Ro- Jtnânese

' Zilnic,' sîntem vizitaţi la re dacţie de cetăţeni din Cluj-Na- poca, din judeţ sau din ■ alte ! localităţi din ţară, care doresc să-şi exprime prin intermediul „ziarului solidaritatea faţă . de Apelul, pentru salvarea patrio ţilor români de la Tiraspol, considerînd gestul lor tiresc şi pe deplin justificat. Impresio nantul sentiment al unităţii de neam în faţa martirajului Ac ceptat de eroii de la Tiraspol ANUL V N R . 1035 cu demnitate este întărit prin z i a r JOI cuvintele tuturor celor care, prin .semnătura lor, contribuie, 23 DECEMBRIE 1993 în aceste zile,-la scrierea isto independent 12 PAGIN M 00 LEI riei zbuciumate a neamului ro- jtnânese. ’ IHTW'll i,,l/l UI■■ »IL^OJlJW[MIJIl!Mi I Din partea UNIPLUS Radio Cluj am primit un tabel conţi- nînd semnăturile următorilor: Letiţia liea, Kovacs Arthur, Călin Precup, Sebastian Hetea, Colinde, Serglu Şteţ, I.aurenţiit Ştefan, Fuiga Dimitrescu,'Ovidiu Fo- dorean, Domniţi Horaţiu, Gabi colinde Lazăr, Paulina Darie, v Mihai drate. la locul ce 11 so cuvin: pas. Asta se- uită în permanen Puică, Renata Roca, Mihai Pop, Vciler CHIOREANU demagogie. Demagogie politică. tă: Nu ştiu ce salariu are d-l „Să ne pregătim să ascultăm, Ana' Micheti, Codin Samoilă, D-l Bogdan Hosu este mai In Bogdan Hosu şl nici de unde îl în luminoasa zi a . praznicului Luiza Budusan, Corina Musca- transigent decît fusese d-l Petre primeşte, dar sînt convins că Naşterii Fiului lui Dumnezeu, lă, Kun Valentina, Delia Grui- . ’are tot mai evident fa p Roman pe vremea jerseului, mal are atîţia băni îneît să-şi paată îngereştile glasuri care , pintâ ţă, Sergiu Mătăsaru, , Daniel P tul, că liderii sindicali ,sînt sindicalist, aş spune, purtînd cumpăra un costum de haine, re- „Slavă întru cei de sus Iul Dum -Boroştean, Tibi Crişan, Gabriel, hotărîţi să-şi asume res jerseul în continuarea exercită nunţînd la vestitul şl demagogi nezeu, pre pămînt pace şi între Chira, Marcel Marian, Simona ponsabilităţi politice. -

RECENT RESEARCHES in SOCIOLOGY, FINANCING, ENVIRONMENT and HEALTH SCIENCES

RECENT RESEARCHES in SOCIOLOGY, FINANCING, ENVIRONMENT AND HEALTH SCIENCES 5th WSEAS International Conference on MANAGEMENT, MARKETING and FINANCES (MMF '11) 2nd WSEAS International Conference on SOCIOLOGY, PSYCHOLOGY, PHILOSOPHY (SOPHI '11) 2nd WSEAS International Conference on ENVIRONMENT, MEDICINE and HEALTH SCIENCES (EMEH '11) Playa Meloneras, Gran Canaria, Canary Islands Spain, March 24-26, 2011 Published by WSEAS Press ISBN: 978-960-474-287-5 www.wseas.org RECENT RESEARCHES in SOCIOLOGY, FINANCING, ENVIRONMENT AND HEALTH SCIENCES 5th WSEAS International Conference on MANAGEMENT, MARKETING and FINANCES (MMF '11) 2nd WSEAS International Conference on SOCIOLOGY, PSYCHOLOGY, PHILOSOPHY (SOPHI '11) 2nd WSEAS International Conference on ENVIRONMENT, MEDICINE and HEALTH SCIENCES (EMEH '11) Playa Meloneras, Gran Canaria, Canary Islands Spain, March 24-26, 2011 Published by WSEAS Press www.wseas.org Copyright © 2011, by WSEAS Press All the copyright of the present book belongs to the World Scientific and Engineering Academy and Society Press. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the Editor of World Scientific and Engineering Academy and Society Press. All papers of the present volume were peer reviewed by two independent reviewers. Acceptance was granted when both reviewers' recommendations were positive. See also: http://www.worldses.org/review/index.html ISBN: 978-960-474-287-5 World Scientific and Engineering Academy and Society RECENT RESEARCHES in SOCIOLOGY, FINANCING, ENVIRONMENT AND HEALTH SCIENCES 5th WSEAS International Conference on MANAGEMENT, MARKETING and FINANCES (MMF '11) 2nd WSEAS International Conference on SOCIOLOGY, PSYCHOLOGY, PHILOSOPHY (SOPHI '11) 2nd WSEAS International Conference on ENVIRONMENT, MEDICINE and HEALTH SCIENCES (EMEH '11) Playa Meloneras, Gran Canaria, Canary Islands Spain, March 24-26, 2011 Editors: Prof. -

New Europe College Ştefan Odobleja Program Yearbook 2009-2010

New Europe College Ştefan Odobleja Program Yearbook 2009-2010 RAFAEL-DORIAN G. CHELARU ATTILA KIM PUIU LÃÞEA ANDREI MURARU ALINA SILIAN ANDREI FLORIN SORA ÁRON ZSOLT TELEGDI-CSETRI AURELIA VASILE New Europe College Ştefan Odobleja Program Yearbook 2009-2010 Editor: Irina Vainovski-Mihai Copyright – New Europe College ISSN 1584-0298 New Europe College Str. Plantelor 21 023971 Bucharest Romania www.nec.ro; e-mail: [email protected] Tel. (+4) 021.307.99.10, Fax (+4) 021. 327.07.74 New Europe College Ştefan Odobleja Program Yearbook 2009-2010 RAFAEL-DORIAN G. CHELARU ATTILA KIM PUIU LĂŢEA ANDREI MURARU ALINA SILIAN ANDREI FLORIN SORA ÁRON ZSOLT TELEGDI-CSETRI AURELIA VASILE CONTENTS NEW EUROPE FOUNDATION NEW EUROPE COLLEGE 7 RAFAEL-DORIAN G. CHELARU CUTTING RELIGIOUS BOUNDARIES: “CONFESSIONAL” DISCOURSE AND ADAPTATION STRATEGIES OF THE CATHOLIC MISSIONARIES IN MOLDAVIA (18TH CENTURY) 19 ATTILA KIM FUNCTION AND FORM IN THE ARCHITECTURAL DEVELOPMENT OF PENITENCIARIES 53 PUIU LĂŢEA DECEPTION, DELAY AND DENIAL OF INDEBTEDNESS: PRELIMINARY REFLECTIONS ON FIELDWORK IN OLTENIA 79 ANDREI MURARU LEGISLATION AND WAR CRIMINALS’ TRIALS IN ROMANIA 109 ALINA SILIAN ACTIVE CITIZENSHIP? THE POSSIBILITIES FOR A ROMANI GRASSROOTS REDEFINITION 177 ANDREI FLORIN SORA ÊTRE FONCTIONNAIRE « MINORITAIRE » EN ROUMANIE. IDEOLOGIE DE LA NATION ET PRATIQUES D’ÉTAT (1918-1940) 205 ÁRON ZSOLT TELEGDI-CSETRI TEMPORALITY AND POLITICS IN KANT 233 AURELIA VASILE LA CRÉATION CINÉMATOGRAPHIQUE DES ANNÉES 1960 AU CROISEMENT DES LOGIQUES POLITIQUES, BUREAUCRATIQUES ET SOCIALES 263 NEW EUROPE FOUNDATION NEW EUROPE COLLEGE Institute for Advanced Study New Europe College (NEC) is an independent Romanian institute for advanced study in the humanities and social sciences founded in 1994 by Professor Andrei Pleşu (philosopher, art historian, writer, Romanian Minister of Culture, 1990–1991, Romanian Minister of Foreign Affairs, 1997-1999) within the framework of the New Europe Foundation, established in 1994 as a private foundation subject to Romanian law. -

Aloha and E Komo Mai Robot Individual We Are Uber Or Lyft Ride Away

Friday, November 23, 2018 Volume 91, Number 1 Daily Bulletin 91st Fall North American Bridge Championships [email protected] | Editors: Sue Munday and Chip Dombrowski Ferguson wins Aloha and E Komo Mai Robot Individual We are Uber or Lyft ride away. With huge scores on the second and third days, thrilled to extend The first Friday is Aloha Friday and we hope Jonathan Ferguson of Ottawa ON won the Fall a very warm you will try to wear aloha attire. You won’t want NABC Robot Individual, averaging 72.17% across welcome to the to miss that night’s welcome party, or the ono the three day-long sessions. Ferguson started with 2018 Fall NABC (delicious) snacks selected for you each night by a 64.20% the first day, which was 62nd place. He in beautiful hospitality chair Marie Ashton. won both the second and third days with scores of Hawaii, where Sunday, Nov. 25, will be Oahu Day and we will 78.18% and 74.14%. you will find have very exciting Tahitian dancers and drummers When Feguson saw soothing trade performing for you after the evening session, along his preliminary score winds, rainbows, with snacks and a cash bar for your enjoyment. Wednesday, he shouted so pristine beaches Watch the Daily Bulletin for special events on loud his neighbor came and the scent of plumeria blossoms right outside Kauai, Maui and Big Island days as well. over. “I haven’t felt that your room at the incredible Hilton Hawaiian Village. Busaba Williams and her menehune extend an much elation about bridge The island of Oahu is known as The Gathering especially warm welcome to our 0–299 masterpoint since I came back to win Place, and our population is a diverse mix of players in the I/N Room, with special prizes, gifts, a KO event with Chris cultures from Polynesia, Asia, the mainland United limited masterpoint games and celebrity speakers.